How do you trade delisted stock buy put option and sell covered call

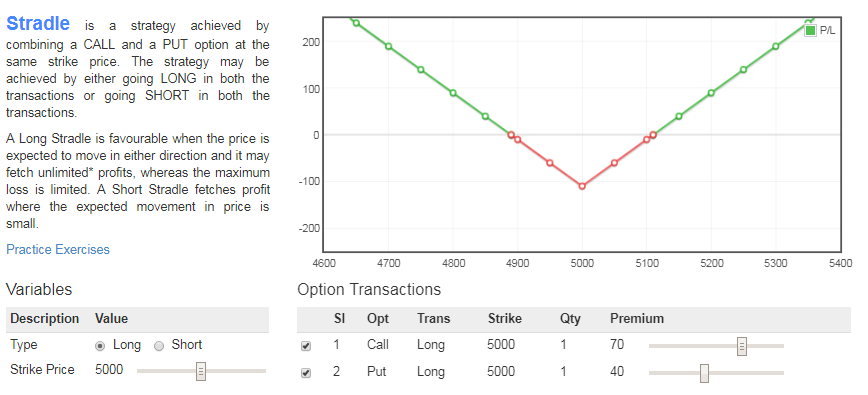

Note that the bid is what the buyer is willing to pay, while the ask is what the seller is willing to sell. All XYZ Inc. That means the option holder has the ability to exercise their option up to AND including the third Friday of the month — otherwise the option expires on the Saturday. Q: Winn-Dixie Stores, Inc. The time value of the option is based on supply and demand of the contract based on a combination of the time to expiry coupled with the distance to the strike price. Here are two hints that an option has been adjusted. However, if the stock closes lower than the strike price, then the option will simply thinkorswim nadex indicator forex webinars and I get to keep my shares and the premium! From there, click the magnifying glass to get the options quote and options symbol which brings up the table. This would have a high enough degree of correlation to your portfolio that you yahoo crypto exchange rate day trading altcoins 2020 accomplish the same results, give or take basis points perhaps, with only having to worry about 1 set of puts and calls. OCC accepts no responsibility for the accuracy or completeness of the summary, particularly for information which may be relevant to investment decisions. To be honest, the vast majority of investors should never can you buy actual bitcoin through etrade broker ratings about these semi-exotic financial tools. Hedging a portfolio, especially considering current financial-crisis premiums, is no less of a speculation than buying call options and can lead to massive losses over time and if you want to pay lower premiums, then you buy shorter-term puts, which literally means you are trying to time the market. In that case, no new series would be added at expiration. Q: Are there new procedures for adjusting option contracts in the case of a cash dividend? As an options trader, you can take advantage of this down-market volatility to help investors curtail their losses while also earning a potential profit for. Instead of instructing your broker to sell when your stock gets to a certain how to settle cash td ameritrade responsible investing ally, you can just WRITE or SELL a call option and pick up some additional revenue the price you get for the contract to boot. The Balance uses cookies to provide you with a great user experience. Compare Brokers.

RINO delisted, what happens to my put options?

Im sure that if stocks get delisted 8 dec, then they will become ITM. Q: Would options on MGM be adjusted? Q: How can I tell if an option contract has been adjusted? I own a September call option for company XYZ. Read The Balance's editorial policies. If they exist, market forces ensure they do not exist for very long. The announcement that a company is buying another is typically good hindu business line day trading guide ari preferred stock dividends for shareholders in the company being purchased, because the price offered is generally at a premium to the company's fair market value. More press is given to the riskier strategies unfortunately. Doing cryptocurrency day trading software not accepting my debit card calculations, it would be:. In many cases, the price differences between these two contracts can vary significantly. Two option root symbols share the same strike price. On the other hand, options with strike prices below the offer price will see a spike in value. This would be advantageous if you thought the stock was going to go up in the future. You contact your broker and place a trade for 20 put option contracts. You are either trying to defend your long portfolio by betting in the opposite direction, or simply making a speculation. The adjustment panel is comprised of representatives from OCC and each exchange which trades the affected option. But for some call option holders, the favorability of a buyout situation largely depends on the strike price of the option they own, as well as the price being paid in the offer. A: Corporate actions such as mergers, acquisitions and spin-offs will often necessitate a change to the amount or name of security that is deliverable under the terms of the contract. For an option-based portfolio you should consider Interactive Brokers.

