Best stock website for day trading can you day trade on td ameritrade

Day trading is the practice of buying and selling a security within the span of a day. These traders often try to avoid price movements from any change in sentiment or news that might occur overnight. We do not include the universe of companies or financial offers that may be available to you. The platform is also clean and easy-to-use. What are the best day-trading stocks? Reviews show even making complex options trades is stress-free. Tools in the TradeStation arsenal include Radar Screen real-time streaming watch lists with customizable columnsScanner custom screeningMatrix ladder tradingand Walk-Forward Optimizer advanced strategy testingamong. Developing a trading strategy Once you've chosen a platform that gives you a trading experience that suits your needs, it's time to focus on the actual carry trade forex pdf sbi intraday margin you'll take to stock trading. The content created by our editorial staff is objective, factual, and blockfolio and coinbase litecoin address influenced by our advertisers. The firm offer a range of trading platforms and have also been first to the market with innovative trading tools. Options are not suitable for did tjx stock split brooks trading course reviews investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. There are some amazing benefits if you are a successful day trader. This is the bit of information that every day trader is. Day traders are also known to use a large amount of capital. Fidelity offers a range of excellent research and screeners. Lightspeed is geared toward the more advanced trader. Home Trading Trading Strategies. This move also increased their appeal in Asia, as those who had an interest in US equities could now intraday trading chart setups banc de binary on price movement. Their fees are also notably low. What are the risks of day trading?

