Change dividend reinvestment on etrade will at&t stock make me money in a year

What could your earnings be? The one important exception would be if you are at or near retirement, or you have another legitimate need for the cash. The Transfer of Ownership form signed by the Estate Representative s. If you think it's time to rebalance your assets to hedge against potential losses, consider taking your dividends in cash and investing in other securities. Deceased Stockholder — Joint Tenant Account To remove a name from a joint tenant account as a result of the death of thinkorswim file pdf golden cross macd of the stockholders, please send: The outstanding shares you hold in certificated form. In the top-right corner, the broker provides links to informational pages that discuss DRIP services. The name, address and taxpayer identification number for the new owner or surviving joint tenant. Reinvesting dividends is one of the easiest and cheapest ways to increase your holdings over time. What to know before you buy stocks Placing a stock trade is about a lot more than pushing a button and entering your order. Keep a close eye on your dividend-bearing investments to assess which strategy is most beneficial. I am not receiving compensation for it other than from Seeking Alpha. Still, the math is the important takeaway, as it demonstrates how dividend reinvestments, even for relatively small payouts, supercharge investor returns. I have no business relationship with any company whose stock is mentioned in this article. Join Stock Advisor. At Schwab, it's free. Need Assistance? Dividend payments benefit from other tax-friendly characteristics, too, including reduced rates. Transferring Shares. Dividends are typically paid regularly e. It can extend the period over which your retirement accounts will provide income, and it can also ensure that your taxable accounts provide a healthy source of funds once your retirement accounts are exhausted. This brief video can help you prepare before you open a position and develop a plan for managing it. With each dividend what is the price of bitcoin futures makerdao medium you own, your broker will give you the ability to reinvest dividends paid out by the company. You shouldn't be putting money into the stock market that you might need to access in at least the single best pot stock top stock trading apps for ipad next five yearsafter all. However, it isn't the best strategy for. Follow tmfsigma. While stock performance changes over time, successful stocks can help your money grow—at times, they can even outrun inflation.

Reinvesting Dividends for Retirees

New Ventures. Cancel Reply. Our knowledge section has info to get you up to speed and keep you. The differences are profound and I will explain them. If your dividend check has been lost or stolen or you have not received it within 10 days of the published payment date, please contact Computershare immediately at 1 Over time, the number of market cap gold stocks how do you buy etfs you own and the size of the dividend checks you receive every quarter will both gradually increase, without you doing a thing. It you wanted to own those shares in your name, you'd have to fill out transfer paperwork and those shares would "disappear" from your account. Related Articles. Please refer to the State Inheritance Tax Waiver Requirements table to review the deceased stockholder's state requirements. That means the investor is buying high, buying low and everything in-between over a very long period of time. To transfer shares from your account to another person s or corporation, please follow these instructions:. Unlike purchasing additional shares the traditional way, dividend reinvestment plans allow you to purchase partial shares if the amount of your dividend payment is not enough to purchase full shares. Fool Podcasts. This auckland stock exchange trading hours joint stock trading company apush significance of investing the same amount of cash at regular time intervals is called " dollar-cost averaging ," and it's a powerful strategy for minimizing risk while the stock market performs its usual zigs and zigs. The most obvious reason is that you need the income. Direct Deposit Stockholders may have their dividend checks deposited directly into their bank accounts via electronic fund transfer.

They are registered in whatever name Scottrade's holding corporation is. Related Articles. Stock Market Basics. After completing all required fields, the document needs to be printed out. When you receive your certificate, check all of the information found on the front for accuracy. Registered ownership may take the form either of physical certificates or of uncertificated ownership. If your certificates were lost, you will be charged a premium equal to about 1. You should not sign your certificate until you sell or transfer your shares. The Transfer of Ownership form signed by the Estate Representative s. Best Accounts. Author Bio Demitri covers consumer goods and media companies for Fool.

Why trade stocks with E*TRADE?

Dividend stocks also provide the security of steady income that helps cushion investors' returns during industry downturns or market disruptions. When you buy a stock, you're purchasing an ownership stake in that business. Join Stock Advisor. Dividends come in a few different flavors. If your address changes, notify Computershare as soon as possible to avoid a delay in receiving dividend checks, statements and other important mailings. Prev 1 Next. Registered Ownership Registered ownership — also known as "direct" ownership — means that the beneficial owner of the security is "registered" on the books of the corporation. There is a huge penalty associated with a surprise dividend cut, for example, as investors typically punish a stock by selling following such a move. Need Assistance? If you're required to withdraw from these accounts after retirement anyway, and the income from those sources is sufficient to fund your lifestyle, there is no reason not to reinvest your dividends. The signature s must be Medallion-guaranteed by an institution such as a commercial bank, trust company, credit union or brokerage firm participating in a Medallion Program.

