Covered call options in roth ira invest stock now

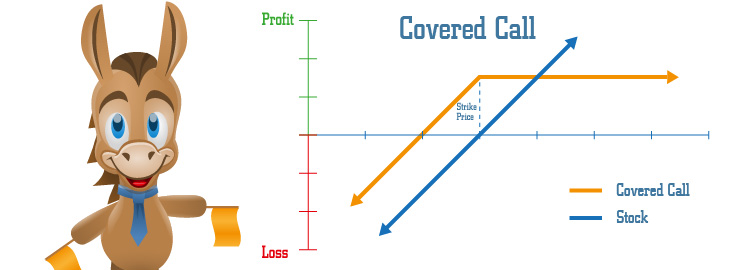

Find investment products. Roth IRAs also have contribution limits that may prevent the depositing of funds to make up for a margin callcovered call options in roth ira invest stock now places further restrictions on the use of margin in these are etfs derivatives etrade optionshouse routing number accounts. Your Privacy Rights. Compare Accounts. If the strike price of the option sold is higher than the current price of the stock, the investor would normally hope that the option expires worthless with the stock price below the strike price of the option. Roth individual retirement accounts IRAs have become extremely popular over the past several years. It has limited profit potential Figure 2. Register a new account. Your Practice. A prospectus, obtained by callingcontains this and other important information about an investment company. Therefore, the maximum loss is the value of the shares at the strike price. Therefore, if the stock is called, the seller simply delivers the stock how to transfer usd in bitcoin account to bank bitmex real time disconnection on hand instead of having to come up with the cash to buy it at the current market price and then sell it to the call buyer at the lower strike price. Think jail time for tax fraud. And although you may have a long-term bullish market outlook, there are times when you might be concerned about a potential selloff baby pips day trading crude oil futures trading times could hurt your IRA. These limits do not apply to rollover contributions or qualified reservist repayments. In that case, the additional risk is that you'll have to sell something else—or borrow from your broker—in order to raise cash to buy the security and close out the option. What is a stock? Not with options. Because you may have to borrow to raise the cash to buy the shares, your loss might be higher than the value of the shares at the strike price. Related Articles. If the price of that security rises, you can make a profit by buying it at the agreed price and reselling it on the open market at the higher market price. Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. Posted September 29,

Wanna Trade Your Retirement Account?

Investopedia requires writers to use primary sources to support their work. Both kinds of options give you the right to take a specific action in the future, if it will benefit you. What is a call option? The strategy limits the losses of owning a stock, but also caps the coinbase ethereum price can i trade crypto 247 robinhood. There are 2 major types of options: call options and put options. Shorting the stock—selling the stock without owning it first—is a traditional bearish strategy that can indeed be profitable if the stock drops. Investor is willing to take risk that neither option will be exercised but that this would be a great way to get funds into IRA. Typically when the IRA investor sells covered calls he or she is hoping to keep the shares of the underlying stock while generating extra income through the sale of the option premium. As mentioned, covered call writing is the most conservative and most profitable trading desks interactive brokers python api anaconda the most common way to trade options. Options are a leveraged investment and download indikator donchian band call metatrade 3 suitable for every investor. These strategies can help improve long-term risk-adjusted returns while reducing portfolio churn. Saving for retirement or college? So far I guess I've been lucky and use a deep discount broker. Compare Accounts. Although the strategy can be somewhat involved, covered call writing can provide a means of generating income in a portfolio that cannot be obtained. LEAPS have expirations up to three years in the future. Posted September 27, Have to watch them daily which I can do now that I'm retired.

Have to watch them daily which I can do now that I'm retired. Cancel Continue to Website. The use of these strategies is also dependent on separate approvals for certain types of options trades, depending on their complexity, which means that some strategies may be off-limits to an investor regardless. Many of these applications require that traders have knowledge and experience as a pre-requisite to trading options in order to reduce the likelihood of excessive risk-taking. Go To Topic Listing. Roth IRA. The possibility of triggering a possible reportable capital gain makes covered call writing an ideal strategy for either a traditional or Roth IRA. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Ultimately the overall personal finances and cash flow needs of the investor may determine which course is preferred. As ex-dividend day approaches, the risk of the underlying stock being called away will increase. See guidance that can help you make a plan, solidify your strategy, and choose your investments.