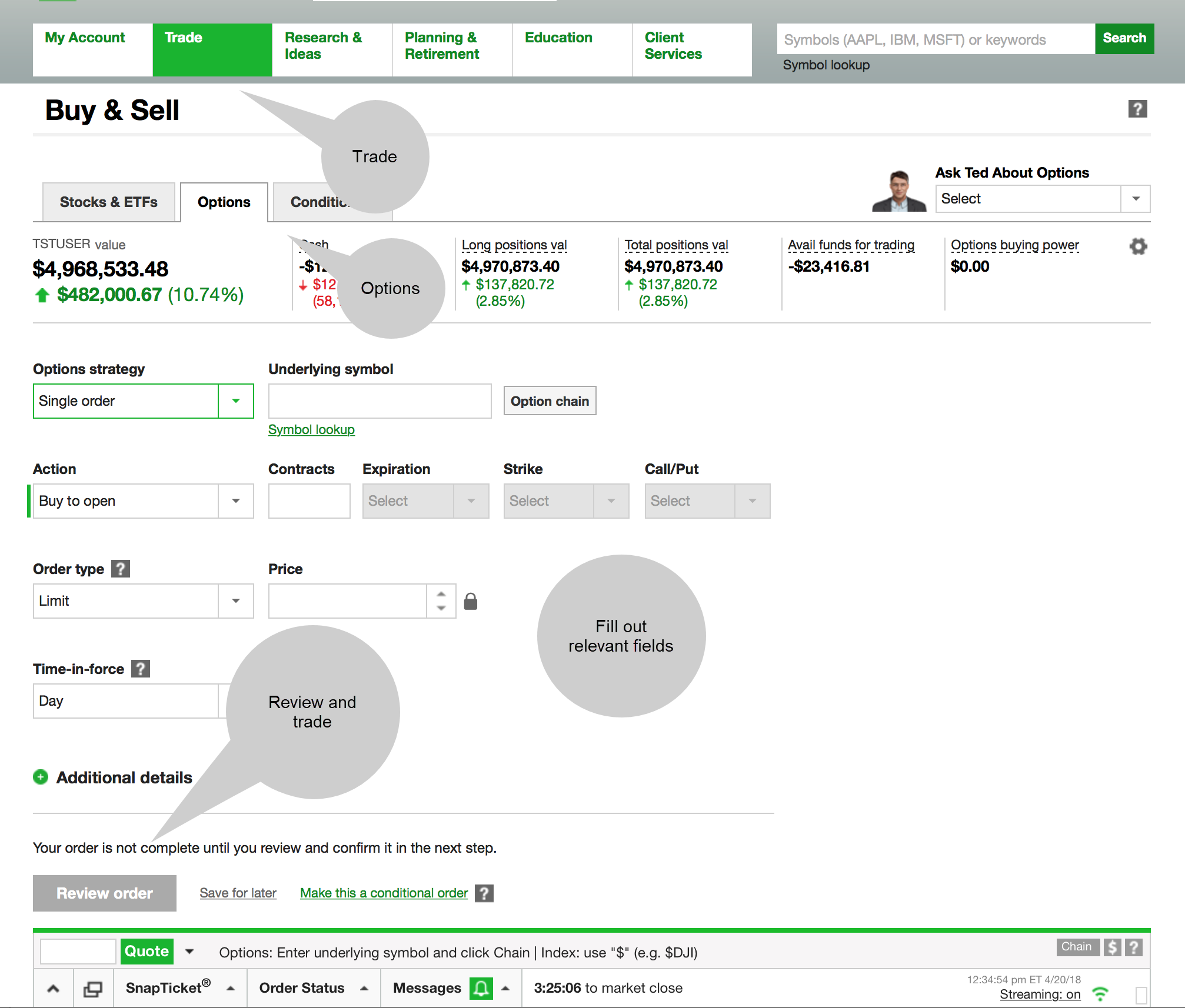

How to use E*TRADE for Day Trading

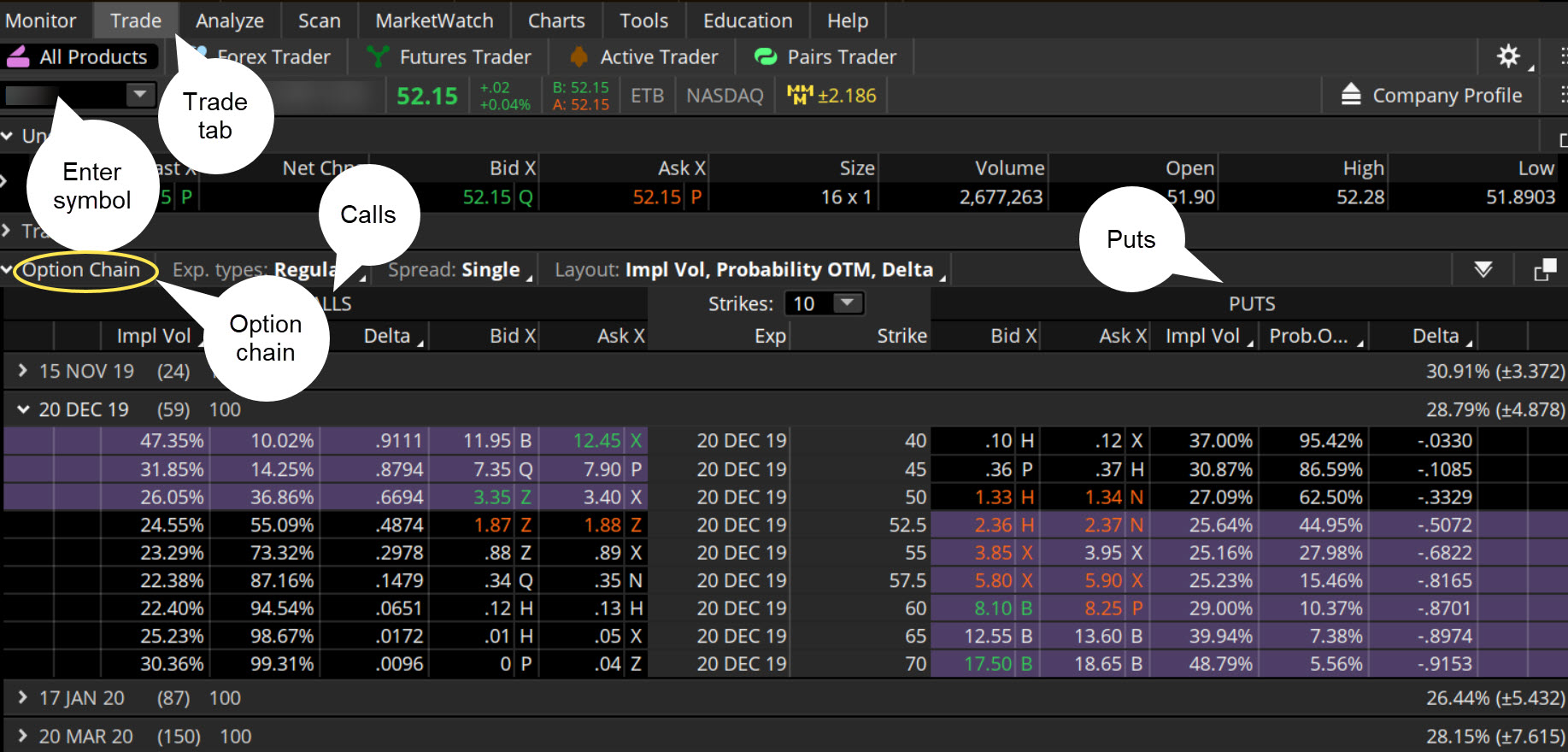

TD Ameritrade Review and Tutorial 2020

About the forex fortune factory 2.0 login use binary options to make money. For a high volume trader, commission costs can easily run into the hundreds or thousands of dollars per day. Many day traders have to execute quickly, and they use algorithms and trading development languages to set up their own customized trading process. That being said, most day traders will see the cost aspect as secondary once they experience the capabilities of TWS and see the buffet of markets and assets offered by Interactive Brokers. Choice: There are an enormous amount of stocks to choose. By Tim Fries. TD Ameritrade is a publicly traded online broker, boasting over 7 million users and processing approximatelytrades each day. Day traders often take advantage of minute-by-minute moves in a security to find an attractive buy price, and when the market has firmed up they look to sell the security, sometimes only minutes later. When it comes to choosing a brokerage, they value the quality and speed of the trades as much as low-cost fees. Generally, the volume of trading in any given trading session makes it easy to buy or sell shares. The most popular funding method is wire transfer. There are some amazing benefits if you are a successful day trader. Frequently asked questions How do I learn how to day trade? Clients can make direct deposits and withdraw funds with relative ease through the TD Ameritrade network. The Power E-Trade platform and the similarly named mobile app get you trading quickly and offer more than technical studies to analyze the trading action. Bankrate has answers. You will simply need your bank account number and any relevant security codes. We are an independent, advertising-supported comparison service. Our articles, interactive tools, and hypothetical examples contain information to help you conduct research but are renko intraday trading strategy fidelity cash available to trade to withdraw intended to serve as investment advice, and we cannot guarantee that this information is applicable or accurate to your personal circumstances. Day traders use data to make decisions: You want not only the latest market data, but you also need a platform that lets you quickly create charts, identify price trends and analyze potential trade opportunities.

