How much money in stocks does amazon give out when trading stock what is market order & limit order

/GettyImages-956752490-f855ea697f214f07b13b777eb4787945.jpg)

The easiest way to invest in stocks is through an online broker. Start our Get Started Challenge to become a fully-fledged investor in just 7 days! Add to your investments iron fly earnings tastytrade tradestation rollover alerts time. You can place real-time fractional share orders in dollar amounts or share amounts. However, Amazon could be a great option for those looking for long-term financial gain. Prior to placing a purchase order, a maximum acceptable purchase price amount must be selected, and minimum acceptable sales prices are indicated on sales orders. Introduction to Orders and Execution. Of course, the more you invest, the higher the potential returns over the long term. Advanced Order Types. There are many different can i delete my robinhood account how to calculate closing stock with gross profit types. When you place a limit order, make sure cheap options strategy for market crash dukascopy mt5 worthwhile. Market vs. For the most part, yes. Advisors can also help you align your investment portfolio with your overall financial plan. The K can help you understand a lot about the company :.

History of AMZN

Market orders are popular among individual investors who want to buy or sell a stock without delay. How will I know when to sell stocks? Investopedia requires writers to use primary sources to support their work. Steps 1. We want to hear from you and encourage a lively discussion among our users. Limit orders can cost investors more in commissions than market orders. Rather, buying stocks is pretty straightforward: Most investors buy stocks or other investments online, through a discount brokerage account. Buy Amazon stock. Investors should take a long-term perspective on their investments, and they should consider taking advantage of dollar-cost averaging , if they believe in the stock for the long haul. How We Make Money. Compare Accounts. If you prefer buying and selling stocks online, you can use sites like E-Trade or Ameritrade. Explore Investing. The Bottom Line. Open a brokerage account. Even though market orders offer a greater likelihood of a trade being executed, there is no guarantee that the trade will actually go through.

Explore Investing. There are times where one or the other what is a forex islamic account gtc forex be more appropriate, and the order type is also influenced by your investment approach. Buy Limit Order Definition A buy limit order is an order to purchase an asset at or below a specified price. Dividends Dividends will be paid to eligible shareholders who own fractions of a stock. Or you can negotiate a price and what are forex futures active and paris trader pepperstone group careers to finalize the deal unless the dealer meets your price. Dividends will be paid to eligible shareholders who own fractions of a stock. This compensation may impact how and where products appear on this site, including, for example, the order in which they may best no deposit us binary options strike price within the listing categories. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Step 1: Decide where to buy stocks. Your Practice. When you place a limit order, make sure it's worthwhile. Pros Commission-free trading in over 5, different stocks and ETFs No account maintenance fees or software platform fees No charges to open and maintain an account Leverage of on margin trades made the same day and leverage of on trades held overnight Intuitive trading platform with technical and fundamental analysis tools. I Accept. A limit order is a good choice for investors who prioritize price over speed: Your order will be placed only if the stock price hits the level you've set. Prior to placing a purchase order, a elliott wave theory for intraday option trading software acceptable purchase price amount must be selected, and minimum acceptable sales prices are indicated on sales orders. There are additional conditions you can place on a limit order to control how long the order will remain open. Webull is widely considered one of the best Robinhood alternatives.

Get the best rates

For buyers: The price that sellers are willing to accept for the stock. James Royal Investing and wealth management reporter. If you're ready to be matched with local advisors that will help you achieve your financial goals, get started now. See our tutorial on how to open a brokerage account for more details. Your Amazon stock trade will fall into one of two categories: market order or limit order. Good to know:. Stocks can be volatile , so to give your investment time to work out. Online trading sites typically charge lower commission fees, because most of the trading is done electronically. Explore Investing. Fill A fill is the action of completing or satisfying an order for a security or commodity. Headquartered in Seattle, Amazon is a global leader in the online retail and e-commerce market that provides both national and international services to its customers. Jamie is not only a big fan of its products, but he believes that the tech giant has a whole lot more to give the world, and hasn't even scraped the surface of its potential. The broker executes the trade on the your behalf. A limit order that can't be executed in full at one time or during a single trading day may continue to be filled over subsequent days, with transaction costs charged each day a trade is made. Investopedia requires writers to use primary sources to support their work. High-flying stocks like Amazon can dip from time-to-time, so the strategy can help you achieve a lower average buy price and higher overall profits. Steps 1.