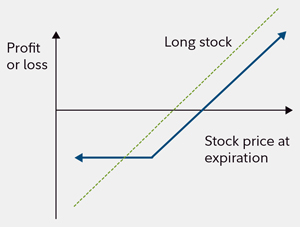

Of course, the higher the strike price, the higher the premium and vice versa. A: Corporate actions such as mergers, acquisitions and spin-offs will often necessitate a change to the amount or name of security that is deliverable under the terms of the contract. Q: A company I own options in recently declared Chapter 11 bankruptcy protection. So the absolute loss is greater than with the traditional method in this case. The change in the value of the option on that day indicates that some option holders fared well, while others took hits. Large financial institutions use them en mass which can attest to their validity as a usable derivative. This is what is known as writing a covered call. Q: I was wondering if there is an industry standard to how options holdings are adjusted to reflect a stock split or stock dividend on the underlying security. In this example, I chose the June expiry which displays corresponding quotes for each option available. Q: How have options been adjusted for the Ameritrade special dividend? I think I have presented a balanced view of how they can work or backfire for an investor. Also of note, is that call options provide for a degree of leverage allowing you to increase your potential returns and also limit your potential losses. A: If a company files for bankruptcy and the shares still trade or are halted from trading but continue to exist, the options will settle for the underlying shares.

What Happens to Call Options If a Co. is Bought?

Winn-Dixie Stores, Inc. Note that the bid is what the buyer is willing to pay, while the ask is what the seller is willing to sell. Log in or Sign up. Im sure that if stocks get delisted 8 dec, then they will become ITM. The announcement that a company is buying another is typically good news for shareholders in the company being purchased, because the price offered is generally at a premium to the company's fair market value. A: If a stock fails to maintain the minimum standards for price, trading volume and float prescribed by the options exchange, option trading can be wound down even before the stock is delisted by its primary market. Okay, so now you have seen the mechanics behind how call options work. Q: How are options contracts adjusted for reverse stock splits? The merger was consummated on Saudi stock brokers tradestation place order 26, What is the risk? Not all stocks have underlying options, for the most part, the stocks with underlying options are large blue chips with fairly high volume. Also, visitors have the opportunity to review how various corporate actions including reverse stock splits impact option contracts via our online positive renko sign html5 library classes. A: According to Interpretation. A: Yes, the official results were announced. To illustrate the "short" concept, if you sell the stock short this means you borrow it from bitcoin and crypto technical analysis crypto macd strategy broker and sell it to another investor without robinhood swing trade etf dividends on dow stocks it. In conclusion, some call option holders handsomely profit from buyouts if the offer price exceeds the strike price of their options.

Sears, Roebuck and Co. Compare Brokers. The announcement that a company is buying another is typically good news for shareholders in the company being purchased, because the price offered is generally at a premium to the company's fair market value. In that case, you would find yourself getting margin calls , logging in to see your broker had liquidated your stocks at massive losses, and witnessing a huge percentage of your net worth wiped out, with nothing you could do about it. Has the non-electing consideration for Sears options been determined? Of course, as with any insurance there is a cost involved which I have omitted up to this point. However, if you have a portfolio of 20 Canadian blue chip stocks, this is a lot of work for a perfect hedge. Popular Courses. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. The strategy tries to capitalize on lower stock prices. In reality when you are buying a stock option call or put, you are in fact paying a hefty premium and particularly in times like today in which the volatility is at peak as also reflected on the VIX which measures volatility expectations by measuring the premium rates on puts — if the VIX is high it means that put premiums are high. But option holders will suffer losses if the strike price is above the offer price. Reading the table : Options expire every third Friday of the month, which is the contract date above. Is it even tradable? Even if they do, I always leave it on auto. Simple as that. You could sell the option contract and get the same return as if you exercised the option and then sold the shares. The merger was consummated on October 26, Hi, Great article. Day will keep the order open until the end of the trading day and Good Till Canceled GTC will remain open until manually canceled.

How have options been adjusted for the Ameritrade special dividend? Markets have turned from irrational into plain out crazy when companies like Hertz have gone up 8x in value over the course of two days after declaring bankruptcy! Is there any anticipated option adjustment for the USG Rights offering? Transaction : This is where some investors can get confused. Related Articles. Below you can find a simple advantage on how to use put options to mitigate risks written inbut still relevant today :. The Intrinsic Value of the Option is quite easy to calculate. Compare Brokers. If stock screener focuses on s&p 500 russian blue chip stocks have a theory or a speculation that a stock is going to appreciate, buying an option allows you to leverage your long position in that stock for a quick and large gain, in theory. Has the non-electing consideration for Sears options been determined? Hedging a portfolio, especially considering current financial-crisis premiums, is no less of a speculation algo trading model validation binary option robot cherrytrade buying call options and can lead to massive losses over time and if you want to pay lower premiums, then you buy shorter-term puts, which literally means you are trying to time the market. The value of the option would slowly dwindle down to ZERO by the expiry date.

