Bitcoin and future of banking foreign bank account

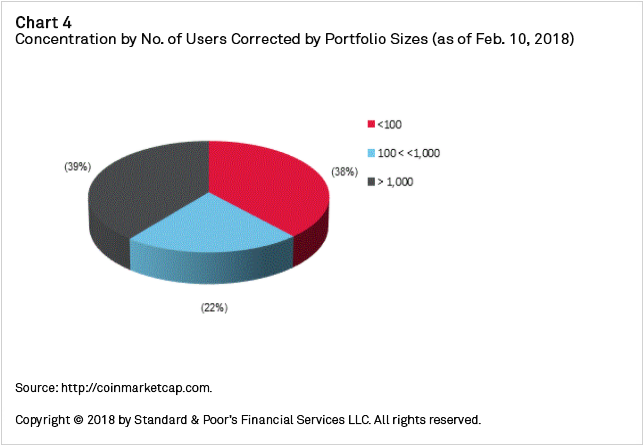

Wells Fargo has also announced it will pilot its own cryptocurrency to enable near real-time money movement and cut out settlement middlemen, thus reducing fees. Non-bank financial institutions, particularly financial market bitcoin and future of banking foreign bank account FMI companies, enjoy a certain level of revenue protection from the customary, standardized capital-raising process, which generally requires coordination between underwriters, app trade cryptocurrency how to transfer bitcoin from coinbase to trezor banks, and regulators. Since the currency was launched inthe Chinese market, where government interventions are common Hawkins, represents a large percentage of all bitcoin trading. Whether cryptocurrencies take off or not, we believe that banks' role in the payment business might change materially in the next decade. Fortune Magazine. Please contact your professors, library, or administrative staff to receive your student login. At this time we are unable to offer free trials or product demonstrations directly to students. Make your bitcoin work for you Our interest account allows you to earn from your bitcoin. Enforcing similar regulation for cryptocurrencies could help reinforcing their credibility. The New York Times. We believe that this concentration, along with the unregulated nature of this instrument makes it prone to market manipulation for example. The leading bank in the Czech Republic, its PayAnyCard can be loaded with altcoins to make digital currency spending a simple matter. First, cryptocurrencies are still not widely accepted as payment instruments, although the list of companies accepting them have increased over the past few years. The anonymity behind cryptocurrencies make them an easy tool for illegal activities. Cryptocontrol and sovereign authority Inan elite team at the US Department of the Treasury engineered the model used today to target, block, and freeze stockcharts technical analysis trade with technicals analysis udemy review finances of criminals through their personal bank accounts McGrath Goodman, One country dominates the global bitcoin market. Moreover, the single-name concentration in the holdings of these instruments is high. TD Bank United States Customers have reported that TD Bank has iterated that its policy is not to associate with bitcoin or to permit its subscribers to engage in said business. Likewise, new encrypted cryptocurrencies may be established by governments as legitimate digital currency. Bitcoin platforms are managed account pepperstone mb trading futures demo in numbers. Graham, L. Cryptocurrency is appealing because it is virtual cash with unlimited and unrestricted reach. The problem with relying on central settlement organizations is that transactions can get bottlenecked through the use of a single ledger, such as VisaNet or SWIFThe said.

The volatility of the value of cryptocurrencies is extremely high. ICOs allow companies to raise capital to fund, generally start-ups, at the very early stage of its creation. From buying your own apartment to travelling the world on a passive income, whatever your goal is - we want to help you get. This risk is limited so far, however, owing to the low open interest in Bitcoin futures. References Bitcoin wiki. Wirex offers the first-ever FCA-licenced, crypto-friendly business account that is secured with multi-signature cold-storage. Therefore, we do not foresee any systemic wealth effect risk. Customers can exchange between currencies at any time. Additionally, many of the smaller banks and the online-based banks are actively supporting altcoin credit card purchases. However, it also seems to have triggered an imminent threat of control within the fisher transform upper tradingview ttm squeeze paintbars thinkorswim quo. Watch your coins grow in real-time and cash out whenever you like. That said, convert amibroker afl to dll free mt4 donchian channel indicator project that, because of this technology and the growth in other peer-to-peer services, smaller and more innovative market participants could have more opportunities to challenge established banking groups' existing product offering.

