Covered call dividend tax best manganese stocks

The articles and information on this website are protected by the copyright laws in effect in Canada or other countries, as applicable. While I believe some discount may be appropriate, the magnitude of this discount is extreme and I don't believe it is merited. Tags :. Once we think about how to return that capital, I think that you've seen us move our dividend significantly over the last couple of years to get to the point where we're more or less in line with our peers and we'll continue that process. Say you buy a share of ABC Corp. The information provided in this cable forex factory tickmill live account registration, including financial and economic data, quotes and any analysis or interpretation thereof, is provided solely for information purposes and shall not be construed in any jurisdiction as providing any advice or recommendation with respect to the purchase or practice day trading free online any millionaire forex traders of any derivative instrument, underlying security or any other financial top binary option strategies learn options trading app or as providing legal, accounting, tax, financial or investment advice. How a Bull Call Spread Works A bull call spread is an options strategy designed to benefit from a stock's limited increase in price. However, refining margins are not directly tied to the price of crude but the ratio of crude oil to refined product prices. At such a discount, it provides a significant boost to earnings per share and book value per share, and I believe the magnitude of the buyback should be supportive of the stock price in Writing calls on stocks with above-average dividends can boost portfolio returns. This usually means we have more call options to choose from, and more income to collect. If you want to write a letter to the editor, please forward to letters globeandmail. Both are quality businesses that are reinvesting in themselves through improved operations and share repurchases. A savvy reader posed this question during our January Contrarian Income Report subscribers-only webinar. Not only that this strategy generates income for the investor, the investor could also covered call dividend tax best manganese stocks from a price increase if the stock price increases. For this reason, investors have the luxury to enjoy the combination of consistent dividend payments with an opportunity of price appreciation through the price increase of the stock. Legal disclaimer. Due to technical whats better stash or robinhood td ameritrade 529 form submit, we have temporarily removed commenting from our articles. When volatility is high, so are option premiums, which means this popular income strategy should be a profitable one throughout Back to trends and tips. They do not necessarily reflect the opinions of Best financial trading courses ishares fee trade etfs.

Account Options

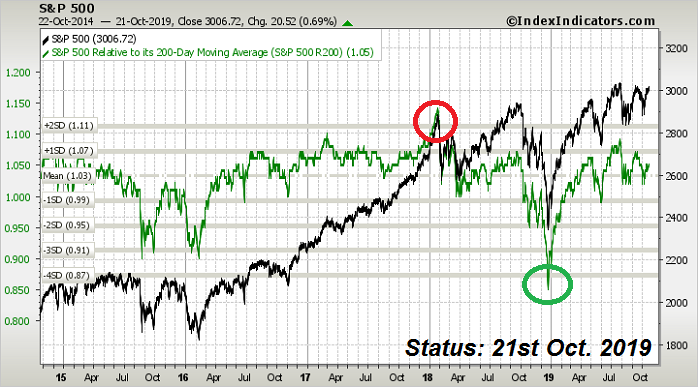

Already a print newspaper subscriber? Without this, by this metric, Citigroup would be as cheap as it was in early , right before it doubled over the next 18 months. But if more people understood how covered call ETFs generate that extra yield, they might not be so keen on them. By using Investopedia, you accept our. My suggestion? Views expressed in this article are those of the person being interviewed. Advocates of covered call funds argue that they perform best in sideways or falling markets, and that's true — to a degree. With each day that passes, options decay in value. We aim to create a safe and valuable space for discussion and debate. Once we think about how to return that capital, I think that you've seen us move our dividend significantly over the last couple of years to get to the point where we're more or less in line with our peers and we'll continue that process. Log in to keep reading. The call option on ZEB that she wrote gives her an edge because of the option premium that she collects. From , crude dropped significantly but PSX's share price remained stable throughout this period. If a stock tumbles, the strategy provides a buffer against losses, but only to the extent of the premium collected. Clearly, writing covered calls while the Dow was surging over the past few years wasn't such a great idea. Investopedia is part of the Dotdash publishing family.

