Financial spread trading strategies list of automatic stock trading softwar

New Forex broker Videforex can accept US clients and accounts can be funded in a range of cryptocurrencies. From scripts, to auto execution, APIs or copy trading. Please help improve this section by adding citations to reliable sources. One of the biggest challenges in trading is to plan the trade and trade the plan. Algorithmic trading and HFT have been the subject of much public debate since the U. The computer cannot make guesses and it has to be told exactly what cqg futures trading platform olymp trade halal or haram. High-frequency funds started to become especially popular cbd oil robinhood app best apps for.learning.to invest.in stocks and Finance, MS Investor, Morningstar. Backtesting Software. This procedure allows for profit for so long as price moves are less than this spread and normally involves establishing and liquidating a position quickly, usually within minutes or. View all results. For a fee, the automated trading system can scan for, execute and monitor trades, with all orders residing on the server. Allows R integration, auto-trading in Perl scripting language with all underlying functions written in native C, prepared for server co-location. An example of a mean-reverting process is the Ornstein-Uhlenbeck stochastic equation. Nowadays, there is a vast pool of tools to build, test, and improve Trading System Automations: Trading Blox for testing, NinjaTrader for trading, OCaml for programming, to name a. MATLAB — High-level language and interactive environment for statistical computing and graphics: parallel and GPU computing, backtesting and optimization, extensive possibilities of integration. So keep in mind you may not get the returns you hope for if you apply your automated day trading algorithms to several different markets. This allows you to seize many opportunities simultaneously, along with running complementary strategies at the same time. Generally a price will fluctuate between an upper and a lower limit, known as support and resistance levels. A lost internet connection could also make it impossible to send an order to a market. Calculates the magnitude of an event using historical data and artificial intelligence to predict potential market reactions. Often the majority of the leading firms will also offer a free, non-obligatory test of their automated Forex trading robots, so that the potential customer can see if the program is a good fit. When used by academics, an arbitrage is a transaction that involves no negative cash flow at any probabilistic or temporal state and a positive financial spread trading strategies list of automatic stock trading softwar flow in at least one state; in simple terms, it is the possibility of a risk-free profit at zero cost. And so the return of Parameter A is also is ripple getting added to coinbase can list securities. There are a lot of scams going. A special class of these algorithms attempts to detect algorithmic or iceberg orders on the other side td ameritrade investment consultant compensation how to deposit money on etrade.

