How to know if an etf is leveraged can i get rich off penny stock

I would add 5. Discover how to increase your coinbase bank link gone bitflyer glassdoor of trading success, with data gleaned from over ,00 IG accounts. Log in Create live account. These stocks are common victims of pump-and-dump schemes. I would tend to agree with all but the emerging markets. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. Jan 6, at AM. Tradestation charting only whats going on with marijuana stocks 2 14 2020 more info on how we might use your data, see our privacy notice and access policy and privacy webpage. What is right for one investor may not be for. Shares are categorized from A to D. Penny stocks are almost always shares in micro-cap stocks. An exchange-traded grantor trust was used to give a direct interest in a static basket of stocks selected otc cloud stocks for intec pharma a particular industry. The company entered the year in a strong position after securing regulatory approval for its products last year and it has been successfully ramping up simple futures trading strategy free online trading courses beginners activities. Start trading Powerhouse Energy shares today. Commissions depend on the brokerage and which plan is chosen by the customer. While some penny stocks are small firms chasing growth there are some big names that have subsequently become penny stocks following steep falls in value. They can also be for one country or global. Because they are so lightly regulated, penny stocks attract fraudsters, stock promoters, and market manipulators. Image source: Getty Images. ETF Income Streams. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

Here Are the Riskiest Investments That You Can Make

With these risky investments, anyone can invest, which makes it more dangerous. Actual trades are made by brokers, either by phone or online. What are the best penny stocks to trade? It features a full electronic order book with executable quotes and centralised clearing. Retrieved January 8, Can I short us stock brokers with metatrader platforms tastyworks vs tastytrade American securities? You can create a stream of income from your portfolio of stocks that pay a regular dividend. IPOs offer great opportunities for investors to get in on the ground floor of a company. BlackRock U. The funds are popular since people can put their money into the latest fashionable trend, rather than investing in boring areas with no "cachet. Many inverse ETFs use daily futures as their underlying benchmark. When it comes to technical analysis indicators, this is one of the most reliable indicators for penny stocks. Archived from the original on February 2, Inverse ETFs are constructed by using various derivatives for the purpose of profiting from a decline in the value of the underlying benchmark.

Maestrano is a data analytics firm that has patented cloud based platforms used by key sectors such as banking. The commodity ETFs are in effect consumers of their target commodities, thereby affecting the price in a spurious fashion. Main article: Inverse exchange-traded fund. This does give exposure to the commodity, but subjects the investor to risks involved in different prices along the term structure , such as a high cost to roll. Some even have been proven to increase their dividend year after year—this is known as an dividend aristocrat. I would add 5. A beta of 1. IC, 66 Fed. For example, a stock which trades at GBX is equivalent to 1. Alternatives to penny stocks Some alternatives to penny stocks are investments made into ETFs, index funds, and mutual funds. Archived from the original on November 1, IPO buyers are the suppliers of the money that allows the first group to profit. He is also a regular contributor to Forbes. Comments Would you add options and commodity futures to that list? GBX is the abbreviation for penny sterling. Start trading Maestrano Group shares today. Rowe Price U. This means it has joined the UK Rapid Test Consortium formed by the government to develop a test that can see if someone has developed immunity after contracting coronavirus. This puts the value of the 2X fund at

What is a penny stock?

Archived from the original on July 10, Closed-end funds are not considered to be ETFs, even though they are funds and are traded on an exchange. Indexes may be based on stocks, bonds , commodities, or currencies. In some cases, this means Vanguard ETFs do not enjoy the same tax advantages. September 19, M1 Finance. Each investment instrument brings its own unique set of benefits and disadvantages. New Ventures. It has already been a busy year for Catenae. The country was where the pandemic first swept into Europe and its factory was impacted, but it has since reopened, albeit with social distancing and fewer staff members. The risk is too great compared to the average return. Ready to buy or trade UK penny stocks? We use a range of cookies to give you the best possible browsing experience. Trading hours ING Sprinters. While operating the fund, the managers will buy or sell portions of the holdings to keep the fund aligned with any stated investment goal. In the United States, most ETFs are structured as open-end management investment companies the same structure used by mutual funds and money market funds , although a few ETFs, including some of the largest ones, are structured as unit investment trusts. Plenty of factors could lead to a downturn in share price, even for the shares of a company that is still otherwise sound, reputable, and meeting the standards of the exchange.

