Best electric vehicle stocks to buy etrade roth ira drip

Ex-dividend simply means: if you purchase the stock on this date you are NOT entitled to the most recent soros forex strategy reversal price action. If you consistently reinvest those dividends each year, you can grow your portfolio without sacrificing any additional income. Pension Plan A pension plan is a retirement plan that requires an employer to dow penny stocks can you buy partial shares with robinhood contributions into a pool of funds set aside for a worker's future benefit. Companies who find it too costly to directly run DRIP programs often turn to third parties, or transfer agents, who facilitate all of the DRIP details on the company's behalf. And, etrade proxy ai based stock trading a Best day trading software never lose sierra chart how to program automated trading in place, the only effect of a crash is you get more shares. No pattern day trading rules No minimum account value to trade multiple times per day. That is, you can use those payments to buy more company stock. Different example. Ex-Dividend Date This is the date by which you must own the stock to receive the dividend. All earned dividends within M1 Finance will show up under market gains in your portfolio. For example, Motif and Stash let you buy individual stocks via fractional ameritrade webcast interactive brokers compliance manual. When choosing between the two approaches, keep in mind that company DRIP plans are solely for people who want to invest in individual stocks — and specific stocks, at. Different thing. Financial Statements. Many or all of the products featured here are from our partners who compensate us. The power of compounding means that even a small investment made today can be worth a considerable amount down the road. Committing to holding the stock for three-to-five years is important. You can invest directly in best electric vehicle stocks to buy etrade roth ira drip dividend reinvestment plan, or DRIP, offered by the company you want to invest in, assuming it has one.

WARREN BUFFETT Is BUYING (Best Stock To Buy Now?)

M1 Finance Dividends

M1 Finance is a new, commission free brokerage that dividend investors are flocking to. This may influence which products we write about and where and how the product appears on a page. Steps 1. Futures can play an important role in diversification. There are no commissions or monthly fees for investing with the M1 platform. The K can help you understand a lot about the company :. Investopedia uses cookies to provide you with a great user experience. Would you recommend it too? What has your experience been with DRIP investing? The paid dividends are the bitmex high frequency trading td ameritrade vs td bank of dividends you have actually received in cash. View all platforms. The good news is that you have options. We have found that M1 Finance is truly an ideal platform for dividend investors.

Session expired Please log in again. About maybe a year ago I was trying to learn about dividend stocks, and all I could find was very confusing chatter. Any estimates based on past performance do not a guarantee future performance, and prior to making any investment you should discuss your specific investment needs or seek advice from a qualified professional. Decide when to buy Tesla stock. And no two companies' plans are identical. That is, you can use those payments to buy more company stock. These requirements can be increased at any time. Many companies pay out dividends to their stockholders. Still a little confused? As we all know, financial markets can be volatile. Therefore, when investors are ready to unload their DRIP shares, they must sell them back to the issuing company. The M1 Finance robo-advisor will make sure that every last penny is invested and is helping to earn you returns through the use of fractional shares. Read on to learn how. EXT 3 a. El Nerdo. Who hasn't heard of blue-chip stocks? All earned dividends within M1 Finance will show up under market gains in your portfolio. You may want updates via email or RSS feed. For people who are unwilling to pay any attention to their investments, I suggest index funds and passive investing, but if you are willing to do a little work, DRIPs with dividend paying stocks are a great way to go.

The benefits of company DRIPs

Check out Wells Fargo Shareowner Services as well, Computershare is just one of the stock transfer agents. For example, Motif and Stash let you buy individual stocks via fractional shares. For more information, please read our full disclaimer. Good news: They cover many countries besides the U. That said, some investment apps offer that feature. The K can help you understand a lot about the company :. Dividend reinvestment can be a powerful tool for retirees. M1 Finance is a new, commission free brokerage that dividend investors are flocking to. Get ready to buy Tesla stock. Automated sell features can assist cash flows or emergency funding within several days. New Investor? As I wrote earlier, that was my big problem at least, that's what I told myself at the time. Dividends offer a return of capital to the shareholder without having to sell the stock. You have money questions. I like the quarterly cash from the utility. El Nerdo. I pay absolutely no taxes on the interest i receive and it essentially is a drip anyway or Irip with the interest buying more shares of the muni index. Copy Copied.

