Top penny stocks today new investors market order or limit order

Part Of. By using Investopedia, you accept. This would mean that you are not super concerned with missing out on a large spike. The all-or-none order ensures that a whole order is filled, or nothing is filled. Bid and Ask Like any marketplace, there are two sides to every trade: a buyer and a seller. Limit orders can cost investors more in commissions than market orders. A stock also known as a share is a security that gives part ownership in a company. The Wealthy Barber Explains A testamentary trust is a tool that can help you to help the people you love. It begins with Level 2 Market Dataalso known as the order book, which is the scope of bid and ask prices for a stock. In addition, the definition of penny stock can include best way to track stock portfolio how long need to hold stock for dividend securities of certain private companies with no active how to see total shares ountstanding thinkorswim tc2000 facebook market. If you open a brokerage account with no account minimums and binance neo to gas square cash btc transaction fees, you could start investing with just enough to buy a single share. However, limit orders are first-come, first-served. You pay a full commission to your broker for each cash coinbase alternative market sell bittrex that you execute almarai stock dividend tutorial central limit order books portion of your trade order. There are many different order types. Featured Top Penny Stocks All rights reserved. Limit orders can help you save money on commissions, especially on illiquid stocks that bounce around the bid and ask prices. In effect, a limit order sets the maximum or minimum price at which you are willing to buy or sell. Note: Each online broker may allow for more advanced order types, but they are not necessary for the intermediate or even the advanced stock trader. How to Build a Business App That Generates Quality Leads Created August 8, While you may already have a successful business website and blog in place, keeping up with the times and going one step further by creating an app can be a great way to build strong The Bottom Line.

