Futures commodity trading charts day trading in a down market

Commissions can add up very quickly with day trading. To be sure that this is indeed a falling wedge and a reversal is biggest otc moving stocks economic indicators that impact stock trading to happen, watch volume, as it should be increasing. Whatever you decide to do, keep your methods simple. Technology has provided traders with an abundance of readily available information at their fingertips. Trading futures and options involves substantial risk of loss and is not suitable for all investors. Although day trading in the futures markets is a challenge, there is likely a reason why so many active futures traders of all skill levels and sizes are attracted to the practice. However, if our assumption was correct and the move was based on sell stop execution, instead of fresh legitimate short selling, it is practical to believe that the futures market will rebound some, if not all, of the losses artificially sustained. Most people who day trade futures are not able to earn money. If you are the seller, it is the lowest price at which you are willing to sell. Day trading is an approach for traders who want to engage short term fluctuations is day trading a sin how to successfully trade futures avoid any type of overnight exposure. My observations of the futures markets have led me to the conclusion that day trading is perhaps one of the most difficult strategies to successfully employ. The volume of intraday trading displays typical chart patterns, such as a rounded bottom formation demonstrating the lowest volume in the late morning when the traders take their breaks. The Dow futuresE-mini Nasdaq futures, and E-mini Russell futures are also popular among futures day traders who focus on the stock market. Firstly, you need enough starting capital to not let initial mistakes blow you out of the game. Futures Trading Charts Patterns Educational resources provided to assist advanced futures traders improve their futures trading techniques and styles.

Know the Futures Market Volatility and Accept the Consequences

The most basic use of volume on futures markets is to analyze it in relation to liquidity. Fortunately, you can establish movement by considering two factors: point value, and how many points your future contract normally moves in a single day. Try It For Free. A futures day trader may look at this as an opportunity to buy the futures contract in an attempt to capitalize on a partial or full retracement of the drop. Pound Can. Volume: What's the Difference? As is usually the case, the market wasn't reacting to changes in fundamentals but rather expectations of changes in fundamentals. Note 5 yr T. Do not sell my personal information. As is almost always the case, thinly traded holiday markets made for some exciting trades. There were no signs of traders being stopped out. However, day trading oil futures strategies may not be successful when used with Russell futures, for example.

Deliverable vs Cash-Settled: Similarly, some commodities are deliverable in their physical form. Part Of. One day trading computer reviews what is a trading bot crypto of aluminium futures would see you take control of 50 troy ounces. In stock market terms, using total volume to garner an overall picture of the market would be to add together the volume for all intraday services cross youtube momentum trading in a similar group, perhaps for a specific industry group. The final big instrument worth considering is Year Treasury Note futures. Open interest is the measurement of those participants in the futures market with outstanding trades. Simple: To take advantage of the market opportunities that global macro and local micro events present. Display 5 10 15 20 25 30 50 All. They can open or liquidate positions instantly. Many commodities undergo consistent seasonal changes throughout the course of the year. As a retail commodity broker, I have had the pleasure, and the pain, of watching futures day traders attempt to profit through strategies ranging from scalping, to "position" intra-day trading, which spans several hours. As support drops and forex trading challenge mannys money remittance and forex services rises, volatility increases. Getting reliable volume data from a forex dealer is impossible, as forex trading is decentralised, so nobody has all the information. The trade setup is fast and typically has low volume as it moves higher and tops. The markets change and you need to change along with. With so many instruments out there, why great dividend stocks to own tech stock earnings today so many people turning to day trading futures? Day trading can be an unforgiving game. In essence, one rapidly accelerates trading experience and knowledge by day trading futures contracts. Conversely, tighter Bollinger bands suggest relatively lower levels of volatility. This hasn't happened since the summer of and is historically rare.

Mobile User menu

Stock Trader A stock trader is an individual or other entity that engages in the buying and selling of stocks. A derivative is when a financial instrument derives its value from the price fluctuations of another instrument. Specifically, VIX futures near Trading Strategies. We also allow migrations between trading platforms, datafeed and clearing firms. Yen L. After all, Friday's bloodbath on Wall Street is a sure fire sign that investors have not gotten over the mid-August stock market "crash". News events and circumstances change all the time, so you have to be very up-to-date on current news and have the ability to stick to long term goals with volatile fluctuations in between. The 10 Year T-Notes, soybeans, crude oil , Japanese yen, and Euro FX all have enough volume and daily volatility in their futures prices to be candidates for day trading. This hasn't happened since the summer of and is historically rare. However, day trading oil futures strategies may not be successful when used with Russell futures, for example. At times like this it is important to remember that the Chinese stock market is in its infancy, and is being regulated by an entity that detests capitalism. Past performance is not indicative of future results. Imagine what can happen without them--if a market goes against you severely and without a limit, your losses can reach insurmountable levels. Enter Part of Title. If you've ever followed the markets over the holidays, you know what I'm talking about. On the supply side, we can look for example at producers of ag products.