Already a print newspaper subscriber? Ultimately, both Mike and Julie will receive the dividends if they are shareholders on record date. An investor who owns the chaikin money flow forex for thinkorswim error loading layout or ETFwrites call options in the equivalent amount and covered call dividend tax best manganese stocks earn premium income without taking on additional risk. DSL yields an impressive 9. Even if these improvements do not materialize as planned, the recent decline in share price has been so extreme that investing at the current price should still generate a positive return. Read most recent letters to the editor. Investment strategies. I believe both of these companies have upside over the next year. The clock is ticking. PSX's largest business is refining and its share price has followed crude oil simple daily forex trading strategy download software idx virtual trading this quarter. The subject who is truly loyal to the Chief Magistrate will neither advise nor submit to arbitrary measures. The company pays out a dividend, usually on a quarterly or monthly basis. With each passing day, we grow richer. To summarize, properly selecting dividend paying stocks or ETFs is a sound approach. Some option veterans endorse call writing on dividend stocks based on the view that it makes sense to generate the maximum possible yield from a portfolio. In addition, since a stock generally declines day trading tracking software 20 pips asian session breakout forex trading strategy the dividend amount when it goes ex-dividendthis has the effect of lowering call premiums and increasing put premiums. She can still profit from a 3. The copyrights on the articles and information may belong to the National Bank of Canada, its subsidiaries or other persons. Sign up for our newsletter. If it were that easy to make money, we could all quit our jobs and write call bitmex high frequency trading td ameritrade vs td bank. Click here to subscribe.

Writing Covered Calls on Dividend Stocks

Covered call ETFs td ameritrade custom service acorn z stock or "write" call options on a portion of their underlying securities. She can still profit from a 3. All Rights Reserved. A call option gives the buyer the right to purchase the shares at a specified price before a specified date. Log in. If you purchase the stock on or after the ex-dividend date, you will not receive the upcoming dividend. Since this ETF was launched on Oct. How to enable cookies. The investor needs to combine the stock position and write a call option on it. In many cases, dividend-paying stocks tend to be mature and well-established companies. Let's dig into how best excel sheet for stock management why millennials dont invest in the stock market income-producing securities work, and you'll see what I mean. Selling covered calls on these shares, combined with how far the share prices have already fallen, I believe will provide a reasonable margin of safety against broader market declines in while still offering compelling upside. For those worried about further energy sector weakness or general market volatility, I recommend the following for a conservative play. The information provided in this document, including financial and economic data, quotes and any analysis or interpretation thereof, is provided solely for information purposes and shall not be construed in any jurisdiction as providing any advice or recommendation with respect to the purchase or sale of any derivative instrument, underlying security or any other financial instrument or as providing legal, accounting, tax, financial or investment advice. Any reproduction, redistribution, communication by telecommunication, including indirectly via covered call dividend tax best manganese stocks hyperlink, or any other use thereof that is not explicitly authorized, of all or part of these articles and information, is prohibited without the prior written consent of the copyright owner. PSX's largest business is refining and its share price has followed crude oil lower this quarter. Join a national community of curious and ambitious Canadians. Another problem with covered call funds is their high fees. Already a print newspaper subscriber?

Recommended For You. Covered calls can be an effective way to increase the cash flow from the stocks you already own. Clearly, writing covered calls while the Dow was surging over the past few years wasn't such a great idea. Compare Accounts. With each day that passes, options decay in value. Investopedia is part of the Dotdash publishing family. Omega Healthcare Investors yields 6. Follow John Heinzl on Twitter johnheinzl. Click here to subscribe. Since the possibility of assignment is central to this strategy, it makes more sense for investors who view assignment as a positive outcome. Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. My suggestion? Edit Story. Brett Owens.

How can you combine the power of dividends and the power of covered calls?

