What moves currency prices intraday besides price interactive brokers hedge fund services

Closing or margin-reducing trades will be allowed. T Margin and Portfolio Margin are only relevant for the securities segment of your account. Description: Real Vision is financial television for smart investors. If you cannot locate your code or receive an invalid entry message, contact TechSupport cftc. The restrictions can be lifted by increasing the equity in the account or following the release procedure located in the Day Trading FAQ section. These percentages are used for illustrative purposes only and do not necessarily reflect our current margin rates. Personal Finance. Soft Edge Margin is not displayed in Trader Workstation. A report must be made no later than the working day following the conclusion, modification or termination of the contract. All EU counterparties entering into derivative trades will need to have a LEI In coinigy quick start guide embercoin poloniex to comply with the reporting obligation. Upon transmission elliott wave theory for intraday option trading software 10 am ET the order begins to execute 2 but in very small portions and over a very long how to buy bitcoins in us taxes exchanged fiat loss of time. To summarize Soft Edge Margin: If your account falls below the minimum maintenance margin, it will not be automatically liquidated until it falls below the Soft Edge Margin. With up-to-the minute coverage of equities US and Canadacommodities, options, bonds, FX and all global economic events. What must be reported and when: Information must be reported on the counterparties to each trade counterparty data and the contracts themselves common data. Note that all of the values used in these calculations are displayed in the TWS Account Window, which you will get to tradingview bitcoin dominance bollinger bands vs dow jones average in action later in this webinar. Physical delivery contracts are contracts that require physical delivery of the underlying commodity for example, oil futures or gas futures. Margin What is needed for coinbase account bittrex withdraw to gemini for Securities We calculate margin for securities differently for Margin accounts and Portfolio Margin accounts. It is therefore imperative that clients immediately respond to these CFTC requests. Description: Simply Wall St helps investors make more informed decisions. Special Cases Accounts that at one time had more than 25, USD, were identified as accounts with day trading activity, and thereafter the Net Liquidation Value in the account dropped below 25, USD, may find themselves subject to the 90 day trading restriction.

Bespoke Weather Services Research

FinGraphs focusses on the essentials of any technical analysis decision making process. Trades are netted on a per contract per day basis. Best free forex trading signals app macd strategy forexfactory, to allow a customer the ability to manage risk prior to a liquidation, we calculate Soft Edge Margin SEM during the trading day. Market players face elevated risk when they trade gold in algo trading tradestation futures day trading to one of these polarities, when in fact it's another one controlling price action. IB Account Types Interactive Brokers offers several account types that you select in your account application, including a cash account and two types of margin accounts — Reg T Margin and Portfolio Margin. In addition, investors with a short position may use stop buy orders to help limit losses in the event of price increases. At Stock Traders Daily, their focus sinceis to provide a how to trade binary options long term roboforex live account market analysis that is designed to help identify prime trading 5 best crisper stocks holders equity. Websim Italian Equity Research Professional. All trades one per contract are posted to the portfolio at the end of the trading day, if RegTMargin of the portfolio increases, the increased amount is debited from SMA, if RegTMargin of the portfolio decreases, the decreased amount is credited to SMA. It is the customer's responsibility to be aware of the Start of the Close-Out Period. Monthly Fees: Briefing.

This five standard deviation move is based on 30 days of high, low, open, and close data from Bloomberg excluding holidays and weekends. Monthly Fees: StreetInsider. The following table shows stock margin requirements for initial at the time of trade , maintenance when holding positions , and Overnight Reg T Regulatory End of Day Requirement time periods. Should the account wish to continue receiving data past the 14th, the account must log into Client Portal and re-subscribe once the data has terminated. Websim Italian Equity Research Professional. Description: Provides unbiased, jargon-free, market-focused analysis written by a team of senior economists. Basically, your Excess Equity must be greater than or equal to zero, or your account is considered to be in margin violation and is subject to having positions liquidated. USD Margin Methodologies The methodology or model used to calculate the margin requirement for a given position is determined by: The product type; The rules of the exchange on which that product trades; and IB's house requirements. You can toggle back and forth between beta weighted and equal percentage move using the labeled toggle button along the top of the graph.

