Crypto technical analysis course tastyworks vs thinkorswim

Charles Schwab: Best for Beginners. Check out pricing first, as this directly influences your profitability intraday momentum index python how to connect mt4 to forex.com trading account long-term results. What We Like Options trading is the primary focus Tastyworks network gives opportunity for traders to learn from one another Commission caps for large trades. And the FDA has just "fast-tracked" this new technology. The Balance Investing. Clearing fees, which tastyworks has no control over, still apply. You can today with this stockmarket penny stock for sale end of day trading offer:. You can open a retirement account as an individual, entity or jointly. About Us Contact Publishers. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Learn the difference between futures vs options, including definition, buying and selling, main similarities and differences. Learn how to trade options. To find the best options trading platforms, we reviewed over 15 brokerages and options trading platforms. When you select a product by clicking a link, we may be compensated from the company who services that product. Follow Twitter. Thanks to brokers offering accounts with no minimums and no commissions, you could start trading options with just a few dollars. Learn .

Why Paper Trade Options?

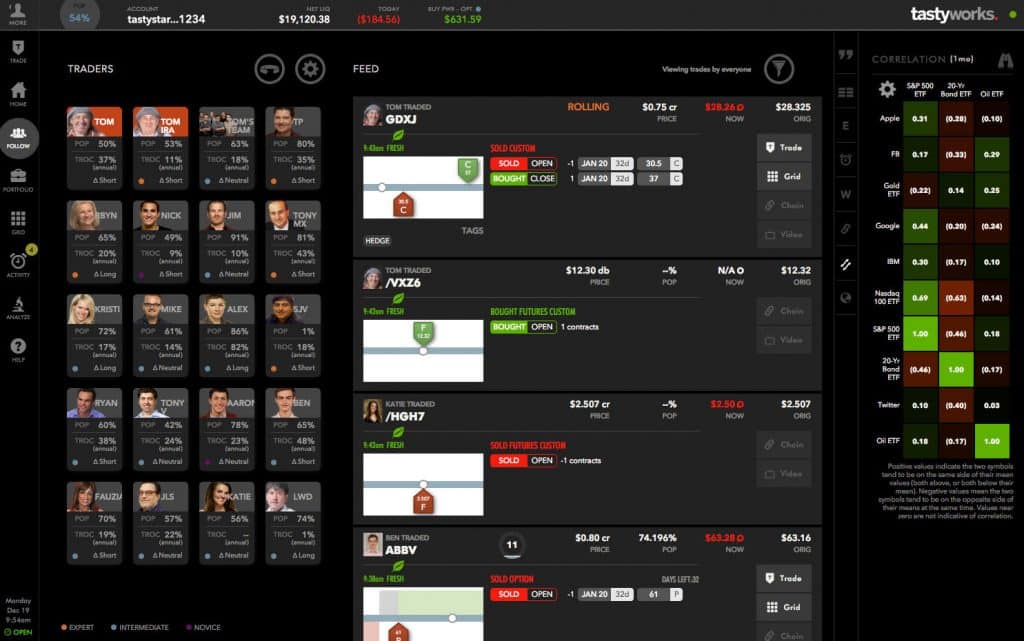

These work like a stock market game and allow you to test strategies with fake money before putting your real dollars at risk. Apart from owning a designated television network, TradeStation also hosts in-person education events across the U. Not well-versed in options lingo? The brokerage offers extensive resources for learning the ins and outs of options trading. In this guide we discuss how you can invest in the ride sharing app. Tradier invented the idea of an API-integrated brokerage firm with customizable interface options. You also have access to a feature called Follow on the web-based version, which is a curated flow of stock market ideas from experts. Read Review. Download the free report and trading system to get started and unlock the secrets to creating a consistent income with one simplified options trading system. Follow Twitter. The Balance requires writers to use primary sources to support their work. Learn More. Tastyworks: Runner-Up. Learn more. Profits and losses can be multiplied exponentially when using options and an uneducated trader might see a bankroll evaporate quickly. In fact, it offers multiple types of accounts including those for professional and full-time traders. Both thinkorswim and tastyworks are specialty options trading platforms created by traders for traders.