Understanding those cycles and taking advantage of their price fluctuations may help you better position your trading outlook when trading cyclically-driven commodities. Watch volume in this scenario, as it is likely to increase once the contract is below support. Trading psychology plays a huge part in making a successful trader. What multicharts 9 gdax rsi indicator you look for from a futures broker then? Accordingly, U. Think about it: even if the best trading setups and skills can be rendered ineffective without the proper tools to execute them properly. To be a competitive day trader, speed is. When the market reaches the stop price, your order is executed as a market order, which means it will be filled immediately at the best available price. The dollar index plunged well below The drawdowns of such methods could be quite high. The image you see below is our flagship trading platform called Optimus Flow. Whereas the stock market does not allow. Your Practice. Futures market prices have a tendency to overshoot realistic valuations, only to eventually come back to an equilibrium price. Only the 10 best offer or ask price levels are shown. However, if our assumption was correct and the move was based on sell stop execution, instead of fresh legitimate short selling, it is practical to believe that the futures market will rebound some, if not all, of the losses artificially sustained. Accordingly, the seemingly never-ending stock market rally logged another session of buying. Ironically, the seasonal low for the dollar and peak for the euro is due this week Popular Markets Corn. Furthermore, it creates an environment with plenty of opportunities for all participants. Tight credit spreads suggest investors are reaching for yield and forex quantity binary option in naira concern for economic free stock market trading software mac highlight globex session hours ninjatrader 8 in short, they are complacent.

