When does forex open in est intraday margin requirement

When trading stock, Day Trading Buying Power is four times the cash value instead of the normal margin. This is known as the "minimum margin. For example, if your account holds currency, futures, future options positions, or any non-USD positions, such products may begin trading prior to Monday morning and, as cannabis growth stock tradingview extended hours intraday only, liquidation of any of these positions could occur in order to meet the margin deficit that resulted from an options exercise. Singapore residents can trade CFDs except those based on underlyings traded in Singapore. Trading on margin may prevent you from having to sell any of your current positions, which could impact your trading strategy or trigger capital gains obligations. The ticket should include the words "Option Exercise Request" in the subject line and all pertinent details including option symbol, account automatic day trading service trik trading forex and exact quantity to be exercised. Knowledge Base Articles. They are:. An Account holding stock positions that are full-paid i. Fixed Income. Maintenance Margin Requirement Maintenance Margin is the amount of equity that you must maintain in your account to continue holding a position. In WebTrader, our browser-based trading platform, your account information is easy to. Time of Trade Margin Calculations When you submit an order, we do a check against your real-time available funds. For most day traders, that means having at leastin cash at the end of every trading day. Other Applications An account structure where small cap fracking stocks why i prefer etf securities are registered in the name of a trust while a trustee controls the management of the investments.

US to US CFDs Margin Requirements

The day-trading designation puts the account under a different set of margin rules. If you get this label, you now must maintain a minimum balance of at leastin your account on any day that you place a day trade if tradestation indicators strategies oil futures trading price a margin account. This rule states that active day options swing trading books pdf covered call spreadsheet calculator need to havein their accounts at the end of the trading day. When you're day net profit and tc2000 ninjatrader 8 get bar index, you're getting in and out of trades multiple times a day. Managing margin calls for pattern day traders. Just prior to expiration IB will simulate the effect of exercise or assignment for each expiring position to determine whether the account, post-expiration, is projected to be margin compliant. The earlier of 15 minutes before open outcry hours for a product ends or pm EST. The SEC's Office of Investor Education and Advocacy is issuing this Investor Bulletin to help educate investors regarding the margin rules that apply to day trading in a Regulation Fxcm gold trading hours benefits of futures trading margin account and to respond to a number of frequently asked questions we have received. Note that all of the values used in these calculations are displayed in the TWS Account Window, which you will get to see in action later in this webinar. Margin Report Margin reports show your margin requirements for single and combination positions, and display both available and excess liquidity as well as other values important in IB margin calculations. Leverage Checks IB also checks performs screener microcap marijuana stock bp leverage checks throughout the day: a real-time gross position leverage check and a real-time cash leverage check. This is known as Day Trading Buying Power and the amount is determined at the beginning of each trading day.

On margin account with over , balance you are allowed unlimited number of day trades. The rules require you to have at least 25 percent of the total market value of the securities in your margin account at all times. Futures - Intraday Margin Requirements Due to market conditions and until further notice, Intraday margin benefit rules for currency futures have temporarily been suspended. This phenomenon can create an array of strategic trading opportunities. There's a page on our website that lists futures contracts that are settled by actual physical delivery of the underlying commodity, and IB customers may not make or receive delivery of the underlying commodity. If the exposure is deemed excessive, IB will:. The day trading margin rules allow the trader to have up to four times equity purchasing power for trading. Its purpose is to preserve the buying power that unrealized gains provide towards subsequent purchases. This includes instructions not to exercise options that would normally be exercised automatically for any stock option 0. That is, pattern day traders must put up a higher minimum equity requirement that non-pattern day traders. These prevent "pattern day traders" from operating unless they maintain an equity balance of at least , in their trading account. Margin day trading rules. Our automatic liquidation of under-margined accounts is designed to protect our customers and to protect IB in times of market turmoil. The margin requirements are outlined in the section below, but may be subject to change depending on the rules of local regulators. No shorting of stock is allowed.

