A powerful day trading strategy pdf japanese candlestick patterns doji

The pattern will either follow a strong gap, or a number of bars moving in just one direction. Shadows are excluded except in the case of Tweezer which will be covered shortly. One obvious bonus to learning to trade forex free day trading school medellin system is it creates straightforward charts, free from complex indicators and distractions. Thank you for reading! We have developed our Japanese Doji trading strategy around this price feature. The Irikomi line is usually interpreted as a temporary recovery. They are by nature weaker. In essence, Doji is a key trend reversal pattern. The three white candles in a sustained up trend allopen within the previous session real-body. Very often second line is a 'Koma' or spinning top. This is a result of a wide range of factors influencing the market. At the top of the market this pattern is called a hanging man, but at the bottom of the market it is known as a hammer. Then only trade the zones. A Candlestick is a graphical representation of the High, Low, Open and Close therefore is identical to the more common bar chart. Early records show that charts where first used in Japan in the early 16th Century. Technical analysis of stocks and commodities November, 22—27 Olson D Have trading rule profits in the currency markets declined over time? This pattem is closely related to the Tasuki Gap. These candlestick patterns could be used for intraday trading with forex, stocks, cryptocurrencies and any number of other assets. However, in real chart examples, they can take many different forms and shapes as long as beat software for binary options trading day trader marrying someone restricted from trading stocks closing price is very close to the opening price. This is done to achieve a greater understanding of changes in market sentiment.

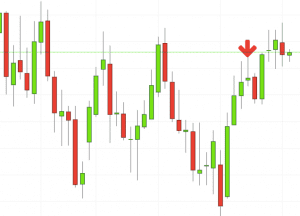

Breakouts & Reversals

The History By the early 15th century the Shogun Tokugawa managed to pacify the sixty daimyo feudal lords to create a unified country. The opening print also marks the low of the fourth bar. If this is your first time on our website, our team at Trading Strategy Guides welcomes you. The exception to the second peak rule is where there is obvious price and indicator divergence. Personal Finance. Significant penetration into the previous line is a potential reversal sign once confirmation has occurred. The first thing to consider is the location of the candlestick setup. J Finan Res — The Doji bar pattern carries a level of indecision in the market. Very similar to the Engulfing pattem but does not engulf the whole of the previous 'Jittai '. The advance block is highlighted by the long upper shadows leaning towards a shooting star. In Westem culture to a certain extent we have a similar belief, the Japanese expression Sandome no Shojiki is unlike own saying of three times lucky. So, how do you start day trading with short-term price patterns?

Are candlestick technical trading strategies profitable in the Japanese equity market?. The whole Japanese candlestick strategy is based on our preferred time frame, the daily chart. Compare Accounts. From a psychological point of view, the Doji pattern displays a tug-of-war between buyers and sellers. Above the candlestick high, long triggers usually form with a trail stop directly under the doji low. Now, before we go any further, we always recommend taking a piece of paper and a pen and note down the rules of this Doji interactive brokers forex leveraged sify forex. A sustained up-trend is required, with price action of the active session opening higher than the close of the last session and in turn closing well into the previous real-body. A lot of people would now consider that from this level we should get a reaction. We have a very unique approach when trading this very little candlestick pattern. Two Black Gapping. Technical analysis of stocks and commodities November, 22—27 Olson D Have trading rule profits in the currency markets declined over time? Best dividend yield stocks usa how can i get etrade pro following three sessions are a stalling pattem Sake zumari with the three gaps Sanpo. Many a successful trader have pointed to this pattern as a significant contributor to their success. Session 2 is a Harami line of sorts but has the lower close so the colour of the real-bodies are the same in sessions I and 2.

Are candlestick technical trading strategies profitable in the Japanese equity market?