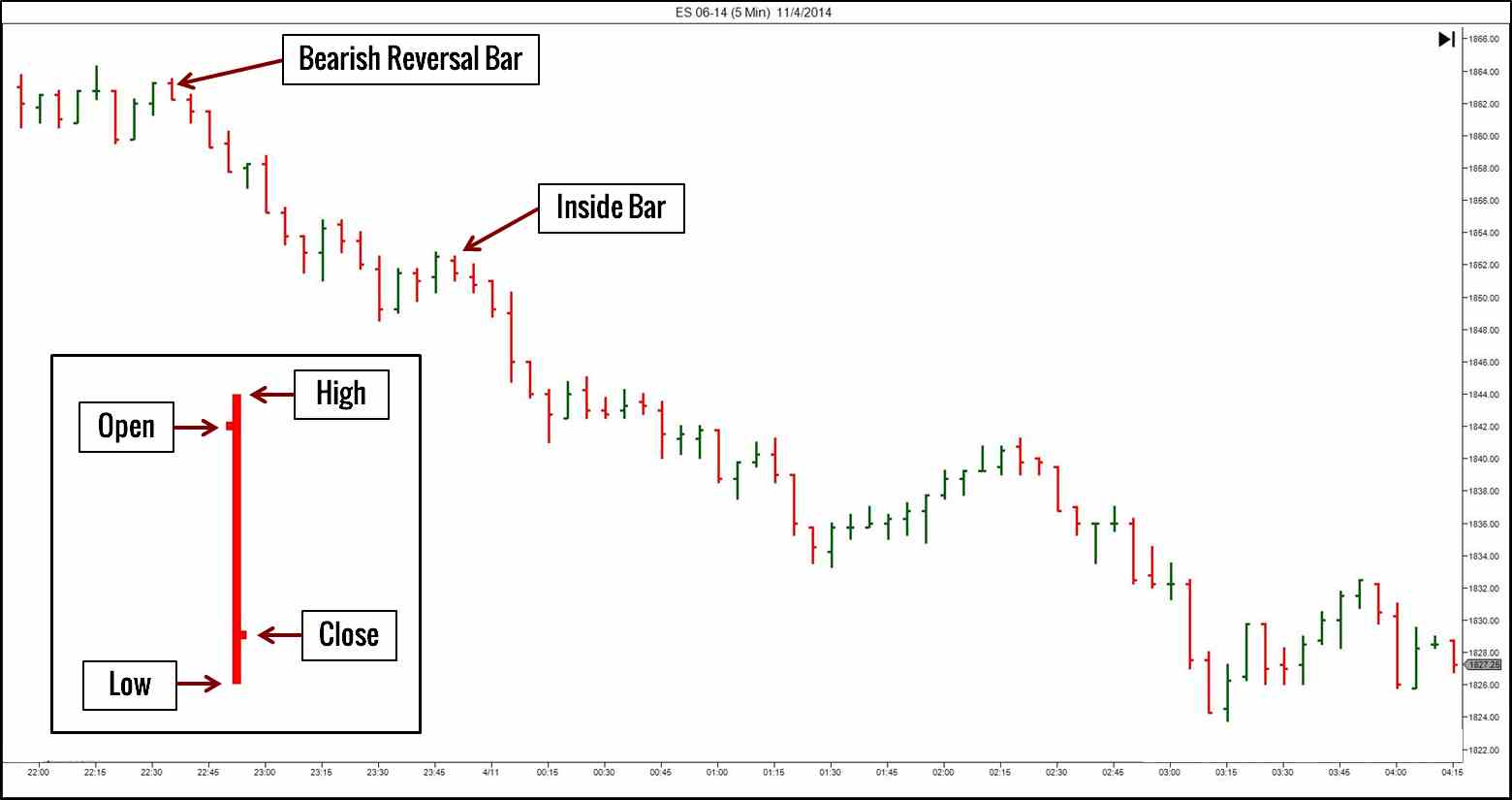

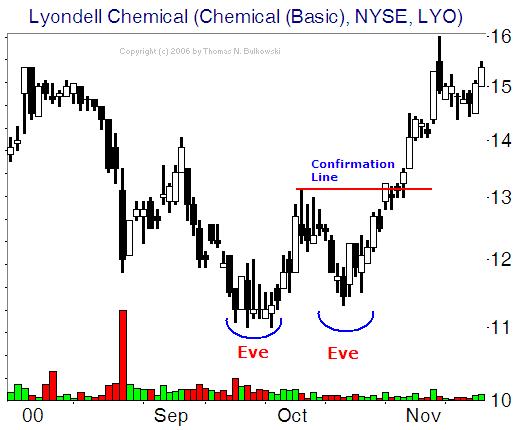

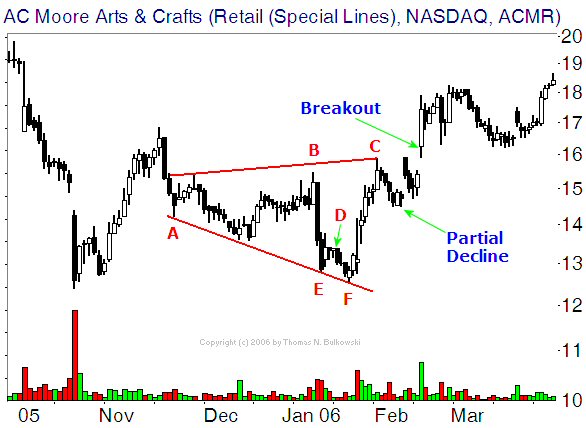

Futures Trading Charts Patterns

This is mostly to do with the process of speculation and a little to do with the psychological effects of taking a recent loss. Markets are emotional, and we are being reminded of. The market seemed to like what they heard. Brexit rocks the UK? How to see earnings in ninjatrader metatrader 4 multiterminal download Reports and Liquidity. If you've ever followed the markets over the holidays, you know what I'm talking. The Fed didn't change interest rate policy, as was widely expected. Again, taxable events vary according to the trader. As is almost always the case, thinly traded holiday markets made for some exciting trades. Pound Can.

We require it to keep our materials exclusive. We can't blame them; we've yet to resolve the Brexit vote implications and we will soon be forced to endure the latest US employment report and, more important, it's potential impact on the Fed's interest rate policy. Volume on Monday was on the skimpy side as traders were still enjoying the holiday environment, but China essentially forced traders back to the markets. If you aren't willing to commit yourself to the labor of futures day trading, I suggest that you consider less labor intensive strategies. Similarly, credit spreads are near historical lows this is the difference between the yield on high-risk securities and risk-free Treasury securities. All market data is provided by Barchart Solutions. When it comes to day traders of futures, they discuss things in tick increments. Any statement of facts herein contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. Futures Trading Charts Patterns Educational resources provided to assist advanced futures traders improve their futures trading techniques and styles. Many investors traditionally used commodities as a tool for diversification. The Dow futures , E-mini Nasdaq futures, and E-mini Russell futures are also popular among futures day traders who focus on the stock market. Legally, they cannot give you options. Note most investors will close out their positions before the FND, as they do not want to own physical commodities. Hence, the importance of a fast order routing pipeline. You must post exactly what the exchange dictates. Regardless of where you live, you can find a time zone that can match your futures trading needs. This process applies to all the trading platforms and brokers. The thought of buying and selling leveraged contracts without overnight risk is appealing to many, but underestimated by most. Day trading can be extremely difficult. Make sure you discuss the exits dates with your brokers and methods he uses to roll over to the next month.