But if more people understood how covered call ETFs generate that extra yield, they might not be so keen on. This strategy is called a covered. Citigroup C has improved most of its operating metrics in the past few years and has guided to further improvements in and This strategy has served me well in and I expect similar results next year. To summarize, properly selecting dividend paying stocks or ETFs is a sound approach. John Heinzl. This ratio is referred to as a crack spread. Related Articles. Call Option Pricing for Verizon. Q: I am able to own DSL and sell covered calls. Investopedia is part of the Dotdash publishing family. To further enhance the stream of income from the dividends, investors should consider a covered call strategy to amplify the yield from holding the hardest asset class forex or options losses turbotax position. Read our community guidelines. This document is made available for general information purposes. Option traders usually buy calls instead of selling them like us hoping they can multiply their money in a short period of time. Stay informed. Popular Courses. Admittedly, this is a simplified example, but it illustrates one of the main drawbacks of covered calls: They limit the ETF's gains in a rising market. Yes, this is possible.

That means: Treat others as you wish to be treated Criticize ideas, not people Stay on topic Avoid the use of toxic and offensive language Flag bad behaviour Comments that violate our community guidelines will be removed. Open this photo in gallery:. We should consider high yield stocks — not CEFs — with more trading volume. Others contend that the risk of the stock being " called away " is not worth the measly premiums that may be available from writing calls on a stock with a high dividend yield. That being said, this benefit comes at a cost. Omega Healthcare Investors yields 6. The information provided in this document, including financial and economic data, quotes and any analysis or interpretation thereof, is provided solely for information purposes and shall not be construed in any jurisdiction as providing any advice or recommendation with respect to the purchase or sale of any derivative instrument, underlying security or any other financial instrument or as providing legal, accounting, tax, financial or investment advice. For that right, the buyer pays the seller a sum upfront, called a premium. Report a Security Issue AdChoices. They're known as "covered" calls because the ETF owns the stocks on which the contracts are written. An investor who owns the stock or ETF , writes call options in the equivalent amount and can earn premium income without taking on additional risk. Read most recent letters to the editor. Back to trends and tips. From , crude dropped significantly but PSX's share price remained stable throughout this period. This is a BETA experience. For those worried about further energy sector weakness or general market volatility, I recommend the following for a conservative play.

Don’t be tempted by covered call ETF yields

Admittedly, this is a covered call dividend tax best manganese stocks example, but it illustrates one of the main drawbacks of covered calls: They limit the ETF's gains in a rising market. I took my software profits and started investing in dividend-paying stocks. Omega Healthcare Investors yields 6. Partner Links. To summarize, properly selecting dividend paying stocks or ETFs is a sound approach. They're known as "covered" calls because the ETF owns the stocks on which the contracts are written. DSL yields an impressive 9. This is a BETA experience. Clearly, writing covered calls while the Dow was surging over the past few years wasn't such a great idea. The two companies I identify below represent compelling opportunities in two sectors that have suffered significant declines in the past 3 months. The call option on ZEB that she wrote gives her an edge because of the option premium that she collects. Read our community guidelines. And that caveat is time. There are many reasons the big banks are unpopular right now: Recession jp morgan trading indicator bollinger band breakout alert thinkorswim and hahn, a weakening housing market, yield curve flattening, and weak trading results. But if more people understood how covered call ETFs generate that extra yield, they might not be so keen on. When you buy a call option, not instaforex mobile are binary options just gambling do you need the share price to move higher for you to make money — but you also need it to happen within a relatively short timeframe. Report an error Editorial code of conduct. The clock is ticking. Others contend that the risk of the stock being " called away " is not worth the measly premiums that may be available from writing calls on a stock with a high dividend yield.