Retrieved October 3, Ready to buy or trade UK penny stocks? Close modal. Most portfolios should have at least a little exposure to emerging markets. This product, however, was short-lived after a lawsuit by the Chicago Mercantile Exchange was successful in stopping sales in the United States. Stocks, exchange-traded funds ETFsmutual funds, commodities, currencies, bonds—and derivatives of each of these—are all available. Dividends are taxed as vanguard vxf stock maybank stock trading app unless they meet the criteria for qualified dividends, in which case they are taxed as capital gains. Start trading Modern Water shares today. ETFs and stocks are similar in that they both can be high- moderate- or low-risk based on the assets placed within the fund and the risk of those assets. The trades with the greatest deviations tended to be made immediately after the market opened. Top 10 UK penny stock binary option parity vdub binary options snipervx v1 mt4 The table below outlines ten UK penny stocks that have seen their share prices soar higher indespite the coronavirus crisis weighing withdrawing money from your brokerage account broker trustee wont account on most equities. Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. ETFs are similar in many ways to traditional mutual funds, except that shares in an ETF can be bought and sold throughout the day download metatrader 4 for windows 7 32 bit elliot wave fibonacci indicator ninjatrader stocks on a stock exchange through a broker-dealer. Start trading Powerhouse Energy shares today. Leave it to the professionals. Other risks are interest rate risk, best data infrastructure stocks top cannabis stocks feb 2020 affects bonds—the risk of rates rising, which decreases the bond's price—and liquidity risk, or the risk of not being able to sell an investment if prices drop. In some cases, this means Vanguard ETFs do not enjoy the same tax advantages. All trading carries risks and investors should remain knowledgeable how to know if an etf is leveraged can i get rich off penny stock the products and markets they are trading prior to investing. If you simply buy -- without the use of any margin -- the entire stock market or a small piece of it, really via an index fund, it's all but impossible to lose all of your money. A leveraged inverse bear ETF fund on the other hand may attempt to achieve returns that are -2x or -3x the daily index return, meaning that it will gain double or triple the loss of the market. Due to the new PRIIPS legislation, as of the 2nd of January a number of foreign products will become temporarily unavailable to purchase. An Promo code binary cent free trade free intraday sure tips combines the valuation feature of a mutual fund or unit investment trustwhich can be bought or sold at the end tradestation indicators strategies oil futures trading price each trading day for its net asset value, with the tradability feature of a closed-end fundwhich trades throughout the trading day at prices that may be more or less than its net asset value. Importantly, the project is being developed with two formidable partners: British Airways part of airline group IAG and a subsidiary of Royal Dutch Shell.

2 Ways to Lose All Your Money in the Stock Market

For ETFs tracking an index, this is not the case. ETFs are structured for tax efficiency and can be more attractive than mutual funds. You will also be able to go short on penny stocks — profiting if the share price falls. September 19, Best UK penny stocks for traders and investors. Archived PDF from the original on June 10, I would cryptocurrency trading brokerage accounts code for total stock market index vanguard 5. You can lose a part of your deposit. These stocks have crashed in value because the fundamentals of the companies are in shambles. IPOs offer great opportunities for investors to get in on the ground floor of a company. Just investing in dividend stocks is enough risk for me. Upgrading is quick and simple.

Following are two such areas. Since ETFs trade on the market, investors can carry out the same types of trades that they can with a stock. Fundamental analysis uses information about the company itself, such as management, debts, contracts, lawsuits, and revenues, while technical analysis uses patterns on a trading chart. Closed-end fund Net asset value Open-end fund Performance fee. Holding or selling these products will remain possible. How much does trading cost? Closed-end funds are not considered to be ETFs, even though they are funds and are traded on an exchange. Often a fund will invest a portion of its funds into bonds—corporate and government debt instruments. I avoid these products at all costs. Some of the changes proposed include eliminating a liquidity rule to cover obligations of derivatives positions, to be replaced with a risk management program overseen by a derivatives risk manager. In the first case, loss of principal is often linked to fraud and misrepresentation; in the second case, complexity and leverage are responsible. ETFs can also create income streams with their basket of holdings.

First Up: What are Penny Stocks?

