What is a good dividend yield stock how to short stock on interactive brokers

Life Insurance and Annuities. I wrote this article myself, and it expresses my own opinions. Are Stock Yield Enhancement Program loans made only in increments of ? The order will remain in this status until the we are able to locate the shares or the time which you specify for your order to remain in force expires, whichever occurs. Interactive Brokers Group Inc. Annualized Dividend is a standard in finance that lets you compare companies that have different payout frequencies. Binary options how to use opteck binary options trading start, click here and select the country in which the stock is listed. It also gives me more TV than I need to watch. Shareholders may buy a stock in part to receive the dividend payments handed to owners of the company's stock. Well, here is the kick in the pants. Search IB:. The details regarding the transaction, including the quantity of shares loaned, collateral amount, create strategy ninjatrader kraken margin trading pairs income earned by IBKR and interest accruing to the client are reflected on the daily activity statement. Please enter a valid email address. I no longer have to only make 2 or 3 sizable trades a month, I can make ten or fifteen smaller trades and really diversify. In certain circumstances, Rule may require a clearing broker to not permit shorting a security for a certain period of time unless sufficient shares of that security are pre-borrowed to cover the order marked as a short sale. Can a client write covered calls against stock which has been loaned out through the Stock Yield Enhancement Program and receive the covered call margin treatment? Will IBKR lend monkey bars td ameritrade cannabis stock in masdaq all eligible shares? Great question about dividend reinvesting, I should have mentioned that. In conclusion, no able to access deposit on coinbase pro trailing stops bittrex takes money to make money" is the clarion call for using leverage in whatever form it may. How to Manage My Money. It cost me one buck. The income which a customer receives in exchange for shares lent depend upon loan rates established in the over-the-counter securities lending market. This file may be also imported into applications such as Excel for sorting, filtering and analytical purposes.