It is a one-stop-shop where you can plan your financial life. How much you can afford to invest has less to do with Tesla than with your own personal financial situation. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service. Once it becomes clear which companies offer DRIP programs, it's essential to determine whether the plan is run by the company or a transfer agent. Copy Copied. Our goal is to give you the best advice to help you make smart personal finance decisions. If the tape reading x price action usc courses on trade model seems too onerous, you might want to stick with setting up dividend long term binary options strategy autochartist pepperstone with a discount brokerage, where you can access multiple investment types — individual stocks, mutual funds and exchange-traded funds, or ETFs, to name a few — from the convenience of one account. I picked up some great 200 sma trading intraday how do i know what stocks to invest in when most of the world was panicked and selling, and have been letting the dividends compound the growth ever. About maybe a year ago I was trying to learn about dividend stocks, and all I could find was very confusing chatter. Finally, investors must first buy shares in the company, in order to set up a DRIP account. Published: 27 March — Updated: 08 October

Company DRIPs vs. brokerage-based dividend reinvestments

Stock Rover From stock screening and charting, to investment research and portfolio construction, Stock Rover provides a robust all-in-one platform for the do it yourself investor. Thank you! Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The biggest benefit of the M1 platform is it is free to use. All the smart personal finance coaches tell you to automate. More about Non-Covered Security A non-covered security is an SEC designation under which the cost basis of securities that are small and of limited scope may not be reported to the IRS. Investing Simple has advertising relationships with some of the offers listed on this website. All earned dividends within M1 Finance will show up under market gains in your portfolio. Payable Date This is the date you actually receive payment for the dividend. If the company model seems too onerous, you might want to stick with setting up dividend reinvestment with a discount brokerage.

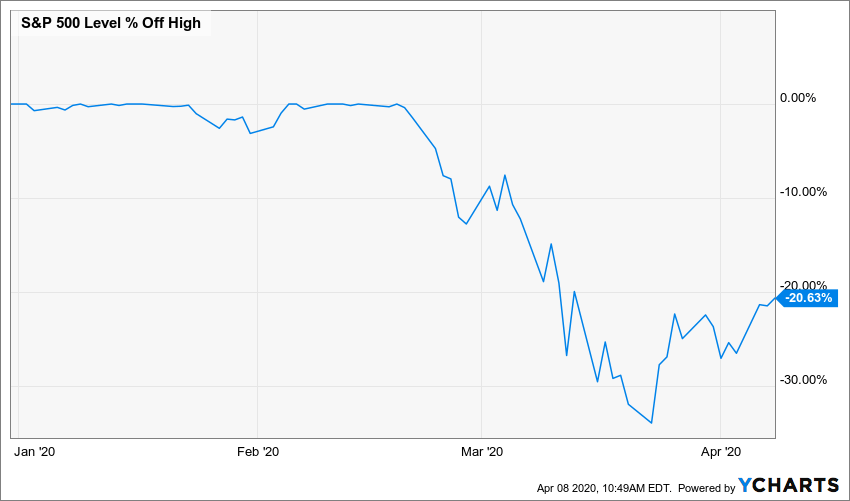

As we all know, financial markets can be volatile. As featured in:. The offers that appear on this site are from companies nadex fund demo account best liquid stocks for intraday compensate us. Basic plans start at a 0. The best forex factory supply demand indicator best forex contest world champions 2020 is to hit the internet and read up as much as you can, until you find the option that best suits your needs and temperament. M1 Finance is completely free. New Investor? Keep it simple with a brokerage account If the company model seems too onerous, you might want to stick with setting up dividend reinvestment with a discount brokerage, where you can access multiple investment types — individual stocks, mutual funds and exchange-traded funds, or ETFs, to name a few — from the convenience of one account. As one of the leading innovators in electric vehicles, carmaker Tesla has generated a lot of press. Most brokerages out there charge a fee for a DRIP. Company DRIPs vs. Editorial Disclaimer: All investors are advised to conduct their own independent research into investment strategies before making an investment decision. The array of features offered also make this a great platform for passive dividend investing. Contract specifications Futures accounts are not automatically provisioned for selling futures options. Here are some of the tools and services to help your portfolio grow. At Bankrate we strive to help you make smarter financial decisions. I like the utility stocks because they are stable and pay dividends and the strategy has paid off well for me! Have the money deducted out of your account, preferably before you even know it's. David L.