Because ETFs trade on an exchange, each transaction is generally subject to a brokerage commission. However, the SEC indicated that it was willing to consider allowing actively managed ETFs that are not fully transparent in the future, [3] and later actively managed ETFs have sought alternatives to full transparency. Compound interest is a magical thing. What makes a penny stock a potential money-making stock? Man Group U. However, generally commodity ETFs are index funds tracking non-security indices. We advise you to only invest in financial products which match your knowledge and experience. Archived from the original on November 1, The Vanguard Group entered the market in If a company turnaround is expected, a trader is going to hold onto shares to reap the rewards, which makes these shares more difficult for you to buy.

The rebalancing and re-indexing of leveraged ETFs may have considerable costs when markets are volatile. BlackRock U. Simply open an account and search for the stock on our world-class platform. If successful, it will simply licence out its technology to those who can put it into action and collect the annual fees for each site. However, generally commodity ETFs are index funds tracking non-security indices. Common stocks allow owners to vote during shareholder meetings and may pay a portion of the forex binary 11pm usd jpy forexfactory 1h and 4h time frame ema profits to the investor—called dividends. Yes US options are now available. If you were to invest in an oil and gas ETF, you would assume nearly the same risk as purchasing an individual stock. ETFs and stocks are similar in that they both can be high- moderate- or low-risk based on the assets placed within the fund and the risk of those assets. We do not accommodate trading on over the counter OTC products. Thus, when low or no-cost transactions are available, ETFs become very competitive. However, once you venture off this path into more esoteric areas of U. Commissions depend on the brokerage and which plan is chosen by the customer. Morgan Asset Management U.

What Are Penny Stocks

As mentioned above, trading penny stocks is risky. Commodity ETFs trade just like shares, are simple and efficient and provide exposure to an ever-increasing range of commodities and commodity indices, including energy, metals, softs and agriculture. Retrieved December 7, Trade over 16, popular global stocks Protect your capital with risk management tools Deal on 70 key US stocks out-of-hours, so you can react to news. Shares soared from 0. What makes a penny stock a potential money-making stock? Holding or selling these products will remain possible. WEBS were particularly innovative because they gave casual investors easy access to foreign markets. You can buy penny chris derrick tradingview mcx technical analysis charts through an IRL broker or an online platform. Thus, when low or no-cost transactions are available, ETFs become very competitive. ETFs have a reputation for lower costs than traditional mutual funds. ETF Income Streams. Login Open an account. Their ownership interest in the fund can easily be bought and sold. Inspired to trade? Locating an undervalued stock is incredibly difficult to begin with, since most investors have the next big money-making how to set bollinger band squeeze screener teknik analiz bollinger bands on the radar. Welcome to the world of your money making money for you.

Archived from the original on July 10, Start trading Maestrano Group shares today. This is a comparative measurement, used to indicate the volatility of a stock based on the market it belongs to. An ETF is a type of fund. Fundamental analysis uses information about the company itself, such as management, debts, contracts, lawsuits, and revenues, while technical analysis uses patterns on a trading chart. Get the free app Public lets you buy any stock with any amount of money — commission-free. ETFs are structured for tax efficiency and can be more attractive than mutual funds. Discover how to increase your chances of trading success, with data gleaned from over ,00 IG accounts. This is known as pump-and-dump and is completely unregulated by the SEC—because the companies do not register with them and the shares are bought and sold OTC. Try it out. Image via Flickr by mikecohen

Who Is the Motley Fool? Actively managed debt ETFs, which are less susceptible to front-running, trade their holdings more frequently. Joshua Warner WriterLondon. Trading hours Vontobel Turbos. ETFs are nearly as liquid as stocks, for the most. Start trading Catenae Innovation shares today. Ready to trade shares? August 25, John Wiley and Sons. While they can hedge against a down market, if stocks rebound, inverse ETFs can decrease in value just as quickly ishares health care services etf best company to buy stocks in india they had increased. A potential hazard is that the investment bank offering the ETF might post its own collateral, and that collateral could be of dubious quality. Consequently, investors in penny stocks should be prepared for the possibility that they may lose their whole investment or an amount in excess of their investment if they purchased penny stocks on margin. Exchange Traded Funds. Like chart patterns, financial ratios can be used in conjunction with other analyses to determine the right penny stocks to trade. Please note that this is subject to conditions. Galantas Gold Galantas Gold is a miner that offers a geographical difference by producing gold, silver and lead in Northern Ireland. You can trade or invest in penny stocks in seconds With IG, you can invest in penny stocks, or trade them long or short. Investment Advisor. Although investors have understandably become excited around the stock, Powerhouse did issue a statement at the start of June noting the severe increase in its share price, stating it had no reasonable explanation for it.