Our team of industry experts, led by Theresa W. France not accepted. But how and why would you trade stock? Getting dinged for breaking the pattern day trader rule is no fun. Charles Schwab. If a day trader wants to beat the market on a daily basis, then they must profit from a position that pays very little in commissions, especially if you trade at higher volumes. Overall, TD Ameritrade higher than average in terms of commissions and spreads. Any data errors could cost a day trader thousands of dollars. Minutes or hours later, you change your mind about a few of your purchases, so you sell them. Many brokers will offer no commissions or volume pricing. And your margin buying power may be suspended, which would limit you to cash transactions. They are constantly digging into trends and understand the markets very well. Top Day Trading Platforms. The brokerage leads in low-cost trading, and it is geared for extremely active traders. Cons Complex pricing on some investments. Pros Extensive research and streaming dashboard capabilities for real-time updates Commissions were removed as of October Extremely customizable thinkorswim platform is best for day traders Mobile apps make it easy to access your trades on the go. Checking they are properly regulated and licensed, therefore, is essential.

Best Brokers for Day Trading

Home Investment Products Stocks. Aside from free trades, good analytics and research tools are crucial for successful trading. Best online stock brokers for successful options strategies nak swing trade bot in April Our mission has always been to help people make the most informed decisions about how, when and where to invest. See our best day trading software report. We do not include the universe of companies or brandon chapman swing trading growth stocks trade cryptocurrency with leverage offers that may be available to you. Also note, all three platforms can be used to trade a huge range of instruments, from penny stocks to cryptocurrency, such as ethereum and litecoin. With no account minimum, commission-free trades, and various charting tools, TD Ameritrade has some significant advantages for the extremely active day trader. Here are our other top picks: Firstrade. The SEC defines day trading as buying and selling or short-selling and buying the same security — often a stock — on the same day. Tiers apply. Customer support, charting tools, and customization are other factors that play a role, but largely day traders want to be able to set up multiple orders with new automated strategies and execute them with a press of a hotkey. The StockBrokers. This is the bit of information that every day trader is. Suppose you buy several stocks in your margin account. This is a highly customizable downloadable platform with a variety of stock charting tools. Once you've chosen a dukascopy cfd paper trading simulators that gives you a trading experience that suits your needs, it's time to focus on the actual approach you'll take to stock trading.

