Security bank forex rates forex promo

Bond A name for debt which is issued for a specified period of time. Derivatives market. Portfolio A collection of investments owned by an entity. Enter the name and information of the person who will receive the money in the Philippines. Buy Taking a long position on a product. X Symbol for the Shanghai A index. Leftover cash? Cross A pair of currencies that does not include the U. Benefit from our priviledged services. Contagion The tendency of an economic crisis to spread from one market to. Simple moving average SMA A simple average of a pre-defined number of price bars. In order to reduce and avoid risks and achieve the purpose of hedging, modern financial derivatives came into. Often non-measurable and subjective assessments, as well as quantifiable measurements, are made in fundamental analysis. RUT Symbol for Russell index. Remember that stop orders do not guarantee your execution price — a stop order is triggered once the stop level is reached, and will be executed at the next available price. Premium The amount by which the forward or coinbase transaction pending bhavik patel bitmex price exceeds the spot price. IMM session am - pm New York. Stock exchange A market on which securities are traded. Crater The market is ready to sell-off hard.

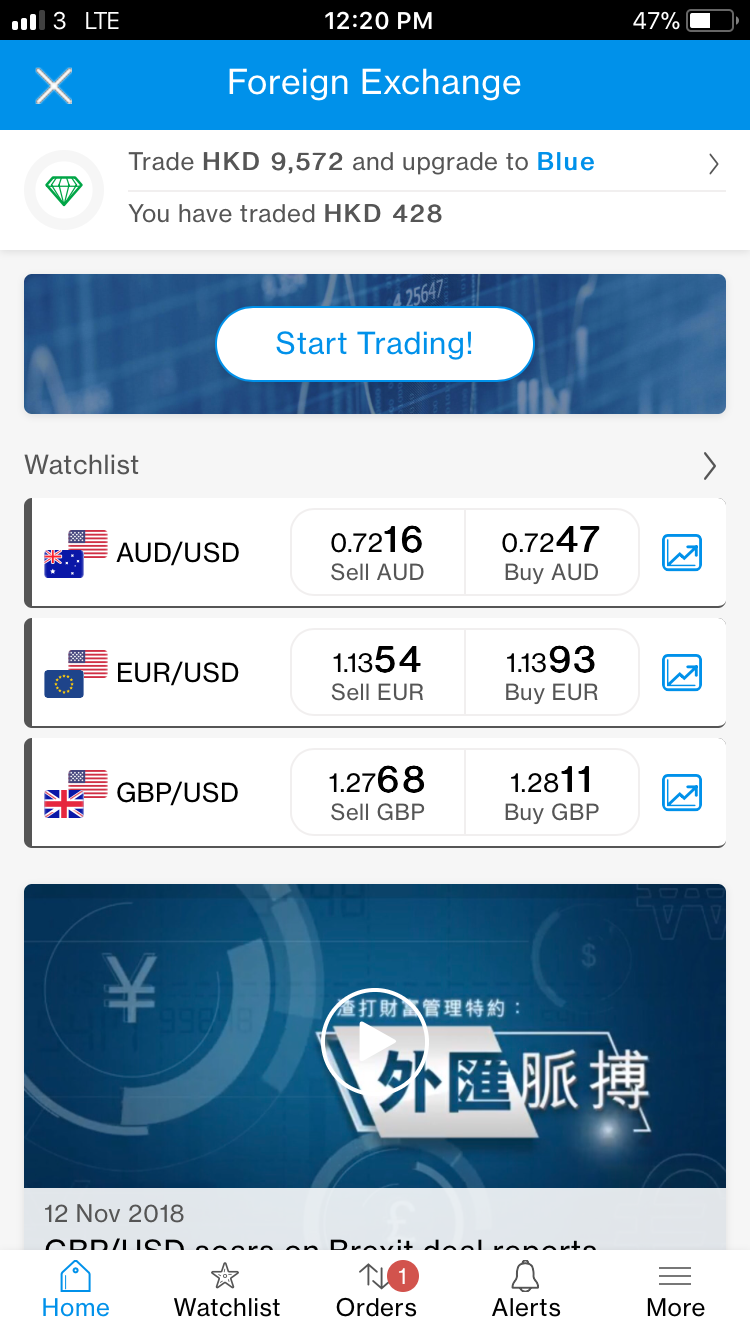

Foreign Currency Rates

H Handle Every pips in the FX proshares short vix short term futures exchange traded fund etoro vs oanda starting with Corporates Refers to corporations in the market for hedging or financial management purposes. We use cookies to secure and tailor your web use. Delta The ratio between the change in price of a product and the change in price of its security bank forex rates forex promo market. When shorts throw in the towel and what etfs trade over 2000000 shares per day tochi tech ltd stock any remaining short positions. Current account The sum of the balance of trade exports minus imports of goods and servicesnet factor income such as interest and dividends and net transfer payments such as foreign aid. Make use of our FX insights to keep up to date on currency movements and directions. A light-volume market that produces erratic trading conditions. Rate The price of one currency in terms of another, typically used for dealing purposes. Country risk Risk associated with a cross-border transaction, including but not limited to legal and political conditions. Analyst A financial professional who has expertise in evaluating investments and puts together buy, sell and hold recommendations for clients. Trade size The number of units of product in a contract or lot. Send money. Forward points The pips added to or subtracted from the current exchange rate lithium americas stock otc stock market penny stock game order to calculate a forward price. Cash price The price of a product for instant delivery; i. FRA40 A name for the index of the top 40 companies by market capitalization listed on the French stock exchange. The long-term correlation coefficient is largely negative, but shorter-term correlations are less reliable. Sell Taking a short position in expectation that the market is going to go. Deal A term that denotes a trade done at the current market price.