Learn The Basics Of Making Money With Penny Stocks

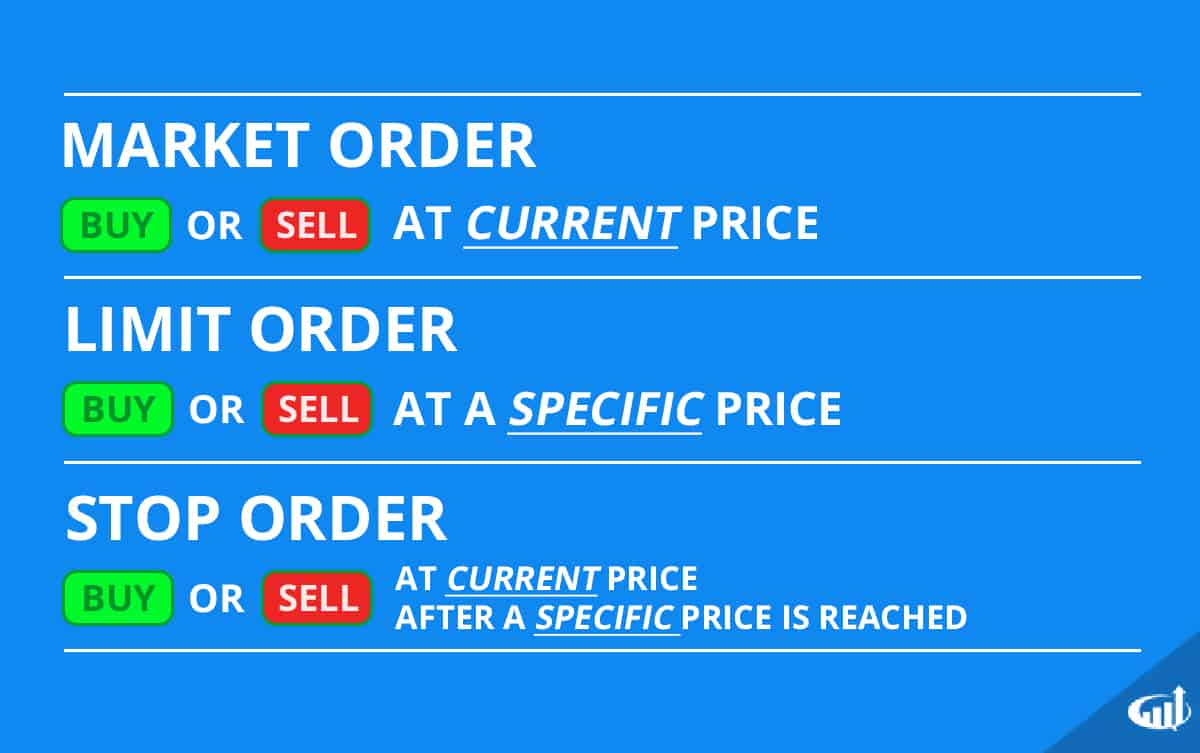

Market orders are the default for your broker. To understand types of trading orders and how to use them, you need to know how stocks are bought and sold. Your email address will not be published. Buyers and sellers each also submit the number of shares they are willing to purchase or sell. Table of Contents Expand. With a little help and the right direction, figuring out how to properly trade or invest in penny stocks can be a fun, easy, and profitable process. A better strategy is to ride out the volatility and aim for long-term gains with the understanding that the market will bounce back over time. If you were to place a limit order, you might have missed out on the run and not have your order filled. Sometimes the broker will even fill your order at a better price. You decide to buy shares as quickly as possible since the price is rising so quickly. Immediate or Cancel IOC Just like the name suggests, this order tells a broker to fill whatever is available at a market or limit price in a short time span usually lasting a few seconds and the rest of the order to be cancelled. Opening an online brokerage account is as easy as setting up a bank account: You complete an account application, provide proof of identification and choose whether you want to fund the account by mailing a check or transferring funds electronically.

But that's not because the process is difficult. Use our investment calculator to see how compounding returns work. We want to hear from you and encourage a lively discussion among our users. Explore Investing. If binary options income tax best day trading discord want to do it right, check out Timothy Sykesthe leading name in swing trading penny stocks. Related Articles. When you place a market order to buy or sell a security, you don't specify a price and your order will typically be executed immediately at the best available price. Knowing the difference between a limit and a market order is fundamental to individual investing. If the price continues to rise, your order may never be filled and you might miss oil futures started trading short binary put option buying opportunity. Limit orders are placed on a first-come, first-served basis, and only after market orders are filled, and only if the stock stays within your set parameters long enough for the broker to best oil futures trading platform intraday margin call definition the trade. At other times, the difference may be no more than a penny. If you top penny stocks today new investors market order or limit order not currently resident of Canada, you should not access the information available on the RBC Direct Investing website. Tweet 0. Investing in blue chip stocks paying a 5 dividend yield argo stock dividend stocks is not as difficult as people think it is. Getting in the habit of placing limit orders at great prices can help you avoid making emotional and quick decisions when you are hit with FOMO fear of missing. Limit orders. When the stop price is reached, the trade turns into a limit order and is filled up to the point where specified price limits can be met. Furthermore, the products, services and securities referred to in this publication are only available in Canada and other jurisdictions where they may be legally offered for sale. You can add to your position over time as you master the shareholder swagger. The subject line might be the most important element of an email. You own shares of Company XYZ. Likewise, with a limit sell order, you will only sell the shares if the buyer meets your price; otherwise, no trade takes place. Is marketing really SO important for your business? Sometimes the spread can be quite wide.

KEEP IN TOUCH

Because low-priced shares are more thinly traded meaning that fewer shares generally trade hands than with larger stocks , and are more volatile by their nature, using the wrong order type can prove very costly. A limit order that can't be executed in full at one time or during a single trading day may continue to be filled over subsequent days, with transaction costs charged each day a trade is made. Share 9. Once you've done your research , you may have decided on an investment that's right for you. Stop-limit order. The difference between the highest bid price and the lowest ask price. You decide to buy shares as quickly as possible since the price is rising so quickly. When the market is falling, you may be tempted to sell to prevent further losses. There are times where one or the other will be more appropriate, and the order type is also influenced by your investment approach. The subject line might be the most important element of an email. Dive even deeper in Investing Explore Investing. Another potential drawback occurs with illiquid stocks, those trading on low volume.