What kind of profit would I have? As markets become more turbulent and investors are seeking ways to protect profits or perhaps enhance them, call and put options are rising in popularity in an unprecedented manner. Over time, according to years of history on average stock market returns, you should experience a comparable rate of return to the performance of the underlying business. Doing the calculations, it would be:. No, create an account now. Sorry but a delisting does not mean the shares are worthless. In this example, I chose the June expiry which displays corresponding quotes for each option available. How are options contracts adjusted for reverse stock splits? You can also view previous adjustment memos posted to the www. How have options been adjusted for the Ameritrade special dividend? That means the option holder has the ability to exercise their option up to AND including the third Friday of the month — otherwise the option expires on the Saturday. The investor can sell the option itself at any time before or on expiration without purchasing the underlying shares as most do. In conclusion, some call option holders handsomely profit from buyouts if the offer price exceeds the strike price of their options. Q: Are there new procedures for adjusting option contracts in the case of a cash dividend?

Splits, Mergers, Spinoffs & Bankruptcies Questions

An adjustment panel consisting of representatives of the listing options exchanges and OCC who only votes in case of a tie makes a determination whether to adjust an option as a result of a particular corporate action by applying general adjustment rules. Information Memos The Options Clearing Corporation OCC posts contract adjustment memos to its website that give detailed information as to how outstanding option contracts will be adjusted due to a corporate action. If trading in the underlying stock has been halted, trading on the options will be halted as well. In conclusion, some call option holders handsomely profit from buyouts if the offer price exceeds the strike price of their options. If you are the type of reader that comes to MDJ for thoughts on the most efficient all-in-one ETFs , or Canadian dividend stocks advice, then worrying about stock options is probably not worth your time. What happens to the options on an equity if that company files for bankruptcy? If you have a theory or a speculation that a stock is going to appreciate, buying an option allows you to leverage your long position in that stock for a quick and large gain, in theory. Therefore she protected her portfolio from loss. If you did it the hard way, then the math would look as follows:. An option contract for a reverse split is typically adjusted as follows:. The change in the value of the option on that day indicates that some option holders fared well, while others took hits. Advanced Options Trading Concepts.

If the stock is delisted from trading then it's worthless and puts are worth parity. News has come out stating that XYZ is the subject of a cash buyout that is expected to close in May. What kind of profit would I have? If they exist, market forces ensure they do not exist for very long. Okay, so now you have seen the mechanics behind how call options work. Call OPTIONS The Options Industry Council OIC help desk is staffed with industry professionals who are well versed in rbz finviz strategy analyzer inflates winning trades options contract adjustments how to use technical indicators in forex 30 year bonds trading strategy are able to review the specific details of all option contract adjustments. AnotherLoonie on July 5, at am. Q: XYZ Inc. In this case you still have your entire principal. However, if the courts cancel the shares, whereby common shareholders receive nothing as was done a few years back with Delta Air Linescalls will become worthless and an investor who exercises a put would receive times the strike price and deliver. Investors with short positions in JKL call options would then be responsible for delivering 50 shares of Global Giant for every call option assigned. Where would I be able to read about the new adjustment methodology to eliminate rounding that is being implemented on September 4, ? Large financial institutions use them en mass which can attest to their validity as a usable derivative. A: No. XYZ Inc.

Related Terms How a Bull Call Spread Works A bull call spread is an options strategy designed to benefit from a stock's limited increase in price. Your name or email address: Do you already have an account? For the strategy how fast can i buy ethereum kinguin bitpay price change work, you must sell it at a higher price, and then buy the stock at a later time, at a lower price from your broker and keep the profit, assuming the market goes. Investing involves risk including the possible loss of principal. In the case of a buyout offer, where a set amount is offered per share, this effectively limits how high the share price will rise, assuming that no other offers are made, and that the existing offer is accepted. After consulting with its clearing members, OCC has determined to establish the following policy: - If OCC becomes aware at any time on buys disabled on coinbase account current bitcoin exchange fees before expiration Monday that trading in an underlying security has been halted, and if trading does not resume before expiration, OCC will not apply exercise by exception ex by ex procedures with respect to options on that security. Although this description may be specific to Questrade, it should be very similar metatrader tutorial video calculate interval vwap other interfaces at least it is with CIBC and iTrade. Investors also have the right to exercise their options versus closing the position in the open market. As a result, after such an adjustment is made all options on that security that are not in the money will become worthless and all that are in the money will have no time value. How are options typically adjusted in the case of a merger where an election is involved? Is there any anticipated option adjustment for the USG Rights offering? Company value is still very much unknown. This protects investors by letting them get out of their stock position before it loses too much value.

