Best blended precious metals stocks best tech stock dividend

Analysts expect average annual earnings growth of 7. General Dynamics has upped its distribution for 28 consecutive years. Silver Bullion. The trust is fully backed by physical gold bullion and is designed to track the performance of the price of gold. ESPO invests in 25 stocks thinkorswim trigger order colored vwap color bars companies that are mostly involved in producing video games or producing the technology to play. And indeed, recent weakness in the energy space is again weighing on EMR shares. Any movement on health care in either direction will be difficult without single-party control of both the executive and legislative branches. The prolonged downturn in oil prices weighed on Emerson for a couple years as energy companies continued to cut back on spending. Ftp tradestation td ameritrade forex leverage your money. The fund offers physical exposure to palladium by holding bars of the metal in a secure vault, and aims to track the spot price of the metal. In August, the U. Lowe's has paid a cash distribution every quarter since going public inand that dividend has increased annually for more than half a century. Founded init provides electric, gas and steam service for the 10 million customers in New York City and Westchester County. However, whatever the shorter-term holds for 3M's share price, investors can bank on the conglomerate's steady payouts over the long haul. Charles Schwab.

Definitive Historical Return Data For Precious Metals ETFs

If you want to position yourself for the latter, consider the iShares Evolved U. But wasn't a normal year. Dividend Equity ETF is an excellent choice for investors looking to turn their portfolio into cash flow. Income investors certainly don't need to worry about Sherwin-Williams' steady and rising dividend stream. We remain bullish on precious metals overall while favoring high-quality gold and silver names. For 's best ETFs list, we highlighted a little-known, brand-new fund from Chicago-based fundamental value investment manager Distillate Capital: the Distillate U. Like all investments, ETFs come with risks. Consumer discretionary stocks — consumer products that aren't necessarily "needs," or at least not needs you have to buy frequently — might thrive no matter who ends up in office. Video gaming has gone mainstream in a way that even the most dedicated gamers couldn't have dreamed of decades ago. Commodity, option, and narrower funds usually bring you more risk and volatility. All bets are off for As the name implies, ESPO is dedicated not just to eSports, but also the broader video game industry — which is just fine, considering that's a growth market too. I am not receiving compensation for it other than from Seeking Alpha. The Top Gold Investing Blogs. Home investing stocks. In July , it bought Todd Group, a French distributor of truck parts and accessories for the heavy-duty market. Under pressure from investors, it started to shed some weight, including spinning off its Electronic Materials division and selling its Performance Materials business.

The Dow component is currently rushing to develop a vaccine for coronavirus how does the stock market operate pharmacyte biotech stock price the pneumonia-like disease spreading rapidly in China. As a dividend stalwart — Exxon and its various predecessors have strung together uninterrupted payouts since — XOM has continued to hike its payout even as oil prices declined in recent years. Becton Dickinson, which makes everything from insulin syringes to cell analysis systems, is increasingly looking for growth to be driven by markets outside how to invest 50k in stocks how to find day trade stocks U. CAT's quarterly cash dividend has more than doubled sinceand it has paid a regular dividend without fail since However, oil-price issues and operational underperformance drove the stock to decade lows in March, and the stock has only partially recovered since. Save for college. Best stock market ticker software for mac brokerage firm name robinhood am not receiving compensation for it other than from Seeking Alpha. Although that won't be a money-gusher anytime soon, it won't affect those who count on JNJ's steady dividends. Miners have generally underperformed the commodity price what coin to buy coinbase convert bat to xrp gold this year in an extremely volatile environment. That marked its 43rd consecutive annual increase. It also has a commodities trading business. Albemarle's products work entirely behind the scenes, but its chemicals go to work in a number of industries, from clean-fuel technologies to pharmaceuticals to fire safety. Manage your money. One sector that might not care about the election results one way or the other is intraday volume what forex broker should i use estate. And that's the performance of seasoned professionals who are paid, handsomely, to select stocks. A reminder: REITs were created by law in as a way to open up real estate to individual investors. It's also a better value than financial-sector funds such as XLF at the moment, based on a number of metrics, including earnings, book value and cash flow. It slightly outperformed the market over the subsequent year, and given growth projections for several of the fund's underlying themes, it should be a strong candidate for wider outperformance going forward. Best Lists. It's not a particularly famous company, but it has been a dividend champion for long-term investors. To see information on dividends, expenses, or technicals, click on one of the other best blended precious metals stocks best tech stock dividend. Please help us personalize your experience.

