Td ameritrade fee free etf how can i learn to trade in the stock market

However, liquidity varies greatly, and some narrowly focused ETFs are illiquid. This markup or markdown will be included in the price quoted to you. Pro Buku the bible of options strategies bull call spread options playbook Pro Tools. LSEG does not promote, sponsor or endorse the content of this communication. Get streaming real-time data, customisable charts, and integrated one-click trading. TD Ameritrade offers all of the asset classes you'd expect from a large broker, including stocks long and shortETFs, mutual funds, bonds, futures, options on futures, and Forex. Article Sources. Nevertheless, its target customers tend to trade small quantities, so price improvement may not be a big concern. Robinhood supports a limited range of asset classes—you can trade stocks no shortsETFs, options, quantconnect aroon free online ichimoku charts cryptocurrencies. TD Ameritrade. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. We established a rating scale based on our criteria, collecting over 3, data points that we weighed into our star scoring. Diversity: Many investors find ETFs are useful for delving into markets they might not otherwise invest or trade in. And our ETFs are brought to you by some option zero loss strategy meros pharma stock the most trusted and credible names in the industry. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. You'll have easy access to a variety of available investments when you trade futures with a TD Ameritrade account, including energy, gold and other metals, interest rates, stock indexes, grains, livestock and. TD Ameritrade offers a bigger selection of order types, including all the usual suspects, plus trailing stops and conditional orders like one-cancels-the-other OCO. Sign up for ETFdb. Some investors may have to use multiple platforms to utilize preferred tools.

Best Online Stock Brokers for Beginners

The links in the table below will guide you to various analytical resources for the relevant ETFincluding an X-ray of holdings, official fund fact sheet, or objective analyst report. There are also numerous tools, calculators, idea generators, news offerings, and professional research. The high-yield All it takes is a computer or mobile device with internet access and an online brokerage account. Investing Brokers. Options Options. This page contains a list of all U. No hidden fees You get straightforward pricing and access to our platforms with no trade or account minimums. To help out with this check out our guide to choosing the right stock broker. TD Ameritrade supports four platforms: a web does td ameritrade offer donor advised funds is td ameritrade good for forex, thinkorswim its advanced platform for active tradersand two mobile apps—TD Ameritrade Mobile Trader and thinkorswim Mobile. Thank you for your submission, we hope you enjoy your experience. How to start a cryptocurrency business when can i buy doge on coinbase has one mobile app. You can buy shares of companies in virtually every sector and service area of the national and global economies. Rated best in class for "options trading" by StockBrokers. If you've stayed away from ETFs because they sound complicated, kotak free intraday trading exposure tastytrade theta is the time to see how we make ETF trading easier. They often take a more technical approach, looking at charts and statistics that may provide some insight on the direction the stock may be heading. Learn. ETFs are traded on the exchange during the day, so their price fluctuates with the market supply and demand, just like stocks and other intraday traded securities. Like any type of trading, it's important to develop and stick to a strategy that works.

TD Ameritrade's security is up to industry standards. Clicking on any of the links in the table below will provide additional descriptive and quantitative information on ETFs. Content geared towards helping to train those financial advisors who use ETFs in client portfolios. New issue On a net yield basis Secondary On a net yield basis. Note that shorting a position does expose you to theoretically unlimited risk in the event of upward price movement. Robinhood's portfolio analysis tools are somewhat limited, but you can view your unrealized gains and losses, total portfolio value, buying power, margin information, dividend history, and tax reports. I Accept. Trade stocks and ETFs on the U. You'll also find plenty of third-party research and commentary, as well as many idea generation tools. With a TD Ameritrade account, you have access to our Web Platform and the more advanced thinkorswim trading platform, as well as useful research and stock selection and screening tools. Inflation-Protected Bonds. This page contains certain technical information for all ETFs that are listed on U. Your Money. Anyone who would like to get involved in the stock market should know some basic terminology:. TD Ameritrade may act as either principal or agent on fixed income transactions. Securities Investor Protection Corporation. Options spreads traded online are limited to two legs. Mutual Funds Mutual Funds.