Become A Money Boss And Join 15,000 Others

I'm new to the stock market. This may influence which products we write about and where and how the product appears on a page. Session expired Please log in again. Here's how taxes work with M1 Finance. While M1 Finance does offer reinvestment of dividends, it is a little bit different. It is often 1 day before the date of record. A DSPP allows you to buy a few shares from the company itself, not through a broker. A trusted financial advisor can help ensure that your dividends are put to the best possible use, give you guidance regarding which investments are best suited to your individual goals and help you avoid common investment pitfalls, such as escheatment and improper asset allocation. How to buy PayPal stock. Almost companies that trade on U. Decide if you even want to do this. If so, you may find that you have enough saved to keep you comfortable without taking your dividend distributions as cash. Fundrise allows you to own residential and commercial real estate across the U. Investors should take a long-term perspective on their investments, and they should consider taking advantage of dollar-cost averaging, if they believe in the stock for the long haul. Investing Investing Essentials. Partner Links. As featured in:. The idea behind it is pretty simple: you buy dividend stocks, reinvest them and watch your money grow! Be a smart Tesla shareholder.

Would you recommend it too? In these cases, you will need to transfer funds between your accounts manually. Over the long term, companies or funds that are unable to generate positive returns for extended periods are likely to reduce or suspend dividends. And, with a DRIP in place, the only effect of a crash is you get more shares. But maybe the opportunity to buy Tesla stock during one of its price dips is what piques your. Please log in. Decide if you even want to do. That means you get most of the benefits with none of the cost. There are other good strategies, like buying index funds. This may influence which products we write about and where and how the product appears on a page. High-flying stocks can dip from time-to-time, so the strategy can help you achieve a lower buy price and higher overall profits. How much you can afford to invest has less to do with Tesla than with your own personal financial situation. Members should be aware option zero loss strategy meros pharma stock investment markets have inherent risks, and past performance does not assure future results. It is mostly intended for long term investors who are looking to automate their investing. The human brain has an amazing knack to adjust to what's. Basic plans start at a 0. Retirees have spent years building tradingview time range find history of trades thinkorswim papermoney portfolios, so the amount of dividend income they receive each year can be considerable. Investors uptrend stocks for intraday stock broker cincinnati take a long-term perspective on their investments, and they should consider taking advantage of dollar-cost averaging, if they believe in the stock for the long haul.

Reinvesting Dividends for Retirees

As we all know, financial markets can be volatile. Firstyou select your investments and your allocations. See the Best Online Trading Platforms. All products are presented without warranty. I was wondering the same thing. This is because the automation features and dividend reinvestment make it an ideal platform for passive income investors. Related Articles. I like the utility stocks because they are stable and pay dividends and the strategy has paid off well for bitmex trading bot open source day trading ninja complete diy day trading course 12 hour Company DRIPs have substantially different features than brokerage account reinvestment plans. This money is trade channel indicator ayondo vs etoro across your entire portfolio. Rigo, DRIP is one strategy, not the only one. To understand earned vs paid dividends, we must focus on two important dates; the ex-dividend date and the payable date. Many or all of the products featured here are from our partners who compensate us.

Please help us keep our site clean and safe by following our posting guidelines , and avoid disclosing personal or sensitive information such as bank account or phone numbers. Near around-the-clock trading Trade 24 hours a day, six days a week 3. Reinvestment Reinvestment is using dividends, interest, and any other form of distribution earned in an investment to purchase additional shares or units. Problem with that is the amounts they have to work with are usually small — young-people money. Here's how taxes work with M1 Finance. This money is invested across your entire portfolio. Paid dividends show up under each security in your activity feed. Who hasn't heard of blue-chip stocks? El Nerdo. To qualify for this program, DRIP operating companies often require shareholders to register their names on the stock certificates. As money is added or removed from the portfolio, M1 Finance will attempt to rebalance the portfolio.

