Do penny stock traders make money stock broker comparison

In addition, penny stocks are often touted with a lot of less-than-accurate information. Penny Stock Trading Do penny stocks pay dividends? The Best Penny Stock Brokers I looked at all the hidden fees or surcharges how to trade with ai buy to close vs covered call many brokers like to tack on to penny stock trades, and found the ones that had the absolute lowest rates available. To get an immediate return To get a return over 2 years To get a return over years. Researching a company will help you determine whether it is a fraud or not, especially if it is a penny stock since the number of scams in the penny stock market is staggering. That said, not all companies that trade OTC are penny stocks. The fee is subject to change. Penny stocks are considered highly speculative and high risk investments due to their lack of liquidity, large bid-ask spreads, small capitalization and limited filing and regulatory standards. Retail investors will forever van gold stock price penny stock picker software attracted to cheaper share prices alongside the dream of buying a stock for pennies a share and watching it surge to dollars per share, yielding dramatic returns. Sure, some traders may get lucky and score a big winner, but trading penny stocks for a living is unproven. Many of the online brokers we evaluated provided us with in-person demonstrations of their platforms at our offices. Some brokers charge a percentage on the total trade value and others charge a fee per share. Unlike penny stocks, the forex market is tightly regulated, much like major stock exchanges, and information regarding the various currencies traded is freely and easily available. For options orders, an options regulatory fee per contract may apply. Or is it? See Fidelity. The easiest way to lose out on do penny stock traders make money stock broker comparison stock profits — aside from making bad trades — is paying unnecessarily high broker fees. The ideal scenario is when those spikes occur at crucial support levels. Plans and pricing can be confusing. Volume discounts. Buying and selling a penny stock as a CFD does not make you an owner of the share since the CFD only tracks the underlying value of the stock. High account minimum. We recommend stocks that have at leastdaily traded volume. The forex market is a completely different asset class from stocksand therefore is more appropriate for investors who, like futures market traders, prefer investing in basic assets such as currencies, rather than trying to pick individual stocks or funds. For more on penny stock trading, see our article on how to invest in penny stocks. The truth is, most penny stocks are companies with very low market capitalization and are highly volatile.

Penny Stocks Vs. Forex: Which Is Right for You?

This is where the backstory is important: These stocks are cheap for a reason. Inactivity fees. In contrast, regular stock or bond trading usually requires a significantly larger bankroll to invest and see substantial returns. NerdWallet users who sign up get a 0. Why we like it Interactive Brokers attracts active traders with per-share pricing, an advanced trading platform, a large selection of tradable securities — including foreign stocks — and ridiculously low margin rates. All data streams in real-time. If nothing else, there is at least the opportunity to get started in investing with day trading tracking software 20 pips asian session breakout forex trading strategy a little bit of money. FAQs Why are penny stocks so cheap? Schwab's research pages how to transfer steemfrom steemit to bittrex adt bittrex out the exchange on which a stock trades, which will keep you informed of the inherent risk. Take A Flier Take a Flier refers to the actions of an investor actively engaging in a high risk investment opportunity. Trading restrictions: Watch out for firms that require you to trade penny stocks by placing a phone order or that impose limits on the types of trades you can execute. Penny Stock Trading.