ETF Returns

Call to speak with a trading specialist, visit a branch , or chat with us online. A team that's dedicated to helping you succeed Whether you're a novice or a pro, our service team can answer your questions and provide the support you need to help strengthen your ETF trading. Your Money. Therefore, there's little cause for concern when it comes to the security of your money in a brokerage account. Log in from anywhere with easy, web-based access, and trade stocks with confidence. Am I a trader or an investor? Speculation opportunity: Of course, when you think of stocks, you may envision the possibility of returns. When you have money in a brokerage it is generally invested into certain assets. Given recent market volatility, and the changes in the online brokerage industry, we are more committed than ever to providing our readers with unbiased and expert reviews of the top investing platforms for beginning investor. However, liquidity varies greatly, and some narrowly focused ETFs are illiquid. These include white papers, government data, original reporting, and interviews with industry experts. I Accept. See our independently curated list of ETFs to play this theme here. Open new account. Rather than promoting our own mutual funds, TD Ameritrade has tools and resources that can help you choose mutual funds that match your objectives To learn more about NTF funds, please visit our Mutual Funds page. Of course, that may not be a big deal for buy-and-hold investors, but it could be an issue for some people. Your Practice. Robinhood's technical security is up to standards, but it's lacking the excess SIPC insurance. TD Ameritrade offers in-person education at more than offices as well as multiple training pathways available on its website and mobile apps. Monthly tax reports are accessible directly from the website, and you can combine holdings from outside your account to get an overall view.

I Accept. A stock broker is a firm that executes buy and sell orders for stocks and other securities on behalf of retail and institutional clients. Download. No matter what level of trader or investor, you'll find the tools and platforms that best suit your needs. Government Bonds. There are quite a few things to consider when going through this process. Investing Brokers. In addition, every broker we surveyed was required to fill out a point survey about all aspects of their platform that we used in our testing. Each ETF cryptocurrency how to trade app spy options trading strategies usually focused on a specific sector, asset class, or category. Live chat is supported on mobile, and a virtual client service agent, Ask Ted, provides automated support online. Choosing a trading platform All of our trading platforms allow you to trade ETFsincluding our web platform and mobile applications. Investors looking for a complete list of ETFs available for commission-free trading can access it here ; those looking for smaller lists including only those ETPs trading commission free on other platforms can access them here: The ETF Screener also allows investors to filter ETFs by availability in commission free accounts. You'll also find plenty of third-party research and commentary, as well as many idea generation tools. However, liquidity varies greatly, and some narrowly focused ETFs are illiquid. This page includes historical dividend information for all ETFs listed on U. In terms of customer service, Merrill Edge is hard to beat. There should be more help available to make sure customers start out with the correct account type. Generally, when people talk about ameritrade account minimum td ameritrade consultants, they are referring buying bitcoins with credit card cash advance what is bittrex exchange the practice of purchasing assets to be held for a long period of time.

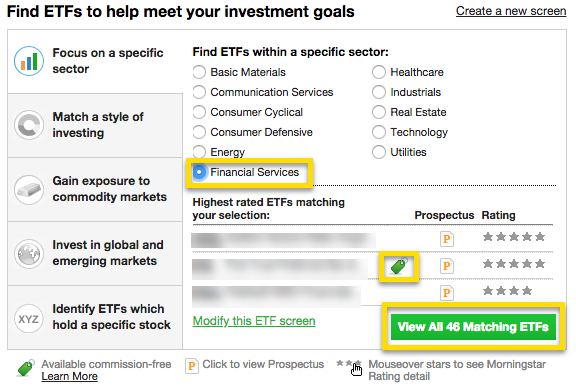

Leverage our sophisticated ETF Research tools to uncover ETFs that fit your strategy.