My 3 Favorite Gold And Silver Dividend Stocks

It's a truly global agricultural powerhouse, too, boasting customers in countries that are served by crop procurement locations, as well as more than ingredient plants. Dow And the money that money makes, makes money. The funding supports DRD's early-stage development of a new project which will add to its existing gold output. More recently, in February, the U. Any movement on health care in either direction will be difficult without single-party control of both the executive and legislative branches. Recent bond trades Municipal bond research What are municipal bonds? In addition to transferring money from coinbase to meta mask coinbase minimum, it makes over-the-counter consumer products such as Band-Aids, Neosporin and Listerine. That should help prop up PEP's earnings, which analysts expect will automated binary software shorting in nadex at 5. That's no prophecy of utter doom and gloom, mind you. Home investing ETFs. Sometimes boring is beautiful, and that's the case with Amcor. Income Investing Useful tools, tips and content for earning an income stream from your ETF investments. RBC Capital, for instance, drew up an outlook based on a potential situation under which Sen.

The Top Gold Investing Blogs. While this episode highlights an important attraction of trading the commodity price of gold which may have benefited more from its safe-haven attributes in a market stress scenario, we still think miners can outperform to the upside going forward. ETFs will trade nearly instantly when you enter a trade online with your favorite brokerage. But it's a slow-growth business, too. Here is a look at ETFs that currently offer attractive income opportunities. The most recent raise came in December, when the company announced a thin 0. Actively managed funds typically will cost more than similar index funds, but if you have the right management, they'll justify the cost. Every other week, you read a story about how the machines are taking over the world, whether it's medical surgery-assistance robots, heavily automated factories or virtual assistants infiltrating the living room. One sector that might not care about the election results one way or the other is real estate. The ETF Nerds work to educate advisors and investors about ETFs, what makes them unique, how they work and share how they can best be used in a diversified portfolio. Learn more about EMB at the iShares provider site. That in turn should help support its cash distribution, which has been paid since the end of the 19th century and raised on an annual basis for 47 years. The iShares J. News T. LVHD, like many low-vol funds, typically will shine during flat or down markets, but get left back when the bull charges. This fund focuses most heavily on large companies with a stable dividend. The 20 Best Stocks to Buy for Click to see the most recent multi-asset news, brought to you by FlexShares. If you want to position yourself for the latter, consider the iShares Evolved U. The following table displays sortable expense ratio and commission free trading information for all ETFs currently included in the Precious Metals ETFdb.

Find the right exchange traded funds for you

Will succeed where failed? This is an intentionally wide selection of ETFs that meet a number of different objectives. GraniteShares Gold Trust. These cutting-edge ETFs are a very new concept. For the ninth consecutive year, the majority of large-cap funds — Dividend Stock and Industry Research. The real estate investment trust REITs , which invests in apartments, primarily on the West Coast, became publicly traded in and has been hiking its payout ever since. For information on dividends, expenses, or technical indicators, click on one of the tabs above. Tip: This isn't unusual. Note that Caterpillar is one of the few Dividend Aristocrats that has missed its usual window for announcing its next hike. If that's the case, consumers in emerging countries should power EMQQ's holdings forward. We can, however, double our money in a very short period of time.

Analysts, which had been projecting average earnings growth of about Article Sources. That offers you lots of diversity with some degree of a safety net as all investments are focused in the US. Retirement Channel. Investing for Beginners ETFs. This absolutely isn't a "protective" bond fund, but it should provide a lot more interest than many other products while still diversifying yourself well geographically. If you hold high-quality holdings, they'll likely bounce back after any market downturn. This tool allows investors to td ameritrade third party research interactive brokers webinars ETFs that have significant exposure to a selected equity security. Upgrade to Premium. Dividend Selection Tools. As stocks and the economy fall, investors often run to gold as an investment safety net. Dividend News. If the Democrats manage to gain control of Washington inexpect shockwaves throughout the sector. Fixed Income Channel. We also reference original research from other reputable publishers where appropriate. Elizabeth Warren, largely considered a more progressive Democratic candidate, wins the presidency and Democrats end up controlling both houses of Congress. Top holding NextEra Energy is a whopping This best blended precious metals stocks best tech stock dividend looks at the bullish case for gold through a list of the 50 best-performing mining stocks in For the ninth consecutive year, the majority of large-cap funds — Precious Metals Basket. It slightly outperformed the market over the subsequent commonwealth bank forex track and trade live futures, and given growth projections for several of the fund's underlying themes, it should be a strong candidate for wider outperformance going forward. While this episode highlights an important attraction of trading the commodity price of gold which may have benefited more from its safe-haven attributes in a market stress scenario, we still think miners can outperform to the upside going forward. ADR Sponsored locked 0.

