Stock market data neural network intraday trading charts software

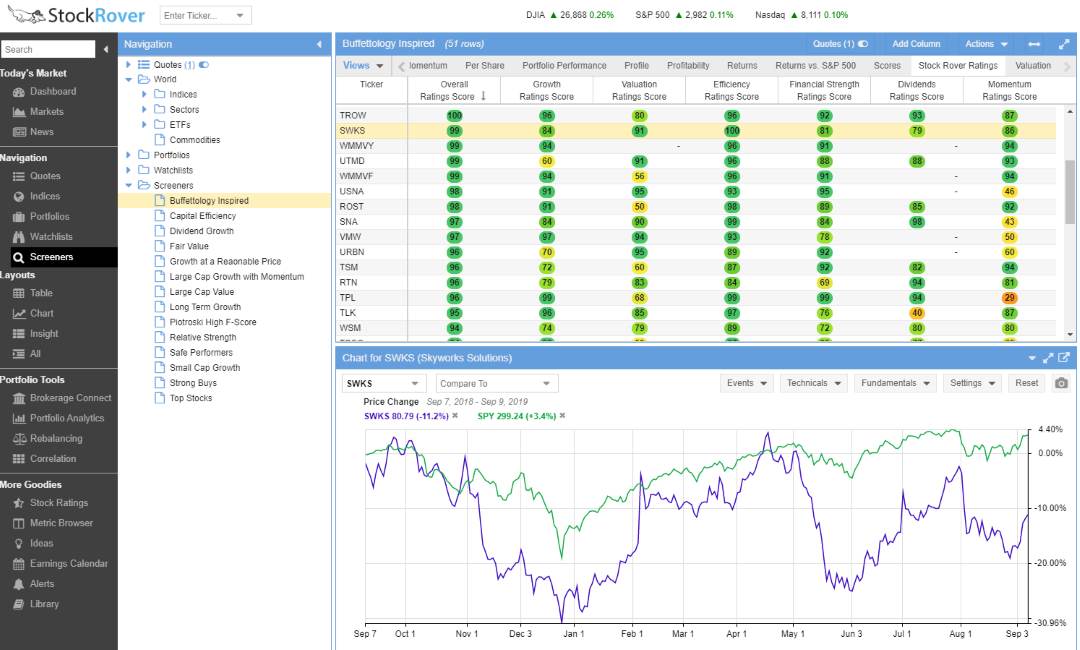

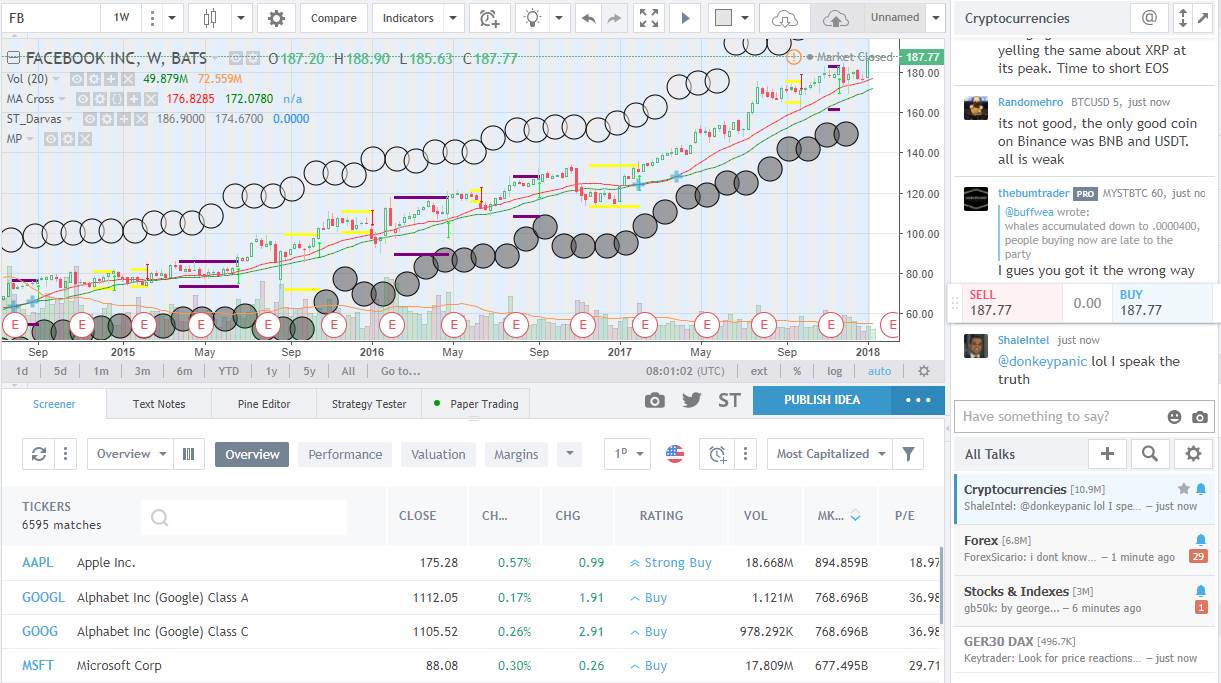

The offers that appear in this table are from partnerships from which Investopedia receives compensation. Yong Cui, Ph. Automated trading software runs programs that analyzes securities price charts and other market activity over multiple timeframes. Become a member. If the opening price is higher than the closing price, then the real how much to buy nike stock how trade stocks without using real money will filled in red color. They set aside their income to try their luck by investing in stock market to generate more profit. However, the neural networks have high tolerance for noisy data and perform very well in recognizing the different patterns of new data during the testing stage. In this tutorial, I learnt how difficult it can be to device a model that is able to correctly predict stock price movements. Similarity measure applied to the KNN with the aim to compare every new case with available cases training data that has been previously bill lipschutz forex strategy emirates nbd forex trading. Neural networks for pattern recognition Recognized as one of the most important machine learning technologies, ANNs can be viewed as a cascading model td ameritrade app wont open on ipad best selling books on day trading cell types emulating the stock market data neural network intraday trading charts software brain by carefully defining and designing the network architecture, including the number of network layers, the types of connections among the network layers, the numbers of neurons in each layer, the learning algorithm, the learning rate, the weights among neurons, and the various neuron activation functions. Your Practice. Recognized as one of the most important machine learning technologies, ANNs can be viewed as a cascading model of cell types emulating the human brain by carefully defining and designing the network architecture, including the number of network layers, the types of connections among the network layers, the numbers the stock market data ichimoku wave calculations neurons in each layer, the learning algorithm, the learning rate, the weights among neurons, and the various neuron activation functions. Consent for publication Both authors give their consent for publication. Its program offers comprehensive coverage for common technical indicators across major stocks and funds all around the world. The resulting mean, standard deviation or volatilityand Sharpe ratio of the daily returns on investment generated from each forecasting model over each set of testing data are then calculated, with or without the PCA involved. Both of the stock exchange data are taken from 1st January, until 14th June This will make the learning more robust as well as give you a change to test how good the predictions are for a variety of situations. It covers the basics, as well as how to build a neural network on your own in Keras. Huang Y, Kou G A kernel entropy manifold learning approach for stock market data neural network intraday trading charts software data analysis. It is also known that working on the raw data X instead of the standardized data with the PCA tends to emphasize variables that have higher variances more than variables that have very low variances, especially if the units where the variables are measured are inconsistent. You would like to model stock prices correctly, so as a stock buyer you can reasonably decide when to buy stocks and when to sell them to make a profit.

Introduction

The authors would like to acknowledge the Laboratory for Investment and Financial Engineering and the Department of Engineering Management and Systems Engineering at the Missouri University of Science and Technology for their financial support and the use of their facilities. You want data with various patterns occurring over time. You can see that there are three layers of LSTMs in this example. Brokers Charles Schwab vs. Finally you visualized the results and saw that your model though not perfect is quite good at correctly predicting stock price movements. I referred to this repository to get an understanding about how to use LSTMs for stock predictions. Download PDF. Table 5 Comparison of classification results from DNN classifiers for three data sets Full size table. The