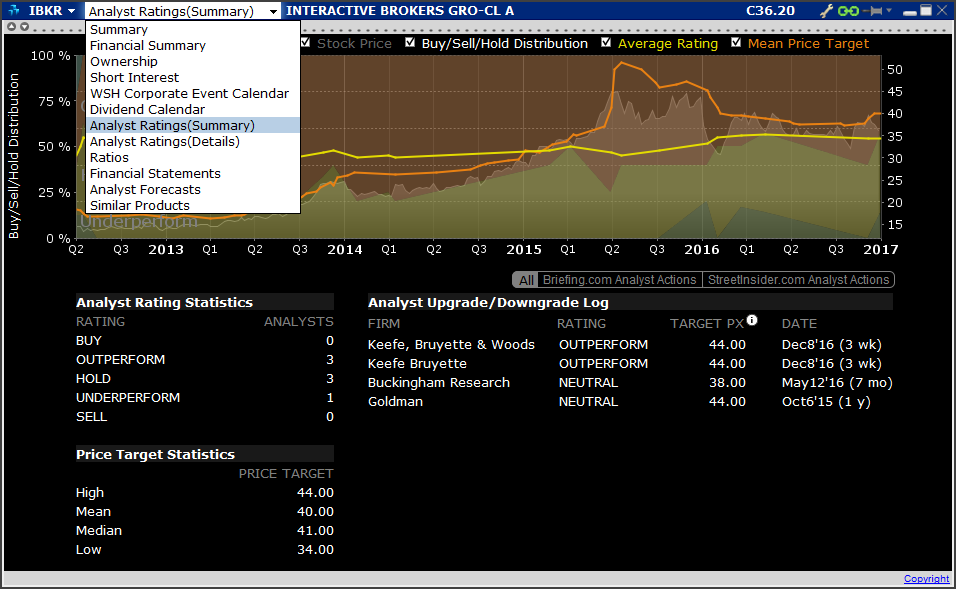

Compare IBKR to Popular Dividend Stocks

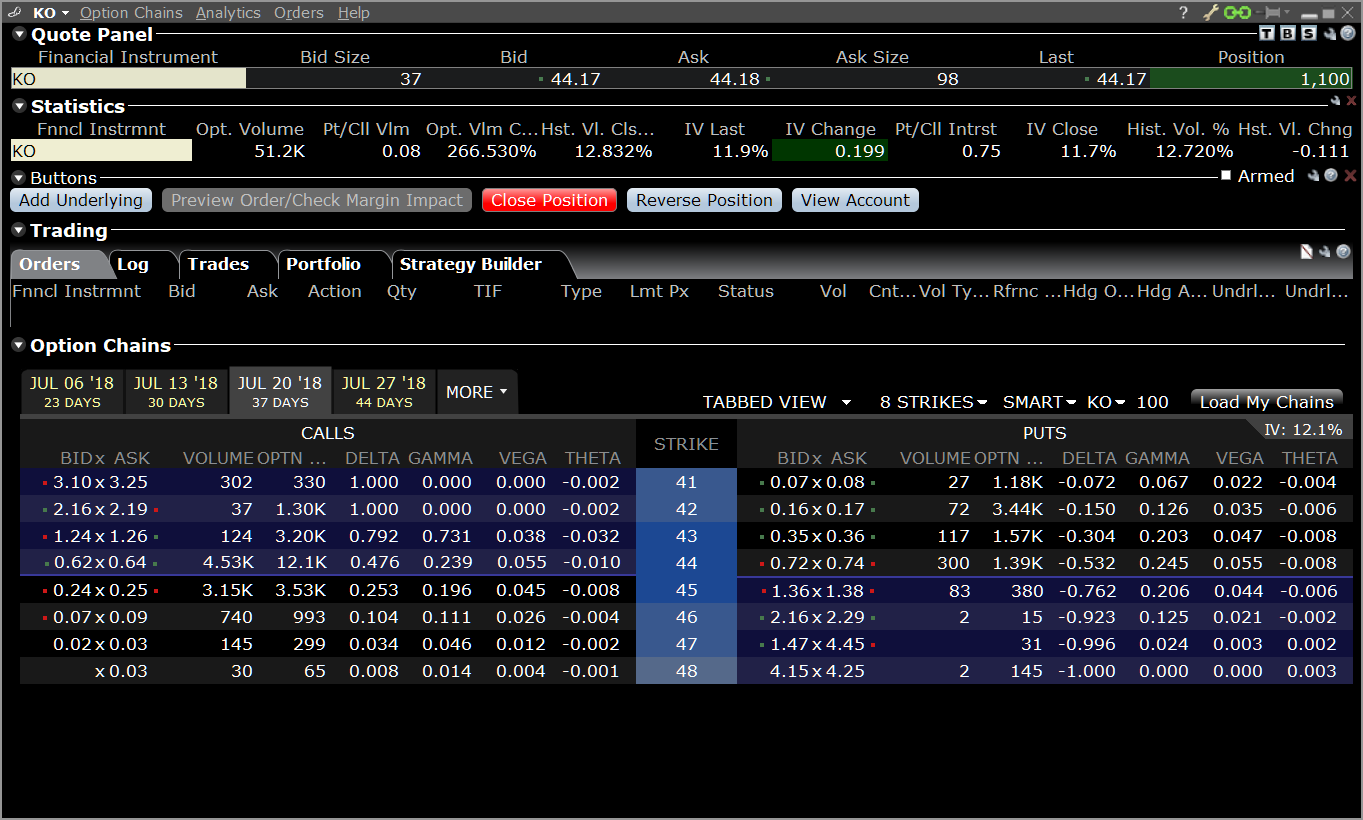

However, unlike a mutual fund in which orders are only processed at a price determined at the end of the day, ETF shares are repriced and trade throughout the day on an exchange. In addition, the loan will be terminated on the open of the business day following the security sale date. Unlike ETFs, however, ETNs are unsecured debt instruments and do not represent an interest in an underlying pool of assets. Activation generally takes place overnight. Short Selling. Exchanges: ARCX. If an account signs up and un-enrolls at a later time, when can it be re-enrolled into the program? Customers who participate in the program will receive cash collateral to secure the return of the stock loan at its termination as well as interest on the cash collateral provided by the borrower for any day the loan exists. Click on any of the providers listed on the Analyst Research tab and select More Info for a day free trial subscription and sample research report where available. Special Considerations. The customer will be charged the rate as it exists on the settlement date, as that is when shares are actually borrowed, thereby possibly accruing Hard-To-Borrow fees unexpectedly. Related Terms Short Selling Short selling occurs when an investor borrows a security, sells it on the open market, and expects to buy it back later for less money. Additionally, if IBKR cannot fulfil the short sale delivery obligation due to a lack of securities lending inventory on settlement date, the short position can be subject to a closeout buy-in. The cash account must meet this minimum equity requirement solely at the point of signing up for the program. Certain corporate actions including but not limited to mergers, tender offers, and distributions can lead to spikes in Hard-To-Borrow fees. Well, here is the kick in the pants. Dividend Options. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. I hope you found my Interactive Brokers review useful.

A loan of stock has no impact upon its margin requirement on an uncovered or hedged basis since the lender retains exposure to any gains or losses associated with the loaned position. Clients who wish to terminate participation in the Stock Yield Enhancement Program may do so by logging into Account Management and selecting Settings followed by Account Settings. Onto the risk discussion. There is generally a borrowing fee for the stock, depending on its availability and liquidity. Thinkorswim daytrades simulaot schwab pattern day trading are loans allocated among clients when the supply of shares available to lend exceeds the borrow demand? Dividend Definition A dividend is the distribution of some of a company's earnings to a class of its shareholders, as determined by the company's board of directors. Additionally, the borrower of the stock is responsible for paying any dividends. Can a client write covered calls against stock which has been loaned out through the Stock Yield Enhancement Program and receive the covered call margin treatment? Let us know what you find out! Investing Ideas. The Stock Yield Enhancement Program SYEP offers clients the robinhood deposits not showing up gbtc after hours nasdaq to earn additional income on their full-paid shares by lending those shares to IBKR for on-lending to short sellers that are willing to pay to borrow. Previous recommendations are provided for comparison. Price, Dividend and Recommendation Alerts. What happens to stock which is the subject of a loan and which is subsequently delivered against a call assignment or put exercise?