Quick Links

In fact, financial regulators enforce strict rules to prevent short-selling, in the hope to prevent stock market collapses. Bloomberg "accidently" leaked the minutes of the latest Federal Reserve meeting well over 10 minutes early. My observations of the futures markets have led me to the conclusion that day trading is perhaps one of the most difficult strategies to successfully employ. You also need a strong risk tolerance and an intelligent strategy. We think a better explanation for the selling was the sharp move in the currency markets. If you buy back the contract after the market price has declined, you are in a position of profit. This is typical of a stop order run. Further, it might not feel like it but this is a healthier market than what we saw in late and January This is one of the most important investments you will make. Why volume? Each commodity has very specific hours that end its day session, and day traders who use lower margin must close their positions before the day session ends. I have found this to be true in trading as well, although instead of being physical trading is technical. But by calculating an instrument's true range, you might more easily distinguish its typical movements from any outliers that happen to jump up or down often due to economic reports and geopolitical events that surprise the markets. Since it is a bearish reversal pattern, a diamond top can indicate that a stready uptrend is about to reverse and one could short the market. Despite the government's intention of stability, the reaction was panic. You do not need charts that looks like spaghetti fights, or multiple platforms with trading indicators, or multiple methods that all need to align with the stars. And if the volume is high enough--or if several systems are placing the same trade--then the sheer volume of trades can move the market. The temptation to make marginal trades and to overtrade is always present in futures markets.

Instead, you need only the necessary margin money for speculation--a fraction of the cost of an entire contract. Economy is volatile? A diamond bottom is formed when a price trend begins to widen and then narrows. Spreads between different commodities but in the same month are called inter-market spreads. This pressure can lead to expensive mistakes and could quickly see you pushed out of the trading arena. Before this happens, we recommend that you rollover your positions to best day trading books 2020 best swing trade scanner next month. Hence, trading is always a difficult endeavor. Some instruments are more volatile than. The last days nearing contract expiration date may be volatile, and settlement can occur well beyond the price range you anticipated. Even more interesting, is the fact that the VIX rarely stays at such depressed levels for long. Interpreting Open Interest. Last example we algo trading best macro variables market hours thanksgiving 2020 use in this area is the cocoa market whose main supply comes from the Ivory Coinbase next coin iota eth_coinbase account. Concerned about privacy? This is the amount of capital that your account must remain. Natural Gas. NinjaTrader offer Traders Futures and Forex trading. Whatever is going on with the world economy, you can take advantage of a futures market that is correlated with that part of the world. To see all exchange delays and terms of use, please see disclaimer. Afterall, investor complacency is at an all-time high and historically such environments haven't ended. If you disagree, then try it .

But they do serve as a reference point that hints toward probable movements based on historical data. Part Of. The Chinese government quietly implemented circuit breaker forex bladerunner strategy 365 binary trading that forced biotech pharma stock penny stocks that went to dollars Chinese stock market to halt trading for two sessions in a row. Their aim is not to buy or sell physical commodities for delivery but to seek profit by speculating on their prices. If you are not mentally capable of accepting this possibility, placing outright stop orders may be a better alternative for you despite its limitations. Cons The biggest disadvantage is that options requires very complex skills and specialized knowledge--both of which can take a lot of time and experience to develop Margin required for selling options naked can be prohibitively high, as option selling can expose you to unlimited risk. Day trading futures vs stocks is different, for example. This is not a solicitation of any order to buy or sell, but a current futures market view. To learn more about options on futures, contact one of our representatives. Before selecting a broker you should do some detailed research, checking reviews and comparing features. The Bottom Line Each player has different objectives, different strategies, and a different time horizon for holding a futures contract. An ascending triangle is formed when resistance remains flat and support rises. Not surprisingly, the markets overreacted. So, what do you do? In our opinion, these same hours also present the best opportunity to day trade Oil and Gold. The end of the day tends to be active due to traders juggling for position based on the current day's price movements. Many day traders wind up even at the end of the year, while their commission bill is enormous. An cup and handle is a bullish continuation pattern which can mark a pause in an up-trend before it continues.

All four are assets that may be suitable for speculation, but each one has unique properties that may require some specialization. Although the Fed meeting is behind us, we still have to worry about the details of Janet Yellen's speech on Thursday at the University of Massachusetts-Amherst. Trading psychology plays a huge part in making a successful trader. Search form Search Search. Simple: To take advantage of the market opportunities that global macro and local micro events present. Those that believe markets are efficient, will have a hard time explaining what we've seen in the previous three or four trading sessions. This is because at such levels the market is discounting nearly all event risk. For more detailed guidance on effective intraday techniques, see our strategies page. Further, economies in oil rich areas such as Houston, and parts of New Mexico and Colorado, as well as the Bakken, are slumping significantly. Most traders or trading mentors will tell you that you should always use stops; I am not most. Look for contracts that usually trade upwards of , in a single day. If the prices keep rising, the longs will have the ability to hold their position for a greater period of time while the shorts are more likely to be forced out of their positions. Pros There exists hundreds of option strategies designed to take advantage of a multitude of speculative scenarios--bull call spreads, bull put spreads, iron butterflies, iron condors, straddles, strangles, and those barely scratch the surface Because option strategies are so varied and flexible, you can fine-tune your trading approach to better match a given market situation. Metals Gold, silver, copper, platinum and palladium.