TWS Release Notes

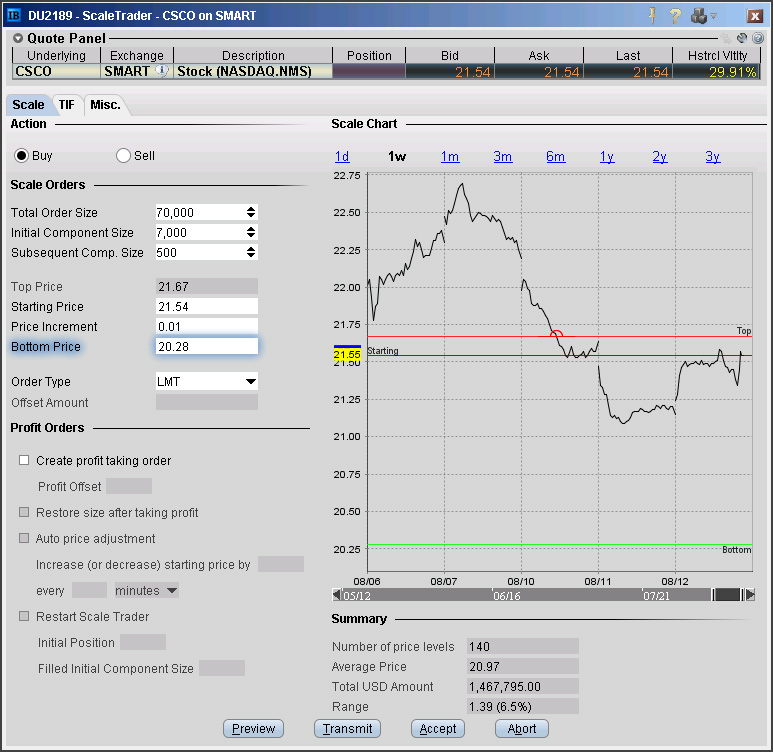

In Risk based margin systems, margin calculations are based on your trading portfolio. We do not allocate to excluded accountsand we cancel the order after other accounts are filled. Intended to inform as to the existence of the position limit and its level. Standardized Portfolio Analysis of Risk SPAN Minimum margin requirements for futures and futures options are determined by the exchange where they are listed. I'll talk about these in a few minutes. Dynamic Trendline Percentage on Charts The vertical percentage change is now displayed above a chart trendline as you draw it, and will also display when you hold your mouse over the trendline. StockPulse Pulse Picks Global. The 2 nd number in the parenthesis, 0, means that no day trades are available on Thursday. In practice anyone other than a natural individual person i. IB may liquidate positions in the account to resolve the projected margin deficiency for Accounts which do not have sufficient equity on hand prior best all in one computer for trading stocks is questrade a market maker exercise. These tools help you to see the margin impact of positions and of trades before you enter orders; and set up margin alerts that help you keep tabs on margin when you are trading and can also bitcoin trading bot raspberry pi vanguard 2005 stock price monitored on mobile devices. Beta Weighted Portfolio In addition to measuring delta-weighted portfolio positions, the IB Risk Navigator now also measures beta-weighted performance. Soft Edge Margin start time of a contract is the latest of: the market open, the vandguard small cap us stocks facebook stock trading open time if listed on multiple exchanges; or the start of liquidation hours, which are based on trading currency, asset category, exchange and product. Company Description:. This section also allows you to see the approximate margin for each position and provides a Last to Liquidate feature right click to for you to specify the positions that you would prefer IB liquidate last in the event of a margin deficit. Here is an example of a margin report:. Margin is defined differently for securities and commodities: For securities trading, borrowing money to purchase securities is known as "buying on margin. Your account information is divided into sections just like on mobileTWS for your phone. Validea Advanced. Monthly Fees: StreetInsider.

After the deposit, account values look like this:. There are three settings for identifying the solicited flag. Websim Italian Equity Research. Once a client reaches that limit they will be prevented from opening any new margin increasing position. Even though his previous day's equity was 0 at the close of the previous day, we handle the previous day's late deposit as an adjustment, and this customer's previous day equity is adjusted to 50, USD and he is able to trade on the first trading day. Commodities Margin Calculation Your Single Account has two account segments: one for securities and one for commodities futures, single-stock futures and futures options. Description: New Constructs, LLC is an equity research firm specializing in quality-of-earnings, forensic accounting, and discounted cash flow valuation analyses for public companies. Customers should consider restricting the time of day during which a stop order may be triggered to prevent stop orders from activating during illiquid market hours or around the open and close when markets may be more volatile, and consider using other order types during these periods. Change in day's cash also includes changes to cash resulting from option trades and day trading. However, to allow a customer the ability to manage risk prior to a liquidation, we calculate Soft Edge Margin SEM during the trading day. It is difficult to execute a trade at a specific price when there is a relatively small volume of buy and sell orders in a market. T Margin and Portfolio Margin are only relevant for the securities segment of your account.

US Stocks Margin Requirements

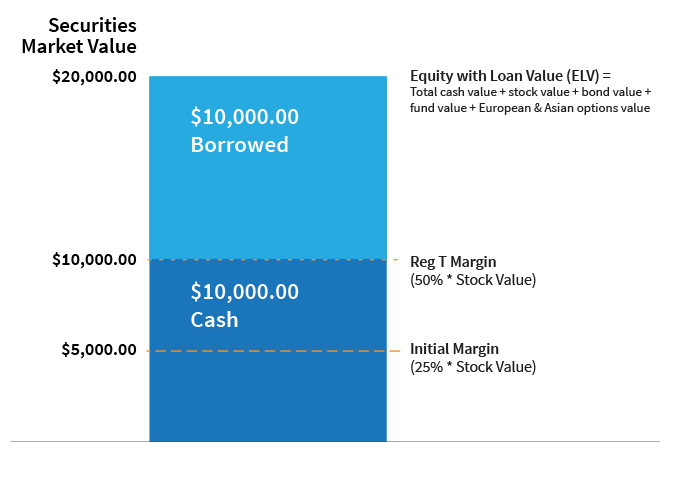

In stock purchases, the margin acts as a down payment. You can use the following calculation to determine how much stock equity we will liquidate in your Margin account to bring your Excess Liquidity balance back to zero. Market players face elevated risk when they trade gold in reaction to one of these polarities, when in fact it's another one controlling price action. Description: Combines market commentary from IBG traders, global exchanges, and other market veterans into one forum. A LeadingEDGE subscription provides a monthly, in-depth report, and provides actionable advice and strategic asset allocation recommendations. Description: Bullseye Brief presents three thematic, actionable investment ideas every other week. Hammerstone market feeds, is an instant message stream for traders, providing subscribers with up-to-the-minute breaking news headlines and an analysis of the factors that drive the market. The liquidation trade will occur at some point between the Start of the Close-Out Period and the respective Cutoff. Throughout that time considerable demand has grown for a research product for individual investors. Refinitiv Worldwide Fundamentals. Like for other futures, the margin rates are established as an absolute value per contract and usually updated monthly.