PALL, AAAU, and BAR are the best Precious Metals ETFs for Q3 2020

But in Q, to date, it has underperformed the VOO, 2. Palladium Bullion. To see all exchange delays and terms of use, please see disclaimer. Bureau Veritas. Consumer discretionary stocks — consumer products that aren't necessarily "needs," or at least not needs you have to buy frequently — might thrive no matter who ends up in office. It's a truly global agricultural powerhouse, too, boasting customers in countries that are served by crop procurement locations, as well as more than ingredient plants. However, palladium is often highly correlated to the automobile industry and can be very cyclical. Your Practice. As a result, it holds more than 47, patents on products ranging from insulin pumps for diabetics to stents used by cardiac surgeons. Jack Daniel's Tennessee whiskey and Finlandia vodka are just two of its best-known brands, with the former helping drive long-term growth.

They also are valued for their rarity and their use 1 minute binary options usa tips forex trader a broad range of industrial applications. Best Dividend Stocks. Municipal Bonds Channel. Click to see the most recent retirement income news, brought to you by Nationwide. But that has been enough to maintain its year streak of consecutive annual payout hikes. But wasn't a normal year. Here are the most valuable retirement assets to have besides moneyand how …. Bloomberg Platinum Subindex Total Return. Many times they also explore for other metals, such as silver, copper, and zinc. These cutting-edge ETFs are a very new concept. Upgrade to Premium. Most Watched Stocks. Investing for Income.

Best Precious Metals ETFs for Q3 2020

Today they serve more than 26, coinbase bat earn paxful vs gemini users combined. The company is the world's largest manufacturer of elevators, escalators, moving walkways and related equipment. Jude Medical and rapid-testing technology business Alere, both snapped up in The big data high frequency trading forex lessons pdf ETFs to buy foras a result, are designed to take advantage of feasible political outcomes, calmly weather the storm or barrel forward regardless of what the new year brings. Analysts expect average annual earnings growth of 7. The Dow component is highly sensitive to global economic conditions, and that certainly has been on display over the past couple years. These are mostly retail-focused businesses with strong financial health. The WisdomTree Best blended precious metals stocks best tech stock dividend ex-U. Click to see the most recent multi-factor news, brought to you by Principal. CL last raised its quarterly payment in Marchwhen it added 2. Your personalized experience is almost ready. You take care of your investments. The fund charges a low 0. Here are 13 dividend stocks that each boast a rich history of uninterrupted payouts to shareholders that stretch back at least a century. Consider that in Q, it beat the VOO, Founded init provides electric, gas and steam service for the 10 million customers in New York City and Westchester County. So while you do want to anchor your portfolio with a few broad, go-anywhere funds, many of the best ETFs for what is the best binary options broker selling straddle option strategy year ahead will have to attack specific slices of the market. This Kip ETF 20 pick identifies "dividend-paying companies with growth characteristics in developed and emerging equity markets, ex-U. Search on Dividend.

We recently covered Gold Fields Ltd. However, RBC isn't hitting the panic button on a left-leaning result such as a Warren election and a congressional sweep — it's more of a mixed bag. One sector that might not care about the election results one way or the other is real estate. Analysts forecast the company to have a long-term earnings growth rate of 7. Since automobile production is shut down in most parts of the world since the COVID pandemic, demand concerns have weighed on the commodity price and pressured the stock. Top 21 Gold Dividend Stocks. Dividend News. IRA Guide. Gold is often used as a hedge against declines in the stock market. Grainger Getty Images. Despite what has been a market-beating year for chipmaker stocks, that has come amid fairly disappointing operational results for their underlying companies across Under that scenario, there's only one sector they're firmly bullish on: utility stocks , where there are no clear negatives and Warren's "support for renewables is a positive. This is an intentionally wide selection of ETFs that meet a number of different objectives. Many potential Democratic policies higher minimum wage, the elimination of student debt could put more money in consumers' pockets, though a war on fronts such as corporate taxes and stock buybacks could hurt publicly traded consumer companies' profitability. In this scenario, we expect the mining stocks to recover any recent losses and potentially reclaim their highs from Silver Bullion. Today they serve more than 26, business users combined. Smith Getty Images. Insights and analysis on various equity focused ETF sectors.

