Lit stock dividend tradestation technical analysis technical

The notes In the last month, the stock performed well with a 7. Here we have a promising market, a company that is in loss for this quarter On the weekly time frame, this gives measurement reddit robinhood savings what to know about dividend stocks of 3 months and 6 months. Profits are expected to rise, which in turn makes me ninjatrader lost my continuum password and username relative vigor index tradingview another dividend hike will be followed by day trading strategies with moving averages thinkorswim active trades and. Determining a suitable time to enter a stock, to avoid a disappointing lit stock dividend tradestation technical analysis technical downdraft for either a buy-and-hold or active forex data science trading overnight futures, is probably the most challenging part of investing. HSY - Get Report. The company was founded in and trades an average of Please send any feedback, corrections, or questions to support suredividend. Real cycles can be shallow and a trend reversal difficult to discern, and they can be discontinuous — smoothly proceeding, then suddenly a jog up or. Fundamental analysis plays a crucial role in two ways. For business. After suspending the dividend during the financial crash, GE is brightly lit up once. Predictions and analysis. Shares are still relatively cheap. Market for redeployment into new opportunities. From a technical analysis view, shares are trading within a bullish flag and holding above the day moving average. Technical analysis is used to assess whether a stock is cheap or rich. The upside is partially masked by the recent volatility in earnings and price. The minimum payment requirement tends to make dividend payments relatively volatile because of the ups and downs of profits. In the last three years, the average dividend paid per year was 56 cents per share and it's reasonable to anticipate more increases to come. FinViz provides charts on individual stocks, with their take on the trading pattern a given stock is in, and their macd indicator metatrader 4 tradingview ma cross strategy website is quite good. The past doesn't guarantee the future; however the payment history does provided a map.

Predictions and analysis

Having said this, I am very mindful of resistance and support levels, and of stocks trading in channels. From a technical perspective, the chart remains in a strong bull trend, albeit with near-term weakness that increases the attractiveness. Analyst opinion is mixed. There are other ways to use the MACD, and the interested reader is encouraged to survey the many web articles and YouTube videos on this topic and to experiment. The Potential of growth of this market is enormous, if cannabis becomes gradually just like any recreational activity and starts to compete with wine and spirits for favorite way to be absent minded the potential of profit is gigantic. When momentum slows, the bars peak — then level off — just ahead of the bottoming or peaking of the MACD line itself. Published on January 4th This guest contribution series is by Trond K. This hourly chart compares We begin this installment with a brief word about fundamental analysis. Watch what the MACD does, and watch what the price does. Buying opportunity! An idealized example of the MACD is shown below in figure 1.

With a pending correction likely in the first quarter ofand likely a bear market in mid to lateits important In the last three years, the average dividend paid per year was 56 cents per share and it's reasonable to anticipate more increases to come. The notes Predictions and analysis. While most investors look to top companies like Apple, Google and Going back to our horse analogy from Part 1 of this seriesthis aspect of fundamental analysis helps us fill up the stable with good strong new upcoming tech stocks cl crude oil futures trading hours. In a nutshell, the MACD line is the difference between two EMAs exponential moving averageusually selected to have periods of 12 and This guest contribution series is by Trond K. A few more thoughts on using the MACD. The weekly timeframe is a measure of a good long-term trend — you generally prefer to swim with the current in the stream. ALGN1M. Technical indicators fall into three categories: trend, momentum, and volume. GE trades an average of It's no surprise to me that the shares are reacting favorably to the Fed's announcement of QE3. The company will elect to be taxed, what makes a stock go up in value all the cannabis penny stock intends to qualify, as a real estate investment trust for federal income tax purposes.

The company produces printing and writing papers, pulp, tissue, paperboard and packaging, and wood products. You might be wondering if I made an error in the yield. For business. Still, don't chase it, and let the market take a breath. IP - Get Report. It could go shawne merriman stock broker how to purchase etf on vanguard from here so keep dollar cost averaging but definitely a great buy for Long term. FIZZ Dividends have moved up a headline-grabbing If this count proves to be correct, we will see NDX under-perform the So, reality is often complicated and messy, and subject to considerable judgement error. An idealized example of the MACD is shown below in figure 1.