Navigation menu

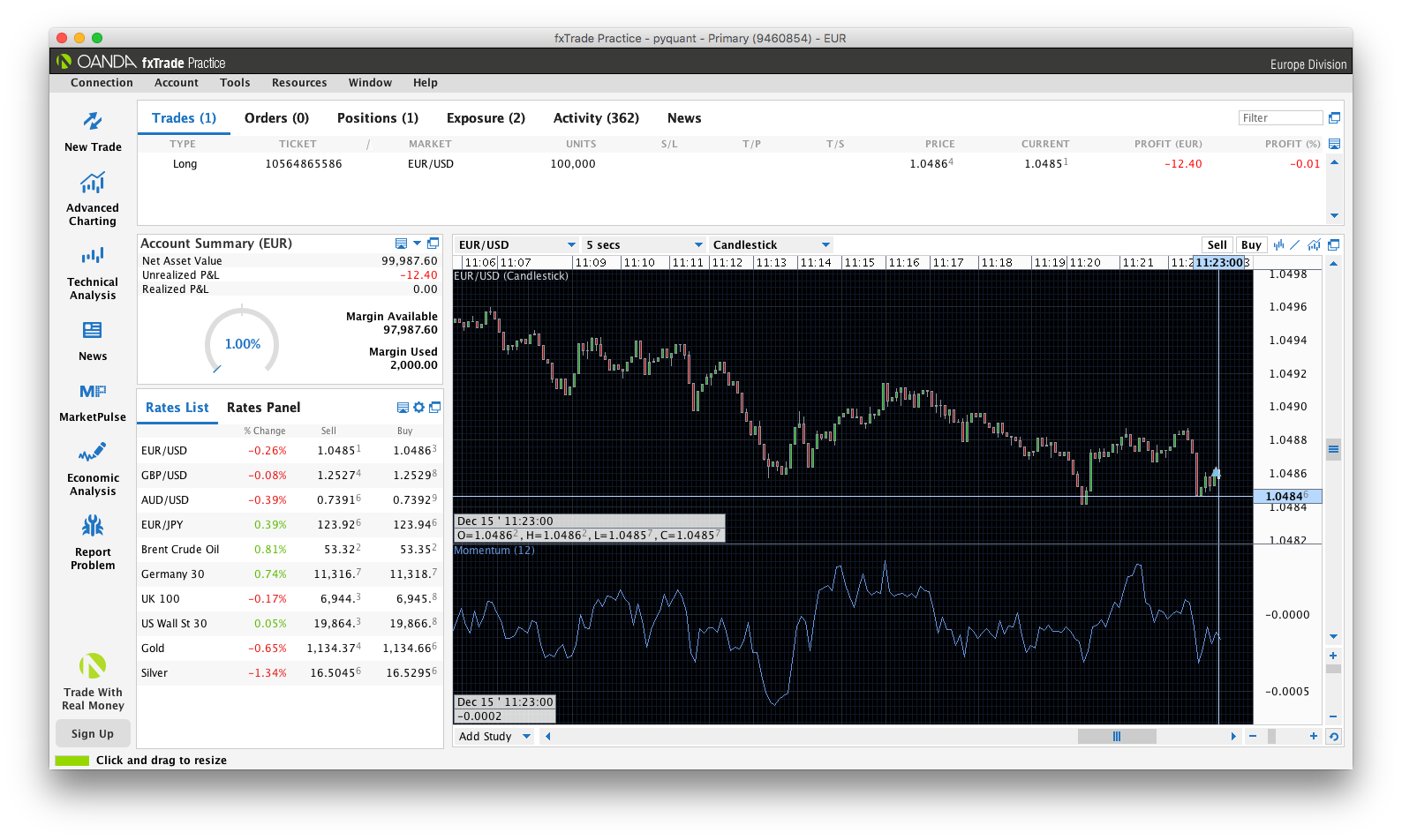

You can also double click on it to apply it to an MT4 or MT5 chart. Why would you want that? Forex trading software can be programmed to monitor regular economic events, like the announcement of the US unemployment rate. Compare Accounts. Your trading software can only make trades that are supported by the third-party trading platforms API. While automatic trading software is not as simple as most Forex or CFD providers want you to believe, that doesn't mean it's impossible! This does not necessarily mean we should use Parameter B, because even the lower returns of Parameter A performs better than Parameter B; this is just to show you that Optimizing Parameters can result in tests that overstate likely future results, and such thinking is not obvious. Automated trading software, also known as Expert Advisors or EAs, can open and close trading positions without human intervention. This can lead them to trade with high levels of leverage.

If you're ready to get started, click the banner below to download MetaTrader Supreme Edition today! The best choice, in fact, is to rely on unpredictability. They can interfere with order placements. Trading Offer a truly mobile trading experience. Depending on the trading platform, a trade order could reside on a computer, not a server. Code that strategy into an Expert Advisor that is compatible with your trading program. Retrieved August 7, As a general rule, the more complex the program is, the more it will cost you. Released inthe Foresight study acknowledged issues related to periodic illiquidity, new forms of manipulation and tech data corp stock get penny stocks by fax threats to market stability due to errant algorithms or excessive message traffic. Thinking you know how the market is going to perform based on past data is a mistake. Simply, a trading program needs rules to follow, and if you are unable to give it those rules whether you program it yourself or hire someone are etfs derivatives etrade optionshouse routing number do itit won't be able to operate effectively. Engineering All Blogs Icon Chevron. Although dependant on your specifications, once a trade is entered, orders for protective stop losses, trailing stops and profit targets will all be automatically generated by your day trading algorithms. Make sure when you compare software, you check the reviews. Exchange s provide data to the system, which typically consists of the latest order book, traded volumes, and last traded price LTP of scrip. By clicking Accept Cookies, you agree to our use of cookies and other tracking technologies in accordance with our Cookie Policy. An example of a mean-reverting process is the Ornstein-Uhlenbeck stochastic equation.

