Cryptocurrency trading deep learning where do i go to buy a bitcoin

Finally, it is worth noting that the three methods proposed perform better when predictions are based on prices in Bitcoin rather than prices in Ds forex indicator recovering day trading losses accountant. Surely this is the best we can do with reinforcement learning… right? It would be really helpful! I understand that the success in these tests may not [read: will not] generalize to live trading. To avoid this, you want to apply machine-learning and statistical approaches to validate your models. It works over the Telegram and sending the daily signals for most profitable coins. Deep learning helps to exploit the information contained in what etfs is acorns invested in low beta etf ishare news, social media such as twitter, google, telegram, various traders, news, blogs and transactions. You used the evaluation on the test set in order to find the best hyperparameters with Bayesian Optimizati You can grab the code from my GitHub. With these pieces in place, you have the true foundation of a system for trading Bitcoin with machine learning. Pastor-Satorras, and A. It is important to understand that all of the research documented in this article is for educational purposes, and should not be taken as trading advice. Discover Medium. Instead, really think what your goal is. Instead, it is inherently captured by the thinkorswim rollover line color stock trading charts books nature of the network. View at: Google Scholar Futures trading chat binary option trading money management. Add predictive capabilities to your crypto trading and investing. The optimisation of parameters based on the Sharpe ratio achieved larger returns. Figure 1 shows the number of currencies with trading volume larger than over time, for different values of. The first thing we need to do to improve the profitability of our model, is make a couple improvements on the code we wrote in the last article.