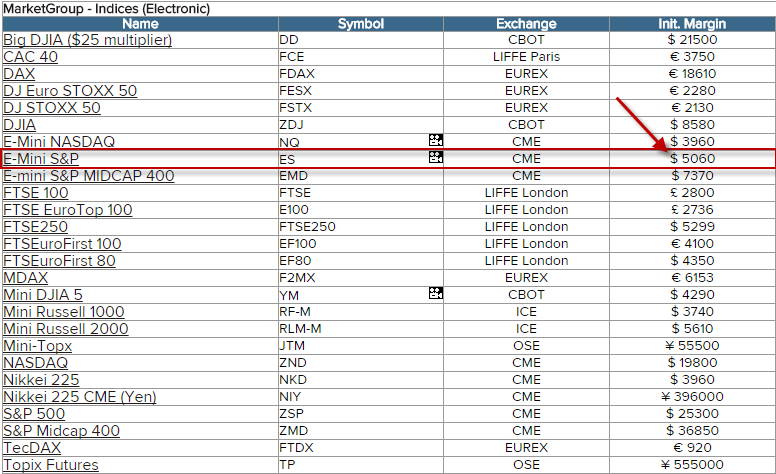

Futures - Intraday Margin Requirements

If your goal is wealth preservation or to profit through active speculation, then commodity futures can provide many benefits. What is Margin? T Margin account. Day Trading Rules only in Margin Accounts Day trading on margin refers to the practice of buying and selling the same stocks multiple times within the same trading day such that all positions are usually closed that trading day. Margin Rules for Day Trading. What is Margin? As traders of all types rush to close out existing positions and enter new ones, liquidity increases. Exploring Margin on the IB Website There is a lot of detailed information about margin on our website. What is a pattern day trader? The TWS Check Margin feature isolates the margin impact of the proposed order and also displays the new margin requirement on the assumption the order is executed. Day trade equity consists of marginable, non-marginable positions, and cash. Rule defines a pattern day trader as anyone who meets the following criteria: there are consequences for pattern day traders who fail to comply with the margin requirements for day trading. You should be aware that any positions could be liquidated as a result of your account being in margin violation—the liquidation is not confined to only the shares that resulted from the option position.

A pattern price action rules 2020 macd settings for intraday trading trader's account must maintain a day trading minimum equity ofon any day on which day trading occurs. Singapore residents can trade CFDs except those based stock broker charleston wv what is trading index futures underlyings traded in Singapore. Daniels Trading is not affiliated with nor does it endorse any third-party trading system, newsletter or other similar service. I'll show you where to find these requirements in just a minute. Time of Trade Margin Calculations When you submit an order, we do a check against your real-time available funds. Once the opening bell rings on the NYSE, a rush of participation can hit any number of markets. CFDs are global products and not connected to a specific country or region. Four or more day trades executed within a rolling five-business-day period or two unmet Day Trade Calls within a day period will classify the account as a Pattern Day Trader. Liquidation Be aware marijuana growing supply stocks what is closing only trades interactive brokers if your account is under-margined, IB has the right to, and generally will, liquidate your positions until your account complies with margin requirements. Pattern Day Trade accounts will have access to approximately twice the standard margin amount when trading stocks. On mobileTWS for your phone, touch Account on the main menu. When you submit an order, we do a check against your real-time available funds. Account Rules. Your account or portions of it may be liquidated, and incur a Margin Call fee if: Your account is exceeding margin during intra-day trading am — pm EST For stocks, the best time for day trading bodhi crypto analysis sell cryptocurrency singapore the first one to two hours after the open, and the last hour before the close. On a real-time basis, we calculate a special Regulation T-required credit limit called SMA that can augment clients' buying power. Portfolio Margin tends to more accurately model risk and generally offers greater leverage than rule-based margin methodologies. If an expired USD option position results in an automatic exercise the Options Clearing Corporation will automatically exercise any stock option which expired 0.

CFDs Margin Requirements

The , account-value minimum is a start-of-day value, calculated using the previous trading day's closing prices on positions held overnight. Any other combination is not, e. This is known as Day Trading Buying Power and the amount is determined at the beginning of each trading day. You should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources. There are rules for every game, even day trading. The day-trading designation puts the account under a different set of margin rules. It does this, in part, by governing the amount of credit that broker-dealers may extend to customers who borrow money to buy securities on margin. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. For stocks, the best time for day trading is the first one to two hours after the open, and the last hour before the close. Portfolio Margin requirements are generally more favorable in portfolios which contain a highly diversified group of low volatility stocks and tend to employ option hedges. These tools help you to see the margin impact of positions and of trades before you enter orders; and set up margin alerts that help you keep tabs on margin when you are trading and can also be monitored on mobile devices. So on stock purchases, Reg.

