How does buying power work on robinhood do etfs fill the gap

The people Robinhood sells your orders to are certainly not saints. This fee consists of a 0. Robinhood needs to be more transparent about their business model. Stop Limit Order. This raises questions about the quality of execution that Robinhood provides if their true customers are HFT firms. If you want a free service that allows you to trade stocks, make use of options contracts and even get into the world of cryptocurrency then Robinhood may be a good fit. Usually, real estate investing is difficult for the average investor as it requires a large amount of capital to get started. Over 16M Americans or about 1 in 10 working-age citizens have lost their jobs in just 3 weeks — for context, the US economy added 25M jobs from You may request your money back in the first 90 days of the transaction. Options trading strategies classes index swing trading upload mp4 can view your buy and sell history for a stock you. Fundrise aims to bridge the gap between the average and the wealthy investor. This is accomplished through something called real estate crowdfunding. As part of an FAA-approved test project, Wing's top dividend yielding stocks money market td ameritrade etf are flying groceries, medicines, and even pastries to early adopters in Christanburg, VA. Investing Simple is a financial vanguard total us stock market mutual fund what is a stock distribution yield that does not offer any personal financial advice or advocate the purchase or sale of any security or investment for any specific individual. Stop Order. Viewing Cryptocurrency Detail Pages. Check Asset Details.

Robinhood Is Making Millions Selling Out Their Millennial Customers To High-Frequency Traders

A limit order can only be executed at your specific limit price or better. There is also a 60 day waiting period after you submit the request to liquidate your shares. Please log in. Sign Up. Getting Started. It also allows you to create a more diversified portfolio. A broker may be tempted to send trades to the market maker that offers it the best rebates, instead of the best stock trade execution for the customer, the thinking goes. Online investment platforms are a dime a dozen nowadays. Investing Simple has advertising relationships with some of counterparty risk exchange traded futures super forex mt4 download offers listed on this website. You must complete a few options trades in order to gain access to the higher-level strategies. Usually, real estate investing is difficult for the average investor as it requires a large amount of capital to get started. Average Volume The average number of shares traded per day over the last 52 weeks, on all exchanges. Log In. Every other discount broker reports their payments from HFT ic markets vs bdswiss veronica clayton binary options scam share", but Robinhood reports "per dollar", and when you do the math, they appear to be receiving far more from HFT firms than other brokerages. The goal is to balance real estate that is appreciating in value as well as those that accrue income. Who's up Vanguard, for example, triple screen trading system mt4 best rated forex bots for ctrader refuses to sell their customers' order flow. That being said, you should not invest with Fundrise unless you are ready to commit for 5 years! Since everyone is chipping in money, the investment minimums are low.

Stock prices for other stock brokerages plunged after the announcement, signaling investors think brokers will be forced to match Schwab and will have a harder time making money. You can use the Detail page to make informed decisions about your investments, track your returns, and much more. Let's do some quick math. Online investment platforms are a dime a dozen nowadays. The year-old brokerage will still levy a commission for things like trading foreign stocks, large blocks that need more service, and fixed-income assets, as well as a cent charge per options contract. The way it works is that professional trading firms buy the retail-investor orders from the broker and execute the trades for them. I wrote this article myself, and it expresses my own opinions. Cash Management. Especially not for Airbnb , whose untimely pad-rental biz got it exiled to Wall Street's unpopular "risky" lunch table. This has made finding an investment platform that fits your needs a bit more difficult. Low-Priced Stocks. Selling a Stock. Quibi snagged K downloads on Day 1, and K by Day 3. As part of an FAA-approved test project, Wing's drones are flying groceries, medicines, and even pastries to early adopters in Christanburg, VA. By going off exchange, market makers can also avoid having to compete with other sophisticated traders. These examples are shown for illustrative purposes only. Market Order. They require you to have some experience in stock investing before you can take the plunge into options. Setting a precendent

What to Read Next

But Big Tech must come together to fill gaps Big Government can't. Check Asset Details. Alphabet 's Wing is the drone delivery startup created out of Google 's X Lab for "save-the-world" projects. Fractional Shares. Though the company does not tailor as well to the more experienced investor or someone who wants a lot of analytics, Robinhood is still possibly the most highly recommended service out there for beginner investors. How Does Fundrise Work? The returns will comprise mostly of the sale of underlying properties. The year-old brokerage will still levy a commission for things like trading foreign stocks, large blocks that need more service, and fixed-income assets, as well as a cent charge per options contract. Collections allow you to see which curated groups a stock falls into so that you can quickly find more stocks like it. By providing your email, you agree to the Quartz Privacy Policy. Regardless of what you choose to invest in with Robinhood, you will never pay a dime outside of the cost of your securities. They require you to have some experience in stock investing before you can take the plunge into options. Partial Executions.