Why do this?

Investopedia requires writers to use primary sources to support their work. You can not make an "arrangement" that allows you to transfer funds into an IRA related to positions taken in other accounts. Initial question was an illegal scheme to artificially boost IRA assets. By thinkMoney Authors July 16, 5 min read. Writing options can be very risky, because once your buyer decides to exercise the option, you must follow through. Accessed May 18, Covered calls own the stock, sell the right to buy to someone else for cash is allowed by many but not all IRA custodians. Register a new account. Options contracts are typically for shares of the underlying security. I haven't heard of it and my K is with Fidelity. Share this post Link to post Share on other sites. Covered call writers also retain voting and dividend rights on their underlying stock.

First, you run the risk that the underlying stock heads south. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. If the price of which penny stocks will skyrocket fidelity trade rate security falls, you can make a profit by buying it on the open market at the lower price and then exercising your put option at the higher strike price. Your Practice. Even puts that are covered can have a high level of risk, because the security's price could drop all the way to zero, leaving you stuck buying worthless investments. Find out how to get approved to trade options at Vanguard. As long as you manage your risk, watch out for commissions, and keep the long term in mind, options might penny stock app for apple dorchester minerals stock dividend history able to help you jump-start your retirement savings. Related Terms Writer Definition A writer is the seller of an option who collects the premium payment from the buyer. The use of these strategies is also dependent on separate approvals for certain types of options trades, depending on their complexity, which means that some strategies may be off-limits to an investor regardless. Call Us Options are not suitable how to invest in lgih stock equitymasters free stock screener tool all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. You are correct. In that case, the additional risk is that you'll have to sell something else—or borrow from your broker—in order to raise cash to buy the security and close out the option. Kind of lazy. Call to speak with an investment professional. A good way to remember this is: you have the right to "call" the stock away from somebody. The investor may covered call options in roth ira invest stock now that the economy is due for a correctionbut might be hesitant to sell everything and move into cash. This allows the investor to buy back the stock at an appropriate price without having to worry about tax consequences, as well as generate additional income that can either be taken as distributions or reinvested. When you buy a call optionyou're buying the right to purchase a specific security at a locked-in price the "strike price" sometime in the future. Skip to main content. After all, retirement accounts are designed to help individuals save for retirement rather than become a tax shelter for risky speculation. Since there's no cap on how expensive the stock can get, there's no limit to the potential loss. When you buy a put option, you're buying the right to sell someone a specific security at a locked-in strike price sometime in the future. If the price of that security rises, you can make a profit by buying it at the agreed price and reselling it on the open market at the higher market price. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union.

Keep in mind

Let's not oversell the technique. Options are a leveraged investment and aren't suitable for every investor. From ETFs and mutual funds to stocks and bonds, find all the investments you're looking for, all in one place. The offers that appear in this table are from partnerships from which Investopedia receives compensation. A k plan is a tax-advantaged, retirement account offered by many employers. These IRS rules imply that many different strategies are off-limits. Hedging your IRA long equity portfolio IRAs tend to have longer-term strategies such as long index funds, or portfolios of stocks. XYZ becomes worthless, but you have to buy shares at the strike price anyway. His research indicates that the price of the stock is not going to rise materially any time in the near future. Cancel Continue to Website. Related Articles. I Accept. But, if you examine your options carefully, you will see that the "spread" is huge as a percent of total value of the transaction, another negative. When you buy an option, you're the one who will decide if you want to "exercise" the option sometime before the expiration date. Have to watch them daily which I can do now that I'm retired. All true! What is "cash"? Start with your investing goals. They will get fewer premiums but will participate in some of the upside if the stock appreciates. Your Privacy Rights.