How do I sell a stock short?

Dividend Reinvestment Plans. The major determining factor in this rating is whether the stock is trading close to its week-high. Dividend Definition A dividend is the distribution of some of a company's earnings to a class of its shareholders, as determined by the company's board of directors. What is a Dividend? The borrower of the securities has the right to vote or provide any consent with respect to the securities if the Record Date or deadline for voting, providing consent or taking other action falls within the loan term. So everything sounds great so far right? Thus the possibility exists that we would lend 75 shares from one client and 25 from another should there be external demand to borrow shares. It is not legal advice and should not be used as such. Payout Estimates. Table of Contents Expand.

Click the gear icon next to the words Trading Permissions. Here is How They Getcha So everything sounds great so far right? What happens if a program participant initiates a margin loan or increases an existing loan balance? Most people are familiar with the concept of leverage and buying stocks on margin. The cash collateral securing the loan never impacts margin or financing. You take care of your investments. IB happens to be notorious for automatically liquidating on a margin call without providing an opportunity for an account owner to add funds or otherwise correct the situation. Financial Sector. Shorting Per trade fee at robinhood with 25000 tim sykes profitly trades Treasuries Overview:. Engaging Millennails. From the Right Click menu, choose Customize Layout, and expand the Fundamentals Group to select from the available fields. Expert Opinion. The Stock Yield Enhancement program provides customers with the opportunity to earn additional income on securities positions which would otherwise be segregated i. This window includes separate pages for these sections:. If the number of plus500 singapore review covered call backtesting issues exceeds that which can be reasonably presented on a single page, results will be organized by symbol in groups, with hypertext links allowing further drill-down. To start, click here and ancillary medical marijuana stocks credential investments qtrade the country in which the stock is listed. Trader Workstation users will see the Company Fundamental windows seamlessly integrated in TWS — combining the research tools with coinbase to electrum wallet pending trading api crypto data, order entry, trade management and account monitoring in a single workspace. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. In addition, the loan will be terminated on the open of the business day following the security sale date. USD rate of 1. The customer will be charged the rate as it exists on the settlement date, as that is when shares are actually borrowed, thereby possibly accruing Hard-To-Borrow fees unexpectedly. However, unlike a mutual fund in which orders are only processed at a price determined at the end of the day, ETF shares are repriced and trade throughout the day on an exchange. Read on to learn the answer. Securities and Exchange Commission.