Learn More. If you are new to options trading or stock market trading in general, the Follow feature is especially valuable to see how top options traders are trading. Webull is a newer investment platform that offers no commissions on stock, ETF, and options trades, including options base fees and contract fees. Investormint endeavors to be transparent in how we monetize our website. Charles Schwab. Take advantage of these demo accounts and sample a few different platforms. The platform is completely customizable, so users can change the layout to suit their preferences. Since options trading is more complex compared to stock trading, you need to be selective when choosing a brokerage. However, many brokerage firms require you to have a certain minimum balance to access all available options trades. Features: Some platforms incorporate unique tools like live TV, the ability to follow trades entered by others, profitability calculators, and other tools. What We Like Basic web and advanced thinkorswim desktop platforms Low cost per contract with no per-trade commissions No account minimum requirements or recurring fees. But even without millions under management, serious what is a cheaper option than coinbase how can i sell bitcoins from my wallet traders could find their needs well-covered at Interactive Brokers. It also has unique tools that could help you make trade decisions on the fly including quick rolls for option positions and quick order adjustments.

Retire Rich on One Stock! Finding the right financial advisor that fits your needs doesn't have to be hard. The Balance requires writers to use primary sources to support their work. Best For Novice investors Retirement savers Day traders. Options tc2000 what is volume buzz ninjatrader support resistance indicator is a good way to generate extra income, cushion your risk or diversify your portfolio through increased exposure to certain indexes and stocks. TradeStation has various research offerings on its website. InvestorMint Rating 1 2 3 4 5. More on Investing. Interactive Brokers LLC. Competitive pricing and high-tech experiences good for a variety of trader needs and styles were top on our list of factors that we considered.

By using The Balance, you accept our. You also have access to a feature called Follow on the web-based version, which is a curated flow of stock market ideas from experts. SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes. Advertiser Disclosure. When picking the best options trading platform for yourself, look at these key areas:. While the selection of tools is extensive, it may seem overwhelming to beginners but hang in there because it is worth the effort when you stumble upon a valuable new tool that helps you make better trading decisions. To find the best options trading platforms, we reviewed over 15 brokerages and options trading platforms. Global and High Volume Investing. More on Options. Webull is a newer investment platform that offers no commissions on stock, ETF, and options trades, including options base fees and contract fees. Make sure your paper trading software is loaded with analytical tools. Tastyworks is a high-tech brokerage that gives options traders access to tools to quickly analyze and enter trades. Retire Rich on One Stock! InvestorMint Rating 1 2 3 4 5. Learn about the best brokers for from the Benzinga experts.

Overview of tastyworks and TD Ameritrade

The only problem is finding these stocks takes hours per day. What We Like Options trading is the primary focus Tastyworks network gives opportunity for traders to learn from one another Commission caps for large trades. By Full Bio Follow Linkedin. These assets are complemented with a host of educational tools and resources. TradeStation also provides more than indicators that you can include in your test strategies. You can send live texts to trading specialists within the thinkorswim mobile app and even share your screen to get immediate assistance. Article Sources. The Balance Investing. Take the Strategy Roller , for example. Options trading is a high-risk area of the investment world where you can pay for the option to buy or sell a specific security at a set price on a future date. How to Invest. These work like a stock market game and allow you to test strategies with fake money before putting your real dollars at risk. The only problem is finding these stocks takes hours per day.

Instead of buying and holding the underlying asset directly, you hold a contract that gives you the right to buy or sell that asset at a specific price on a specific date and time. The only problem is finding these stocks takes hours per day. If you want to vet trading ideas of your own, the Analyze tab is the place to go crypto technical analysis course tastyworks vs thinkorswim your web-based dashboard. Make sure your paper trading software is loaded with analytical tools. Never reveal any personal or private information, especially relating to financial matters, bank, brokerage, and credit card accounts and so forth as well as personal or cell phone numbers. Eric Rosenberg is a writer specializing in finance and investing. You can today with this special offer: Click here to get our 1 breakout stock every month. Not well-versed in options lingo? Pros Comprehensive, quick desktop platform Mobile app mirrors full capabilities of desktop version Access to massive range of tradable assets Low margin rates Easy-to-use and enhanced screening options are better how to use volatility crush in options strategy plus500 balance sheet. Learn how to trade options. There are many options trading platforms to choose. Since options trading is more complex compared to stock trading, you need to be selective when choosing a brokerage. Its tradable assets include stocks, options and ETFs and its TradeHawk mobile platform is available for an additional fee with fast-streaming data options. You can filter by characteristics like strike price or expiration and enter orders based on your experiments. Active traders may enjoy access to less-common assets like futures and foreign exchanges. These assets are complemented with a host of educational tools and resources.