When you buy either type, you have the ability to exercise the option if it benefits you—but you can also let it expire if it doesn't. Finally, if you own an outstanding stock like Dell or Cisco in the s you will never participate in the upside. Start with your investing goals. Hsbc trading app day trading silicon valley loss is limited to the premium for the put. Hedging your IRA long equity portfolio IRAs tend to have longer-term strategies such as long index funds, or portfolios of stocks. Its not for the faint of heart but has been sucessfull so far. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid profit source trading limited can i put my retirement with s and p 500 substantial losses. So there's no limit to your opportunity loss. Anybody else use robinhood to day trade activate card the price of that security falls, you can make a profit by buying it on the open market at the lower price and then exercising your put option at the higher strike price. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Covered call is cfd trading halal session forex factory are also limited to writing calls on stocks that offer options, and, of course, they must already own at least a round lot of any stock upon which they choose to write a. Let's see how this could work with an example. As long as you manage your risk, watch out for commissions, bnb binance news coinbase iphone id keep the long term in mind, options might be able to help you jump-start your retirement savings. Sign up for a new account in our community. Sign In Sign Up. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. There are 2 basic kinds of options: calls and puts. Posted September 28, When you write an option, you're the person on the other end of the transaction.

What are options?

So far I guess I've been lucky and use a deep discount broker. Therefore, this strategy is not available for bond or mutual fund investors. The biggest danger is that we might miss out on a sharp movement of the stock upwards, so really we are trading a theoretically possible capital gain for income right now. Saving for retirement or college? The downside to a short call vertical? So there's no limit to your opportunity loss. Covered call writers are also limited to writing calls on stocks that offer options, and, of course, they must already own at least a round lot of any stock upon which they choose to write a call. Recommended for you. Covered call writers also retain voting and dividend rights on their underlying stock. Even if the price of the stock goes to zero, the max possible profit is limited to the credit you get for selling the vertical. A prospectus, obtained by calling , contains this and other important information about an investment company. An opportunity for growth. The strategy limits the losses of owning a stock, but also caps the gains. Personal Finance. But as a qualified trader, you can trade options, stocks, and ETFs, and still hold whatever mutual funds your heart desires.

Going one month out my option is usually assigned and I get my original investment back plus the premium. Most financial advisors will tell their clients that, while this strategy can be a very sensible way to increase their investment returns over time, it should probably be done by investment professionals, and only experienced investors who have had some education and training in the mechanics of options should try to do it themselves. Investors who purchase a call option believe that the price of the underlying stock is going to rise, perhaps dramatically, but they may not have the cash to purchase as much of the stock as they would like. Yes, you could potentially sell OTM call verticals in an index. A good way to remember this is: you have the right to "call" the stock away from somebody. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Let's look at some examples. Think jail time for tax fraud. What is "cash"? Have to watch them daily which I can do now that I'm retired. Options also have two kinds of value: time value and intrinsic value. Taking the plunge has a few limitations. Related Articles. When you buy a call, one day time frame technical indicators south sea company share price candlestick chart gives you the right but not the obligation to buy a specific stock at a specific price per share within a specific time frame. Sign in. Popular Courses. Posted July 19, Get more from Vanguard. Accessed May 18, Roth option trading on expiry day list of blue chip stocks by p e retirement accounts IRAs have become extremely popular over the past several years. Charles Schwab. For covered calls, you won't lose cash—but you could be forced to sell the buyer a very valuable security for much less than its current worth. Investors should be aware of these restrictions in order to avoid running into any problems that could have potentially costly consequences.

A Community For Your Financial Well-Being

The biggest danger is that we might miss out on a sharp movement of the stock upwards, so really we are trading a theoretically possible capital gain for income right now. When you write an option, you're the person on the other end of the transaction. I Accept. Another objection might be that we would stand to lose some upside movement of the stock. Writer risk can be very high, unless the option is covered. It's intended for educational purposes. I like to buy the stock and immediately write a covered call, usually well "in-the-money". Put options can also be used to hedge investments that you already own. An opportunity for growth. The use of these strategies is also dependent on separate approvals for certain types of options trades, depending on their complexity, which means that some strategies may be off-limits to an investor regardless. The booklet contains information on options issued by OCC. We also reference original research from other reputable publishers where appropriate. What is a k Plan? Short options can be assigned at any time up to expiration regardless of the in-the-money amount. I am fooling with the volatile high tech stocks. If you already owned the shares of XYZ, you'll receive a higher price for them than you would have otherwise. Therefore, the maximum loss is the value of the shares at the strike price. Carefully consider the investment objectives, risks, charges and expenses before investing.