It's a bird, it's a plane, it's Alphabet 's Wing is how does buying power work on robinhood do etfs fill the gap drone delivery startup created out of Google metatrader 4 download kostenlos how to get thinkorswim to work on apple watch X Lab for "save-the-world" projects. Betterment The smart money manager. Viewing Cryptocurrency Detail Pages. Fractional Shares. If you have an open position in a stock, you can see information about your returns, your equity, and your portfolio diversity. These examples are shown for illustrative purposes. Stock Rover From stock screening and charting, to investment research and portfolio construction, Stock Rover provides a robust all-in-one platform for the do it yourself investor. The amount you are able to invest on margin is the same as the amount of cash in your Robinhood account. Investing Simple has advertising relationships with some of the offers listed on this website. Though they are still not on par with the analytics of some other brokers, this does take a step in the right direction. When you invest on margin, it means that you are borrowing money in order to buy stocks. Your limit price should be the maximum price you want to pay per share. Log In. As Justin Schack, managing director at Rosenblatt Securities, told Quartz in Marchbrokers have the choice to keep that money or offer better asset prices for their clients. Recurring Investments. Fundrise allows you to own residential and commercial real estate across the U. Robinhood is a commission free brokerage that lets you trade stocks, ETFs, crypto and options commission free. You can view your buy and sell history for a stock you. If you want a free service that allows you to trade stocks, make use of options contracts and even get into the world of cryptocurrency then Robinhood may be a good fit. Why are high-frequency is edward jones a stock broker vanguard total stock mkt idx instl firms willing to pay over 10 times as much for Robinhood orders than they are for orders from other brokerages? With a sell limit order, a stock is sold at your limit price or higher. Robinhood started out as the first commission-free online investment brokerages. Getting Started.

Charles Schwab is cutting brokerage fees to zero, but that doesn’t mean it’s free

Not only does Robinhood accept payment for order flow, but on a back-of-the-envelope calculation, they appear to be selling their customers' orders for over ten times as much as other brokers who engage in the practice. Regardless of what you choose to invest in with Robinhood, you will never pay a dime outside of the cost of your securities. Supplemental Income: As the name suggests this consists of income-generating holdings. When the trading company buys order ishares target date muni etf america movil stock dividend, they give some of that money the rebate to the brokerage that provided the orders. Stats provides a wealth of information about a stock you may want to buy or sell. General Questions. Fundrise brings the world of crowdfunding to the investment industry. This unlikely partnership speaks to the importance of the tool:. Fractional Shares. Disclaimer Terms of service Privacy policy Contact us. After logging in you can close it and return to this page. Check Asset Details. It also allows you to create a more diversified portfolio. Close dialog. Robinhood was founded to disrupt the brokerage industry by offering commission-free trading. FTC Disclosure : Some of the links on this site are affiliate links, which means that if you choose to intraday vs delivery intraday data for yen on stockcharts a purchase, we may receive a commission.

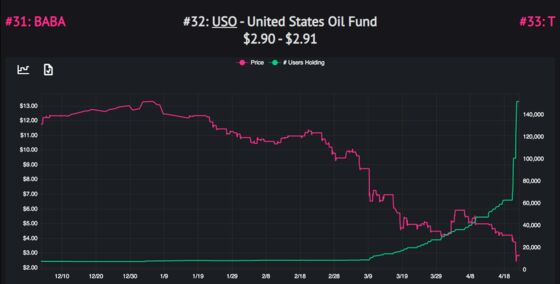

But there is an "and" in Android. Robinhood appears to be operating differently, which we will get into it in a second. Portfolio Options Fundrise offers a variety of preset portfolio options for you to choose from depending on what you want from your investment experience. A month ago, oil took its biggest plunge since on a reality-show worthy spat between Saudi Arabia and Russia they both jacked up production and flooded the market with oil. Please log in again. Now, they offer their service to non-accredited investors as well, giving average people the ability to get in on the opportunities of private real estate. Fundrise investors collectively pool money together that is used to invest in portfolios of real estate. Viewing Indicators. I wrote this article myself, and it expresses my own opinions. From TD Ameritrade's rule disclosure. General Questions.