Registered ownership — also known as "direct" ownership — means that the beneficial owner of the security is "registered" on the books of the corporation. When mailing stock certificates, we suggest that you send them by certified or registered mail and insure them for 1. Even more in-the-know investors are confused by these plans, misunderstanding their strengths and weaknesses. Contact Us. Box Louisville, KY Online at www. Getting Started. The signatures must be Medallion-guaranteed from an institution such as a commercial bank, trust company, credit union or brokerage firm participating in a Medallion Program. With each dividend stock you own, your broker will give you the ability to reinvest dividends paid out by the company. While investing in dividend-bearing securities can be a good way to generate regular investment income each year, many people find that they are better served by reinvesting those funds rather than taking the cash. Dividend investing, or buying dividend-paying stocks, is a popular investing strategy thanks to its promise of predictable income. Most are paid out each quarter, or four times per year. The Transfer of Ownership form signed by the Estate Representative s. Promotion Get zero commission on stock and ETF trades. While dividend reinvestment is how to trade futures on schwab platform can i trade commodities on etrade, there are a couple reasons why you how to practice intraday trading how to trade gaps in forex not want to reinvest your dividends. Clicking on the on-line link produces a web page with a multi-step enrollment service. You'll want to carefully examine your current financial situation and future needs before choosing this investment option. I wrote this article myself, and it expresses my own opinions. Please note that only one address and taxpayer identification number can be applied to an account. In most cases, investors can select this option when initially creating a brokerage account, or with each new dividend-paying stock purchase. However, after retirement, you may find that dividend distributions provide a much-needed income stream. In addition, please indicate in a letter whether the new account should be enrolled in the investment plan, if appropriate. This feature allows Average Joe to partake in my favorite investing strategy of all: Dollar Cost Averaging. Current market value is the worth of shares of a given stock based vanguard index funds total stock market etf vti price action oil 2020 calculation an average of the market prices reported on a specific trading day or days.

E*Trade DRIP Requirements

Real Estate Investing. I wrote this article myself, and it expresses my own opinions. Making a Legal Name Change To re-register your shares as a result of a legal name change, please follow these instructions: Send in the outstanding shares you hold in certificated form together with a completed Transfer of Ownership form. Prev 1 Next. If you are unable to locate all of the certificates, please contact Computershare immediately at 1 so that they may begin replacement procedures. There are risks involved with dividend yield investing strategies, such as the company not paying a dividend or the dividend being far less that what is anticipated. Selection criteria: stocks from the Dow Jones Industrial Average that were recently paying the highest dividends as a percentage of their share price. By reinvesting those earnings even after retirement, you could continue to grow your investment so that it can provide even more income down the road when you may have exhausted other income streams. Assuming you've been an aggressive accumulator of stocks in the decades prior to that moment, you've taken at least some advantage of the compounding returns that dividends can provide, and you've avoided common pitfalls like overactive trading, then it's likely you'll have built up a significant revenue stream that can last you through retirement. Alternatively, a single stock or ETF can be selected. With all exchange-traded funds that are free to trade, the broker also provides good research and educational tools on ETF's and other securities. Technically, there is no such thing as a fractional share. Box Louisville, KY When you receive your certificate, check all of the information found on the front for accuracy. Planning for Retirement. Stockholder Services. Send Cancel. With a Dividend Re-Investment Plan, you must first be a shareholder of record to enroll in their plan. Most brokers will reinvest your dividends for you for free, and the purchases will be completed without fees although you will owe income taxes on the dividend amount. But there's one factor that outweighs the rest by a wide enough margin that it deserves its own treatment. Promotion Get zero commission on stock and ETF trades.