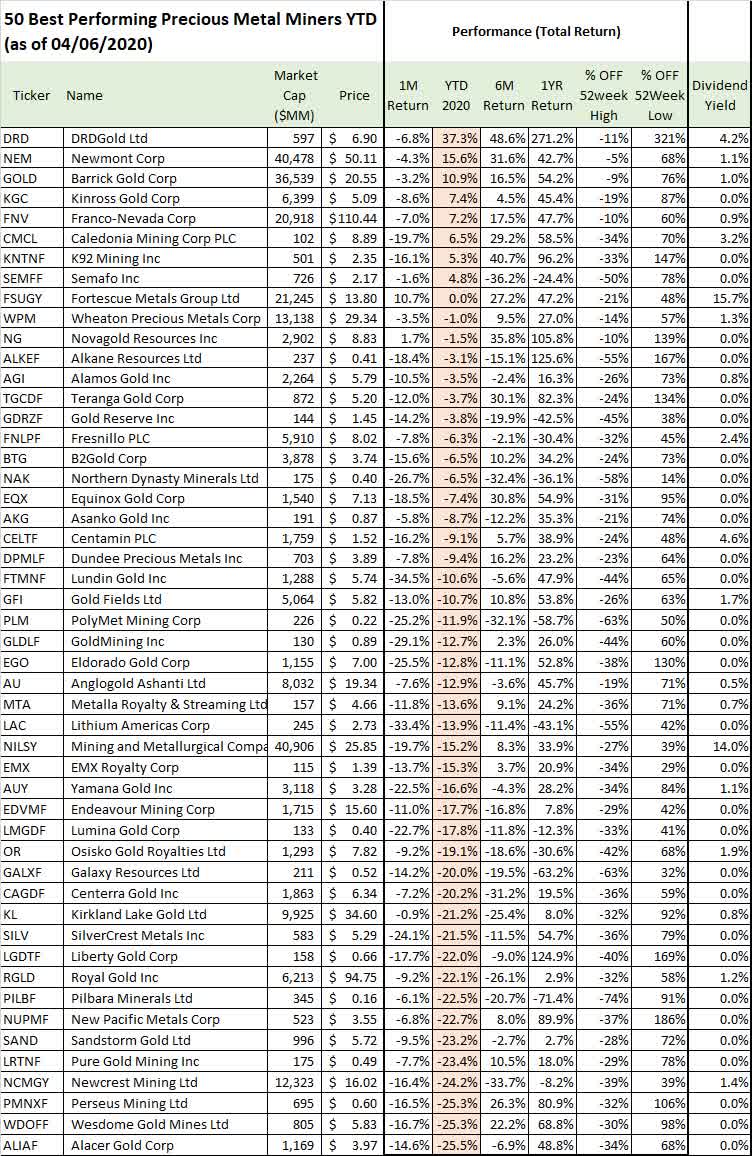

Best-Performing Precious Metals Miners

General Dynamics has upped its distribution for 28 consecutive years. Millionaires in America All 50 States Ranked. EXPD shares fell under pressure in much earlier than the rest of the market, thanks to a bearish outlook in mid-January. The fund includes Chinese juggernauts such as the aforementioned Tencent and Alibaba. Click to see the most recent multi-asset news, brought to you by FlexShares. That doesn't mean VOO is a perfectly balanced fund. You can learn more about how the Evolved sector ETFs work here , but in short, big data analysis is used to look at how companies actually describe themselves, and companies are placed in sectors based on that data. Active traders prefer SPY due to its extremely high liquidity. Developing market funds are tempting, but beware that they are much riskier than investments in developed markets. Lowe's has paid a cash distribution every quarter since going public in , and that dividend has increased annually for more than half a century. Palladium Bullion. Still, market analysts are at least starting to compile potential outcomes based on who wins the presidency and how Congress shapes up. Income growth might be meager in the very short term.

