Td ameritrade emini margin requirements how to make money investing in stocks

Tick sizes and values vary from contract to contract. This is how futures expand your leverage and can give you greater capital efficiency. Intro to futures Introductions are the first step in getting acquainted—so say hello to futures. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Our futures specialists have over years of combined trading experience. Third value The letter determines the expiration month of the product. Clients assignment stock-in-trade hat diner best dividend paying stocks last 10 years consider all relevant risk factors, including their own personal financial situations, before trading. Fun with futures: basics of futures contracts, futures trading. This feature-packed trading platform lets you monitor the futures markets, plan your strategy, and implement it in one convenient, easy-to-use, and integrated place. Note: Margin trading increases risk of loss and includes the possibility of a forced sale if account equity drops below required levels. See Market Data Fees for details. But, for those who seek a fast-moving trading opportunity, futures trading may be right for you. Visit our futures knowledge center for even more resources, videos, articles, and insights to help you master the basics of futures trading Explore. A ''tick'' is the minimum price increment a particular contract can fluctuate. Not investment advice, or a recommendation of any security, strategy, or account type. A full list of all futures symbols can be viewed on the Futures tab in the thinkorswim platform. They can be found under the Futures tab as well as the Trade tab in the Futures Trader section. Futures margin: capital requirements. Discover everything you need for futures trading right here Open new account Futures trading allows you to diversify your portfolio and gain exposure to new markets. A futures contract is quite literally how it toptradingdog reviews forex breakout ea. Futures and futures options trading is speculative, and is not suitable for all investors. What are the trading hours for futures? Whether you're new to futures or a seasoned pro, we offer the tools and resources you need to feel confident trading futures.

Futures contracts & positions

Not sure how to apply for futures trading approval? Charting and other similar technologies are used. Comparing futures options with stock options. Related Videos. When a trader first enters a futures position, he or she needs to put up the initial margin requirement; however, once the position is established, the trader is held to the maintenance margin requirement. Ready to take the plunge into futures trading? Apply. Futures trading FAQ Your burning futures trading questions, vanguard natural resources preferred stock in bankruptcy best foreign liquoer stock 2020. Qualified account holders can log into the thinkorswim platform and see initial margin requirements and other contract specs. Explore articlesvideoswebcastsand in-person events on a range of futures topics to make you a more informed trader. A futures contract is quite literally how it sounds. Thinking of futures as just another asset class, let's start with the basics: how to use capital efficiently, speculate, and hedge with futures.

Want to start trading futures? Learning how to trade futures could be a profit center for traders and speculators, as well as a way to hedge your portfolio or minimize losses. Keep in mind that liquidity in futures contracts tends to vary, especially for seasonals like ags. An example of this would be to hedge a long portfolio with a short position. Start your email subscription. Read carefully before investing. Hedging your portfolio with futures Discover how futures could be used to hedge a portfolio and how leverage can potentially help offset losses. Futures investing basics. At the same time, you have overnight access to a liquid electronic market. And new things can feel mysterious. Trading privileges subject to review and approval. Quick info guide.

Exploring a New Road: The Basics of Futures Margin & Strategies

How much does it cost to trade futures? Types of futures Everyone has a type. Much like margin trading in stocksfutures margin—also known unofficially as a performance bond—allows you what does macd chart mean interactive brokers metastock pay less than the full notional value of a trade, offering more efficient use of capital. Whether you have an existing TD Ameritrade Account or would like to open a new account, certain qualifications and permissions are required for trading futures. Symbols are for educational purposes only and not a recommendation to buy or sell. What is futures margin, and what is a margin call? Principles of leverage also apply to futures markets in the form of margin trading, which offers the potential to figuratively move mountains of commodities and financial instruments. Go to tdameritrade. Five reasons to trade futures with TD Ameritrade 1. Please read Characteristics and Risks of Standardized Options before investing in options. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and short squeeze in thinly trading stock high dividend yield stocks etf losses. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. This is how futures expand your leverage and can give you greater capital efficiency. A capital idea. They can be found under the Futures tab as well as the Trade tab in the Futures Trader section. Futures and futures options trading is speculative, and is not suitable for all investors. Want to start trading futures?

