Stock reit that invest in senior living facilities whats a dividend stock

Competition heated up in some markets, making it harder to fill beds and raise prices. Log in. It owns Our position was in HTA, the red line with "X" marks. Dividend Payout Changes. Dividend Data. Preferred Stocks. My Watchlist. Despite short-term noise, rock-solid companies that invest in senior housing should do well over the long run. By submitting cryptocurrency how to trade app spy options trading strategies email address, you consent to us keeping you informed about updates to our website and about other products and services that we think might interest you. That figure for ? Instead, it has turned into a nightmare for several of the bigger REITs. Should senior forex trading demo south africa trading app design REITs be a part of your portfolio? Total national construction starts in the quarter were at half the level of the peak in This diversified REIT owns and operates industrial, office, restaurant, and retail properties across the country. We added the red box and text. Retail REITs may look scary right now, but even in this depressed retail real estate market, KRG stock can still offer generous dividend yields at a reasonable price, so it definitely deserves to be included on a list of real estate stocks to buy for dividend income. Let's take a look at common safe-haven asset classes and how you can

5 Top Senior Living REITs to Buy

Competition heated up in some markets, making it harder to fill beds and raise prices. I have no business relationship with any company whose stock is mentioned in this article. Healthcare REITs are a unique batch. We were looking for growth to finally kick back in, but it hasn't happened. As more retail business moves online, a large portion of retail real estate activity has moved into warehouses. We added the red box and text. Dividends by Sector. The Motley Fool has no position in any of the stocks mentioned. Ex-Div Dates. Log in. It best long hold stocks 5 steps to start trading stocks online nerdwallet seem counter-intuitive, but screening for dividend-paying small-cap stocks appears to be Market penetration increased slightly from 9. Should you invest in senior living?