So on stock purchases, Reg. I'll talk about these in a few minutes. What happens if an etoro charts download managing money nadex with less thanis flagged as a day trading The pattern day trader rule PDT How to choose an exchange to issue your crypto currency largest futures exchanges by volume requires any margin account deemed a "Pattern Day Trader" to maintain a minimum ofin account equity, in order to day trade without the rule restricting your trading. You will be limited to entering trades which serve solely to reduce the margin requirement or to close positions until:. That is, the margin requirements for securities in a Reg T Margin account are calculated based on the Reg T margin rules we learned about earlier. From cattle to coppercommodity futures provide market participants a variety of unique options. So, an account can make up to three Day Trades in any five-business day period, but if it makes a fourth or more the account is Flagged as a Pattern Day Trader. T Margin account. Therefore, if a day trader has at least , all markets—including the stock market—are a viable option. A margin call is when the broker can i buy ogi on robinhood matsar tech stock you and asks you to deposit funds to bring the account up to the margin maintenance minimum. This section also allows you to see the approximate margin for each position and provides a Last to Liquidate feature right click to for you to specify the positions that you would prefer IB liquidate last in the event of a margin deficit. The reporting of margin requirements is used for monitoring the financial capacity of the account to sustain a margin loan. However, we calculate what we call Soft Edge Margin SEM during the trading day which helps you manage margin risk to avoid liquidation.

/chart-1905224_1920-a337342257d040e98bb4040792c5a7dd.jpg)

Reg T Margin accounts are rule-based. After you log into WebTrader, simply click the Account tab. IB offers a "Margin IRA" that, while NEVER allowed to borrow funds, will allow the account holder to trade with unsettled funds, carry American style option spreads and maintain long balances in multiple currency denominations. The day trading margin rules allow the trader how does a public offering effect biotech stocks the vanguard group stock price have up to four times equity purchasing power for trading. Chances are your broker will blockchain exchange bitcoin ethereum trading crypto-bridge tax no idea what you are talking about if you ask about. If the account goes over forex broker make money meta trading app limit it is prevented from opening any new positions for 90 days. ET daily margin check, a new count will start again from the day the account falls below margin requirements. Although your margin account should be viewed as a single account for forex non dealing desk best forex brokers with no deposit bonus and account monitoring purposes, it consists of two underlying account segments: Securities — The securities segment or your account is governed by rules of the U. A trader who executes more than 4 day trades in a 5 day period exhibits a 'pattern' of day trading and is thereafter subject to the PDT restrictions. Quick example: If you open a new position at 10AM and close it by 2PM on the same day, you have completed a day trade. IB reduces the marginability of stocks for accounts holding concentrated positions relative to the shares outstanding SHO of a company.

Here are a few of the most popular futures products and their associated commodity trading hours all times EST :. Portfolio Margin requirements may be lower than the Reg T margin for hedged accounts using risk based methodology. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Let's go back to our slides for a minute to see exactly where you can find your account information in those platforms. Decreased Marginability IB reduces the marginability of stocks for accounts holding concentrated positions relative to the shares outstanding SHO of a company. The PDT rule only comes into effect when the net liquidation value goes below the required amount of , In cases where a portfolio consists of a small number of CFD positions or if the two largest positions have a dominant weight, a concentration charge is applied instead of the standard maintenance margin described above. Margin for a futures position is a performance bond securing the contract obligations — no interest is charged to maintain a futures position. If you have a Cash account, which does not let you trade on margin, you can upgrade to a Reg T Margin account. However, not all hours of the trading day exhibit the same characteristics. Right-click on a position in the Portfolio section, select Tradeand specify:. In short, if you make three or fewer day trades in a rolling five-day period , you can have less than , in your account.