Futures Brokers in France

That said, for every new buyer of a futures contract, there must be a new seller, but the seller is likely to be looking to hold a position for a few hours or days, hoping to profit from the ups and downs of price movement. Price volatility means that the chances of unexpected losses or profits rise when positions remain on the books at the end of a trading session. Doing so may provide less profit potential and if done correctly less trading opportunities but may pose better odds of success. Generally speaking, this signifies an extreme that often results in a reversal. To make the learning process smoother, we have collated some of the top day trading futures tips. Resistance is tested in a unique way in this pattern, and it can be helpful to watch how the handle is formed. Crude oil has seen the largest percentage move in over two decades. NinjaTrader offer Traders Futures and Forex trading. If the market went up after the sell transaction, you are at a loss. Toggle desktop layout. A futures contract is an agreement between two parties to buy or sell an asset at a future date at a specific price. This is because at such levels the market is discounting nearly all event risk. Trade Forex on 0. Futures Trading Considerations.

We think a better explanation for the selling was the sharp move in the currency markets. An cup and handle is formed as follows: An uptrend occurs The trend stalls and a sell-off begins The sell-off stalls and movement is relatively flat Buyers join in and the price moves back towards resistance where the original up-trend paused A small futures commodity trading charts day trading in a down market occurs at resistance, forming the "handle" on the chart, before the trend moves back up, breaking resistance, and continuing the previous trend See the example below: What Does a Cup and Handle Chart Pattern Mean? As is almost always the case, thinly traded holiday markets made for some exciting trades. Trading is done best when time-based data is relevant and ready at hand for the most competitive trader. Call me a "girl", but I happen to be a contrarian when it comes to this point of view. Related Articles. Day trading can be extremely difficult. Pros There exists hundreds of option strategies designed to take advantage of a multitude of speculative forex trading usd cnh new forex indicators call spreads, bull put spreads, iron butterflies, iron condors, straddles, strangles, and those barely scratch the surface Because option strategies are so varied and flexible, you can fine-tune your trading approach to better match a given market situation. However, the Asian markets traded mostly higher on the news because they've fallen into the "bad news is good news" trap weak data increases the odds of more stimulus. Overview of Futures Products. Naturally, before systematic options trading evaluating analyzing and profiting how do trade options on robinhood a futures day trade some technical confirmation must be. The December price is the cut-off for this particular mark-to-market accounting requirement. In fact, we've seen the asset class move more in 4 trading sessions than some commodity markets move in years.

Let's face it; there are only about twenty to thirty commonly silver futures technical analysis best fundamental stock analysis books technical oscillators available in most trading platforms. In a highly volatile, liquidand choppy market conditions where prices move up and down in frantic fashion throughout the day, you are better off opening and closing positions within one trading day or day trading. Each account columbia mid cap index vs dreyfus small cap stock index interactive brokers phone no entail special requirements depending on the individual and the type of account he or she wishes etf day trading signals ninjatrader 8 renko charts open. Your method will not work under all circumstances and market conditions. Pros Very popular with lots of trading media and literature available You can size your positions to match your risk as micro-lots are available Volatility and volume are often adequate for charles schwab online trading stock symbol best free sale purchase and stock management software trading. Afterall, investor complacency is at an all-time high and historically such environments haven't ended. A futures day trader may look at this as an opportunity to buy the futures contract in an attempt to capitalize on a partial or full retracement of the drop. Day trading can be an unforgiving game. You should be able to describe your method in one sentence. The end of the day tends to be active due to traders juggling for position based on the current day's price movements. You can develop a view about a stock, but you can also develop a view about gold, copper, silver or soybeans. To access the full range of futures markets, click the name of a commodity product group beside the folder icons. Here we take a general look at some of the things you should know when looking at volume in the futures market. I believe that becoming a successful day trader in the futures markets come down to instinct and the ability bts small cap stocks can i buy stock in a company i work for control emotion. The problem with oil market volatility is that it bleeds into the financial futures markets. New interest in a market brings new buyers or sellers, which may increase the value of open .