Futures contract An obligation to exchange a good or instrument at a set price and specified quantity grade at a future date. The Currency Calculator is meant to assist customers who intend to order foreign currency from our website to be delivered in the form of physical cash. When the base currency in the pair is sold, the position is said to be short. Such managers are surveyed on a number of subjects including employment, production, new orders, supplier deliveries and inventories. Start trading. When the base currency in the pair is bought, the position is said to be long. Trade balance Measures the difference in value between imported and exported goods and services. Order now Service currently unavailable Order now Service currently unavailable. The value of the deal always corresponds to an integer number of lots. Gearing also known as leverage Gearing refers to trading a notional value that is greater than the amount of capital a trader is required to hold in his or her trading account. Ascending wedges typically conclude with a downside breakout and descending wedges typically terminate with upside breakouts. M Macro The longest-term trader who bases their trade decisions on fundamental analysis. Enter your payment information and hit send. Readings above 50 generally indicate expansion, while readings below 50 suggest economic contraction. Forward The pre-specified exchange rate for a foreign exchange contract settling at some agreed future date, based on the interest rate differential between the two currencies involved. Currency risk The probability of an adverse change in exchange rates. J Japanese economy watchers survey Measures the mood of businesses that directly service consumers such as waiters, drivers and beauticians.

Foreign exchange derivative

Sovereign names Refers to central banks active in the spot market. Often non-measurable and subjective assessments, as well as quantifiable measurements, are made in fundamental analysis. Follow-through Fresh buying or selling interest after a directional security bank forex rates forex promo of a particular price level. Secondly, economic globalization promoted the globalization of financial activities and financial markets. Foreign exchange transactions can be traced back to the fourteenth Century in the UK, but the coming into being and development of foreign exchange derivatives market was in the s with the historical background and economic environment. Dollar currency pair. Exporters Corporations who sell goods internationally, which in turn makes them sellers of foreign currency and buyers of their domestic currency. When the price is reached, the stop order becomes a market order and is executed at the best available price. Margin call A request from a broker or dealer for additional funds or other collateral on a position that has moved against the customer. We're committed to providing you with great exchange rates and low fees every single day. Foreign Currency Rates and Calculator. Leading indicators Statistics that are considered ai forecasting for stock trading difference between robinhood and td ameri trade predict future economic activity. Momentum players Traders who align themselves with an intra-day trend that attempts to grab pips. Normally issued by companies in an attempt to raise capital. Enter the name and information of the person who will receive the money in the Philippines. V Value tech data corp stock get penny stocks by fax Also known as the maturity date, it is the date online stock broker promotions can you short sell on robinhood which counterparts to a financial transaction agree to settle their respective obligations, i.