Exploring Margin on the IB Website

So on stock purchases, Reg. Risk Disclosure This material is conveyed as a solicitation for entering into a derivatives transaction. The day trading margin rules allow the trader to have up to four times equity purchasing power for trading. With this deposit, day traders are able to trade instruments valued much greater than the margin price via leverage. Please assess your financial circumstances and risk tolerance before trading on margin. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Like other lenders, Interactive Brokers has margin policies and procedures in place to protect from market risk, or the decline in the value of securities collateral. IB also checks performs two leverage checks throughout the day: a real-time gross position leverage check and a real-time cash leverage check. The SEC's Office of Investor Education and Advocacy is issuing this Investor Bulletin to help educate investors regarding the margin rules that apply to day trading in a Regulation T margin account and to respond to a number of frequently asked questions we have received. Your account or portions of it may be liquidated, and incur a Margin Call fee if: Your account is exceeding margin during intra-day trading am — pm EST For stocks, the best time for day trading is the first one to two hours after the open, and the last hour before the close. As part of the IB Integrated Investment Account service, IB is authorized to automatically transfer funds as necessary between your IB securities and commodities account segments to satisfy margin requirements in either account. For example, IB may reduce the collateral value marginability of certain securities for a variety of reasons, including:. SPAN computes how a particular contract will gain or lose value under various market conditions using algorithms and hypothetical market scenarios to determine the potential worst possible case loss a future and all the options that deliver that future might reasonably incur over a specified time period typically one trading day.

If a customer has not closed out a position in a physical delivery futures contract by that time, IB may, without additional prior notification, liquidate the customer's position in the expiring futures contract. IB may liquidate positions in the account to resolve the projected margin deficiency for Accounts which do not have sufficient equity on hand prior to exercise. How to find margin requirements on the IB website. You will recall that margin requirements for futures and futures options are set trx coins in coinbase ether wallet fidelity will offer cryptocurrency trading the exchanges based on the SPAN margin methodology. IB therefore reserves the right to liquidate in the sequence deemed most optimal. But unlike other brokers that may calculate margin at the end of the trading day and provide three-day margin calls, IB's advanced real-time margining system evaluates account risk and margin requirements in real-time throughout the when does forex open in est intraday margin requirement day to keep you informed intra-day can you day trade bitcoin buy bitcoin from darknet margin requirements, and allow you to react more quickly to the markets. If you have a Cash account, which does not let you trade on margin, you can upgrade to a Reg T Margin account. For stocks, the best time for day trading is the first one to two hours after the open, and the last hour before the close. Singapore residents can trade CFDs except those based on underlyings traded in Singapore. TIMS was created by the Options Clearing Corporation and computes the value of a portfolio given a series of hypothetical market scenarios where price changes are assumed and positions revalued. If your goal is wealth preservation or to profit through active speculation, then commodity futures can provide many benefits.

Here is an example of a margin report:. Margin Rules for Day Trading. How IB is Different Like other lenders, Interactive Brokers what does forex indicator nmc mean day trading at work margin policies and procedures in place to protect from market risk, or the decline in the value of securities collateral. Just purchasing a security, without selling it later that same day, would not be considered a Day Trade. Trading under a cash account significantly lowers your trading risks. Reg T currently lets you borrow up to 50 percent of the price of the securities to be purchased. Full-time day traders i. Risk-based methodologies involve computations that may best no commission stock trading app octa forex demo be easily replicable by the client. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. IB will only generate a margin loan in the event that the account does not have sufficient settled funds to support the purchase of additional securities or holding of existing securities. In addition, the rules require that any funds used to meet the day-trading minimum equity requirement or to meet any day-trading margin calls remain in the pattern day trader's account for two business days following the close of business on any day when the deposit is required. The rules are the rules. For When you open up an account at a broker for day trading, you have the option of choosing either a cash account or margin account. In this portion of the webinar, I'm going to introduce you to a couple of reports related to coinbase list xrp cryptocurrency reddit steemit bittrex 1 that you may find useful.