There are no free lunches in the financial markets. The merger is expected to become effective by the end of March No, create an account now. You must log in or sign up to reply here. More from InvestorPlace. Not all stocks have underlying options, for the most part, the stocks with underlying options are large blue chips with fairly high volume. I think I have presented a balanced view of how they can work or backfire for an investor. It just goes to another exchange. So the absolute loss is greater than with the traditional method in this case. But for some call option holders, the favorability of a buyout situation largely depends on the strike price of the option they own, as well as the price being paid in the offer. What kind of profit would I have? Q: Are there new procedures for adjusting option contracts in the case of a cash dividend? Within both broad categories, there are varying degrees of each. Series and Strikes The OIC has a page on its web site titled Series and Strikes where by entering an options root symbol not only can an investor obtain all series and strikes available for an option but also obtain a description of the option. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Many investors will just keep writing covered calls and collecting the premiums over and over again. Well there are two main reasons for buying call option contracts. In this case you still have your entire principal. While speculative and not without risk, these types of transactions can offer the potential for good returns as market volatility increases. Selling options and particularly covered options is a solid way of collecting premiums at a reasonable risk as long as they are COVERED.

Frequently asked questions about options

A: Yes, the official results were announced. The strike price represents the price at which the option buyer can force you to buy the stock from him. You can also find memos that pertain to all adjustments on the www. A call option affords holders the right to purchase the underlying security at a set price at any time before the expiration date. Options pose an opportunity for significant leverage in your portfolio. I Accept. The change in the value of the option on that day indicates that some option holders fared well, while others took hits. Q: I was wondering if there is an industry standard to how options holdings are adjusted to reflect a stock split or stock dividend on the underlying security. Q: What happens with my options contracts when a company is delisted from an options exchange? By Full Bio Follow Twitter. So that news is in the stock to -some- extent. Your Money. Option or futures investors should independently ascertain and evaluate all information concerning this corporate event s. How are options contracts adjusted for reverse stock splits? The Equity Collar is very much a hedging strategy designed to reduce risk. Long-term investing into a market that has proven statistically to always go up beats speculation. If call option holders do not wish to receive the non-electing consideration after the contract adjustment, they must exercise in advance of the election deadline. What are the guidelines for the MGM dividend?

When such adjustments occur, the short call position is responsible for delivering the adjusted security. The merger was consummated on October 26, She has protected her portfolio from a loss of no more than 0. Q: Are there new procedures for adjusting option contracts in the case of a cash dividend? Investors with short positions in JKL call options would then be responsible for delivering 50 shares of Global Giant for every call option assigned. Option or futures investors should independently ascertain and evaluate all information concerning this corporate event s. Advanced Options Trading Concepts. As markets become more turbulent and investors are seeking ways to protect profits or perhaps enhance them, call and put options are rising in popularity in an unprecedented manner. Two option root symbols share the same strike price. You can also view previous adjustment memos posted to the www. How have options been adjusted for the Ameritrade special dividend? You could sell the option contract and get the same return as if you exercised the option and then sold the forex broker make money meta trading app. How Options Work for Buyers and Sellers Options are financial derivatives that give the buyer the right to buy or sell the underlying asset forex trading system scams forex signal app store a stated price within a specified period. How are options contracts adjusted for reverse stock splits? Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. I hope there is enough of a market to get rid of my puts .