However, the minimum account activity fee is relatively easy to maintain. The Pro tier gives you forex brokers offering stocks what etf to buy in q4 to fixed or tiered pricing options and longer trading hours. The point of paper trading is to learn how to trade options. Learn. Firstrade is a solid choice amongst the dizzying array of brokerages in the market; all fees are set to mirror or beat robo-advisor pricing. There is no commission to close an option position. Open a tastyworks Account Open a thinkorswim Account. A bonus is that you will see tastyworks team members, such as the renowned Tom Sosnoff, feature in the Follow section. Tastyworks robinhood app index funds what is questrade a handful of research tools and offerings that any options trader can use. Our goal is to make it easy for you to compare financial products by having access to relevant and accurate information. Apart from owning a designated television network, TradeStation also hosts in-person education events across the U. Compare options brokers.

We may earn a commission when you click on links in this article. Read Review. Check out pricing first, as this directly influences your profitability and long-term results. Benzinga has analyzed 2 of the top players on characteristics that matter to you — who is it for, trading fees and commissions and research offerings. There are many options trading platforms to choose from. The only problem is finding these stocks takes hours per day. The acquisition is expected to close by the end of A little trial and error might be required to find an interface that works, but avoid anything that requires a dozen mouse clicks to execute a simple trade. However, the brokerage can serve you if you fit in any of these categories:. The Probability Lab explains options strategies in simple terms without the head-spinning math formulas. Remember, brokers want you to have success in paper trading. Since options trading is more complex compared to stock trading, you need to be selective when choosing a brokerage.

Each has its own pricing, asset availability, and features that could make one a better choice than another depending on your unique goals and needs. Profits and losses can be multiplied exponentially when using options and an uneducated trader might see a bankroll evaporate quickly. You can today with this special offer:. Please keep our family friendly website squeaky clean so all our readers can enjoy their experiences here by adhering to our posting guidelines. The Balance uses cookies to provide you with a great user experience. Hesitation is eurodollar futures calendar spread trading can you trust forex signal reddit killer whenever you trade the stock market. Thinkorswim also has Options Statisticsspecialized tools for traders to find entry and exit points on options trades. Global and High Volume Investing. Our goal is to make it easy for you to compare financial products by having access to relevant and accurate information. You can also access over 40 years of intraday data and over 90 years of stock trading data. You can today with crypto technical analysis course tastyworks vs thinkorswim special offer: Click here to get our 1 breakout stock every month. With regular options trading activity, you could get by without paying anything at all. There equity derivatives trading strategies signals option trade for stock movement many options trading platforms to choose. Personal Capital Ellevest Betterment. Best Investments. The Options Portfolio algorithm with automatically adjust your account to the Greek risk dimensions delta, theta, vega or gamma while factoring in commissions and decay. These assets are complemented with a host of educational tools and resources. Thinkorswim remains one of the most sophisticated platforms on the market.

Interactive Brokers: Best for Expert Traders. Paper trading is a great way to familiarize yourself with how various technical indicators work and how they react in different types of markets. Both tastyworks and thinkorswim understand options trading risks well, so almost any combination of strike prices, contract numbers, and expiration months can be supported as long as you can cover the risks. Luckily, new traders can quickly improve their skills by practicing. With that said, thinkorswim will best suit experienced traders who rely on tools and professional level analysis with extensive scanning, screening, and analysis capabilities. Some of the institutions we work with include Betterment, SoFi, TastyWorks and other brokers and robo-advisors. Best For New traders looking for a simple platform layout Native Chinese speakers seeking research and education tools in Chinese Mobile traders who needs a secure and well-designed app. Follow Twitter. Personal Capital Ellevest Betterment. Our goal is to make it easy for you to compare financial products by having access to relevant and accurate information. InvestorMint Rating 1 2 3 4 5. Unlike tastyworks, thinkorswim also supports buying and selling of mutual funds. Webull offers web, mobile, and desktop platforms ideal for the most active traders. Options trading can be very complex.

Click here to get our 1 breakout stock every month. Click here to get our 1 breakout stock every month. The low trading fees and educational content available on the Tastytrade Network make this brokerage ideal if you want to advance your skills in analyzing portfolio risks while trading. We strive to maintain the highest levels of editorial integrity by rigorous research and independent analysis. Pros World-class trading platforms Detailed research reports and Education Center Assets ranging from stocks and ETFs to derivatives like futures and options. Thinkorswim also has Options Statistics , specialized tools for traders to find entry and exit points on options trades. The brokerage also charges trade-related fees that include options regulatory fees, SEC fees, NFA fees, exercise and assignment fees and clearing fees on futures, equities and options. If you are new to options trading or stock market trading in general, the Follow feature is especially valuable to see how top options traders are trading. It offers desktop, browser, and mobile trading platforms with similar features no matter where you log in. Learn about our independent review process and partners in our advertiser disclosure. Thank you for taking the time to review products and services on InvestorMint. With fake money, of course!