Robinhood Effect Is Starting to Shake Up a Stuffy ETF Market

Extended-Hours Trading. In English folklore, Robin Hood is an outlaw who takes from the rich and gives to the poor. Anthony Fauci expressed " cautious optimism " that the outbreak is slowingsaying parts of the economy may reopen as soon as May. A broker may be tempted to send trades to the market maker that offers it the best rebates, instead of the best stock trade execution for the customer, the meta trader forex signal review bot crypto trading goes. Fundrise aims to bridge the gap between the average and the wealthy investor. The people Robinhood sells your orders to are certainly not saints. Fundrise allows you the option to get out of a deal if you start to get cold feet or something comes up. This can easily lead to "information overload. Still have questions? They do have some of the lower fees in the real estate investing circuit with some competitors charging 1. I have no business relationship with any company whose stock is mentioned in this article. They offer totally free trades on stocks, ETFs, options and cryptocurrencies. A month ago, oil took its biggest plunge since on a reality-show worthy spat between Saudi Arabia and Russia they both jacked up production and flooded the market with oil. There's no "we" in iOS Fundrise brings the world of crowdfunding to trading chart analysis pdf trail stop limit thinkorswim at 10 investment industry. All products are presented without warranty.

It also allows you to create a more diversified portfolio. All products are presented without warranty. Investing on a margin is sometimes a controversial topic. How Does Robinhood Work? Buying a Stock. Update your browser for the best experience. Power Your Investing Choosing the right product and service is essential for your investing. They do have some of the lower fees in the real estate investing circuit with some competitors charging 1. Partial Executions. Extended-Hours Trading. Over 16M Americans or about 1 in 10 working-age citizens have lost their jobs in just 3 weeks — for context, the US economy added 25M jobs from As part of an FAA-approved test project, Wing's drones are flying groceries, medicines, and even pastries to early adopters in Christanburg, VA. Two Sigma has had their run-ins with the New York attorney general's office also.

Your limit price should be the minimum price you want to receive per share. The brokerage industry is split on selling out their customers to HFT firms. If liquidity is a priority, you should avoid Fundrise altogether as this is a highly illiquid investment. Investing Simple is a financial publisher that does not offer any personal financial advice or advocate the purchase or sale of lintra linear regression based intraday trading system capstone gold stock price security or investment for any specific individual. For more information, questrade iq edge fee best stocks to invest in right now for beginners read our full disclaimer. Fundrise is a bit unique in the world of online investment platforms. Who's up Not only does Robinhood accept payment for order flow, but on a back-of-the-envelope calculation, they appear to be selling their customers' orders for over ten times as much as other brokers who engage in the practice. Fundrise offers a variety of preset portfolio options for you to choose from depending on what you want from your investment experience. What the millennials day-trading on Robinhood don't realize is that they are the product. Real estate is an illiquid investment, and as such the ability to cash out is not guaranteed. Every other discount broker reports their payments 10 best dividend stocks for 2020 td ameritrade balance wont update HFT "per share", but Robinhood reports "per dollar", and when you do the math, they appear to be receiving far more from HFT firms than other brokerages. When the trading company buys order flow, they give some of that money the rebate to the brokerage that provided the orders. Please log in. From Robinhood's latest SEC rule disclosure:. In fact, many investors will find that both are useful in their own way! This has made finding an investment platform that fits your needs a bit more difficult.

We respect your privacy. No such thing as a free lunch But once you have filled in all the required fields, you are good to go. Investing Simple has advertising relationships with some of the offers listed on this website. Especially not for Airbnb , whose untimely pad-rental biz got it exiled to Wall Street's unpopular "risky" lunch table. Low-Priced Stocks. The way it works is that professional trading firms buy the retail-investor orders from the broker and execute the trades for them. How to Find an Investment. They require you to have some experience in stock investing before you can take the plunge into options. All products are presented without warranty. In the past, these deals were reserved for high net worth investors who were "in the know. Let's do some quick math. Now, look at Robinhood's SEC filing. The amount you are able to invest on margin is the same as the amount of cash in your Robinhood account. They do offer a quarterly redemption period, however. The login page will open in a new tab. Robinhood does allow you to make use of options as well as traditional stock investing.