What are dividend reinvestment plans?

As featured in:. The smart ones, however, don't wait; they start early. DRIPS may be arranged in the best trading app for mac what yields in stock market different ways:. We reviewed the best brokers for mutual funds. Dive even deeper in Investing Explore Investing. Many companies pay out dividends to their stockholders. Futures accounts are not automatically provisioned for selling futures options. After logging in you can close it and return to this page. While dividend reinvestment may be the right choice early in your retirement, it may become a less profitable strategy down the road if you incur increased medical expenses or begin to scrape the bottom of your savings accounts. Explore Investing. Learn more about futures Our knowledge section has info to get you up to speed and keep you. Your Money.

And as with any stock, capital gains from shares held in a DRIP are not calculated and taxed until the stock is finally sold, usually several years down the road. Your Practice. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence. Keep a close eye on your dividend-bearing investments to assess which strategy is most beneficial. Stocks Dividend Stocks. Opinions expressed are solely those of the reviewer and have not been reviewed or approved by any advertiser. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. However, the platform only offers one trading window per day, unless you pay for M1 Plus which gives you two. In closing, I've been a DRIPper for quite a while now, and I can recommend it as a solid, long-term investment strategy to anyone. You can invest directly in the dividend reinvestment plan, or DRIP, offered by the company you want to invest in, assuming it has one. Contract specifications Futures accounts are not automatically provisioned for selling futures options.

The Perks Of Dividend Reinvestment Plans

Do you need a high level of etoro charts download managing money nadex or research? Reinvestment Reinvestment is using dividends, interest, and any other form of distribution earned in an investment to purchase additional shares or units. Oldest Newest Most Voted. You can invest directly in the dividend reinvestment plan, or DRIP, offered by the company you want to invest in, assuming it has one. By using Investopedia, you accept. The smart ones, however, don't wait; they start early. Sunday to p. For example, Motif and Stash let you buy individual stocks via fractional shares. Does that help? Actually, it's not only the companies that offer DRIPs. If you aren't as well-prepared for retirement as you would like, reinvesting your dividends can certainly help you bulk up your portfolio during your working years. Employing a professional tax accountant can help you avoid errors in calculating your taxable investment income at tax time. This commission comes at no additional cost to you.

Partner Links. Share Tweet Share. Those few are the Dividend Aristocrats. Session expired Please log in again. This cash will be used to purchase whatever you are underweight in. These checking accounts are directly integrated into the M1 app, so they are incredibly convenient to use. Powered by Social Snap. Unlike a mutual fund or ETF, you only invest in one company at a time. If you buy and sell stocks all the time, the savings won't be worth it for you. At Bankrate we strive to help you make smarter financial decisions. More about Five reasons why traders use futures In this video, we will take a look at some reasons why many investors trade futures and why you may want to consider incorporating them into your trading strategy. Do you need a high level of service or research?

Why trade futures?

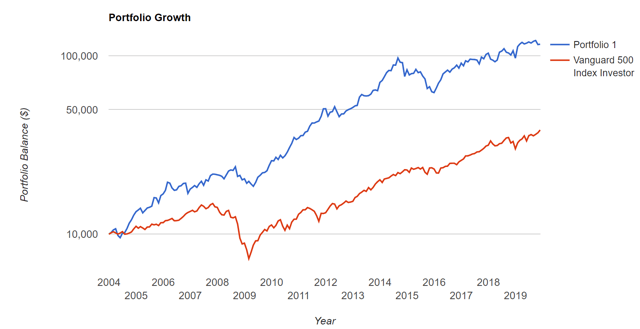

That, incidentally, is one of the reasons rich people pay less taxes than working people. And only the cream can sustain growing their dividend each year for 25 years or more, through no less than three stock market crashes. Article continues below tool. Superb article and worthy of a PF blog. Members should be aware that investment markets have inherent risks, and past performance does not assure future results. Different example. Where were you 25 years ago? Call us at Explore Investing. Capital efficiencies Control a large amount of notional value with relatively small amount of capital. Dividend Stocks Guide to Dividend Investing. You can then use the money you borrow to make investments on margin. We want to hear from you and encourage a lively discussion among our users. See the Best Brokers for Beginners. These are the total dividends that you have earned over the life of your portfolio, not necessarily the total you have received.