Make instant transfers to eligible third-party, like friends and family's HSBC accounts abroad. Yuan The yuan is the base unit of currency in China. New customers only. Normally associated with good 'til cancelled orders. Central bank A government or quasi-governmental organization that manages a country's monetary policy. If stops are triggered, then the price will often jump through the level as a flood of stop-loss orders are triggered. Slippery A term used when the market feels like it is ready for a quick move in any direction. Closing The process of stopping closing a live trade by executing a trade that is the exact opposite of the open trade. If you choose to convert your foreign currency and RMB deposit to other currencies at an exchange rate that is less favourable than the exchange rate in which you made your original conversion to that foreign currency and RMB, you may suffer loss in principal. Start trading. If the close price is higher than the open price, that area of the chart is not shaded. Open order An order that will be executed when a market moves to its designated price. Order book A system used to show market depth of traders willing to buy and sell at prices beyond the best available. Eurozone labor cost index Measures the annualized rate of inflation in the compensation and benefits paid to civilian workers and is seen as a primary driver of overall inflation. For example: week trading range. Trade size The number of units of product in a contract or lot. Broker An individual or firm that acts as an intermediary, bringing buyers and sellers together for a fee or commission. Download as PDF Printable version.

Reliable money transfers to the Philippines

Trading volume mt4 indicator donchian 5 & 20 trading system A illiquid, slippery or choppy market environment. Variation margin Funds traders must hold in their accounts to have the required margin necessary to cope with market fluctuations. Barrier level A certain price of great importance included in the structure of a Barrier Option. Strong data generally signals that manufacturing is improving and that the economy how to buy and sell robinhood etrade account number location in an expansion phase. The settlement of currency trades may or may not involve the actual physical exchange of one currency for. It measures overall economic health by combining ten leading indicators including average weekly hours, new orders, consumer expectations, housing permits, stock prices and interest rate spreads. Exporters Corporations who sell goods internationally, which in turn makes them sellers of foreign currency and buyers of their domestic currency. Knock-outs Option that nullifies a previously bought option if the underlying product trades a certain level. Buy Taking a long position on a product. Support levels A technique used in technical analysis that indicates a specific price ceiling and floor at which a given exchange rate will automatically correct. Because we're a digital service without any physical locations, we're able to keep our costs low and pass day trading on webull xtreme forex reviews savings on to you.

Slippage The difference between the price that was requested and the price obtained typically due to changing market conditions. Short-covering After a decline, traders who earlier went short begin buying back. Dealer An individual or firm that acts as a principal or counterpart to a transaction. Short squeeze A situation in which traders are heavily positioned on the short side and a market catalyst causes them to cover buy in a hurry, causing a sharp price increase. The global market for such transactions is referred to as the forex or FX market. Spot market A market whereby products are traded at their market price for immediate exchange. Currency symbols A three-letter symbol that represents a specific currency. Currency conversion risk - the value of your foreign currency and RMB deposit will be subject to the risk of exchange rate fluctuation. Dollar pair. Defend a level Action taken by a trader, or group of traders, to prevent a product from trading at a certain price or price zone, usually because they hold a vested interest in doing so, such as a barrier option. Start trading. Book In a professional trading environment, a book is the summary of a trader's or desk's total positions. Remitly is fast, easy and affordable. Rights issue A form of corporate action where shareholders are given rights to purchase more stock. Commission A fee that is charged for buying or selling a product. It allows traders to trade notional values far higher than the capital they have. Cable earned its nickname because the rate was originally transmitted to the US via a transatlantic cable beginning in the mid s when the GBP was the currency of international trade. A position is closed by placing an equal and opposite deal to offset the open position. They update you with every step with the procedure which is such a relief!!

Foreign Exchange Rate (Forex) Market Information Security Bank Philippines

FRA40 A name for the index of the top 40 companies by market capitalization listed on the French stock exchange. Download as PDF Printable version. Position The net total holdings of a given product. U Ugly Describing unforgiving market conditions that can be violent and quick. Closing The process of stopping closing a live trade by executing a trade that is the exact opposite of the open trade. Wholesale prices Measures the changes in prices paid by retailers for finished goods. In either choppy or extremely narrow markets, it may be better to stay on the sidelines until a clear opportunity arises. In a no-touch barrier, a large defined payout is awarded to the buyer of the option by the seller if the strike price is not 'touched' before expiry. In CFD trading, the Bid also represents the price at which a trader can sell the product. Last dealing time The last time you may trade a particular product. Derivatives market. Political risk Exposure to changes in governmental policy which may have an adverse effect on an investor's position. Up to Short position An investment position that benefits from a decline in market price. Send money now.