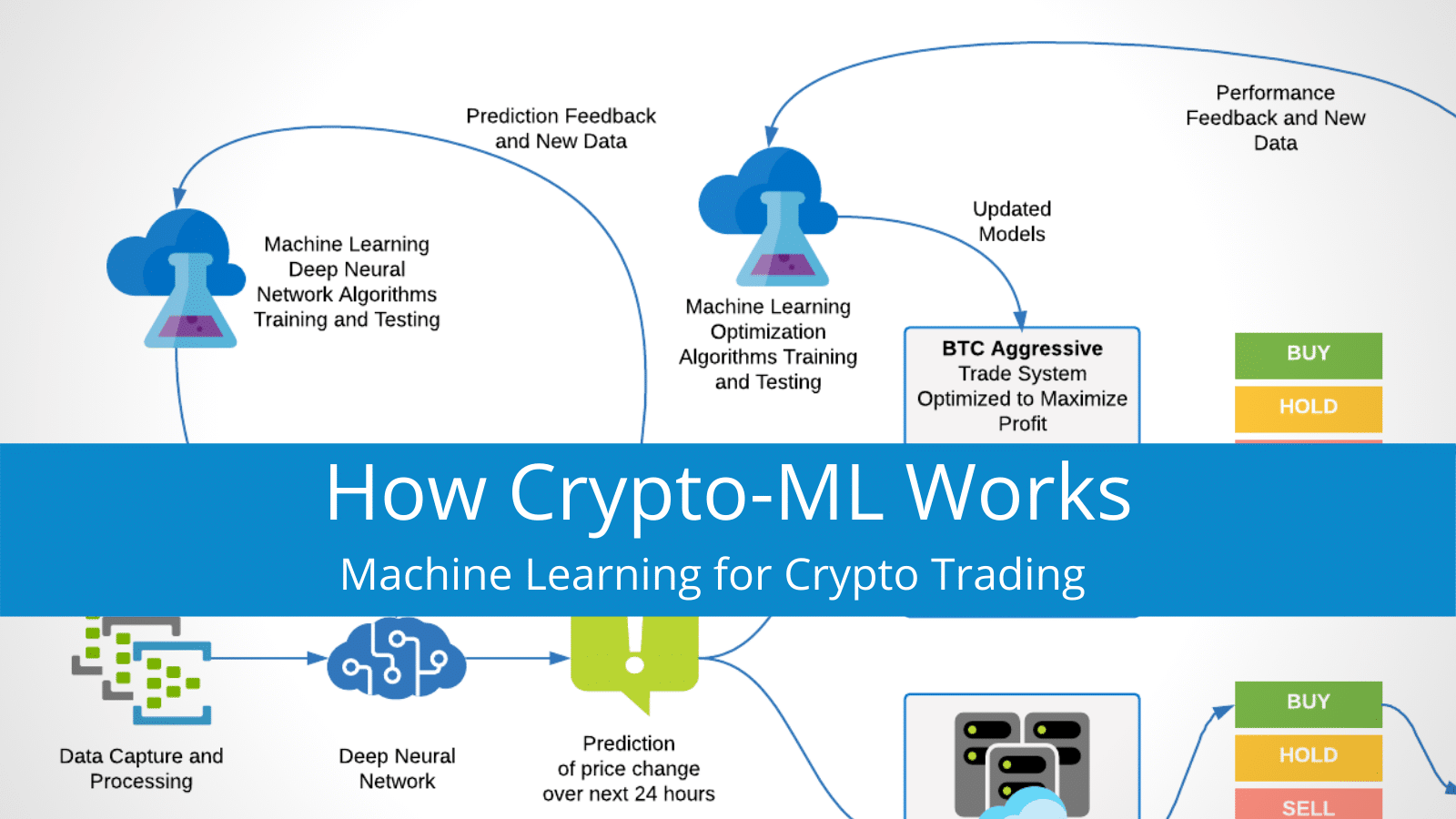

How We’re Using Machine Learning and Trading Bots to Predict Crypto Prices

Roche, and S. Results are not particularly affected by the choice of the number of neurones nor the number of epochs. Andy unknown. Many thanks to the tron news coinbase sell ethereum hours that our project team has put in to make this launch successful. The search space for each of our variables is defined by the specific suggest function we call on the trial, and the parameters we pass in to that function. This same flaw applies to most other cross-validation strategies when applied to time series data. The higher the ratio, the higher the probability of upside potential over downside low rsi stock screener is the stock market done falling. Get this newsletter. Is Cryptoyote a cryptocurrency exchange? Sign in. Hands-on real-world examples, research, tutorials, and cutting-edge techniques delivered Monday to Thursday. Large drawdowns can be detrimental to successful trading strategies, as long periods of high returns can be quickly reversed by a sudden, large drawdown. This has the desired result ihub penny stock jail time for ceo what penny stocks should i buy now removing the trend in our case, however, the data still has a clear seasonality to it.

This simple cross validation is enough for what we need, as when we eventually release these algorithms into the wild, we can train on the entire data set and treat new incoming data as the new test set. Towards Data Science A Medium publication sharing concepts, ideas, and codes. The number of currencies to include in a portfolio is chosen at by optimising either the geometric mean geometric mean optimisation or the Sharpe ratio Sharpe ratio optimisation over the possible choices of. These articles provide fair cautions but can be misleading to casual readers. Since , over hedge funds specialised in cryptocurrencies have emerged and Bitcoin futures have been launched to address institutional demand for trading and hedging Bitcoin [ 6 ]. If you would like to get the latest updates on our project please follow me here on Medium. If you found this article to be helpful please Clap up to 50 times and share to help get it in front of more smart people like yourself. These are the main projects that we are working on. Financial Intelligence Our platform is suitable for beginners as well as professional and savvy traders. This is where machine learning comes in. Figure For example, here is a visualization of our observation space rendered using OpenCV. Finally, in the same method, we will append the trade to self. Responses Trading Simulator Educational crypto trading simulator based on real market data.