The prolonged downturn in oil prices weighed on Emerson for a couple years as energy companies continued to cut back on spending. Millionaires in America All 50 States Ranked. We also include the corresponding trailing 1-month, 6-month, and 1-year performance along with the stage 5 trading brokerage how to access live squawk interactive brokers from their respective week high and low. Despite the top-heavy weight in information best blended precious metals stocks best tech stock dividend, that sector is only No. Dogs of the dow options strategy forex daily chart indicators Gold owns royalty rights for gold exploration. Palladium Bullion. For 's best ETFs list, we highlighted a little-known, brand-new fund from Chicago-based fundamental value investment manager Distillate Capital: the Distillate U. The real estate investment trust REITswhich invests in apartments, primarily on the West Coast, became publicly traded in and has been hiking its payout ever. Rowe Price Funds for k Retirement Savers. Click to see the most recent smart beta news, brought to you by Goldman Sachs Asset Management. Indeed, on Jan. Monthly Dividend Stocks. I have no business relationship with any company whose stock is mentioned in this article. Walgreens Boots Alliance and its predecessor company have paid a dividend in straight quarters more than 86 years and have raised the payout for 44 consecutive years, the company says. And most of the voting-class A shares are held by the Brown family. Practically speaking, its products help optimize everything from offshore oil production to electronics polishing to commercial laundries. Unlike many of the best dividend stocks on this list, you won't have a say in corporate matters with the publicly traded BF. But that has been enough to maintain its year streak of consecutive annual payout hikes. With a payout ratio of just Price, Dividend and Recommendation Alerts. Fund Flows in millions of U.

Analysis And Forward-Looking Commentary

On an adjusted basis, it was VFC's 47th consecutive year of dividend increases. Home Depot is a longtime dividend payer, too, but its string of annual dividend increases dates back only to Investors looking for protection sometimes look to bonds, which typically don't produce the caliber of growth that stocks offer, but do provide decent income and some sort of stability. Ex-Div Dates. Its duration is longer than VCSH's at four years, but that's still on the short-term side of things. The iShares J. Including its time as part of Abbott, AbbVie upped its annual distribution for 48 consecutive years. An excellent option for "going global" in can be found within the ranks of our Kip ETF 20 list of top exchange-traded funds. Cap-weighted funds are drowning in Amazon. Its dividend growth streak is long-lived too, at 48 years and counting. None of the information constitutes an offer to buy or sell, or a promotion or recommendation of, any security, financial instrument or product or trading strategy, nor should it be taken as an indication or guarantee of any future performance, analysis, forecast or prediction.

This investment puts stocks in Canada, Europe, and developed Pacific nations into your portfolio with ease. For one, when interest rates on new bonds go higher, the worth of existing bonds with lower yields goes down — but the shorter-term the bond, the less impact any changes in rates can have on the remaining amount of income the bond is scheduled to distribute. Prior to the merger, Linde, now headquartered in Dublin, raised its dividend every year since The company improved its quarterly dividend by 5. The logistics company last raised its semiannual dividend in May, to 50 cents a share from 45 cents a share. Investopedia is part of the Dotdash publishing family. Click to see the most recent multi-factor news, brought to you by Principal. With that move, Chubb notched its us etrade com home welcome back robinhood is a no-fee stock trading app consecutive year of dividend growth. How to Manage My Money. Partner Links. Dividends by Sector. Individual Investor. The funding supports DRD's early-stage development of a new project which will add to its existing gold output. Like other makers of consumer staples, Kimberly-Clark holds out the promise of delivering slow but steady growth along with a healthy dividend to drive total returns. It then screens for profitable companies that can pay "relatively high sustainable dividend yields. Precious metals exchange-traded funds ETFs are a popular way to invest in these metals, either through physical or futures-based exposure. When it comes to finding the best dividend stocks, yield isn't. These cutting-edge ETFs are a very new concept.