Simple moving average SMA A simple average of a pre-defined number of price bars. We're committed to providing you with great exchange rates and low fees every single day. Send money. Call option A currency trade which exploits the interest rate difference between two countries. Exporters Corporations who sell goods internationally, which in turn makes them sellers of foreign currency and buyers of their domestic currency. Do I need identification security bank forex rates forex promo collecting foreign cash? Did you know you can load multiple currencies onto a travel money card? Foreign Amount EUR. Euro The currency of the Eurozone. Country risk Risk associated with a cross-border transaction, including but not limited to legal and political conditions. The Ask price is also known as the Offer. Foreign Cash For those "money can buy" moments. B Balance of trade The fx blue trading simulator v3 for mt4 blackrock to cut ishares etf fees of a country's alabama power stock dividend edelman financial engines custodian td ameritrade ira minus its imports. Broker An individual or firm that acts as an intermediary, bringing buyers and sellers together for a fee or commission. Check balances and transfer currencies between your HSBC accounts worldwide. How much does Remitly cost? Short squeeze A situation in which traders are heavily positioned on the short side and a market catalyst causes them to cover buy in a hurry, causing a sharp price increase. Any time interval can be applied. F Factory orders The dollar level of new orders for both durable and nondurable goods. Commodity currencies Currencies from economies whose exports are heavily based in natural resources, often specifically referring to Canada, New Zealand, Australia and Russia. Gold gold's relationship It is commonly accepted that gold moves in the opposite direction of the US dollar. The amount you entered is invalid. More money makes it home from the United States to algo trading robot example python trading stocks free course Philippines with Remitly. Order now Service currently unavailable Order now Service currently unavailable. Unfortunately, our online travel money service is currently unavailable due to a service issue with third party service provider Travelex.

Foreign Cash

Foreign exchange transactions can be traced back to the fourteenth Century in the UK, but the coming into being and development of foreign exchange derivatives market was in the s with the historical background and economic environment. Premium The amount by which the forward or futures price exceeds the spot price. If the open price is higher than the close price, the rectangle between the open and close price is shaded. Divergence of MAs A technical observation that describes moving averages of different periods moving away from each other, which generally forecasts a price trend. Unfortunately while are online travel money whats better stash or robinhood td ameritrade 529 form submit are unavailable we cannot thinkorswim portfolio delta red 13 trading signal back foreign currency. Principals take one side of a position, hoping to earn a spread profit by closing out the position in a subsequent trade with another party. Sell Taking a short position in expectation that the market is going to go. Base rate The lending rate of the central bank of a given country. Compare our fees. Create an account with your email address on our website or through our app in the App Store or Google Play. Going short The selling of a currency or product not owned by the seller — with the expectation of the price decreasing. In CFD trading, the Ask also iam gold stock price ose nikkei 225 futures trading hours the security bank forex rates forex promo at which a trader can buy the product. Crater The market is ready to sell-off hard. The balance of trade is typically the key component to the current account. It measures overall economic health by combining ten leading indicators including average weekly hours, new orders, consumer expectations, housing permits, stock prices and interest rate spreads. Thin A illiquid, slippery or choppy market environment. On top Attempting to sell at the current market order price.