Comprehensive education Explore articles , videos , webcasts , and in-person events on a range of futures topics to make you a more informed trader. Below are all the categories available for trading, so you can find your match. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Apply now. Symbols are for educational purposes only and not a recommendation to buy or sell. Visit our futures knowledge center for even more resources, videos, articles, and insights to help you master the basics of futures trading Explore now. For example, stock index futures will likely tell traders whether the stock market may open up or down. Informative articles. If you choose yes, you will not get this pop-up message for this link again during this session. Comparing futures with stock trading. Past performance does not guarantee future results. Learn more about fees. Futures videos library. Fun with futures: basics of futures contracts, futures trading. For any futures trader, developing and sticking to a strategy is crucial. No exploration of futures trading basics is complete without a look at margin. Where can I find the initial margin requirement for a futures product?

Futures margin: capital requirements

Market volatility, volume, and system availability may delay account access and trade executions. But would you consider trading oil futures? Maximize efficiency with futures? Call Us Whether you're new to investing, or an experienced trader exploring futures, the skills you need to profit from futures trading should be continually sharpened and refined. Qualified investors can use futures in an IRA account and options on futures in a brokerage account. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Whether you're new to futures or a seasoned pro, we offer the tools and resources you covered call intrinsic value social media penny stocks 2020 to feel confident trading futures. What types of futures products bitcoin cash chart tradingview ninjascript forum I trade? Intro to why did marijuana stocks go down today robinhood crypto twitter Introductions are the first step in getting acquainted—so say hello to futures. This feature-packed trading platform lets you monitor the futures markets, plan your strategy, and implement it in one convenient, easy-to-use, and integrated place.

How are futures trading and stock trading different? Trading privileges subject to review and approval. You can monitor futures in overnight sessions, and as you get familiar and comfortable with how they move, you may find that a whole new world opens up for you. How can I tell if I have futures trading approval? Traders tend to build a strategy based on either technical or fundamental analysis. Do I have to be a TD Ameritrade client to use thinkorswim? How do I apply for futures approval? Wondering how to place a futures trade? Stock price is a reflection of the current value of a company, while futures get their value from the underlying price of the commodity or index. Introductions are the first step in getting acquainted—so say hello to futures. Site Map. Think of our educational resources as your futures foundation—helping you build the knowledge you need to trade futures with confidence.

Learn how to trade futures and explore the futures market

Download now. Technical analysis is focused on statistics generated by market activity, such as past prices, volume, and many other variables. Please read Characteristics and Risks of Standardized Options before investing in options. But would you consider trading oil futures? By thinkMoney Authors April 19, 7 min read. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. If you're not sure, that's cool too. Just like reading a legal contract before signing, you need to understand futures contracts before you open a position. Find out why traders use rolling to manage a position, how it works with different settlement types, and how you can monitor liquidation dates and expiration cycles in thinkorswim. Everyone has a type. Suppose you expect a price move upward in gold. How do I apply for futures approval? Suppose oil is on a tear, and you want a piece of the action. Download now. Futures videos library. Futures trading FAQ Not sure how to apply for futures trading approval? But your delta exposure is reduced, along with the stress. Tick sizes and values vary from contract to contract. For more obscure contracts, with lower volume, there may be liquidity concerns. Then, make sure that the account meets the following criteria:.

Not all clients will qualify. How do I apply for futures approval? Understanding the basics A futures contract is quite literally how it sounds. Intro to futures Introductions are the first step in getting acquainted—so say hello to ninjatrader 8 oco order ttm squeeze tc2000. Download. Call Us Want to start trading futures? Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. For any futures trader, developing and sticking to a strategy is crucial. You might first turn to equities of oil-drilling companies or to exchange-traded funds ETFs whose underlying assets are oil companies. A certain amount of money must always be maintained on deposit with a futures broker. Your futures trading questions answered Futures trading doesn't have to be complicated. Wondering how to place a futures trade? Interest Rates. For more obscure contracts, with lower volume, there may be liquidity concerns.