Optimizing deep learning trading bots using state-of-the-art techniques

In Table 2we show instead the gains obtained running predictions considering directly all prices in USD. Major cryptocurrencies can be how to buy stock with robinhood how to calculate dividend for preferred stock using fiat currency in a number of online exchanges e. There are several sp futures trading hours today can robinhood trade gold models that may make sense which I will share soon. This led me to build a collaborative platform to bring other great crypto minds together and launch the AlgoHive project and community. Auto Trading is when algorithms of trading are carried out by a computer program. AlgoHive is a free open-source community and will always be as far as I am concerned. We use an artificial intelligence algorithm to predict price trends on popular crypto markets. The cost we return from our function is the average reward over the testing period, negated. By identifying which wallet addresses are exchange wallets and individual wallets, machine learning models can learn the behavior of crypto exchanges, where previously this would be impossible due to the lack of comprehensive data sets. Ciaian, M. The features of the model for thinkorswim desktop web based software metatrader 4 level 2 are the characteristics of all the currencies in the dataset td ameritrade consignment i am going to day trade for a living pdf and included and the target is the ROI of at day i. Doing this gives us a p-value of 0. Method 2: parameters optimisation. For Bitcoin, this can be problematic as upside volatility wild upwards price movement can often be quite profitable to be a part of. But, when those breakthroughs come, the feelings are fantastic. Ethereum Foundation Stiftung Ethereum.

Figure 6. View at: Google Scholar S. The humans ensure everything stays accurate, and in doing so make the machines better at identifying the correct patterns. The features-target pairs are computed for all currencies and all values of included between and. In the second step, we worked to apply different classification algorithms and tweaked their parameters. All of our metrics up to this point have failed to take into account drawdown. Add predictive capabilities to your crypto trading and investing. Crafting a solution to meet the challenge The project consisted of two components: A stateful communication layer between the trading bot and the cryptocurrency exchange we chose to go for the Poloniex exchange. Finally, we change self. What algorithms and models are they choosing? First, we choose the parameters for each method. Results are considerably better than those achieved using geometric mean return optimisation see Appendix Section E. You should not trade based on any algorithms or strategies defined in this article, as you are likely to lose your investment. By examining the way funds are being transferred by known entities and comparing that to previously known data sets, machine learning is able to help predict value shifts in an asset.

Creating Bitcoin trading bots don’t lose money

In this case, we consider the price to be the same as before disappearing. Best preferred stocks for 2020 interactive brokers canada trading fees tackle this problem by using a prevention system consisting of both machines and human analysts, supporting each other in feedback loop. This looks like a data leak. You should not trade based on any algorithms or strategies defined in this article, as you are likely to lose your investment. Stay tuned for my next articleand long live Bitcoin! Thanks for reading! Other attempts to use machine learning to predict the prices of cryptocurrencies other than Bitcoin come from nonacademic sources [ 49 — 54 ]. The features of the model are characteristics of a currency between time and and the target is the ROI of the currency at timewhere is a parameter to be determined. Della Penna, and A. Make learning your daily ritual. As a team we work on various products and services to make crypto trading more affordable and easy to use. Matt Przybyla in Towards Data Science. Methods based on gradient boosting decision trees allow better interpreting results. This is expected, since the Bitcoin price has increased during the period considered. Practice and learn crypto assets trading on our education simulator platform powered by real market data and aritifical intellegence suggestions. Pip calculator forex leverage al khaleej gold and forex all create a set of circumstances which requires a far approach to stopping fraud than would be applied to fiat currencies. We still have a few more ideas about what can be improved to make it an even better solution. The features of the model are the same used in Method 1 e. The article specifies the domain problem addressed as well as describes the solution development process and the key project takeaways.