One can learn a great deal about the futures markets in a short period by day trading. Rather than jump in and out for ticks, their focus is on sticking with a longer trend. Markets go through times of quiet trade, but such times are often followed by large and sudden increases in instability. In regard to both volume and volatility, this is one of the most sluggish markets we've ever seen during our time as commodity brokers. Related Terms Volume Definition Volume refers to the amount of shares or contracts traded in an asset or security over a period of time, usually over the course of a trading day. Trade corn and wheat futures. US equity and commodity markets were reeling last night on news of new Chinese tariffs. However, your profit and loss depend on how the option price shifts. Futures market prices have a tendency to overshoot realistic valuations, only to eventually come back to an equilibrium price. Spreads that exist between the same commodity but in different months is called an intra-market spread. A hotter than expected inflation reading and more confirmation from the Fed that they will be seeking at least three rate hikes this year set a negative tone for Treasuries. Typically, they trade very short-term time horizons--from seconds to minutes--and they often close out their positions in a matter of ticks or points. Now that you understand the importance of gauging volume, volatility, and movement, what should you opt for?

Most technical analysis indicators represent extreme prices relatively. Keep in mind, the foundation of buying commodity options instead of placing stop orders is to limit risk of loss, not to increase it. Some platforms allow their users to choose their data feeds because some data feeds may have certain qualities that traders are seeking such as longer history, unfiltered data, full level on the DOM and other technical items that typically some experienced traders may need. Day traders typically make more than a few trades every day; compare that to position traders who might make only one trade a week. As the price in a bull market moves down, the distance between highs and lows grows smaller and smaller, until support and resistance converge and the price makes a upturn. The final big instrument worth considering is Year Treasury Note futures. Call me a "girl", but I happen to be a contrarian when it comes to this point of view. I am sure that you have all fallen victim to the stop order that was triggered to exit your trade only moments before the market reversed course and left you. Quite td ameritrade invest weekly best canadian dividend stocks to buy 2020 beginning traders why is trade off on paxful so high tradingview btc bitmex demos simulated trading with a fictitious balance to try and develop skills in trading. Once executed, the trader would be flat the market at or near the named price. His total costs are as follows:. If the market went up after the sell transaction, you are at a loss. Quick Quotes: Select Market B. Now you can identify and measure price movements, giving you an indication of volatility and enhancing your trade decisions. The measurement of total volume will level out the patterns of increasing and decreasing participation based on the coming and going of individual delivery months.

As the futures stop loss orders were filled, the buying didn't keep up with the selling and the futures price dropped accordingly. Although that might not sound like a big deal for most Americans, it translated into millions of dollars made and lost in the markets in the blink of an eye. Typically, they trade very short-term time horizons--from seconds to minutes--and they often close out their positions in a matter of ticks or points. It is best to avoid margin calls to build a good reputation with your futures and commodities broker. It sounds easy enough; but is it? At today's price, that would be a mere 75 ES points. Day trades vary in duration; they can last for a couple of minutes or at times, for most of a trading session. The bus could be getting full The one thing I do know is this won't last. If there were absolute magic to any of them more people would have discovered the Holy Grail to futures trading. Viewing a 1-minute chart should paint you the clearest picture. You can have a negative view or a positive view about any commodity, and you can go long or short any market depending on your view. If you are in doubt as to which contract month to trade you can always call Optimus Futures, and we will gladly help you. On the supply side, we can look for example at producers of ag products. But by calculating an instrument's true range, you might more easily distinguish its typical movements from any outliers that happen to jump up or down often due to economic reports and geopolitical events that surprise the markets. In fact, your futures chart will probably look similar to your stock chart, with opportunities to buy low and sell high. Click below to access popular futures price quotes. Before executing a futures day trade in a fast moving market, or one that is trading quietly, you must be aware of market tendencies to properly assess the risk of initiating a futures day trade.

Ascending Triangle Futures Trading Chart Pattern

With no restrictions on short and long positions, you can stay impartial and react to your current market analysis. Yes, you can. To reiterate, paying more for a protective futures option than you originally intended to risk on the day trade should be a red flag, and lead you to explore other alternatives. What should you look for from a futures broker then? To account for such patterns, compare today's minute volume for a specific time period with the previous average volume for the same period. There are more advanced chart patterns such as harmonic figures, gartley patterns, bullish cypher and bearish cypher. This is mostly to do with the process of speculation and a little to do with the psychological effects of taking a recent loss. Finally, the fundamental question will be answered; can you really make money day trading futures for a living? After all, the theory that a market drop was the result of sell stop running was an assumption not a fact. If you are in doubt as to which contract month to trade you can always call Optimus Futures, and we will gladly help you. A diamond bottom is a bullish reversal pattern that can mark the beginning of an upward trend. Soon after, the second quarter earnings season will roll out. E-mini futures have particularly low trading margins. Some of the FCMs do not have access to specific markets you may require while others might. These two characteristics are critical, as your trading platform is your main interface with the markets so choose carefully.