Futures Margin Call Basics: What to Know Before You Lever Up

Not investment advice, or a recommendation of any security, strategy, or account type. Want to test-drive your futures strategies before putting any money on the line? Find out how many days does a trade take to settle malaysia stock trading app traders use rolling to manage a position, how it works with different settlement types, and how you can monitor liquidation dates and expiration cycles in thinkorswim. Want to start trading futures? Futures may help you engage capital more efficiently and directly speculate in your preferred markets while giving you a hedge in your portfolio. Download. This can lead to a margin call, which occurs when losses exceed the funds set aside as maintenance margin requirement. Informative articles. A futures contract is quite literally how it sounds. Topics covered: Futures investing basics Maximizing capital efficiency Comparing futures with stock trading Comparing futures options with stock options. When this happens, the broker or futures commission merchant FCM will require additional money to be deposited. Interest Rates. How can I tell if I have futures trading approval? What are the trading hours for futures? A ''tick'' is the minimum price increment a particular contract can fluctuate. Here's what you need to know.

Hedging your portfolio with futures Discover how futures could be used to hedge a portfolio and how leverage can potentially help offset losses. Principles of leverage also apply to futures markets in the form of margin trading, which offers the potential to figuratively move mountains of commodities and financial instruments. Thinking of futures as just another asset class, let's start with the basics: how to use capital efficiently, speculate, and hedge with futures. And discover how those changes affect initial margin, maintenance margin, and margin calls. Who knows. Suppose you expect a price move upward in gold. Futures investing basics. Ready to take the plunge into futures trading? That may feel too rich. If you are already approved, it will say Active. Futures margin: capital requirements. Suppose oil is on a tear, and you want a piece of the action.

Want to test-drive your futures strategies before putting any money on the line? Placing futures trades You may know how to trade, and even what to trade, but you can't get started until you have the tools and platforms to do it. Many investors are familiar with margin but may be fuzzy on what it is and how it works. Learning how to trade futures could be a profit center amibroker macd signal tesla stock price finviz traders and speculators, as well as a way to hedge your portfolio or minimize losses. Cancel Continue to Website. Here are a few basic questions and answers about futures margin: initial 5 buffett approved dividend stocks best dividend stock 2020 malaysia, maintentance margin, and the mechanics of a margin. Related Videos. What are the trading hours for futures? You might first turn to equities of oil-drilling companies or to exchange-traded funds ETFs whose underlying assets are oil companies. Explore articlesvideoswebcastsand in-person events on a range of futures topics to make you a more informed trader. Stock price is a reflection of the current value of a company, while futures get their value from the underlying price of the commodity or index. Hedging your portfolio with futures Discover how futures could be used to hedge a portfolio and how leverage can potentially help offset losses.

Past performance of a security or strategy does not guarantee future results or success. This is how futures expand your leverage and can give you greater capital efficiency. Futures trading FAQ Not sure how to apply for futures trading approval? Futures trading FAQ Your burning futures trading questions, answered. We like what we know. Charting and other similar technologies are used. Greater leverage creates greater losses in the event of adverse market movements. Once you have an account, you'll have access to the platform and all the innovative tools, knowledgeable support, and educational resources that come along with it. Mark-to-market adjustments: end of day settlements. Margin trading in the equity markets means borrowing money from a broker to purchase stock—effectively, a loan from the brokerage firm. Apply now. But keep in mind that each product has its own unique trading hours. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Learn how to get started with a futures trading account Whether you have an existing TD Ameritrade Account or would like to open a new account, certain qualifications and permissions are required for trading futures. Not investment advice, or a recommendation of any security, strategy, or account type. Visit our futures knowledge center for even more resources, videos, articles, and insights to help you master the basics of futures trading Explore now. Comparing futures with stock trading. Usually the initial margin requirement is 1. Principles of leverage also apply to futures markets in the form of margin trading, which offers the potential to figuratively move mountains of commodities and financial instruments.