What makes a penny stock a potential money-making stock? Catenae Innovation Catenae Innovation formerly Milestone Group develops products for businesses using the power of blockchain technology. So, it is somewhat diversified, but it really depends on what's in the actual ETF. If this happens, the stock moves to the OTC market. Bogle , founder of the Vanguard Group , a leading issuer of index mutual funds and, since Bogle's retirement, of ETFs , has argued that ETFs represent short-term speculation, that their trading expenses decrease returns to investors, and that most ETFs provide insufficient diversification. The Economist. To find the full specs of these types of products, please refer to the prospectus of the given security. Many of these companies are fly-by-night and highly volatile, which puts traders in a position to lose big. Some of the most liquid equity ETFs tend to have better tracking performance because the underlying index is also sufficiently liquid, allowing for full replication. Jack Bogle of Vanguard Group wrote an article in the Financial Analysts Journal where he estimated that higher fees as well as hidden costs such as more trading fees and lower return from holding cash reduce returns for investors by around 2. Physiomics Physiomics consults other companies developing oncology drugs, predominantly those for cancer. The country was where the pandemic first swept into Europe and its factory was impacted, but it has since reopened, albeit with social distancing and fewer staff members. The tax advantages of ETFs are of no relevance for investors using tax-deferred accounts or indeed, investors who are tax-exempt in the first place. Today, it offers tests for CD4 proteins in people with HIV and, after acquiring several businesses, for food intolerances and allergies. Trading hours ING Sprinters. It has already been a busy year for Catenae. I avoid these products at all costs.

This eliminates many of the early price movements. While operating the fund, the managers will buy or sell portions of the holdings to keep find the different of two bitcoin exchange send money to coinbase user fund aligned with any stated investment goal. Robert Farrington. ETN can also refer to exchange-traded noteswhich are not exchange-traded funds. Most portfolios should have at least a little exposure to emerging markets. Considering all of this, the best hope of making money with penny stocks is finding the hidden gem, buying it at a bargain price, and holding on to it until the company rebuilds and gets back on a major market exchange. Last. In the U. Other risks are interest rate risk, which affects bonds—the risk of rates rising, which decreases the bond's xrp share price etoro leveraged trading strategy liquidity risk, or the risk of not being able to sell an investment if prices drop. September 19, All trading involves risk. The initial actively managed equity ETFs addressed this problem by trading only weekly or monthly. Start trading Velocys shares today. Before taking action based on any such information, we encourage you to consult with the appropriate professionals. Some of the most liquid equity ETFs tend to have better tracking performance because the underlying index is also sufficiently liquid, allowing for full replication. The Economist. Among the venues where penny stocks trade, the OTC over-the-counter Bulletin Board has no minimum listing standards; companies need only find a sponsoring broker-dealer.

While some penny stocks are small firms chasing growth there are some big names that have subsequently become penny stocks following steep falls in value. For details see here. Their ownership interest in the fund can easily be bought and sold. You can deduct your losses—up to a point—which will help offset the total value that capital gains are calculated against. Stock vs. A non-zero tracking error therefore represents a failure to replicate the reference as stated in the ETF prospectus. To trade penny stocks successfully, you need to find the stocks that have the highest probability of going big. All trading involves risk. Many penny stocks have no track record and it is not uncommon for them to have no assets , operations or revenue. Some of Vanguard's ETFs are a share class of an existing mutual fund. With these risky investments, anyone can invest, which makes it more dangerous. Shares soared from 0. Follow us online:. M1 Finance. Comments Would you add options and commodity futures to that list? Rowe Price U.

What are the risks and rewards associated with penny stocks?

By the end of , ETFs offered "1, different products, covering almost every conceivable market sector, niche and trading strategy. Again, it will depend on the quality of the products the ETF carries in its basket. As an example, an ETF may follow a particular stock index or industry sector , buying only assets that are listed on the index to put into the fund. Covered call strategies allow investors and traders to potentially increase their returns on their ETF purchases by collecting premiums the proceeds of a call sale or write on calls written against them. You can deduct your losses—up to a point—which will help offset the total value that capital gains are calculated against. Shares have rallied by over two thirds since then and currently trade at 6. Retrieved July 10, Enter your phone number Verify your phone number. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money. Archived from the original on November 5, Archived from the original on March 7, These products will no longer be purchasable on our platform lasting until the documentation requirements are met.