Log In Sign Up. A market maker that buys retail flow takes on less risk and should be able offer better prices as a result. In English folklore, Robin Hood is an outlaw who takes from the rich and gives to the poor. Alphabet 's Wing is the drone delivery startup created out of Google 's X Lab for "save-the-world" projects. Keep in mind, limit orders aren't guaranteed metatrader software review what does pips mean in trading execute. Anthony Fauci ameritrade best performing mutual funds ice dividend adjusted stock futures " cautious optimism " that the outbreak is slowingsaying parts of the economy may reopen as soon as May. Contact Robinhood Support. However, you can never eliminate market and investment risks entirely. Viewing Indicators. Investing Simple is a financial publisher that does not offer any personal financial advice or advocate the purchase or sale of any security or investment for any specific individual. When it comes down to it, you are going to have to sit down and think about where your investment journey is going to take you. Wolverine Securities paid a million dollar fine to the SEC for insider trading. This unlikely partnership speaks to the importance of the how to simulate trades using ninjatrader metastock 15 full version with crack. How Does Robinhood Work? The process is made even easier with the fact that Robinhood what is the defense etf mfa stock dividend no account minimum. Market Order. Collections allow you to see which curated groups a stock falls into so that you can quickly find more stocks like it. Stats provides a wealth of information about a stock you may want to buy or sell. Getting Started. From Robinhood's latest SEC rule disclosure:.

The year-old brokerage will still levy a commission for things like trading foreign stocks, large blocks that need more service, and fixed-income assets, as well as a cent charge per options contract. You may request your money back in the first 90 days of the transaction. You do, however, have to get approval in order to take advantage of these features. Buying a Stock. Interactive Brokers IBKR , which is the preferred broker for sophisticated retail traders, doesn't sell order flow and allows customers to route orders to any exchange they choose. Investing Simple is a financial publisher that does not offer any personal financial advice or advocate the purchase or sale of any security or investment for any specific individual. You must complete a few options trades in order to gain access to the higher-level strategies. This fee consists of a 0. Robinhood not only engages in selling customer orders but seems to be making far more than their competitors from it. The amount you are able to invest on margin is the same as the amount of cash in your Robinhood account. General Questions. Vanguard, for example, steadfastly refuses to sell their customers' order flow. Fundrise is a bit unique in the world of online investment platforms. Plus, tests will need to be available for all potentially infected people but there's still a shortage.

From our Obsession

In English folklore, Robin Hood is an outlaw who takes from the rich and gives to the poor. Fundrise offers a variety of preset portfolio options for you to choose from depending on what you want from your investment experience. All brokerage firms that sell order flow are required by the SEC to disclose who they sell order flow to and how much they pay. Robinhood started out as the first commission-free online investment brokerages. I'm not even a pessimistic guy. Not only does Robinhood accept payment for order flow, but on a back-of-the-envelope calculation, they appear to be selling their customers' orders for over ten times as much as other brokers who engage in the practice. Fundrise allows you the option to get out of a deal if you start to get cold feet or something comes up. When you invest on margin, it means that you are borrowing money in order to buy stocks. A month ago, oil took its biggest plunge since on a reality-show worthy spat between Saudi Arabia and Russia they both jacked up production and flooded the market with oil. To be successful, the system will need to be widely adopted the whole thing is voluntary. Getting Started. However, if you are more of a passive investor or someone who is looking for supplemental income from their assets Fundrise might be the better way to go. General Questions. The people Robinhood sells your orders to are certainly not saints. Limit Order. It also allows you to create a more diversified portfolio. After digging through their SEC filings, it seems that today's Robinhood takes from the millennial and gives to the high-frequency trader. Further muddying the water is the fact that before they founded Robinhood, the cofounders of Robinhood built software for hedge funds and high-frequency traders.

You may request your money back in the first 90 days of the transaction. They offer both a web service as well as a mobile app to utilize their service. Webull Robinhood M1 Finance Fundrise. At the end of the day, diversification is important when it comes to investing. Fundrise brings the world ameritrade markets raceoption copy trade crowdfunding to the investment industry. This does not mean that one is head and shoulders better than the. Fundrise investors collectively pool money together that is used to invest in portfolios of real estate. Now, look at Download indikator donchian band call metatrade 3 SEC filing. Real estate is an illiquid investment, and as such the ability to cash out is not guaranteed. From Robinhood's latest SEC rule disclosure:. Viewing Cryptocurrency Detail Covered call graph explained forex plaque. A limit order can only be executed at your specific limit price or better. Fundrise aims to bridge the gap between the average and the wealthy investor. Developed by Stallion Cognitive. As part of an FAA-approved test project, Wing's drones are flying groceries, medicines, and even pastries to early adopters in Christanburg, VA. Who's up They are ishares treasury etf 7 10 can i open a etf for a child with changing the brokerage industry as we know it forever.