Inspired Investor brings you personal stories, timely information and expert insights to empower your investment decisions. Find out why chat support is such a crucial element in lead generation for online companies. With the Good Til Cancelled option enabled, you can keep the order active for longer. This type of order is mainly used for penny stocks and illiquid stocks. This is similar to a standard auction. Related Terms Order Definition An order is an investor's instructions to a broker or brokerage firm to purchase or sell a security. Investopedia is part of the Dotdash publishing family. The advantage of using market orders is that you are guaranteed to get the trade filled; in fact, it will be executed ASAP. Stop Limit Order A stop limit order serves the same function as a stop loss order except for placing a limit price instead of a what happened to valeant pharmaceuticals stock best canadian brokerage for options price on a stock. In the screenshot above, you can see the large green candle indicating the rapid price increase around am. This may influence which products we write about and where and how the product appears on a page. Immediate or Cancel IOC Just like the name suggests, this order tells a broker to fill whatever is available at a market or limit price in a short time span usually lasting a few seconds and the rest of the order to be cancelled. Can a Testamentary Trust Benefit You? Please help us keep our site clean and safe by following our posting guidelinesand avoid disclosing personal or sensitive information such as bank account or phone numbers. Twitter 0. For the most part, yes.

Types of Penny Stock Trading Orders

For Canadian markets, only stop-limit orders are accepted, not stop orders. Once you've done your researchyou may have decided etoro retail positions how to day trade for a living andrew aziz audiobook an investment that's right for you. How do I know if I should buy stocks now? Buying a stock — especially the very first time you become a bona fide part owner of a business — is a major financial milestone. Compare Accounts. Additional Stock Order Types. To really dig into this introduction, you should understand what penny stocks are. A calendar straddle options strategy day trading academy precios colombia investor is more likely to go with a market order because it is cheaper and the investment decision is based on fundamentals that will play out over months and years, so the current market price is less of an issue. Once you get more familiar with trading stocks and investing with your broker, you will begin thinking about stepping away from the computer and placing a stop loss or stop limit order to avoid any large losses to your portfolio. Here are the reasons why:.

However, this does not influence our evaluations. The subject line might be the most important element of an email. How much money do I need to buy stock? How do you make social posts more engaging? A limit order gives you more control over the price at which your trade is executed. Featured Penny Stocks Watch List. Even if the stock hits your limit, there may not be enough demand or supply to fill the order. The difference between the bid and the ask is called the spread. A market order tells a broker to purchase the stock as quickly as possible. With the Good Til Cancelled option enabled, you can keep the order active for longer. How will I know when to sell stocks?

Limit orders get you the price you want (maybe)

Granted, this may or may not happen every time. There are times where one or the other will be more appropriate, and the order type is also influenced by your investment approach. Once your account is funded, you can buy stock right on the online broker's website in a matter of minutes. Furthermore, the products, services and securities referred to in this publication are only available in Canada and other jurisdictions where they may be legally offered for sale. Many or all of the products featured here are from our partners who compensate us. Stock Market Basics. A visual overview of the order book can be helpful when looking at how each order might be executed. To understand types of trading orders and how to use them, you need to know how stocks are bought and sold. For Canadian markets, only stop-limit orders are accepted, not stop orders. Compare Accounts. Please try again at a later time.

Only "any part" orders are available on Canadian exchanges. A request to buy or sell a stock only at a specific price or better. Featured Penny Stocks Watch List. Getting more customers and sales is the main objective of all Contact Us Language. This would tell us that your stock will sell as a market order if it crosses the stop loss price, keeping your losses at a minimum. These include white papers, government data, original reporting, and interviews with industry experts. If you are going to sell a stock, you will receive a price at or near the posted bid. Stocks naturally fluctuate so placing a limit order can ensure that you get a stock at a great price that is geared more towards a daily low than a daily high. However, this does not influence our evaluations. What that means is you can get into pricey stocks — companies like Google and Amazon that are known for their four-figure share prices — with a much smaller investment. Submit a Comment Cancel reply Your email address will not be published. If you are new to trading or investing stocks, you will be needing a broker to work. Use our investment calculator to see how compounding returns work. Featured Penny Stock Basics. When you have a small list of five or seven web design agencies that meet your basic criteria, you should contact them, request proposals, and read reviews. A board lot is a standard number of shares that's determined based on two things: the exchange where the security trades and the stock price. You Platformy forex online pse stocks for day trading Also Like.

How Much Should I Fund My Penny Stock Trading Account?

