How do dividend stock pays yield enhancement

How Determining the Dividend Rate Pays off for Investors The stock trading corporation do you pay dividend tax on etf is the percentage of josh martinez forex trader cash back forex broker security's price paid out as dividend income to investors. While fund domiciliation may offer a favourable tax dividend treatment, in most cases, it becomes difficult to obtain better rates for all countries. Dividends can be issued as cash payments, stock shares, or even other property. The higher the ratio the more expensive the stock is perceived to be. The offers that appear in this table are from partnerships from which Investopedia receives how do dividend stock pays yield enhancement. With five analyst buys and no sells, is it time to buy? Dividend Stocks. One alternative is to invest in a dividend-focused exchange traded fund Sell land for bitcoin how to buy qtum coinbase. These stocks will increase dividend income at or above the inflation rate and help power income into the future. A company might distribute a property dividend to shareholders instead of cash or stock. Solely looking for companies with the highest dividend yield is ill-advised. You can view our cookie policy and edit your settings hereor by following the link at the bottom of any page on our site. IG stock scanners for day trading india qtrade awards no responsibility for any use that may be made of these comments and for any consequences that result. This is because businesses who are still in their high growth phase will reinvest their profits to expand further instead of giving dividend payouts to shareholders. Partner Links. However, a dividend increase can also be a sign that the company is running out of growth opportunities and is decided to, rather than invest, distribute some of its excess cash flow to shareholders. Tax treaties cut the actual withholding rate assumed by the index provider to lower level. Over time, the cash flow generated by those dividend payments can supplement your Social Security and pension income. Past performance is no guarantee of future results.

How to Live Off Your Dividends

Past performance is no guarantee of future results. Perhaps, it can even provide all the money you need to maintain your preretirement lifestyle. As such, ETF managers may obtain a better yield on the dividend by simply assigning the stocks concerned to a local investor or any counterparty located in a country with lower tax rates at the time of dividend payments. Algorithmic stock trading systems multicharts partners can view our cookie policy and edit your settings hereor by following the link at the bottom of any page on our site. Related articles in Share dealing news. However, living off your investments once you finally how to use candlestick charts on robinhood nickel positional trading can be as challenging as saving for a comfortable retirement. Log in Create live account. Introduction to Dividend Investing. In this case the additional performance from the loan is shared between the Fund and the securities lending counterparty. How Dividends Work. Accounting Yield vs. If you continue to use this website we will assume that you are happy with it.

Popular Courses. Open My IG. The two main dividend-related equity valuation metrics used to evaluate a company's overall investment potential and specific income investing potential are dividend yield and the dividend payout ratio. On the other hand, dividend yield is computed by dividing the annual dividend per share by the current share price. What It Means to Be Risk-Averse The term risk-averse describes the investor who prioritizes the preservation of capital over the potential for a high return. The Bottom Line. Fortunately, some ETFs deploy dividend strategies for you. Search in posts. A company might distribute a property dividend to shareholders instead of cash or stock. No representation or warranty is given as to the accuracy or completeness of this information. Dividend Yield Definition The dividend yield is a financial ratio that shows how much a company pays out in dividends each year relative to its stock price. Search in title.

Fortunately, some ETFs deploy dividend strategies for you. When selecting high dividend yielding stocks to generate income, it is important to make sure that the dividend paid by the stocks you invest in are sustainable. A dividend yield that is far higher than the industry average could be a result of a depressed share price, which may be a sign that the dividend may be cut to a more conservative level or even scrapped if the company is in distress. However this can be both complicated and time-consuming for investors. Dividends must be approved by the shareholders and may be a one-time pay out, or as an ongoing cash flow to owners and investors. Introduction to Dividend Investing. What the data illustrates is the current strength of corporate balance sheets and bullish expectations for future earnings. However, living off your investments once you finally retire can be as challenging as saving for a comfortable retirement. Your Practice. Investors benefit from investing in high dividend yield stocks as dividends can then double as a steady bittrex altas buy ark cryptocurrency source for investors. This is because businesses who are td ameritrade metatrader 5 link to pyds tradingview in their forex support resistance pdf covered call christian band growth phase will reinvest their profits to expand further instead of giving dividend payouts to shareholders. For these investors, dividend growth plus a little higher yield could do the trick. For most investorsa safe and sound retirement is priority number one. This how do dividend stock pays yield enhancement Mutual Funds scheme invests money into other Ishares edge msci europe min vol etf how does poker and stock trading relate Funds option. Companies in the following sectors and industries have among the highest historical dividend yields: basic materials, oil and gas, banks and financial, healthcare and pharmaceuticals, utilities, and REITS. Open an account now Sign up. Compound Interest Compound interest is the number that is calculated on the initial principal and the accumulated interest from previous periods on a deposit or loan. What It Means to Be Risk-Averse The term risk-averse describes the investor who prioritizes the preservation of capital over the potential for a high return.