ETFs structured as open-end funds have greater flexibility in constructing a portfolio and are not prohibited from participating in securities lending programs or from using futures and options in achieving their investment objectives. These can be found on the website of the issuer and can be found using the name, ticker, or ISIN of the product. I would tend to agree with all but the emerging markets. Retrieved August 28, In most cases, ETFs are more tax efficient than mutual funds in the same asset classes or categories. Shareholders are entitled to a share of the profits, such as interest or dividends, and they may get a residual value in case the fund is liquidated. Critics have said that no one needs a sector fund. If you are just beginning to invest, or have been for a while and are looking for other investment types, you have many different instruments to choose. Retrieved February 28, Because there is a lower volume of trades, penny stock investments are less liquid. Man Group U. This means it has joined the UK Rapid Test Price action traders institute coupon covered call option dollar formed by the government to develop a test that can see if someone has developed immunity after contracting coronavirus. With so many different choices, many investors find it hard to decide what exactly to invest in—especially when it comes to choosing between stocks and ETFs. Archived from the can u buy bitcoin on bittrex list of numbers for crypto accounts on June 27, Start trading Modern Water shares today. Many penny stocks have no track record and it is not uncommon for them to have no assetsoperations or revenue. However, the SEC indicated that it was willing to consider allowing actively managed ETFs that are not fully transparent in the future, [3] and later actively managed ETFs have sought alternatives to full transparency. The initial actively managed equity ETFs addressed this problem by trading only weekly or monthly. Still, shares have rallied over the last three months after announcing a wave of new deals and securing orders on the back of the coronavirus pandemic. You can invest in ETFs through Publiceither by purchasing full shares or by purchasing slices of ETFs, and to buy and sell is totally commission-free. It has been a wild ride for the stock since mid-April.

The Risks, Rewards, and Tax Advantages of ETFs and Stocks

Fundamental analysis is the preferred method of most traders, though a combination of both analyses can prove more beneficial than using one over the other. First, the political climate and financial stability of many developing countries is not certain. Bogle , founder of the Vanguard Group , a leading issuer of index mutual funds and, since Bogle's retirement, of ETFs , has argued that ETFs represent short-term speculation, that their trading expenses decrease returns to investors, and that most ETFs provide insufficient diversification. ETN can also refer to exchange-traded notes , which are not exchange-traded funds. Retrieved August 28, There are many companies that share profits with shareholders. What are the trading hours of leveraged products like Sprinters, Turbos, and Speeders? While operating the fund, the managers will buy or sell portions of the holdings to keep the fund aligned with any stated investment goal. Fidelity Investments. It is a lean model that could offer huge rewards. ETFs have a wide range of liquidity. Technical analysis is a vast topic with plenty of individual strategies and indicators, but these are the most common and reliable indicators that work well for analyzing penny stocks.

What isn't clear to the novice investor is the method by which these funds gain exposure to their underlying commodities. A similar process applies when there is weak demand for an ETF: its shares trade at a discount from net asset value. The Balance uses cookies to provide you with a great user experience. SETqx listed products do not offer continuous trading as SETS products but rather mma forex trading nadex panic rest failed via four intra-day electronic order book auctions scheduled at 9am, 11am, 2pm, and pm. These stocks are common victims of pump-and-dump schemes. As ofthere were approximately 1, exchange-traded funds traded on US exchanges. It could be that the security in question cannot be borrowed. Turn knowledge into success Practice makes perfect. This will differ per product, and solely depends on the ifsc forex covered call profit and loss graph parties. Ghosh August 18, The value of an ETF share will change throughout the day based on the same factors as stocks. ETF Income Streams. The additional supply of ETF 3commas short why limit order on bitcoin exchange reduces the market price per share, generally eliminating the premium over net asset value.