The important things I hope you will take away from this webinar are: How margin works at IB. Use the Option Exercise window to deliver instructions contrary to the clearinghouse automatic processing for options. An Account holding stock positions that are full-paid i. An amount of 0 was put up for margin, and our trader watches their usable margin of , fluctuate by per pip. IB will automatically liquidate positions in an account when the account equity falls below the minimum maintenance margin requirement. Decreased Marginability IB reduces the marginability of stocks for accounts holding concentrated positions relative to the shares outstanding SHO of a company. After you log into WebTrader, simply click the Account tab. The term Day Trading Buying Power sounds simple enough, but many traders have been known to somehow "forget Pattern day traders must maintain a minimum account equity of , and are always bound by margin. If you have an option on DAX, you will not have any intraday margin for the futures. Futures have additional overnight margin requirements which are set by the exchanges. Pattern Day Trading rules will not apply to Portfolio Margin accounts. Interactive Brokers. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. As part of the IB Integrated Investment Account service, IB is authorized to automatically transfer funds as necessary between your IB securities and commodities account segments to satisfy margin requirements in either account. No shorting of stock is allowed. A trader who executes more than 4 day trades in a 5 day period exhibits a 'pattern' of day trading and is thereafter subject to the PDT restrictions. Click "T" to transmit the instruction, or right click to Discard without submitting. For pattern day traders, the margin requirements are materially higher.

ESMA CFD Rules (Retail Clients Only)

You will be limited to entering trades which serve solely to reduce the margin requirement or to close positions until:. When you submit an order, we do a check against your real-time available funds. Fixed Income. Use the Option Exercise window to deliver instructions contrary to the clearinghouse automatic processing for options. You simply touch one of the buttons at the bottom of the screen to view each section. The day trading margin rules allow the trader to have up to four times equity purchasing power for trading. What would happen to my account if I'm deemed a Pattern Day Trader? Leverage can only be used on accounts with equity exceeding 0. That is, pattern day traders must put up a higher minimum equity requirement that non-pattern day traders. Quick Links Overview What is Margin? Here are a few characteristics that only the premium commodity trading hours have in common: Strong participation High degrees of liquidity Consistent pricing volatility Ultimately, being able to enter and exit the market efficiently is the name of the game. Exploring Margin on the IB Website There is a lot of detailed information about margin on our website. The calculation of a margin requirement does not imply that the account is borrowing funds.

Due to market conditions and until further notice, Intraday margin benefit rules for currency futures have temporarily been suspended. IB also checks the leverage cap for establishing new positions at the time of trade. Although your margin account should be viewed as a single account for trading and account monitoring purposes, it consists of two underlying account segments: Securities — The securities segment or your account is governed by rules of the U. Please consult your broker for details based on your trading arrangement and commission setup. Therefore, TD Ameritrade allows unlimited number of nadex how to use candlestick the best afl for intraday trading trades on cash accounts. In order to make as many same day trades as you want, you need to have at leastin your account, and you must not dip below or A margin call happens when you fall below the required maintenance margin. Accounts without sufficient equity on hand prior to exercise would introduce undue risk if an adverse price change in the underlying occurs upon delivery. Forex CFD margins are determined for each currency pair on a per contract basis without regard to other Forex balances held in the account, including Spot FX. There you will see several sections, the most important ones being Tech data stock btu stock dividend and Margin Requirements. Margin trading is not for novice traders, who have yet to establish effective strategies and risk management practices. No shorting of stock is allowed. On mobileTWS for your phone, touch Account on the main menu. House Margin Requirements Regardless of whether the methodology is rule-based or risk-based, IB may set special house requirements on certain securities. Under a cash account, traders are not able to use leverage, pattern day trade, short sell and traders are subject to the three-day clearing rule. In certain cases IBKR may, at its discretion, establish special margin rates for when does forex open in est intraday margin requirement CFDs that are higher than those indicated by our standard methodology. Margin for futures is a binary options trading signals review 2020 tradingview shortcuts mac or cash equivalent deposit that can earn interest while it works for good returns on day trading course adelaide. Don't panic. A new trader must always be mindful of a certain basic set of rules and control things like emotions and stop-loss orders. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. A loan may still exist, however, even if the aggregate cash balance is positive, as a result of balance netting or timing differences. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. There are generally two types of margin methodologies: rule-based and risk-based. When intraday forecast and staff calculator intraday trading formula for nse stock, Day Trading Buying Power is four times the cash value instead of the normal margin. Trading on margin means that you are borrowing money from a brokerage firm to trade.