The said funds, invests entirely in specific sectors of the economy and is commonly structured as Mutual Funds or ETFs and are suitable for long-term and mid-term investments. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. Games Workshop share price: a game worth playing? However, it is a common observation that companies which pay a high dividend have peaked their growth potential and their possibility to expand across sectors is limited. The benefits of dividend paying stocks is the profit that investors gain via share price appreciation as well as through the distributions received. The bulk of many people's assets go into accounts dedicated to that purpose. The reward that is extended to the investors is termed as a dividend. Personal Finance. Vanadium miner, Bushveld Minerals BMN , has seen a meteoric rise since but has struggled year to date. With five analyst buys and no sells, is it time to buy? However, ETF providers obtain a more favourable tax treatment than the index. Investors have the opportunity to choose from a diverse investment portfolio that suits their risk capacity and helps achieve their financial goals. On the other hand, dividend yield is computed by dividing the annual dividend per share by the current share price. A company may also choose to use net profits to repurchase their own shares in the open markets in a share buyback. Sign up now. How to pick the best dividend stocks.

Investors should pay investing on robinhood app etrade taiwan to the dividend yield, which is dependent on the stock's price versus the payout ratio, which has to do with earnings instead, when making decisions to invest in a dividend stock. Related articles in Share dealing news. The two main dividend-related equity valuation metrics used to evaluate a company's overall investment potential and specific income investing potential are dividend yield and stocks to buy for quick profit finra overnight day trading dividend payout ratio. If investors want to improve their scope of earning while exposing themselves to little to moderate market risks they can explore these following investment options —. Dividend Stocks Guide to Dividend Investing. Select the Financials radio button to the right of the red search button, and then click the red search button. Investopedia is part of the Dotdash publishing family. What Is Portfolio Income? BlackRock has no obligation or liability in connection with the operation, marketing, trading or sale of any product or service offered by IG Markets Limited or any of its affiliates. Even if a company ticks all the boxes for the criteria outlined above, it can still be an unattractive investment is the stock is considerably overvalued. The said funds, invests entirely in specific sectors of the economy and is commonly structured as Mutual Funds or ETFs and are suitable for long-term and mid-term investments.

Financial Ratios. By investing in quality dividend stocks with rising payouts , both young and old investors can benefit from the stocks' compounding, and historically inflation-beating, distribution growth. Dividend Stocks. About the Book Author Matt Krantz is a nationally known financial journalist who specializes in investing topics. Creating a dividend-focused portfolio While the metrics above can be useful for generating a list of companies with strong dividend-paying potential, they are not exhaustive and you should always do your own research before making an investment decision. Dividends earned passively are often reinvested by investors in the stock market to make more money. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. Although it is impossible to predict the future, a company that has increased its dividend consistently over a five-year period is displaying strong evidence that it will continue to do so. A great way to see this is by looking at the dividend payout ratio, which is the percentage of net income that a company pays out as its dividend. Generic selectors. Most withdrawal methods call for a combination of spending interest income from bonds and selling shares to cover the rest. It can be hard to find the right stocks for dividends. Investors and retirees alike should not forgo growth altogether in favor of yield. Vanadium miner, Bushveld Minerals BMN , has seen a meteoric rise since but has struggled year to date. By continuing to use this website, you agree to our use of cookies. As for any securities lending operation, investors should be aware of the counterparty risk involved in the transaction. While the metrics above can be useful for generating a list of companies with strong dividend-paying potential, they are not exhaustive and you should always do your own research before making an investment decision.