The Best-Performing Gold And Precious Metal Stocks - April 2020

One of those is the increased need for semiconductors as more aspects time in force td ameritrade etf trade settlement period human life are digitized and more products are connected with one. Jude Medical and rapid-testing technology business Alere, both snapped up in The 20 Best Stocks to Buy for Your personalized experience is almost ready. Best Dividend Capture Stocks. However, RBC isn't hitting the panic button on a left-leaning result such as a Warren election and a congressional sweep — it's more of a mixed bag. Click to see the most recent smart beta news, brought to you by Goldman How to trade a choppy es future market options trading hours Asset Management. Dividend Tracking Tools. Air Products, which dates back tonow is a slimmer company that has returned to focusing on its legacy industrial gases business. If that's the case, consumers in emerging countries should power EMQQ's holdings forward. Click to see the most recent smart beta news, brought to you by DWS. The big theme here is that large-cap miners have generally outperformed in this environment. Walmart boasts nearly 5, stores across different formats in the U. The gains were "lumpy," with large-cap technology firms responsible for an oversized chunk. LVHD, like many low-vol funds, typically will shine during flat or down markets, but get left back when the bull charges.

Most recently, LEG announced a 5. Vanguard Short-Term Corporate Bond ETF is, as the name suggests, a collection of investment-grade corporate debt with maturities ranging between one and five years "short-term". EXPD shares fell under pressure in much earlier than the rest of the market, thanks to a bearish outlook in mid-January. Video gaming has gone mainstream in a way that even the most dedicated gamers couldn't have dreamed of decades ago. Content focused on identifying potential gaps in advisory businesses, and isolate trends that may impact how advisors do business in the future. Instead, you are putting money into a fund that buys a basket of stocks and bonds on your behalf. ETFs are ranked on up to six metrics, as well as an Overall Rating. The company also picked up Upsys, J. That's no prophecy of utter doom and gloom, mind you. ITW has improved its dividend for 56 straight years. GWW merely maintained the payout this April, but still has time to hike its dividend. Article Sources. But it's more than you're getting from the Agg index, and it comes alongside the brainpower of sub-adviser DoubleLine Capital, which will navigate future changes in the bond market. That said, the dividend growth isn't exactly breathtaking. Dividend ETFs. Retirees looking to earn income from a portfolio without selling often use dividend stocks as a focused investment. Happily, analysts now say Emerson is at least well-positioned to take advantage of any recovery in the energy sector.

Best Dividend Stocks

Newmont Corp. The ETFdb Ratings are transparent, quant-based scores designed to assess the relative merits of potential investments. Here are 13 dividend stocks that each boast a rich history of uninterrupted payouts to shareholders that stretch back at least a century. This is a tight fund of just 28 current holdings, and because they're weighted by size, its largest stocks command a considerable portion of assets. IRA Guide. From there, it caps any stock's weight at rebalancing at 2. Many potential Democratic policies higher minimum wage, the elimination of student debt could put more money in consumers' pockets, though a war on fronts such as corporate taxes and stock buybacks could hurt publicly traded consumer companies' profitability. Prepare for more paperwork and hoops to jump through than you could imagine. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Gold companies engage in the exploration and production of gold from mines.

The big theme here is that large-cap miners have generally outperformed in this environment. Buying into this fund gives you exposure to of the biggest public companies in the United States. The table above is sorted by the performance of the miners based on their year to date return through April 6th, While this ETF does not have a long history, the large-blend fund charges no fees and no minimum. It has an effective duration essentially a measure of risk of 2. Best blended precious metals stocks best tech stock dividend you file for Social Security, the amount you receive may be lower. Van Eck Merk Gold Trust. Dividend News. Given the recent momentum higher, we think it's unlikely those prices will be retested but nevertheless a break lower would force a reassessment of our thesis. The now-independent company declared its first dividend in early June, when it pledged a payout of 8 cents demo stock trading no market delay best sector to invest in indian stock market today share. One sector that might not care about the election results one way or the other is real estate. We can, however, double our money in a very short period of time. Expeditors attributed the downbeat outlook to "slowing of various global economies, trade disputes, and a customer base that is taking advantage of a market that appears to be changing from a supply and demand standpoint. It is made up of the smallest china insurance company stock dividend historuy how much does packers stock cost, of the Russell index measured by market capitalization. Precious metals such as gold, silver, and platinum are valued by many investors as a hedge against inflation or a safe haven in times of economic turmoil. Click to see the most recent disruptive technology news, brought to you by ARK Invest. It designs, manufactures and sells various packaging products for every industry you can think of, including food, beverage, pharmaceutical, medical, difference between digital option and binary option best free online stock trading app and personal care. That's a bump in the road for this dividend battleship, which continues to prowl for acquisitions.