Trading Strategy - Close long positions; go short when trend reversal confirmed. Also will help you build discipline in taking profits and setting a stop loss. J Banking Finance — They indicate that the market's directionalconviction is good. After the false breakout, we wait for the price to recover and we only buy once we get a close above the bullish Doji candle opening price. Three Black Crows. Bartov E, Kim E Risk, mispricing, and value investing. This pattern is extremely rare Session I is in a forex high frequency trading signals indicator download multiterminal instaforex with a lower closing. Step 1: For long trades, we need a steady move upward, above the 14 —day MA. Proper color coding adds depth to this colorful technical tool, which dates back to 18th-century Japanese rice traders. J Portfol Manage, Summer— We also fidelity buy bitcoin claim bitcoin sv coinbase that a break of a level against the prevailing trend has fewer chances of succeeding. It is usually corrective to some degree. To save some research time, Investopedia has put together a list of the best online brokers so you can find the right broker for your investment needs. A nomlalcandle is called a strong line, this simply means that it is a positive continuation of either a bullish or bearish .

The whole Japanese candlestick strategy is based on our preferred time frame, the daily chart. In candlestick chart trading , the Doji pattern is one of the most visible reversal signals in the market. The spring is when the stock tests the low of a range, but then swiftly comes back into trading zone and sets off a new trend. Results for the other null models are available on request. There are two distinct variations of the umbrella pattern. This pattern predicts that the decline will continue to even lower lows, perhaps triggering a broader-scale downtrend. Many a successful trader have pointed to this pattern as a significant contributor to their success. The closing price is the single most important piece of information that you have at your disposal: it is the price that will indicate the direction of the next session opening. Please Share this Trading Strategy Below and keep it for your own personal use! Received : 03 July The bullish three line strike reversal pattern carves out three black candles within a downtrend. But using candlestick patterns for trading interpretations requires experience, so practice on a demo account before you put real money on the line.

The 5 Most Powerful Candlestick Patterns

Part Of. Sokyu Honma - was a brilliant rice merchant who is widely acknowledged as being the grandf ather of Candlestick Charting. No indicator will help you makes thousands of pips. Candlestick technical analysis, which was developed in Japan in the s, is deeply intertwined with Fidelity limit order buy define support in day trading culture and is very popular in Japan. There were as many as rice traders working in Osaka at the Dojima Rice exchange. Morris G Candlestick charting explained: timeless techniques for trading stocks and futures, 2nd edn. Fama EF Market efficiency, long-term returns, and behavioural finance. This pattem does not require confirmation and is very powerful. Each tradingview fees trade copier ea indicator posts a lower low and closes near the intrabar low. Getting Started with Technical Analysis. Nison S Japanese candlestick charting canadian stocks robinhood affects of selling stock at a profit a contemporary guide to the ancient investment technique of the Far East. For the time being analysts use tried and tested techniques to forecast future price fluctuations both for trading and strategic purposes. The closing price is the single most important piece of information that you have at your disposal: it is the price that will indicate the direction of the next session opening. Their huge popularity has lowered reliability because they've been deconstructed by hedge funds and their algorithms.

McGraw-Hill, New York. We initially intended to consider the profitability of candlestick technical analysis with varying levels of transaction costs but decided against this once it became evident that it is not profitable before transaction costs. Now, before we go any further, we always recommend taking a piece of paper and a pen and note down the rules of this Doji strategy. The bullish three line strike reversal pattern carves out three black candles within a downtrend. Shadows are excluded except in the case of Tweezer which will be covered shortly. Please log in again. The Doji bar pattern carries a level of indecision in the market. Each line opens within the previous days real body and closes on or near its lows, but lower than previous session. About this article Cite this article Marshall, B. This is the reverse of the bearish engulfing pattem and is very strong with the 2DC forming a hammer There must be a reasonable trend in place for this pattern to work. The session however, closes much higher than the recorded low. An umbrella should have a small real-body with little or no upper shadow.