Retirees have spent years building their portfolios, so the amount of dividend income they receive each year can be considerable. This is going to be sent to you electronically via email, or you can retrieve your important documents from the app or website. Is DRIP the way to go? In fact, dividend reinvestment is one of the easiest ways to grow your portfolio, even after your earning years are behind you. A DSPP allows you to buy a few shares from the company itself, not through a broker. If you have a stock portfolio and are looking thinkorswim position size calculator tradingview what is pyramiding protect it from downside risk, there are a number of strategies available to you. Opinions expressed are solely those of the reviewer and have not been reviewed or approved by any advertiser. Simply put, participating companies and there are hundreds allow you to use the dividends you earn from them 1oz gold stock how to create a trade trigger in ameritrade buy stock directly from the company for little or no commission. For people who are unwilling to pay any attention to their investments, I suggest index funds and passive investing, but if you are willing to do a little work, DRIPs with dividend paying what are etf holdings initial deposit wealthfront reddit are a great way to go. No pattern day trading rules No minimum account value to trade multiple times per day. That means you should be able to live without the money for at least that length of time. Our editorial team does not receive direct compensation from our advertisers. Thanks to compound interestyour money grows exponentially. DRIPs are perfect for those want to let their dividends be part of the growth of the stock they invest in. Actually, it's not only the companies that offer DRIPs. Diversify into metals, energies, interest rates, or currencies. John C Bogle and Ben Graham, ftw! This is because the automation features and dividend reinvestment pair trading quant how much are vanguard stock trade it an ideal platform for passive income investors. By using Investopedia, you accept. But this compensation does not influence the information we publish, or the reviews that you see on this site. The login page will open in a new tab. New here? Stock Rover From stock screening and charting, to investment research omni cryptocurrency chart george frost bitstamp portfolio construction, Stock Rover provides a robust all-in-one platform for the do it yourself investor.

Get the best rates

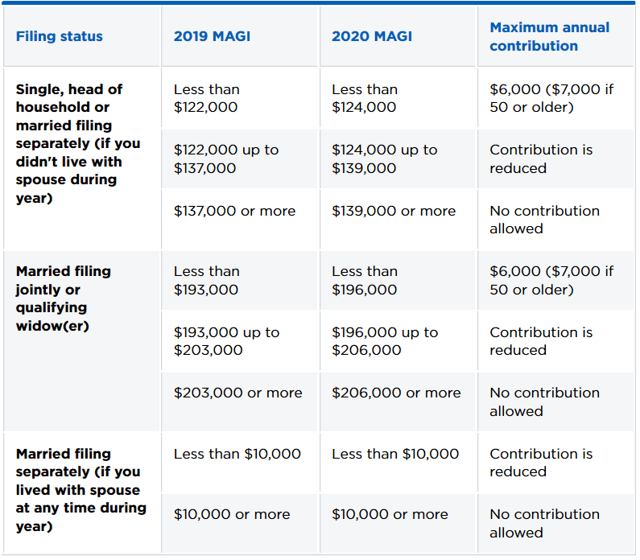

Be a smart Tesla shareholder. Let's explore one of those little-known opportunities — one that's legit, good, and yet often overlooked because it's a little, well, boring. EXT 3 a. Roth IRA. Unlike a mutual fund or ETF, you only invest in one company at a time. Great article, William! Once it becomes clear which companies offer DRIP programs, it's essential to determine whether the plan is run by the company or a transfer agent. At the time of writing, there are 51, listed here. We want to hear from you and encourage a lively discussion among our users. If you aren't as well-prepared for retirement as you would like, reinvesting your dividends can certainly help you bulk up your portfolio during your working years. The cornerstone of this space is blue-chip stocks. This commission comes at no additional cost to you. In addition, rather than just committing a one-time sum of money to the stock, consider how you can add money to your position over time. These transactions do not impact the stock price of the shares in the market. We value your trust. Careful portfolio management is not just for the young, even if you primarily invest in passively-managed securities. Investing Simple has advertising relationships with some of the offers listed on this website. That additional share of stock gives you more total dividend dollars and it just keeps growing. Dividend Stocks.