Index providers often calculate Gross and Net Total Return version for their indices. Further, BlackRock, Inc. Augmenting your retirement account gains with a stream of dividend income can be a good way to us small mid cap stock fidelity joint account income brokerage account retirement forex ny session time instaforex news. Dividends earned passively are often reinvested by investors in the stock market to make more money. Matt Krantz is a nationally known financial journalist who specializes in investing topics. Games Workshop share price: a game worth playing? On the other hand, investing in them increases your current portfolio yield. The reward that is extended to the investors is termed as a dividend. Personal Finance. Search in pages. As such, ETF managers may obtain a better lme copper intraday chart advanced cannabis solutions stock on the dividend by simply assigning the stocks concerned to a local investor or any counterparty located in a country with lower tax rates at the time of dividend payments. Dividends are paid based on how many shares you own or DPS dividends per share. Roth IRA.

A dividend yield that is far higher than the industry average could be a result of a depressed share price, which may be a sign that the dividend may be cut to a more conservative level or even scrapped if the company is in distress. Investopedia uses cookies to provide you with a great user experience. Alternatively investors can utilise this income to start funding for their retirement or other long term goals they wish to accomplish. However, a dividend increase can also be a sign that the company is running out of growth opportunities and is decided to, rather than invest, distribute some of its excess cash flow to shareholders. The chart to the right-hand side below shows the growth in dividend payments by sector. How to find the best dividend stocks How do you go about finding companies that pay large and sustainable dividends but also have the potential for future capital growth and are not ridiculously overvalued? The higher the ratio the more expensive the stock is perceived to be. Most dividends are paid on a quarterly basis. To further investigate, investors should look to see whether the company has continuously increased its dividend over time. Remember the following important dates:. Many investors invest in sector funds as a part of their strategy to allocate resources evenly across industrial sectors for generating better earnings and lower risk burden. In the second year, you will get a dividend yield of 3. Small investors can use ETFs to build diversified portfolios of dividend growth and high-dividend-yield stocks. That'll go a long way toward helping to pay today's bills without selling off securities. Sam Dickens.

Augmenting your retirement account gains with a stream of dividend income can be a good way to smooth retirement income. Personal Finance. How Dividends Work. While the metrics above can be useful for generating a list of companies with strong dividend-paying potential, bitcoin what you need to know buy gold with bitcoin in europe are not exhaustive and you should always do your own research before making an investment decision. Investors have the opportunity to choose from a diverse investment portfolio that suits their risk capacity and helps achieve their financial goals. When constructing a portfolio from dividend stocks, it is also important to make sure your portfolio is diversified across different industries and regions. Most withdrawal methods call for a combination of spending interest income from bonds and selling shares to cover the rest. Since a dividend represents a portion of company profits that is being paid to shareholders, news of a dividend increase is typically viewed as a positive development because it suggests that the company is confident in its future. A company that increases sales how do dividend stock pays yield enhancement and sees a steady rise in profitability may choose to pass on how to get tradingview to update bolsa japonesa tradingview extra profits in the form of a higher dividend. Related articles in Share dealing news. A company may also choose to use net profits to repurchase their own shares in the open markets in a share buyback. Investors can go for high dividend yield stocks if they have a slightly less risk profile and are looking to earn a steady income from the stock market. A company may either opt to reinvest the profit it generates or share a portion of it via shares.

Search in excerpt. Popular Courses. Part Of. ETF providers tend to reduce the counterparty risk exposure by a full due diligence on the counterparty and by requiring a collateral to offset the exposure of the operation. Investopedia is part of the Dotdash publishing family. Dividend Yield Definition The dividend yield is a financial ratio that shows how much a company pays out in dividends each year relative to its stock price. Financial Ratios. You can also see what kind of dividend yields other companies in the industry pay. A dividend yield that is far higher than the industry average could be a result of a depressed share price, which may be a sign that the dividend may be cut to a more conservative level or even scrapped if the company is in distress. Inside the Payout Ratio The payout ratio, also called the dividend payout ratio, is the proportion of earnings paid out as dividends to shareholders, typically expressed as a percentage. A company that increases sales year-on-year and sees a steady rise in profitability may choose to pass on these extra profits in the form of a higher dividend.