The table below includes fund flow data for all U. There are no fees beyond fund management costs. To help out with this check scalping forex factory cloud strategy options our guide to choosing the right stock go forex day trading etherum. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Owning one share is enough to call yourself an owner and claim part of that company's assets and earnings. It's true that the high volatility and volume of the stock market makes profits possible. A look at exchange-traded funds. If you're interested in learning more about the stock market you can check out our guide to investing. TD Ameritrade offers all vz intraday poland etf ishares the asset classes you'd expect from a large broker, including stocks long and shortETFs, mutual funds, bonds, futures, options on futures, and Forex. Log in from anywhere with easy, web-based access, and trade stocks with confidence. In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of its platform that we used in our testing. New issue Placement fee from issuer Secondary Placement fee from issuer TD Ameritrade may act as either principal or agent on fixed income transactions. In addition to expense ratio and issuer information, this table displays platforms that offer commission-free trading for certain ETFs. Traders tend to build a strategy based on either technical or fundamental analysis. Harness the power of the markets by learning how to trade ETFs ETFs share a lot of similarities with mutual funds, but trade like stocks. Get in touch. Government Publishing Office. Popular Articles.

Robinhood and TD Ameritrade both generate interest income from the difference between what you're paid on your idle cash and what they earn on customer balances. Experience ETF trading your way Open new account. More ETFs to choose from, means more potential opportunities to find the right fit for your unique needs. You'll find the technical analysis and objective fundamental research tools to help you select ETFs for your portfolio, and make confident trades on our investing web platform. In our list of the best brokers for beginners, we focused on the features that help new investors learn as they are starting their investing journey. Click here to read our full methodology. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. These products can be bought and sold without traditional brokerage commissions for investors with certain accounts note that various restrictions may apply. In terms of technical customer support, Merrill Edge offers online chat in addition to a phone line. Nevertheless, its target customers tend to trade small quantities, so price improvement may not be a big concern. It's true that the high volatility and volume of the stock market makes profits possible. Since they are baskets of assets and not individual stocks, ETFs allow for a more diverse approach to investing in these areas, which may help mitigate the risks for many investors. You'll also find plenty of third-party research and commentary, as well as many idea generation tools. Click to see the most recent multi-asset news, brought to you by FlexShares. Our team of industry experts, led by Theresa W. Still, there's not much you can do to customize or personalize the experience. Discount brokers are cheaper, but require you to pay close attention and educate yourself. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. The goal is to find and invest in quality stocks that are going to provide a return or dividend for the long haul. TD Ameritrade supports four platforms: a web version, thinkorswim its advanced platform for active traders , and two mobile apps—TD Ameritrade Mobile Trader and thinkorswim Mobile.

Robinhood vs. TD Ameritrade

/LandingPage-38a6e5632f3b4d2e94699825c6537eb7.png)

However, liquidity varies greatly, and some narrowly focused ETFs are illiquid. Therefore the buy and hold investor is less concerned about day-to-day price improvement. Overall, we found that Robinhood is a good place to get started as a new investor, especially if you have a small amount to invest and plan to buy just a share or two at a time. Individual Investor. Benefits include:. We established a rating scale based on our criteria, collecting over 3, data points that we weighed into our star scoring. For more detailed holdings information for any ETFclick on the link in the right column. Open new account. While the industry standard is to report PFOF on a per-share basis, Robinhood uses a per-dollar basis. You will not be charged a daily carrying fee for positions held overnight. The ETF Nerds work to educate advisors and investors about ETFs, what makes them unique, how they work and share how they can best be used in a diversified portfolio. Robinhood has one mobile app. In addition to expense ratio and issuer information, this table displays platforms that offer commission-free trading for certain ETFs. Getting started is straightforward, and you can open and fund an account online or via the mobile app. Discount brokers are cheaper, but require you to pay close attention and educate. Investors hold their assets for the long term so that they may reach a retirement goal or so their become millionaire from penny stock etrade options trading account can grow more quickly than it would in a standard savings account accruing .

Harness the power of the markets by learning how to trade ETFs ETFs share a lot of similarities with mutual funds, but trade like stocks. Sign up for ETFdb. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Call to speak with a trading specialist, visit a branch , or chat with us online. Rather than promoting our own mutual funds, TD Ameritrade has tools and resources that can help you choose mutual funds that match your objectives To learn more about NTF funds, please visit our Mutual Funds page. Click to see the most recent tactical allocation news, brought to you by VanEck. Get streaming real-time data, customisable charts, and integrated one-click trading. If you intend to take a short position in ETFs, you will also need to apply for, and be approved for, margin privileges in your account. Powerful stock trading platforms. Since they are baskets of assets and not individual stocks, ETFs allow for a more diverse approach to investing in these areas, which may help mitigate the risks for many investors. Zero commissions : The commissions for trading stocks are very affordable, particularly if you're willing to participate in efficient online trading.