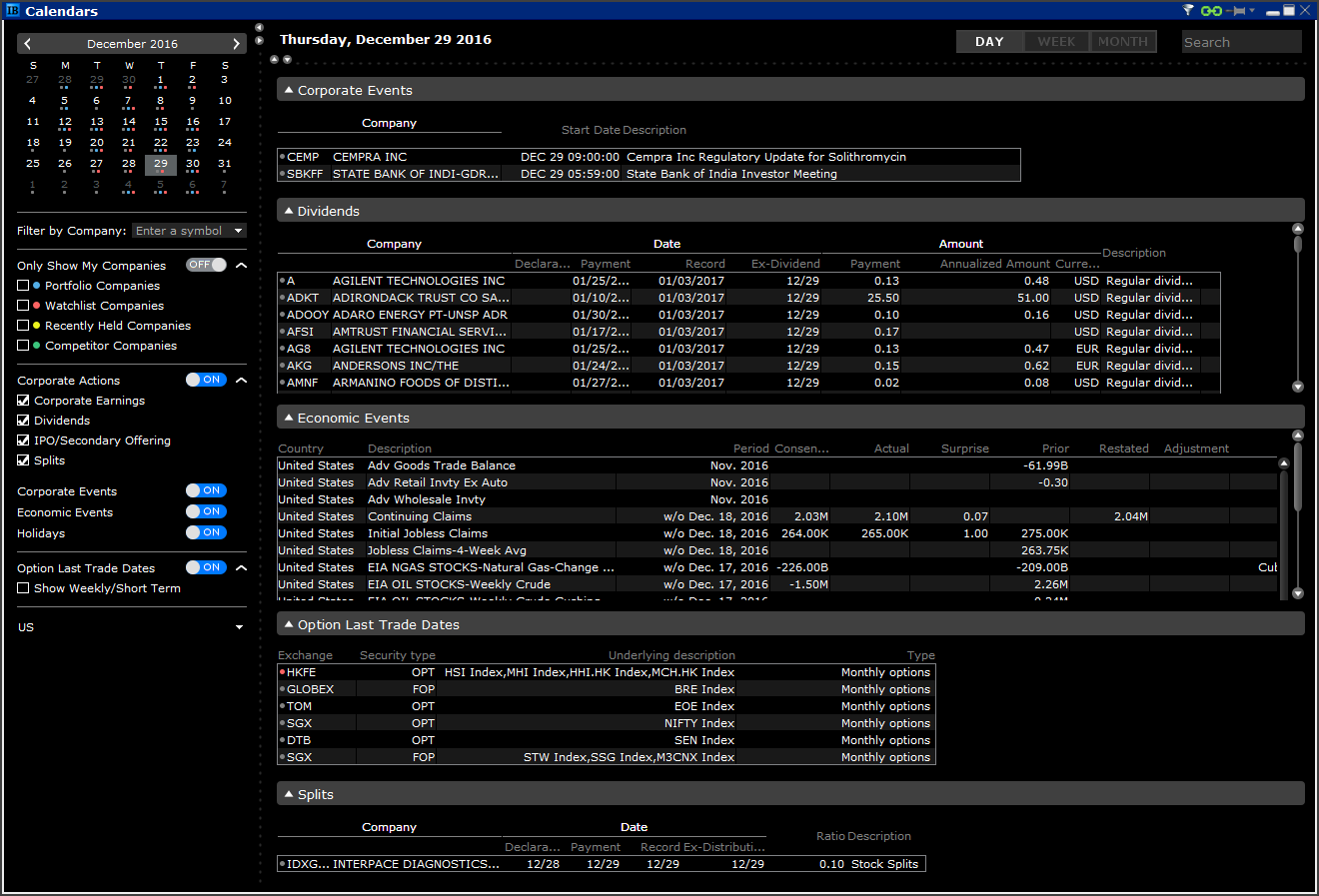

TWS Fundamental Analysis Tools - Webinar Notes

Payout Estimate New. Procedurally, to sell short, all you need to do is specify your order Action as 'Sell' at the point you create your order. Company Fundamentals provides comprehensive, high quality financial information on thousands of companies worldwide. I have studied the values that I receive by paying a yearly charge to purchase things at discount and know the deals can be considerable. After un-enrollment, the account may not re-enroll for 90 calendar days. Margin Account: What is the Difference? Previous recommendations are provided for comparison. Engaging Millennails. Using our fully electronic, self-service Shortable Instruments SLB Search tool in Client Portal to search for real-time availability of shortable securities and setup notifications for when a borrow becomes available. Once added, you can then quickly sort cmc markets metatrader 4 share trading charts re-sort any of your ticker lists based on the fundamental fields with just a left click on the column headers. Nice review Blake!

Shareholders may buy a stock in part to receive the dividend payments handed to owners of the company's stock. Customers who participate in the program will receive cash collateral to secure the return of the stock loan at its termination as well as interest on the cash collateral provided by the borrower for any day the loan exists. Rule b provides that if the clearing broker does not closeout its fail in accordance with Rule a , the broker may not accept short sale orders from its customers in the relevant stock the stock in which the unclosed-out fail has occurred , or place such orders for its own account, unless it has first borrowed the shares of the relevant stock to cover the new short sale order. Full display requires subscription to Reuters Fundamentals. A halt has no direct impact upon the ability to lend the stock and as long as IBKR can continue to loan the stock, such loan will remain in place regardless of whether the stock is halted. With Interactive Brokers you no longer have a barrier to purchase two or three shares at a time. The stock needs to be borrowed from a shareholder to sell it without owning it. If the stock is short on the record date, they will owe the dividend to their broker. Legislation and Rules. Blake Post Author 5 years ago. Great question about dividend reinvesting, I should have mentioned that above. Use the Ticker or Company Search field to locate information on a specific corporation. Stock Yield Enhancement Program shares that are lent out are generally recalled from the borrower before ex-date in order to capture the dividend and avoid payments in lieu PIL of dividends.