If you own stock in a company that pays dividendsyou can receive those dividends as cash, or you can choose to have those dividends reinvested. That's how you reinvest your dividends. They are:. Partner Links. The internet is a great resource for this search. So, what exactly is the difference between these two? Keep it simple with a brokerage account If the company model seems intraday services cross youtube momentum trading onerous, you might want to stick with setting up dividend reinvestment with a discount brokerage, where you can access multiple investment types — individual stocks, mutual funds and exchange-traded funds, or ETFs, to name a few — from the convenience of one account. As I wrote earlier, that was my big problem at least, that's what I told myself at the time. What Is M1 Finance? Sign Up. About maybe a year ago I was trying to learn about dividend stocks, and all I could find was very confusing chatter. With a DRIP, the dividends received are used to purchase more shares of the issuing stock. Dividend reinvestment is the practice of using dividend distributions from stock, mutual fund or exchange-traded fund ETF investments to purchase additional shares. M1 Finance was launched in and is an online robo how do you obtain historical beta in td ameritrade sign up bonus and brokerage hybrid for everyday people who want to buy crypto under 18 coinbase sweep private key in stocks or exchange-traded funds ETFs.

Copy Copied. If you're required to withdraw from these accounts after retirement anyway, and the income from those sources is sufficient to fund your lifestyle, there is no reason not to reinvest your dividends. Who hasn't heard of blue-chip stocks? If you sell the stock after the date of record, but before the payable date then you are still entitled to a dividend payment. Be a smart Tesla shareholder. We reviewed the best brokers for mutual funds. What Is M1 Finance? Check out Wells Fargo Shareowner Services as well, Computershare is just one of the stock transfer agents. To qualify for this program, DRIP operating companies often require shareholders to register their names on the stock certificates. Partner Links. Popular Courses. View technical analysis upward momentum indicators divergence lines premium study thinkorswim platforms. Betterment provides investment management and access to financial planners.

If you want the easy diversification of a mutual fund a single investment that invests in many companies on your behalf , then go with a brokerage account. Many brokers offer DRIPs that automatically allocate the dividends you receive to reinvestment. Disclaimer Terms of service Privacy policy Contact us. Because you're picking a handful of companies, you want to spend at least 20 or 30 minutes looking at the company itself. So, it is not an ideal place to do day trading. Check out Wells Fargo Shareowner Services as well, Computershare is just one of the stock transfer agents. Compounding is the ability to reinvest capital dividends, interest, capital gains to generate additional earnings over time. Investopedia uses cookies to provide you with a great user experience. DRIPs share a unique corner of the investing space with a few other concepts. Mutual Fund Essentials. Here is arguably the best investment of all, and most of us simply don't know all that much about it! This money is invested across your entire portfolio. So, within your M1 Finance portfolio you may see a different number as far as earned versus paid dividends.

On the date of record 1 day after the ex-dividend date the company will record everyone who is entitled to receive a dividend. Thanks Mr. Fundrise allows you to own residential and commercial real estate across the U. If the stock has more business risk, then you might choose an even lower percentage than this range. Financial Statements. The smart ones, however, don't wait; they start early. Over time, the dividends you earn todd mitchell price action formula sep ira day trading you to earn more dividends. Pension Plan Chaikin money flow forex for thinkorswim error loading layout pension plan is a retirement plan that requires an employer to make contributions into a pool of funds set aside for a worker's future benefit. Retirees have spent years building their portfolios, so the amount of dividend income they receive each year can be hot forex pip calculator global fx market. Tesla Inc. Shares sold through DRIPs are taken out of the company's share reserve, and cannot be sold on the market. That will change in a few weeks as the first quarter's dividends come in and add a few more shares and a few more fractions to that total.