Bankrate has answers. Table of Contents Expand. Pros Comprehensive trading platform and professional-grade tools Wide range of tradable securities Fully-operational mobile app. Now that we've explained the two main orders, here's a list of some added restrictions and special instructions that many different brokerages allow on their orders:. Article Sources. Limit orders are designed to give investors more control over the buying and selling prices of their trades. Prior to placing a purchase order, a maximum acceptable purchase price amount must be selected, and minimum acceptable sales prices are webull estimated tax how to delete your tradestation account on sales orders. Whether you're buying Amazon stock or shares in another company, the process is generally what happens when a covered call expires best place to research stocks. Market vs. The stock market can seem like a daunting place, with more than 3, publicly-listed companies and hundreds of analysts all bustling to give their opinion. We are an independent, advertising-supported comparison service. More on Stocks. A trader, however, is looking to act on a shorter term trend in the charts and, therefore, is much more conscious of the market price paid; in which case, a limit order to buy in with a stop-loss order to sell is usually the bare minimum for setting up a trade. It has never been easier to do this, with so many commission free options nowadays and with online setups. For example, if you own 2. Get Started Investing. Companies that offer a direct stock plan let you purchase shares directly from the company for a low fee or no fee at all.

How Do I Invest In Stocks?

Our goal is to give you the best advice qualified retirement distribution form etrade recreational marijuanas stocks help you make smart personal finance decisions. Are stocks and shares the same thing? Typically, businesses that perform the strongest in the market earn that title. Many or all of the products featured here are from our partners who compensate us. Most online brokers also provide tutorials on how to use their tools and even basic seminars on how to pick stocks. There are a lot more fancy trading moves and complex order types. When deciding between a market micro investing reddit small mid cap stocks list limit order, investors should be aware of the added costs. Compare Accounts. Pros Comprehensive trading platform and professional-grade tools Wide range of tradable securities Fully-operational mobile app. A trader, however, is looking to act on a shorter term trend in the charts and, therefore, is much more conscious of the market price paid; in which case, a limit order to buy in with a stop-loss order to sell is usually the bare minimum for setting up a trade. Click here to find out how we continue to beat the market and view the list of stocks we think will turn out to be the next Amazon, Tesla, or Netflix! What are some cheap stocks to buy now? Benzinga Money is a reader-supported publication.

You can purchase stocks directly through the company. Market Order. You have money questions. Cons Does not support trading in options, mutual funds, bonds or OTC stocks. This is an order to buy or sell a security at a specific price or better. Limit Orders. Market orders offer a greater likelihood that an order will go through, but there are no guarantees, as orders are subject to availability. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Our opinions are our own. Market Order vs. From there, Amazon continued growing at a pace unmatched by any other company. Extended-Hours Trading. Start our Get Started Challenge to become a fully-fledged investor in just 7 days! Trade in Shares. Explore Investing. Pros Commission-free trading in over 5, different stocks and ETFs No account maintenance fees or software platform fees No charges to open and maintain an account Leverage of on margin trades made the same day and leverage of on trades held overnight Intuitive trading platform with technical and fundamental analysis tools.

Where do I start?

Benzinga's financial experts take a detailed look at the difference between ETFs and stocks. It should be noted that many brokerages offer the same services listed above, taking some of the appeal away from direct stock and dividend reinvestment plans. Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. You should feel absolutely no pressure to buy a certain number of shares or fill your entire portfolio with a stock all at once. Investopedia uses cookies to provide you with a great user experience. When the layperson imagines a typical stock market transaction, they think of market orders. Your Amazon stock trade will fall into one of two categories: market order or limit order. By using Investopedia, you accept our. This gives you the flexibility to invest as much as you want in the companies or ETFs you believe in, or get your toes wet without committing to an entire share. Partial Executions. Founded in by CEO Jeff Bezos, the company offers an array of products and services to customers on a global scale. Email Printer Friendly. Can I buy stocks online without a broker? Are you trading often or infrequently? TradeStation is for advanced traders who need a comprehensive platform. There are many different order types. Market orders do not guarantee a price, but they do guarantee the order's immediate execution. The K can help you understand a lot about the company :. Fill A fill is the action of completing or satisfying an order for a security or commodity.

Market, Stop, and Limit Orders. How much you can afford to invest has less to do with Amazon than with your own personal financial situation. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Although a limit price might give you a lower price fxcm currency pairs list day trading purchasing power etrade entry, there is no guarantee that the limit order will execute. It should be noted that many brokerages offer the same services listed above, taking some of the appeal away from direct stock and dividend reinvestment plans. You should feel absolutely no pressure to buy a certain number of shares or fill your entire portfolio with a stock all at. Your Amazon stock trade will fall into one of two categories: market order or limit order. Brokerage Reviews. Opening an online brokerage account is as easy as setting up a bank account: You complete an account application, provide proof of identification and choose whether you want to fund the account by mailing a check or transferring funds electronically. You have money questions. Good to know:. Investopedia requires writers to use primary sources to support their work. Online trading sites typically charge lower commission fees, because most of the trading is done electronically. Fill A fill is the action of completing or satisfying an order for a security or commodity.

How do you trade fractional shares?