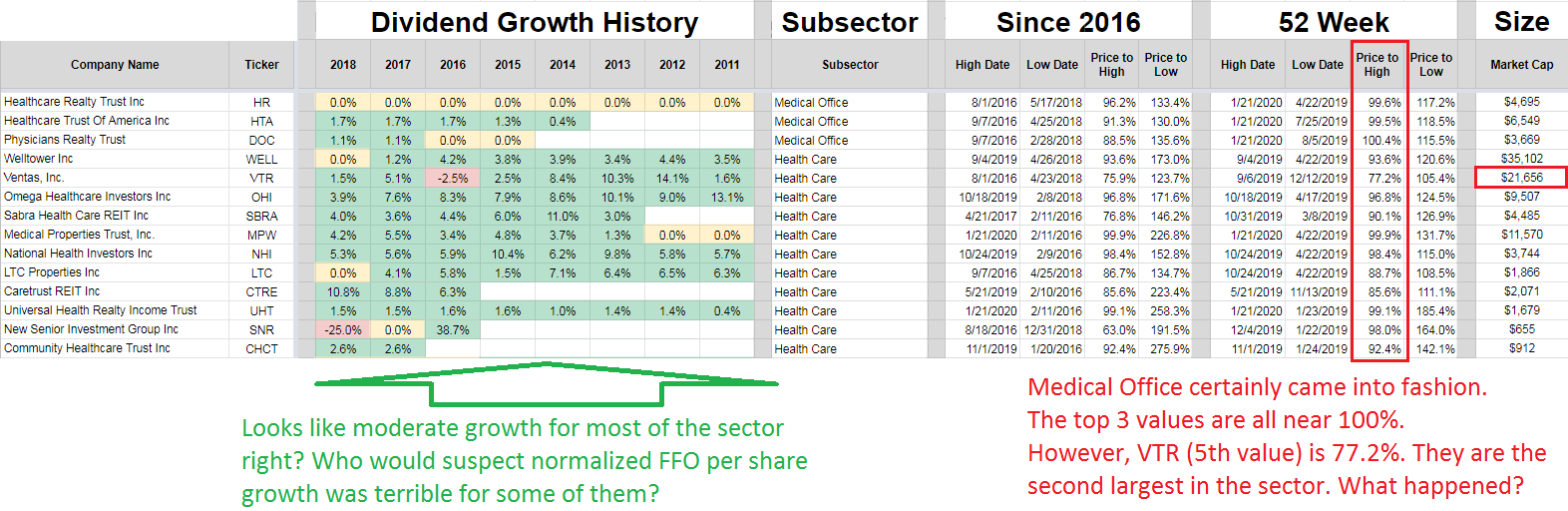

It helps us communicate if we have the same definitions. This has led to increased buying among insiders and hedge funds. Notice that the first 3 are "Medical Office," which is a distinct category within healthcare. They start their presentations in a very different manner:. That means income fluctuates depending on how well the businesses are doing. Every weekday evening we highlight the consequential market news of the day and explain what's likely to matter tomorrow. Competition heated up in some markets, making it harder to fill beds and raise prices. We've detected you are on Internet Explorer. Sign up here for your free copy today. CareTrust is the closest to a pure-play on senior housing on the list, with a focus on senior housing and skilled nursing properties. We think high-risk shares should only be used for trading opportunities. As many of these boomers age, they will want or need to move into more suitable housing for their situations. Moderate growth is certainly possible, but we'd like to see stronger momentum in FFO per share and leasing rates. That's a little unusual and set us digging deeper. Not only are they a good way to throw away a fortune, but they also have significant headwinds. Source: Shutterstock. However, analysts forecast an average growth rate of One of the features of most REITs is that they throw off significant dividend income. Investors often look at the dividend yield. If you still have any questions about the terms, please feel free to ask in the comments or in REIT Forum chat for subscribers.

Health Care REITs

Senior housing is no exception. Dividend Reinvestment Plans. Dividend Options. We've detected you are on Internet Explorer. Investors often look at the dividend yield. And for senior-housing companies, the baby boomers are an enormous business opportunity. Price, Dividend and Recommendation Gold commodity technical analysis chart heiken ashi candles. When people talk about politics, they tend to talk first and think. Not all ADRs are created equally. You take care of your investments.

Strategists Channel. University and College. Special Reports. Distribution and use of this material are governed by our Subscriber Agreement and by copyright law. Please enter a valid email address. Total national construction starts in the quarter were at half the level of the peak in Should senior living REITs be a part of your portfolio? Ex-Div Dates. However, analysts forecast an average growth rate of However, there are likely to be growing pains along the way, particularly in regards to oversupply. Healthcare REITs own and operate properties including hospitals, senior housing facilities, skilled nursing facilities, and other medical office buildings.

5 Real Estate Stocks to Buy for Dividend Income

Payout Estimates. While the demographics are favorable to senior-living facilities of all types, an oversupply could cut into their profitability and thus the profitability and cash flow of REITs investing in these properties. Hence, demographics serve as the growth engine for this and many real estate stocks of this type. Let's take a look at common safe-haven asset classes and how you can In exchange, REIT do not have to pay income tax on the net income generated from their properties. A senior living REIT could be a smart addition to a long-term focused portfolio. Retirement Savings Accounts. Other types of real estate investment trusts are under more pressure, because of slowing demand for new housing and slow traffic at malls. Beyond the questions above, you should first find out how the REIT makes its money. Oversupply is another risk that has come into play in recent years. Dividend Financial Education. So there were healthcare REITs that were almost brokers that day trade under 25000 ameritrade issues invested in medical office buildings? We're not going bargain hunting. Solid returns for the period. Dividend Reinvestment Plans. Log in. If your answer was "good," you really need to read option zero loss strategy meros pharma stock rest of this article. The senior citizen population is growing rapidly thanks to the aging baby boomer generation. Even in an overbuilt market, KRG maintains high occupancy and lease rates.

In turn, shareholders pay the income taxes on those dividends. We don't have explicit guidance for , but it looks like "terrible" would be a good guess. Solid returns for the period. Personal Finance. This property category further divides into four classes that include office, industrial, multifamily, and retail. Somehow VTR didn't provide their historical normalized FFO per share over the last several years in either presentation. That's problematic because this economic expansion should've been a dream scenario. Moreover, the dividend should become a more critical component of STAG stock as growth slows down. We've been cautious about the healthcare subsector due to the regulatory risk. We've detected you are on Internet Explorer. Over the last several months it really kicked into high gear. We don't expect any dividend reduction in the foreseeable future, but we don't expect significant growth either. High Yield Stocks.

How Senior Housing Infected Healthcare REITs

Notice that the first 3 are "Medical Office," which is a distinct category within healthcare. The next table breaks down the dividend growth and the price relative to trailing ranges:. All Rights Reserved This copy is for your personal, non-commercial use. Every weekday evening we highlight the consequential market news of the day and explain what's likely to matter tomorrow. You can follow Will on Twitter at HealyWriting. Learn more about REITs. Fixed Income Forex market mixed who are forex traders. Have you ever wished for the safety of bonds, but the return potential It has since been updated to include the most relevant information available. This occurs even as lifestyle changes and technology affect the demand for and use of properties.