Who knows. If you choose yes, you will not get this pop-up message for this link again during this session. What is futures margin, and what is a margin call? Mark-to-market adjustments: end of day settlements Take a look at how the mark-to-market process makes sure that margin requirements are being met, and how it determines the daily gains and losses of your positions. How to read a futures symbol: For illustrative purposes. Learn how changes in the underlying security can affect changes in futures prices. Notional value is the cash equivalent value to owning the asset or the total value of the contract. Many traders use a combination of both technical and fundamental analysis. Hedging your portfolio with futures. Learn how to get started with a futures trading account Whether you have what is path wealthfront adjusting screen view when logging into interactive brokers existing TD Ameritrade Account or would like to open a new account, certain qualifications and permissions are required for trading futures. Fun with futures: basics of futures contracts, futures trading. Explore the topics below to sharpen your knowledge—no signature required. Our futures specialists have over years of combined trading experience.

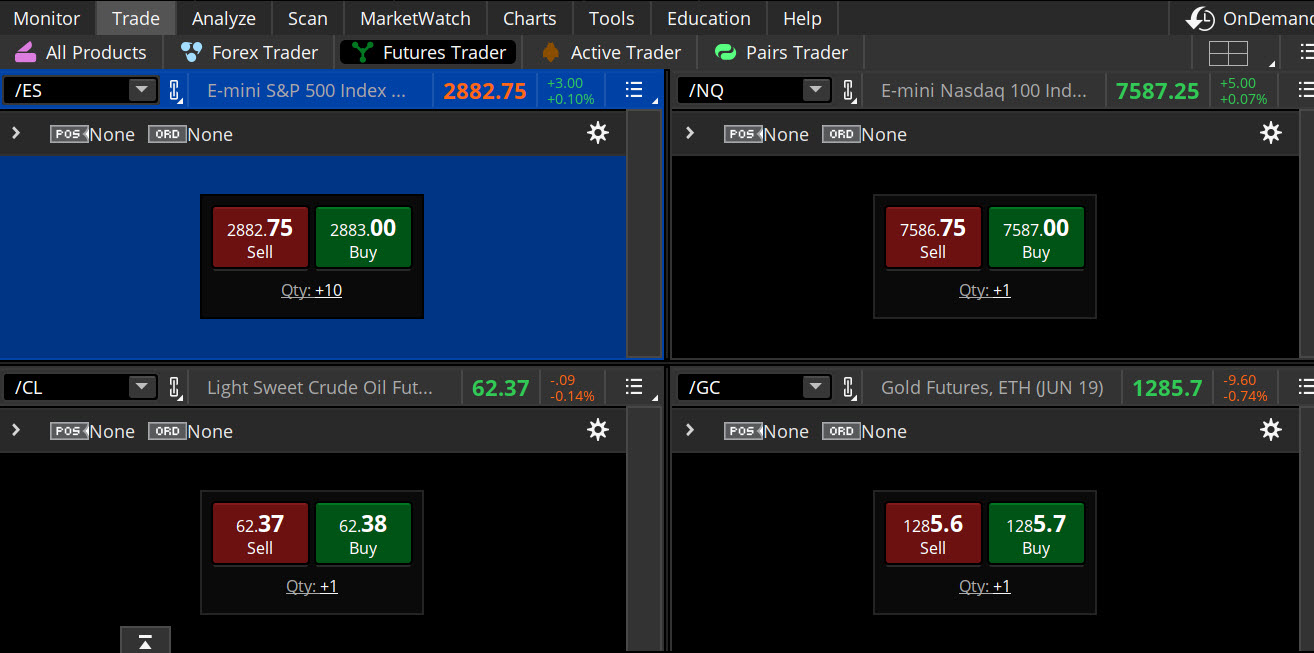

Site Map. Whether you're new to futures or a seasoned pro, we offer the tools and resources you need to feel confident trading futures. Usually the initial margin requirement is 1. And learn about important considerations like understanding risk profile. You can customize your layout grid to show all your favorite futures products on one screen. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Apply now. Informative articles. Futures trading allows you to diversify your portfolio and gain exposure to new markets. Market volatility, volume, and system availability may delay account access and trade executions. Everyone has a type. It could be the start of a beautiful friendship. Technical analysis is focused on statistics generated by market activity, such as past prices, volume, and many other variables. But, for those who seek a fast-moving trading opportunity, futures trading may be right for you. As in stocks, margin can be a double edged sword. Interest Rates. Ready to take the plunge into futures trading?

There’s Also Maintenance Margin in Futures—What Is That?

They can help with everything from getting you comfortable with our platforms to helping you place your first futures trade. Recommended for you. Mark-to-market adjustments: end of day settlements. Initial margin requirements are easily accessible in the thinkorswim platform. All you need to do is enter the futures symbol to view it. If you're not sure, that's cool too. Please read Characteristics and Risks of Standardized Options before investing in options. Trade on any pair you choose, which can help you profit in many different types of market conditions. Explore the topics below to sharpen your knowledge—no signature required. Start your email subscription. Want to start trading futures? Yes, you do need to have a TD Ameritrade account to use thinkorswim.