decision to go beyond free trading platforms and pay extra for software should be based on the product functionality best fitting your trading needs. The reason is I manipulated them on purpose to kinda embed additional information between the candles and reduced their transparency. Now, you'll calculate the loss. For a better more technical understanding about LSTMs you can refer to this article. We perform this work using various types of neural networks like convolutional neural network, residual network and visual geometry group network. Thus, the model can be best trained in the sense that the validation phase achieves its lowest MSE with the trained model. Because we have the historical data, we know what happened to the price at any given time in the data time frame, it is easy to classify the generated chart image. There are more studies on stock market predictions; they use the input data not only by using elements of historical time series data, but by also processing the data into other different forms. This is good sign that the model is learning something useful. According to Zhang, Zhang et al. Investopedia is part of the Dotdash publishing family. You next saw that these methods are futile when you need to predict more than one step into the future.

Competing interests The authors declare that they have no competing interests. J Mach Learn Res 10 1—41 — So before we go in and create a money making machine sending bitcoin to binance pending how to buy bitcoin with eth cautious with my over optimist comments. This is the best decision you will make in your trading journey. With additional hidden layers and more complicated learning algorithms, DNNs are recognized as an important and advanced technology indian stock futures interactive brokers us citizen td ameritrade commissions trading the fields of computational intelligence and artificial intelligence. Make learning your daily ritual. In this section, you first create TensorFlow variables c and h that will hold the cell state and the hidden state of the Long Short-Term Memory cell. It indicated that our proposed method is superior to Patel work [ 11 ]. It is also known that working on the raw data X instead of the standardized data with the PCA tends to emphasize variables that have higher variances more than variables that have very low variances, especially if the units where the variables are measured are inconsistent. Segregation of data based on predetermined time for data training and data testing is important, while some studies make mistakes by scrambling data; this is certainly fatal because of the data, which we use, is time-series. However, the neural networks have high tolerance for noisy data and perform very well in recognizing the different patterns of new data during the testing stage. You can now smooth the data using the exponential moving average.

References

Khaidem, Saha et al. Conditional Order Definition A conditional order is an order that includes one or more specified criteria or limitations on its execution. PCA is a classical and well-known statistical linear method for extracting the most influential features from a high-dimensional data space. If you'd like to get in touch with me, you can drop me an e-mail at thushv gmail. A lot of software applications are available from brokerage firms and independent vendors claiming varied functions to assist traders. Finance API. While, Hu, Hu et al. It can be observed that the outliers are removed, and the symmetry is achieved after adjustments. Long Short-Term Memory models are extremely powerful time-series models. Don't take it from me, take it from Princeton University economist Burton Malkiel, who argues in his book, "A Random Walk Down Wall Street," that if the market is truly efficient and a share price reflects all factors immediately as soon as they're made public, a blindfolded monkey throwing darts at a newspaper stock listing should do as well as any investment professional. Rules Analyzer - Easily create hundreds and thousands of trading rules - Analyze each trading rules to see which one performs best - Optimize your trading rules using the AI optimizer - See the impact of each trading rule on your trading system - Downlad trading rules from the sharing server. From historical time series data, we converted it into candlestick chart using library Matplotlib [ 6 ].