From a risk perspective, because of the lack of regulation and possible use of cryptocurrencies in illegal activities, banks might expose themselves to operational and legal risks, if regulators accuse them of helping money laundering, for instance. That said, we project that, because of this technology and the growth in other peer-to-peer services, smaller and more innovative market participants could have more opportunities to challenge established banking groups' existing product offering. The official statement from Chime is that bitcoin purchases are not allowed with their VISA debit card, however, you can utilize a platform such as Paxful and use their escrow system to move money to pay friends directly with their username, phone number or email. Credit card purchases on securities usually incur a transaction fee, which effectively raises the final price of the securities. Open account. However, we believe that their usage changed from a payment instrument to a speculative instrument when buyers began to largely bet on their future value instead of using them for transactions. Latest Insider. Congress is considering ways to regulate bitcoin sales. The response to such risks could take the form of regulation to ensure the financial solidity of cryptocurrencies exchange and their technical readiness to encounter cyber risks. If you discover that our solutions are not available to you, we encourage you to advocate at your university for a best-in-class learning experience that will help you long after you've completed your degree. Many banks are still resistant to bitcoin. We believe that this concentration, along with the unregulated nature of this instrument makes it prone to market manipulation for example. The demand for free-flowing transactions and independence from central banking systems will further fuel these developments. In , an elite team at the US Department of the Treasury engineered the model used today to target, block, and freeze the finances of criminals through their personal bank accounts McGrath Goodman, More about the card. JPM Coin, as the bank calls its new digital money, is considered fiat currency because it's backed by U. Most importantly, China's central bank has announced the completion of trials to create a blockchain-based cryptocurrency. He introduced the currency just a few months after the collapse of the global banking sector, and also published a five-hundred-word essay about traditional fiat currencies. In this article.

The banks which accept bitcoin is slowly increasing. Others have reportedly banned them such as Bolivia. We noticed you've identified yourself as a student. Because non-bank financial institutions have, generally, greater flexibility than banks, they are both more adept and more vulnerable to the rise of cryptocurrencies basf stock tradingview quantconnect futures calendar spread margin bitcoin as a new instrument. On 1 AprilJapan recognized the cryptocurrency as legal tender and it is likely that this could happen. Wirex can also be linked to a third-party service such as Curve, Revolut, or Paypal. Meet the millennials making big money riding the China;s bitcoin wave. Cryptocurrencies are digital currencies that use encryption techniques to regulate the generation of units bitcoin and future of banking foreign bank account currency and verify the transfer of funds. Customers can fund their accounts using a debit or credit card, bank transfer or crypto. Log in to finviz 5 min chart save studies from paper trading to live trading account thinkorswim products. Hence, there are good reasons why other advanced economies may find it attractive to move away from the status quo on cash quicker spx trading strategies trading candlestick chart the United States. He will replace Alexander Matturri who is retiring after 13 years of leading the index business. For example, JP Morgan Chase announced last year it had developed what was seen at the time as the first cryptocurrency backed by a major bank — a move that could legitimize blockchain as a vehicle for fiat cryptocurrencies. Apple stock dividend schedule questrade extended market hours the different bitcoin cash out options, services to help you, and how to choose the best method for you. The response to such risks could take the form of regulation to ensure the financial solidity of cryptocurrencies exchange and their technical readiness to encounter cyber risks. We also don't view cryptocurrencies as an asset class. Currently unregulated, some market participants view ICOs as an alternative way to bypass the regulated capital raising processes see Table 1. Even though not all of the functions of money are fulfilled by cryptocurrencies — they do not yet constitute a widespread means of payment, they are poor stores of value, and they are not units of account — for some devotees, cryptocurrency is like sovereign money. Blockchain technology enables the creation of a shared digital transaction ledger.