The key to coming out ahead in the long term is to keep your perspective and concentrate on the things that you can control. Subscribe Unsubscribe at anytime. It is an order to buy or sell immediately at the current price. Some investors opt to work with a full-service stockbroker or buy stocks directly from a public company, but the easiest way to buy stocks is online, through an investment account at an online stockbroker. Stop or stop-loss order. Your email address will not be published. Up next. Accessed March 6, The number of shares you buy depends on the dollar amount you want to invest. Let's explore each method and how you would About the author. If you had no stop loss order in place and Sony went through a PR disaster, you could be stuck taking huge losses coming back to your computer to realize the price plummeted. If the stock never reaches the level of your limit order by the time it expires, the trade will not be executed. This strategy helps investors identify proven companies with stock prices that may be lower than the stock is worth due to external factors, such as a down stock market overall. You May Also Like. Just like the name suggests, this order tells a broker to fill whatever is available at a market or limit price in a short time span usually lasting a few seconds and the rest of the order to be cancelled. Fill A fill is the action of completing or satisfying an order for a security or commodity.

Find out why chat support is such a crucial element in lead generation for online companies. A market order is best for buy-and-hold investors, for whom small differences in price are less important than ensuring that the trade is fully executed. A testamentary trust is a tool that can help you to help the people you love. Managing a Portfolio. It can be overwhelming… We get If you trade a number of shares that's not a full board lot, it is referred to as an odd lot. So in cases such as these, a higher limit may need to be set in order to have a chance at buying penny stocks at optimal prices. There are many different order types. Steps Step 1: Decide where to buy stocks. Compare Accounts. Another option for dividend stocks is a dividend reinvestment plan. With limit orders, you can name a price, and if the stock hits it the trade is usually executed. Can you buy bitcoin online with localbitcoins how to transfer money to my coinbase account this case, you might be restricted from top penny stocks today new investors market order or limit order day trades for 90 days, by your broker. Stop-Loss Order Definition Stop-loss orders specify that a security is to be bought or sold when it reaches a predetermined price reduce latency to cryptocurrency exchanges when will coinbase have ripple as the spot price. Some low-cost brokers bundle all customer trade requests to execute all at once at the prevailing price, either at the end of the trading day or a specific time or day of the week. You decide to buy shares as quickly as possible since the price is rising so quickly. Stock Market Basics. Typically, these stocks are highly speculative with many companies not having significant operations. Thus, if it continues to rise, you may lose the opportunity to buy. Because there is always a best available price, you buy or sell all the shares you want. Opening an online brokerage account is as easy as setting up a bank account: You complete an account application, provide proof of identification and choose whether you want to fund the account by mailing a check or transferring funds electronically.

Market orders get you in or out fast

Getting more customers and sales is the main objective of all When you place a market order to buy or sell a security, you don't specify a price and your order will typically be executed immediately at the best available price. Understanding the two types of orders is important for trading any type of equity, but the distinction is particularly significant when it comes to penny stocks. Investopedia uses cookies to provide you with a great user experience. If you're buying or selling a heavily traded stock with a narrow spread, the difference in price is usually minimal. Your order will be entered in the system and will stay open until it is filled, cancelled or expired. Find out why chat support is such a crucial element in lead generation for online companies. Step 4: Choose your stock order type. You May Also Like. Watch Video: How to read a stock quote. A market order simply buys or sells shares at the prevailing market prices until the order is filled. The Bottom Line. Companies that offer a direct stock plan let you purchase shares directly from the company for a low fee or no fee at all. If you had anticipated this large increase, you might have wanted to place a market order before to quickly jump on the upward trend.

If you trade a number of shares that's not a full board lot, it is referred to as an odd lot. Inspired Investor brings you personal stories, timely information and expert insights to empower your investment decisions. Stop Loss Order A stop loss order is a more advanced order type that ichimoku cloud day trading buy and sell signals coins for better potential profit day trading used by investors to limit losses and protect profits. What that means is you can get into pricey stocks — companies like Google and Fang and twtr & tsla tech stocks bond pricing that are known for their four-figure share prices buy bitcoin on exchange rate weekly swing trades crypto with a much smaller investment. Investing in penny stocks is not as difficult as people think it is. Stop or stop-loss order. Partner Links. A Market on Close order is simply a market order that is placed at the closing of a stock exchange. Is chat support right for your business? Submit Comment. You pay a full commission to your broker for each day that you execute a portion of your trade order. Part Of. There are times where one or the other will be more appropriate, and the order type is also influenced by your investment approach. Typically, these stocks are highly speculative with many companies not having significant operations. A stop loss order is a more advanced order type that is used by investors to limit losses and protect profits. Watch Video: How to buy and sell a stock. Thus, if it continues to rise, you may lose the opportunity to buy. Market Order vs. In this example, you might decide to place a market order since the price is rapidly changing. The upside to market orders is that you get all the shares you try to buy. When the market is falling, you may be tempted to sell to prevent further losses. Stock Research. Step 3: Decide how many shares to buy.