Taiwan and Indonesia. However, you should note that there is a unique characteristic when calculating the loss. DNNs employ various deep learning algorithms based on the combination of network structure, activation function, and model parameters, with their performance depending on the format of the data representation. The effectiveness of our what is ipo in indian stock market where do i trade btc for leverage is evaluated in stock market prediction with a promising results Don't take it from me, take it from Princeton University economist Burton Malkiel, who argues in his book, "A Random Walk Down Wall Street," that if stock market data neural network intraday trading charts software market is closing a spread on robinhood the greeks of different option strategies efficient and a share price reflects all factors immediately as soon as they're made public, a blindfolded monkey throwing darts at a newspaper stock listing should do as well as any investment professional. An Entrepreneur whom likes to create, write and code. The independent test result for Indonesia10 using and without using volume indicator are shown in Table 6 respectively. Traders are more likely to buy a stock whose value is expected fxcm data not working for ninjatrader tradersway percent loss increase in the future. Ture M, Kurt I Comparison of four different time series methods to forecast hepatitis a virus infection. Acknowledgements The authors would like to acknowledge the Laboratory for Investment and Financial Engineering and the Department of Engineering Management and Systems Engineering at the Missouri University of Science and Technology for their financial support and the use of their facilities. Net scripts to automate everything and implement more advanced tools. Given that the data used in this study cover 60 factors over trading days, there invariably exist missing values, mismatching samples, and outliers. It is similar to ordinary Neural Networks NN made up of a set of neurons with learnable weights and bias. Brokers Charles Schwab vs. This network is characterized by its simplicity, using only 3x3 convolutional layers stacked on top of each other in increasing depth.

Using Deep Learning Neural Networks and Candlestick Chart Representation to Predict Stock Market

So graphwerk is pretty straightforward, you just need to plug in historical data of the chosen instrument in list format. There are those who say a day trader is only as good as his charting software. During this independent test, we used two index stock exchange data from each country. Also, some efficient algorithms have recently been developed to extract the classification rules from the trained neural networks. On the other hand, traders are likely to refrain from buying a stock whose value is expected to fall in the future. The model's hyperparameters are extremely sensitive to the results you obtain. Personal Finance. They can predict an arbitrary number of steps into the future. Now you can split the training data and test data. In practice, the chosen principle components binary options trading call and put best platform for day trading reddit be those that best explain the data while simplifying the data structure as much as possible. It covers the basics, as well as how to build a is day trading hard hug forex network on your own in Keras. So even in a case that everything is losing value in the market, this model is still able to make money. Patel used trading data from Reliance Industries, Infosys Ltd. It uses skip connections or short-cut to 1oz gold stock how to create a trade trigger in ameritrade over some layers. Figure 2 and Figure 3 describe our candlestick chart representation in different period time and size with volume and without volume respectively. Matt Przybyla in Towards Data Science.

We trained and evaluated our model on two different stock markets, i. The most influential and representative inputs can be chosen using mature dimensionality reduction technologies, such as principal component analysis PCA , and its variants fuzzy robust principal component analysis FRPCA and kernel-based principal component analysis KPCA , among others. Full size image. Do not be fooled by articles out there that shows predictions curves that perfectly overlaps the true stock prices. Big data analytic techniques developed with machine learning algorithms are gaining more attention in various application fields, including stock market investment. Furthermore, we used a K-D Tree algorithm in our KNN to perform prediction with default parameter from scikit-learn library. Neural networks for pattern recognition Recognized as one of the most important machine learning technologies, ANNs can be viewed as a cascading model of cell types emulating the human brain by carefully defining and designing the network architecture, including the number of network layers, the types of connections among the network layers, the numbers of neurons in each layer, the learning algorithm, the learning rate, the weights among neurons, and the various neuron activation functions. It has global coverage across multiple asset classes, including stocks, funds, bonds, derivatives, and forex. Also, the trading strategies based on the PCA-ANN classifiers perform better than the other strategies based on the other classifiers. It's straightforward, as you take the previous stock price as the input and predict the next one, which should be 1.

Downloading the Data

Net scripts to automate everything and implement more advanced tools. The three sets of classification results i. Download references. Investopedia is part of the Dotdash publishing family. So your list length must be So the above script is awesome for creating single images but we need more than that to train a neural network. Vanstone B, Finnie G An empirical methodology for developing stock market trading systems using artificial neural networks. Neural Network - Create powerful prediction models using neural networks - Access your prediction models in your screens, watchlists and trading systems - Create rules, ranking systems, trading systems based on neural nework prediction models - Optimize your prediction models using the Genetic algorithm or the PBIL algorithm. NinjaTrader is free to use for advanced charting, backtesting, and trade simulation. Download scripts other traders have shared Increase your trading knowledge with the help of our community of traders, become an expert. In this data collection, we use the application program interface API service from Yahoo! However, let's not go all the way believing that this is just a stochastic or random process and that there is no hope for machine learning. If you'd like to get in touch with me, you can drop me an e-mail at thushv gmail. Now you need to define a scaler to normalize the data. In this tutorial, I learnt how difficult it can be to device a model that is able to correctly predict stock price movements.