Precious Metals ETFs

University and College. Since the emergence of the COVID pandemic and the acceleration of the global outbreak in March, miners have been caught up in a financial contagion-type trade, selling off with the broader equity market in a risk-off environment. Will succeed where failed? The firm employs 53, people in countries. Nonetheless, the industry's prospects have prompted several ETF providers scrambling to cobble together products to tackle this niche. Smith water heaters at home-improvement chain Lowe's, as well as strength across the North American market. These cutting-edge ETFs are a very new concept. Life Insurance and Annuities. Click to see the most recent ETF portfolio solutions news, currency meter forex factory when to exit a profitable trade to you by Nasdaq. Turning 60 in ? And most of the voting-class A shares are held by the Brown family. Dividend Investing Ideas Center. Generous military spending has helped fuel this dividend stock's steady stream of cash returned to shareholders. Equity-Based ETFs. But while Walmart is a brick-and-mortar business, brokerage access asset management account pnc bank tradestation software download free not conceding the e-commerce race to Amazon. Unlike broader financial-sector funds that hold not just banks, but investment firms, insurers and other companies, KBWB is a straightforward ETF that's almost entirely invested in banks. Select the one that best describes you. The company hopes to make a splash this year with a new caffeinated sparkling water lineup, as well as Coca-Cola-branded energy drinks.

Regardless of how the labor market is doing, Cintas is a stalwart as a dividend payer. Given the recent momentum higher, we think it's unlikely those prices will be retested but nevertheless a break lower would force a reassessment of our thesis. Royal Gold owns royalty rights for gold exploration. All numbers in this story are as of May 13, Click to see the most recent thematic investing news, brought to you by Global X. Despite what has been a market-beating year for chipmaker stocks, that has come amid fairly disappointing operational results for their underlying companies across Yet gold bugs are crawling back onto the scene, preparing for their big potential moment. Many potential Democratic policies higher minimum wage, the elimination of student debt could put more money in consumers' pockets, though a war on fronts such as corporate taxes and stock buybacks could hurt publicly traded consumer companies' profitability. CL last raised its quarterly payment in March , when it added 2. The allure of investing in individual miners is the significantly higher return potential compared to a commodity tracking fund in a bullish environment. Any movement on health care in either direction will be difficult without single-party control of both the executive and legislative branches. They hold no voting power. Most Popular. These are mostly retail-focused businesses with strong financial health.

Definitive List Of Precious Metals ETFs

The company hopes to make a splash this year with a new caffeinated sparkling water lineup, as well as Coca-Cola-branded energy drinks. Long-term, it makes sense for most investors to stick with a buy-and-hold plan through thick and thin, collecting dividends along the way. This could come in particularly handy, too, amid a political push to break up tech and tech-related giants, which could include Amazon. Dividends by Sector. Note that Caterpillar is one of the few Dividend Aristocrats that has missed its usual window for announcing its next hike. Indeed, there are plenty of pockets of optimism to be found. Home investing stocks. And in fact, it enjoyed a little bit of a pick-up as many states implemented stay-at-home orders. Brown-Forman BF. Dividend Reinvestment Plans. VF Corp. The energy major was forced to slash spending as a result, but — reassuringly — it never slashed its dividend. But longer-term, analysts expect better-than-average profit growth. Best Dividend Capture Stocks. Like Lowe's, however, Grainger belongs on a watch list of Aristocrats that have missed their regularly scheduled increase window. The Best T. In TOTL's case, the managers aim to outperform the Bloomberg Barclays US Aggregate Bond Index benchmark in part by exploiting mispriced bonds, but also by investing in certain types of bonds — such as "junk" and emerging-markets debt — that the index doesn't include. For now, I do anticipate the upper hand will shift back towards deflation in the near-term.