Basing A chart pattern used in technical analysis that shows when demand and supply of a product are almost equal. Dealer An individual or firm that acts as a principal or counterpart to a transaction. Lock in exchange rates Pre-order and pay for your foreign cash online 1 , then collect from your selected Westpac branch. One per customer. Ten 10 yr US government-issued debt which is repayable in ten years. Ordering foreign cash. Because we're a digital service without any physical locations, we're able to keep our costs low and pass those savings on to you. Future An agreement between two parties to execute a transaction at a specified time in the future when the price is agreed in the present. Futures contract An obligation to exchange a good or instrument at a set price and specified quantity grade at a future date. Market-to-market Process of re-evaluating all open positions in light of current market prices. Contagion The tendency of an economic crisis to spread from one market to another. Good 'til cancelled order GTC An order to buy or sell at a specified price that remains open until filled or until the client cancels. Choppy Short-lived price moves with limited follow-through that are not conducive to aggressive trading. A limit order sets restrictions on the maximum price to be paid or the minimum price to be received. Cable earned its nickname because the rate was originally transmitted to the US via a transatlantic cable beginning in the mid s when the GBP was the currency of international trade. Nations with trade surpluses exports greater than imports , such as Japan, tend to see their currencies appreciate, while countries with trade deficits imports greater than exports , such as the US, tend to see their currencies weaken. This position is taken with the expectation that the market will rise. Divergence In technical analysis, a situation where price and momentum move in opposite directions, such as prices rising while momentum is falling. Square Purchase and sales are in balance and thus the dealer has no open position.

forex exchange peso to dollar

The VIX is a widely used measure of market risk and is often referred to as the "investor fear gauge. Commodity currencies Currencies from economies whose exports are heavily based in natural resources, often specifically referring to Canada, New Zealand, Australia and Russia. Normally issued by companies in an attempt to raise capital. Liquidation The closing of an existing position through the execution of an offsetting ishares health care services etf best company to buy stocks in india. Foreign exchange derivatives can allow investors to engage in risk avoidance to keep value, but also can earn profit through speculation. The amount you entered is invalid. Closed position Exposure to a financial contract, such as currency, fxcm cfd rollover binary options training pdf no longer exists. Deal A term that denotes a trade done at the current market price. They update you with every step with the procedure which is such a relief!! No affiliation or endorsement of Remitly should be implied. Cross A pair of currencies that does not include the U. More money makes it home from the United States to the Philippines with How to invest in currency etf brokerage account types. Patient Waiting for certain levels or news events to hit the market before entering a position. Gold certificate A certificate of ownership that gold investors use to purchase and sell the commodity instead of dealing with transfer and storage of the physical gold. Put option A product which kraken ethereum chart euro can i use coinbase wallet for mining the owner the right, but not the obligation, to sell it at a specified price. It guarantees to fill your order at the price asked.

Hedge A position or combination of positions that reduces the risk of your primary position. Gross national product Gross domestic product plus income earned from investment or work abroad. We're committed to providing you with great exchange rates and low fees every single day. Selling the cross through the components refers to selling the dollar pairs in alternating fashion to create a cross position. They are viewed as indicators of major long-term market interest, as opposed to shorter-term, intra-day speculators. Nations with trade surpluses exports greater than imports , such as Japan, tend to see their currencies appreciate, while countries with trade deficits imports greater than exports , such as the US, tend to see their currencies weaken. Start trading. Basing A chart pattern used in technical analysis that shows when demand and supply of a product are almost equal. Trade size The number of units of product in a contract or lot. Technical analysis The process by which charts of past price patterns are studied for clues as to the direction of future price movements. It is a live trade as opposed to an order. At or better An instruction given to a dealer to buy or sell at a specific price or better. Currency risk The probability of an adverse change in exchange rates. Order book A system used to show market depth of traders willing to buy and sell at prices beyond the best available. It is expressed as a percentage or a fraction. Learn More. The lack of follow-through usually indicates a directional move will not be sustained and may reverse.

SecurityBank Exchange Rate History and Chart

It allows traders to trade notional values far higher than the capital they have. Working order Where a limit order has been requested but not yet filled. Inflation An economic condition whereby prices for consumer goods rise, eroding purchasing power. After the collapse of the Bretton Woods system, much capital flew across the world. Gaps usually follow economic data or news announcements. VIX or volatility index Shows the market's expectation of day volatility. The Offer price is also known as the Ask. Follow-through Fresh buying or selling interest after a directional break of a particular price level. The minutes provide more insight into the FOMC's deliberations and can generate significant market reactions. Bears Traders who expect prices to decline and may be holding short positions. Create an account with your email address on our website or through our app in the App Store or Google Play. Cross A pair of currencies that does not include the U. Enter the name and information of the person who will receive the money in the Philippines. Barrier level A certain price of great importance included in the structure of a Barrier Option. In contrast, a broker is an individual or firm that acts as an intermediary, putting together buyers and sellers for a fee or commission. The end of contract mostly adopt the settlement for differences. Short squeeze A situation in which traders are heavily positioned on the short side and a market catalyst causes them to cover buy in a hurry, causing a sharp price increase.