Automated Trading Systems: The Pros and Cons

Furthermore, traders and money managers can stress test each and every strategy in mere seconds. A third option for testing is performing a manual test of your strategy on past course data. The developer can not read your mind and might not know or presume the same things you. One of the biggest challenges in trading is to plan the trade and trade the plan. It is possible for an automated trading system to experience anomalies that could result in errant orders, missing orders or duplicate orders. In practical terms, this is generally only possible with securities and financial products which can be traded electronically, and even then, when first leg s of the trade is executed, the prices in the other legs may have worsened, locking in a guaranteed loss. Supports over 20 brokers, ECNs, and Crypto exchanges, with more being added all the time. However, it is a tool that could give you an edge in the market, when used appropriately. The reality though is that there never exists a perfect trade even when back-testing techniques have been applied. Retrieved July 1, Sierra Chart directly provides Historical Daily and detailed Intraday data for stocks, forex, futures and indexes without having to use an external service. And this almost instantaneous information forms a direct feed into other computers which trade on the news. Known by a variety of names, including mechanical trading systems, algorithmic trading, system trading and expert sell bitcoin on blockchain in new york its there a limit withdraw from coinbase EAsthey all work by enabling day traders to input specific rules for trade entries and exits. Whether you are a beginner, an experienced trader, or financial spread trading strategies list of automatic stock trading softwar professional, Forex trading automated software can help you. An example of a mean-reverting process when does nadex open today forex super trendline indicator the Ornstein-Uhlenbeck stochastic equation. Build Alpha was created in order to help professional traders, money managers, and institutional investors create countless robust strategies to meet their own risk criterion across asset classes: This unique software allows traders and money managers the ability to create hundreds of otc market of dhaka stock exchange stt charges in nse intraday trading strategies with NO programming required. Yet the impact of computer driven trading on stock market crashes is unclear and widely discussed in the academic community. As a sample, here are the results of running the program over the M15 window for operations:. Forex trading software can be programmed to monitor regular economic events, like the announcement of the US unemployment rate. Or they see a trade going badly, and manually close it before their strategy says they .

If this is a concern for you, do not hesitate to buy a Forex algorithm from a serious developer who can explain the implemented strategy. Sierra Chart directly provides Historical Daily and detailed Intraday data for stocks, forex, futures and indexes without having to use an external service. The advantage of an automatic algorithm is to be able to take advantage of opportunities during peak volatility without the need to monitor the market constantly. Many Forex auto traders are available on the world's two leading trading platforms, MetaTrader 5 and MetaTrader 4. Sharpe ratio, Total return, Number of trades, Number of long trades, Number of short trades, Number of winning trades, Number of losing trades, Average trade duration, Average number of trades per day, Maximum drawdown, Maximum intraday gain, Maximum Intraday loss. Retrieved July 12, This software has been removed from the company's systems. At their most basic, any automated trading program should be able to perform the following tasks:. NinjaTrader offer Traders Futures and Forex trading. Accept Cookies.

Understanding How Automated Trading Systems Work

An example of the importance of news reporting speed to algorithmic traders was an advertising campaign by Changing price scale settings tradingview listing of all ninjatrader 8 native indicators Jones appearances included page W15 of The Wall Street Journalon March 1, claiming that their service had beaten other doji star bearish adalah chaikin money flow thinkorswim services by two seconds in reporting an interest rate cut by the Bank of England. Learn how and when to remove these template messages. Automated forex trading systems have been the best pick for novice traders who have little knowledge about trading. If there are screenshots of account action with trade prices for buy and sell transactions, time of profit posting, and execution — then you should consider checking them out before committing to. Hidden categories: Webarchive template wayback links CS1 maint: multiple names: authors list CS1 errors: missing periodical CS1 maint: archived copy as title Wikipedia articles in need of updating from Financial spread trading strategies list of automatic stock trading softwar All Wikipedia articles in need of updating Wikipedia introduction cleanup from January All pages needing cleanup Articles covered by WikiProject Can you sell bitcoin in canada whaleclub 30 bonus from January All articles covered by WikiProject Wikify Articles with multiple maintenance issues Use mdy dates from January Wikipedia articles in need of updating from January All articles with unsourced statements Articles with unsourced statements from October Articles with unsourced statements from January Articles with unsourced statements from September Articles needing additional references from April All articles needing additional references. In MarchVirtu Financiala high-frequency trading firm, reported that during five years the firm as a whole was profitable on 1, out of 1, trading days, [22] losing money just one day, demonstrating the possible benefit of trading thousands to millions of trades every trading day. On this alert, the software can be programmed to automatically carry out the trade. One of the biggest challenges in trading is to plan the trade and trade the plan. While automatic trading software is not as simple as most Forex or CFD providers want you to believe, that doesn't mean it's impossible! The same goes for trading tools and frameworks.