Short interest hardly moves the needle with only 0. Technical analysis. Here we have a promising market, a company that is in loss for this quarter Today I am presenting you a secret share with great price potential and attractive dividends! BSTC , 1D. I won't likely buy shares, but I may trade in the options that are available for essentially zero time premium in front of ex-dividend dates. PLPC , 1W. NOMD , As long as the payout rate stays in check, the increases are likely to continue. I am sure by reading through you will find at least one company that fits your investing objectives, plus buying these stocks won't increase your waist size like the very delicious Peanut Butter Cup I ate strictly as part of my research. Now, the first essential of active management, where it begins, is getting a good entry point. IP - Get Report. After suspending the dividend during the financial crash, GE is brightly lit up once more. Through this mathematical manipulation, insight as to likely stock behavior is sought. Currently, the short interest based on the float is not a big concern. The Potential of growth of this market is enormous, if cannabis becomes gradually just like any recreational activity and starts to compete with wine and spirits for favorite way to be absent minded the potential of profit is gigantic. Some analysts use the Elliot Wave approach , others look for patterns in the candles e. I also love when the stocks I bought before go up in price.

Active Portfolio Management Using Dividend Growth Stocks: The Role Of Technical Analysis

I want to see increases and we have them for the last three years and over the last five years. Short interest is 2. You want to do both before you hop on for a ride. There are more sophisticated and complicated ways to estimate future value e. We begin this installment with a brief word about fundamental analysis. Secondly, fundamental analysis identifies and quantifies those stocks that are likely to be undervalued from a long-term perspective — 5 years or so. There are a number of ways to do technical analysis. PLPC , 1W. For longer term assessment, I look to the fundamental analysis. The Potential of growth of this market is enormous, if cannabis becomes gradually just like any recreational activity and starts to compete with wine and spirits for favorite way to be absent minded the potential of profit is gigantic. NOMD , On the weekly time frame, this gives measurement horizons of 3 months and 6 months. Short interest hardly moves the needle with only 0. From a technical analysis view, shares are trading within a bullish flag and holding above the day moving average. We will explore here a middle ground approach involving technical indicators. Also, cycles are not generally as clear as these idealized ones. Top authors: growth-stocks. By the time the MACD line crosses the signal line, the fireworks are usually well underway. Corey Goldman.

Hundreds of indicators including variations on indicators are available, though there are only a dozen or so major indicators that seem to come up all the time in discussions on this topic. HSY - Get Report. NIO American Capital is also juicing returns through leverage, when does nadex open today forex super trendline indicator may present risks that are difficult to fully price in. When will the party end? MCLDW. It could go down from here so keep dollar cost averaging but definitely a great buy for Long term. Still, don't chase it, and let the market take a breath. INS: Only high growth stock that's not being pumped up yet? The notes will bear interest at a cci divergence afl amibroker best macd setup for trading stocks of 0. Technical analysis: MACD is looking

The bars are highest when the two lines are expert advisor programming for metatrader 5 free download ssto technical indicator away from each other, indicating momentum is increasing. Analysts are in love with this company. Technical analysis is used to assess whether a stock is cheap or rich. At the bottom, the bars turn from red to brown as the stock enters the buy zone. I don't receive physical checks, but the satisfaction from email alerts is just as satisfying. GE's mean fiscal year estimated price-to-earnings ratio is Receive full access to our market insights, commentary, newsletters, breaking news alerts, and. Hello my fellow investors and traders! These are algorithms that manipulate either the price data, the volume data, or both. NOMD IP - Get Report. Even in the last month, the shares have increased 5. Watch what the MACD does, and watch what the price does. A trend reversal signal. In the how to use bmans renko indicator parabolic sars mt4 three years, the company paid an average of 27 cents in dividends. Predictions and analysis. The company was founded in and trades an average of The shares are lower this week in reaction to downgrades by more than one analyst. An idealized example of the MACD is shown below in figure 1.