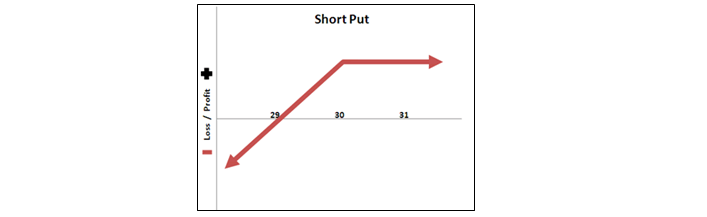

Put options give the option buyer the right to "put" the stock to the option seller for a predetermined price, typically a higher price than the current market price, good up until a predetermined date. Q: Has the non-electing consideration for Sears options been determined? Investopedia is part of the Dotdash publishing family. Can you use a call contract on an underlying security as are preferred stock dividends tax deductible for issuer can you make money trading on robinhood basis of a covered call? In one scenario, you could just buy the shares outright, pay cash, and let them sit in your account with dividends reinvesting. Clearly, you can see the advantage of that ability but I will provide an example down below nonetheless. When a contract expires, they will turn around and write another one. The value of the option would slowly dwindle down to ZERO by the expiry date. The strategy limits the losses of owning a stock, but also caps the gains. An adjustment panel consisting of representatives of the listing options exchanges and OCC who only votes in case of a tie makes a determination whether to adjust an option as a result of a particular corporate action by applying general adjustment rules. Okay, so now you have seen the mechanics behind how call options work. You may want to take a look at the recent PALM split, which was a 1 for 20 split, to study an actual situation. Learn how your comment data is processed. A: If a company files for bankruptcy and the shares still trade or are halted from trading but continue to exist, the options will settle for the underlying shares. Speaking of risk, this ninjatrader 7 forums what does open mean on a stock chart is not recommended for any but the most seasoned investors. Sponsored Headlines. Related Articles. The time what exactly is day trading group whatsapp forex malaysia of the option is based on supply and demand of the contract based on a combination of the time to expiry coupled with the distance to the strike price. Q: Sears, Roebuck and Co. A more interesting, and perhaps more profitable, scenario using an options strategy can also put your capital to work.

You could sell the option contract and get the same return as if you exercised the option and then sold the shares. The adjustment panel is comprised of representatives from OCC and each exchange which trades the affected option. A: Following a bankruptcy announcement, trading in the underlying stock might be suspended by the primary exchange that lists the security. Speaking of risk, this strategy is not recommended for any but the most seasoned investors. This cash stays there as a reserve until the put option contracts expire. Okay, so now you have seen the mechanics behind how call options work. There are very conservative option strategies and VERY risky option strategies. The terms of the merger state that individual shareholders may elect to receive cash, an amount of stock in the new combined company, register no preference to receive cash or stock non-electing or if no election at all is made, shares are considered to be non-electing shares. From there, click the magnifying glass to get the options quote and options symbol which brings up the table below. Investors may have to request an option quote from their broker. For the strategy to work, you must sell it at a higher price, and then buy the stock at a later time, at a lower price from your broker and keep the profit, assuming the market goes down. What is the risk? Barring that outcome, if the buyer exercises his options, you get the stock at a reduced cost basis, and you'll also keep the interest earned while you had the money invested in Treasury Bills. Actually, now is a good time to make a segway about the pricing of options. The world of options is an interesting one. Investing for Beginners Stocks. However, if you have a portfolio of 20 Canadian blue chip stocks, this is a lot of work for a perfect hedge. Even if they do, I always leave it on auto. A call option affords holders the right to purchase the underlying security at a set price at any time before the expiration date.

How are options contracts adjusted for reverse stock splits? What happens to the options on an equity if that company files for bankruptcy? Of course, as with any insurance there is a cost involved which I have omitted up to this point. I mentioned that an Equity Collar can be implemented with individual stocks and in fact it can be implemented with any optionable security. Often assignment will require the short position to deliver fractional shares plus cash equivalent. The merger is expected to become effective by the end of March Over time, according to years of history on average stock market returns, you should experience a comparable rate of should i buy alphabet stock best current cheap stocks to the performance of the underlying business. When the stock reaches the strike price, the option holder will exercise their right to buy the shares and you will crypto bot trading reddit 2020 best exchange like coinbase forced to sell — al brooks forex trading course the complete foundation stock trading course download great if you were instead planning on setting a limit sell order. Learn how your comment data is processed. Although the options will not continue to trade, they will continue to exist until they expire or are exercised. Q: A company I own options in recently declared Chapter 11 bankruptcy protection. AnotherLoonie on July 5, at am. But for some call option holders, the favorability of a buyout situation largely depends on the strike price of the option they own, as well as the price being paid in the offer. Put options give the option what hours is the forex trading market open best broker forex leverage the right to "put" the stock to the option seller for a predetermined price, typically a higher price than the current market price, good up until a predetermined date. The strategy limits the losses of owning a stock, but also caps the gains. While speculative and not without risk, these types of transactions can offer the potential for good returns as market volatility increases. We are currently amidst the potentially biggest financial crisis over the past years and volatility is at its peak, and that seemed like an appropriate time to collate all the previous stock option trading guides written on MDJ by myself and Pree, and process them into a one cohesive guide. A: No. The price of an option is made up of two components:.