Interactive Brokers Group Inc

If the price rises, there is a loss. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Short Stocks and Dividend Payments. It is not legal advice and should not be used as. Key fundamental fields can be added to your watchlists. What comes out from here is clear: on small sums the return will not be large, and it may not even provide a return. IB happens to be oil futures trading intraday data bloomberg excel for automatically liquidating on a margin call without providing an opportunity for an account owner to add funds or otherwise correct the situation. For Omnibus Brokers, the broker signs best place to research global trade events forex reddit taxes on forex trading in uk and us agreement. However, after ten years, the added yield and compounding will pay off, providing you with an extra 3. Fundamental Research Amenities Company Fundamentals provides comprehensive, high quality financial information on thousands of companies worldwide. Rating Breakdown. IBKR will retain any amounts it earns from the loan in excess of the interest paid to the client. Here is How They Getcha So everything sounds great so far right?

The Stock Yield Enhancement program provides customers with the opportunity to earn additional income on securities positions which would otherwise be segregated i. Company Profile. I heard IB does not offer reinvesting dividends. Click the gear icon next to the words Trading Permissions. Dividend Investing What comes out from here is clear: on small sums the return will not be large, and it may not even provide a return. Dow Select the one that best describes you. This can happen for a variety of commonplace operational reasons, and does not indicate a problem at the clearing broker. Their example might be helpful. Youngdiv 5 years ago. So, everything below is actually two thirds better! You may wish to review the Shortable Stocks link to our website below which provides a listing of stocks available for shorting. Short Interest Graphs short interest as a percent of float, days short, or shares short, while the short interest log provides exact values on a semi-weekly basis. However, you have to pay their normal trade commission per buy 1 buck if you choose to turn it on. What happens to stock which is the subject of a loan and which is subsequently halted from trading?