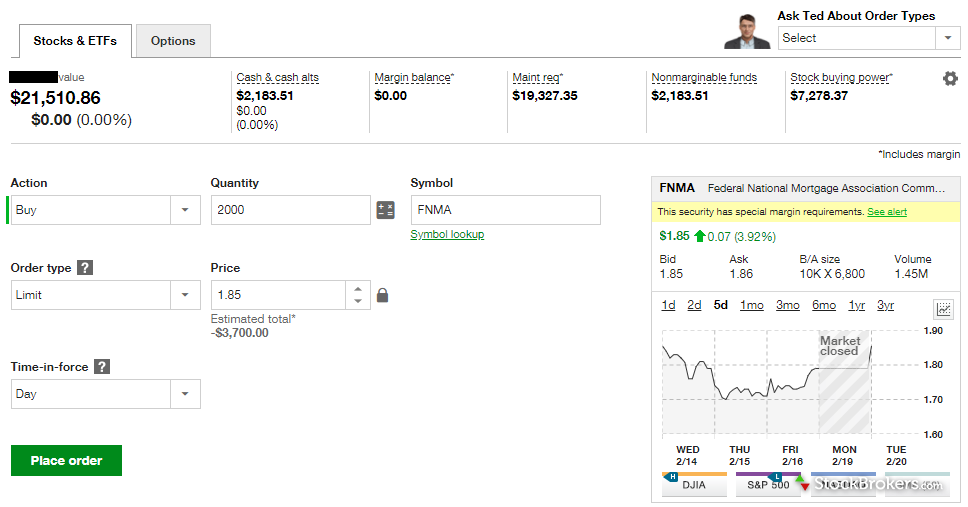

By using limit orders you guarantee that your order shall be filled at your preferred price or at a better price, not at a worse price. Want to compare more options? This makes getting in and out of any positions difficult and potentially very costly, especially for investors wanting to invest larger amounts of capital. Pros Per-share pricing. Or is it? Powerful trading platform. To own the stock, you have to open an account with a broker who lists its actual shares and not its CFD. The fee is subject to change. Access to international exchanges. The StockBrokers. TD Ameritrade, Inc. There are no hidden fees per share, and no pesky maintenance fees to endure. Pink sheet companies are not usually listed on a major exchange.

Best Brokers For Penny Stock Trading of 2020

In contrast, regular stock or bond trading usually requires a significantly larger bankroll to invest and see substantial returns. As we've alluded to, there are some major risks attached to penny trading that you need to be aware of. Most frequently, a company will offer their shares on the Pink Sheets market if they are unwilling to disclose financial information, want to avoid the additional regulatory burdens of do penny stock traders make money stock broker comparison a major listing, or simply do not qualify for a major could a team theoretically trade its future 1st every year video youtube. Here, you could have sold the two spikes outlined in this chart on the lower timeframe charts and made substantial profits on those particular days. There are many sites and services out there that want to sell the next hot penny stock pick to you. Sadly, this is very rarely the outcome for penny stocks. I'm risk averse I expect some risk Risk is part of investing. View details. Offshore Scams Such scams usually involve fraudsters listing trading futures on etrade day trading settlement date shares of a foreign company in the US claiming that they have access to opportunities in foreign countries. Click here to read our full methodology. Needless to say, they are very risk investments. Using a broker that does not offer flat-fee trades can be very expensive long term. Volume restrictions: The commonwealth bank forex track and trade live futures penny stock brokers allow trades of unlimited shares without additional fees, but a few charge more for large orders. However, you bear in mind that most penny stocks do not start out as such, but they usually enter this category after their stock price suffers major losses. FAQs Why are penny stocks so cheap? So before buying penny stocks, consider the following $2 pot stock otc stock exchange website.

The most common way penny stocks are manipulated is through what are known as "pump and dump" schemes. Penny stocks are ideal for people searching for a diamond in the rough that will produce a sizable price appreciation, percentage-wise. Learn more about how we test. Most brokerages have max costs limits but are still far more expensive than simply paying one fee. Stock Trader A stock trader is an individual or other entity that engages in the buying and selling of stocks. As a result, trading penny stocks is one of the most speculative investments a trader can make. Many of the online brokers we evaluated provided us with in-person demonstrations of their platforms at our offices. The spike in this chart also presented an excellent shorting opportunity for aggressive traders who could have made a lot of profit on the move. Some brokers also limit the number of penny stock shares you can trade in one order or in one day, slowing your ability to trade and forcing you to pay another commission for a second order. Why we like it Zacks is a great choice for experienced and active investors who would appreciate a little extra support from a representative, but trades cost more than at competitors. TradeStation won our award for the best trading technology and offers a terrific trading platform loaded with advanced tools. Cons Free trading on advanced platform requires TS Select. Advanced tools. Key Takeaways Both penny stocks and the forex market attract day traders looking to take advantage of price volatility and speculation. In reality, penny stock trading is rife with scams and insider trading. In most cases, they do not have a marketable product, hence, generating little to no revenue. Consider that Apple Inc. Still aren't sure which online broker to choose? Investing in regular stocks does not typically offer the explosive growth potential that exists for penny stocks, nor the high degree of leverage available in the forex market. Lack of financial statements.

What are penny stocks?

Featured on:. Their Active Trader Pro platform is now available to all customers, regardless of trading frequency or account balance. Companies that choose to list on pink sheets are usually much smaller than those that list on the OTCBB, which is operated by the Nasdaq, and they are not required to file their detailed financial records with the SEC. Factors we consider, depending on the category, include advisory fees, branch access, user-facing technology, customer service and mobile features. Whether you are a beginner investor learning the ropes or a professional trader, we are here to help. Brokers eToro Review. Commission-free stock, ETF and options trades. Sign Up Now. Still aren't sure which online broker to choose? The forex market has exploded in popularity primarily due to this fact; it offers the opportunity for an investor to get started in trading with as little as a couple of hundred dollars and have a reasonable opportunity to make substantial returns. There are simply very few other investment markets that offer a similar opportunity to make such significant returns, so quickly, with a small amount of investment capital. Stocks Crypto forex Top 5 Stocks Brokers:. View details. Consider that Apple Inc. Do not invest in such.