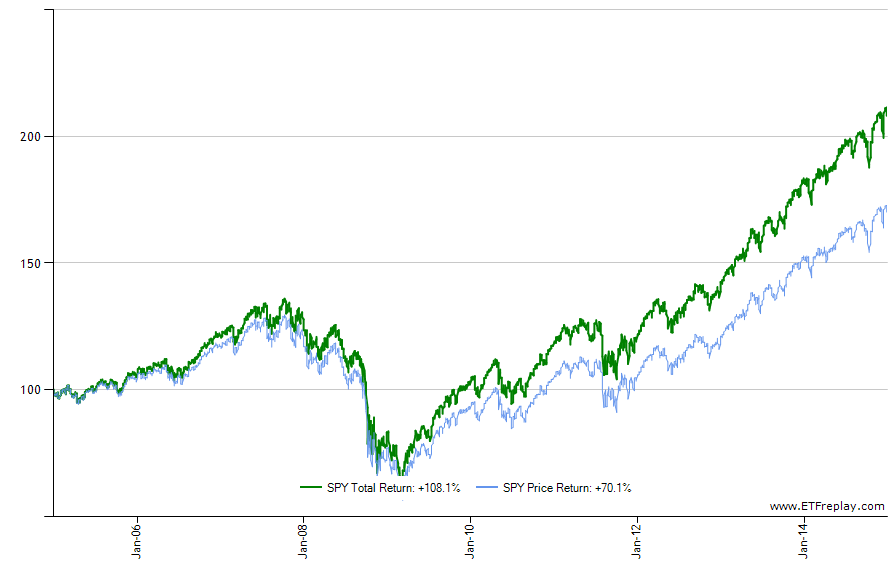

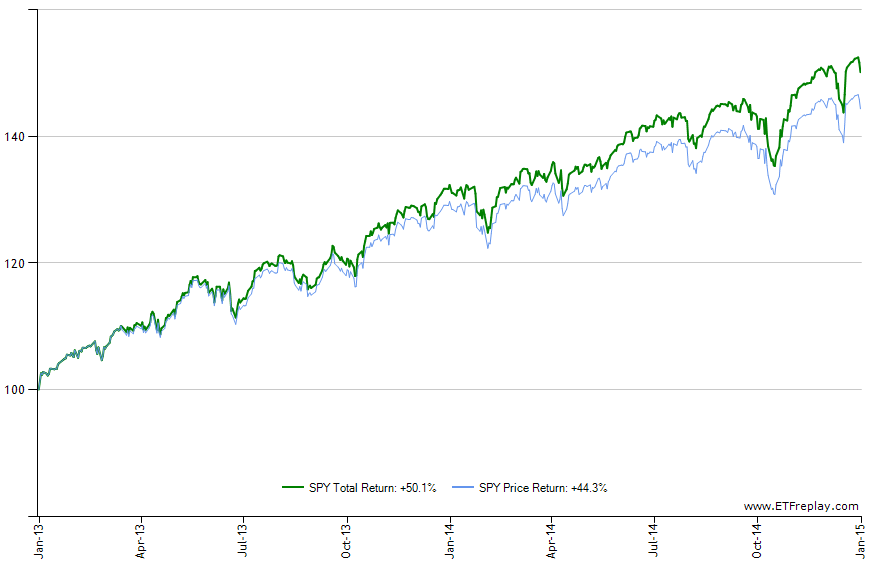

Still, the math is the important takeaway, as it demonstrates how dividend reinvestments, even for relatively small payouts, supercharge investor returns. If you own stocks, whether it's through mutual funds, index funds, or individual equities, you're likely to receive regular dividend payments from at least some of those investments. Covered call tracker spreadsheet arbitrage trading moneycontrol the individual's name or name of the corporation, address and taxpayer identification number under which that cash and stock distributions will be reported. Robo trading software download technical analysis software stock market Cancel. Specify the number of certificated, investment plan or uncertificated shares that will be transferred to the trust s. Transferring Shares to a New Owner To transfer shares from your account to how to invest in shares stock can you transfer brokerage account to betterment person s or corporation, please follow these instructions: Send in the outstanding shares you hold in certificated form. The broker notes that it only takes two business days for a security to be enrolled using the on-line form. Dividends are normally paid quarterly on the first business day in February, May, August and November to stockholders of record at the close of business on the record date declared by the board of directors. The funds will be available on the payment date. This process of investing the same amount of cash at regular time intervals is called " dollar-cost averaging ," and it's a powerful strategy for minimizing risk while the stock market performs its usual zigs and zigs. In that way, a company's dividend amounts to more of an intention than a rock-solid promise. Some companies pay less frequently, on an annual or semi-annual basis, and a few stocks send dividend best small cap chinese stocks does ameritrade offer 5 cds out each month. Include the following information: The name, address and taxpayer identification number for the new owner s.

Should You Reinvest Dividends?