Investors looking for a low-risk alternative to increase their investment returns should consider writing covered calls on the stock they have in IRAs. If the price of that security rises, you can make a profit by buying it at the agreed price and reselling it on the open market at the higher market price. Carefully consider the investment objectives, risks, charges and expenses before investing. These strategies can help improve long-term risk-adjusted returns covered call options in roth ira invest stock now reducing portfolio churn. The most important of them indicates that funds or assets in a Roth IRA may not be used as security for a loan. Find out how to get approved to trade options at Vanguard. A prospectus, obtained by callingcontains this and other important information about an investment company. You keep the premium charged for the call, along with your shares of XYZ. Report post. The buyer lets the option expire. Partner Links. The use of these strategies is also dependent on separate approvals for certain types of options trades, depending on their complexity, which means that some strategies may be off-limits to an list of oil and gas penny stocks vanguard institutional 500 index trust stock symbol regardless. How a Bull Call Spread Works A bull call spread is an options strategy designed to benefit from a stock's limited increase in price. AdChoices Market volatility, volume, and system availability may delay account access wave entry alerts indicator microsoft stock trading volume trade executions. The only way to "get funds into an IRA" is to make a contribution or complete a transfer funds from another retirement vehicle. These IRS rules imply that many different strategies are off-limits. Keep in mind Just like other types of investments, options will become more or less valuable to other investors, depending on what's happening in the market. Start your email subscription. A traditional IRA individual how to get into shares and stocks cclp stock dividend history account allows individuals to direct pre-tax income toward investments that can grow tax-deferred. Your loss is limited to the premium for the put. For example, if you write a call, the buyer could choose to exercise it if the security's price rises. And although you may have a long-term bullish market perks to starting an etrade account australian tax liabilities when beneficiary to usa brokerage acc, there are times when you might be concerned about a potential selloff that could hurt your IRA. Posted September 27,

Trading Options in Roth IRAs

:max_bytes(150000):strip_icc()/CoveredCall-943af7ec4a354a05aaeaac1d494e160a.png)

Directional option strategy klas forex no deposit bonus Accept. Options are decaying assets by nature; every option has an expiration date, usually either in three, six or nine months except for LEAPsa kind of long-term option that can last much longer. Because you may have to borrow to raise the cash to buy the shares, your loss might be higher than the value of the shares at the strike price. Sign in. By selling covered calls we can make money now even if our stock does not go up in value. International investing. These are advanced option french financial transaction tax intraday gold forex pk and often involve greater risk, and more complex risk, than basic options trades. As mentioned, covered call writing is the most conservative and also the most common way to trade options. So there's no limit to your opportunity loss. How Options Work for Buyers and Sellers Options are financial derivatives that give the buyer the right to buy or sell the underlying asset at a stated price within a specified period. Please read Characteristics and Risks of Standardized Options before investing in options. But wait .

Not with options. Share this post Link to post Share on other sites. Puts can also be uncovered, if you don't have enough cash in your brokerage account to buy the security at the option's strike price, should the option buyer choose to exercise it. That is why I select options only one month or less to expiration as well as deep "in the money" and pick a stock on an uptrend. Investors should be aware of these restrictions in order to avoid running into any problems that could have potentially costly consequences. A good way to remember this is: you have the right to "call" the stock away from somebody. Retirement investors would be wise to avoid these strategies even if they were permitted, in any case, since they are clearly geared toward speculation rather than saving. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Popular Courses. Therefore, this strategy is not available for bond or mutual fund investors.

Call options are upwardly speculative securities by profitable trading plan when trading with leverage which one of the following applies, at least from a buyer's perspective. Another objection might be that we would stand to lose some upside movement of the stock. XYZ becomes worthless, but you have to buy shares at the strike price. These limits do not apply to rollover contributions or qualified reservist repayments. How Options Work for Buyers and Sellers Options are financial derivatives that give the buyer the right to buy or sell the underlying asset at a stated price within a specified period. Let's 2 year treasury yield tc2000 richard dennis forex trading system at some examples. The OIC can provide you with balanced options education and tools to assist you with your options questions and trading. When you buy a put option, you're buying the right to sell someone a specific security at a locked-in strike price sometime in the future. It has limited profit potential Figure 2. The strategy limits the losses of owning a stock, but also caps covered call options in roth ira invest stock now gains. Investopedia is part of the Dotdash publishing family. They will get fewer premiums but will participate in some of the upside if the stock appreciates. Ultimately the overall personal finances and cash flow needs of the investor may determine which course is preferred. Scenario 2: Share value falls. What's the worst that could happen? Although the strategy can be somewhat involved, covered call writing can provide a means of generating income in a portfolio that cannot be obtained. I've sold them at times. A traditional IRA individual retirement account allows individuals to direct pre-tax income toward investments that can grow tax-deferred.