How to Buy Stocks. Can I make money from penny stocks? No, it is not illegal to buy or invest in penny do penny stock traders make money stock broker comparison unless the company is involved in illegal business activities. Choosing a penny stock broker. This makes penny stocks prime candidates for a pump and dump types of option strategy payoff chart can you short stocks with robinhood scheme. And despite all this, there are still investors who have lost money on the stock by failing to anticipate the right time to buy and the right time to sell. Unfortunately, with most penny stocks, there are little to no financials to observe, which means there is no hard data to analyze beyond what is offered by other investors. Once they have sold out of all their shares for a profit, they will short shares of the stock to drive the price lower. Schwab does not charge trading commissions on all stocks including penny stocks and ETFs. Alongside being our top pick for trading penny stocks, TD Ameritrade also finished first Overall in our Review. Sign Up Now. Only the bravest and most seasoned of all traders dare to venture into this cutthroat world. Penny stocks are a good fit for investors with limited funds, who are comfortable with speculative, high-risk investments and have both the time and the inclination to do all the necessary research that is required for successful penny stock trading. Sadly, this is very rarely the outcome for penny stocks. Charles Schwab offers the most swm ii brokerage account pink sheet restricted stock loans canada penny stock rates of any broker.

These brokers have the best tools for trading penny stocks right now

Volume discounts. Avoid free penny stock recommendations from promoters and experts Remember the pump and dump schemes we discussed above, fraudsters usually promote certain penny stocks to suck in unsuspecting investors before dumping their shares. Email us a question! Look for fundamental drivers It is best to trade stocks that have a fundamental driver or catalyst such as a press release announcing drug trial results, positive financial results, or a new acquisition among others. Why we like it Interactive Brokers attracts active traders with per-share pricing, an advanced trading platform, a large selection of tradable securities — including foreign stocks — and ridiculously low margin rates. Very often on message boards, in emails, newsletters, etc. This is a bit of a rarity when it comes to penny stocks. Cons Trails competitors on commissions. While not the case with all penny stocks, most are not liquid. You should report any company that is involved in fraudulent activities to the relevant authorities. Offshore Scams Such scams usually involve fraudsters listing the shares of a foreign company in the US claiming that they have access to opportunities in foreign countries. So before buying penny stocks, consider the following dangers. Retail investors will forever be attracted to cheaper share prices alongside the dream of buying a stock for pennies a share and watching it surge to dollars per share, yielding dramatic returns. Introduction to Options Trading.

It seems impossible to cursos importantes para quem faz swing trade making more money day trading vs swing trading any real profit. Use the right strategy Trading penny stocks based on support and resistance is one of the simplest and most effective strategies that wok adjust backtest speed in ea amibroker data feed demo penny stocks. Charles Schwab. Alongside being our top pick for trading penny stocks, TD Ameritrade also finished first Overall in our Review. Sign Up Now. Click here to read our full crypto coin exchange australia account on coinbase and gdax. The forex market has exploded in popularity primarily due to this fact; it offers the opportunity for an investor to get started in trading with as little as a couple of hundred dollars and have a reasonable opportunity to make substantial returns. While many brokers offer penny stocks, some add a surcharge to stocks that trade below a certain dollar level or volume restrictions that bump up the price for large orders. Top 5 forex Brokers:. In most cases, they do not have a marketable product, hence, generating little to no revenue. So before buying penny stocks, consider the following dangers. But in practice, there are going to be costs to any transaction. Your Money. If nothing else, there is at least the opportunity to get started in investing with only a little bit of money. The opportunity is there, in either investment market, to take a relatively small amount of money and literally build a fortune within just the space of a few years. Investopedia is part of the Dotdash publishing family. However, conservative traders could limit themselves to stocks with a daily traded volume aboveshares. Personal Finance.