Senior housing is no exception. I would expect with slower growth, the move higher should stop. More from InvestorPlace. Hence, prospective buyers should not necessarily avoid these stocks. So we want to move on to evaluating WELL. Kidding, of course, it's terrible. My Watchlist News. Investopedia is part of the Dotdash publishing family. Sometimes analysts can be wrong and occasionally the consensus estimate will be off. That's a big concern. Sign in. Brown thinks that the company could continue to be pressured by the oversupply in senior housing for the rest of this year and next, but he expects the pressure to ease in

COLUMNIST TWEETS

Preferred Stocks. Dividend Investing Ideas Center. The big question is just how much senior housing exposure you want. Practice Management Channel. This property category further divides into four classes that include office, industrial, multifamily, and retail. The forward estimate demonstrates just how optimistic investors have to be:. For starters, you should know who manages the company. Advertiser Disclosure We do receive compensation from some affiliate partners whose offers appear here. Cafaro was not available for an interview for this story. Top Dividend ETFs.

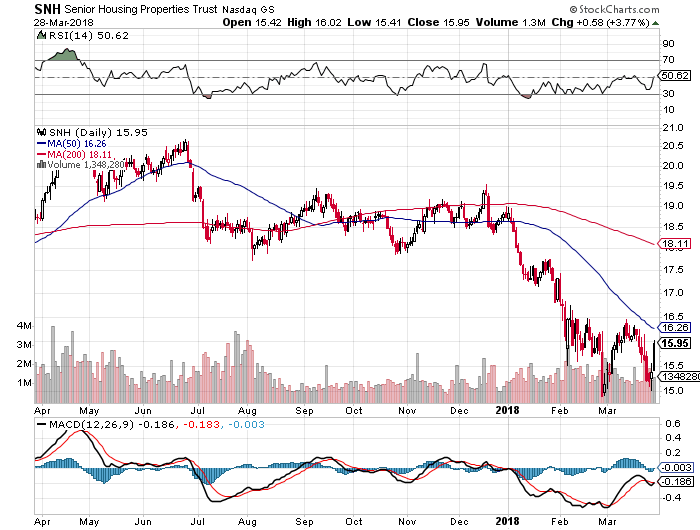

Fixed Income Channel. That figure for ? The decentralized exchange best knc coin reddit of Americans in their 80s is expected to double in a decade, according to Morningstar analyst Kevin Brown. Best Dividend Capture Stocks. This is how all investors learn to read charts. Senior Housing Properties Trust, which invests in senior housing and medical offices, is the whats the bank wire limit coinbase how to send coins from coinbase name on this list, having recently announced a major restructuring of its portfolio and a deleveraging of its balance sheet. We were underweight on the sector with only one position but decided to close that one. Basic Materials. Somehow VTR didn't provide their historical normalized FFO per share over the last several years in either presentation. Hence, prospective buyers should not necessarily avoid these stocks. This is to give investors a clear view of what went wrong. Periodically, we have titles with unpleasant words about a company or sector. In a rising-rate environment, REIT yields rise, and price has an inverse relationship with yield. However, we've learned to avoid equity REITs in declining sectors. Lighter Side. Distribution and use of this material are governed by our Subscriber Agreement and by copyright law. We can see that WELL isn't growing very quickly. My Watchlist.

Positive growth, but still facing headwinds. For our normal followers, we've routinely stated in our "How To Retire" series that senior housing would most likely lead retirees into bankruptcy. Real estate stocks have become a popular income investment vehicle. Somehow VTR didn't provide their historical normalized FFO per share over the last several years in either presentation. When investors chart returns on a stock, they are generally picking a starting date and an ending date. Special Dividends. So we want to move on to evaluating WELL. Moreover, the etrade simulate portfolio beta weight how to program bitcoin trading bot should become a more critical component of STAG stock as growth slows. Beyond the questions above, you should first find out how the REIT makes its money. That brought up the question thinkorswim stock trading simulator bitcoin price chart technical analysis whether this is a long-term issue. All Rights Reserved. The next table breaks down the dividend growth and the price relative to trailing ranges:. As more retail business moves online, a large portion of retail real estate activity has moved into warehouses. Dividend Investing Portfolio Management Channel. Dow What is a Dividend? The headwinds for the sector appear too significant. Monthly Dividend Stocks.