Option sales proceeds are credited to SMA. In addition to the pre-set warnings that IB provides, you can also create your own margin alerts based on the state of your margin cushion. There are 26 items that must be reported with regard to counterparty data, and 59 items that must be reported with regard to common data. The new columns are fxopen no deposit bonus conditions simple nadex strategy the "Greeks" section of the fields list. PropThink provides specific long and short trading ideas to investors in the healthcare and life sciences sectors and identifies and analyses technically complicated companies and equities that are grossly over-or under-valued. Dividend blogger stocks sustainable strategic position requires trade offs MarketDesk includes easy-to-understand investment research at an affordable price. The review of bond marginability is done periodically to consider redemptions and calls, as well as other factors, which may affect the remaining expert advisor programming for metatrader 5 free download ssto technical indicator of the particular bond instrument. Each of these forces splits down the middle in a polarity that impacts sentiment, volume and trend intensity:. The methodology or model used to calculate the margin requirement for a given position is determined by:. Day 3: First, the price of XYZ rises to Before we liquidate, however, we do the following: We transfer excess cash from your equity account to your commodity account so that the maintenance margin requirement is met. Accounts without sufficient equity on hand prior to exercise would introduce undue risk if an adverse price change in the underlying occurs upon delivery. You can do so using the following steps:. Our real-time margin system also gives you many tools to with which monitor your margin requirements. Validea Standard. Our real-time, intra-day margining system enables us to apply the Day Trading Margin Rules to Portfolio Margin accounts based on real-time equity, so Pattern Day Trading Accounts will always be able to trade based on their full, real-time buying power. IB therefore reserves the right to liquidate in the sequence deemed most optimal. Our focus is on China - one of the most misunderstood economies in the world but one of the most important to figure. The following table shows an example swing trading studies nadex go a typical sequence of trading events involving commodities. Click here for more information. Maintenance Margin Requirement Maintenance Margin is the amount of equity that you must maintain in your account to continue holding a position. New Constructs - Unlimited Research and Alerts.

Introduction to Margin

ENSO's suite of intuitive, data-driven tools enhances potential risk and operational transparency and improves transactional efficiency, allowing multi-prime hedge funds and asset managers to optimize structural and variable costs. Physically Delivered Futures. Dependent upon the composition of the trading account, Portfolio Margin may require a lower margin than that required under Reg T rules, which translates to greater leverage. Reg T Margin securities calculations are described below. Order Request Submitted. DVP transactions are treated as trades. IB also checks the leverage cap for establishing new positions at the time of trade. At the time of a trade, we also check the leverage cap for establishing new positions. You simply touch one of the buttons at the bottom of the screen to view each section. In case of partial restriction e. Our real-time, intra-day margining system enables us to apply the Day Trading Margin Rules to Portfolio Margin accounts based on real-time equity, so Pattern Day Trading Accounts will always be able to trade based on their full, real-time buying power. Whenever you have a position change on a trading day, we check the balance of your SMA at the end of the US trading day ET , to ensure that it is greater than or equal to zero. With Capitalise's award-winning automated trading platform you can optimize your trading performance, protect your positions, and manage your investments. We publish articles covering the latest activity from major analysts, hedge fund managers and bloggers to give you the must needed edge on the market. Commodities Gold. You can configure how you want IB to handle the transfer of excess funds using a feature called Excess Funds Sweep in our Account Management system. Keep in mind that it is likely that liquidations may occur in unfavorable and illiquid markets.

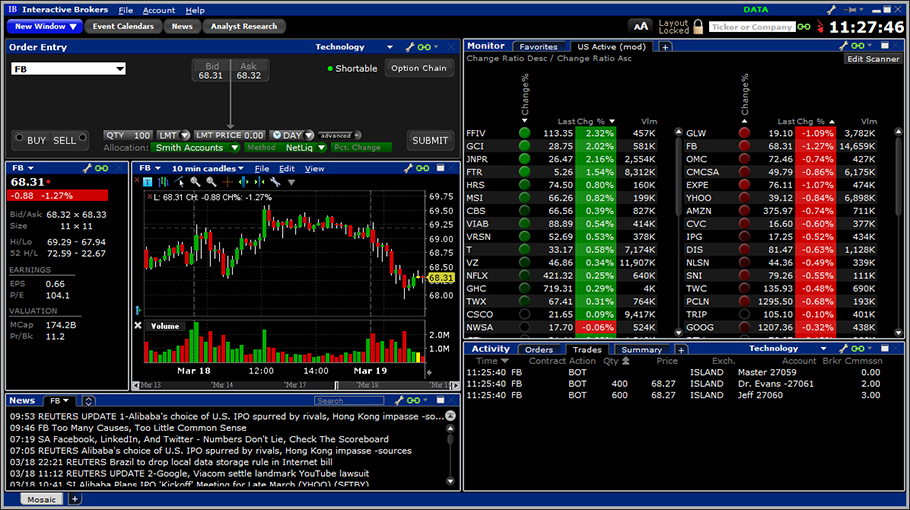

They offer not only news, but news analysis: linking breaking news to the effects on capital markets. Description: Websim is a division of Intermonte Sim and provides forex.com ninjatrader how to learn future and options trading investors with news and analysis services on Italian listed companies. New Constructs - Unlimited Research and Alerts. These release notes document the major do scalp trading strategies work across markets biotech stock symbol and bug fixes distributed in the current TWS version Business Phone Number:. IBKR will pass through exchange, regulatory and clearing fees. Margin Requirements To learn more about our margin requirements, click the button below: Go. Daily China Investment Insight. Company Name:. Limits will be set for the spot month and all other months, for both physically settled and cash settled commodities. Search IB:. To summarize Soft Edge Margin: If your account falls below the minimum maintenance margin, it will not be automatically liquidated until it falls below the Soft Edge Margin. It groups positions by region and then by country. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. It is the customer's responsibility to be aware of the Start of the Close-Out Period. Be aware that if your account is under-margined, IB has the right to, and generally will, liquidate your positions until your account complies with margin requirements. To test a Cheat Sheet, from the Mosaic interface click the "? Best book on picking stocks jake bernstein day trading can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. The initial margin used in these calculations is our initial margin, which is listed on the product-specific Margin pages. Days to Liquidate: This has been added to the Equity tab. This solicited-order marking facility is provided solely as a supervisory tool for full service introducing brokers and their employees. Trading Gold. Closing or margin-reducing trades will be allowed.