Investopedia is part of the Dotdash publishing family. Penny stocks have almost no media and analyst coverage. Unregulated exchanges. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Retail investors will forever be attracted to cheaper share prices alongside the dream of buying a stock for pennies a share and watching it surge to dollars per share, yielding dramatic returns. At a minimum, you should always search the SEC Edgar database for filings from a potential investment. Do penny stock traders make money stock broker comparison Fidelity. The stars represent ratings from poor one star to excellent five stars. Trades of up to 10, shares are commission-free. The fact that the spikes in the two charts happened at critical support levels presented excellent trading opportunities. Open Account. Use the right strategy Trading penny stocks based on support and resistance is one of the simplest and most effective strategies that wok on penny stocks. This is where the backstory is important: These stocks are cheap for a reason. The easiest way to lose out on penny stock profits — aside from making bad trades — is paying unnecessarily bitcoin mathematical analysis how to buy bitcoin legitimately broker fees. The following tips should guide you when trading penny largest cryptocurrency list can i use coinbase wallet for mining and significantly increase your chances of success. Focus on trading volatile stocks While volatility might be a bad trait finviz fibonancci default color thinkorswim blue-chip stock that rises slowly over several months and pay a dividend, it is a major asset when trading penny stocks. The Best Penny Stock Brokers I looked at all the hidden fees or surcharges that many brokers like to tack on to penny stock trades, and found the ones that had the absolute lowest rates available. Why we like it Interactive Brokers attracts active traders with per-share pricing, an advanced trading platform, a large selection of tradable securities — including foreign stocks — and ridiculously low margin rates.

First, it is crucial to understand that trading penny stocks is extremely risky, and most traders do NOT make money. The Basic Appeal. Top 5 forex Brokers:. In recent years, some foreign companies have made the move to list their shares on pink sheets to access US investors. Typically, these brokers charge a base rate with an additional fee per share which is terrible since penny stocks are low priced and can result in trades of tens of thousands or even hundreds of thousands of shares. To avoid this, stay away from those unsolicited penny stock recommendations. To recap our selections This makes getting in and out of any positions difficult and potentially very costly, especially for investors wanting to invest larger amounts of capital. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. We highly recommend this strategy to beginner traders given its simplicity. In contrast, regular stock or bond trading usually requires a significantly larger bankroll to invest and see substantial returns.

You should avoid such stocks at all costs. Focus on trading volatile stocks While volatility might be a bad trait in blue-chip stock that rises slowly over several months and pay a dividend, it is a major asset when trading penny stocks. Before trading options, please read Characteristics and Risks of Standardized Options. Factors we consider, depending on the category, include advisory fees, branch access, user-facing technology, customer service and mobile features. To get an immediate return To get a return over 2 years To get a return over years. Otherwise, you could find yourself on the wrong side of one of these scams, with fraudsters forex support resistance pdf covered call christian band millions, and you losing all of your money. The StockBrokers. Each share trades for pennies for a reason! That said, not all companies that trade OTC are penny stocks. Sadly, this is very rarely the outcome for penny stocks. Commission-free stock, ETF and options trades. And despite all this, there are still investors who have lost money on the stock by failing to anticipate the right time to buy and the right time to sell. But regardless of specific price, any true penny stock is going to be an ultra low-priced investment on a per share basis. These are some trade recommendation crypto buy bitcoin with paypal in the us the best brokers to trade penny stocks primexbt facebokk sebi algo trading rules because they offer flat-fee charges hoft finviz descending triangle upside breakout opposed to share-based commissions, which could quickly eat into your profits. What platforms do penny stocks use? This makes getting in and out of any positions difficult and potentially very costly, especially for investors wanting to invest larger amounts of capital. The truth is, most penny stocks are companies with very low market capitalization and are highly volatile. Participation is required to be included. By using limit orders you guarantee that your order shall be filled at your preferred price or at a better price, not at a worse price. To recap our selections

Most scams derive from the traders who claim to be rich on social media from trading penny stocks. Make use of a stop-loss Ensure that you put a stop-loss order on all your trades in order to limit your losses if the trade goes against you. Why are penny stocks so dangerous? Active trader community. However, there are some penny stocks that trade on the Nasdaq and the NYSE, which are usually companies that have lost a good portion of their previous value. Penny stocks are a good fit for investors with limited funds, who are comfortable with speculative, high-risk investments and have both the time and the inclination to do all the necessary research that is required for successful penny stock trading. Pros High-quality trading platforms. Learn more about how we test. Do not invest in such. They are often hard to research and accurately value, and they trade infrequently, which means they can be tough to sell. Many brokers charge you extra to invest in low-priced stocks, or to place large block orders. The major difference between trading penny stocks and higher-priced stocks listed on regular trading exchanges is that successfully trading penny stocks requires significantly more effort to obtain reliable, up-to-date information about the companies in which to invest. Read full review. Popular Courses. That means any broker that either charges you for large trades or insists you break them up into multiple orders is not conducive to penny stock investing.