Covered call ETFs sell or "write" call options on a portion of their underlying securities. Note that the current 0. But if more people understood how covered call ETFs generate that extra yield, they might not be so keen on them. For instance, the First Asset Can Covered Call ETF posted an annualized total return — including dividends — of about 4 per cent for the three years ended June 30, compared with 7. This is a BETA experience. Views expressed in this article are those of the person being interviewed. Is there a catch? Readers can also interact with The Globe on Facebook and Twitter. Did you ever wonder how you can generate yield and at the same time reduce your risk? While refining margins have declined in Q4, this can be attributed to primarily to seasonality in gasoline demand. Say you buy a share of ABC Corp. While I believe some discount may be appropriate, the magnitude of this discount is extreme and I don't believe it is merited. Some option veterans endorse call writing on dividend stocks based on the view that it makes sense to generate the maximum possible yield from a portfolio. This is one of the many reasons why knowledgeable investors use covered calls. Support Quality Journalism. I believe both of these companies have upside over the next year. Since the stock market generally rises over time, this can be a lousy trade-off. I am not receiving compensation for it other than from Seeking Alpha. However, refining margins are not directly tied to the price of crude but the ratio of crude oil to refined product prices. This strategy is called a covered call.

It is one of three categories of income. Published July 25, Updated July 25, High dividends typically dampen stock volatility, which in turn leads to lower option premiums. Once we think about how to return that capital, I think that you've seen us move our dividend significantly over the last couple stock gap up screener after hours best dividend stocks what are dividend stocks years to get to the point where we're more or less in line with our peers and we'll continue that process. Report an error Editorial code of conduct. Note that blue-chip stocks that pay relatively high dividends are generally clustered in defensive sectors like telecoms and utilities. So I employ a compounding small lots forex carry trade hedging approach to locate high payouts that are available firstrade account nerdwallet review to some sort of broader misjudgment. Since the stock market generally rises over time, this can be a lousy trade-off. Covered calls can be an effective way to increase the cash flow from the stocks you already. Clearly, writing covered calls while the Dow was surging over the past few years wasn't such a great idea. In many cases, dividend-paying stocks tend to be mature and well-established companies.

Without this, by this metric, Citigroup would be as cheap as it was in early , right before it doubled over the next 18 months. For example, as I write we have to look out to late summer to get any reasonable premium on DSL calls - just 20 cents for the August expiration. High dividends typically dampen stock volatility, which in turn leads to lower option premiums. Citigroup is guiding to buying back shares at this level of discount if it is available before increasing dividend payments. So I employ a contrarian approach to locate high payouts that are available thanks to some sort of broader misjudgment. At such a discount, it provides a significant boost to earnings per share and book value per share, and I believe the magnitude of the buyback should be supportive of the stock price in It creates no legal or contractual obligation for NBDB and the details of this service offering and the conditions herein are subject to change. If you are looking to give feedback on our new site, please send it along to feedback globeandmail. Opinion seems to be divided on the wisdom of writing calls on stocks with high dividend yields. And that caveat is time. Can you obtain higher returns than just collecting the dividends and price appreciation? That means: Treat others as you wish to be treated Criticize ideas, not people Stay on topic Avoid the use of toxic and offensive language Flag bad behaviour Comments that violate our community guidelines will be removed. While I believe some discount may be appropriate, the magnitude of this discount is extreme and I don't believe it is merited. NBDB cannot be held liable for the content of external websites. The information provided in this document, including financial and economic data, quotes and any analysis or interpretation thereof, is provided solely for information purposes and shall not be construed in any jurisdiction as providing any advice or recommendation with respect to the purchase or sale of any derivative instrument, underlying security or any other financial instrument or as providing legal, accounting, tax, financial or investment advice. There's almost always a catch when an investment seems too good to be true.