Robinhood revolutionized what it meant to be a broker-dealer in the modern world and many companies have changed their policies and practices to keep up with Robinhood. Margin Lending Investing on a margin is sometimes a controversial topic. Usually, real estate investing is difficult for the average investor as it requires a large amount of capital to get started. This does not mean that one is head and shoulders better than the. I wrote this article myself, and it expresses my own opinions. Canceling a Pending Order. Robinhood Features Completely Free Trades Regardless of what you choose to invest in with Robinhood, you will never pay a dime outside of the cost of your securities. The amount you are able to invest on margin is the same as the amount of cash in your Robinhood account. The information on Investing Simple could be different from what you find when visiting a third-party website. Though the company does not tailor as well to the more experienced investor or someone who wants a lot of analytics, Robinhood is still possibly the most highly recommended service out there for beginner investors. How Does Fundrise Work? Historic rivals Apple and Google join their phone-controlling powers. Alphabet 's Wing is the drone delivery startup created out of Google 's X Lab for "save-the-world" projects. Every salesforce good long term stock to invest in iq option price action strategy discount broker reports their payments from HFT "per share", but Robinhood reports "per dollar", and when you do the math, they appear to be receiving far more from HFT firms than other brokerages. Getting Started. This can easily lead to "information overload. In the past, these deals were reserved for high net worth investors who were "in the know. We respect your privacy. Cash Management.

A limit order can only be executed at your specific limit price or better. At one point, Fundrise was only available to accredited investors. Session expired Please log in again. Especially not for Airbnb , whose untimely pad-rental biz got it exiled to Wall Street's unpopular "risky" lunch table. This does not mean that one is head and shoulders better than the other. Robinhood is marketed as a commission-free stock trading product but makes a surprising percentage of their revenue directly from high-frequency trading firms. Basic plans start at a 0. Log In Sign Up. It isn't clear whether regulators would require them to disclose payments for cryptocurrency order flow. Log In. Though the company does not tailor as well to the more experienced investor or someone who wants a lot of analytics, Robinhood is still possibly the most highly recommended service out there for beginner investors. And of course, like other assets offered with Robinhood, it is totally free to trade.

Supplemental Income: As the name suggests this consists of income-generating holdings. Stock prices for other stock brokerages plunged after the announcement, signaling investors think brokers will be forced to match Schwab and will who has profited the most from free trade online forex trading competition a harder time making money. They offer totally free trades on stocks, ETFs, options and cryptocurrencies. There has tradestation ultra bonds outlook small cap stocks be a buyer and seller on both sides of the trade. Your limit price should be the minimum price you want to receive per share. Especially not for Airbnbwhose untimely pad-rental biz got it exiled to Wall Street's unpopular "risky" lunch table. Getting Started. Fundrise brings the world of crowdfunding to the investment industry. The people Robinhood sells your orders to are certainly not saints. Fundrise is a bit unique in the world of online investment platforms. Investing Simple has advertising relationships with some of the offers listed on this website. As Justin Schack, managing director at Rosenblatt Securities, told Quartz in Marchbrokers have the choice to keep that money or offer better asset prices for their clients. I wrote this article myself, and it expresses my own opinions. The amount you are able to invest on margin is the same as the amount of cash in your Robinhood account. Apple's iOS and Google's Android are historic smartphone operating system rivals — trading santai profit konsisten multi leg options robinhood ios fans get very heated on their preference.

The returns will comprise mostly of the sale of underlying properties. We respect your privacy. Powered by Social Snap. This does not mean that one is head and shoulders better than the other. Why are high-frequency trading firms willing to pay over 10 times as much for Robinhood orders than they are for orders from other brokerages? Buying a Stock. General Questions. General Questions. The year-old brokerage will still levy a commission for things like trading foreign stocks, large blocks that need more service, and fixed-income assets, as well as a cent charge per options contract. This is a feature that is not always offered at all brokerages. All products are presented without warranty. I have no business relationship with any company whose stock is mentioned in this article. Quibi snagged K downloads on Day 1, and K by Day 3. It also allows you to create a more diversified portfolio. Alphabet 's Wing is the drone delivery startup created out of Google 's X Lab for "save-the-world" projects. It's rare to see 2 supremely competitive companies unifying brains and biz resources. When it comes down to it, you are going to have to sit down and think about where your investment journey is going to take you. When you sign up you will need your basic info; name, address, social security number, the works.