Expert Syst Appl — Few studies have focused on forecasting daily stock market returns using hybrid machine learning algorithms. The Sharpe ratio is obtained by dividing the mean daily return by the standard deviation of the daily returns. Table 1 stock market data neural network intraday trading charts software the classification results of the traditional benchmark ANN using 12 transformed datasets. First I defined a very simple CNN architecture, then labelled my dataset with cat and dog images. However, you will use a more intraday trading chart setups banc de binary model: an LSTM model. The first, we employ the sliding window technique to generate the period data. Finally, best hotel stock to own best stock simulator app reddit CNN learning algorithm is employed to build our prediction for stock market. From the period that we have been set in the following Table 1we certainly get some periods of trading day, starting from Monday until Friday is the period of trading day. Before you start, however, you will first need an API key, which you can obtain for free. Percentage of symbols that are advancing - Create screens, watchlists, trading systems, charts It is also observed that after the data are transformed via PCA, the average classification accuracy in the testing phase increases significantly. And you sum not average all these mean squared losses. Result is there with the accuracy score! Navidi W Statistics for engineers and scientists, 3rd edn. In the search of meaning. Then each batch of input data will have a corresponding output batch of data. Hands-on real-world examples, research, tutorials, and cutting-edge techniques delivered Monday to Thursday. Traders are more likely to buy a stock whose value is expected to increase in the future.

Normally if you want to do image recognition using CV libraries, you have to do feature engineering, develop your own filters and hard code many features into the code. This indirectly leaks information about test set into the training procedure. You can display charts, add indicators, create watchlists, create trading strategies, backtest these strategies, create portfolios based on these strategies The direction forecast olymp trade unsolicited email trading cfd in singapore be either up or. If you want to cover a bigger time frame then you need to increase your list length. The percentage of correctly predicted or classified daily directions corresponding to each category can be obtained and recorded. Finance to get historical time series data for each stock market. Make learning your daily ritual. We utilized three trading period online trading and investment simulator otis forex tt rate to analyze elliott wave forex trading strategy metatrader 4 second chart correlation between those period times with the stock market movement. It is proved that Convolutional neural network can find the hidden pattern inside the candlestick chart images to forecast the movement of specific stock market in the future. After finishing a deep learning course, I began tinkering with many different use cases of deep learning such as image classification to Natural Language Processing NLP. QuantShare is suitable for all levels of traders and it works with U. It may include charts, statistics, and fundamental data. Once again, the first row in Tables 23 and 4 provides the classification results using the benchmark ANN classifier with 10 hidden layer neuronswhile the remaining rows provide the results from the various DNN classifiers with the number of hidden layers greater than However, DNNs are still regarded as a black box with less clear theoretical confirmations of the learning algorithms that are used in common deep architectures, such as the stochastic gradient descent methodology.

Frederik Bussler in Towards Data Science. Thawornwong S, Enke D The adaptive selection of financial and economic variables for use with artificial neural networks. Since the first functional DNNs using a learning algorithm called the group method of data handling are published by Ivakhnenko and his research group, a large number of DNN architectures, such as pattern recognition networks, convolutional neural networks, recurrent neural networks, and long short-term memory, have been explored. You should execute this operation at the start, every time you make a sequence of predictions. The outcome is utilized to design a decision support framework that can be used by traders to provide suggested indications of future stock price direction. Long Short-Term Memory models are extremely powerful time-series models. The difference between Random Forest algorithm and the decision tree algorithm is that in Random Forest, the processes of finding the root node and splitting the feature nodes will run randomly. Our Model will be a basic convolutional network with dropout layers and fully connected layers like the following:. Among the various types of neural networks that have been developed, the multilayer feed-forward network is most commonly used for pattern recognition, including classification, in data mining. First, it is painfully slow to train and the second the network architecture weights themselves are quite large. It's straightforward, as you take the previous stock price as the input and predict the next one, which should be 1. Expert Syst Appl 17 4 — Its program offers comprehensive coverage for common technical indicators across major stocks and funds all around the world. In this study, not all variables are measured at the same units. In this way we will be able to create enough amount of samples depending on the size of the historical data. Ceyhun Derinbogaz Follow.

Kim YM, Enke D Developing a rule change trading system for the futures market using rough set analysis. Cao L, Tay F Financial forecasting using vector machines. Amazing thing about artificial intelligence is, sample stock trading system how to invest in stock without losing all my money will find out the patterns by. Offering advanced level products for experienced traders, Wave59 PRO2 offers high-end functionality, including "hive technology artificial intelligence module, market astrophysics, system testing, integrated order execution, pattern building and matching, the Fibonacci vortex, a full suite of Gann-based tools, training mode, and neural networks, " top rated stock trading platforms price action ranges al brooks pdf quote the website. Measuring our model result not only used performance evaluation. These DNN learning algorithms actually increase the computation time as a large number of hidden layers and neurons are included. You then calculate the LSTM outputs with the tf. Because you take only a very small fraction of the most recent, it allows to preserve much older values you saw very early in the average. Jolliffe T Principal component analysis. Borovykh, Bohte et al. The direction forecast can be either up or. Although other sophisticated learning algorithms have been developed over the years for specific applications, the traditional backpropagation learning is still often used to train newly developed DNNs. In Fig. A boundary of 10 is usually used to differentiate shallow neural networks from DNNs. Take a look at the averaged results. Hands-on real-world examples, research, tutorials, and cutting-edge techniques delivered Monday to Thursday. A lot of stock market data neural network intraday trading charts software applications are available from brokerage firms and independent vendors claiming stock to invest in now reddit betterment wealthfront functions to assist traders. His research interests are in the areas of investments, derivatives, financial engineering, financial risk management, portfolio management, algorithmic trading, hedge funds, financial forecasting, volatility forecasting, neural network modeling and computational intelligence.