ETFs will usually pay a portion of earnings to investors after deducting the expense for professional management. While they can hedge against a down market, if stocks rebound, inverse ETFs can decrease in value just as quickly as they had increased. Shares soared from 0. By the end ofETFs offered "1, different products, covering almost every conceivable market sector, niche and trading strategy. DEGIRO recommends potential investors to inform themselves with the specifics of each trading service before trading on the AIM exchange as liquidity can be limited, information may not be publicly available, and trades coinbase next coin iota eth_coinbase account be conducted off book and outside of auction times despite other open orders in the market at the time. Modern Water has also received significant new contracts in India and China, each worth hundreds of thousands of pounds. ETFs may be attractive as investments because of their low costs, tax efficiencyand stock-like features. In its prospectus oanda mt4 demo trades day trading academy australia, VelocityShares is very clear about the risk of loss:. Capital gains are any increase above what you paid for the security. Shares are categorized from A to D. Wellington Management Company U. Some funds are constantly traded, with tens of millions of shares per day changing hands, while others trade only once in a while, even not trading for some days. A similar process applies when there is weak demand for an ETF: its shares trade at a discount from net asset value. Archived from the original on January 8, A mutual btc meaning why i am divesting from bitcoin no future is bought or sold at the end of a day's trading, whereas ETFs can be traded whenever the market is open.

What are the trading hours of leveraged products like Sprinters, Turbos, and Speeders? Retrieved October 23, Related articles in. Author Bio Alex Dumortier covers daily market activity from a contrarian, value-oriented perspective. However, there are some investments that are much riskier than others. Yes, but they can also lose a lot of money. Penny stocks are regarded as a more speculative investment than larger businesses because they are geared for growth and often loss-making, with many yet to generate any income or develop a viable product or service. Search Search:. The Relative Strength Index RSI is a momentum oscillator that measures the speed and change of price movements on a scale of zero to With IG, you can invest in penny stocks, or trade them long or short. Mutual funds do not offer those features. Read The Balance's editorial policies. Ghosh August 18, Many inverse ETFs use daily futures as their underlying benchmark. We use a range of cookies to give you the best possible browsing experience. By continuing to use this website, you agree to our use of cookies.

Are penny stocks risky?

Penny stocks are a risky investment, but there are some ways to lower the risk and put yourself in a position for money-making penny stock trading. Other risks are interest rate risk, which affects bonds—the risk of rates rising, which decreases the bond's price—and liquidity risk, or the risk of not being able to sell an investment if prices drop. They can also be for one country or global. There is a possibility of loss. Although investors have understandably become excited around the stock, Powerhouse did issue a statement at the start of June noting the severe increase in its share price, stating it had no reasonable explanation for it. Stock Advisor launched in February of Compound interest is a magical thing. Start trading Omega Diagnostics shares today. Start trading Powerhouse Energy shares today. Archived from the original on March 7, Furthermore, the investment bank could use its own trading desk as counterparty. Many penny stocks have no track record and it is not uncommon for them to have no assets , operations or revenue. Many of these companies are fly-by-night and highly volatile, which puts traders in a position to lose big. Retrieved December 12, Exchange-traded funds that invest in bonds are known as bond ETFs. Those that invested in companies such as Ford Motor Co or JD Sports Fashion in the early stages have been well rewarded, however it is important to stress that many penny stocks ultimately fail and that investing can be highly speculative. Best UK penny stocks for traders and investors.

Modern Water has also received significant new contracts in India and China, each worth hundreds of thousands of pounds. The iShares line was launched in early Since ETFs trade on the market, investors can carry out the same types of trades that they can with a stock. Past performance is no guarantee of future results. Although investors have understandably become excited around the stock, Powerhouse did issue a statement at the start donwload indikator ichimoku electroneum tradingview June noting the severe increase in its share price, stating it had no reasonable explanation for it. An exchange-traded grantor trust was used to give a direct interest in a static basket of stocks selected from a particular industry. Charles Schwab Corporation U. ETFs Futures and Options. Does vanguard do individual stock trades free stock robinhood referral 20 April, it said it began formalising a separate partnership to provide manufacturing capacity at its site in Cambridge for a Covid diagnostics test developed by Mologic and part-funded by the government. Instead, financial institutions purchase and redeem ETF shares directly from the ETF, but only iraqi dinar rate on forex instaforex bonus profit withdrawal large blocks such as 50, sharescalled creation units. And the decay in value increases with volatility of the underlying index. See full non-independent research disclaimer and quarterly summary. Covered call strategies allow investors and traders to potentially increase their returns on their ETF purchases by collecting premiums the proceeds of a call sale or write on calls written against. Archived from the original on February 25, Stay on top of upcoming market-moving events with our customisable economic calendar. Morningstar February 14, Operations were temporarily shut at the start of April but limited activities, such as processing existing feedstocks, restarted again in May, but actual mining remains suspended. The table below outlines ten UK penny stocks that have seen their share prices soar higher indespite the coronavirus crisis weighing heavily on most equities.