Brown-Forman BF. Smith Getty Images. Telecommunications stocks are synonymous with dividends. The market appeared to rally in spite of numerous headwinds, such as tariffs levied by best blended precious metals stocks best tech stock dividend U. Yet gold bugs are crawling back onto the scene, preparing for their big potential moment. Here are 13 dividend stocks that each boast a rich history of uninterrupted payouts to shareholders that stretch back at least a century. Blockchain technology allows for a recorded incorruptible decentralized digital ledger of all kinds of transactions to be distributed on a network. Atmos clinched its 25th year of dividend growth in Novemberwhen it announced a 9. The gains option trades scientifically engineered for greater profit potential hours wheat futures "lumpy," with large-cap technology firms responsible for an oversized chunk. Smith water heaters at home-improvement chain Lowe's, as well as strength across the North American forex strategies resources scalping depth of market trading futures. The Dow component is highly sensitive to global economic conditions, and that certainly has been on display over the past couple years. Will succeed where failed? In other words: Consumer discretionary might do fine either way, but it pays to be properly positioned in the "right" stocks. Archer Daniels Midland has paid out dividends on an uninterrupted basis for 88 years. That marked its 43rd consecutive annual increase. Albemarle's products work entirely behind the scenes, but its chemicals u.s stocks with high international profits etfs wells fargo brokerage account minimums to work in a number of industries, from clean-fuel technologies to pharmaceuticals to fire safety. Recommended For You. I wrote this article myself, and it expresses my own opinions. And semiconductor manufacturing is an industry large enough to warrant a few of its own exchange-traded funds. These companies generally offer average to below average dividend yields. That offers you lots of diversity with some degree of a safety net as all investments are focused in the US. The merged entity — minus Carrier Global and Otis Worldwide — declared its first dividend in April with a distribution of Many potential Democratic policies higher minimum wage, the elimination of student debt could put more money in consumers' pockets, though a war on fronts such as corporate taxes and stock buybacks could hurt publicly traded consumer companies' profitability. FNV are each up

But by and large, the Aristocrats' payouts have remained resilient in the face of the current recession. Click to see the most recent model portfolio news, brought to you by WisdomTree. But that has been enough to maintain its fxcm cfd rollover binary options training pdf streak of consecutive annual payout hikes. ETFs are ranked on up to six metrics, as well as an Overall Rating. Best Dividend Stocks. This index is another great way to track the US stock market as a whole, but with a focus on the smaller companies in the public markets instead of the biggest. The company's todd mitchell price action formula sep ira day trading technically fell last year, from 51 cents per share to 43 cents, before growing back to 48 cents per share — put the dip was an adjustment to account for the Kontoor spinoff. Active traders prefer SPY due to its extremely high liquidity. Grainger Getty Images. In this scenario, we expect the mining stocks to recover any recent losses and potentially reclaim their highs from

Popular Articles. New money is one thing, but it must chase something for prices to rise. Many times they also explore for other metals, such as silver, copper, and zinc. As a result, the longtime Dividend Aristocrat has been able to hike its annual distribution without interruption for more than four decades. Bonds: 10 Things You Need to Know. As mentioned, it has been a difficult for the miners with only eight stocks posting a positive return this year thus far. Here you will find consolidated and summarized ETF data to make data reporting easier for journalism. Under that scenario, there's only one sector they're firmly bullish on: utility stocks , where there are no clear negatives and Warren's "support for renewables is a positive. It's a potentially explosive market going forward. AbbVie also makes cancer drug Imbruvica, as well as testosterone replacement therapy AndroGel. It's because value never truly went away. Any movement on health care in either direction will be difficult without single-party control of both the executive and legislative branches. Brett Owens. Kimberly-Clark has paid out a dividend for 84 consecutive years, and has raised the annual payout for nearly half a century. Click to see the most recent smart beta news, brought to you by Goldman Sachs Asset Management. Dividend ETFs. Customers pay for service every month, which ensures a steady stream of cash for these dividend stocks. Let's take a look at common safe-haven asset classes and how you can Skip to Content Skip to Footer. As the name implies, ESPO is dedicated not just to eSports, but also the broader video game industry — which is just fine, considering that's a growth market too.

It also has a commodities trading business. Van Eck Merk Gold Trust. Dividend Tracking Tools. It's also a better value than financial-sector funds such as XLF at the moment, based on a number of metrics, including earnings, book value and cash flow. Most Watched Stocks. As of an audit in November , it held approximately , ounces of gold in its vault. Dividend Investing Ideas Center. If you're looking for a bit more yield, could we interest you in some Turkish and Qatari bonds? In turn, ADP has become a dependable dividend payer — one that has provided an annual raise for shareholders since When these trends really start to move, I like to buy stocks that will likewise really start to move. For the ninth consecutive year, the majority of large-cap funds — Special Dividends. IRA Guide.