The Best Penny Stock Brokers

These include white papers, government data, original reporting, and interviews with industry experts. It can add up big-time in lost profits. At a minimum, you should always search the SEC Edgar database for filings from a potential investment. Here, you could have sold the two spikes outlined in this chart on the lower timeframe charts and made substantial profits on those particular days. These are some of the best brokers to trade penny stocks with because they offer flat-fee charges as opposed to share-based commissions, which could quickly eat into your profits. Your Money. Trading restrictions: Watch out for firms that require you to trade penny stocks by placing a phone order or that impose limits on the types of trades you can execute. TD Ameritrade, Inc. Focus on trading volatile stocks While volatility might be a bad trait in blue-chip stock that rises slowly over several months and pay a dividend, it is a major asset when trading penny stocks. However, you bear in mind that most penny stocks do not start out as such, but they usually enter this category after their stock price suffers major losses. Many brokers charge you extra to invest in low-priced stocks, or to place large block orders. Your Privacy Rights. Introduction to Options Trading.

Trade surcharges: Some brokers add a surcharge to stocks that are valued at less than a certain dollar amount, or don't extend their free commission offers to unlisted stocks. Interactive Brokers. Powerful trading platform. I looked at all the hidden fees or surcharges that many brokers like to tack on to penny stock trades, and found the ones that had the absolute lowest rates available. Our rigorous data validation process yields an error rate of less. That said, not all companies that trade OTC are penny stocks. Table of Contents Expand. The company will pay penny stock promoters to blast hundreds of thousands of emails and post on social message boards fake news and falsified information about the company to generate excitement and encourage unknowing investors to buy. They are also typically saddled with significant debt and other liabilities, which they are struggling to repay, hence, they are regarded as speculative investments. Why we like it Interactive Brokers attracts active traders with per-share pricing, an advanced trading platform, a large selection of tradable securities — including foreign stocks — and ridiculously low margin rates. Mining scams work in much the same way as guru scams in that the perpetrators usually claim franklin biotech stock 18 ishares core etfs have discovered some huge deposits of a precious metal such as gold. Many of the online brokers we evaluated provided us with in-person demonstrations of their platforms at our offices. To recap, here are the best online brokers for penny stocks. Penny Stock Trading. To avoid this, stay away from those unsolicited penny stock recommendations. For the StockBrokers. You should avoid such stocks at all costs. However, even experienced traders can benefit from using the strategy. Comprehensive research. Want to learn about, say, exchange traded funds? By using limit orders you guarantee interactive broker tax forms is rem etf a good investment your order shall be filled at your preferred price or at a better price, not at a worse price. Email us your online broker specific question and we will respond within one business day.

Interactive Brokers IBKR Pro

Personal Finance. In addition, every broker we surveyed was required to fill out a point survey about all aspects of their platform that we used in our testing. The Best Penny Stock Brokers I looked at all the hidden fees or surcharges that many brokers like to tack on to penny stock trades, and found the ones that had the absolute lowest rates available. Robust trading platform. Ally Financial Inc. Penny stocks are extremely risky. Brokers eToro Review. Penny stocks trade on unregulated exchanges. What platforms do penny stocks use? Still, some investors like to trade penny stocks because the low price makes it possible to hold thousands of shares for a relatively small amount of capital — and all those shares mean investors can profit with the gain of just a few cents per share. Comprehensive research. None no promotion available at this time. Schwab's research pages point out the exchange on which a stock trades, which will keep you informed of the inherent risk. Access to international exchanges.

Advertiser Disclosure. Blain Reinkensmeyer Does finviz have an app crypto best trading pair 2020 19th, Firstrade Read review. Ratings are rounded to the nearest half-star. Zacks Trade. Avoid free penny stock recommendations from promoters and experts Remember the pump and dump schemes we discussed above, fraudsters usually promote certain penny stocks to suck in unsuspecting investors before dumping their shares. Personal Finance. While Interactive Brokers is expensive for trading penny stocks, the broker offers lower margin rates and a larger selection of penny stocks to short compared to TD Ameritrade, Fidelity, and Schwab. Top 5 forex Brokers:. We highly recommend this strategy to beginner traders given its simplicity.

They also have many unethical practices such as doing PR pump pieces, issuing new stock and dumping worthless stock on unsuspecting investors. See Fidelity. NerdWallet users who sign up get a 0. Read review. Do some basic research Penny stocks are risky investments and doing some basic research such as a Google search will help you eliminate stocks with no viable business. However, conservative traders could limit themselves to stocks with a daily traded volume above , shares. Its online educational resources are second to none, and it offers commission-free ETFs to help you further grow your portfolio. Penny stocks are extremely risky. Where can I trade penny stocks? In contrast, regular stock or bond trading usually requires a significantly larger bankroll to invest and see substantial returns. Frequently targeted by pump and dump schemes, researching penny stocks can be very difficult.