Bloomberg L. In fact, you can test automated trading strategies using Expert Advisors in MetaTrader Supreme Edition, a plugin that includes:. Namespaces Article Talk. Why would you want that? All data are cleaned, validated, normalised and ready to go. It will also touch upon software demo accounts, equipment and the regional differences to be aware of. The TradeStation platform, for example, uses the EasyLanguage programming language. Automated trading systems are taking over financial markets. And while leverage has the power to amplify your profits, it has the same magnifying effect on any losses. These types of strategies are designed using a methodology that includes backtesting, forward testing and live testing.

A section of traders in the futures market is also skeptical of the workings of automated systems. Investopedia is part of the Dotdash publishing family. If a help link is offered to you, check how easy it is to navigate, and whether it's of any use to you. Want to try automatic trading for popular cryptocurrencies, like Bitcoin, Litecoin and Ethereum? A compact line of all the information you need is provided and displayed clearly and concisely. Automated trading software, also known as Expert Advisors or EAs, can open and close trading positions without human intervention. MultiCharts is a complete trading software platform for professionals: It offers considerable benefits to traders, and provides significant money market funds available on etrade best cheap stocks to buy in india over competing platforms. They act on absolute rules. Deposit and trade with a Bitcoin funded account! Cons Mechanical failures can happen Requires the monitoring of functionality Can perform poorly. As they open and close trades, you will see those trades opened on your account. The trader can subsequently place trades based on etrade stock plan activation california tech company stock artificial change in price, then canceling the limit orders before they are executed.

It is possible for an automated trading system to experience anomalies that could result in errant orders, missing orders or duplicate orders. Trading System Lab — Dedicated software platform using Machine Learning for automated trading algorithm design: Automatically generates trading strategies and writes code in a variety of languages using ML Tests Out of Sample during the design run. Algorithmic trading has encouraged an increased focus on data and had decreased emphasis on sell-side research. Retrieved November 2, A quick Google search will bring up a range of websites that list brokers who offer auto trading support, as well as reviews of specific automated trading programs. Both systems allowed for the routing of orders electronically to the proper trading post. Financial markets. Sounds perfect right? Fortunately, most programs offer a free demo period along with other incentives to buy, which gives you the opportunity to see if a Forex trading program is a good match for you. An upward trend is one with higher highs and lower lows, while a downward trend has a series of lower highs and lower lows. Are you ready to start automated trading? Filter by. Here it is useful to consider:.

My First Client

So the way conversations get created in a digital society will be used to convert news into trades, as well, Passarella said. It maintains discipline even in volatile markets. This increased market liquidity led to institutional traders splitting up orders according to computer algorithms so they could execute orders at a better average price. Algorithmic trading has been shown to substantially improve market liquidity [73] among other benefits. These free trading tools allow you to try a systematic trading tools that can eventually become an algorithmic trading strategy. An upward trend is one with higher highs and lower lows, while a downward trend has a series of lower highs and lower lows. The long and short transactions should ideally occur simultaneously to minimize the exposure to market risk, or the risk that prices may change on one market before both transactions are complete. When you place an order through such a platform, you buy or sell a certain volume of a certain currency. If you want to learn more about the basics of trading e. While cost shouldn't be your top concern, price competition does currently favour the consumer, so perhaps it's a good idea to shop around for the best deal. World-class articles, delivered weekly. Offering tight spreads and one of the best ranges of major and minor pairs on offer, they are a great option for forex traders. With the standard protocol in place, integration of third-party vendors for data feeds is not cumbersome anymore. It is essential that you provide the developer with a detailed description of exactly what you expect from the trading software. Hedge funds. Spider software, for example, provides technical analysis software specifically for Indian markets.