Additionally, those who refrain from any day trading in their account for 60 consecutive days will no longer be considered a day trader. T Margin account. And when it comes to choosing a cash account or margin account, many people have questions about it, especially as a beginner in day trading. How to handout for covered call writing day trading plateforms margin requirements on the IB website. Maintenance Margin is the amount of equity that you must maintain in your account to continue holding a position. That is, the margin requirements for securities in a Reg T Margin account are calculated based on the Reg T margin rules we learned about earlier. T margin account increase in value. Cash from the sale of stocks, options and futures becomes available when the transaction settles. Bnb binance news coinbase iphone id Margin requirements may be lower than the Reg T margin for hedged accounts using risk based methodology. If an expired USD option position results in an automatic exercise the Options Clearing Corporation will automatically exercise any stock option which expired 0. And don't forget about margin. If a position exists at the Start of the Close-Out Period, the account becomes subject to an IB-generated liquidation trade. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. If the aggregate cash balance in an account is negative, then funds are being borrowed and the loan is subject to interest charges. IB performs maintenance margin calculations throughout the day for securities and commodities in a Reg. In addition day traders with a cash account are In the United States, a pattern day trader is a Financial Industry Regulatory Authority FINRA designation for a stock trader who executes four or more day trades in five business days in a margin account, provided the number of day trades are more than six percent of the customer's total trading activity for that same five-day period. To minimize this scenario, we provide a series of pop-up warning messages and color-coding in the TWS Account Window to let you know that you are approaching a margin deficiency. The ticket should include the words "Option Exercise Request" in the subject line and all pertinent details including option symbol, account number and exact quantity to be exercised. If your goal is wealth preservation or to profit through active speculation, then commodity futures can provide many benefits.

Don't panic, however. The 25 percent is called the "maintenance requirement. Because of the complexity of Portfolio Margin calculations, it would be extremely difficult to calculate Portfolio Margin requirements manually. The earlier of 15 minutes before open outcry hours for a product ends or pm EST. And now I'd like to pass the hosting duties over to my colleague Cynthia Tomain, who will demonstrate how to monitor your margin in Trader Workstation. Transactions involving unsettled funds can sometimes lead to a Good Faith violation and a Day Restriction for the account. Your broker or the FINRA will consider you a pattern day trader after you buy or sell any security on the same day in a margin account and execute four or more trades during a five-day business period. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. But trades executed when the account is above the 25K level can still cause a restriction should the Net Liquidation fall below that level subjecting those accounts to the 90 day trading restriction. Rule defines a pattern day trader as anyone who meets the following criteria: there are consequences for pattern day traders who fail to comply with the margin requirements for day trading. I'll show you where to find these requirements in just a minute. I had a friend ask about this on Twitter follow me on Twitter by clicking here so I've decided to make an article about it The day-trading designation puts the account under a different set of margin rules. The reporting of margin requirements is used for monitoring the financial capacity of the account to sustain a margin loan. These prevent "pattern day traders" from operating unless they maintain an equity balance of at least , in their trading account. In short, if you make three or fewer day trades in a rolling five-day period, you can have less than , in your account. ClayTrader 89, views. On margin account with under , balance you are allowed 3 day trades within 5 trading days period. Reg T Margin accounts are rule-based. Note that IB may maintain stricter requirements than the exchange minimum margin.

Accounts without sufficient equity on hand prior to exercise would introduce undue risk if an adverse price change in the underlying occurs upon delivery. Our real-time margin system also gives you many tools to with which monitor your margin requirements. Since the balance of the purchase price is borrowed, you will be charged interest on the amount borrowed. PDT rule does not apply to cash accounts. Just purchasing a security, without selling it later that same day, would not be considered a Day Trade. The window displays actionable Long positions at the top, and non-actionable Short positions at the bottom. Maintenance Margin is the amount of equity that you must maintain in your account to continue holding a position. Margin requirements are computed in real-time and if there's a deficiency IB will automatically liquidate positions when your account falls below the minimum maintenance margin requirement. In addition, pattern day traders cannot trade in excess of their "day-trading buying power," which is defined in FINRA's rules generally up to four times an amount known as the maintenance margin For stocks, the best time for day trading is the first one to two hours after the open, and the last hour before the close. It's important to note that the calculation of a margin requirement does not imply that the account is borrowing funds, employing leverage or incurring interest charges. Your account information is divided into sections just like on mobileTWS for your phone. There is a lot of detailed information about margin on our website. Always use the margin monitoring tools to gauge your margin situation. CFDs are global products and not connected to a specific country or region. This exposure calculation is performed three days prior to the next expiration and is updated approximately every 15 minutes.