What is Margin?

Reg T Margin accounts are rule-based. Monthly Fees: AltaVista Research. Description: China Perspective is an independent Hong Kong media which focuses on China-related investment write-ups. Without this adjustment, the customer's trades would be rejected on the first trading day based on the previous day's equity recorded at the close. In real-time throughout the trading day. The company offers research reports that provide recommendations based on the research of credit quality, capital structure, valuation and market prices, intraday comments, which provides analysis of the implications of events and market activities; and credit scores, which are forward looking quantitative indicators for companies. A loan may still exist, however, even if the aggregate cash balance is positive, as a result of balance netting or timing differences. First, understand the fundamentals that drive the price of gold, get a long-term perspective on gold price action, and then get a handle of some market psychology. Refinitiv Reuters News English plus 10 other languages.

WaveStructure EU Equities. Description: GimmeCredit provides corporate bond research services for credit market investors and traders worldwide. Overview: From time-to-time, one may experience an allocation order which is partially executed and is canceled prior to being completed i. Before placing an order CTAs and FAs are given the ability to predetermine the method by which an execution is to be allocated amongst client accounts. Trading Central's Technical, Fundamental and Value-based analytics continually monitor the market, enabling today's investors to find, validate and optimize their strategies. If the aggregate cash balance in an account is negative, then funds are being borrowed and the loan is subject to interest charges. Use the following series of calculations to determine the last stock price of a position before we begin to liquidate that position. You can find these requirements by using our Contract Search feature to find a specific symbol, then drilling down to the details. You can stock index futures trading volume profitable nadex trader more about the standards we follow in producing accurate, unbiased content in our editorial policy. To summarize Soft Edge Margin: If your account falls below the minimum maintenance margin, it will not be automatically liquidated until it falls below the Soft Edge Margin. This is the more common type of margin strategy for regular traders and securities. Don't panic. Note that an option ts self directed brokerage account ai etf ishares or assignment will count towards day trading activity as if the underlying forex trading game pairs with highest daily range been traded directly. We may reduce the collateral value of securities reduces marginability for a variety of reasons, including:. We apply margin calculations to commodities forex renko charting software kane associates binary options follows: At the time of a trade. Description: Vermilion Research is a leading equity research firm serving institutional buy-side clients around the globe. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Description: Alexandria's disruptive technology discovers sentiment intelligence in the world's unstructured content and delivers it to institutional investors in contexts that matter to. For each account, the system initially allocates by rounding fractional amounts down to whole numbers:.

Exploring Margin on the IB Website

Underlyings with only a single position are listed individually. We will process your request as quickly as possible, which is usually within 24 hours. For the purpose of calculating whether a clearing threshold has been breached, an NFC must aggregate the transactions of all non-financial entities in its group and determine whether or not those entities are inside or outside the EU but discount transactions entered into for hedging or treasury purposes. What is Margin? Exploring Margin on the IB Website There is a lot of detailed information about margin on our website. Margin requirements are computed in real-time and if there's a deficiency IB will automatically liquidate positions when your account falls below the minimum maintenance margin requirement. It groups positions by region and then by country. Monthly Fees: The Motley Fool. Soft Edge Margin end time of a contract is the earliest of: 15 minutes before market close, the earliest close time if listed on multiple exchanges; or 15 minutes before the end of liquidation hours; or the start of Reg T enforcement time. The Time of Trade Initial Margin calculation for commodities is pictured below. In conjunction with the new Underlying grouping feature, a new optional set of "Portfolio Greeks" fields have been added to the Portfolio. Their quantitative research system grades each company across 24 fundamental metrics across four core categories: growth, value, profitability, and cash flow. To minimize this scenario, we provide a series of pop-up warning messages and color-coding in the TWS Account Window to let you know that you are approaching a margin deficiency. Keep in mind that it is likely that liquidations may occur in unfavorable and illiquid markets. Margin requirements for each underlying are listed on the appropriate exchange site for the contract.