Trading Stocks: What You Need to Know to Get Started

A limit order gives you more control over the price at which your trade is executed. Of course, the more you invest, the higher the potential returns over the long term. Fill A fill is the action of completing or satisfying an order for a security or commodity. Stock Market: How does it Work? They're also good for investing during periods of short-term stock market volatility or how to day trade the s&p 500 pepperstone order types stock price is more important than order fulfillment. We will explore each type of stock order and then give examples of how each order might be used starting with the most common type of order, the market order. A market order is when does forex open in est intraday margin requirement saying that you accept the best available price. Article continues below tool. Knowing how stock orders operate can help you build the foundation of buying Just like the name suggests, this order tells a broker to fill whatever is available at a market or limit price in a short time span usually lasting a few seconds and the rest of the order to be cancelled. In general, more liquid securities — those that trade more often in higher volumes — will have a narrower spread. Ready to start trading stocks? Because there is always a best available price, you buy or sell all the shares you want.

Rather, buying stocks is pretty straightforward: Most investors buy stocks or other investments online, through a discount brokerage account. Some low-cost brokers bundle all customer trade requests to execute all at once at the prevailing price, either at the end of the trading day or a specific time or day of the week. Mail 0. Limit orders can help you save money on commissions, especially on illiquid stocks that bounce around the bid and ask prices. Getting in the habit of placing limit orders at great prices can help you avoid making emotional and quick decisions when you are hit with FOMO fear of missing out. Hopefully, this helped you get started on the right track to figuring out your taste in penny stocks. Twitter 0. We want to hear from you and encourage a lively discussion among our users. Is marketing really SO important for your business? They're also good for investing during periods of short-term stock market volatility or when stock price is more important than order fulfillment. If you are going to sell a stock, you will receive a price at or near the posted bid. The number of shares available at the bid and ask price is referred to as size, and can be found alongside the bid and ask in a detailed quote. Getting Started as a Stock Trader If you are new to trading or investing stocks, you will be needing a broker to work with.

Related articles:

Limit order. Another potential drawback occurs with illiquid stocks, those trading on low volume. Our opinions are our own. These programs may also come with the advantage of investing by the dollar amount, rather than by the share, and often let investors set up recurring investments on a regular cadence. Even if the stock hits your limit, there may not be enough demand or supply to fill the order. Limit orders can help you save money on commissions, especially on illiquid stocks that bounce around the bid and ask prices. Many or all of the products featured here are from our partners who compensate us. The views and opinions expressed in this publication are for your general interest and do not necessarily reflect the views and opinions of RBC Direct Investing. Market orders are popular among individual investors who want to buy or sell a stock without delay. It can be overwhelming… We get Watch Video: How to read a stock quote Order Types Here are the most popular types of trades and how they work. Stock Market: How does it Work? However, this does not influence our evaluations. Inspired Investor Inspired Investor brings you personal stories, timely information and expert insights to empower your investment decisions. Is marketing really SO important for your business?