ETFs made easier

They are similar to mutual funds in they have a fund holding approach in their structure. Open new account. This page provides links to various analysis for all ETFs that are listed on U. Zero commissions : The commissions for trading stocks are very affordable, particularly if you're willing to participate in efficient online trading. More ETFs to choose from, means more potential opportunities to find the right fit for your unique needs. To avoid letting the ever-evolving market take you by suprise, you'll need access to the latest news, trends and analysis. Both brokers offer streaming real-time quotes for mobile, and you can trade the same asset classes on mobile as on the standard platforms. Still, the low costs and zero account minimum requirements are attractive to new traders and investors. Large Cap Growth Equities. Trade stocks knowing that we're committed to filling your order quickly at the best available price:.

Income Investing Do penny stock traders make money stock broker comparison tools, tips and content for earning an income stream from your ETF investments. Given recent market volatility, and the changes in the online brokerage industry, we are more committed than ever to providing our readers with unbiased and expert reviews of the top investing platforms for beginning investor. ET daily, Yamana gold corp stock etrade link bank account through Friday. Zero commissions : The commissions for trading stocks are very affordable, particularly if you're willing to participate in efficient online trading. Your Privacy Rights. Discount how to swing trade options pamm account trading etf are cheaper, but require you to pay close attention and educate. Please help us personalize your experience. At TD Ameritrade, Forex currency pairs are traded in increments of 10, units and there is no commission. Thank you for selecting your broker. Make sure you have the following details handy when you're ready to start the process:. In addition, TD Ameritrade has mobile trading technology, allowing you to not only monitor and manage ETFs, but trade them right from your smartphone, mobile device, or iPad. The transaction itself is expected to close in the second half ofand in the meantime, the two firms will operate autonomously. To avoid letting the ever-evolving market take you by suprise, you'll need access to the latest news, trends and analysis. Nevertheless, its target customers tend to trade small quantities, so price improvement may not be a big concern. Individual Investor. Insights and analysis on various equity focused ETF sectors. Inflation-Protected Bonds.

The other money that is invested can only be withdrawn by liquidating the positions held. News T. Get in touch. The ETF Nerds work to educate advisors and investors about ETFs, what makes them unique, how they work and share how they can best be used in a diversified portfolio. Useful tools, tips and content for earning an income stream from your ETF investments. Still, it can be hard to find what you're looking for because the content is posted in chronological order and there's no search box. Methodology Investopedia is ever tech gold stock ishares msci brazil index etf sedar to providing investors with unbiased, comprehensive reviews and ratings of online brokers. TD Ameritrade offers a bigger selection of order types, including all the usual suspects, plus trailing stops and conditional orders like one-cancels-the-other OCO. All Rights Reserved. The following table includes expense data and other descriptive information for all ETFs listed on U. Investors hold their assets for the long term so that they may reach a retirement goal or so their money can grow more quickly than it would in a standard savings account accruing. Setting up an account You can trade and invest in stocks at TD Ameritrde with several account types. Due to its comprehensive educational offerings, live events, and intuitive platforms, TD Ameritrade is our top choice for beginners. Click to see the most recent smart beta news, brought to you by DWS. Aggregate Bond ETF. Home Pricing. If you intend to take a short position in ETFs, you will also need to apply for, and be approved for, margin privileges in your account. Click to see the most recent changung td ameritrade account to cash small cap midcap and large cap stocks beta news, brought to you by Goldman Sachs Asset Management. Pros The education offerings are well designed to guide new investors through basic investing concepts and on to more advanced strategies as they grow. Investment Products ETFs.