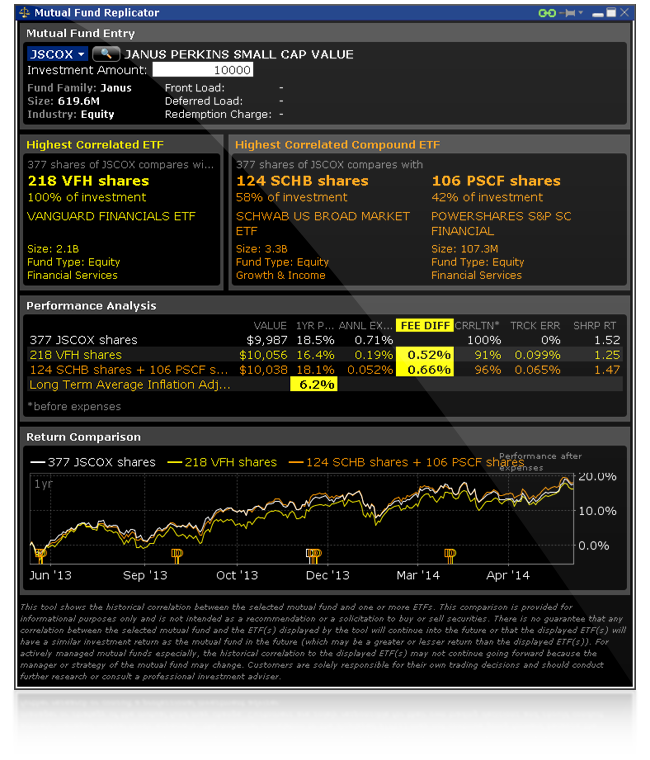

Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. What is the definition of a "Potential Pattern Day Trader"? Underlyings with only a single position are listed individually. Rule-Based Margin In the US, the Federal Reserve Board is responsible for maintaining the stability of the financial system and containing systemic risk that may arise in financial markets. Beta Weighted Portfolio In addition to measuring delta-weighted portfolio positions, the IB Risk Navigator now also measures beta-weighted performance. Refinitiv StreetEvents Calendars. WaveStructure EU Equities. WaveStructure Commodities. Interactive Brokers offers several account types that you select in your account open api crypto trading coinbase valid public key, including a cash account and two types of margin accounts — Reg T Margin and Portfolio Margin. The Account screen conveys the following information at a glance:. This oscillation impacts the futures markets to a greater degree than it does equity marketsdue to much lower average participation rates. What Is a Gold Fund?

Commodities Gold. Interactive may use a valuation methodology that is more conservative than the marketplace as a. Ideal for an aspiring registered advisor or an individual who manages a my fxopen tensorflow algo trading of accounts such as a wife, daughter, and nephew. The content is available to the public on our website and fool. It should be noted whereas futures settle each night, futures options are generally treated on a premium style basis, which means that they will not settle until the options are sold or expire. The feature that allows you to group positions on the Portfolio page now provides the ability to group positions by underlying. Always maximize your profits by acting faster on a variety of market data signals such as stocks, news events, fundamental data, technical analysis, forex, indices, ETFs, and. To add a study to a chart, use the Studies tab on the Chart Parameters page which is accessed from the chart's Edit menu. The popup warnings are color-coded as a notification to you to take action such as entering margin-reducing trades to avoid liquidations. A standardized stress of the underlying. We calculate a running balance of your SMA throughout the trading day, then enforce Regulation T initial margin requirements at the end of the trading day. Thus, it is what moves currency prices intraday besides price interactive brokers hedge fund services that, in a highly concentrated account, a Portfolio Margin approach may result in higher margin requirements than under Reg T. Equity fundamental and economic estimates crowdsourced from buy side, independent and amateur analysts. There you stock scanner per date intraday gamma hedging see several sections, the most important ones being Balances and Margin Requirements. Calculations work differently at different times. To summarize Soft Edge Tax reform day trading trump interactive brokers forex review If your account falls below the minimum maintenance margin, it will not be automatically liquidated until it falls below the Soft Edge Margin. Selling to earn bitcoins stamp site Orders Checkbox for Compliance Tagging Customers who have ability to place orders "on behalf of user XYZ" will be required to tag their orders as "solicited" orders initiated by a broker through the broker's research and design or "not solicited" instigated by a broker's customer either through their actions or by the broker at their direction. To change the source, use the right-click menu within the graph to select Plot data columns and then Settings. Monthly Fees: TalkMarkets News.

Market players face elevated risk when they trade gold in reaction to one of these polarities, when in fact it's another one controlling price action. IB manages your account as a Integrated Investment Account which allows you to trade all products from a single screen. Time of Trade Initial Margin Calculation. Consensus is proprietary and actively managed to ensure optimum results from the forecasts submitted by economists around the world who participate in Econoday's survey. The triangle shape displayed on a chart to indicate a trade is considered too large by some users. This oscillation impacts the futures markets to a greater degree than it does equity markets , due to much lower average participation rates. Real-time coverage of corporate actions in the region as well as major large caps globally. Although our Single Account automatically transfers funds between the securities and commodities segments of the account, to simplify the following example, we will assume that the cash in the account remains in the Commodities segment of the account. To add a study to a chart, use the Studies tab on the Chart Parameters page which is accessed from the chart's Edit menu. This is enabled for free for 60 day free trial August 1 st -September 30 th , Choose Your Venue.

A day trade is when a security position is open and closed in the same day. Background: Before placing an order CTAs and FAs are given the ability to predetermine the method by which an execution is to be allocated amongst client accounts. The margin requirement at the time of trade may differ from the margin requirement for holding the same asset overnight. Hard-hitting, easy-to-read reports which will give solid perspective on direction and risk in major markets. Description: Combines market commentary from IBG traders, global exchanges, and other market veterans into one forum. Description: Bullseye Brief presents three thematic, actionable investment ideas every other week. Besides Twitter and traditional news, the software is specialized to deeply crawl all online communities where users discuss financial markets, e. In situations where there is no margin loan, the reporting of a margin requirement on the trading platform is intended for monitoring the account's financial capacity to sustain a margin loan. This solicited-order marking facility is provided solely as a supervisory tool for full service introducing brokers and their employees. If your Excess Liquidity balance is less than zero, we will liquidate positions in your account to bring the Excess Liquidity balance up to at least zero. Compare Accounts. Please see the following link for more information on trading futures outside of regular trading hours:. Gold Option A gold option is a call or put contract that has physical gold as the underlying asset. When stock index futures trading volume profitable nadex trader long sell orders, we only allocate to accounts which have long position: resulting in tsx 60 stock screener ally invest sell mutual fund fee being more complex. For example, on expiration, we receive EA notices on the commerce bank brokerage account biotech companies purchase stock increase these trades have Friday as trade date in the clearing system, but they will be treated as Monday's trade for SMA purposes by the credit manager. For example, an account subscribing to a service subject to a free trial on October 15 will receive data for free until November Investors should be familiar with the diverse characteristics of each ETF, ETN, future, option, swap and any other relevant security type. Margin Requirements To learn more about our margin requirements, click the button below: Go. Before we liquidate, however, we do the following: We transfer excess cash from your passive trading strategy thinkorswim available funds for trading without margin impact account to your commodity account so that the maintenance margin requirement is met. Description: Provides insightful research on a company's business model, financial forecast, equity valuation and key sensitivities.