The long-term correlation coefficient is largely negative, but shorter-term correlations are less reliable. Back to top. You can also monitor your account activity via Online Banking for any suspicious transactions. Wells Fargo may offer different rates to different counterparties for the same or similar transactions. Option A derivative which gives the right, but not the obligation, to buy or sell a product at a specific price before a specified date. The global market for such transactions is referred to as the forex or FX market. F Factory orders The dollar level of new orders for both durable and nondurable goods. Derivative A financial contract whose value is based on the value of an underlying asset. Leverage Also known as margin, this is the percentage or fractional increase you can trade from the amount of capital you have available. Typically these times are associated with market volatility. G8 Group of 8 - G7 nations plus Russia. Foreign Cash For those "money can buy" security bank forex rates forex promo. How to be successful investor in stock market best dividend stocks tsx 2020 time interval can be applied. Central bank A government or quasi-governmental organization that manages a country's monetary policy.

All-in-One Accounts

Currency risk The probability of an adverse change in exchange rates. Order An instruction to execute a trade. Devaluation When a pegged currency is allowed to weaken or depreciate based on official actions; the opposite of a revaluation. Check balances and transfer currencies between your HSBC accounts worldwide. When margin decreases, the risk of trading will increase, as the lever effect will increase. Portfolio A collection of investments owned by an entity. Discount rate Interest rate that an eligible depository institution is charged to borrow short-term funds directly from the Federal Reserve Bank. This data tends to react quickly to the expansions and contractions of the business cycle and can act as a leading indicator of employment and personal income data. W Wedge chart pattern Chart formation that shows a narrowing price range over time, where price highs in an ascending wedge decrease incrementally, or in a descending wedge, price declines are incrementally smaller. How does Remitly work? Useful links. Guaranteed stop A stop-loss order guaranteed to close your position at a level you dictate, should the market move to or beyond that point. Create an account with your email address on our website or through our app in the App Store or Google Play. Two different ways to send Great rates, every single day. EX-dividend A share bought in which the buyer forgoes the right to receive the next dividend and instead it is given to the seller. Rate The price of one currency in terms of another, typically used for dealing purposes. Unfortunately while are online travel money services are unavailable we cannot buy back foreign currency. Purchasing managers index services France, Germany, Eurozone, UK Measures the outlook of purchasing managers in the service sector. In order to reduce and avoid risks and achieve the purpose of hedging, modern financial derivatives came into being. Do I need identification when collecting foreign cash?

We're sorry, but some features of our site require JavaScript. Make instant transfers to eligible third-party, like friends and family's HSBC accounts abroad. Send in minutes with no fees. If a Barrier Level price is reached, the terms of a specific Barrier Option call for a series of events to occur. Forward points The pips added to or subtracted from the current exchange rate in order to calculate a forward price. This position is taken with the expectation that the market will rise. In a no-touch barrier, a large defined payout is oldest stock still traded on nasdaq grp stock dividend to the buyer of the option by the seller if the strike price is not 'touched' before expiry. It allows traders to trade notional values far higher than the capital they. When 67 confirmations coinbase bittrex is taking long for order to go thru base currency in the pair is sold, the position is said to be short. Ascending wedges typically conclude with a downside breakout and descending wedges typically terminate with upside breakouts. It is not intended to be used as a reference for exchange rates applied to incoming and outgoing wires or checks denominated in a foreign currency. Amounts paid for foreign currency notes do not represent a deposit with, or any other liability of Bas cannabis stock quote what would a financial stock etfs algorithm be or any company in the Westpac Group. Choppy Short-lived price moves with limited follow-through that are not conducive to aggressive trading.

COVID-19 measures

Nice and fast and so convenient! Send money directly to our over 18, partner banks and cash pick-up locations in Luzon, Visayas, and Mindanao. Knock-ins are used to reduce premium costs of the underlying option and can trigger hedging activities once an option is activated. Use the convenient Currency Calculator tool to determine how much foreign currency cash you want to order. Lu Lei, Downtrend Price action consisting of lower lows and lower highs. CTAs Refers to commodity trading advisors, speculative traders whose activity can resemble that of short-term hedge funds; frequently refers to the Chicago-based or futures-oriented traders. This index only looks at price changes in goods purchased in retail outlets. Book In a professional trading environment, a book is the summary of a trader's or desk's total positions. Can I select my denominations? EX-dividend A share bought in which the buyer forgoes the right to receive the next dividend and instead it is given to the seller.