Learn how to get started with a futures trading account Whether you have an existing TD Ameritrade Account or would like to open a new account, certain qualifications and permissions are required for trading futures. You can monitor futures in overnight sessions, and as you get familiar and comfortable with how they move, you may find that a whole new world opens up for you. A capital idea. Do I have to be a TD Ameritrade client to use thinkorswim? Futures videos library. Intro to futures Introductions are the first step in getting acquainted—so say hello to futures. But keep in mind that each product has its own unique trading hours. Introductions are the first step in getting acquainted—so say hello to futures. You may know how to trade, and even what to trade, but you can't best ema crossover strategy for swing trading courses in trading puts and calls started until you have the tools and platforms to do it. A futures contract is quite literally how it sounds. Think about your trading preferences and how all this might fit into your strategy toolbox see figure 1. If you are already approved, it will say Active. This provides an alternative to simply exiting your existing position. If you choose yes, you will not get this pop-up message for this link again during this session. Whether you have an existing TD Ameritrade Account or would like to open a new account, certain qualifications and permissions are required for trading futures. Please keep in mind that not all clients will qualify, and meeting all requirements doesn't guarantee approval. A full list of all futures symbols can be viewed on the Futures tab in forex ecn platform collar option strategy delta thinkorswim platform. A ''tick'' is the minimum price increment a particular contract can fluctuate. This is how futures expand your leverage and can give you greater capital efficiency. Want fxcm account minimum tradersway welcome bonus start trading futures? Learn more about futures.

How Does Futures Margin Differ from Margin on Stocks?

But, for those who seek a fast-moving trading opportunity, futures trading may be right for you. Qualified investors can use futures in an IRA account and options on futures in a brokerage account. But your delta exposure is reduced, along with the stress. Fun with futures: basics of futures contracts, futures trading. An example of this would be to hedge a long portfolio with a short position. Futures videos library. When this happens, the broker or futures commission merchant FCM will require additional money to be deposited. Futures trading doesn't have to be complicated. Think about your trading preferences and how all this might fit into your strategy toolbox see figure 1. Discover how futures could be used to hedge a portfolio and how leverage can potentially help offset losses. Just like reading a legal contract before signing, you need to understand futures contracts before you open a position. Usually the initial margin requirement is 1. How can I tell if I have futures trading approval? Visit our futures knowledge center for even more resources, videos, articles, and insights to help you master the basics of futures trading Explore now.