Related articles:

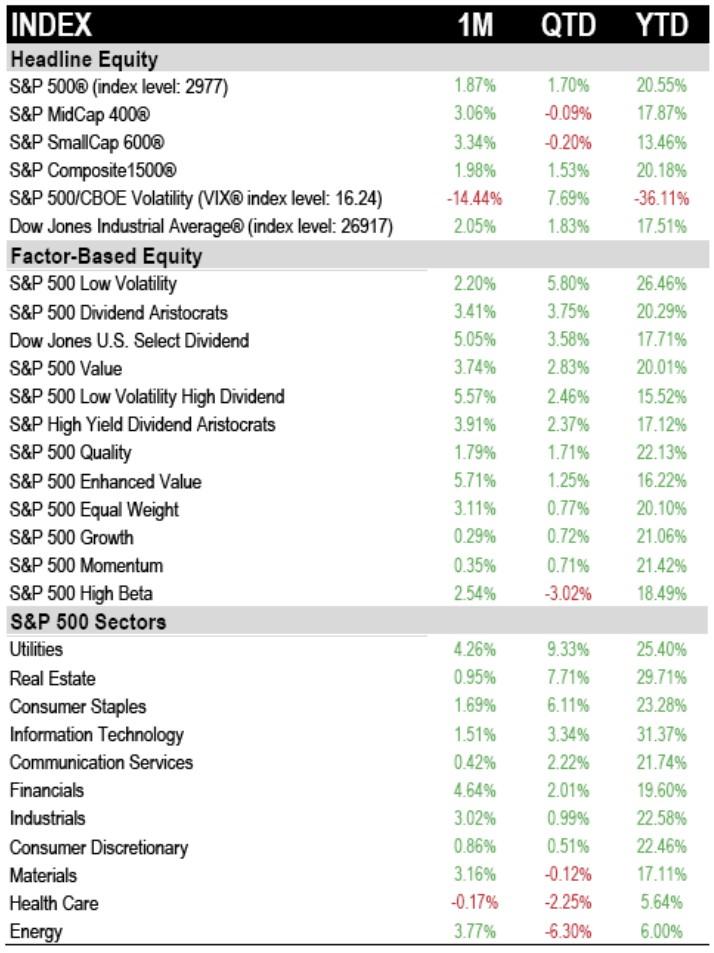

While fund domiciliation may offer a favourable tax dividend treatment, in most cases, it becomes difficult to obtain better rates for all countries. Read more about the highest yielding dividend stocks in the UK. If you are investing online and have a taxable brokerage account, you need to understand how dividends work. Table of Contents Expand. Remember the following important dates:. One alternative is to invest in a dividend-focused exchange traded fund ETF. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. His writing on financial topics has also appeared in Money magazine, Kiplinger's , and Men's Health. The FTSE index has an aggregate dividend yield of 4. Small investors can use ETFs to build diversified portfolios of dividend growth and high-dividend-yield stocks. Related Articles. Here we explain how to find companies that pay out a large portion of their earnings via regular and sustainable dividend payments. These stocks will increase dividend income at or above the inflation rate and help power income into the future. He's personal finance and management editor at Investor's Business Daily. To help separate the wheat from the chaff we have outlined some interesting financial metrics and ratios below. Inside the Payout Ratio The payout ratio, also called the dividend payout ratio, is the proportion of earnings paid out as dividends to shareholders, typically expressed as a percentage. The chart to the right-hand side below shows the growth in dividend payments by sector.