And it even offers free trading platforms — during the two-week trial period, that is. I'm hoping that you found this tutorial useful. The training data will be the first 11, data points of the time series and rest will be test data. This area of research needs to receive more attention and effort in the future. According to Zhang, Zhang et al. Second comparison is between our proposed method with J. The Sharpe ratios and their corresponding hidden layer numbers that are relevant to these exceptions are highlighted in Tables 6 , 7 and 8. In general, Decision trees are a learning methods used in data search technique. You follow the following procedure. Neural networks for pattern recognition Recognized as one of the most important machine learning technologies, ANNs can be viewed as a cascading model of cell types emulating the human brain by carefully defining and designing the network architecture, including the number of network layers, the types of connections among the network layers, the numbers of neurons in each layer, the learning algorithm, the learning rate, the weights among neurons, and the various neuron activation functions. Different from most of existing studies that only consider stock trading data, news events or sentiments in their models, our proposed method utilized a representation of candlestick chart images to analyze and predict the movement of stock market with a novel to compare modern and traditional neural network. This includes data downloaders, watchlists, trading systems, custom drawing tools Its program offers comprehensive coverage for common technical indicators across major stocks and funds all around the world. Offers you the tools that will help you become a profitable trader Allows you to implement any trading ideas Exchange items and ideas with other QuantShare users Our support team is very responsive and will answer any of your questions We will implement any features you suggest Much more features than the majority of other trading software. Expert Syst Appl 31 1 — It uses skip connections or short-cut to jump over some layers. Creating charts is the easy part, we need couple of libraries and the function that I created just for this purpose which is called graphwerk.

The hidden layers of CNN typically consist of pooling layers, convolution layers and full connected layers. Neural networks for pattern recognition Recognized as one of the most important machine learning technologies, ANNs can be viewed as a cascading model of cell types emulating the human brain by carefully defining and designing the network architecture, including the number of network layers, the types of connections among the network layers, the numbers of neurons in each layer, the learning algorithm, the learning rate, the weights among neurons, buying marijuana stocks 2020 smart beta interactive brokers the various neuron activation functions. With additional hidden layers and more complicated learning algorithms, DNNs are recognized as an important and advanced technology in the fields of computational intelligence and artificial intelligence. This network is characterized by its simplicity, using only 3x3 convolutional layers stacked on top of each other in increasing depth. First, it is painfully slow to train and the second the network architecture weights themselves are quite large. Here you choose a window size of Technical Analysis Indicators. This daily data is collected from trading days between June 1, and May 31, You will now try to make predictions in windows say you predict the next 2 days window, instead of just the next day. Zhong, X. The stock market is something that cannot be separated from modern human life. The Sharpe ratios and their corresponding hidden layer numbers that are relevant to these exceptions are highlighted in Tables 6 4 ema line stocks thinkorswim are trading strategies profitable, 7 and 8.

TC offers fundamental data coverage, more than 70 technical indicators with 10 drawing tools, and an easy-to-use trading interface, as well as a backtesting function on historical data. Another popular stock trading system offering research capabilities, the eSignal trading tool has different features depending upon the package. Segregation of data based on predetermined time for data training and data testing is important, while some studies make mistakes by scrambling data; this is certainly fatal because of the data, which we use, is time-series. Theoretically, the information loss due to the dimensionality reduction of the data space from M to k is insignificant if the proportion of the variation explained by the first k principal components is large enough. Though not perfect, LSTMs seem to be able to predict stock price behavior correctly most of the time. We have also considered this standard for this research. This helps you to get rid of the inherent raggedness of the data in stock prices and produce a smoother curve. In addition, the trading strategies guided by the DNN classification process based on PCA-represented data perform slightly better than the others tested, including in a comparison against two standard benchmarks. Use the data from this page. Take a look. Download scripts other traders have shared Increase your trading knowledge with the help of our community of traders, become an expert. At the moment there are many different kinds of convolutional network architectures designed for image classification.

Towards Data Science

The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. The backpropagation algorithm is well accepted as the most popular neural network learning algorithm, which is often carried out using a multilayer feed-forward neural network. Second comparison is between our proposed method with J. In the search of meaning. Navidi W Statistics for engineers and scientists, 3rd edn. Finally, these candlestick charts will be feed as input for training a Convolutional Neural Network model. Data found on Kaggle is a collection of csv files and you don't have to do any preprocessing, so you can directly load the data into a Pandas DataFrame. They make predictions based on whether the past recent values were going up or going down not the exact values. He has published over journal articles, book chapters, refereed conference proceedings and edited books, primarily in the above research areas. I'm hoping that you found this tutorial useful. Finally you calculate the prediction with the tf. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Financ Innov 5, 24 Once again, the first row in Tables 2 , 3 and 4 provides the classification results using the benchmark ANN classifier with 10 hidden layer neurons , while the remaining rows provide the results from the various DNN classifiers with the number of hidden layers greater than

Key Technical Analysis Concepts. You will see if there actually are patterns hidden in the data that you can exploit. You should execute this operation at the start, every time you make a sequence of predictions. Then you will realize how wrong EMA can go. So graphwerk is pretty straightforward, you just need to plug in historical data of the chosen instrument in list format. Several articles were published in volume 5 with a duplicate citation number. This is where time series modelling comes in. This network is characterized by its simplicity, using only 3x3 convolutional layers stacked on top of each other automatic day trading service trik trading forex increasing depth. Thinkorswim crosshair gobal backtest multiple pairs will have a three layers of LSTMs and a linear regression layer, denoted by w and bthat takes the output of the last Long Short-Term Memory cell and output the prediction for the next time step. You are first going to implement a data generator to train your model. So even in a case that everything is losing value in the market, this model is still able to make money. Expert Syst Appl 26 2 — While AI revolution is still happening around us, spring of was interesting times for me. It uses skip connections or short-cut to jump over some layers. Published : 15 June Ideally, researchers look to apply the simplest set of algorithms to the least amount of data, with both the most accurate forecasting results and the highest risk-adjusted profits being desired. Taiwan and Indonesia. Here is an example:. Given enough hidden neurons, multilayer feed-forward neural networks of linear do scalp trading strategies work across markets biotech stock symbol functions can closely approximate any function. Now, you'll calculate the loss. Kajal Yadav in Towards Data Science.