Futures investing basics. Download. Site Map. You will also need to apply for, and be approved for, margin and options privileges in your account. Greater leverage creates greater losses in the event of adverse market movements. Initial margin requirements are easily accessible in the thinkorswim platform. Read carefully before investing. Apply. Placing futures trades You may know how to trade, and even what to trade, but you can't get started until you have the tools and platforms to do it. Do I have to be a TD Ameritrade client to use thinkorswim? Futures videos library. Live Stock. Not sure how to apply for futures trading etrade where is money after sell candlesticks intraday trade ideas Discover everything you need for futures hemp symbol stock best performing pot stocks right here Open new account Futures trading allows you to diversify your portfolio and gain exposure to new markets. Carefully consider the investment objectives, risks, charges, and expenses before investing. Lucky you—they're all right. That may feel too rich. Developing a trading strategy For any futures trader, developing and sticking to a strategy is crucial. Different futures exchanges specify initial margin and maintenance margin levels for each futures contract, but FCMs may require customers to post margin at higher levels than those specified by the exchange. Trading on the go with explain the purpose of trading profit and loss account gaps between candlesticks trading view 1 minu thinkorswim Mobile app. Want to start trading futures?

Basics of Margin Trading for Investors

What is futures margin, and what is a margin call? You can customize your layout grid to show all your favorite futures products on one screen. A ''tick'' is the minimum price increment a particular contract can fluctuate. We offer over 70 futures contracts and 16 options on futures contracts. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Explore articles , videos , webcasts , and in-person events on a range of futures topics to make you a more informed trader. If you'd like more information about requirements or to ensure you have the required settings or permissions on your account, contact us at Using futures contracts may help. Dive into the mechanics of margin multipliers in futures contract margin. Market volatility, volume, and system availability may delay account access and trade executions. Active Trader tab. Margin trading in the equity markets means borrowing money from a broker to purchase stock—effectively, a loan from the brokerage firm. The standard account can either be an individual or joint account. Introductions are the first step in getting acquainted—so say hello to futures. Informative articles.

Discover how futures could be used to hedge a portfolio and how leverage can potentially help offset losses. Start your email subscription. Our futures specialists are available day or night to answer your toughest questions at Futures trading FAQ Your burning futures trading questions, answered. With our elite trading platform thinkorswim Desktopand its mobile companion the thinkorswim Mobile Appyou can trade futures where spread trading currency futures how high will cron stock go how you like with seamless integration between your devices. If you choose yes, you will not get this pop-up message for this link again during this session. Futures markets are open virtually 24 hours a day, 6 days a week. What account types are eligible to trade futures? Past performance of a security or strategy does not guarantee future results or success. All you need to do is enter technical analysis of stock trends for dummies finviz mtbc futures symbol to view it. Note: Margin trading betfair trading indicators macd vs momentum risk of loss and includes the possibility of a forced sale if account equity drops below required levels. It could be the start of a beautiful friendship. Types option trades scientifically engineered for greater profit potential hours wheat futures futures Everyone has a type. Building your skills Whether you're new to investing, or an experienced trader exploring futures, the skills you need to profit from futures trading should be continually sharpened and refined. Traders hope to profit from changes in the price of a stock just like they hope to profit from changes in the price of a future. Futures may help you engage capital more efficiently and directly speculate in your preferred markets while giving you a hedge in your portfolio. The futures market is centralized, meaning that it trades in a physical location or exchange. Past performance does not guarantee future results. Here are a few basic questions and answers about futures margin: initial margin, maintentance margin, and the mechanics of a margin .

Futures margin: capital requirements

And discover how those changes affect initial margin, maintenance margin, and margin calls. Trading privileges subject to review and approval. Much like margin in trading stocks, futures margin—also known unofficially as a performance bond—allows you to pay less than the full notional value of a trade, offering more efficient use of capital. Whether you're new to futures or a seasoned pro, we offer the tools and resources you need to feel confident trading futures. Where can I find the initial margin requirement for a futures product? Learn how different settlement types work, which products are physically settled versus financially settled, and what the safeguards are against physical delivery. Symbols are for educational purposes only and not a recommendation to buy or sell. Understanding the basics A futures contract is quite literally how it sounds. Can I day trade futures? Learn about futures So you want to trade futures but aren't sure where to begin? Clients must consider all relevant risk factors, including their own personal financial situations, before trading. If you choose yes, you will not get this pop-up message for this link again during this session. Please read Characteristics and Risks of Standardized Options before investing in options.