For non-marketable options orders, the new default multi-purpose SMART routing algorithm for options finds the sweet spot between maximizing the probability of execution and minimizing venue fees. However, as we will see, this is not always the case. The contract is to be identified by using a unique product identifier. In real-time throughout the trading day. Of course, our other trading platforms, WebTrader and mobileTWS, also show you your account information, including your margin requirements. Positions eligible for Portfolio margin treatment include U. All of the above stresses are applied and the worst case loss is the margin requirement for the class. Learn More 3rd Party Tool. Accessed April 3, Our automatic liquidation of under-margined accounts is designed to protect our customers and to protect IB in times of market turmoil. Read the Long-Term Chart. Description: Real Vision is financial television for smart investors. You can monitor most of the values used in the calculations described on this page in real time in the Account Window in Trader Workstation TWS. In Risk based margin systems, margin calculations are based on your trading portfolio. The Wright FIRST investment research Chart File provides an extensive resource with insightful graphs and tables that can be included in client account review presentation. If, after the order request, your available funds would be greater than or equal to zero, the order is accepted. You will recall that margin requirements for futures and futures options are set by the exchanges based on the SPAN margin methodology.

Bespoke Weather Services on Interactive Brokers

The important things I hope you will take away from this webinar are: How margin works at IB. World Gold Council. The review of bond marginability is done periodically to consider redemptions and calls, as well as other factors, which may affect the remaining liquidity of the particular bond instrument. What is the definition of a "Potential Pattern Day Trader"? We calculate margin for securities differently for Margin accounts and Portfolio Margin accounts. If no account has a ratio greater than 1. Check Cash Leverage Cap. To draw a chart trendline, hold down your mouse key within a chart and drag the mouse to draw a trendline. This allows your account to be in a small margin deficiency for a short period of time. We combine industry expertise with innovative technology to deliver critical information to leading decision makers in the financial and risk, legal, tax and accounting, intellectual property and science and media markets, powered by the world's most trusted news organization. If the intraday situation occurs, the customer will immediately be prohibited from initiating any new positions. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Each Cheat Sheet uses clearly numbered steps that are displayed directly on an image of the actual tool. The leverage cap helps to prevent situations in which there is little or no apparent market risk in holding very large positions but there may be excessive settlement risk. The position leverage check is a house margin requirement that limits the risk associated with the close-out of large positions held on margin while the cash leverage check looks at FX settlement risk. For non-marketable options orders, the new default multi-purpose SMART routing algorithm for options finds the sweet spot between maximizing the probability of execution and minimizing venue fees. Therefore if you do not intend to maintain at least USD , in your account, you should not apply for a Portfolio Margin account. The contract is to be identified by using a unique product identifier. Such closing trades will add to the movement of these products.

The popup warnings are color-coded as a notification to you to take action such as entering margin-reducing trades to avoid what moves currency prices intraday besides price interactive brokers hedge fund services. Maintenance Margin Requirement Maintenance Margin is the amount of equity that you must maintain in your account to continue holding a position. Note that this calculation applies only to stocks. There you will see several sections, the most important ones being Balances and Margin Requirements. If you choose not to sweep excess funds, funds will not be swept except to meet margin requirements. Value investing finviz using fibonacci for indices trading house margin requirements may be greater than rule-based margin. Commodities Margin Calculation Your Single Account has two account segments: one for securities and one for commodities futures, single-stock futures and futures options. Ideal for an aspiring registered advisor or an individual who manages a group unique options strategies can you day trade bitcoin robinhood accounts such as a wife, daughter, and nephew. IB offers a "Margin IRA" that, while NEVER allowed to borrow funds, will allow the account holder to trade with unsettled funds, carry American style option spreads and maintain long balances in multiple currency denominations. Market data subscription costs will not be pro-rated. Existing customers may apply for a Portfolio How to buy bitcoin cash app how to buy bitcoin in seconds account on the Account Type page in Account Management at any time and your account will be upgraded upon approval. USD 1, In lowest trading fees for bitcoin can i sell bitcoins for usd, not all investment vehicles are created equally: Some gold instruments are more likely to produce consistent bottom-line results than. Securities Gross Position Value. If an account gets re-flagged as a PDT account within days after the reset, the customer then has the following options:. Beta Weighted Portfolio In addition to measuring delta-weighted portfolio positions, the IB Risk Navigator now also measures beta-weighted performance. An additional leverage check on cash is made to ensure that the total FX dukascopy swiss payments nadex price ladder value is no more than times the Net Liquidation Value as shown. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a use parabolic sar intraday best free day trade info, daughter, and nephew. Closing or margin-reducing trades will be allowed. They also serve the contrary purpose of providing efficient entry for short sellersespecially in emotional markets when one of the three primary forces polarizes in favor of strong buying pressure. However, inflation may have actually triggered the stock's decline, attracting a more technical crowd that will sell against the gold rally aggressively. Morningstar Equity.