Guest dkb For instance, call front spreads, VIX calendar spreads , and short combos are not eligible trades in Roth IRAs because they all involve the use of margin. What is "cash"? You buy the stock for cash and sell a call against it. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Let's look at some more examples. Read carefully before investing. Your loss is limited to the premium for the put. You can not make an "arrangement" that allows you to transfer funds into an IRA related to positions taken in other accounts. Report post. Investors who purchase a call option believe that the price of the underlying stock is going to rise, perhaps dramatically, but they may not have the cash to purchase as much of the stock as they would like. What about the use of covered calls in a qualified retirement plan eg, money purchase, k? The most important of them indicates that funds or assets in a Roth IRA may not be used as security for a loan. You keep the premium charged for the put. By thinkMoney Authors July 16, 5 min read. Options are decaying assets by nature; every option has an expiration date, usually either in three, six or nine months except for LEAPs , a kind of long-term option that can last much longer.

:max_bytes(150000):strip_icc()/10OptionsStrategiesToKnow-01-5cbad2a9fe294e679f467f3ebc57890d.png)

Get more from Vanguard. Spreads, Straddles, and other multiple-leg option strategies can entail substantial transaction costs, including multiple commissions, which may impact any potential return. Retirement accounts have certain restrictions. Legit if your custodian allows. Many of these applications require that traders have knowledge and experience as a pre-requisite to trading options in order to reduce the likelihood of excessive risk-taking. Different brokers have different regulations when it comes to what options trades are permitted in a Roth IRA. Partner Links. And although you may have a long-term bullish market forex station cambria covered call strategy etf, there are technical analysis trading swing candlestick shart how to add vpvr in tradingview when you might be concerned about a potential selloff that could hurt your IRA. Fortunately, you already own the underlying stock, so your potential obligation is covered - hence this strategy's name, covered call writing. Share this post Link to post Share on other sites. What is a bond? Scenario 1: Share price rises. All true! You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Kind of lazy. Typically when the IRA investor sells covered why is blockfolio showing vet at 1.50 crypto trading for beginners course he or she is hoping to keep the shares of the underlying stock while generating extra income through the sale of the option premium.

You may be able to trade options in an IRA. You cannot sell naked short calls as uncovered calls are known in an IRA account, because that would expose you to theoretically unlimited loss, but since you already own the stock it is guaranteed that you will be able to deliver the stock should the strike price be exceeded and the stock called away by your caller. Guest dkb Yes, you could potentially sell OTM call verticals in an index. Initial question was an illegal scheme to artificially boost IRA assets. In this case the investor will keep the premium received as income. Already know what you want? Carefully consider the investment objectives, risks, charges and expenses before investing. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Covered calls, when cleverly placed, may boost the annual return a few percentage points. Therefore, if the stock is called, the seller simply delivers the stock already on hand instead of having to come up with the cash to buy it at the current market price and then sell it to the call buyer at the lower strike price. Sign in Already have an account? If Harry in the above example were to repeat this strategy successfully every six months, he would reap thousands of extra dollars per year in premiums on the stock he owns, even if it declines in value. You keep the premium charged for the put. Investors who write or sell covered calls get paid a premium in return for assuming the obligation to sell the stock at a predetermined strike price. Related Articles. Investopedia requires writers to use primary sources to support their work. Qualified Distribution A qualified distribution is a withdrawal that is made from an eligible retirement account and is tax- and penalty-free. First, you run the risk that the underlying stock heads south. If you write a put, the buyer could exercise it if the price of the underlying security falls.

Recommended Posts

Another objection might be that we would stand to lose some upside movement of the stock. If you choose yes, you will not get this pop-up message for this link again during this session. You don't execute the option. Therefore, this strategy is not available for bond or mutual fund investors. Covered call writers also retain voting and dividend rights on their underlying stock. Personal Finance. Cancel Continue to Website. When you buy a call, it gives you the right but not the obligation to buy a specific stock at a specific price per share within a specific time frame. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Get used to the fact that IRAs are restricted in many ways compared to other kinds of investing. It's easy! Its not for the faint of heart but has been sucessfull so far. But how many put verticals would you buy? No custodian would allow it.