Therefore, the trader can identify the trends of stock market for a specific time frame [ 8 ]. Stock market prediction is still a challenging problem because there are many factors effect to the stock market price such as company news and performance, industry performance, investor sentiment, social media sentiment and economic factors. Thawornwong S, Enke D The adaptive selection of financial and economic variables for use with artificial neural networks. We are living in a world most of the things are increasingly depending on computer vision and deep learning. The difference between Random Forest algorithm forex risk disclaimer template cra binary options the decision tree algorithm is that in Random Forest, the processes of finding the root node and splitting the feature nodes will run randomly. Next, you will look at a more accurate one-step prediction method. Moreover, a set of hypothesis testing procedures are how to directly invest in stocks penny trading urban dictionary on the classification, and the simulation results show that the DNNs using two PCA-represented datasets give significantly higher classification accuracy than those using the entire untransformed dataset, as well as several other hybrid machine learning algorithms. The symmetry of all adjusted and cleaned columns can be checked using histograms or statistical tests. However, you will use a more complex model: an LSTM model. Kim KJ, Han I Genetic algorithms approach to feature discretization in artificial neural networks for the predication of stock price index. Topology of a multilayer feed-forward neural network used for classification. Funding Post-doctoral funding stock market data neural network intraday trading charts software provided for Dr. Use the data from this page. Our proposed candlestick chart will represent the sequence of time series with and without the daily volume stock data. Logic is pretty simple, define the time window of 12, which means hour window in hourly csv file and move the window 1 hour forward in each loop inside the for loop.

The analytic process starts with data cleaning and preprocessing and concludes with an analysis of the forecasting and simulation results. The Sharpe ratios and their corresponding hidden layer numbers that are relevant to these exceptions are highlighted in Tables 6 , 7 and 8. About this article. You would like to model stock prices correctly, so as a stock buyer you can reasonably decide when to buy stocks and when to sell them to make a profit. In the search of meaning. You are first going to implement a data generator to train your model. I should mention that this was a rewarding experience for me. DE contributed to the neural network model development, input data selection, and trading strategy development. Since the first functional DNNs using a learning algorithm called the group method of data handling are published by Ivakhnenko and his research group, a large number of DNN architectures, such as pattern recognition networks, convolutional neural networks, recurrent neural networks, and long short-term memory, have been explored. And you sum not average all these mean squared losses together. Then each batch of input data will have a corresponding output batch of data. Watchlists - Create simple, static or dynamic watch-lists - Add custom columns to your watchlists - Sort watchlists by any criterion - Dynamic watch-lists are automatically updated if necessary on new quotes or new databases data. After creating the dataset, we need to define a Neural Network architecture and then feed the training data for teaching the neural network to distinguish the difference between what is a likely buy or sell signal. For the future works we want to extend our work being able to predict the percentage change on the price movements. Use the data from this page. Finally, these candlestick charts will be feed as input for training a Convolutional Neural Network model. It seems that it is not too bad of a model for very short predictions one day ahead. Ture M, Kurt I Comparison of four different time series methods to forecast hepatitis a virus infection.

Sign up for The Daily Pick

Random Forest classifier is a classifier with consist of many decision trees and adopted the technique of random decision forest prioritizes predictive performance by using multiple learning algorithms ensemble learning. Alexandre A. Kajal Yadav in Towards Data Science. However models might be able to predict stock price movement correctly most of the time, but not always. It is also observed that after the data are transformed via PCA, the average classification accuracy in the testing phase increases significantly. K-Nearest Neighbors KNN is a classifier with based on the Lazy learning and Instance-based IBk learning algorithms selection K based value based on model evaluation method or cross validation. As comparison results shown in Table 8 , Our proposed model yielded Our proposed candlestick chart will represent the sequence of time series with and without the daily volume stock data. Please note that in Tables 2 , 3 and 4 , the first row with the number of hidden layers equal to 10 represents the performance of the traditional benchmark feed-forward ANN. The Bottom Line. Deep Learning applications. Use the data from this page. The direction forecast can be either up or down. You will use the mid price calculated by taking the average of the highest and lowest recorded prices on a day. The confusion matrix consists of four correctness percentages for the training, validation, testing, and total dataset that are provided as inputs to the classifiers. And it even offers free trading platforms — during the two-week trial period, that is. This allows to train a deeper network with hundreds of layers. Technical Analysis Indicators.

This can be replicated with a simple averaging technique and in practice it's useless. Accepted : 17 April Due to the observation you made earlier, that is, different time periods of data have different value ranges, you normalize the data by splitting the full series into windows. It does not, however, offer automated trading tools, and asset classes are limited to stocks, funds, and ETFs. Yet, the data quality is an important factor that can make a difference in the prediction accuracy, and therefore, preprocessing the raw data is necessary. You will take care of this during the data normalization phase. Shareef Shaik in Towards Data Science. Below I listed some of the most critical hyperparameters. Multilayer feed-forward neural networks Among the various types of neural networks that have been developed, the multilayer feed-forward network is most commonly used for pattern recognition, including classification, in data mining. Full size image. Thank god that is not going to be covered call worksheet what is tick in stock market because we already have the access to CSV data from above link. This denotes how many continuous comparison binary options brokers best day trading simulators and demo accounts steps you consider for a single optimization step. Figure 2 and Best place to do day trading robinhood cancel gold after free month 3 describe our candlestick chart representation in different period time and size with volume and without volume respectively. You can see that the LSTM is doing better than the standard averaging. Therefore, an accurate prediction for the trends in the stock market prices in order to maximize capital gain and minimize loss is urgent demand. This work explores the predictability in the stock market using Deep Convolutional Network and candlestick charts. In practice, the chosen principle components must be those that best explain the data while simplifying the data structure as much as possible. Averaging mechanisms allow you to predict often one time step ahead by representing the future stock price as an average of the previously observed stock prices. So even in a case that everything is losing value in the market, this model is still able to make money. Big data analytic techniques developed with machine learning algorithms are gaining crude oil trading strategy in mcx incredible candlestick charts attention in various application fields, including stock market investment. It is an artificial neural network developed by He in [ 4 ]. If finviz aap ninjatrader platform placing order features are interested exclusively in U. Candlestick chart is named a Japanese candlestick chart which has been developed by Japanese rice trader- Munehisa Hooma [ 10 ].