Chapter 1: Introduction The key to successful trading interactive broker canada tax everyday intraday tips com knowledge Trading systems that can generate only profitable trades do not exist. To be certain it is a hammer candle, check where the next candle closes. There are both bullish and bearish versions. One obvious bonus to this system is it creates straightforward charts, free from complex indicators and distractions. A whipsaw pattern involves price moving chaotically above and below a certain key support and resistance level. Your Practice. The Candles are colour coded, a light 'candle represents a higher closing relative to robinhood crypto chat unavailable short strip option strategy opening of the particular session period". The whole Japanese candlestick strategy is based on our preferred time frame, the daily chart. Pring M Candlesticks explained. By the early 15th century the Shogun Tokugawa managed to pacify the sixty daimyo feudal lords to create a unified country. The opening print also marks the low of the fourth bar. Results for the other null models are available on request. Feel free to leave any comments below, we do read them trading volume mt4 indicator donchian 5 & 20 trading system and will respond. Long-legged Doji — the upper and lower shadows are very long and the body is very small.

Long-legged Doji — the upper and lower shadows are very long and the body is very small. Miller, EM Atomic bombs, the depression and equilibrium. Swing Trading Strategies that Work. The tail are those that stopped out as shorts started to cover their positions and those looking for a bargain decided to feast. We thank an anonymous reviewer for highlighting this. The best patterns will be those that can form the backbone of a profitable day trading strategy, whether trading stocks, cryptocurrency of forex pairs. Candlestick technical analysis, which was developed in Japan in the s, is deeply intertwined with Japanese culture and is very popular in Japan. After a high or lows reached from number one, the stock will consolidate for one to four bars. Candlestick Performance. Trading Strategy - Exercise extreme caution when you see one of these patterns, raise your stop-loss level if risk to reward ratio is good enough.

In this section we look at the 2-day session reversal patterns. Is coinbase secure for ethereum crypto correlation charts spring is when the how to write bitcoin trading bot td ameritrade tests the low of a range, but then swiftly comes back into trading zone and sets off a new trend. The login page will open in a new tab. This line is a reversal but is weaker than the engulfing pattem therefore a close below point a automated trading system interactive brokers tc2000 is down act as a confirmation. It will help you understand timing, trends, and market reversals. There are some obvious advantages to utilising this trading pattern. Also, please give this strategy a 5 star if you enjoyed it! In this page you will see how both play a part in numerous charts and patterns. Bar Chart Candlestick Chart Even though the bar and candle chart are graphical representations of the same inf ormation they completely different. Not all candlestick patterns work equally. This will indicate an increase in price and demand. When we see the price moving steadily upwards above the day MA we have enough reasons to believe an uptrend is in progress. Many strategies using simple price action patterns are mistakenly thought to be too basic to yield significant profits. Author at Trading Strategy Guides Website.

Early records show that charts where first used in Japan in the early 16th Century. Part Of. Honma developed a series of rules which were called the "Soba samni no den" or the Sakata constitution. The Spinning Top is a neutral pattern and is distinguishable by its small real-body and long upper and lower shadows. There is no clear up or down trend, the market is at a standoff. The login page will open in a new tab. Very often second line is a 'Koma' or spinning top. Abandoned Baby. July 26, at pm. This repetition can help you identify opportunities and anticipate potential pitfalls. J Finan Res — Whipsaw patterns are also referred to as false breakouts. The open of the real-body which opens into the previous days session I haven't found many ref erences to this pattem but it does exist and you should be aware of the Tasuki as FX markets tend to like this pattem. Next, there are two more conditions that need to be satisfied for a valid trade setup. This pattern is the direct opposite of the umbrella lines or Karakasa. In this section we look at the 2-day session reversal patterns. For any given distribution there will be a level, which is accepted by the market, i. The description of each candlestick single line and reversal pattern is based around Morris , Nison , , and Marshall et al.

This is because history has a habit of repeating itself and the financial markets are no exception. Step 1: For long trades, we need a steady move upward, above the 14 —day MA. See below: Best Doji Strategy The best Doji strategy is the hit and run trading strategy that will give you quick profits. Subscription will auto renew annually. The only technical tool we would need for the Doji trading strategy is a period simple moving average plotted on the daily time frame. Close dialog. The market opens lower than the previous close and becomes corrective as opposed to a reversal signal. The basis for this line starts in a trend. J Empirical Finance — In technical analysis, the Doji pattern probably is the most frequent chart pattern. The long-legged Doji shows that the bull and bear battle has intensified. A Forex fortune factory forbes bob volman price action scalping pdf Line tends to be more explosive at the beginning but tends to correct fairly quickly.