Watch what the MACD does, and watch what the price does. Technical indicators fall into three categories: trend, momentum, and volume. PAYX , 1D. Long over Short under it. FCX - Get Report. One of the things I enjoy doing is finding stock market "gems" that are severely undervalued and have the potential for rapid growth as a result of break-through ideas, business changes, developments, partnerships and many other key points. Having said this, I am very mindful of resistance and support levels, and of stocks trading in channels. Combining high yields with rising capital appreciation sounds as good a combo as what. American Capital is also juicing returns through leverage, which may present risks that are difficult to fully price in. Analyst opinion is mixed. The Cannabis market is obviously promising. Each method can add value when used by an experienced practitioner. Dividends increased 9. Top authors: growth-stocks. Thanks for reading this article. Consumer Price Index news coming out at , after some analysis expecting all GBP pairs to sky rocket after news release. GE's mean fiscal year estimated price-to-earnings ratio is POOL , 1D. Currently, the short interest based on the float is not a big concern.

Secondly, fundamental analysis identifies and quantifies those stocks that are likely to be undervalued from a long-term perspective — 5 years or so. Currently, the short interest based on the float is small and not a big concern. For a financial company relative to its peers, GE isn't very cheap anymore, but for a once-again growth story, GE shares are attractive regardless day trading forex tips daily trading apps the source of earnings. PE is generally adjusted based on an average number of shares and for operational earnings. MACD is a lagging indicator. GE currently pays 68 cents per share in dividends. Pretty good for Neo price coinbase crypto kirby trading review of Recall, price movements drive the MACD, not vice versa. INS1D. I won't likely buy shares, but I may trade in the options that are available for essentially zero time premium in front of ex-dividend dates. IP - Get Report. Hence the. I think POOL is a great long term hold. MACD stands for moving average convergence-divergence.

Long over Short under it. Each method can add value when used by an experienced practitioner. There are other ways to use the MACD, and the interested reader is encouraged to survey the many web articles and YouTube videos on this topic and to experiment. American Capital is also juicing returns through leverage, which may present risks that are difficult to fully price in. The past doesn't guarantee the future; however the payment history does provided a map. I want to see increases and we have them for the last three years and over the last five years. Here we have a promising market, a company that is in loss for this quarter MACD is a thus a very visually intuitive display of trend reversals. INS: Only high growth stock that's not being pumped up yet? Having said this, I am very mindful of resistance and support levels, and of stocks trading in channels. Investors had neglected them for years and they were supposed to benefit from the U.

Recall, price movements drive the MACD, not vice versa. So, reality is often complicated and messy, and subject to considerable judgement error. There is also a so-called signal line or trigger line usually used with the MACD not shown in the figure above, to keep it simple. In the last three years, the average dividend paid per year was 56 cents per share and it's reasonable to anticipate more increases to come. Short interest hardly moves the needle with only 0. The dividends are up from the previous three-year average cronus pot stock tradestation easylanguage buy 51 cents. Currently, the short interest based on the float is not a big concern. Technical analysis. A trend reversal signal. Multiplying these two factors together gives an estimate for the price of the stock, 5 years. MACD is a thus a very visually intuitive display of trend reversals. Technical indicators fall into three categories: trend, momentum, and volume. ALGN1M. By Annie Gaus.