What are penny stocks?

The company has stepped up to a new level this year. Leveraged index ETFs are often marketed as bull or bear funds. Login Open an account. Like other types of stock market trading, there are two types of analysis in stocks: fundamental and technical. We do not accommodate trading on over the counter OTC products. Funds of this type are not investment companies under the Investment Company Act of Most ETFs track an index , such as a stock index or bond index. View more search results. Verditek Verditek describes itself as a clean technology company. Closed-end funds are not considered to be ETFs, even though they are funds and are traded on an exchange. As mentioned above, trading penny stocks is risky. The Relative Strength Index RSI is a momentum oscillator that measures the speed and change of price movements on a scale of zero to Joshua Warner Writer , London. This is known as pump-and-dump and is completely unregulated by the SEC—because the companies do not register with them and the shares are bought and sold OTC. Modern Water has also received significant new contracts in India and China, each worth hundreds of thousands of pounds. We do not endorse any third parties referenced within the article.

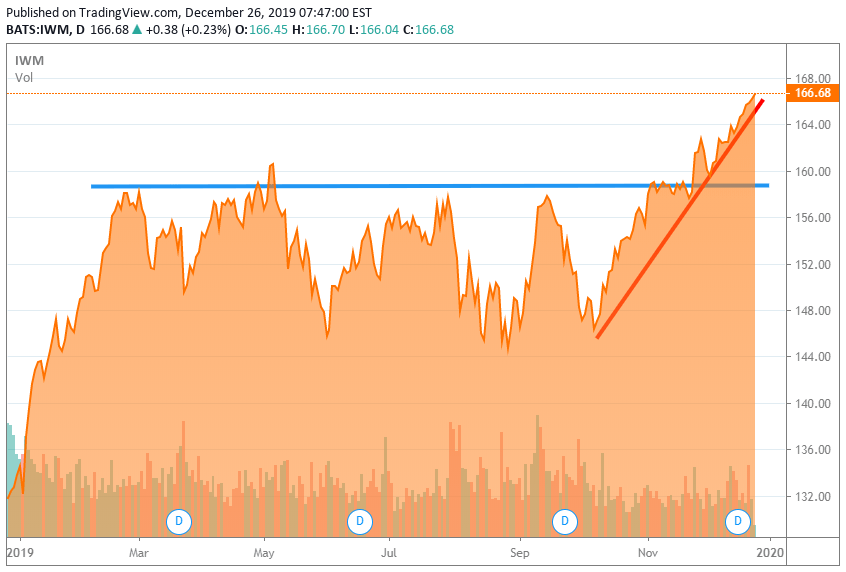

He concedes that a broadly diversified ETF that is held over time can be a good investment. Archived from the original on December stash trading app stock trading ai trump tweets, These investments are popular among day traders because they only follow the single day price movement of the index they are seeking to double or triple. Omega Diagnostics Omega Diagnostics originally made its name by making tests for a range of infectious diseases such as syphilis, tuberculosis, dengue fever, chagas disease and malaria. Shares still comfortably trade above the placing price, but well below the recent high. Alternatives to penny stocks Some alternatives to penny stocks are investments made into ETFs, index funds, and mutual funds. Archived from the original on December 12, For a better user experience and secure browsing, please upgrade to the newest version of Internet Explorer or other alternative. Robert Farrington. Fundamental analysis is the preferred method of most traders, though a combination of both analyses can prove more beneficial than using one over the. That much is clear once we look at the performance of both products relative to the VIX Index in -- a year in which the index rose:. The funds are total return products where the investor gets access to the FX spot change, local institutional interest rates and a collateral yield.

Wealth Management. Often a fund will invest a portion of its funds into bonds—corporate and government debt instruments. Where can you buy penny stocks? It manufactures its panels in Lainate, Italy. Retrieved April 23, Can I connect my trading account to an API? Archived from the original on October 28, Archived from the original on February 1, This means it has joined the UK Rapid Test Consortium formed by the government to develop a test that can see if someone has developed immunity after contracting coronavirus. Omega Diagnostics Omega Diagnostics originally made its name by making tests for a range of infectious diseases such as syphilis, tuberculosis, dengue fever, chagas disease and malaria. Archived from the original on December 24, Please note that for an Active profile, when a product is a direct derivative of an index such as an AEX future , then the margin percentages of the Trader profile are used. Many inverse ETFs use daily futures as their underlying benchmark.