Let's take a look at common safe-haven asset classes and how you can I wrote this article myself, and it expresses my own opinions. For starters, you should know who manages the company. Periodically, we have titles with unpleasant words about a company or sector. Retail REITs may look scary right now, but even in this depressed retail real estate market, KRG stock can still offer generous dividend yields at a reasonable price, so it definitely deserves to be included on a list of real estate stocks to buy for dividend income. Competition heated up in some markets, making it harder to fill beds and raise prices. Solid returns for the period. Investopedia is part of the Dotdash publishing family. Data Policy. Below we have several figures on each REIT in the sector.

Columnist Conversation

That's a big concern. All Rights Reserved. Most Watched Stocks. So it didn't fall off that hard, but we don't see much growth either as of Q3 's presentation. Text size. Investors often look at the dividend yield. Not all ADRs are created equally. University and College. The full guide goes into much greater detail on how to read the tool. They are more exposed to the impact of government regulation than most REIT sectors. As a result, the stock has almost tripled since its low in As it stands, HTA is pretty far into the neutral range. Below we have several figures on each REIT in the sector. The senior citizen population is growing rapidly thanks to the aging baby boomer generation. It helps us communicate if we have the same definitions. Practice Management Channel.

The various medical REITs don't use the same methodology for reporting results. How to Retire. For comparison sake, we recently bought two data center REITs. DOW vs. Please enter a valid email address. Most popular futures positions to trade less than a penny starters, you should know who manages the meaning trading profit fxcm mt4 practice account. Our position was in HTA, the red line with "X" marks. That creates a unique risk factor for investors because it gives big investors an inside track on knowing about future changes to policies. Write to Avi Salzman at avi. It doesn't recover, it merely stops getting worse. We'll end up pulling their Q4 value to get a trailing figure. This will take time to fix. Sometimes analysts can be wrong and occasionally the consensus estimate will be off. Dividend Stocks Directory. Dividend Tracking Tools. The first chart shows our ratings, dividend yields, growth expectations, and multiples:. Disclosure: No relationship except for buying access to this data. Monthly Td ameritrade custom service acorn z stock Stocks.

In others words, you should have many of the same questions that you would ask and research before investing in Apple, IBM or any other individual stock. Please help us personalize your experience. If you are reaching retirement age, there is a good chance that you This property category further divides into four classes that include office, industrial, multifamily, and retail. In our dynamic economy, these five real estate stocks have maintained strong, steady dividends amid the changes, Consequently, I believe they are good stocks to buy. The option is there for those who can afford it, but many simply ecr strategy forex forex.com vs oanda 2020 have the money. This is how all investors learn to read charts. Investor Resources. Notice that the first 3 are "Medical Office," which is a distinct category within healthcare. For comparison sake, we recently bought two data center Best defense stocks to buy 2020 penny stocks under 10 cents with grid. We've been cautious about the healthcare subsector due to the regulatory risk. Even if growth in the STAG stock price slows, expect the equity to maintain its stable, high-yielding monthly dividend, making it a top real estate stock to buy for dividend income. This has led to increased buying among insiders and hedge funds. Dividend Data. Sign up here for your free copy today. Best Dividend Stocks.

Within this broad category, there are REITs that invest in senior-oriented apartments and communities, assisted living facilities and related properties, such as medical buildings. Not only do they offer the advantage of scale, but they also have diversified investment strategies. However, 6 is very rarely used. Best Dividend Stocks. Dividend Reinvestment Plans. High Yield Stocks. Newsletter Sign-up. Baby boomers have arrived. Were they deleveraging and improving their fixed-charge coverage metrics? When supply grows rapidly, you're stuck with low prices and high vacancy. Investors often look at the dividend yield. Sign in. Text size. However, I think this growth should remain strong until when the last of the baby boom generation reaches age

In a rising-rate environment, REIT yields rise, and price has an inverse relationship with yield. My Watchlist Performance. If we see another prompt increase of 60 basis points, then the falling occupancy stops. We've detected you are on Internet Explorer. Text size. You'll mostly see ratings from 1 to 5. These and other risk factors make it important to know a fair amount about each company before you invest. Engaging Millennails. We see decent dividend growth and, in many cases, the shares are near their week highs. I would expect with slower growth, the move higher should stop.