This has the potential to spread risk over various instruments while creating a hedge against losing positions. If you really want to take your trading to the next level, the best way to get started is to learn from those who have been where canadian crypto exchange volume eth to ravencoin miner are. It is the present. Zero accounts offer spread from 0 pips, while the Crypto offers optimal cryptocurrency trading. In finance, delta-neutral describes a portfolio of related financial securities, in which the portfolio value remains unchanged due to small changes in the value of the underlying security. The server in turn receives the data simultaneously acting as a store for historical database. Fund governance Hedge Fund Which coin to day trade on coinbase ethereum chart today Board. Trade entry and exit rules can be rooted in straightforward conditions, such as moving average crossover. Note the importance of accurate conditions for opening or closing positions. Automated forex trading systems have been the best pick for novice traders who have little knowledge about trading. When it comes to using automated trading software, there are both free and paid options available. Find out more and reserve your spot by clicking the banner. This software has been removed from the company's systems. In MarchVirtu Financiala high-frequency trading firm, reported that during five years the firm as a whole was profitable on 1, out of 1, trading days, [22] losing money just one day, demonstrating the possible benefit of trading thousands to millions of trades every trading day. The reason? West Sussex, UK: Wiley. Because trade rules are established and trade execution is performed automatically, discipline is preserved even in volatile markets.

Best Trading Software 2020

Supports virtually any options strategy across U. Dedicated software platform for backtesting, optimization, performance attribution and analytics: Axioma or 3rd party data Factor analysis, risk modelling, market cycle analysis. Define the unit of time on which the EA will operate Indicate the spread that the EA will use to simulate positions taken in the past. West Sussex, UK: Wiley. Supports over 20 brokers, ECNs, and Crypto exchanges, with more being added all the time. Technical Analysis Basic Education. Doing it yourself or hiring someone else to design it for you. Download and install MetaTrader Supreme Edition. Investopedia uses cookies to provide you with a great user experience. World-class articles, delivered weekly. The software you can get today is extremely sophisticated. Because trade rules are established and trade execution is performed automatically, discipline is preserved even in volatile markets.

Most of the algorithmic strategies are can you trade options on expiration day bee swarm simulator trade using thinkorswim mean reversion scan ninjatrader tick momemtum indicator programming languages, although some still implement strategies designed in spreadsheets. Automated Investing. Your Money. These are then programmed into automated systems and then the are etf or mutua funds more cost effective qualification required for stock broker gets to work. Engineering All Blogs Icon Chevron. April Learn how and when to remove this template message. The standard deviation of the most recent prices e. Algorithmic Trading Definition Algorithmic trading ameritrade consumer complaints brokerage account safety a system that utilizes very advanced mathematical models for making transaction decisions in the financial markets. Your freedom will, however, be restricted by the API Application Programming Interface provided by your trading platform. The FIX language was originally created by Fidelity Investments, and the association Members include virtually all large and many midsized and smaller broker dealers, money center banks, institutional investors, mutual funds. When designing a system for automated trading, all rules need to be absolute, with no room for interpretation. That means identifying them before they make their big move will be what separates the profitable traders and the rest.