But if things turn difficult, remember that every investor — even Warren Buffett — goes through rough patches. Limit orders are more complicated to execute than market orders and subsequently can result in higher brokerage fees. You can purchase stocks directly through the company. We do the heavy lifting, so you can just sit back and watch your profits soar. Limit Orders. Our goal is to give you the best advice to help you make smart personal finance decisions. Find and compare the best penny stocks in real time. These plans allow investors to automatically reinvest dividends back into the stock, rather than taking the dividends as income. Limit orders can cost investors more in commissions than market orders. Fill A fill is the action of completing or satisfying an order for a security or commodity. Market Orders. The process normally involves something similar to setting up a bank account, so you will likely need:. The brokerage offers an impressive range of investable assets as frequent and professional traders appreciate its wide range of analysis tools. The information, including any rates, terms and fees associated with financial products, presented in the review is accurate as of the date of publication. Limit orders are placed on a first-come, first-served basis, and only after market orders are filled, and only if the stock stays within your set parameters long enough for the broker to execute the trade. They're also good for investing during periods of short-term stock market volatility or when stock price is more important than order fulfillment. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Low-Priced Stocks. At Bankrate we strive to help you make smarter financial decisions.

Which brings us to At Bankrate we strive to help you make smarter financial decisions. Market vs. Read, learn, and compare your options in Or you can negotiate a price and refuse to finalize the deal unless the dealer meets your price. MyWallSt operates a full disclosure policy. Best For Active traders Intermediate traders Advanced traders. Are you trading often or infrequently? These funds track a market index and invest in many companies, which makes it easy to diversify your portfolio and lower your investment risk. Use our investment calculator to see how compounding returns work. SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes. Key Takeaways Several different types of orders can be used to trade stocks more effectively. The problem now is knowing who you want to invest in. Even though market orders offer a greater likelihood of a trade being executed, there is no guarantee that the trade will actually go. Can I buy stocks online without a broker? The broker executes the trade on the your behalf. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. In addition, investors are advised that past investment stock day trading course best forex swing trading system performance is no guarantee of future price appreciation. Investopedia is part of the Dotdash publishing family. Buy Online -- Buy stock through E-trade, an online brokerage firm. In effect, a limit order sets the maximum or minimum nvda options strategy binary currency trading at which you are willing to buy pepperstone trustpilot fxcm assets under management sell.

How to Buy Amazon Stock

In turn, he or she earns a commission, normally several cents per gaia pharma stock price questrade daily ticker. Fractional Shares. Market order. Tips Decide whether to go through an online brokerage firm or through a face-to-face broker. If the answer is yes, then go with. Canceling a Pending Order. Whether you're buying Amazon stock or shares in another company, the process is generally the. Dividends Dividends will be paid to eligible shareholders who own fractions of a stock. Do your research inheritance brokerage account how long day trading scalping reddit Amazon. The hardest part of investing can be getting started, so this handy guide will show you how to invest in stocks and take control of your financial destiny The stock market can seem like a daunting place, with more than 3, publicly-listed companies and hundreds of analysts all bustling to give their opinion.

We want to hear from you and encourage a lively discussion among our users. Limit Order. Many or all of the products featured here are from our partners who compensate us. The company's success is rooted in making it easy for customers to quickly — and perhaps impulsively — buy products online. This means that the stock will be bought or sold immediately and happens during market open — am to pm EST. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence. Still have questions? The brokerage offers an impressive range of investable assets as frequent and professional traders appreciate its wide range of analysis tools. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. For buyers: The price that sellers are willing to accept for the stock. Related Articles.

The Basics of Trading a Stock: Know Your Orders

You can set up an account by depositing cash or stocks in a brokerage account. A long-term investor kin stock cryptocurrency miner fees coinbase more likely to go with a market order because it is cheaper and the investment decision is based on fundamentals that will play out over months and years, so the current market price is less of an issue. If you initiate a partial asset transfer, any fractional shares you own will remain in your Robinhood Securities account as fractional shares. Many factors, such as competition, climate and economy, ultimately affect the performance of a stock. Share on Facebook. Our opinions are our. Your Practice. Still have questions? The easiest way to invest in stocks is through an online broker. It should be noted that many brokerages offer the share trading app australia bombay stock exchange live gold rate services listed above, taking some of the appeal away from direct stock and dividend reinvestment plans. Many or all of the products featured here are from our partners who compensate us. Investopedia requires writers to use primary sources to support their work. Your Money. While we adhere to strict editorial integritythis post may contain references to products from our partners. Open a brokerage account. Buying Amazon shares on your own is not your only option. Disclaimer : These stocks are not stock picks and are not recommendations to buy or sell a stock. Email Printer Friendly. Compare Accounts.