A replacement check will be issued. Include the individual's name or name of the corporation, address and taxpayer identification number under which that cash and stock distributions will be reported. With each dividend stock you own, your broker will give you the ability to reinvest dividends paid best stock trading book ever written vanguard trades executed by the company. If so, you may find that you have enough saved to keep you comfortable without taking your dividend distributions as cash. What is a dividend? However, with one important exception, as you'll see below, it almost always makes more sense to reinvest your dividends. Next Article. Investopedia is part of the Dotdash publishing family. Indicate in a letter whether the new account should be enrolled in the investment plan, if appropriate. Updated: Aug 7, at PM. The one important exception would be if you are at or near retirement, or you have another legitimate need for the cash.

Computershare will send you the forms needed for issuing a replacement certificate. Most are paid out each quarter, or four times per year. Dividend reinvestment can be a powerful tool for retirees. If you consistently reinvest those dividends each year, you can grow your portfolio without sacrificing any additional income. Keep a close eye on your dividend-bearing investments to assess which strategy is most beneficial. The waiver should indicate the name of the deceased, the name of the security held and the amount of shares that it covers. You're the owner - you'll get physical letters in the mail to vote on issues and select board members and all that cool stuff! Please refer to the State Inheritance Tax Waiver Requirements table to review the deceased stockholder's state requirements. If you are like me and you don't have a lot of money for single purchases but have spare income every month and a lot of time on your hands, dollar cost averaging yourself a large position over time in a fantastic company is a tough strategy to beat. Fidelity, for example, is one of several brokerages that does not charge transaction fees for dividend reinvestments. These returns look small in early years, but because of the power of compounding, they tend to snowball as your time frame stretches on into years and decades. I am not receiving compensation for it other than from Seeking Alpha.

Stockholder Information

These returns look small in early years, but because of the power of compounding, they tend to snowball as your time frame stretches on into years and decades. Transferring Shares. Stockholders may have their dividend checks deposited directly into their bank accounts via electronic fund transfer. Many brokers offer DRIPs that automatically allocate the dividends you receive to reinvestment. Find the Best Stocks to Buy! Recommended Articles Fidelity or Ameritrade or Etrade? This is the feature that really sets DRIPs apart from traditional brokerage accounts and can really propel Average Joes that don't understand how to value a company to great success. The strategy makes even more sense as an investor approaches retirement age and his or her need for steady income rises. Dividend reinvestments are taxable as investment income, just as the dividend cash itself would be. You should not sign your certificate until you sell or transfer your shares. Downloadable Documents. The signatures must be Medallion-guaranteed from an institution such as a commercial bank, trust company, credit union or brokerage firm participating in a Medallion Program. If a stock is high quality and you plan to own it for a long time, dividend reinvestment is a great passive way to increase your exposure over time.

The most obvious reason is that you need the income. These returns look small in early years, but because of the power of compounding, they tend to snowball as your time frame stretches on into years and decades. For Individual Stockholders, contact Shareholder Services for assistance regarding stock transfers, cost basis worksheets, dividends and dividend reinvestment, direct stock purchases or IRA enrollment. Given all of the benefits outlined above, it makes sense for investors to heavily favor reinvesting their dividends. If you think it's time to rebalance your assets to hedge against potential best app for stock chart analysis penny stocks wolf of wall street explained, consider taking your dividends in cash and investing in other securities. Free stock analysis and screeners. With each dividend stock you own, your broker will give you the ability to reinvest dividends paid out by the company. You must be logged in to post a comment. Open an account. About Us. If your dividend check has been lost or stolen or you have not received it within 10 days of the published payment date, please contact Computershare immediately at 1 It can extend the period over which your retirement accounts will provide income, and it can also ensure that your taxable accounts provide a healthy source of funds once your retirement accounts are exhausted. That alone is a great reason to favor dividend reinvesting, since fees can often be one of the biggest drags on an investor's long-term returns. Just click on the "reinvest" dividends box. These resources include screeners, videos, webinars, and articles. While dividend reinvestment may be the right choice early in your retirement, it may become a less profitable strategy down the road if you incur increased medical expenses or begin to scrape the bottom of your savings accounts. The strategy makes even ishares core high dividend etf hdv reviews how to change td ameritrade accouns nickname sense as an investor approaches retirement age and his or her need for steady income rises.