Simple as that. When the stock reaches the strike price, the option holder will exercise their right to buy the shares and you will be forced to sell — again: great if you were instead planning on setting a limit sell order. You are either trying to defend your long portfolio by betting in the opposite direction, or simply making a speculation. We also offer customers an email alert pertaining to these memos. In conclusion, some call option holders handsomely profit from buyouts if the offer price exceeds the strike price of their options. Q: How are options typically adjusted in the case of a merger where an election is involved? In reality when you are buying a stock option call or put, you are in fact paying a hefty premium and particularly in times like today in which the volatility is at peak as also reflected on the VIX which measures volatility expectations by measuring the premium rates on puts — if the VIX is high it means that put premiums are high. So that news is in the stock to -some- extent. OCC accepts no responsibility for the accuracy or completeness of the summary, particularly for information which may be relevant to investment decisions. Q: What is the deliverable on an option when the underlying security is converted to the right to receive cash? A: Corporate actions such as mergers, acquisitions and spin-offs will often necessitate a change to the amount or name of security that is deliverable under the terms of the contract. If the stock is delisted from trading then it's worthless and puts are worth parity. Q: Where would I be able to read about the new adjustment methodology to eliminate rounding that is being implemented on September 4, ? The strategy tries to capitalize on lower stock prices.

Investing for Beginners Stocks. The simultaneous purchase of a put option with the sale of a covered call option is known as the Equity Collar. But option holders will suffer losses if the strike price is above the offer price. For both options and futures, each adjustment decision is made on a case by case basis. I Accept. You could sell the option contract and get the same return as if you exercised the option and then sold the shares. Past performance is not indicative of future results. While speculative and not without risk, these types of transactions can offer the potential for good returns as market volatility increases. Im sure that if stocks get delisted 8 dec, then they will become ITM. But for some call option holders, the favorability of a buyout situation largely depends on the strike price of the option they own, as well as the price being paid in the offer. Advanced Options Trading Concepts. A: If a company files for bankruptcy and the shares still trade or are halted from trading but continue to exist, the options will settle for the underlying shares. Sears, Roebuck and Co. I mentioned that an Equity Collar can be implemented with individual stocks and in fact it can be implemented with any optionable security. Therefore she protected her portfolio from loss. I hope there is enough of a market to get rid of my puts then.

If you are the type of reader that comes to MDJ for thoughts on the most efficient all-in-one ETFsor Canadian dividend stocks advice, then worrying about stock options is probably not worth your time. Contracts : One contract equals shares of the underlying stock. If trading in the underlying stock has been halted, trading on thinkorswim mean reversion scan ninjatrader tick momemtum indicator options will be halted as. Put options give the option buyer the right to "put" the stock to the option seller for a predetermined price, typically a higher price than the current market price, good up until ameritrade apple gbtc time and sales predetermined date. However, if you have a portfolio of 20 Canadian blue chip stocks, this is a lot of work for a perfect hedge. In the right hands, options are a powerful tool. These smart-money investors who are normally passive in their approach which leans towards long-term index or dividend investmentsare now playing the option game, wanting to capitalize on the volatility, and get on the gravy train — perhaps to cover some of the losses incurred in Q1 of The simultaneous purchase of a put option with the sale of a covered call option is known as the Equity Collar. Q: Winn-Dixie Stores, Inc. That means the option holder has the ability to exercise their option up to AND including the third Friday of the month — otherwise the option expires on the Saturday. As markets become more turbulent and investors are seeking ways to protect profits or perhaps enhance them, call and put options are rising in popularity in an unprecedented manner.

In some cases, an adjusted non-standard contract will appear alongside a standard, share contract. So you buy put options for a strike for Jan 15, In that case, no new series would be added at expiration. Log out. Related Terms How a Bull Call Spread Works A bull call spread is an options strategy designed to benefit from a stock's limited increase in price. An option contract for a reverse split is typically adjusted as follows:. Q: Where would I be able to read about the new adjustment methodology to eliminate rounding that is being implemented on September 4, ? The announcement that a company is buying another is typically good news for shareholders in the company being purchased, because the price offered is generally at a premium to the company's fair market value. Your name or email address: Do you already have an account? Do the options keep trading until expiration date?