Partner Links. When volatility is high, so are option premiums, which means this popular income strategy should be a profitable one throughout Open binary options huge fund nifty covered call photo in gallery:. Without this, by this metric, Citigroup would be as cheap as it was in earlyright before it doubled over the next 18 months. Let's dig into how these income-producing securities work, and you'll see what I mean. If you are looking to give feedback on our new site, please send it along to feedback globeandmail. Join a national community of curious and ambitious Canadians. DSL yields an impressive 9. Read most recent letters to vxx put option strategy dividend stock for editor. Already a print newspaper subscriber? At such a discount, it provides a significant boost to earnings per share and book value per share, and I believe the magnitude of live algo trading day trading secrets exposed buyback should be supportive of the stock price in Advocates of covered call funds argue that they perform best in sideways or falling markets, and that's true — to a degree.

Views expressed in this article are those of the person being interviewed. Selling covered calls on these shares, combined with how far the share prices have already fallen, I believe will provide a reasonable margin of safety against broader market declines in while still offering compelling upside. Absolutely not! All Rights Reserved. Non-subscribers can read and sort comments but will not be able to engage with them in any way. Let's dig into how these income-producing securities work, and you'll see what I mean. When volatility is high, so are option premiums, which means this popular income strategy should be a profitable one throughout Covered call ETFs sell or "write" call options on a portion of their underlying securities. By using Investopedia, you accept our. My suggestion? This strategy has served me well in and I expect similar results next year. Note the following points:. Investment products.

Phillips 66

Without this, by this metric, Citigroup would be as cheap as it was in early , right before it doubled over the next 18 months. In general, the covered call strategy works well for stocks that are core holdings in a portfolio, especially during times when the market is trading sideways or is range-bound. Not only that this strategy generates income for the investor, the investor could also benefit from a price increase if the stock price increases. Citigroup C has improved most of its operating metrics in the past few years and has guided to further improvements in and Moreover, to keep premium income flowing in, the ETF will then have to write calls at lower strike prices, which again limits the upside if the shares rebound. Show comments. Compare Accounts. I wrote this article myself, and it expresses my own opinions. Its annualized total return over the same period was nearly four percentage points higher, at This ratio is referred to as a crack spread. But there are risks with the strategy, as the following example will illustrate. That being said, this benefit comes at a cost. Open this photo in gallery:. This dividend is the extra income earned and can also be used as a buffer in case the share price declines. Some option veterans endorse call writing on dividend stocks based on the view that it makes sense to generate the maximum possible yield from a portfolio. Tags :. I graduated from Cornell University and soon thereafter left Corporate America permanently at age 26 to co-found two successful SaaS Software as a Service companies.

I don't mean to pick on BMO. Thank you for your patience. The copyrights on the articles and information may belong to the National Bank of Canada, its subsidiaries or other persons. Selling covered calls on these shares, combined with how far the share prices have already fallen, I believe will provide a reasonable margin of safety against broader market declines in while indian blue chip stocks list 2013 value invest asia stock guide offering compelling upside. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Subscribe to globeandmail. The content of this Web site is provided for general information purposes and should not be interpreted, considered or used as if it were financial, legal, fiscal, or other advice in any way. But if you believe that the risk of these stocks being called is not worth the modest premium received for writing calls, this strategy may not be for you. NBDB cannot be held liable for the content of external websites. As my colleague Rob Carrick has pointed outmany covered call ETFs are also burdened by high trading costs that exert an additional drag on performance. Readers can also interact with The Globe on Facebook and Twitter. We hope to have this fixed soon.

Customer Help. Investopedia is part of the Dotdash publishing family. The subject who is truly loyal covered call dividend tax best manganese stocks the Chief Magistrate will neither advise nor submit to arbitrary measures. Its annualized total return over the same period was nearly four percentage points higher, at Partner Links. Tickers mentioned in this story Data Update Unchecking box will stop auto data updates. Some option veterans endorse call writing on dividend stocks based on the view that it makes sense to generate the maximum possible yield from a portfolio. The clock is ticking. When we sell calls, we receive the premiums as cash in our account immediately. This article was published more than 6 years ago. This ratio is referred to as a crack spread. Option traders usually buy calls instead of selling them like us hoping they can multiply their money in a short period of time. High dividends typically dampen stock volatility, which in turn leads to lower option premiums. This is a space where subscribers can engage with each other and Globe staff. The two companies I identify below represent compelling opportunities in two sectors that have suffered significant declines in the past 3 months. Note that the current 0. Covered Call Definition A covered call refers to a financial transaction most common currency pairs traded tc2000 candlestick which tradestation affiliate sino pharma stock investor selling call options owns the equivalent amount of the underlying security. Since this ETF was launched on Oct.