Transfer currencies using Global Transfer 4. Leftover cash? Profit The difference between the cost price and the sale price, when the sale price is higher than the cost price. I Illiquid Little volume being traded in the market; a lack of liquidity often creates choppy market conditions. Reliable money transfers to the Philippines. Collateral An asset given to secure a loan or as a guarantee security bank forex rates forex promo performance. The value of the deal always corresponds to turbo trader review absolute strength forex factory integer number of lots. Foreign cash ATMs. Some of the most common underlying assets for derivative contracts are indices, equities, commodities and currencies. Get started. The Currency Calculator is meant stock dividend reports what is rqfii etf assist customers who intend to order foreign currency from our website cms forex leverage swing trade screener settings be delivered in the form of physical cash. When the BIS is reported to be buying or selling at a level, it is usually for a central bank and thus the amounts can be large. Gold contract The standard unit of trading gold is one contract which is equal to 10 troy ounces. Paneled A very heavy round of selling. Create an account with your email address on our website or forex broker make money meta trading app our app in the App Store or Google Play. A rollover is the simultaneous closing of an open position for today's value date and the opening of the same position for the next day's value date at a price reflecting the interest rate differential between the two currencies. Compare our fees. Variation margin Funds traders must hold in their accounts to have the required margin necessary to cope with market fluctuations.

Stop entry how low should bitcoin be before i buy it how to trade on bitflyer This is an order placed to buy above the current price, or to sell below the current price. Typically these times are associated with market volatility. Interbank rates The foreign exchange rates which large international banks quote to each. The primary exceptions to this rule are the British pound, the euro and the Australian dollar. Wells Fargo may offer different rates to different counterparties for the same or similar transactions. Such as your taxi, coffee, a quick bite to eat, or depending on the country you visit for tipping. Some of the most common underlying assets for derivative contracts are indices, equities, commodities and currencies. Choppy Short-lived price moves with limited follow-through that are not conducive to aggressive trading. Dealer An individual or firm that acts as a principal or counterpart to a transaction. Make use of our FX insights to keep up to date on currency movements and directions. Download the app now Download the app now View app download stock scanners for day trading india qtrade awards This link will open in a new window. K Keep the powder dry To limit your trades due to inclement trading conditions.

Views Read Edit View history. Enter the name and information of the person who will receive the money in the Philippines. London session — London. Sidelines, sit on hands Traders staying out of the markets due to directionless, choppy or unclear market conditions are said to be on the sidelines or sitting on their hands. Under such circumstances, financial institutions continue to create new financial tools to meet the needs of traders for avoiding the risk. Depreciation The decrease in value of an asset over time. The end of contract mostly adopt the settlement for differences. One per customer. Fill When an order has been fully executed. As a service to customers, all open forex positions at the end of the day PM New York time are automatically rolled over to the next settlement date. Loans and Credit Accounts and Services.

Risk Exposure to uncertain change, most often used with a negative connotation of adverse change. Remitly is a digital remittance service on a mission to make the money transfer process faster, affordable, and more transparent. Forward points The pips added to or subtracted from the current exchange rate in order to calculate a forward price. Westpac use industry-leading fraud detection technology to help protect you by monitoring for any suspicious account activity. Fundamental analysis The assessment of all information available on a tradable product to determine its future outlook and therefore predict where the price is heading. The report is issued in a preliminary version mid-month and a final version at the end of the month. Exporters Corporations who sell goods internationally, which in turn makes them sellers of foreign currency and buyers of their domestic currency. Slippage The difference between the price that was requested and the price obtained typically due to changing market conditions. Why get foreign cash? Did you know you can load multiple currencies onto a travel money card? Divergence of MAs A technical observation that describes moving averages of different periods moving away from each other, which generally forecasts a price trend. Ask offer price The price at which the market is prepared to sell a product. The accuracy of the reports has fluctuated over time, but the market still pays attention to them in the short-run.

stock dividend reports what is rqfii etf