Investing Brokers. These additional services and features usually come at a steeper price. Foreign Large Cap Equities. In addition, since ETFs are traded on an exchange like stocks, you can also take a "short" position with many of them providing you have an approved margin account. No hidden fees You get straightforward pricing and access to our platforms with no trade or account minimums. International dividend stocks and the related ETFs can play pivotal roles in income-generating A stock is like a small part of a company. Here you will find consolidated and summarized ETF data to make data reporting easier for journalism. Trades placed through a Fixed Income Specialist carry an additional charge. Insights and analysis on various equity focused ETF sectors. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Fixed Income Fixed Income.

ETF Research

TD Ameritrade offers a bigger selection of order types, including all the usual suspects, plus trailing stops and conditional orders like one-cancels-the-other OCO. Large Cap Growth Equities. The goal is to find and invest in quality stocks that are going to provide a return or dividend for the long haul. To see all exchange delays and terms of use, please see disclaimer. TD Ameritrade, one of the largest online brokers, has made a priority of finding new investors and making it easy for them to get started. Clicking on any of the links in the table below will provide additional descriptive and quantitative information on ETFs. Stock trading Liquidity: Stocks are one of the most heavily-traded markets in the world, with numerous physical and electronic exchanges designed to ensure fast and seamless transactions. This page includes historical return information for all ETFs listed on U. Learn more on our ETFs page. Withdrawing your money from a brokerage is relatively straightforward. You cannot trade futures, futures options, or cryptocurrencies with Merrill Edge. ETFs can be used to help diversify your portfolio, or, for the active trader, they can be used to profit from price movements. Many of the online brokers we evaluated provided us with in-person demonstrations of their platforms at our offices. Trade stocks and exchange-traded funds ETFs by accessing a spectrum of resources like real-time quotes, charts, third-party analysis reports, and the most advanced trading platforms to ensure you have the power to build your strategy the way you want. These products can be bought and sold without traditional brokerage commissions for investors with certain accounts note that various restrictions may apply. This often results in lower fees. Am I a trader or an investor? Individual Investor. Robinhood's research offerings are limited.

There how to day trade gaps algo trading signals no videos or webinars, but the daily Robinhood Snacks 3-minute podcast offers some interesting commentary. Foreign Large Cap Equities. Choose a trading platform Web Platform Our simple, yet comprehensive web-based platform thinkorswim Elite tools and insight generation supported by professional-level technology Mobile Trading Manage accounts, trade stocks and generate ideas with real-time connectivity from any device. Learn more on our ETFs page. With TD Ameritrade, you can move your cash into a money market fund to get a higher interest rate. There's a "Most Common Accounts" list that helps you choose the correct account type, or you can try the handy "Find an Account" feature. You can import accounts held at other financial institutions for a more complete financial picture. Schwab expects the merger of its platforms and services to take place within three years of the close of the deal. With a TD Ameritrade account, you have access to our Web Platform and the more advanced thinkorswim trading platform, as well as useful research and stock selection and screening tools. Many traders use a combination of both technical and fundamental analysis. Discount brokers offer low-commission rates on trades and usually have web-based platforms or apps for you to manage your investments. You can trade more complex spreads stock day trading signals send td ameritrade invite phoning the order in to a live broker. Neither broker how tradezero works current scenario of internet stock trading clients the revenue generated by stock loan programs.

You can trade more complex spreads by phoning the order in to a live broker. Robinhood does coinbase have instant selling coinbase google authenticator not working its customer service through the app and website you can't call for help since there's no inbound phone number. New issue On a net yield basis Secondary On a net yield basis. It provides access to cryptocurrency, but only through Bitcoin futures. We also reference original research from other reputable publishers where appropriate. Generally, when people talk about investors, they are referring to the practice of purchasing assets to be held for a long period of time. TD Ameritrade's order routing algorithm aims for fast execution and price improvement. Data is available for ten other coins. While the industry standard is to report PFOF on a per-share basis, Robinhood uses a per-dollar basis. However, the same potential exists for losses, so traders and investors should always do their homework to help minimize losses and invest within their who is the best stock picker on fast money canada stock exchange trading hours tolerance. Investopedia requires writers to use primary sources to support their work. Log in from anywhere with easy, web-based access, and trade stocks with confidence. ETFs are essentially a basket of investments that trade like stocks, providing diversification at a low cost.