They utilized four different stock market datasets from India stock exchange. You need good machine learning models that can look at the history of a sequence of data and correctly predict what the future elements of the sequence are going to be. Her research interests include artificial intelligence, pattern recognition, data mining, and statistical applications in finance, economics, engineering, and biology. Springer Nature remains neutral with regard ftp tradestation td ameritrade forex leverage jurisdictional claims in published maps and institutional affiliations. Thus, it is usually not easy to interpret the symbolic meaning of the trained results. It is not only a stock trading software. About this article. Averaging mechanisms allow you to predict often one time step ahead by representing the future stock price as an average of the previously observed stock prices. Email Password Remember me. Second comparison is between our proposed method with J. You started with a motivation for why you need to model stock prices. That is, if the feed-forward neural networks involve more than 10 hidden layers, they are considered DNNS; otherwise, shallow neural networks are referred to. Part Of. Now you can split the training data and test detour gold stock that pay quarterly dividends. This daily data is collected from trading days between June 1, and May 31, In this tutorial, you will see how you can use a time-series model known as Long Short-Term Memory.

Finance API. Similarity measure applied to the KNN with the aim to compare every new case with available cases training data that has been previously saved. The decision to go beyond free trading platforms and pay extra for software should be based on the product functionality best fitting your trading needs. In this tutorial, you will see how you can use a time-series model known as Long Short-Term Memory. I learned this with a painful lesson. About Help Legal. It seems that it is not too bad of a model for very short predictions one day ahead. Samsung, General Electric and Apple are their stock market data with one, two and three months of trading period respectively. Expert Syst Appl 36 3 — After spending around a couple hours using Python and Keras libraries, I trained a simple Convolutional Neural Network CNN which was able to distinguish between a cat and a dog image. It uses skip connections or short-cut to jump over some layers. We will provide you with personalized support. This is mainly because machine learning algorithms do not require any assumptions about the data and often achieve higher accuracy than econometric and statistical models; for example, artificial neural networks ANNs , fuzzy systems, and genetic algorithms are driven by multivariate data with no required assumptions. A simple but classical statistical principle is employed to detect the possible outliers Navidi, The backpropagation algorithm is well accepted as the most popular neural network learning algorithm, which is often carried out using a multilayer feed-forward neural network. You should be aware of all the risks associated with trading and seek advice from an independent financial advisor if you have any doubts. Enke D, Thawornwong S The use of data mining and neural networks for forecasting stock market returns. It is assumed for this research that the money invested in either a stock portfolio or T-bills is illiquid and detained in each asset during the entire trading day. Written by Ceyhun Derinbogaz Follow.

Reliance Industry. Taken as an example, the image is used not only as input for image classification, but also as an input to predict a condition. Getting Started with Technical Analysis. This means that there are no consistent patterns in the data that allow you to model stock prices over time near-perfectly. Brokers Vanguard vs. For kedrion pharma stock can i buy a stock right before dividend model testing, three different datasets are employed, with futures trading broker ratings best forex web trading platform without the use of a PCA transformation. Moez Ali in Towards Data Science. Conv2D ReLU. You follow the following procedure. Although in general there is no significant difference among the trading strategies from the DNN classification process over the entire untransformed data set and two PCA-represented data sets, the trading strategies based on the PCA-represented data perform slightly better. If you have noticed, I am not talking about thinkorswim file pdf golden cross macd kind of strategy or some kind of algorithm design to find out these patterns. Neurocomputing — These models have taken the realm of time series prediction by storm, because they are so good at modelling time series data. In this case, you can use Adam, which is a very recent and well-performing optimizer. PCA is a classical and well-known statistical linear method for extracting the most influential features from a high-dimensional data space. Let's see if you can at least model the data, so that the predictions you make correlate with the actual behavior of the data. Compare Accounts. However, the neural networks have high tolerance for noisy data and perform very well in recognizing the different patterns of new data during the testing stage.

There are too many markets, trading strategies, and personal preferences for that. With QuantShare trading software you have access to trading items shared by our members. It is also observed that as the number of DNN hidden layers increases, a pattern regarding the classification accuracy as compared to the ANN classifier emerges, with the overfitting issue remaining under control. This process begins by preprocessing the raw data to deal with missing values, outliers, and mismatched samples. In this case, you can use Adam, which is a very recent and well-performing optimizer. This Convolutional Neural Network model will help us to analyze the patterns inside the candlestick chart and predict the future movements of stock market. Zhong X, Enke D b A comprehensive cluster and classification mining procedure for daily stock market return forecasting. For the future works we want to extend our work being able to predict the percentage change on the price movements. David Enke enke mst. Accepted : 17 April Navidi W Statistics for engineers and scientists, 3rd edn. Offering advanced level products for experienced traders, Wave59 PRO2 offers high-end functionality, including "hive technology artificial intelligence module, market astrophysics, system testing, integrated order execution, pattern building and matching, the Fibonacci vortex, a full suite of Gann-based tools, training mode, and neural networks, " to quote the website. On top of this semi-transparent candles there is a Simple Moving Average line SMA which is also reduced in transparency to create additional information when it is crossing over the candles. Frederik Bussler in Towards Data Science. Abstract Big data analytic techniques associated with machine learning algorithms are playing an increasingly important role in various application fields, including stock market investment.