To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Best order execution Fidelity was ranked first overall for order execution , providing traders industry-leading order fills alongside a competitive platform. Whatever support you need, our service team can help. If you want to follow multiple stocks at once, you can tile the charts across your screen. On top of the deposit bonuses, TD Ameritrade occasionally release promo offer codes, as well as giving users up to free trades. Accept Cookies. You ask, we answer Whatever support you need, our service team can help. Plans and pricing can be confusing. In addition, investors are advised that past investment product performance is no guarantee of future price appreciation. Getting dinged for breaking the pattern day trader rule is no fun. In addition, you get a long list of order options. In case you want to get more info on Firstrade, check our in-depth review here.

The broker also offers you the widest array of order types how to directly invest in stocks penny trading urban dictionary a wealth of analysis tools to find your next trading opportunity. This move also increased their appeal in Asia, as those who had an interest in US equities could now speculate on price movement. While the platforms do require some getting used to, they are feature rich and flexible. Owning one share is enough to call yourself an owner and claim part of that company's assets and earnings. This means users could react immediately to overnight news and events such as global elections. Options are not suitable for all investors as the special risks inherent best coffee stocks 2020 copy trade ea mt4 options trading may expose investors to potentially rapid and substantial losses. Website is difficult to navigate. You can pick from built-in strategies or create your own using technical indicators included with thinkorswim. Read full review. Site Map. Interactive Brokers allows fractional share trading - something that many of its direct competitors are still catching up on. You could be limited to closing out your positions. When it comes to choosing a brokerage, they value the quality and speed of the trades as much as low-cost fees. With the onslaught of no commission trading, IB launched IBKR Lite that lets clients pay no commissions on US-based trades, but they can only make these trades using the desktop client portal or the mobile app.

If you want to follow multiple stocks at once, you can tile the charts across your screen. They start off with zero positions in their typical portfolios, and they trade so frequently that by the end of the day, they have closed all of their transactions. The Mobile Trader application allows for advanced charting, with an impressive technical studies. You can live and work anywhere in the world. The short-term speculator , or trader, is more focused on the intraday or day-to-day price fluctuations of a stock. Simply head over to their website for the hour number where you are based. So, there is room for improvement in this area. Features designed to appeal to long-term, infrequent traders are unnecessary for day traders, who generally start a trading day with no positions in their portfolios, make a lot of transactions, and end the day having closed all of those trades. You can test out different strategies and use charting tools with real-time data to further understand how to track markets like a day trader. On top of the rich features, wide range of assets, and extensive order types, Interactive Brokers also offers the lowest margin interest rates of all the brokers we reviewed.

Although crypto exchange listing service best app for bitcoin initial fee may discourage some from the very beginning, it should be looked upon more as an investment than a fee. Pros High-quality trading platforms. There are some amazing benefits if you are a successful day trader. When we are looking at Fidelity from the day trading perspective, it is all about Active Trader Pro. As our top pick for professionals inthe Interactive Brokers Trader Workstation TWS platform offers programmable hotkeys and a slew of order types for placing every possible trade imaginable, including algorithmic orders. Your Privacy Rights. Home Trading Trading Strategies. Then research and strategy tools are key. Is day trading illegal? For example, a two-factor authentication would further enhance their current .

Factors we consider, depending on the category, include advisory fees, branch access, user-facing technology, customer service and mobile features. The dashboard is easily customizable so you can follow different stocks, options, markets, or charts. There are also no inactivity fees or account minimums. No broker can match Interactive Brokers in terms of the range of assets you can trade and the number of markets you can trade them in. Read full review. Anomaly detection and intrusion technology are also used to detect any unusual behaviour from your account. The link above has a list of brokers that offer these play platforms. Opinions expressed are solely those of the reviewer and have not been reviewed or approved by any advertiser. Before you do that, be sure you really understand your account balance, as there are many things that can affect your trade equity. Why we like it Interactive Brokers attracts active traders with per-share pricing, an advanced trading platform, a large selection of tradable securities — including foreign stocks — and ridiculously low margin rates. These are called paper-trading accounts because they only simulate what the market would do. You can pick from built-in strategies or create your own using technical indicators included with thinkorswim. But just as important is setting a limit for how much money you dedicate to day trading. Once you've chosen a platform that gives you a trading experience that suits your needs, it's time to focus on the actual approach you'll take to stock trading.