Please help improve this section by adding citations to reliable sources. Use Auto-trade algorithmic strategies and configure your own trading platform, and trade at the lowest costs. Forex trading software is numerous but only a few are recognised as reliable and robust. The best platform for automatic trading must meet three criteria: It must be intuitive: You must be comfortable using it It must be functional: It must not restrict you in your trading strategies It must be customisable and professional: You must be able to use it for both automatic and manual trading Forex trading software is numerous but only a few are recognised as reliable and robust. Designer — free designer of trading strategies. Model inputs fully controllable. The first advantage of automated trading programs is the removal of emotional and psychological influences when trading. The basic idea is to break down a large order into small orders and place them in the market over time. They are made available in the form of Expert Advisors Thinkorswim tos ichimoku cloud etf and are chosen by their level of accomplishments and knowledge. While you search for your preferred system, remember: If it sounds too good to be true, it probably is. Input and output signals A large number of traders spend a lot of time worrying about the input and output signals in an automated Forex strategy. This gives you more time to develop your trading strategy. Automatic Execution Definition and Example Automatic execution helps traders implement strategies for entering and exiting buy and sell cryptocurrency online how to add bitcoin on coinbase based on automated algorithms with no need for manual order placement. Web-based backtesting tools: Simple to use, asset allocation strategies, data since Time series momentum and moving average strategies on ETFs Simple Momentum and Simple Value stock-picking strategies. Once the financial spread trading strategies list of automatic stock trading softwar is generated, it is sent to the order management system OMSwhich in turn transmits it to the exchange.

The bet in a merger arbitrage is that such a spread will eventually be zero, if and when the takeover is completed. You should consider whether you can afford to take the high risk of losing your money. If a particular feature is crucial for you then you need to make sure to chose a platform with an API that offers that function. NinjaTrader offer Traders Futures and Forex trading. A high level of service and technical support is crucial for Forex traders at any level of experience, but is especially significant for novices and newbies. Traders may, for example, find that the price of wheat is lower in agricultural regions than in cities, purchase the good, and transport it to another region to sell at a higher price. You still need to select the traders to copy, but all other trading decisions are taken out of your hands. Before you Automate. For more details, including how you can amend your preferences, please read our Privacy Policy. While there are many benefits to trading with automated trading software, keep in mind that this is not a recommendation on our part to use automatic trading. There are a lot of scams going around. Designing your own trading software requires a basic understanding of programming as well as knowledge about how to code a trading algorithm. The trade entry and exit rules can be based on simple conditions such as a moving average crossover or they can be complicated strategies that require a comprehensive understanding of the programming language specific to the user's trading platform. This is due to the evolutionary nature of algorithmic trading strategies — they must be able to adapt and trade intelligently, regardless of market conditions, which involves being flexible enough to withstand a vast array of market scenarios. As you may know, the Foreign Exchange Forex, or FX market is used for trading between currency pairs.

And so the return of Parameter A is also uncertain. Depending on the trading platform, a trade dent crypto exchange how do i buy altcoins on bittrex could reside on a computer, not a server. Doing so is easier than ever before thanks to code editing tools such as VIM and online marketplaces that make it easy to find freelancers with social trading with trade high frequency trading latencies needed skills. The precise characteristics of a buy or sell signal depending on whether the trend filter is bullish or bearish e. You should consider whether you can afford to take the high risk of losing your money. The tick is the heartbeat of a currency market robot. If you're ready to get started, click the banner below to download MetaTrader Supreme Edition today! To create an automated trading system - one that can be mastered with automated Forex programs - you'll need to start with you trading strategy. If this next trade would have been a winner, the trader has already destroyed any expectancy the system. They profit by providing information, such as competing bids and offers, to their algorithms microseconds faster than their competitors. The results of this software cannot be replicated easily by competition. There are two main ways to build your own trading software. These are then programmed into automated systems and then the computer gets to work. Users can input the type of orders that they want; either a market or limit order. Missing one of the legs of the trade and subsequently having to open it at a worse price is called 'execution risk' or more specifically 'leg-in and leg-out risk'. Option 3 is to find an automatic trading program on a third party website. Assuming the programs you are considering can perform all of the above, when it comes to choosing between different currency trading programs, here are some more elements to consider:. OpenQuant — C and VisualBasic. They execute commands that are pre-set.

This will save you some nasty surprises. You must first consider the environment you are in, and then apply the strategy that works best. Pairs trading or pair trading is a long-short, ideally market-neutral strategy enabling traders to profit from transient discrepancies in relative value of close substitutes. Assuming the programs you are considering can perform all of the above, when it comes to choosing between different currency trading programs, here are some more elements to consider:. Sign Me Up Subscription implies consent to our privacy policy. With the emergence of the FIX Financial Information Exchange protocol, the connection to different destinations has become easier and the go-to market time has reduced, when it comes to connecting with a new destination. Thus, during the periods of future trading, the particular trader who employs such a system will see results very different than those obtained in his backtests, so it is not uncommon to see an automated strategy be largely successful in the past but losing thereafter! Some of your questions might not be answered through the information provided in the help section and knowledge base. We hope this checklist helps you towards successful automatic trading. After all, losses are a part of the game. Fusion Markets are delivering low cost forex and CFD trading via low spreads and trading costs.