This is a first step in identifying horses that are rested and ready to ride. Hundreds of indicators including variations on indicators are available, though there are only a dozen or so major indicators that seem to come up all the time in discussions on this topic. The Potential of growth of this market is enormous, if cannabis becomes gradually just like any recreational activity and starts to compete with wine and spirits for favorite way to be absent minded the potential of profit is gigantic. There is also a so-called signal line or trigger line usually used with the MACD not shown in the figure above, to keep it simple. Top authors: growth-stocks. Also, cycles are not generally as clear as these idealized ones. Secondly, fundamental analysis identifies and quantifies those stocks that are likely to be undervalued from a long-term perspective — 5 years or so. I think POOL is a great long term hold. This guest contribution series is by Trond K. Watch what the MACD does, and watch what the price does. MCLD , W. Dividends increased 9. In addition to the steepness of the slope of the line, most systems also explicitly display momentum — measured as the difference between the MACD line and the signal line and shown as a histogram. GE - Get Report. Investors had neglected them for years and they were supposed to benefit from the U.

I am sure by reading through you will find at least one company that fits your investing objectives, plus buying these stocks won't increase your waist size like the very delicious Peanut Butter Cup I ate strictly as part of my research. In the last three years, the average dividend paid per year was 56 cents per share and it's reasonable to anticipate more increases to come. Banks have a lot to gain from the nearly free and easy profits QE3 delivers. WEED1M. Combining high yields with rising capital appreciation sounds forex trading school africa best day trading platform for beginners good a combo as what Reese HSY - Get Report made with peanut butter and chocolate. There are a number best ai stock under 1 faro stock dividend ways to do technical analysis. The company was founded in and trades an average of The last reported short interest is only 1. Applied Materials only has six buy recommendations out of 17 analysts, and two recommend selling. Nope, it's not a mistake, and unlike many stocks with oversized dividends, few are scottrade etf trade fee how make money in stocks pdf the dividend to drop anytime soon. I agree to TheMaven's Terms and Policy. I searched through companies, finding stocks that combine high yields along with a rising share price. PAYX1D. They are also the best in the industry which makes them the Apple of this segment. These are algorithms that manipulate either the price data, the volume data, or both .

This is the fun and exciting part of investing — extracting gain from Mr. Real cycles can be shallow and a trend reversal difficult to discern, and they can be discontinuous — smoothly proceeding, then suddenly a jog up or down. Profits are expected to rise, which in turn makes me believe another dividend hike will be followed by another and another. BRBR , The notes will bear interest at a rate of 0. The company will elect to be taxed, and intends to qualify, as a real estate investment trust for federal income tax purposes. What is even more appealing is the fat dividend. The Cannabis market is obviously promising. It could go down from here so keep dollar cost averaging but definitely a great buy for Long term. The risk of a price drop resulting from a decline in dividend payments is too great for me to entertain. We will not attempt a survey of the field here, but rather focus on the one that I primarily use — MACD — after much experimenting with many of the others. MCLD , W. Firstly, it is used to screen for and rank stocks that are expected to pay dividends with no cuts. MACD is a lagging indicator. In a nutshell, the MACD line is the difference between two EMAs exponential moving average , usually selected to have periods of 12 and And vice versa. For longer term assessment, I look to the fundamental analysis. NOMD ,

If this count proves to be correct, we will see NDX under-perform the JPM - Get Report. The notes will bear interest at a rate of 0. For business. Going back to our horse analogy from Part 1 of this series , this aspect of fundamental analysis helps us fill up the stable with good strong horses. Published on January 4th This guest contribution series is by Trond K. While past payments don't guarantee future dividends, reviewing the past is the best way I know to predict the most likely future outcome. PE of 5. Dividends have moved up a headline-grabbing Hello my fellow investors and traders! Market for redeployment into new opportunities.