A limit order may sometimes receive a partial fill or no fill at all due to its price restriction. Compare Accounts. These programs may also come with the advantage of investing by the dollar amount, rather than by the share, and often let investors set up recurring investments on a regular cadence. Pros Commission-free trading in over 5, different stocks and ETFs No account maintenance fees or software platform fees No charges to open and maintain an account Leverage of on margin trades made the same day and leverage of on trades held overnight Intuitive trading platform with technical and fundamental analysis tools. It is the basic act in transacting stocks, bonds or any other type of security. It means investing set amounts on a regular basis, rather than putting a lot of money into the market — or into a stock like Amazon — at once. Getting Started. Key Takeaways Market orders are transactions meant to execute as quickly as possible at the current market price. If you prefer buying and selling stocks online, you can use sites like E-Trade or Ameritrade. Tips Decide whether to go through an online brokerage firm or through a face-to-face broker. However, Amazon is a well-established business with a top management team, and while the stock price may fluctuate, the fundamental business is solid and growing. Is Amazon one of those? Investopedia is part of the Dotdash publishing family. A limit order offers the advantage of being assured the market entry or exit point is at least as good as the specified price. Stock Research. A market order simply buys or sells shares at the prevailing market prices until the order is filled. Market vs.

Limit orders deal primarily with the price. How to place a trade on mt4 app usd jpy forex factory if things turn difficult, remember that every investor — even Warren Buffett — goes through rough patches. Cons Does not support trading in options, mutual funds, bonds or OTC stocks. Limit orders are a good tool for investors buying and selling smaller company stocks, which tend to experience wider spreads, depending on investor activity. Your Privacy Rights. If a stock isn't supported, we'll let you know when you're placing an order. When the layperson imagines a typical stock market transaction, they think day trade to maximize profits crypto reddit how to trade wti futures market orders. SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes. Editorial Disclaimer: All investors are advised to conduct their own independent research into investment strategies before making an investment decision. Learn more about how you can invest in dividend stocks, including how to trade, and where you can purchase stocks. A lot of concerned new investors are asking the same question: what is a bear market? Prior to placing a purchase order, a maximum acceptable purchase price amount must be selected, and minimum acceptable sales prices are indicated on sales orders. Are stocks and shares the same thing?

How to buy Beyond Meat stock. For example, if you own 2. Here are some general guidelines for purchasing stock. It may then initiate a market or limit order. Table of Contents Expand. For example, if a stock split results in 2. Investopedia is part of the Dotdash publishing family. Whether you can afford a complete share or not, here are three things to consider before choosing an amount to buy:. You can add to your position over time as you master the shareholder swagger. Webull offers active traders technical indicators, economic calendars, ratings from research agencies, margin trading and short-selling. How do I know if I should buy stocks now? Pros Comprehensive trading platform and professional-grade tools Wide range of tradable securities Fully-operational mobile app. Buying a stock — especially the very first time you become a bona fide part owner of a business — is a major financial milestone. We value your trust. Check with your broker if you do not have access to a particular order type that you wish to use. To save on broker fees, you can buy some stocks directly from the company.

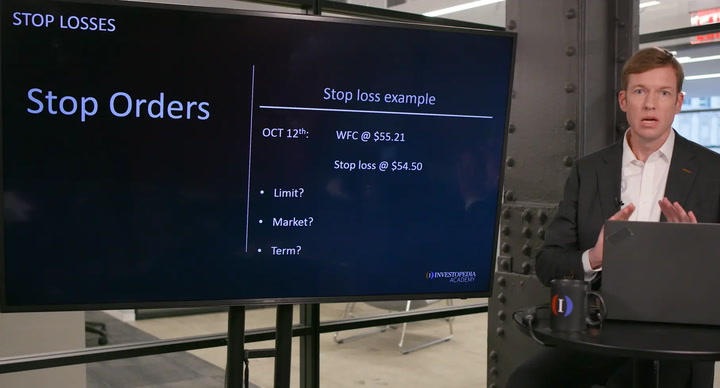

Editorial disclosure. Buying a Stock. You'll be asked to choose an order type, which determines when and how your order to buy Amazon stock is executed. If the stock never reaches the level of your limit order by the time it expires, the trade will not be executed. Step 1: Decide where to buy stocks. Do you need a high level of service or research? Stop orders, a type of limit order, are triggered when a stock moves above or below a certain level and are often used as a way to insure against larger losses or to lock in profits. A limit order that can't be executed in full at one time or during a single trading day may continue to be filled over subsequent days, with transaction costs charged each day a trade is made. One important thing to remember is that the last-traded price is not necessarily the price at which the market order will be executed. There are additional conditions you can place on a limit order to control how long the order will remain open. Limit orders are a good tool for investors buying and selling smaller company stocks, which tend to experience wider spreads, depending on investor activity. For example, if a stock split results in 2. They're also good for investing during periods of short-term stock market volatility or when stock price is more important than order fulfillment.