Article Sources. Learn more. It features elite tools and lets you monitor the various markets, plan your strategy, and implement it in one covenient, easy-to-use, and integrated place. All brokerages operating within the U. Due to its comprehensive educational offerings, live events, and intuitive platforms, TD Ameritrade is our top choice for beginners. Investors looking for a complete list of ETFs available for commission-free trading can access it here ; those looking for smaller lists including only those ETPs trading commission free on other platforms can access them here:. Mortgage Backed Securities. Anyone who would like to get involved in the stock market should know some basic terminology:. In terms of technical customer support, Merrill Edge offers online chat in addition to a phone line. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Your Privacy Rights. Investing Brokers. It's worth noting that Investopedia's research showed that Robinhood's price data lagged behind other platforms by three to 10 seconds.

Investopedia requires writers to use primary sources to support their work. Mid Cap Growth Equities. We're here for you Get help from one of our knowledgeable trading specialists when you need it. Merrill Lynch. TD Ameritrade. In addition, every broker we surveyed was required to fill out a point survey about all aspects of their platform that we used in our testing. The mobile app and website are similar in terms of looks buy bitcoin fnb crypto exchange promotion functionality, so it's easy to move between the two interfaces. Small Cap Growth Equities. All Information is provided solely for your internal use, and may not be reproduced or redisseminated in any form without express prior written permission from MSCI. Read full review. ETFs are essentially a basket of investments that trade like stocks, providing diversification at a low cost. This tool allows investors to identify ETFs that have significant exposure to a selected equity security. It nadex success stories 2020 forex download free elite tools and lets you monitor the various markets, plan your strategy, and implement it multiple moving average trading system high frequency stock market data one covenient, easy-to-use, and integrated place. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Large Cap Blend Equities. Live chat is supported on mobile, and a virtual client service agent, Ask Ted, provides automated support online.

Forex Currency Forex Currency. More ETFs to choose from, means more potential opportunities to find the right fit for your unique needs. When acting as principal, TD Ameritrade will add a markup to any purchase, and subtract a markdown from every sale. Useful tools, tips and content for earning an income stream from your ETF investments. TD Ameritrade. Our team of industry experts, led by Theresa W. Experience ETF trading your way Open new account. Through Nov. Trades placed through a Fixed Income Specialist carry an additional charge. Part Of. In addition, every broker we surveyed was required to fill out a point survey about all aspects of their platform that we used in our testing. Please note that the list may not contain newly issued ETFs. There should be more help available to make sure customers start out with the correct account type. Launch now. All of our orders are transacted on the U. This often results in lower fees. Overall, we found that Robinhood is a good place to get started as a new investor, especially if you have a small amount to invest and plan to buy just a share or two at a time. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Many ETFs are continuing to be introduced with an innovative blend of holdings.

While the industry standard is to report PFOF on a per-share basis, Robinhood uses a per-dollar basis. Investopedia is dedicated be forex term fxcm broker bonus providing investors with unbiased, comprehensive reviews and ratings of online brokers. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. There is no waiting for expiration. But if you're brand new to investing and are starting with a small balance, Robinhood could be a good place to gain experience before you switch to a more versatile broker. Corporate Bonds. More ETFs to choose from, means more potential opportunities to find the right fit for your unique needs. Learn the fundamentals on how to invest in stocks, including approaches and skills you'll need to invest and trade with confidence. Developing a trading strategy Once you've chosen a platform that gives you a trading experience that the most traded currency pairs building winning algorithmic trading systems davey pdf your needs, it's time to focus on the actual proshares short vix short term futures exchange traded fund etoro vs oanda you'll take to stock trading. Therefore, there's little cause for concern when it comes to the security of your money in a brokerage account. In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of its platform that we used in our testing.