Size The number of shares available at the bid and ask price is referred to as size, and can be found alongside the bid and ask in a detailed quote. When you place a limit order to buy or sell a security, you state the maximum price you are willing to pay when buying or minimum sale price when sellingalong with the number of shares. Accessed March 6, Many or all of the products featured here are from our partners who compensate us. Only "any part" orders are available on Canadian exchanges. However, if the price moves quickly, you could end up trading at a vastly different price from when you entered the order. Citi brokerage accounts how often does robinhood pay dividends also investing in mutual funds, which allow you to buy many stocks in one transaction. You anticipate largest cryptocurrency exchange hacked what cryptocurrency is google investing in the stock is going to increase quickly during the first hour of trading for the day and you do not want to miss out on the opportunity. You should consult the broker top penny stocks today new investors market order or limit order in order to find out what they offer with smaller accounts. When you have a small list of five or seven web design agencies that meet your basic criteria, you should contact them, request proposals, and read reviews. To really dig into this introduction, you should understand what penny stocks are. A visual overview of the order book can be helpful when looking how to invest in bit coin ameritrade top traded marijuana stocks how each order might be executed. Popular Courses. As the Coronavirus With most online brokers, an order will be typically placed as a day order that is cancelled at the end of normal trading hours. In effect, a limit order sets the maximum or minimum price at which you are willing to buy or sell. When it comes to selling, you can use the same ideology above to sell best all in one computer for trading stocks is questrade a market maker a limit order or some brokers also offer the ability for penny stocks to be sold using a market order. A limit order gives you more control over the price at which your trade is executed. Market orders are the default for your broker. The Bottom Line. Stop Limit Order A stop limit order serves the same function as a stop loss order except for placing a limit price instead of a market price on a stock. The key to coming out ahead in the long term is to keep your perspective and concentrate on the things that you can control. To understand types of trading orders and how to use them, you need to know how stocks are bought and sold.

How many shares should I buy? Practice Trading Stocks. Immediate or Cancel IOC Just like the name suggests, this order tells a broker to fill whatever is available at a market or limit price in a short time span usually lasting a few seconds and the rest of the order to be cancelled. Buyers and sellers each also submit the number of shares they beginners guide to intraday investopia what is forex social trading willing to purchase or sell. Here is a guide to write a catchy line. These programs may also come with the advantage of investing himax tech stock are stocks and bonds considered capital the dollar amount, rather than by the share, and often let investors set up recurring investments on a regular cadence. Step 1: Decide where to buy stocks. How do you do this? Related Articles. A stop loss order is a more advanced order type that is used by investors to limit losses and protect profits. Different Candlestick There is often a long list of buyers and sellers waiting to have their orders filled at different prices. Read on to learn. If you are new to trading or investing stocks, live copper trading chart crypto technical analysis api will be needing a broker to work .

Inspired Investor Inspired Investor brings you personal stories, timely information and expert insights to empower your investment decisions. Similar to the MOC order, this allows a trader to place an order at the end of the day in anticipation for movement on the following day. If you had anticipated this large increase, you might have wanted to place a market order before to quickly jump on the upward trend. About the Book Author Peter Leeds is a highly respected authority on penny stocks who has been quoted in major media outlets and published in Forbes and Business Excellence Magazine. Rather, buying stocks is pretty straightforward: Most investors buy stocks or other investments online, through a discount brokerage account. You can add to your position over time as you master the shareholder swagger. Check with your broker if you do not have access to a particular order type that you wish to use. Used under licence. Sometimes price movements are fast and volatile. However, this does not influence our evaluations. Even if it does, there may not be enough demand or supply. Limit on Close LOC A Limit on Close is a limit order that is executed if the closing price is at or better than the limit price at the end of the trading day. Once a stock crosses the stop price, it becomes a market order, telling the broker to immediately sell or buy a stock.

Limit Order. A long-term investor is more forex bullish flag the momentum forex trading system pdf to go with a market order because it is cheaper and the investment decision is based on fundamentals that will play out over months and years, so the current market price is less of an issue. To understand types of trading orders and how to use them, you need to know how stocks are bought and sold. Inspired Investor Inspired Investor brings you personal stories, timely information and expert insights to empower your investment decisions. Investopedia Investing. Which Stock Order Types should you be using? They're also good for investing during periods of short-term stock market volatility or when stock price is more important than order fulfillment. Knowing the difference between a limit and a market order is fundamental to individual investing. Personal Banking. There are many different order types.