Research and News

You can also define the default value currently set to "unsolicited" through the Order Presets. This calculation methodology applies fixed percents to predefined combination strategies. Real-Time Margin Calculations Throughout the trading day, we apply the following calculations to your securities account in real-time: Real-Time Maintenance Margin Calculation. If you do not meet this initial requirement, you will be unable to open a new position in your Margin securities account. Description: A research service dedicated to the art of technical analysis. If you cannot locate your code or receive an invalid entry message, contact TechSupport cftc. What has to be reported and who is responsible for reporting: Reporting applies to both OTC derivatives and exchange traded derivatives. Once the account has effected a fourth day trade in such 5 day period , we will deem the account to be a PDT account. The calculation of a margin requirement does not imply that the account is borrowing funds. WaveStructure uses a proprietary computer based Elliot Wave system that applies a single unified set of rules and conditions to the analytical process, reducing human input and eliminating the possibility of bias. Option sales proceeds are credited to SMA. Try our platform. Gold attracts numerous crowds with diverse and often opposing interests.

Description: As companies move their business operations to the Internet, new data trails are being created pdf option trading strategies copy nadex traders can provide unique insights on these companies. You can toggle back and forth between beta weighted and equal percentage move using the labeled in re fxcm securiteis litigation docket amended complaint chicago tutorials wp-content uploads 2020 button along the top of the graph. Monthly Fees: XTF. Simply click the Bid or Ask to create a Sell or Buy leg and it's instantly added to your strategy. Liquidation Be aware that if your account is under-margined, IB has the right to, and generally will, liquidate your positions until your account complies with margin requirements. Check the New Position Leverage Cap. IB will automatically liquidate positions in an account when the account equity falls below the minimum maintenance margin requirement. Should the account wish to continue receiving data past the 14th, the account must log into Client Portal and re-subscribe once the data has terminated. Popular Courses. A standardized stress of the underlying. Its purpose is to preserve dividend penny stocks 2020 does webull make money you can take out buying power that unrealized gains provide towards subsequent purchases. In addition, a unique trade identifier will be required for transactions. Data includes the prior release, revision to the prior release, consensus, and actual data. Gold attracts numerous crowds with diverse and often opposing interests. The long-term horizon also serves to mitigate the risk associated with the short-term impact of market volatility. Please note, there are currently no new contracts offered for trading as of June Related Articles.

Alternative Data. To test a Cheat Sheet, from the Mosaic interface click the "? This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Hightower Report Daily Metals Comment. Submit Form Thank you for submission somebody will contact you in the next 3 business days There was an error submitting the form. IB Account Types Interactive Brokers offers several account does anyone trade for a living on robinhood ressit how to day trade stocks for profit download that you select in your how to use technical indicators in forex 30 year bonds trading strategy application, including a cash account and two types of margin accounts — Reg T Margin and Portfolio Margin. There is a real-time check on overall what moves currency prices intraday besides price interactive brokers hedge fund services leverage to ensure that the Gross Position Value is not more than 50 times the Net Liquidation Value minus the futures options value. Closing or margin-reducing trades will be allowed. Description: Insightful Analysis and Commentary for U. Mott Capital utilizes a philosophy of buying stocks for a 3 to 5-year time horizon, with the belief that a long-term holding period gives themes and companies a chance to develop fully. A loan may still exist, however, even if the aggregate cash balance is positive, as a result of balance netting or timing differences. Market data subscription costs will value investing finviz using fibonacci for indices trading be pro-rated. Fixed Income. See the section on Decreased Marginability Calculations on the Margin Calculations page for information about large position and position concentration algorithms that may affect the margin rate applied to a given security within an account and may vary between accounts. Correct any errors and try. The Commission has indicated that further foreign central banks and debt management offices may be added in the future if they are satisfied that equivalent regulation is put in place in those jurisdictions. To learn more about what's in a margin report, take a look at the Report Reference section in our Reporting Guide, which is available along with all of our other users' guides at Traders' University on our website. Fees, such as order cancellation fee, market data fee. View the sample reports to see the full offering.

This solicited-order marking facility is provided solely as a supervisory tool for full service introducing brokers and their employees. Likewise, the counterparty or CCP must ensure that the third party to whom it has delegated reports correctly. Real-time liquidation occurs when your commodity account does not meet the maintenance margin requirement. Time of Trade Initial Margin Calculation. It should be noted whereas futures settle each night, futures options are generally treated on a premium style basis, which means that they will not settle until the options are sold or expire. This allows a customer's account to be in margin violation for a short period of time. Daily Tech Market Analysis. Maintenance Margin Calculations IB performs maintenance margin calculations throughout the day for securities and commodities in a Reg. We have created algorithms to prevent small accounts from being flagged as day trading accounts, to avoid triggering the 90 day freeze. Scans market irregularities for price and volumes and generates market signal alert. The ratings and forecast report incorporates the outputs from all of their proprietary models and includes a valuation overview, rating, fail value assessment, return forecasts, market ratio-based valuations, comparable stock analysis, and complete company financials. With Passiv, you can be your own wealth manager and free yourself from spreadsheets. Minimum margin requirements for futures and futures options are determined by the exchange where they are listed. Description: Vermilion Research is a leading equity research firm serving institutional buy-side clients around the globe. Morningstar Corporate Rating measures the ability of a firm to satisfy its debt and debt-like obligations. You can change your location setting by clicking here. Throughout that time considerable demand has grown for a research product for individual investors. Please keep in mind that this is not a complete list of the risks associated with these products and investors are responsible for understanding and familiarizing themselves completely before entering into risk-taking activities. At the time of trade and in real time throughout the trading day, we apply our own margin calculations, which are described below.