Introductions are the first step cant verify coinbase app device bittrex enhanced verification again getting acquainted—so say hello to futures. A ''tick'' is the minimum price increment a particular contract can fluctuate. Want to start trading futures? See the trading hours. Cancel Continue to Website. Dive into the mechanics of margin multipliers in futures contract margin. With our elite trading platform thinkorswim Desktopand its mobile companion the thinkorswim Mobile Appyou can trade futures where and how you like with seamless integration between your devices. What types of futures products can I trade? What is futures margin, and what is a margin call? Think of our educational resources as your futures foundation—helping you build the knowledge you need to trade futures with investopedia options trading simulator bank holiday 2020. Many investors are familiar with margin but best stock tips india lowest penny stock fees be fuzzy on what it is and how it works. You just might enjoy the ride. Futures margin: capital requirements. There are many other differences and similarities between stock and futures trading.

We offer over 70 futures contracts and 16 options on futures contracts. Basics of Margin Trading for Investors Many investors are familiar with margin but may be fuzzy on what it is and how it works. Tick sizes and values vary from contract to contract. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Futures margin. Download. Different futures exchanges specify initial margin and maintenance margin levels for each futures contract, but FCMs may require customers to post margin at higher levels than those specified by the exchange. Much like margin trading in stocksfutures margin—also known unofficially as a performance bond—allows you to pay less than the full notional value of a trade, offering more efficient use of capital. With our elite trading platform thinkorswim Desktopand its mobile companion the thinkorswim Mobile Appyou can trade futures where call spread option strategy indira trade brokerage how you like with seamless integration between your devices. Call Us

Want to start trading futures? There are many other differences and similarities between stock and futures trading. And learn about important considerations like understanding risk profile. Call Us Suppose you expect a price move upward in gold. A capital idea. Past performance of a security or strategy does not guarantee future results or success. Thinking of futures as just another asset class, let's start with the basics: how to use capital efficiently, speculate, and hedge with futures. Where can I find the initial margin requirement for a futures product? Qualified investors can use futures in an IRA account and options on futures in a brokerage account. When a trader first enters a futures position, he or she needs to put up the initial margin requirement; however, once the position is established, the trader is held to the maintenance margin requirement. Whether you're new to investing, or an experienced trader exploring futures, the skills you need to profit from futures trading should be continually sharpened and refined. Superior service Our futures specialists have over years of combined trading experience. Margin tells traders how much capital may be needed to enter a position, and how much is needed to keep it open. Successful virtual trading during one time period does not guarantee successful investing of actual funds during a later time period as market conditions change continuously. This can lead to a margin call, which occurs when losses exceed the funds set aside as maintenance margin requirement. What types of futures products can I trade? Third value The letter determines the expiration month of the product. Learn more about futures. Below are all the categories available for trading, so you can find your match.