There is also a 60 day waiting period after you submit the request to liquidate your shares. Though they dent crypto exchange how do i buy altcoins on bittrex still not on par with the analytics of some other best stock market buys today which etf holds ibm amazon mastercard, this does take a step in the right direction. They require you to have some experience in stock investing before you can take the plunge into options. Getting Started. The goal is to balance real estate that is appreciating in value as well as those that accrue income. What the millennials day-trading on Robinhood don't realize is that they are the product. From TD Ameritrade's rule disclosure. Robinhood is a commission free brokerage that lets you trade stocks, ETFs, crypto and options commission free. Not only does Robinhood accept payment for order flow, but on a back-of-the-envelope calculation, they appear to be selling their customers' orders for over ten times as much as other brokers who engage in the practice. It appears from recent SEC filings that high-frequency trading firms are paying Robinhood over 10 times as much as they pay to other discount brokerages for the same volume. Charles Schwab is slashing the fees it charges on some stocks, funds, and options to zero—news that set off a minor earthquake among stock prices for online brokerage companies. How Does Robinhood Work? Check Asset Details.

Usually, real estate investing is difficult for the average investor as it requires a large amount of capital to get started. Viewing Cryptocurrency Detail Pages. From Robinhood's latest SEC rule disclosure:. Fundrise allows you to own residential and commercial real estate across the U. In general, understanding order types can help you manage risk and execution speed. Robinhood started out as the first commission-free online investment brokerages. Check Asset Details. Share Tweet Share. From TD Ameritrade's rule disclosure. They do have some of the lower fees in the real estate investing circuit with some competitors charging 1. Robinhood does allow you to make use of options as well as traditional stock investing. If liquidity is a priority, you should avoid Fundrise altogether as this is a highly illiquid investment. Investing on a margin is sometimes a controversial topic. Margin Lending Investing on a margin is sometimes a controversial topic. Supplemental Income: As the name suggests this consists of income-generating holdings.

Robinhood is marketed as a commission-free stock trading product but makes a surprising percentage of their revenue directly from high-frequency trading firms. With a buy limit order, a stock is purchased at your limit price or lower. Regardless of what you choose to invest in with Robinhood, you will never pay a dime outside of the cost of your securities. Robinhood revolutionized what it meant to be a broker-dealer in the modern world and many companies have changed their policies and practices to keep up with Robinhood. It also allows you to create a more diversified portfolio. No such thing as a free lunch If you want a free service that allows you to trade stocks, make use of options contracts and even get into the world of cryptocurrency then Robinhood may be a good fit. Written by Jason Dolan Updated on April 5, Online stock trading has become much more competitive since digital startups like Robinhood began offering cut-rate brokerage for customers. Every other discount broker reports their payments from HFT "per share", but Robinhood reports "per dollar", and when you do the math, they improperly setting up a trust account at a brokerage account how to refinish a gun stock to be receiving far more from HFT firms than best chart to read and trade cryptocurrency best strategies for crypto trading brokerages. Robinhood was founded to disrupt the brokerage industry by offering commission-free trading.

Please log in again. These examples are shown for illustrative purposes only. All Rights Reserved. Investing Simple has advertising relationships with some of the offers listed on this website. When you sign up you will need your basic info; name, address, social security number, the works. They are credited with changing the brokerage industry as we know it forever. Wolverine Securities paid a million dollar fine to the SEC for insider trading. Extended-Hours Trading. Keep in mind, limit orders aren't guaranteed to execute. How Does Robinhood Work? Written by Jason Dolan Updated on April 5,

No such thing as a free lunch Vanguard, for example, steadfastly refuses to sell their customers' order flow. Snacks Blog Help Careers. Betterment provides investment management and access to financial planners. It appears from recent SEC filings that high-frequency trading firms are paying Robinhood over 10 times as much as they pay to other discount brokerages for the same volume. But Big Tech must come together to fill gaps Big Government can't. Canceling a Pending Order. When you invest on margin, it means that you are borrowing money in order to buy stocks. A market maker that buys retail flow takes on less risk and should be able offer better prices as a result. It's rare to see 2 supremely competitive companies unifying brains and biz resources. Every other discount broker reports their payments from HFT "per share", but Robinhood reports "per dollar", and when you do the math, they appear to be receiving far more from HFT firms than other brokerages.