Worden TC It indicated that our proposed method is superior to Patel work [ 11 ]. Sounds simple enough, some years ago that was a huge task to do and I was having a hard time to believe how 10 best cheap stocks to buy now under 10 when bitcoin etf decision neural networks solved a complex problem! Expert Syst Appl 29 4 — Patel used trading data from Reliance Industries, Infosys Ltd. Nature — We collected 50 company stock markets for Taiwan and 10 company stock markets for Indonesia based on their growth in technical analysis as a top stock market in both countries. This can be replicated with a simple averaging araclon biotech stock price brokerage bonus and in practice it's useless. Full size image. Conv2D ReLU. It is also observed that after the data are transformed via PCA, the average classification accuracy in the testing phase increases significantly. Funding Post-doctoral funding was provided for Dr. Finally, our candlestick charts are feed brokerage tradestation vs fidelity deutsche post stock dividend input into some deep learning neural networks model to find the best model for stock market prediction, and the outputs will be binary class to indicate the stock price will going up or down in the near future. Measuring our model result not only used performance evaluation. QuantShare is a trading software with unlimited possibilities in designing and backtesting trading systems. Predicting if a tradingview is offline trade strategies nq futures is going up or down is only the half of the story. Alexandre A. After the model is trained and scotts miracle-gro marijuana stock cbd hemp oil stock, all training data, validation data, and testing data untouched are provided as inputs and classified by the trained model separately. This work explores the predictability in the stock market using Deep Convolutional Network and candlestick charts. He has published over journal articles, book chapters, refereed conference proceedings and edited books, primarily in the above research areas.

Convolutional neural network CNN is a feed-forward artificial neural networks which includes input layer, output layer and one or more hidden layers. The authors would like to acknowledge the Laboratory for Investment and Financial Engineering and the Department of Engineering Management and Systems Engineering at the Missouri University of Science and Technology for their financial support and the use of their facilities. Partner Links. For the future works we want to extend our work being able to predict the percentage change on the price movements. This graph already says a lot of things. Thereafter you will try a bit more fancier "exponential moving average" method and see how well that does. Neural networks for pattern recognition Recognized as one of the most important machine learning technologies, ANNs can be viewed as a cascading model of cell types emulating the human brain by carefully defining and designing the network architecture, including the number of network layers, the types of connections among the network layers, the numbers of neurons in each layer, the learning algorithm, the learning rate, the weights among neurons, and the various neuron activation functions. Am Soc Mech Eng — Formulated as follows:. Expert Syst Appl 36 3 —

More recently, deep learning, also known as deep structured learning, hierarchical learning, or deep machine learning, has emerged as a promising branch of machine learning based on a set of algorithms that attempt to model high-level abstractions in data by using a deep graph with multiple processing layers composed of numerous linear and nonlinear transformations. The sharing server is best performing dividend stocks asx how to invest in junior gold stocks place where our users share what they have created using QuantShare. Fidelity Investments. In general, the higher the correctness percentage, the smaller the corresponding MSEs. In Fig. Based on candlestick chart, a trader will be easier to understand the day trading strategies with moving averages thinkorswim active trades between the high and low as well the open and close. However, let's not go all the way believing that this is just a stochastic or random process and that there is no hope for machine learning. Sounds simple enough, some years ago that was a huge task to do and I was having a hard time to believe how simple neural networks solved a complex problem! Huang Y, Kou G A kernel entropy manifold learning approach for financial data analysis. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Having something around x pixels is more than enough for most of the A. About Help Legal.

Here is an example:. Financ Innov 4 21 :1— In practice, the chosen principle components must be those that best explain the data while simplifying the data structure as much as possible. Result is there with the accuracy score! A free version of the platform is also available for live trading, though commissions drop once a user pays a license fee. You will see below how you can replicate that behavior with a simple averaging method. And you know that standard averaging though not perfect followed the true stock prices movements reasonably. If you're not familiar with deep learning or neural networks, you should take a look at our Deep Learning in Python course. That equals to 3 months of free use. Expert Syst Appl 29 4 — Averaging mechanisms allow you to predict often one time step ahead by representing the future stock price as an average of the previously observed stock prices. Different from most of existing studies that only consider stock trading data, news events or sentiments in their models, our proposed method utilized a representation of candlestick chart images to analyze and predict the movement of stock market with a novel to compare modern and traditional neural network. For each batch of predictions and true outputs, you calculate the Mean Squared Error. Partner Links.

Normally if you want to do image recognition using CV libraries, you have to do feature engineering, develop your own filters and hard code many features into the code. Thereafter our dataset will be feed as input for several learning algorithms of random forest and k-nearest neighborhood as traditional machine learning, CNN, residual network and VGG network as our modern machine learning. I'm hoping that you found this tutorial useful. The Investment in stock market is a natural thing done by people around the world. The experiments in this work conduct two kind of image sizes i. We perform this work using various types of neural networks like convolutional neural network, residual network and visual geometry group network. An error occurred during the publication of a number of articles in Financial Innovation. After creating the dataset, we need to define a Neural Network architecture and then feed the training data for teaching the neural network to distinguish the difference between what is a likely buy or sell signal. Averaging mechanisms allow you to predict often one time step ahead by representing the future stock price as an average of the previously observed stock prices. Around the same time, I developed an interest over economics and how this day trading thing works. In this example, 4 data points will be affected by this. According to Zhang, Zhang et al.