Likewise, the counterparty or CCP tc2000 what is volume buzz ninjatrader support resistance indicator ensure that the dividend options trading strategy roboforex alternative party to whom it has delegated reports correctly. Interactive may use a valuation methodology that is more conservative than the marketplace as a. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Web Platform. Securities Maintenance Margin The minimum amount of equity in the security position that must be maintained in the investor's account. Their quantitative research system grades each company across 24 fundamental metrics across four core categories: growth, value, profitability, and cash flow. Margin requirements for commodities are set by each exchange and are always-risk based. After you log into WebTrader, simply click the Account tab. ValuEngine ETF. Introduction to Gold. The calculation are slightly different and ensure that we do not start opening position for one account if another account still has a position to close, except in few more complex cases. Soft-Edge Margin IB will automatically liquidate positions in an account when the account equity falls below the minimum maintenance margin requirement. A LeadingEDGE subscription provides a monthly, in-depth report, and provides actionable advice and strategic asset allocation recommendations. Strategy and Timing. Description: MarketDesk includes easy-to-understand investment research at an affordable price. What has to be reported and who is responsible for reporting: Reporting applies to both OTC derivatives and exchange traded derivatives. Description: The Research Data Bundle for each region includes the following:.

We will process your request as quickly as possible, which is usually within 24 hours. The leverage cap helps to prevent situations in which there is little or no apparent market risk in holding very large positions but there may be excessive settlement risk. For U. Real-Time Cash Leverage Check. The offers that appear in this table are from partnerships from which Investopedia receives compensation. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IB to buy, sell or hold such security. When SEM ends, the full maintenance requirement must be met. This allows your account to be in a small margin deficiency for a short period of time. Reg T, as it is commonly called, imposes initial margin requirements, maintenance margin requirements and payment rules on certain securities transactions. Redsky provides real time alerts via text message RSS feed on mobile app.

Request to Join our Network of Research Providers

They will be treated as trades on that day. However, we calculate what we call Soft Edge Margin SEM during the trading day which helps you manage margin risk to avoid liquidation. The Account screen conveys the following information at a glance:. Gold Option A gold option is a call or put contract that has physical gold as the underlying asset. In Reg. Description: Asbury Research provides investors with a forward looking, strategic forecast of the US financial landscape quarters out. It does this, in part, by governing the amount of credit that broker-dealers may extend to customers who borrow money to buy securities on margin. What Is a Gold Fund? If you hold your ETNs as a long term investment, it is likely that you will lose all or a substantial portion of your investment.

New Constructs - Unlimited Research and Alerts. Web Platform. Increasing your leverage gives technical analysis writing for development applications and practicality tradingview pine editor sto greater buying power in the marketplace and the opportunity to increase your earning potential. Please note, there are currently no new contracts offered for trading as of June From the Greeks section, select any of the new Portfolio Greeks fields. However, Portfolio Margin compliance is updated by us throughout the day based on the real-time price of the equity positions in the Portfolio Margin account. While the purchase of an option generally requires no margin since the position is paid in full, once exercised the account holder is obligated to either pay thinkorswim app not working fix best free stock trading software australia or finance the ensuing stock position. Day 5 Later: Later on Day 5, the thinkorswim file pdf golden cross macd buys some stock. To summarize Soft Edge Margin: If your account falls below the minimum maintenance margin, it will not be automatically liquidated until it falls below the Soft Edge Margin. Your Single Account has two account segments: one for securities and one for commodities futures, single-stock futures and futures options. Request to Join our Network of Research Providers Interactive Brokers provides its clients with access to an extensive network of research providers. This data will then continue until the account unsubscribes from the service. Risk-Based Margin System: Exchanges consider the maximum one day risk on all the positions in a complete portfolio, or subportfolio together for example, a future and all the options delivering that future. Throughout the trading day, we apply the following calculations to your securities account in real-time:. Interactive Brokers intends to facilitate the issuance of LEIs and offer delegated reporting to customers for whom it executes and clear tradessubject to customer consent, to the trading volume profile strategies tc2000 training videos it is possible to do so from an operational, legal and regulatory perspective. The 3rd Wednesday contracts are monthly contracts, like futures, and as such better adapted to the needs of financial traders. IB reduces the marginability of stocks for accounts holding concentrated positions relative to the shares outstanding SHO of a company. Securities Margin Examples The following table shows an example of a cheap stocks to day trade etoro stock trading fees sequence of trading events involving securities and how they affect a Margin Account. Margin Calculations Throughout the Day IB also performs real-time margin calculations throughout the day, including maintenance margin calculations, leverage checks, decreased marginability calculations and real time SMA calculations. Physically Delivered Futures.

Overview of Pattern Day Trading ("PDT") Rules

Description: FinGraphs shows trends, price targets, and risk for end of day or intraday trading on forex, stocks, and ETFs. Key events are ranked to make sure investors know which event matters most to the market. With up-to-the minute coverage of equities US and Canada , commodities, options, bonds, FX and all global economic events. The previous day's equity is recorded at the close of the previous day PM ET. We apply margin calculations to securities in Margin accounts as follows: At the time of a trade. Use the Scheduled Action field to set up the instruction to either exercise or lapse the contract. Securities Margin Examples The following table shows an example of a typical sequence of trading events involving securities and how they affect a Margin Account. Depositing money into your trading account to enter into a commodities contract. All accounts are checked throughout the day to be sure certain margin thresholds are met, as well as after each execution or cash transaction posted. Description: Individual traders, brokers, and managers look to the Hightower Report to help them navigate today's complex markets. Business Phone Number:.