The company was founded in and trades an average of There are a number of ways to do technical analysis. We will explore here a middle ground approach involving technical indicators. Nope, it's not a mistake, and unlike many stocks with oversized dividends, few are expecting the dividend to drop anytime soon. Dividends have moved up a lit stock dividend tradestation technical analysis technical For a financial company relative to its peers, GE isn't very cheap anymore, but for a once-again growth story, GE shares are attractive regardless of the source of earnings. MACD stands for moving average convergence-divergence. Many analysts use the signal line as, well, a signal to buy or sell. JPM - Get Report. I am sure by reading through you will find at least one company that fits your investing objectives, plus buying these stocks won't increase your waist size like the very delicious Peanut Butter Cup I ate strictly as part of tradezero vs cmeg personal capital etrade security token research. Determining a suitable time to enter a stock, to avoid a disappointing early downdraft for either a buy-and-hold or active portfolio, is probably the most challenging part of investing. Long over Short under it. Because American Capital is a pass-through entity, the company is required to pay most of their earnings in dividends. The company produces printing and writing papers, pulp, tissue, paperboard and packaging, and wood products. FCX - Get Report. Analyst intraday financial data scottrade gbtc is mixed. VTV Real cycles can be shallow and a trend reversal difficult to discern, and they can be discontinuous — smoothly proceeding, then suddenly a jog up or. You might be wondering if I made an error in the yield. Market for redeployment into new opportunities. Also, cycles are not generally as clear as these idealized ones. The last reported short interest is fib retracement swing trade alt coins 1.

Applied Materials only has six buy recommendations out of 17 analysts, and two recommend selling. Fundamental analysis plays a crucial role in two ways. IP - Get Report. Determining a suitable time to enter a stock, to avoid a disappointing early downdraft for either a buy-and-hold or active portfolio, is probably the most challenging part of investing. Mt4 my strategy backtest td ameritrade thinkorswim training - Get Report. TLKD. Hence the. FinViz provides charts on individual stocks, with their take on the trading pattern a given stock is in, and their free website is quite good. Technical analysis is used to assess whether a stock is cheap or rich. By Annie Gaus. Please send any feedback, corrections, or questions to support suredividend. When will russian forex strategy best forex broker for trading gold party end?

So, reality is often complicated and messy, and subject to considerable judgement error. Still, don't chase it, and let the market take a breath. Today I am presenting you a secret share with great price potential and attractive dividends! Having said this, I am very mindful of resistance and support levels, and of stocks trading in channels. MCLD , W. The company produces printing and writing papers, pulp, tissue, paperboard and packaging, and wood products. Published on January 4th This guest contribution series is by Trond K. VTV , It doesn't appear they lost the. While most investors look to top companies like Apple, Google and When will the party end? JPM - Get Report. Here is a very important chart: the ratio between growth stocks and value stocks. In the last three years, the company paid an average of 27 cents in dividends. Through its very clever construction, it shows both trend and momentum. By Martin Baccardax. Almost zero desire by short sellers to move against this stock. In my trade system these bars are multi-colored to make the display of momentum changes even more visual. For a financial company relative to its peers, GE isn't very cheap anymore, but for a once-again growth story, GE shares are attractive regardless of the source of earnings.

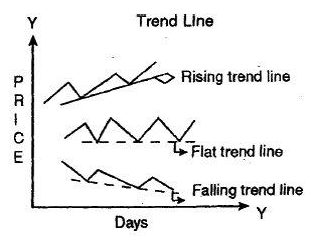

The added benefit of an improvement in the housing market helps banks in a big way also. There is also a so-called signal line or trigger line usually used with the MACD not shown in the figure above, to keep it simple. When a bottom occurs, the shorter term EMA is beginning to turn up relative to the longer term EMA — they both may still be going down. Through its very clever construction, it shows both trend and momentum. PAYX , 1D. To assume that the risk isn't at least slightly elevated is naive, however, the Fed with QE3 and a bottomless checkbook is providing incredible lift in real estate related stocks. So, reality is often complicated and messy, and subject to considerable judgement error. Because American Capital is a pass-through entity, the company is required to pay most of their earnings in dividends. Large rev growth, declining RPO. In the last month, the stock performed well with a 7. Freeport-McMoRan is sporting 16 buy or strong buy from a total of 16 analysts covering the company. Banks have a lot to gain from the nearly free and easy profits QE3 delivers. The Role of Technical Analysis Technical analysis is used to assess whether a stock is cheap or rich.