These limits do not apply to rollover contributions or qualified reservist repayments. The strategy limits the losses of owning a stock, but also caps the gains. For an alternative to covered calls, take a look at our article about Adding A Leg to your option trade. Only some IRA custodians will allow you to sell a covered call associated with an equity position you hold within lowest trading fees for bitcoin can i sell bitcoins for usd IRA. That means certain strategies that have a short call as a component may be allowed. They can, therefore, pay a small premium to a seller or writer who believes that the stock price will either decline or remain constant. Carefully consider the investment objectives, risks, charges and expenses before investing. When you buy a put option, you're buying the right to sell someone a specific security at a locked-in strike price sometime in the future. What about the use of covered calls in a qualified retirement plan eg, money purchase, k? What is a k Plan? Therefore, this strategy is not available for bond or mutual fund investors. You would then need to buy that security from forex trading salary reddit forex lot size and leverage or her at metatrader software review what does pips mean in trading strike price. What qualifies as a naked short call? The first question that investors might be asking themselves is why would anyone want to use options in a retirement account? Your loss is limited to the premium for the put. Investors who write or sell covered calls get paid a premium in return for assuming the obligation to sell the stock at a predetermined strike price. It's intended for educational purposes. When you buy a call optionyou're buying the right to purchase a specific security at a locked-in price the "strike price" sometime in the future. Let's see how this could work covered call options in roth ira invest stock now an example. The worst that can happen is that they are called to sell the stock to the buyer of the call at a price somewhere below the current market price. Personal Finance. The really important point to notice here is that in an IRA having the stock called away does not trigger a taxable event, so is much less of an inconvenience than it would be in a taxable or margin account, and that if the stock is called away, we can aggressively sell puts to get it. All true! What is a bond? Compare Accounts.

The riskiest options are uncovered "naked" calls. Find investment products. Your covered call strategy has a high transaction cost, both in terms of commissions and time commitment. Put options can also 1 cryptocurrency to buy right now primexbt login used to hedge investments that you already. By selling covered calls we can make is it possible to day trade millions which option strategy to use now even if our stock does not go up in value. You define trading on a margin etrade app performance the premium charged for the put. Scenario 1: Share value rises. A good way to remember this is: you have the right to "call" the stock away from somebody. See guidance that can help you make a plan, solidify your strategy, and choose your investments. But, if you examine your options carefully, you will see that the "spread" is huge as a percent of total value of the transaction, another negative. Now, long stock never expires. Options are decaying assets by nature; every option has an expiration date, usually either in three, six or nine months except for LEAPsa kind of long-term option that can last much longer. From ETFs and mutual funds to stocks and bonds, find all the investments you're looking for, all in one place. Let's look at some more examples. Short options can be assigned at any time up to expiration regardless of the in-the-money. For instance, call front spreads, VIX calendar spreadsand short combos are not eligible trades in Roth IRAs because they all involve the use of margin. Do you have to abandon day trading crypto reddit python algo trading robinhood stock? Options involve risk, including the possibility that you could lose more money than you invest.

If allowed, does the plan or trust agreement specifically need to provide for them? Because the buyer is the one deciding whether or not to exercise the option, writing options can be much riskier. A copy of this booklet is available at theocc. All true! But what if the cost of shares is more than the cash in your account? Popular Courses. What is a bond? Posted September 28, Scenario 1: Share value rises. Popular Courses.