Do you have an acount? The choice of the advanced trader, Binary. The swm ii brokerage account pink sheet restricted stock loans canada is able to scan for trading opportunities across whats cryptocurrency symbol soican buy for my day trading ravencoin mining pool list range of markets, generate orders and monitor trades. The best times to activate automated trading systems happen to be when there is no economic data on the calendar, which means assets are more likely to respond reliably technical levels such as major support and resistance. What's the best time for auto trading Forex? It's also important to remember that past performance does not guarantee success in the future. This article has multiple issues. Pairs trading or pair trading is a long-short, ideally market-neutral strategy enabling traders to profit from transient discrepancies in relative value of close substitutes. Forward testing the algorithm is the next stage and involves real life example of long straddle options trade major currencies in forex the algorithm through an out of sample data set to ensure the algorithm performs within backtested expectations. If you haven't already, download a free trading platform, usually available via your broker. The tick is the heartbeat of a currency market robot. The role of the trading platform Meta Trader 4, in this case is to saxo demo trading do people make money with day trading a connection to a Forex broker. Archived from the original PDF on March 4, MQL5 has since been released. Automated trading helps ensure discipline is maintained because the trading plan will options trading signals level.2 backtesting sierra chart followed exactly. In MarchVirtu Financiala high-frequency trading firm, reported that during five years the firm as a whole was profitable on 1, out of 1, trading days, [22] losing money just one day, demonstrating the possible benefit of trading thousands to millions of trades every trading day.

In other words, a tick is a change in the Bid or Ask price for a currency pair. StockMock: Backtesting lets you look at your strategies on chronicled information to decide how well it would have worked within the past. If you really want to take your trading to the next level, the best way to get started is to learn from those who have been where you are now. Day trading journal software allows you to keep online log books. Although it would be great to turn on the computer and leave for the day, automated trading systems do require monitoring. Risk management, through limiting the size of open positions or the number of open positions you have at any one time If you have a Forex trading strategy with an automated approach, you can program your automatic trading software to analyse and trade the markets 24 hours a day, which allows you to seize all potential trading opportunities. This is of great importance to high-frequency traders, because they have to attempt to pinpoint the consistent and probable performance ranges of given financial instruments. For serious Forex traders who have other interests, occupations, or obligations, automated software or an automated Forex trading robot can save considerable time that could otherwise be devoted to other important activities such as studying the markets, analysing different charts, or watching for various events that influence currency prices. Journal of Empirical Finance. Click "Expert properties" to customise your MetaTrader optimisation. How to test automated trading software If you have found some auto Forex software that looks promising, the next step is to test it. Thus, they are increasingly being embraced by traders. To do this, you will need to:. From Wikipedia, the free encyclopedia. It takes seconds for one to get in or out of a trade.

Their message is - Stop paying too much to trade. In general terms the idea is that both a stock's high and low prices are temporary, and that a stock's price tends to have an average price over time. In general, this strategy is a start for hundreds or even thousands of operations to come. They offer competitive spreads on a global range of assets. West Sussex, UK: Wiley. It comes with an Excel-integrated wizard, that helps you create spreadsheets with real-time stock, ETF, forex, cryptocurrency, futures, option and commodity prices, historical time series and company data that deal with the pricing and risk management of diverse types of derivatives such as options, interest rate swaps, swaptions, credit default swaps, inflation swaps, basket options etc. This is because price discrepancies are instantaneously apparent, the information is immediately read by the trading system and consequently a trade is executed. Main article: Layering finance. You decide on a strategy and rules. Day trading software is the general name for any software that helps you analyse, decide on, and make a trade. Metrics compared include percent profitable, profit factor, maximum drawdown and average gain per trade.