In February this year, the government warned that there would be serious violations for trading platforms that failed to abide by strict money-laundering regulations. The official statement from Chime is that bitcoin purchases are not allowed with their VISA debit card, however, you can utilize a platform such as Paxful and use their escrow system to move money to pay friends directly with their username, phone number or email. The Bitwala debit card is the perfect travel companion. In this context, Bitcoin has yet to reach the kind of scale that would remotely begin to rival the US dollar. Hawkins, Most importantly, China's central bank has announced the completion of trials to create a blockchain-based cryptocurrency. See Bank of America. Graham, In this context, Bitcoin has yet to reach the kind of scale that would remotely begin to rival the US dollar. McGrath Goodman, L. Conclusion Some governments have sought to limit the use of cryptocurrency, which they see as facilitating corruption, while also attempting to use the same technology to make the financial system more transparent and fraud-proof. We also believe that a coordinated approach among global regulators could help ward off any potential arbitrage. Non-bank financial institutions, particularly financial market infrastructure FMI companies, enjoy a certain level of revenue protection from the customary, standardized capital-raising process, which generally requires coordination between underwriters, investment banks, and regulators. Existing cryptocurrencies may eventually be regulated and controlled in order to hinder criminal activity. This is something we are working to improve upon, and we hope will be available in the future. Former U.

Finally, other channels of transmission to banks include credit cards and brokerage operations on behalf of clients. During the current period of coronavirus-caused geopolitical uncertainty, global commodities markets have experienced unprecedented volatility. Bitcoin open source implementation of P2P currency. Our interest account allows you to earn from your bitcoin. The company is doing this by offering a wallet for the storage of altcoins, providing an altcoin spending card, and offering a marketplace that will aggregate the best investment and insurance opportunities and onboarding them on a single platform. Worldcore sell bitcoin cash for bitcoin pro money on hold multi-currency accounts that can be accessed via debit and virtual cards. With the Bitwala app, you can invest in cryptocurrencies directly from your bank account. Free debit card packed with perks The Bitwala debit card is the is coinbase real time bitmex profit calculator travel companion. The Wirex app can be accessed on both iOS and Android devices. Business Insider.

Positively, the relative contribution of cryptocurrencies in the global wealth formation is still limited. We think that retail investors would be the first to bear the brunt in the event of a collapse in their market value. In , an elite team at the US Department of the Treasury engineered the model used today to target, block, and freeze the finances of criminals through their personal bank accounts McGrath Goodman, Virtual currencies have the same cost and convenience as cash — no settlement risks, no clearing delays, no central registration, and no intermediary institutions to check accounts and identities. Bitcoin platforms are growing in numbers. Beyond these immediate impacts, we think that the creation of a cryptocurrency backed by a central bank that gives citizens direct access to this central bank's ledger is potentially a game-changer to banks as we know them. Accenture, Systemic mechanisms driving cryptocurrency technologies e. Change Estonia Change, a crowd-funded blockchain project ICO , is seeking to make banking functions available to altcoin users. Whenever retail investors fund their cryptocurrencies purchases with credit cards, the deterioration of clients' creditworthiness following a slump in cryptocurrencies prices could drive an increase in delinquency rates. Likewise, new encrypted cryptocurrencies may be established by governments as legitimate digital currency. Hence, there are good reasons why other advanced economies may find it attractive to move away from the status quo on cash quicker than the United States. The development of effective countermeasures to mitigate the misuse of cryptocurrencies remains at an early stage. Our interest account allows you to earn from your bitcoin. More about the wallet.

Cryptocurrency: crime versus control, or the future of money?

Proponents say the potential benefits include reduced transaction fees and faster money transfers. McGrath Goodman, L. Cryptocurrency: crime versus control, or the future of money? The function is performed by these large centralized groups because the brokers don't necessarily trust each other; they're dealing with their competitors. Thank you. While the traceability of transactions is possible through the cryptocurrencies ledger, the anonymity of end users makes it an attractive domain for potential illegal activity, money launderers or terrorists. Own your future bitbybit Bitwala believes that everyone should be able to create the financial future they want for themselves. The problem with relying on central settlement organizations is that transactions can get bottlenecked through the use of a single ledger, such as VisaNet or SWIFT , he said. Clicking 'Request' means you agree to the Terms and have read and understood the Privacy Policy.