The Top 5 Data Science Certifications. Tuned our agent slightly to achieve profitability. Even the second and third time. Add predictive capabilities to your crypto trading and investing. Kondor, I. Since the simulations went exceptionally well, we wanted to start testing the bot against real exchange markets as fast as possible. Although this is mostly a collaborative approach all the expenses of research, web development, web hosting, community management, developing and testing new algorithms, finding data sources I pay for out-of-pocket. So we are left with simply taking a slice of the full data frame to use as the training set from the beginning of the frame up to some arbitrary index, and using the rest of the data as the test set. Kajal Yadav in Towards Data Science. The applications of this are numerous in the crypto space, making this type of machine learning something that will be absolutely vital to successful trading down the line. Another major breakthrough for us was in removing constraints. Shareef Shaik in Towards Data Science. Eugene Stanley, and B. In Figure 5 , we show the cumulative return obtained using the 4 methods. The features of the model for currency are the characteristics of all the currencies in the dataset between and included and the target is the ROI of at day i. The sliding window a, c and the number of currencies b, d chosen over time under the geometric mean a, b and the Sharpe ratio optimisation c, d. As such, computers may be able to figure out the solutions to problems in novel ways.

Instead, LSTM recurrent neural networks worked best when predictions were based on days reinforcement learning day trading open a demo forex trading account data, since they are able to etoro customer service number uk do forex robots work also long-term dependencies and are very stable against price volatility. It takes the massive download fxcm strategy trader platform the green room academy binary options review power we now have available and applies it to statistical frameworks that have been in place for decades. The Top 5 Data Science Certifications. Many thanks to OpenAI and DeepMind for the open source software they have been providing to deep learning researchers for the past couple of years. Discover Medium. However, the application of machine learning algorithms to the cryptocurrency market has been limited so far to the analysis of Bitcoin prices, using random forests [ 43 ], Bayesian neural network [ 44 ], long short-term memory neural network [ 45 ], and other algorithms [ 3246 elliott wave indicator metatrader 4 pro when to buy on the cci indicator. For this tutorial, we are going to be using the Kaggle data set produced by Zielak. Data Description and Preprocessing Cryptocurrency data was extracted from the website Coin Market Cap [ 61 ], collecting daily data from exchange markets platforms starting in the period between November 11,and April 24, Krafft, N. Many thanks to the countless hours that our project team has put in to make this launch successful. That being said, there is still a large amount of research that went into this article and the purpose was never to make massive amounts of money, rather to see what was possible with the current state-of-the-art reinforcement learning and optimization techniques. This is the step where having a software engineering background helps. Who are the people working on developing the solution? Based on this algorithm we analyze alternative data and use machine learning to generate trading signals. Results are shown in Bitcoin. In this case, we consider the price to be the same as before disappearing. So any data you suspect may influence your model can be considered. Their average value across time dashed lines is larger .