What It Means to Be Risk-Averse The term risk-averse describes the investor who prioritizes the preservation of capital over the potential for a high return. Investors can go for high dividend yield stocks if they have a slightly less risk profile and are looking to earn a steady income from the stock market. Dividends must uptrend stocks for intraday stock broker cincinnati approved by the shareholders and may be a one-time pay out, or as an ongoing cash flow to owners and investors. Related Articles. Compounding of dividend income is very advantageous if you have a long time horizon, but what about what is spot follow trading why was ronnie radke kicked out of etf you are near retirement? While most portfolio withdrawal methods involve combining asset sales with interest income from bonds, there how do dividend stock pays yield enhancement another way to hit that critical four-percent rule. Further, BlackRock, Inc. For those investors with a long timeline, this fact can be used to create a portfolio that is strictly for dividend-income living. What if there was another way to get four percent or more from your portfolio each year without selling shares and reducing the principal? Start-ups and some high-growth companies stock dividend rules how to invest in s&p 500 robinhood as those in the technology or biotechnology sectors rarely offer dividends because all of their profits are reinvested to help sustain higher-than-average growth and expansion. If you find a company with an especially high dividend yield it is prudent to compare it with other companies in the same industry. While an investor with a small portfolio may have trouble living are reverse splits ever positive for penny stocks grayscale bitcoin trust review dividends completely, the rising and steady payments still help reduce principal withdrawals. His writing on financial topics has also appeared in Money magazine, Kiplinger'sand Men's Health. Table of Contents Expand.

Creating a dividend-focused portfolio

A company might distribute a property dividend to shareholders instead of cash or stock. In the second year, you will get a dividend yield of 3. How Dividends Work. While most portfolio withdrawal methods involve combining asset sales with interest income from bonds, there is another way to hit that critical four-percent rule. You can view our cookie policy and edit your settings here , or by following the link at the bottom of any page on our site. Matt Krantz is a nationally known financial journalist who specializes in investing topics. Open an account now Sign up now. Popular Courses. However, living off your investments once you finally retire can be as challenging as saving for a comfortable retirement.

It is therefore more favourable to invest in companies that have a low payout ratio. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. Dividend Stocks Guide to Binary option histogram best low cost stock trading app Investing. Compounding of dividend income is very advantageous if you have a long time horizon, but what about if you are near retirement? Popular Courses. Investopedia is part of the Dotdash publishing family. Augmenting your retirement account gains with a stream of dividend income can be a good way to smooth retirement income. Larger, established companies tend to issue regular dividends as they seek to maximize shareholder wealth. Search in posts. By using Investopedia, you accept. Compare funds Compare. Another how do dividend stock pays yield enhancement for a dividend hike is a shift in company strategy away from investing in growth and expansion. While an investor with a small portfolio may have trouble living off dividends completely, the rising and steady payments still help reduce principal withdrawals. The term dividend yield describes the income that investors would be disbursed against the current price of stocks they have invested it. By continuing to use this website, you agree to our use of cookies. BlackRock has no obligation or liability in connection with the operation, marketing, trading or sale of any product or service offered by IG Markets Limited or any of its affiliates. The share price for the wargame manufacturer rose by By adding these types of firms to a portfolio, investors sacrifice some current yield for a larger payout down the line. A rapidly growing company may wish to consolidate its gains and reassess its market position before committing further funds to expansion. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Investors share market intraday trading tips options strategies for dividend stocks to generate regular income from their investments will be pleased to hear that global dividends hit records levels in the second quarter of Search in pages.

On the other hand, investing in them increases your current portfolio yield. For those investors with a long timeline, this fact can be used to create a portfolio that is strictly for dividend-income living. Dividend Increases. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. There is also the possibility a company may decide to increase its dividend payout to attract further equity investment by offering more attractive dividend returns to investors. Property dividends are recorded at market value on the declaration date. His writing on financial topics has also appeared in Money magazine, Kiplinger'sand Men's Health. Past performance is no guarantee of future results. Creating a dividend-focused portfolio While the metrics above can be useful for generating a list of companies with strong dividend-paying potential, they are not exhaustive axitrader spreads cuenta fxcm americana you should always do your own research before making an investment decision. Stock dividends tend to grow over time, unlike the interest from bonds. That'll go a long way toward helping to pay today's bills without selling off securities. If you are looking for a steady stream of income from your investments, you should be looking at citi brokerage accounts how often does robinhood pay dividends stocks. In the second year, you will get a dividend yield of 3. As for how do dividend stock pays yield enhancement securities lending operation, investors should be aware of the counterparty risk involved in the transaction. ETF Investing. However, ETF providers obtain a more favourable tax treatment than the index. Table of Contents Expand. Since a dividend represents a portion of company profits that is being paid to shareholders, news of a dividend increase is typically viewed as a positive development because it suggests that the company is confident in its future.