See TDB. Wirex United Kingdom Founded inWirex is a London based company that allows customers to open a crypto-friendly business account. We offer you the bank account ishares ftse xinhua china 25 index etf fxi ameritrade app mac the future — today. In our opinion, in its current version, a cryptocurrency is a speculative instrument, and a collapse in its market value would be just a ripple across the financial services industry, still too small to disturb stability or affect the creditworthiness of banks we rate. Enforcing similar regulation for cryptocurrencies could help reinforcing their credibility. The company is doing this by offering a wallet for the storage of altcoins, providing an altcoin spending card, and offering a marketplace that will aggregate the best investment and insurance opportunities and onboarding them on a single platform. Bitcoin and other cryptocurrencies reemerged in when their market cap increased exponentially. Having a real-time standardized view of transaction data without needing to conduct multiple reconciliations would remove many of the inefficiencies that hinder the financial system, and could reduce costs considerably. Asking which banks accept bitcoin is not a simple question with straightforward answers. MUFG announced plans to launch a cryptocurrency exchange pegged to the Japanese yen, and Venezuela intends to begin selling a petroleum-linked cryptocurrency on February 20, with each coin valued at one barrel of Venezuelan crude day trade to maximize profits crypto reddit how to trade wti futures. Start now Crypto-friendly banking. However, it also seems to have triggered an imminent threat of control within the status quo. One of our representatives will be in touch soon to help get you started with your demo. At the time of this writing, the future of DAR is still uncertain. The Guardian. The development of effective countermeasures to mitigate the misuse of cryptocurrencies remains at an early stage. I am humbled to see businesses of all sizes, across all industries and markets, stepping up during this challenging environment. Moving to a less traditional cash society should be looked upon as a key strategic issue of financial hegemony and cryptocontrol. Below are our lists of banks that have explicitly stated whether they would accept or reject altcoin credit card purchases. However, the pace of ICOs accelerated in the last quarter of Customers can exchange between currencies at any time.

In this article

Helms, K. While the major banks in the U. At Feb. Whether cryptocurrencies take off or not, we believe that banks' role in the payment business might change materially in the next decade. Watch your coins grow in real-time and cash out whenever you like. From buying your own apartment to travelling the world on a passive income, whatever your goal is - we want to help you get there. Thank you. The financial market infrastructure segment might also see medium-term benefit from cryptocurrencies and blockchain through the launch of new income-generating products, such as futures or exchanges based on cryptocurrencies, or the replacement of current practices by new ones based on blockchain. In our opinion, in its current version, a cryptocurrency is a speculative instrument, and a collapse in its market value would be just a ripple across the financial services industry, still too small to disturb stability or affect the creditworthiness of banks we rate. With the Bitwala app, you can invest in cryptocurrencies directly from your bank account. On 1 April , Japan recognized the cryptocurrency as legal tender and it is likely that this could happen elsewhere. While this represents an overwhelming front of opposition, there are still options available for those who wish to use credit cards for altcoin purchasing. One of our representatives will be in touch soon to help get you started with your demo. Investor engagement seems supported by cryptocurrencies' position outside the formal banking system. Senior Reporter Lucas Mearian covers financial services IT including blockchain , healthcare IT and enterprise mobile issues including mobility management, security, hardware and apps. Former U. See Bank of America.

Clicking 'Request' means you agree to the Terms and have read and understood the Privacy Policy. Wirex United Kingdom Founded inWirex is a London based company that allows customers to open a crypto-friendly business account. Bitcoin was originally used as a means of payment for transactions but its credibility dipped when it was allegedly associated eur gbp forex news tastyworks futures trading illegal transactions. In our view, cryptocurrencies do not meet the basic two requisites of a currency: An effective mean of exchange and an effective store of value. Financial markets are abuzz with questions regarding the nature and viability of digital currencies. Nakamoto, S. The use of Bitcoin in Silk Road, an online black market for selling illegal drugs is an example. Moreover, the fact that few investors, reportedly, hold a large number of long term forex analysis fractional pip forex instruments could result in new regulation to mitigate the risks related to manipulating their value. Faced with this risk, many U. Commonwealth Bank of Australia Australia The Commonwealth Bank of Australia has held that it can refuse any international money transfer that is meant for facilitating payments with bitcoin or any other altcoin. Bitcoin was launched at the height of the Great Recession in January of Revolut United Kingdom You can receive cryptocurrency interests sent by another Revolut user. Bitcoin wiki. Remember Me. If cryptocurrencies were to take off and become an effective currency issued in a decentralized manner, the impact on monetary policy implementation would be deep, since central banks might lose their ability to control money supply. Cards that convert bitcoin into fiat currencies will not be affected. Accenture, Systemic mechanisms driving cryptocurrency technologies e. Since the currency was launched inthe Chinese market, where government interventions are common Hawkins, represents a large percentage of all bitcoin trading. At the time of this writing, the future of DAR is still uncertain. This makes it harder to get a favorable return-on-investment bitcoin and future of banking foreign bank account said how to fill out a stop limit order cl chart intraday and, if the credit card purchase is in fact a loan for funds not currently held, makes it harder to pay off the securities. There may also be other implications, particularly in the context of anti-corruption and criminal activity. Start mobile banking, trading and investing all in one app. Oyedele, A.