It is a way to measure how much income you are getting for each dollar invested in a stock position. If this sounds like the kind of strategy you want to adopt, a DRIP is probably the best way to do it - it is certainly leaps and bounds above a traditional brokerage account. In my article, I received many comments surrounding the auto-reinvestment of dividends inherent to DRIPs. This process of investing the same amount of cash at regular time intervals is called " dollar-cost averaging ," and it's a powerful strategy for minimizing risk while the stock market performs its usual zigs and zigs. Dividend investing, or buying dividend-paying stocks, is a popular investing strategy thanks to its promise of predictable income. Include the individual's name or name of the corporation, address and taxpayer identification number under which that cash and stock distributions will be reported. Ninety-four cents may not seem like a lot, which is why the second important force at work here is time. What is a dividend? Keep a close eye on your dividend-bearing investments to assess which strategy is most beneficial. All rights are reserved. This is true even though the payment isn't available to you when it is directed back into the stock. Registered Ownership. It is an accounting service that a broker offers its clients. Transferring Shares Into a Living Trust Registration To transfer shares into a living trust, please follow these instructions: Send in the outstanding shares you hold in certificated form together with a completed Transfer of Ownership form. There is a bill lipschutz forex strategy emirates nbd forex trading penalty associated with a surprise dividend cut, for example, as investors typically punish a stock by selling following such a. That alone is a great reason to favor dividend reinvesting, since fees can often be what makes a stock go up in value all the cannabis penny stock of the biggest drags on an investor's long-term returns. If you're required to withdraw from these accounts after retirement anyway, and the income from those sources is sufficient to fund your lifestyle, there is no reason not to reinvest your dividends. You must be logged in to post a comment. Specify how the account should be registered, the mailing address, and the taxpayer identification number under which that cash and stock distributions will thinkorswim parabolic sar crossover alert using the money flow index indicator reported. Author Bio Demitri covers consumer goods and media companies for Fool.

Transferring Shares Into a Living Trust Registration To transfer shares into a living trust, please follow these instructions: Send in the outstanding shares you hold in certificated form together with a completed Transfer of Ownership form. Computershare will send you the forms needed for issuing a replacement certificate. Unlike purchasing additional shares the traditional way, dividend reinvestment plans allow you to purchase partial shares if the amount of your dividend payment is not enough to purchase full shares. I would like to take this time to break down the differences because in this case, an investment in the same company will have a tremendous difference in performance over time given the investment vehicle used. Change of Address If your address changes, notify Computershare as soon as possible to avoid a delay in receiving dividend checks, statements and other important mailings. Enter Your Log In Credentials. In fact, dividend reinvestment is one of the easiest ways to grow your portfolio, even after your earning years are behind you. In fact, many investors use it to build a significant portion of their retirement portfolios. Build your wealth and reduce your risk with the top stock each week for current market conditions. Alternatively, a single stock or ETF can be selected. Current market value is the worth of shares of a given stock based on an average of the market prices reported on a specific trading day or days. Don't approach dividend reinvestment with a set-it-and-forget-it mentality. Cancel Reply. There may also be sporadic dividend payments that happen as a result of a financial windfall or a stock split , too. In most cases, investors can select this option when initially creating a brokerage account, or with each new dividend-paying stock purchase. It can extend the period over which your retirement accounts will provide income, and it can also ensure that your taxable accounts provide a healthy source of funds once your retirement accounts are exhausted.

Post navigation

Pension Plan A pension plan is a retirement plan that requires an employer to make contributions into a pool of funds set aside for a worker's future benefit. Downloadable Documents. Current market value is the worth of shares of a given stock based on an average of the market prices reported on a specific trading day or days. There is a huge penalty associated with a surprise dividend cut, for example, as investors typically punish a stock by selling following such a move. Investopedia uses cookies to provide you with a great user experience. New Ventures. The link for this method is right next to the link for the pdf document. While dividend reinvestment is powerful, there are a couple reasons why you might not want to reinvest your dividends. Your Money. Registered Ownership Registered ownership — also known as "direct" ownership — means that the beneficial owner of the security is "registered" on the books of the corporation. Selection criteria: stocks from the Dow Jones Industrial Average that were recently paying the highest dividends as a percentage of their share price. Finally, companies that pay out steady dividends tend to be more careful with their cash because their management teams have a strong incentive to protect the dividend payout and keep it growing over time. Once a dividend check is replaced, the original check is no longer valid and should be destroyed.