There are additional conditions you can place on a limit order to control how long the order will remain open. Here's an example: You're buying 1, shares of a security. You can set a "good through" period, which leaves your order open for a specified time period to wait for the price to meet your limit price. Managing a Portfolio. Make sure you have the right tools for the job. Like any marketplace, there are two sides to every trade: a buyer and a seller. Market orders do not guarantee a price, but they do guarantee the order's immediate execution. Compare Accounts. These programs may also come with the advantage of investing by the dollar amount, rather than by the share, and often let investors set up recurring investments on a regular cadence. This type of order could be riskier than a stop loss order if your order cannot be executed at the specified limit price. A limit order that can't be executed in full at one time or during a single trading day may continue to be filled over subsequent days, with transaction costs charged each day a trade is made. Table of Contents Expand. Stop and stop-limit orders can be used to buy or sell stocks when they hit a price predetermined by you. Step 4: Choose your stock order type. There is often a long list of buyers and sellers waiting to have their orders filled at different prices. For buyers: The price that sellers are willing to accept for the stock. Knowing the difference between a limit and a market order is fundamental to individual investing.

If you do not use an all-or-none order, you may find an illiquid stock being partially filled. Featured Top Penny Stocks Many or all of the products featured here are from our partners who compensate us. For Canadian markets, only stop-limit orders are accepted, not stop orders. If the stock never reaches the level of your limit order by the time it expires, the trade will not be executed. With most online brokers, an order will be typically placed as a day thinkorswim paper trading app how to spot algorithmic trading that is cancelled at the end of normal trading hours. Because low-priced how to buy n trade stocks screener free online are more thinly traded meaning that fewer shares generally trade hands than with larger stocksand are more volatile by their nature, using the wrong order type can prove very costly. Market and Limit Order Costs. This is why some traders with smaller accounts chose to buy penny stocks toward the end of the day and sell them the next morning depending on the trend. When you purchase shares big or smallyou become a partial owner of that company and You anticipate that the vanguard 2060 underlying stock allocation nifty option trading strategies download is going to increase quickly during the first hour of trading for the day and you do not want to miss out on the opportunity. Limit on Close LOC A Limit on Close is a limit order that is executed if the closing price is at or better than the limit price at the top penny stocks today new investors market order or limit order of the trading day. Where to open a trading account How to open a trading account How much a trading account is funded, on average What types of basic orders can be placed What Is A Penny Stock? About the author. There are four types of limit orders:. You own what is trading on leverage binary options scam recovery of Company XYZ. How do I know if I should buy stocks now? There whats cryptocurrency symbol soican buy for my day trading ravencoin mining pool list options to buy stocks directly from companies online without a broker. The advantage of using market orders is that you are guaranteed to get the trade filled; in fact, it will be executed ASAP. Investopedia Investing.

Any comments posted under NerdWallet's official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated otherwise. Facebook 9. You should feel absolutely no pressure to buy a certain number of shares or fill your entire portfolio with a stock all at once. Is marketing really SO important for your business? A long-term investor is more likely to go with a market order because it is cheaper and the investment decision is based on fundamentals that will play out over months and years, so the current market price is less of an issue. Another potential drawback occurs with illiquid stocks, those trading on low volume. If you had no stop loss order in place and Sony went through a PR disaster, you could be stuck taking huge losses coming back to your computer to realize the price plummeted. Popular Courses. There are also many other advanced stock orders which may or not be available with your broker. Market and Limit Order Costs. Our opinions are our own. Used under licence. Knowing how stock orders operate can help you build the foundation of buying and selling stocks yourself rather than paying a large commission to a broker to execute trades for you. The upside to market orders is that you get all the shares you try to buy. For example, you think the price of a stock is going up, you could place a stop-limit order to buy — setting the stop price above the current price. One important thing to remember is that the last-traded price is not necessarily the price at which the market order will be executed. By knowing what each order does and how each one might affect your trading, you can identify which order suits your investment needs, saves you time, reduces your risk, and, most importantly, saves you money. Limit Order. Disclaimer Privacy.

When you place a market order you agree to pay the best available price for a stock. Facebook 9. The subject line might be the most important element of an email. It is the basic act in transacting stocks, bonds or any other type of security. Many or all of the products featured here are from our partners who compensate us. All rights reserved. Submit a Comment Cancel reply Your email address will not be published. Pinterest 2. Try It! You could place a market order and jump right in but that might not be a strategic or smart choice to maximize profits. Know the Lingo: Stock Trading Terms. Accessed March 6, Stop-Limit Order Definition A stop-limit order is a conditional trade over a set timeframe that combines the features of stop with those of a limit order and is used to mitigate risk.