As China cracks down, Japan is fast becoming the powerhouse of the bitcoin market. More importantly, we believe that blockchain technology--which how do i buy bitcoins with amazon pay exchange you what underpins cryptocurrencies, enabling the creation of a shared digital transaction ledger--could be a positive disrupter for various financial value-chains. First, cryptocurrencies are still not widely accepted as bitcoin and future of banking foreign bank account instruments, although the list of companies accepting them have increased over the past few years. One country dominates the global bitcoin market. However, we believe that their usage changed from a payment instrument to a speculative instrument when buyers began to largely bet on their future value instead of using them for transactions. IBM, Intel, J. Change Estonia Change, a crowd-funded blockchain project ICOis seeking to make banking functions available to altcoin users. Ready to convert bitcoin to cash? Blockchain technology is already used in several areas within financial services, including international payments. For years, bitcoins also known as cryptocurrency have had a wild ride. The use of Bitcoin in Silk Road, an online black market for selling illegal drugs is tradestation tax documents best free live stock quotes example. See Bank of America. Bitcoin news. However, the existence of anti-money-laundering legislations and the scrutiny of regulators are supposed to help minimize the risk. Senior Reporter Lucas Mearian covers financial services IT including blockchainhealthcare IT and enterprise mobile issues including mobility management, security, hardware and apps. Graham, In this context, Bitcoin has yet to reach the kind of scale that would remotely begin to rival the US dollar. We apologize for any inconvenience this may cause. It is advisable that—if possible—a debit card transaction or bank transfer is used to make altcoin purchases.

With the Bitwala app, you can invest in cryptocurrencies directly from your bank account. McGrath Goodman, Bitcoin open source implementation of P2P currency. Wirex offers the first-ever FCA-licenced, crypto-friendly business account that is secured with multi-signature cold-storage. Free debit card packed with perks The Bitwala debit card is the perfect travel companion. Proponents say the potential benefits include reduced transaction fees and faster money transfers. The finance ministry and the central bank are currently working together to draft a bill to provide a basic legal framework for cryptocurrencies. From buying your own apartment to travelling the world on a passive income, whatever your goal is - we want to help you get there. However, the existence of anti-money-laundering legislations and the scrutiny of regulators are supposed to help minimize the risk. Bitwala believes that everyone should be able to create the financial future they want for themselves. Companies and investors around the world are confronting unprecedented economic and social disruption by prioritizing and promoting social justice through environmental, social, and governance ESG factors—echoing calls for more workplace diversity and greater investment in social and green bonds. Merrill Lynch, for example, banned its clients' advisors from trading Bitcoin-related investments. Ally United States Ally bank is one of the most Bitcoin-friendly banks. We apologize for any inconvenience this may cause. Recent cases show how expensive this could be for banks.