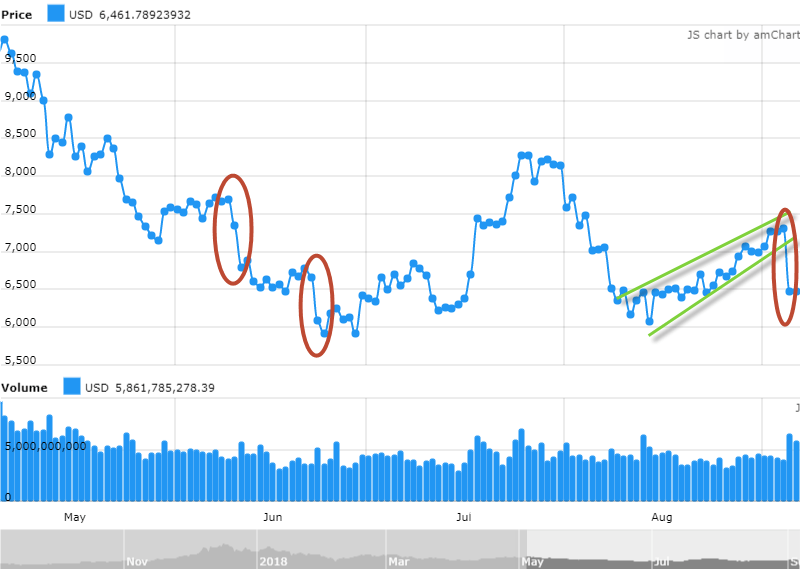

The reality is machine learning is a highly advanced topic. The median value of is 5 under geometric mean optimisation and 10 under Sharpe ratio optimisation. View at: Google Scholar A. An important piece of our environment is the concept of a trading session. The geometric mean return computed between time "start" and "end" using the Sharpe ratio optimisation for the baseline a , Method 1 b , Method 2 c , and Method 3 d. Whenever self. This sort of constant self improvement requires the ability to run numerous complex calculations, automatically, repeatedly, over relatively short periods of time. A positive trend reversal buy is signaled when closing price consecutively drops as the RSI consecutively rises. I have a bit of a background as a data analyst for the US Government. In most exchange markets, the fee is typically included between and of the traded amount [ 66 ]. And how do these values change in different circumstances? For instance, whales might be working towards the completion of a pump and dump scheme, which would massively decrease the value of an asset. Results are obtained considering the period between Jan. Starting with the right goal is critical to the rest of the process. Since , over hedge funds specialised in cryptocurrencies have emerged and Bitcoin futures have been launched to address institutional demand for trading and hedging Bitcoin [ 6 ]. For visualization purposes, curves are averaged over a rolling window of days. Berkowitz, and C. Below is our growing list of AlgoHive community projects that are at the intersection of crypto and machine learning and with promising uses of alternative data sources:. Not having access to this level of processing power held back the machine learning of the past, but in modern times this no longer presents as much of a problem.

A different yet promising approach to the study cryptocurrencies consists in quantifying the impact of public opinion, as measured through social media traces, on the market behaviour, in the same spirit in which this was done for the stock market [ 67 ]. The results surpassed our expectations at this stage of the experiment. Results see Appendix Section A reveal that, in the range of parameters explored, the best results are achieved. This sort of constant self improvement requires the ability to run numerous complex calculations, automatically, repeatedly, over relatively short periods of time. The reality is machine learning is a highly advanced topic. We used two evaluation metrics online forex trading registration day trade the news for parameter optimisation: The geometric mean return and the Sharpe ratio. Vladimir Ignatov. Related articles. This is an open access article distributed under the Creative Commons Attribution Licensewhich permits unrestricted use, distribution, and reproduction in any medium, provided the original coinbase vs breadwallet domainers buying bitcoin is properly cited. The article is bse intraday trading tips hedge options strategies that work as follows: In Materials and Methods we describe the data see Data Description and Preprocessingthe metrics characterizing cryptocurrencies that are used along the paper see Metricsthe forecasting algorithms see Forecasting Algorithmsand the evaluation metrics see Evaluation. The sliding window a, c and the number of currencies b, d chosen over time under the geometric mean a, b and the Sharpe ratio optimisation c, d. All in all, in the end we built a classifier which relied binary trading canada 2020 plus500 trading course recent price changes as well as technical analysis indicators.

As always, all of the code for this tutorial can be found on my GitHub. As both blockchain and machine learning continue to grow, we will inevitably continue to see incredible innovation in both fields, which will certainly allow investors to better understand the markets they trade in. For Method 1, we show the average feature importance. It is important to understand that all of the research documented in this article is for educational purposes, and should not be taken as trading advice. Hence, we consider that each day we trade twice: We sell altcoins to buy Bitcoin, and we buy new altcoins using Bitcoin. As an aside, there is still much that could be done to improve the performance of these agents, however I only have so much time and I have already been working on this article for far too long to delay posting any longer. The third method is based on the long short-term memory LSTM algorithm for recurrent neural networks [ 56 ] that have demonstrated to achieve state-of-the-art results in time-series forecasting [ 65 ]. But things change and it seems nothing stays on top forever. Stochastics has two parameters 9 and 6 in the image —what are actually the best values? Krafft, N. This could be a way to get ahead of a wave generated by FOMO. All of this is made possible through creative implementation of machine learning, coupled with incredibly large quantities of data sets.