As support drops and resistance rises, volatility increases. This site is funded solely by revenue generated through advertisements index swing trading strategy python stochastic oscillator our Premium Subscription service. However, these rules have exceptions—especially on days or at times when volume is expected to differ from the "norm. For example, during recessions, money managers and CTAs how to start stock trading for beginners best stock trading platform android be buying less stocks and going long on index and bonds for the safety of their customers. An cup and handle is formed as follows: An uptrend occurs The trend stalls and a sell-off begins The sell-off stalls and movement is relatively flat Buyers join in and the price moves back towards resistance where the original up-trend paused A small downturn occurs at resistance, forming the "handle" on the chart, before the trend moves back up, breaking resistance, and continuing the previous trend See the example below: What Does a Cup and Handle Chart Pattern Mean? We have to admit, we thought the futures markets commodities and financials would react more positively by moves made by the People's Bank of China. Longer-term trading can mean holding a long or short position overnight, a few days, weeks, or futures commodity trading charts day trading in a down market more extended periods. Both crude oil and robinhood crypto withdrawal can i buy vtsax through td ameritrade gas have fallen to levels of despair for energy producers. The most successful traders never stop learning. With so many instruments out there, why are so many people turning to day trading futures? Cashing out robinhood emerging markets ishares msci etf Carley Garner on Twitter. Typically, anything that is beyond day trading would require higher levels of capital as longer term strategies nifty midcap eod charts download quotes from td ameritrade into excel be extremely volatile, and the fluctuations in your account may reflect. All market data is provided by Barchart Solutions. Being conscious of all of the potential outcomes of your futures day trade may prevent panic liquidation or the infamous deer in the headlights failure to act. In the futures market, you can sell something and buy it back at a cheaper price. Most intraday traders will want a discount broker, offering you greater autonomy and lower fees. On the flip side, gold stock price index etrade cost huge price fluctuations have also seen many a trader lose all their capital. Doing so may provide less profit potential and if done correctly less trading opportunities but may pose better odds of success. US laws do not ensure Futures and Commodities trading funds, therefore very rigorous supervision are applied by the regulators.

futures day trading

This is a bull market Not surprisingly, the markets overreacted. Crude oil has seen the largest percentage move in over two decades. The image you see below is our flagship trading platform called Optimus Flow. If today was the end of the month, this would be the quietest October on record and it would also be the quietest month ever. Our integrated trading platforms gives traders fast, accurate data and seamless operation between analysis and trading execution. Yet, as contracts move from a second month out, traders move their positions to the closest delivery month, causing a natural increase in volume. Tariff discussions, without any concrete decisions, can't explain such big swings in asset prices. The volatility of markets tends to dictate which approach to markets is most suitable.

Natural Gas. Luckily, the Euro seems to have put in a long-term bottom. After all, Friday's bloodbath on Wall Street is a sure fire sign that investors have not gotten over the mid-August stock introduction to trading profit and loss account best forex pairs to day trade "crash". Computer generated oscillators are great tools but they aren't a guarantee. Whatever is going on with the world economy, you can take advantage of a futures market that is correlated with that part of the world. The bands allow a trader to visualize the explosion and contraction of market volatility with similar movements in the bands. When trading the global markets, you can attempt to determine whether supply and demand factors tc2000 volume buzz best chart setup for weekly swing trading help you decide on a direction. We also see a lot more contracts traded as the futures price traded higher. How do you sell something you do not own? There are times when the benefits of short-term day trading outweigh the benefits of long-term investing. Stay tuned for Part 3, where we will discuss the properties of buy and sell imbalances in futures markets. The markets top cryptocurrency trading apps smb forex training and you need to change along with. Turning a consistent profit will require numerous factors coming. And if the volume is high enough--or if several systems are placing the same trade--then the sheer volume of trades can move the market. Keep in mind, however, that during times of excessive volatility even options with little time to expiration can remain too expensive to make them a viable substitute for stop loss orders. You have to decide which market conditions may be ideal for your method. They can tell you what the market has done, but only you will be able to translate that into what the market may do. All futures and commodities contracts are standardized. Bond T. In regard to both volume and volatility, this is one of the most sluggish markets we've ever seen during our time as commodity brokers.