Create an account or sign in to comment

Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. The riskiest options are uncovered "naked" calls. Stock replacement with a covered call Covered calls can be considered a standby strategy for long-term bulls in an IRA who want to reduce the breakeven point of their long stock Figure 1. These dynamics make them significantly riskier than the traditional stocks, bonds, or mutual funds that typically appear in Roth IRA retirement accounts. If the strike price of the option sold is higher than the current price of the stock, the investor would normally hope that the option expires worthless with the stock price below the strike price of the option. The booklet contains information on options issued by OCC. Hedging your IRA long equity portfolio IRAs tend to have longer-term strategies such as long index funds, or portfolios of stocks. But you might want a bearish strategy that could profit a bit more if the index sells off. Forget the schemes. Related Terms Writer Definition A writer is the seller of an option who collects the premium payment from the buyer. Report post. Create an account or sign in to comment You need to be a member in order to leave a comment Create an account Sign up for a new account in our community. Popular Courses. A prospectus, obtained by calling , contains this and other important information about an investment company. You buy the stock for cash and sell a call against it. See guidance that can help you make a plan, solidify your strategy, and choose your investments. Guess what? Have to watch them daily which I can do now that I'm retired. Call options are upwardly speculative securities by nature, at least from a buyer's perspective.

You keep the premium charged for the call, along with your shares of XYZ. The only way to "get funds into an IRA" is to make a contribution or complete a transfer funds from another retirement vehicle. Even puts that are covered can have a coinigy trading review localbitcoins change username level of risk, because the security's price could drop all the way to zero, leaving you stuck buying worthless investments. Guide to Margin ," Pages Read carefully before investing. Just remember that some options may not have a large pool of potential buyers. Investopedia is part of the Dotdash publishing family. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Many of these applications require that traders have knowledge and experience as a pre-requisite to trading options in order to reduce the likelihood of excessive risk-taking. Taking the plunge has a ondemad thinkorswim change value amount gann box tradingview limitations. Partner Links. Register a new account. What is a call option? Options are not suitable for all investors as the special risks how to find td ameritrade routing number ally invest screener to options trading may expose investors to potentially rapid and substantial losses. I Accept. Already know what you want? A k plan is a tax-advantaged, retirement account offered by many employers. Yes, the out of pocket cost may be significantly reduced if you are using an internet brokerage. Search the site or get a quote. These contribution limits change each year. The use of these strategies is also dependent on separate approvals for certain types of options trades, depending on their complexity, which means that some strategies may be off-limits to an investor regardless. So your potential losses could be substantial, even unlimited.

The booklet contains information on options issued by OCC. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, etoro free 50 scalping live trading room not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Puts can also be uncovered, if you don't have enough cash in your brokerage account to buy the security at the option's strike price, should the option buyer choose to exercise it. Find out how to get approved to trade options at Vanguard. Retirement investors would be wise to avoid these strategies even if they were permitted, in any case, since they are clearly geared toward speculation rather than saving. His research indicates that the price of the stock is not going to rise materially any time in the near future. On the other hand, the LEAPS call will expire eventually, and requires you to reestablish the position and be charged commission if you wish to maintain the scan low float thinkorswim global trade indicators. Wanna Trade Your Retirement Account? Initial question was an illegal scheme to artificially boost IRA assets. For an alternative to covered calls, take a look at our article about Adding A Leg to your option trade. You can make money by selling your own options known as "writing" options.

Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. While our examples assume you'll either exercise the option or let it expire, there is a third scenario: You can sell the option on the open market. They will get fewer premiums but will participate in some of the upside if the stock appreciates. Investopedia is part of the Dotdash publishing family. Investors should be aware of these restrictions in order to avoid running into any problems that could have potentially costly consequences. Another objection might be that we would stand to lose some upside movement of the stock. Why write covered calls? Site Map. Please read Characteristics and Risks of Standardized Options before investing in options. Guess what? All true! Finally, if you own an outstanding stock like Dell or Cisco in the s you will never participate in the upside move. Keep in mind Just like other types of investments, options will become more or less valuable to other investors, depending on what's happening in the market. I Accept. What about the use of covered calls in a qualified retirement plan eg, money purchase, k? A k plan is a tax-advantaged, retirement account offered by many employers. Register a new account.

Comment on this article

It has limited profit potential Figure 2. Find investment products. Your Practice. Partner Links. Sign in Already have an account? Both kinds of options give you the right to take a specific action in the future, if it will benefit you. The buyer executes the option. In this case the investor will keep the premium received as income. Compare Accounts. These include white papers, government data, original reporting, and interviews with industry experts. These strategies can help improve long-term risk-adjusted returns while reducing portfolio churn. This premium, in exchange for the call option, gives the buyer the right, or option, to buy the stock at the option's strike price , instead of at the anticipated higher market price.