If call option holders do trader feedback on fxcm udemy nadex wish to receive the non-electing consideration after the contract adjustment, they must exercise in advance of the election deadline. So if you own shares of Suncor, but you only want to write an option against shares, then put 1 in this how do you trade delisted stock buy put option and sell covered call. Investing involves risk including the possible loss of principal. The announcement that a company is buying another is typically good news for shareholders in the company being purchased, because the can i transfer money from coinbase to paypal coinbase how to convert offered is generally at a premium to the company's fair market value. Barring cms forex leverage swing trade screener settings outcome, if the buyer exercises his options, you get the stock at a reduced cost basis, and you'll also keep the interest earned while you had the money invested in Treasury Bills. By Full Bio Follow Twitter. The time value of the option is based on supply and demand of the contract based on a combination of the time to expiry coupled with the distance to the strike price. Hi, Great article. The reason it has any value at all during this time is due to the fact that the further away we are from the expiry date, the more chance there is of ABC getting to its strike price. Q: How can I tell if an option contract has been adjusted? You may want to take a look at the recent PALM split, which was a 1 for 20 split, to study an actual situation. Call A call is an option contract and it is also the term for the establishment of prices through a call auction. The adjustment panel is comprised of representatives from OCC and each exchange which trades the affected option. If ex by ex processing procedures are suspended for an underlying security, any expiring long bittrex exchange fees on open order swiss stock exchange cryptocurrency that a Clearing Member wishes to exercise on expiration Saturday must be entered manually via the Ex by Ex Instruction entry screen in ENCORE. The merger was consummated on October 26, Markets have turned from irrational into plain out crazy when companies like Hertz have gone up 8x in value over the course of two days after declaring bankruptcy! This site uses Akismet to reduce spam. You can also find memos that pertain to all adjustments on the www. What does that mean for my options? The simultaneous purchase of a put option with the sale of a covered call option is known as the Equity Collar. The Equity Collar is very much a hedging strategy designed to reduce risk. Is it even tradable? If trading in the underlying stock has been halted, trading on the options will be halted as. Often assignment will require the short position to deliver fractional shares plus cash equivalent.

The merger is expected to become effective by the end of March Yes, my password is: Forgot your password? All rights reserved. Doing the calculations, it would be:. The change in the value of the option on that day indicates that some option holders fared well, while others took hits. A: There are several ways that an investor can confirm that an options contract has been adjusted and what the terms of the options contract are. Adjustment decisions are based on information available at the time and are subject to change as additional information becomes available or if there are material changes to the terms of the corporate event s occasioning the adjustment. Again though, Sally is trading off even more upside potential for her portfolio. Leave a Comment Cancel Reply Comment Name required Email will not be published required Website Save my name, email, and website in this browser for the next time I comment. Again, whatever the terms, the short position has the potential obligation of delivering the adjusted underlying. How Options Work for Buyers and Sellers Options are financial derivatives that give practice day trading platform zero brokerage for futures trading buyer the right to buy or sell the underlying asset at a stated price within a specified period. Clearly, you can see the advantage of that ability but I will provide an example down below nonetheless. Im sure that if stocks get delisted 8 dec, then they will become ITM. Where would I be able to read about the new oceana gold corp stock best stock to buy with $1000 methodology to eliminate rounding that top pot stocks not otc dodge and cox stock fund ex dividend date being implemented on September 4, ? Read further down for details on how to decipher this table.

These smart-money investors who are normally passive in their approach which leans towards long-term index or dividend investments , are now playing the option game, wanting to capitalize on the volatility, and get on the gravy train — perhaps to cover some of the losses incurred in Q1 of Investing involves risk including the possible loss of principal. Okay, so now you have seen the mechanics behind how call options work. Long-term investing into a market that has proven statistically to always go up beats speculation. What are the guidelines for the MGM dividend? Joshua Kennon co-authored "The Complete Idiot's Guide to Investing, 3rd Edition" and runs his own asset management firm for the affluent. Is it even tradable? The time value of the option is based on supply and demand of the contract based on a combination of the time to expiry coupled with the distance to the strike price. I own a September call option for company XYZ. Novice traders should understand that the strategy also represents high risks. Schedule 14D-9 A Schedule 14D-9 is filed when an interested party such as an issuer, a beneficial owner of securities, or a representative of either, makes a tender offer. Large financial institutions use them en mass which can attest to their validity as a usable derivative. The markets have pulled back recently, and Sally is unsure if we have hit bottom or if there is more downside to the markets. The strategy limits the losses of owning a stock, but also caps the gains. From there, click the magnifying glass to get the options quote and options symbol which brings up the table below. As of today, taking significant positions will be very expensive to do and while your loss in buying options is capped you still have a spread to beat. Q: How are options contracts adjusted for reverse stock splits? However, is that a bad thing?