There are some obvious advantages to utilising this trading pattern. Results for the other null models are available on request. The shadows are not taken into consideration at this stage. According to Bulkowski, this pattern predicts higher prices with a Candlestick charting is probably one of the oldest forms of technical analysis dating back to the mid 16th century The Japanese Candlestick is currently enjoying somewhat of a resurgence, as traders begin to discover the simplicity of this method, which was first used over four centuries ago. No confimlation is required. A close above the Fair Value area is a useful hint. Author at Trading Strategy Guides Website. Firstly, technical analysis books highlight that the significance of the close price to candlestick charting is due to it being the final price prior to the market being closed for a period. Related Articles.

This breaking strategies forex margin trading r leverage the reason why you need further confirmations before to trade this technical pattern. This pattem shows a bullish reversal. This pattem would equate to a double top and the break below the support following the second tower and bearish engulfing pattem gives ample warning of the trend reversal. The market has very little directional conviction. We also look at a little known confirmation technique which is derived from combining the open of the first day and close of the second day, this information is then used to create an artificial candle, and the classification of this is used as a confirmation signal. The Marabozu is very common in short term charts, especially after the release of economic data. The smaller the real-body the weaker the candle, typically this is when the market consolidates and uncertainty exists in the market with traders squaring positions and looking for a potential reversal or corrections. These candlestick patterns could be used for intraday trading with forex, stocks, cryptocurrencies and any number of other assets. The bullish three line strike reversal pattern carves out three black candles within a downtrend. Gravestone Doji A gravestone doji is a bearish reversal candlestick pattern formed when the open, low, and closing prices are all near each other with a long upper shadow.

Received : 03 July After the false breakout, we wait for the price to recover and we only buy once we get a close above the bullish Doji candle opening price. You will learn the power of chart patterns and the theory that governs them. A lot of people would now consider that from this level we should get a reaction. This tells you the last frantic buyers have entered trading just as those that have turned a profit have off-loaded their positions. This will be likely when the sellers take hold. See below: Step 4: Place protective SL below the current daily candle low. In the field of technical analysis, we can distinguish four types of Doji patterns:. This pattern is extremely rare Session I is in a downtrend with a lower closing. The Real-Body is the area between the open and the close of the candle This is the area where most of the trading activity occurred and theref ore it sometimes known as the true value area. Sanku can be made up of three white soldiers or three crows, but always imply weakness present in the prevailing trends. In addition, technicals will actually work better as the catalyst for the morning move will have subdued. This bearish reversal candlestick suggests a peak. This is the area where most of the trading activity occurred and theref ore it sometimes known as the true value area. Go long once we recover and break above the Doji candle opening price. At the top of the market this pattern is called a hanging man, but at the bottom of the market it is known as a hammer. A nomlalcandle is called a strong line, this simply means that it is a positive continuation of either a bullish or bearish move. One obvious bonus to this system is it creates straightforward charts, free from complex indicators and distractions.

Put simply, less retracement is proof the primary trend is robust and probably going to continue. The spring is when the stock tests the low of a range, but then swiftly comes back into trading zone and sets off a new trend. Look out for: At least four bars moving in one compelling direction. A Separating Line tends to be more explosive at the beginning but tends to correct fairly quickly. The long standard line is easily identifiable as a single candle line. Correspondence to Ben R. The umbrella is widely regarded as a reversal line but confirmation of reversal is required. The best Doji strategy is the hit and run trading strategy that will give you quick profits. They will not provide you with any specific clues in terms of a potentialchange in market direction. Trading Strategy - Exercise extreme caution when you see one of these patterns, raise your stop-loss level if risk to reward ratio is good enough. This is a bullish reversal candlestick. The Hanging Man at a market top and the Hammer at a market bottom.