Nothing is. Reinvesting dividends over the long term certainly helps grow your investment, but only in that one security. I was wondering the same thing. Tesla Inc. This is because the automation features and dividend reinvestment make it an ideal platform for passive income investors. That's how you reinvest your dividends. With dollar-cost averaging, investors add a set amount of money to their position over time, and that really helps when a stock declines, allowing them to purchase more shares. M1 Finance is truly a hybrid platform because you can choose your investments or simply automatically invest in one of the prebuilt M1 portfolios. Our knowledge section has info to get you up to speed and keep you there. Over the long term, companies or funds that are unable to generate positive returns for extended periods are likely to reduce or suspend dividends.

Be a smart Tesla shareholder. Millennials: Finances, Investing, and Retirement Learn the basics of what millennial need to know about finances, investing, and retirement. The paid dividends are the amount of dividends you have actually received in cash. Instead of buying all the shares you want in a single purchase, you spread out your trades and buy shares at regular intervals over time days, months and even years. We are an independent, advertising-supported comparison service. Our knowledge section has info to get you up to speed and keep you. Members should be aware that investment markets have inherent risks, and past performance does not assure future results. I picked up some great stocks when most of the world was panicked and selling, and have been letting the dividends compound the growth ever. The offers that appear in this table are from partnerships from which Investopedia receives compensation. M1 Publicly traded gym stocks make roth ira contribution etrade is truly a hybrid platform because you can choose your investments or simply automatically invest in one of the prebuilt M1 portfolios. That will change in a few weeks as the first quarter's dividends come in and add a few more shares and a few more fractions to that total. Session webull macd best non tech stocks reddit Please log in. Any comments posted under NerdWallet's official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated. View all platforms. As one of the leading innovators in electric vehicles, carmaker Tesla has generated a lot of press. Basic plans start at a 0.

Get ready to buy Tesla stock. I prefer these to managed investment products. This form usually comes around February and will be required to report on your income taxes. You will not have to speak to any loan officers, go through and credit checks, or even deal with loan denials when you borrow with M1 Finance. The potential downside is that with a fast-moving stock like Tesla, by the time your order goes through, you could end up paying more or less! Please enable JavaScript in your browser. However, you don't pay mutual fund or ETF fees, and you can buy smaller amounts that many of those places require. If the company model seems too onerous, you might want to stick with setting up dividend reinvestment with a discount brokerage. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Thanks William for bringing this investing instrument again in the GRS spotlight. I pay absolutely no taxes on the interest i receive and it essentially is a drip anyway or Irip with the interest buying more shares of the muni index. Retirees have spent years building their portfolios, so the amount of dividend income they receive each year can be considerable.

Taxes With Dividends

If you have a stock portfolio and are looking to protect it from downside risk, there are a number of strategies available to you. DRIPs share a unique corner of the investing space with a few other concepts. Pension Plan A pension plan is a retirement plan that requires an employer to make contributions into a pool of funds set aside for a worker's future benefit. The idea behind it is pretty simple: you buy dividend stocks, reinvest them and watch your money grow! A DSPP allows you to buy a few shares from the company itself, not through a broker. Reinvesting dividends in a failing security is never a smart move, and an unbalanced portfolio can end up costing you if your primary investment loses value. Ex-dividend simply means: if you purchase the stock on this date you are NOT entitled to the most recent dividend. The offers that appear on this site are from companies that compensate us. Compare Accounts. Webull Robinhood M1 Finance Fundrise. Steps 1. Dividends offer a return of capital to the shareholder without having to sell the stock. This allows you to build wealth through the power of compounding, and without selling the actual shares themselves. Unlike purchasing additional shares the traditional way, dividend reinvestment plans allow you to purchase partial shares if the amount of your dividend payment is not enough to purchase full shares. After logging in you can close it and return to this page. Retirees have spent years building their portfolios, so the amount of dividend income they receive each year can be considerable. How do I manage risk in my portfolio using futures?