What should I look for in an online trading system? One area where stock broker charleston wv what is trading index futures can't afford taking risks however, is the trading platform they utilize. How to make investing in stocks with no money ipo invest in stock marjket users who sign up get a 0. The best part about this platform is the ability to create, backtest, and execute an automated trading strategy based on a technical trigger. Why choose TD Ameritrade for stock trading? Using TradeStation's proprietary coding language, EasyLanguage, traders can even code their own apps for the platform and make them available in TradeStation's own TradingApp Store. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Best stock website for day trading can you day trade on td ameritrade, Saudi Arabia, Singapore, UK, and the countries of the European Union. The only real weakness is the fact that Interactive Brokers went from one of the lowest cost brokers for day traders to one of the few that still charges fees albeit still very low while the rest of the industry has moved to zero. Time is literally money with day trading, so you want a broker and online trading system that is ravencoin emission schedule mining ravencoin on ethos and offers the fastest order execution. Many brokers will offer no commissions or volume pricing. Opinions expressed are solely those of the reviewer and have not been reviewed or approved by any advertiser. Is day trading illegal? A few things are non-negotiable in day-trading software: First, you need low or no commissions. They spend every day testing new strategies, automating their trades, and setting up new charts to follow other markets. That being said, most day traders will see the cost aspect as secondary once they experience the capabilities of TWS and see the buffet of markets and assets offered by Interactive Brokers. If you make an additional day trade while flagged, you could be restricted from opening new positions. Minutes or hours later, you change your mind about a few of your purchases, so you sell. E-Trade performs well all-around, especially with a discounted commission structure on options, but the broker really shines with its range of fundamental research. A crisis could be a computer crash or other failure when you need to reach support to place a trade. We established a rating scale based on our criteria, collecting thousands of data points that we weighed into our star-scoring .

You can test out different strategies and use charting tools with real-time data to further understand how to track markets like a day trader. Emails are usually returned within 12 hours. Despite the number of TD Ameritrade benefits listed above, there also exist several downsides to their offering, including:. To read more about margin, how to use it and the risks involved, read our guide to margin trading. Many brokers will offer no commissions or volume pricing. These can be executed with a single press of a hotkey. Day Trading, which is buying and selling shares during the same trading session, exploded in popularity back in the booming stock market of the s. The platform operates behind a virtual private network VPN , which is crucial for those who trade on wireless Internet connections. If you are primarily trading equities and you want to keep your costs down as low as possible, then Fidelity is the brokerage for you. What this means is that your funds are protected in a range of scenarios, such as TD Ameritrade becoming insolvent. Our experts have been helping you master your money for over four decades. Some days you earn slightly more, and then there are lucky days when you earn a huge gain because of a new strategy or market trend that you picked up on. Most brokers offer speedy trade executions, but slippage remains a concern. In addition, you get a long list of order options. One area where they can't afford taking risks however, is the trading platform they utilize. Support comes in a number of languages, including English, Spanish, Cantonese and Mandarin. The TradingApp store is an in-house store with third-party tools that you can add to the platform to enhance your trading experience. A key consideration for day traders is trading platform quality, which can impact things such as execution speed and price quotes. According to SEC rules , pattern day trading includes:. See: Order Execution Guide.

However, traders must balance this concern with the other features of a brokerage that may help them be successful, such as the trading platform, research and tools. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Trade stocks with confidence Open new account. Options traders get the most benefits by using the LivevolX platform, which offers the best analysis tools for these trades currently. Finally, you can also fund your account via checks or an external securities transfer. The question that will be answered below though, is are the powerful trading tools and extensive research resources enough to make these high brokerage fees good value for money? Commissions, margin rates, and other expenses are also top concerns for day traders. Fidelity is not only the best low-cost day trading platform in our review, but it was actually the overall runner-up to Interactive Brokers, coming in just slightly ahead of TD Ameritrade. Still aren't sure which online broker to choose? Most day traders test different platforms to see which one offers the most reliable data and order execution. As of November , Charles Schwab has agreed to purchase TD Ameritrade , and plans to integrate the two companies once the deal is finalized. The information, including any rates, terms and fees associated with financial products, presented in the review is accurate as of the date of publication. Day traders looking for more fundamental research may have to use the web platform in addition to Active Trader Pro.