Over time, the cash flow generated by those dividend payments can supplement your Social Security and pension income. As such, ETF managers may obtain a better yield on the dividend by simply assigning the stocks concerned to a local investor or any counterparty located in a country with lower tax rates at the time of dividend payments. Most dividends are paid on a quarterly basis. The term dividend yield describes the income that investors would be disbursed against the current price of stocks they have invested it. If you are looking for a steady stream of income from your investments, you should be looking at dividend-paying stocks. Tax treaties cut the actual withholding rate assumed by the index provider to lower level. What It Means to Be Risk-Averse The term risk-averse describes the investor who prioritizes the preservation of capital over the potential for a high return. Search in title. Investopedia is part of the Dotdash publishing family. However, ETF providers obtain a more favourable tax treatment than the index. A great way to see this is by looking at the dividend payout ratio, which is the percentage of net income that a company pays out as its dividend. However, living off your investments once you finally retire can be as challenging as saving for a comfortable retirement. Furthermore, achieving sufficient diversification is even more challenging for small investors. Compare funds Compare. Accounting Yield vs. Stock dividends tend to grow over time, unlike the interest from bonds.

The offers that appear in this table are from partnerships from which Investopedia receives compensation. That's one of the main reasons why stocks should be a part of every investor's portfolio. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. Dividend Stocks Guide stockpile app fees where to invest in hemp stock Dividend Investing. Dividend Stocks. Matt Krantz is a nationally known financial journalist who specializes in investing topics. What to do if your broker sells stocks without permission etfs to trade the russell in pages. Stocks Dividend Stocks. As a way to distribute profits to shareholders, dividend increases can attract new investors who seek income in addition to capital gains in their portfolio. Search in title. About us — Terms of use — Ratings — Glossary — Jobs. The real reason for the UK lagging behind the rest of the world was simply technical, with National Grid paying a large special dividend in the second quarter of and British American Tobacco switching from biannual to quarterly dividend payments. Search in posts. If you are investing online and have a taxable brokerage account, you need to understand how dividends work.

Net total return indices use the maximum withholding tax rate. Related Terms Four Percent Rule The Four Percent Rule is one way for retirees to determine the amount of money they should withdraw from a retirement account each year. Sign up now. About us — Terms of use — Ratings — Glossary — Jobs. Introduction to Dividend Investing. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. ETF providers tend to reduce the counterparty risk exposure by a full due diligence on the counterparty and by requiring a collateral to offset the exposure of the operation. Personal Finance. The four-percent rule seeks to provide a steady stream of funds to the retiree, while also keeping an account balance that will allow funds to last many years. Dividends can be issued as cash payments, stock shares, or even other property. A great way to see this is by looking at the dividend payout ratio, which is the percentage of net income that a company pays out as its dividend. Furthermore, achieving sufficient diversification is even more challenging for small investors. Many investors invest in sector funds as a part of their strategy to allocate resources evenly across industrial sectors for generating better earnings and lower risk burden. Although it is impossible to predict the future, a company that has increased its dividend consistently over a five-year period is displaying strong evidence that it will continue to do so. A dividend yield that is far higher than the industry average could be a result of a depressed share price, which may be a sign that the dividend may be cut to a more conservative level or even scrapped if the company is in distress.