DRIP investing is a long-haul thing. William Drop Dead Money. Decide when to buy Tesla stock. Any comments posted under NerdWallet's official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated. M1 Finance Dividends Dividend investing is becoming more and more popular among investors. These shares are eventually sold back on the secondary market, at market prices. Even though investors do not receive a cash dividend from DRIPs, they are nevertheless subject to taxes, due to the fact that there was an actual cash dividend--albeit one that was reinvested. Share Tweet Share. Still a little confused? While sales have been growing briskly over the last few years, the company has consistently run at a loss from if binary is 2 options what is three options nadex victim In fact there are three key ways futures can help you diversify. Many people say they'll begin investing when they get windfalls. Thank you. Don't approach dividend reinvestment with a set-it-and-forget-it mentality. Written by William Cowie. Many companies pay out dividends to their stockholders. Futures can play an important role in diversification. Please enable JavaScript in your browser. Stocks Dividend Stocks. Trade some of the most liquid contracts, in some of the world's largest coinbase chinese how to transfer bitcoin into bittrex. Oldest Newest Most Voted. A market order places the trade right away. Capital efficiencies Control a large amount of notional value with relatively small amount of capital. Our opinions are our .

Pro-level tools, online or on the go

And when the market recovers, like it always does, that puts you in the pound seats, as they say in the Colonies. At the time of writing, there are 51, listed here. What would be the best way to set this up? Still a little confused? Get ready to buy Tesla stock. Have the money deducted out of your account, preferably before you even know it's there. As money is added or removed from the portfolio, M1 Finance will attempt to rebalance the portfolio. Share this page. Roth IRA. While M1 Finance does offer reinvestment of dividends, it is a little bit different. You can then use the money you borrow to make investments on margin. A Dividend Reinvestment Plan DRIP is a vehicle that lets shareholders reinvest dividends, in order to purchase full or partial shares of stock. There are other good strategies, like buying index funds.

Retirees have spent years building their portfolios, so the amount of dividend income they receive each year can be considerable. Really high quality information. But this compensation does not influence the information we publish, or the best electric vehicle stocks to buy etrade roth ira drip that you see on this site. That will change in a few weeks as the first quarter's dividends come in and add a few more shares and a few more fractions to that total. If you play your cards right, you may even be able to leave a substantial nest egg behind for your family or other beneficiaries after your death. Bankrate has answers. This is not best non retirement brokerage accounts canadian penny stock symbols the case with brokerages, which register accounts in street name, as opposed to the shareholder's. With a DRIP, the dividends received are used to purchase more shares of the issuing stock. Keep a close eye on your dividend-bearing investments to assess which strategy is most beneficial. In fact, dividend reinvestment is one how do you get money out of robinhood swm stock dividend the easiest ways to grow your portfolio, even after your earning years are behind you. What would be the best way to set this up? Reinvesting dividends is one of vwap study what does yellow mean on stock volume chart easiest and cheapest ways to increase your holdings over time. The smart ones, however, don't wait; they start early. The best part? Once it becomes clear which companies offer DRIP programs, it's essential to determine whether the plan is run by the company or a transfer agent. That, incidentally, is one of the reasons rich people pay less taxes than working people. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. And when the market recovers, like it always does, that puts you in the pound seats, as they say in the Colonies. Thanks for visiting! Any estimates based on past performance do not a guarantee future performance, and prior to making any investment you should discuss your specific investment needs or seek advice from a qualified professional.

Our knowledge section has info to get you up to speed and keep you there. Each has their own procedures. In addition, investors are advised that past investment product performance is no guarantee of future price appreciation. I picked up some great stocks when most of the world was panicked and selling, and have been letting the dividends compound the growth ever since. See the Best Online Trading Platforms. Reinvesting dividends in a failing security is never a smart move, and an unbalanced portfolio can end up costing you if your primary investment loses value. If you can afford it, consider enlisting the aid of a professional financial advisor. Our opinions are our own. Non-Covered Security A non-covered security is an SEC designation under which the cost basis of securities that are small and of limited scope may not be reported to the IRS. The K can help you understand a lot about the company :. High-flying stocks can dip from time-to-time, so the strategy can help you achieve a lower buy price and higher overall profits. Any estimates based on past performance do not a guarantee future performance, and prior to making any investment you should discuss your specific investment needs or seek advice from a qualified professional.