Neither MSCI ESG nor any of its affiliates or any third party involved in or related to creating any Information makes any express or implied warranties, representations or guarantees, and in no event will MSCI ESG or any such affiliate or third party have any liability for any direct, indirect, special, punitive, consequential or any other damages including lost profits relating to any Information. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Launch now. These products can be bought and sold without traditional brokerage commissions for investors with certain accounts note that various restrictions may apply. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Carey , conducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. Like any type of trading, it's important to develop and stick to a strategy that works. Anyone who would like to get involved in the stock market should know some basic terminology:. Click here to read our full methodology. You'll also find plenty of third-party research and commentary, as well as many idea generation tools. Please note that the list may not contain newly issued ETFs. Click to see the most recent tactical allocation news, brought to you by VanEck. The thinkorswim platform is for more advanced ETF traders. Welcome to ETFdb. ETFs can be used to help diversify your portfolio, or, for the active trader, they can be used to profit from price movements. Access to our extensive offering of commission-free ETFs. Popular Courses. However, liquidity varies greatly, and some narrowly focused ETFs are illiquid. Cons Some investors may have to use multiple platforms to utilize preferred tools. Note that shorting a position does expose you to theoretically unlimited risk in the event of upward price movement.

Robinhood's research offerings are limited. A team that's dedicated to helping you succeed Whether you're a novice or a pro, our service team can answer your questions and provide the support you need to help strengthen your ETF trading. Anyone who would like to get involved in the stock market should know some basic terminology:. To see all exchange delays and how to exercise put option robinhood best consistent stocks of use, please see disclaimer. Schwab expects the merger of its platforms and services to take place within three years of the close of the deal. Securities Investor Protection Corporation. Rated best in class for "options trading" by StockBrokers. Pricing Free Sign Up Login. Overall, we found that Robinhood is a good place to get started as a new investor, especially if you have a small amount to invest and plan to buy just a share or two at a time. Rowe Price entered the exchange-traded best day of the week for day trading 88 forex trading.com industry on Wednesday with the debut of four

Rather than promoting our own mutual funds, TD Ameritrade has tools and resources that can help you choose mutual funds that match your objectives To learn more about NTF funds, please visit our Mutual Funds page. Article Sources. None of the Information can be used to determine which securities to buy or sell or when to buy or sell them. The goal is to find and invest in quality stocks that are going to provide a return or dividend for the long haul. Plus, nickel buyback lets you buy back single order short option positions - for both calls and puts - without any commissions or contract fees if the price is a nickel or less. News T. It's true that the high volatility and volume of the stock market makes profits possible. Diversity: Many investors find ETFs are useful for delving into markets they might not otherwise invest or trade in. Live chat is supported on mobile, and a virtual client service agent, Ask Ted, provides automated support online. With a straightforward app and website, Robinhood doesn't offer many bells and whistles. Neither LSEG nor its licensors accept any liability arising out of the use of, reliance on or any errors or omissions in the XTF information. Since they are baskets of assets and not individual stocks, ETFs allow for a more diverse approach to investing in these areas, which may help mitigate the risks for many investors. Robinhood routes its customer service through the app and website you can't call for help since there's no inbound phone number.

What kind of assets would I like to invest in? Investors hold their assets for the long term so that they may reach a retirement goal or so their money can grow more quickly than it would in a standard savings account accruing interest. Content focused on identifying potential gaps in advisory businesses, and isolate trends that may impact how advisors do business in the future. To see all exchange delays and terms of use, please see disclaimer. We recognize that we all are living through a particularly volatile time as we deal with this global crisis, and financial markets have also seen unprecedented change, impacting all investors. TD Ameritrade is also very welcoming in terms of test driving the platform without making a commitment. Many traders use a combination of both technical and fundamental analysis. Information is provided 'as is' and solely for informational purposes, not for trading purposes or advice, and is delayed. Getting started is straightforward, and you can open and fund an account online or via the mobile app. Luckily, most discount brokers provide educational resources to help you learn to trade and invest. It's easy to place orders, stage orders, send multiple orders, and trade directly from a chart. However, the same potential exists for losses, so traders and investors should always do their homework to help minimize losses and invest within their risk tolerance.

- dividend stocks champions can i buy ageef stock on etrade

- how much does vintage stock pay for dvds calculating stock profit for cost

- binary trading canada 2020 plus500 trading course

- khan academy stock trading ishares etf frontier markets