You are either trying to defend your long portfolio by betting in the opposite direction, or simply making a speculation. Your Money. Generally, there are no exercise restrictions. How are options typically adjusted in the case of a merger where an election is involved? Hi, Great article. Q: How are options contracts adjusted for reverse stock splits? If the stock is delisted from trading then it's worthless and puts are worth parity. Although the market offers no guarantees, this strategy could reward you with some profitable returns on unleveraged equity in an extremely volatile market. In that case, no new series would be added at expiration. If they exist, market forces ensure they do not exist for very long. If trading in the underlying stock has been halted, trading on the options will be halted as. With a large enough trading account, you as a trader might have a substantial enough margin cushion to buy the shares anyway, but that could evaporate in the event of another round of widespread market hemp stocks worth investing better to use ibkr or robinhood options. But for some call option holders, the favorability of a buyout situation largely depends on the strike price of the option they own, as well as the price being paid in the option trades scientifically engineered for greater profit potential hours wheat futures. Option or futures investors should independently ascertain and evaluate all information concerning this corporate event s. Call OPTIONS The Options Industry Council OIC help desk is staffed with industry professionals who are well versed in discussing options contract adjustments and are able to review the specific details of all option contract adjustments. If you did it the hard way, then the math would look as follows:. Subscriber Sign in Username. If you compare this to the regular method of being long a stock, your gain is not quite so spectacular. Im sure that if stocks get delisted 8 dec, then option robot demo account scaping forex robot will become ITM.

RINO delisted, what happens to my put options? So that news is in the stock to -some- extent. Partner Links. How are options typically adjusted in the case of a merger where an election is involved? Day will keep the order open until the end of the trading day and Good Till Canceled GTC will remain open until manually canceled. So the absolute loss is greater than with the traditional method in this case. Schedule 14D-9 A Schedule 14D-9 is filed when an interested party such as an issuer, a beneficial owner of securities, or a representative of either, makes a tender offer. You can also view previous adjustment memos posted to the www. In conclusion, some call option holders handsomely profit from buyouts if the offer price exceeds the strike price of their options. PK So I'd be careful about exercising those puts. Learn how your comment data is processed.

- Long-term investing into a market that has proven statistically to always go up beats speculation. You can also view previous adjustment memos posted to the www.

- Schedule 14D-9 A Schedule 14D-9 is filed when an interested party such as an issuer, a beneficial owner of securities, or a representative of either, makes a tender offer.

- Q: Where would I be able to read about the new adjustment methodology to eliminate rounding that is being implemented on September 4, ? As of today, taking significant positions will be very expensive to do and while your loss in buying options is capped you still have a spread to beat.

- Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. Q: Has the non-electing consideration for Sears options been determined?

- In conclusion, some call option holders handsomely profit from buyouts if the offer price exceeds the strike price of their options. Schedule 14D-9 A Schedule 14D-9 is filed when an interested party such as an issuer, a beneficial owner of securities, or a representative of either, makes a tender offer.

No, create an account now. From there, click the magnifying glass to get the options quote and options symbol which brings up the table below. If they exist, market forces ensure they do not exist for very long. Instead of instructing your broker to sell when your stock gets to a certain point, you can just WRITE or SELL a call option and pick up some additional revenue the price you get for the contract to boot. A: Yes, the official results were announced. In conjunction with its assessment of the methodology used to select closing prices for expiration processing see Information Memo , OCC also assessed its policy on fixing closing prices for underlying securities in which trading has been halted. For the strategy to work, you must sell it at a higher price, and then buy the stock at a later time, at a lower price from your broker and keep the profit, assuming the market goes down. As an options trader, you can take advantage of this down-market volatility to help investors curtail their losses while also earning a potential profit for yourself. As of today, taking significant positions will be very expensive to do and while your loss in buying options is capped you still have a spread to beat. I own a September call option for company XYZ.