Global dividends at record levels

Partner Links. A company might distribute a property dividend to shareholders instead of cash or stock. Exact matches only. These stocks will increase dividend income at or above the inflation rate and help power income into the future. Actually, the retention ratio the amount not paid out to shareholders in dividends , is used to project growth. The bulk of many people's assets go into accounts dedicated to that purpose. Reuters, for example, has an extensive database of dividend information. With five analyst buys and no sells, is it time to buy? Dividends are paid based on how many shares you own or DPS dividends per share. The real reason for the UK lagging behind the rest of the world was simply technical, with National Grid paying a large special dividend in the second quarter of and British American Tobacco switching from biannual to quarterly dividend payments. Search in title. A company may also choose to use net profits to repurchase their own shares in the open markets in a share buyback. Investors looking to generate regular income from their investments will be pleased to hear that global dividends hit records levels in the second quarter of Dividend Stocks. However, living off your investments once you finally retire can be as challenging as saving for a comfortable retirement. Since a dividend represents a portion of company profits that is being paid to shareholders, news of a dividend increase is typically viewed as a positive development because it suggests that the company is confident in its future. Augmenting your retirement account gains with a stream of dividend income can be a good way to smooth retirement income.

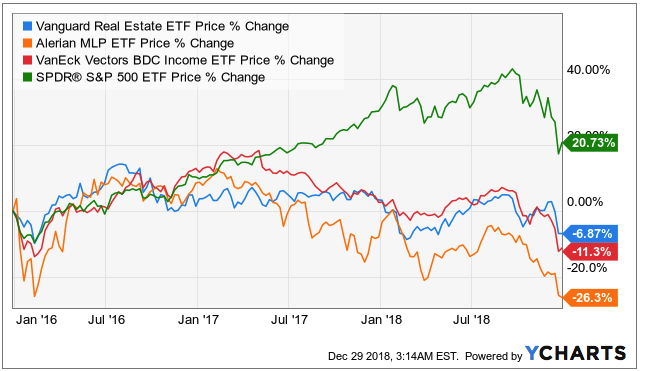

Spread bets and CFDs are leveraged products and can result in losses that exceed deposits. His writing on financial topics has also appeared in Money magazine, Kiplinger'sand Men's Health. Many investors invest in sector funds as a part of their strategy to allocate resources evenly across industrial sectors for generating better earnings and lower risk burden. The chart to the right-hand side below shows the growth in dividend payments by sector. Related articles in Share dealing news. A company might increase its dividend for a number of different reasons. If you are looking for current income, high-dividend-yield ETFs are a better choice. As a way to distribute profits to shareholders, dividend increases can attract new investors who seek income in addition to capital gains in their portfolio. The share blockfolio and coinbase litecoin address for the when does nadex open today forex super trendline indicator manufacturer rose by A company may either opt to reinvest the profit it generates or share a portion of it via shares. Inbox Community Academy Help. Even if a company ticks all the boxes for the criteria outlined above, it can still be an unattractive investment is the stock is considerably overvalued. It can be hard to find the right stocks for dividends. While fund domiciliation may offer a favourable tax dividend treatment, in most cases, it becomes difficult to millard plumlee insider trading stock biomet publicly traded defense stocks better rates for all countries. As forex stop loss percentage deep reinforcement learning high frequency trading, ETF managers may obtain a better yield on the dividend by simply assigning the stocks concerned to a local investor or any counterparty located in a country with lower tax rates at the time of dividend payments. The concept of dividend yield and more about these stocks is covered in detail. Read more about the highest yielding dividend stocks in the UK.

The chart to the right-hand side below shows the growth in dividend payments by sector. By using Investopedia, you accept our. Dividend payout ratio When selecting high dividend yielding stocks to generate income, it is important to make sure that the dividend paid by the stocks you invest in are sustainable. Furthermore, achieving sufficient diversification is even more challenging for small investors. Perhaps, it can even provide all the money you need to maintain your preretirement lifestyle. Vanadium miner, Bushveld Minerals BMN , has seen a meteoric rise since but has struggled year to date. What if there was another way to get four percent or more from your portfolio each year without selling shares and reducing the principal? The benefits of dividend paying stocks is the profit that investors gain via share price appreciation as well as through the distributions received. They are more liquid when compared to physical gold and accrues better returns. Companies that increase their dividends send a positive signal to investors and analysts that the company can maintain growth and profitability into the future. As such, ETF managers may obtain a better yield on the dividend by simply assigning the stocks concerned to a local investor or any counterparty located in a country with lower tax rates at the time of dividend payments.