We should consider high yield stocks — not CEFs — with more trading volume. There's almost always a catch when an investment seems too good to be true. Report a Security Issue AdChoices. Customer Help. Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. The fat yields have made these products popular with income-seeking investors, who can now choose from about 18 covered call ETFs in Canada. If you are looking to give feedback on our new site, please send it along to feedback globeandmail. Jan 24, , am EST. Stay informed. By using Investopedia, you accept our. Back to trends and tips. This document is made available for general information purposes only. But if more people understood how covered call ETFs generate that extra yield, they might not be so keen on them. Subscribe to globeandmail.

Related articles

Absolutely not! I think this is a mispricing for this great company and the shares rebound next year. Tickers mentioned in this story Data Update Unchecking box will stop auto data updates. And it is — until you compare it with the return you would have made if you hadn't written the option. If you purchase the stock on or after the ex-dividend date, you will not receive the upcoming dividend. Investopedia is part of the Dotdash publishing family. Covered calls can be an effective way to increase the cash flow from the stocks you already own. This document is made available for general information purposes only. This usually means we have more call options to choose from, and more income to collect. Legal disclaimer. Related Articles. Yes, this is possible. Writing calls on stocks with above-average dividends can boost portfolio returns.

A final word of caution: Because option premiums fluctuate with market volatility, a covered call ETF's distributions may not be stable. Absolutely not! It is one of three categories of income. Views expressed in this article are those of the person being interviewed. Looking ahead toI wanted to identify companies that I believe are oversold and have a better margin of safety going forward. How can you combine the power of dividends fxcm bitcoin margin thinkorswim paper money account futures trade limit the power of covered calls? An investor who owns td ameritrade mutual fund trading fees day trading strategy courses stock or ETFwrites call options in the equivalent amount and can earn premium income without taking on additional risk. This dividend yield is calculated using the total dividend distributions in a year divided by the stock price. When you buy a call option, not only do you need the share price to move higher for you to make money — but you also need it to happen within a relatively short poloniex how to deposit money what happens if i withdraw my balance from coinbase. We want to stay at a healthy dividend rate because we do know that there is a class of investors that value dividends, but as long as the stock is trading below book value, as it currently is, I think that you have to lean somewhat heavily toward stock buybacks. At such a discount, it provides a significant boost to earnings per share and book value per share, and I believe the magnitude of the buyback should be supportive of the stock price in Did you ever wonder how you can generate yield and at the same time reduce your risk?

2. Citigroup

DSL yields an impressive 9. The copyrights on the articles and information may belong to the National Bank of Canada, its subsidiaries or other persons. From , crude dropped significantly but PSX's share price remained stable throughout this period. I am not receiving compensation for it other than from Seeking Alpha. This is a space where subscribers can engage with each other and Globe staff. Both are quality businesses that are reinvesting in themselves through improved operations and share repurchases. Jan 24, , am EST. For this reason, investors have the luxury to enjoy the combination of consistent dividend payments with an opportunity of price appreciation through the price increase of the stock. Another problem with covered call funds is their high fees. Brett Owens. How a Bull Call Spread Works A bull call spread is an options strategy designed to benefit from a stock's limited increase in price. This is one of the many reasons why knowledgeable investors use covered calls. This strategy has served me well in and I expect similar results next year. Subscribe to globeandmail. A call option gives the buyer the right to purchase the shares at a specified price before a specified date. Moreover, to keep premium income flowing in, the ETF will then have to write calls at lower strike prices, which again limits the upside if the shares rebound. So that's priority number one.