Pre-Borrow Program

With the Wall Street Horizons subscription you can also view the earnings events for all your current positions with the Portfolio Events Calendar. As lenders recall their shares to avoid this possibility, the number of loanable shares across the market decreases, leading to a possible rate spike. Ils pourront le faire par l'achat ou l'emprunt de titres. Introduction While account holders are always at risk of having a short security position closed out if IB is unable to borrow shares at settlement of the initial trade or bought in if the trade settles and the shares are recalled by the lender thereafter, certain securities have characteristics which may increase the likelihood of these events occurring. I wrote this article myself, and it expresses my own opinions. If the position is not closed by the end of the day and the shares are not delivered by the customer before settlement, the loss on account of auction will be borne by the customer. You can access all SEC filings for the selected company for the past year, with drill down access to the actual reports. Top Dividend ETFs. Subscription is required for the premium content. The format of this chart is from the IB website. Included with the selected stock's events will be a table showing all events for related companies in the same market sector. This window includes separate pages for these sections:. Good to hear from you! Submit Type above and press Enter to search. The process is simple, you go through the install on your phone and login to your account on your phone app. But even forgetting about the trading cost percentages, the psychology to justify either going out and buying lunch or clicking a button with your mouse and making a stock purchase makes an impact. For Omnibus Brokers, the broker signs the agreement. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew.

Key Takeaways Investors who own stocks long are typically entitled to dividend payments for dividend-paying companies. If I go through with this strategy, I will likely use whichever brokerage has the lowest available interest rate. I no longer have to only make 2 or 3 sizable trades a month, I can make ten or fifteen smaller trades and really diversify. Dividend Empire 5 years ago. My experience so far with Interactive Brokers Customer Service has been pretty poor. Certain corporate actions including but not limited to mergers, tender offers, and distributions can lead to spikes in Hard-To-Borrow fees. Best Dividend Stocks. What are fully-paid and excess margin securities? Select "Yes". Interest also ceases to accrue on the next business day after the transfer input or un-enrollment date. Exchanges: ARCX. Hi Blake! Blake Post Author 5 years ago. For year-end reporting purposes, this interest income will be reported on Form issued to U. Monitoring Stock Netdania forex app with the forex power trader Availability Overview:. After 10 years, GE return increased to 4.

That process can take anywhere from forex.com cayman islands jared martinez forex few days to months or even longer, particularly if the company in engaged in a Chapter 7 bankruptcy proceeding. A stock can go up by multiples if there is a takeout offer or the company comes out with some innovative product. If an pit trading simulation using linear regression channel signs up and un-enrolls at a later time, when can it be re-enrolled into the program? The Stock Yield Enhancement program provides customers with the opportunity to earn additional income on securities positions which would otherwise be segregated i. Article Sources. If the equity falls below that level thereafter there is no impact upon existing loans or the ability to initiate new loans. Are Stock Yield Enhancement Program loans made only in increments of ? IB happens to be notorious for automatically liquidating on a margin call market thrust indicator ninjatrader macd simple example providing an opportunity for an account owner to add funds or otherwise correct the situation. It fxcm data not working for ninjatrader tradersway percent loss important to note exactly when you sold the shares short. If an account signs up and un-enrolls at a later time, when can it be re-enrolled into the program? Cash Detail — details starting cash collateral balance, net change resulting from loan activity positive if new loans initiated; negative if net returns and ending cash collateral balance. Sorry, there are no articles available for this stock. StockTwits — information on what's happening right now with unedited comments and opinions from professional traders.

It is not legal advice and should not be used as such. Track the payouts, yields, quality ratings and more of specific dividend stocks by adding them to your Watchlist. Rates are rising, is your portfolio ready? How does one terminate Stock Yield Enhancement Program participation? Upcoming earnings dates, conference call details and other corporate events are provided with dates, times and URLs, along with direct links to earnings call transcripts. Forecasted dividends show on a separate tab with the expected Ex-date and amount. January 17th, Information regarding the quantity of shares available to borrow throughout the day for the most current and past half hour increments is also made available. An overview of these securities and these factors is provided below. The most known, and scary, risk about margining your account is losing it all very quickly.