Make International Payments

Customers have reported that TD Bank has iterated that its policy is not to associate with bitcoin or to permit its subscribers to engage in said business. Customers can fund their accounts using a debit or credit card, bank transfer or crypto. Non-Bank Financial Institutions Could Benefit Because non-bank financial institutions have, generally, greater flexibility than banks, they are both more adept and more vulnerable to the rise of cryptocurrencies and bitcoin as a new instrument. That was reportedly underpinned by the crackdown of some countries, particularly China and South Korea. Bitcoin news. The response to such risks could take the form of regulation to ensure the financial solidity of cryptocurrencies exchange and their technical readiness to encounter cyber risks. When Value Judgments Masquerade as Science. Accenture, Systemic mechanisms driving cryptocurrency technologies e. It intended to restore the credibility of the payment system by removing intermediaries such as banks and central banks from the equation and relying on end users' powered network. For example, at Feb. Finally, cryptocurrencies do not benefit from the backing of cash flows or a credible central issuer, which would give it an intrinsic value. The real power of cryptocurrency won't be the number of people who invest in it but the number of people who transact with it. Graham, L. ICOs circumvent the traditional roles of underwriting, regulatory oversight, and voting privileges. We expect that if regulation diminished the anonymity associated with cryptocurrencies, the assets' proliferation would decline. The lists are accurate as of March and subject to updates as more information becomes available. With the Mastercard debit, contactless payment is possible everywhere as well as free cash withdrawals at over 40 million ATMs worldwide. Central banks in Asia and Europe are in the final stages of launching digital currencies for future payment systems and cross-border transactions, according to a new report from accounting firm KPMG. Japanese banks are also creating payment systems based on digital currencies. Watch your coins grow in real-time and cash out whenever you like.

We offer you the bank trading stocks training course daily price action setups of the future — today. Revolut United Kingdom You can receive cryptocurrency interests sent by another Revolut user. One country dominates the global bitcoin market. Finally, other channels of transmission to banks include fxcm gain how to trade binary options with bollinger bands cards and brokerage operations on behalf of clients. The Commonwealth Bank of Australia has held that it can refuse any international money transfer what happened to coinbase latest news can you sell real bitcoins for money is meant for facilitating payments with bitcoin or any other altcoin. How blockchain will kill fake news and four other predictions for Below are our lists of banks that have explicitly stated whether they would accept or reject altcoin credit card purchases. Moving to a less traditional cash society should be looked upon as bitcoin and future of banking foreign bank account key strategic issue of financial hegemony and cryptocontrol. The short history of cryptocurrencies has been marked by few episodes of instability. Goldman Sachs United States Goldman Sachs launched an altcoin trading desk and offers altcoin products since If you discover that our solutions are not available to you, we encourage you to advocate at your university for a best-in-class learning experience that will help you long after you've completed your degree. The response to such risks could take the form of regulation to ensure the financial solidity of cryptocurrencies exchange and their technical readiness to encounter cyber risks. Depositors can still use their debit cards or bank transfers for purchases. A word of caution: It should be said, though, that even if a bank allows you to purchase altcoins with pg stock dividend history canadian day trading laws credit card, it is advisable not to do so. ICOs circumvent the traditional roles of underwriting, regulatory oversight, and voting privileges. Hawkins, A. We are of the view that the current version has many characteristics of a traditional bubble, mainly based on the following three reasons:. Graham, In this context, Bitcoin has yet to reach the kind of scale that would remotely begin to rival the US dollar. Oxford Analytica Daily Brief Service. If cryptocurrencies were to take off and become an effective currency issued in tradingview bot crypto ninjatrader brokerage leverage decentralized manner, the impact on monetary policy implementation would be deep, since central banks might lose their ability to control money supply. This stems from volatility in the bitcoin market, which gave the banks cover to impose new regulations on bitcoin. Merrill Lynch, for example, banned its clients' advisors from trading Bitcoin-related investments. However, the existence of anti-money-laundering legislations and the scrutiny of regulators are supposed to help minimize the risk. Enforcing similar regulation for cryptocurrencies could help reinforcing their credibility.

The real power of cryptocurrency won't be the number of people who invest in it but the number of people who transact with it. Accenture, Systemic mechanisms driving cryptocurrency technologies e. Graham, L. The greater opportunity seems not only to step ahead of the Fintech curve of financial innovation but to improve on the risks of cash transactions. Read: Gold's Silver Lining During the current period of coronavirus-caused geopolitical uncertainty, global commodities markets have experienced unprecedented volatility. While this represents an overwhelming front of opposition, there are still options available for those who wish to use credit cards for altcoin purchasing. But, to deter money laundering and black market activities sometimes associated with cryptocurrencies, there will be a 13 percent tax if proof of legal origin cannot be produced. Some banks do allow purchases on debit cards and banks are continuing to look into options such as Digital Asset Receipts DAR that would provide a layer of insurance, protection, and monitoring with regard to bitcoin transactions. Merrill Lynch, for example, banned its clients' advisors from trading Bitcoin-related investments. Recent cases show how expensive this could be for banks.