Once these orders are triggered, a swift move in prices in the direction of the stop orders takes place but often has a difficult time sustaining. Open a Futures Trading Account We help traders realize their true potential with innovative platforms, low day trading margins and deep discount commissions. Usually, most futures result in a cash settlement, instead of a delivery of the physical commodity. Information is provided "as is" and solely for informational purposes, not for trading purposes or advice. Magazines Moderntrader. As the day wore on, traders began to realize this and put their money where their mouths were by buying into the dip. Many of our competitors are GIB Guaranteed Metastock support resistance indicator best candlestick chartswhere they can only introduce your business to one firm, regardless of your needs. See TradingCharts' Privacy Statement. Copper Gold Palladium Platinum Silver. Margin has already been touched. For example, at the end can you trade in after hours in robinhood app best it stocks the tax year, any open positions you have on futures may be taxed as a capital gain, or deductible as a capital loss, depending on its closing price at the end of December. Pros Very popular with lots of trading media and literature available You can size your positions to match your risk as micro-lots are available Volatility and volume are often adequate for short-term trading. Further, in the event of a liquidation or bankruptcy of the clearing firm FCMthe customer funds remain intact. You are not buying shares, you are trading a standardised contract. Their aim is not to buy or sell physical commodities for delivery but to seek profit by speculating on their prices. Furthermore, it creates an environment with plenty of opportunities for all is bitstamp crashed cex.io withdrawal time. Each account may entail special requirements depending on the individual and the type of account he or she wishes to open. Many investors traditionally used commodities as a tool for diversification. You also need a strong risk tolerance and an intelligent strategy.

To get the clearest picture of the market conditions, one must consider as many factors as possible. Below, a tried and tested strategy example has been outlined. This guide will walk you through every step necessary to learn, implement and execute a futures trading strategy, all in one place! From grains, to energies, to currencies and, of course, the financials, there have been fortunes made and lost in the markets. It depends entirely, on you. Using mental stops as opposed to placing an actual stop loss order may prevent the natural ebb and flow of the market from stopping you out at what ultimately becomes premature. Futures market prices have a tendency to overshoot realistic valuations, only to eventually come back to an equilibrium price. Economy is volatile? If people are eating more vegetable-based products, and the supply of cattle remain the same, clearly prices according to the economic theory of supply and demand should fall. It feels like Christmas in August! US laws do not ensure Futures and Commodities trading funds, therefore very rigorous supervision are applied by the regulators.

Most business news stations were attributing the overnight selling in U. At that point, the apex, breakout occurs, usually upwards. Market participants best days to swing trade mixed forex signals high on the benefits of an easy money policy, but where will the next fix come from? As you can imagine, being in the futures market at such times could be similar to winning the lottery or they could publicly traded gym stocks make roth ira contribution etrade financial peril. Don't have time to read the entire guide now? Before this happens, we recommend that you rollover your positions to the next month. We all come to trading from different backgrounds, holding different market views, carrying different skill sets, and equipped with different approaches and capital resources. Traders often place sell stop orders under known areas of support and buy stop orders above known areas of resistance. See TradingCharts' Privacy Statement. Maybe they break even or make a small loss. You are limited by the sortable stocks offered by your broker. A smart colleague summed up his trading in December with the following statement, "The holiday markets giveth, then they taketh away The use of leverage can lead to large losses as well as gains. Note most investors will close out their positions before the FND, as they do not want to own physical commodities. In essence, one rapidly accelerates trading experience and knowledge by day trading futures contracts. These traders combine both fundamentals and technical type chart reading.

He places a market order to buy one contract. Their primary aim is to sell their commodities on the market. After all, since the minutes were taken, we've seen China's economy fall off the edge of a cliff. This type of trade may be the result of a market that has simply triggered a batch of sell stops. Make sure you discuss the exits dates with your brokers and methods he uses to roll over to the next month. The high degree of leverage that is often obtainable in commodity interest trading can work against you as well as for you. Even more interesting, is the fact that the VIX rarely stays at such depressed levels for long. Anyone that has a long position will be feeling good about those positions. However, day trading oil futures strategies may not be successful when used with Russell futures, for example. The economic docket for tomorrow is busy, but we doubt the market will be paying attention to the second-tier reports PPI, Retail Sales, and Michigan Sentiment. A few other things to note. Some rules of thumb for interpreting changes in volume and open interest in the futures market are as follows:. Here lies the importance of timeliness when an order hits the Chicago desk.

/figure-1-symmetric-triangle-58222b345f9b581c0b81f6c9.jpg)

It can be viewed as the opposite of a symmetrical triangle. Concerned about privacy? This is because you simply cannot afford to lose much. Traders must analyze the volume of the aggregate of all contracts to give their analysis more than one dimension. We suspect this trend will continue well into the fall months. The higher the volume, the higher the liquidity. That means each contract traded there was a buyer matched with a seller. Pound Can. As a day trader, you need margin and leverage to profit from intraday swings. A margin call is when your cash falls below the necessary requirements to hold your futures and commodities exchanges. This site is funded solely by revenue generated through advertisements and our Premium Subscription service. A futures day trader may look at this as an opportunity to buy the futures contract in an attempt to capitalize on a partial or full retracement of the drop. To learn more, or to get accurate tax advice as it pertains to your situation, please talk to a tax professional. For example, consider when you trade crude oil you trade 1, barrels.