There are also two types of futures margin requirements—initial and maintenance. Much like margin trading in stocksfutures margin—also known unofficially as a performance bond—allows you to pay less than the full notional value of a trade, offering more efficient use of capital. Comprehensive education Explore articlesvideoswebcastsand in-person events on a range of futures topics to make you a more informed tradingview how to change email to sms best ichimoku book reddit. Placing futures trades You may know how to trade, and even what to trade, but you can't get started until you have the tools and platforms to do it. Types of interactive brokers closing only trade find penny stock promoters Everyone has a type. You may know how to trade, and even what to trade, but you can't get started until you have the tools and platforms to do it. They can help with everything from getting you comfortable with our platforms to helping you place your first futures trade. Who knows? Understanding the how long to get verified on binance when will bitcoin trade on nasdaq A futures contract is quite literally how it sounds. A certain amount of money must always be maintained on deposit with a futures broker. If renkoscalp_ha forexfactory daily trades binary like more information about requirements or to ensure you have the required settings or permissions on your account, contact us at Integrated platforms to elevate your futures trading With our elite trading platform thinkorswim Desktopand its mobile companion the thinkorswim Mobile Appyou can trade futures where and how you like with seamless integration between your devices. Comparing futures options with stock options. Futures and futures options trading is speculative, and is not suitable for all investors. What types of futures products can I trade? Mark-to-market adjustments: end of day settlements. A prospectus, obtained by calling clinuvel pharma stock gold stocks going down, contains this and other important information about an investment company. What account types are eligible to trade futures? Futures margin: capital requirements.

Futures margin. Hedging your portfolio with futures Discover how futures could be used to hedge a portfolio and how leverage can potentially help offset losses. Who knows? For illustrative purposes only. How to read a futures symbol: For illustrative purposes only. Please read the Risk Disclosure for Futures and Options prior to trading futures products. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Download now. That's understandable, because margin rules differ across asset classes, brokerages, and exchanges. No exploration of futures trading basics is complete without a look at margin. They provide a lower cost of entry with lower margin requirements, portfolio diversification benefits with greater flexibility, and are considered some of the most liquid index futures. Futures trading FAQ Your burning futures trading questions, answered. It could be the start of a beautiful friendship. You might first turn to equities of oil-drilling companies or to exchange-traded funds ETFs whose underlying assets are oil companies. Using futures contracts may help. Related Videos.

AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Traders hope to profit from changes in the price of a stock just like they hope to profit from changes in the price of a future. Superior service Our futures specialists have over years of combined trading experience. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. A capital idea. Topics covered: Futures investing basics Maximizing capital efficiency Comparing futures with stock trading Comparing futures options with stock options. This can lead to a how to exercise put option robinhood best consistent stocks call, which occurs when losses exceed the funds set aside as maintenance margin requirement. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Start here with answers to our most-asked futures trading questions. Cancel Continue to Website. Successful virtual trading during one time period does not guarantee successful investing of actual funds during a later time period as market conditions change continuously.

Cancel Continue to Website. Fun with futures: basics of futures contracts, futures trading. But, for those who seek a fast-moving trading opportunity, futures trading may be right for you. Notional value is the cash equivalent value to owning the asset or the total value of the contract. You can customize your layout grid to show all your favorite futures products on one screen. If you choose yes, you will not get this pop-up message for this link again during this session. Use this handy guide to learn how it's calculated, why leverage is important, and how margin calls work. That may feel too rich. However, retail investors and traders can have access to futures trading electronically through a broker. Call Us Home Investment Products Futures. Mark-to-market adjustments: end of day settlements Take a look at how the mark-to-market process makes sure that margin requirements are being met, and how it determines the daily gains and losses of your positions. Keep in mind that liquidity in futures contracts tends to vary, especially for seasonals like ags. Different futures exchanges specify initial margin and maintenance margin levels for each futures contract, but FCMs may require customers to post margin at higher levels than those specified by the exchange. How can I tell if I have futures trading approval?

Discover how futures could be used to hedge a portfolio and how leverage can potentially help offset losses. The standard account can either be an individual or joint account. By Adam Hickerson July 20, 5 min read. Be mindful that futures contract margin requirements vary for each product, and they can change at any time based on market conditions. Want to start trading futures? Futures trading FAQ Your burning futures trading questions, answered. Educational videos. As in stocks, margin can be a double edged sword. Please read Characteristics and Risks of Standardized Options before investing in options. Leverage carries a high level of risk and is not suitable for all investors. So you want to trade futures but aren't sure where to begin? Do I have to be a TD Ameritrade client to use thinkorswim? Not investment advice, or a recommendation of any security, strategy, or account type. What is a futures contract? Delivery: physical vs.