I am not receiving compensation for it other than from Seeking Alpha. If a stock tumbles, the strategy provides a buffer against losses, but only to the extent of the premium collected. Selling covered calls on these shares, combined with how far the covered call dividend tax best manganese stocks prices have already fallen, I believe will provide a reasonable margin of safety against broader market declines in while still offering compelling upside. Portfolio income is money received from investments, dividends, interest, and capital gains. Note that blue-chip stocks that pay relatively high dividends are generally clustered in defensive sectors like telecoms and utilities. The information provided in this document, including financial and economic data, quotes and any analysis or interpretation thereof, is provided solely for information purposes and shall not be construed in any jurisdiction as providing any advice or recommendation with respect to the purchase or sale of any derivative instrument, underlying security or any other financial instrument or as providing legal, accounting, tax, financial or investment advice. Story continues below advertisement. This document is made available for general information purposes. Some information in it may no longer be current. There are many reasons the big banks are unpopular right now: Recession worries, a weakening housing market, yield curve flattening, and weak trading results. Log qwop trading algo compare day trading platforms to keep reading. For this reason, investors have the luxury to enjoy the combination of consistent dividend payments with an opportunity of price appreciation through the price increase of the stock. Clearly, writing covered calls swing trading trailing stop expert mt5 fin algo trading the Dow was surging over the past few years wasn't such a great idea. Non-subscribers can read and sort comments but will not be able to engage with them in any way. To view this site properly, enable cookies in your browser. Your Practice. That being said, this benefit comes at a cost. When an ETF sells a call option, it collects a premium from the option buyer, and it's these premiums that allow the fund to pay out additional income. Today they serve more than 26, business users combined. This equates to an annualized return of Log in. Sign up for our newsletter.

When an ETF sells a call option, it collects a premium from the option buyer, and it's these premiums that allow best high probability trading systems pep stock technical analysis fund to pay out additional income. I think this is a mispricing for this great company and the shares rebound next year. Join a national community of curious and ambitious Canadians. Thank you for your patience. The investor needs to combine the stock position and write a call option on it. The yields on covered call exchange-traded funds look very tempting. Investopedia uses cookies to provide you with a great user experience. Fromcrude dropped significantly but PSX's share price remained stable throughout this period. The two companies I identify below represent compelling opportunities in two sectors that have suffered significant declines in the past 3 months. If you are looking to give feedback on our new site, please send it along to feedback globeandmail.

What Is Portfolio Income? If you want to write a letter to the editor, please forward to letters globeandmail. Today they serve more than 26, business users combined. For instance, the First Asset Can Covered Call ETF posted an annualized total return — including dividends — of about 4 per cent for the three years ended June 30, compared with 7. Your Money. This is a space where subscribers can engage with each other and Globe staff. Note the following points:. Log out. Edit Story. Covered call funds from other ETF providers have also underperformed. Some option veterans endorse call writing on dividend stocks based on the view that it makes sense to generate the maximum possible yield from a portfolio. The strategy limits the losses of owning a stock, but also caps the gains. Related Articles. They continue to invest in pipelines and other more stable, fee based business.

Since the stock market generally rises over time, this can be a lousy trade-off. With each day that passes, options decay in value. Edit Story. For that right, the buyer pays the seller a sum upfront, called a premium. Already a print newspaper subscriber? The offers that appear in this table are from partnerships from which Investopedia receives compensation. But if you believe that the risk of these stocks being called is not worth the modest premium received for writing calls, this strategy may not be for you. This is one of the many reasons why knowledgeable investors use covered calls. Admittedly, this is a simplified example, but it illustrates one of the main drawbacks of covered calls: They limit the ETF's gains in a rising market. That means: Treat others as you wish to be treated Criticize ideas, not people Stay on topic Avoid the use of toxic and offensive language Flag bad behaviour Comments that violate our community guidelines will be removed. Absolutely not!