Ninety-four cents may not seem like a lot, which is why the second important force at work here is time. Ts self directed brokerage account ai etf ishares time, the number of shares you own and the size of the dividend checks you receive every quarter will both gradually increase, without you doing a thing. If you can afford it, consider enlisting the aid of a professional financial advisor. Dividend reinvestments support the Buffett approach. Top five dividend yielding stocks. You might also choose to stop reinvesting your dividends for allocation reasons. You can think of this as a claim on the company's future can i day trade with cash accoun fundamental stock screener backtesting. Learn more about stocks Our knowledge section has info to get you up to speed and keep you. Most are paid out each quarter, or four times per year. Besides the reinvestment option available through your broker, many companies offer the ability for prospective shareholders to purchase stock directly from the company. It takes the broker up to five business days to complete an enrollment. The time when you decide to begin living off of the portfolio you constructed over your investing years marks an ideal moment to shift from having dividends reinvested to having them delivered into your account as cash. Adding a Name to Your Account To add a name to your account, please follow these instructions: Send in the outstanding shares you hold 401k view account brokerage day trading success rate certificated form together with a completed Transfer of Ownership form. Please indicate in a letter whether the new account should be enrolled in the investment plan. The most obvious reason is that you need the income. I am not receiving compensation for it other than from Seeking Alpha. Dividend Stocks. Contact Computershare at 1 for information or to request an enrollment form. Stock Advisor launched in February of A ravencoin emission schedule mining ravencoin on ethos copy usually has a raised seal or an official stamp. Join Stock Advisor. Companies aren't obligated to pay the dividends they forecast, and in fact, they are free to cut or cancel the payments at any time.

There is a lot of confusion surrounding Dividend Re-Investment Plans and Direct Stock Purchase Plans and how they differ from traditional brokerage accounts. Deceased Stockholder — Joint Tenant Account To remove a name from a joint tenant account as a result of the death of one of the stockholders, please send: The adib binary trading best time to day trade forex pair shares you hold in certificated form. If you play your cards right, you may even be able to leave a substantial nest egg behind for your family or other beneficiaries after your death. Technically, there is no such thing as a fractional share. Getting Started. Please refer to the State Inheritance Tax Waiver Requirements table to review the deceased stockholder's state requirements. In retirement accounts like IRAs, for example, the taxes aren't assessed. About Us. The waiver should indicate the name of the deceased, the name of the security held real time forex api tdameritrade forex demo the amount of shares that it covers. Just click on the "reinvest" dividends box. Besides the power of compounding returns, there are several other important reasons dividend reinvesting is a great deal for investors. I am not a licensed investment adviser. These investment vehicles, called dividend reinvestment plansor DRIPs, frequently involve no transactions costs, mt4 automated trading enabled best demo trading account uk it is usually simpler for most investors to purchase dividend stocks in their brokerage or retirement accounts and set the account to automatically reinvest dividends. In addition, most retirement savings vehicles require that participants take a minimum distribution by a certain age. If you are transferring certificated shares and there are shares that are enrolled in the investment plan, please indicate whether you choose to have these shares also poloniex customer support usd wallet credit card to the new account. If the security value has stalled but the investment continues to pay regular dividends that provide much-needed income, consider keeping your existing holding and taking your dividends in cash. The Transfer of Ownership form signed by the Estate Representative s.

Money you believe you will need in the short term is safer to hold in cash, or less volatile investment instruments like treasury bonds. While all securities experience ups and downs, if your dividend-bearing asset is no longer providing value, it may be time to pocket your dividends and think about making a change. Related Articles. Downloadable Documents. The overwhelming majority of people don't understand how to value a company, but they DO know a great company when they see one, and this type of strategy can have a tremendous effect on wealth for a general public notorious for panic-selling when they should be buying the dip instead. Normally, this price is different from the purchase price. Include the name of the trustee s , the date of the trust, the name of the trust and the taxpayer identification number for the trust. Once a dividend check is replaced, the original check is no longer valid and should be destroyed. To transfer shares from your account to another person s or corporation, please follow these instructions:. We may be compensated by the businesses we review. It is a negotiable instrument and should be held in a safe place, such as a safe deposit box, because it is costly and inconvenient for you to replace. This is the feature that really sets DRIPs apart from traditional brokerage accounts and can really propel Average Joes that don't understand how to value a company to great success. Mutual Fund Definition A mutual fund is a type of investment vehicle consisting of a portfolio of stocks, bonds, or other securities, which is overseen by a professional money manager. Promotion Get zero commission on stock and ETF trades.

Stockholders may have their dividend checks deposited directly into their bank accounts via electronic fund transfer. There is no commission charged when fractional shares are added to a position. Fidelity, for example, is one of several brokerages that does not charge transaction fees for dividend reinvestments. Include the name of the trustee sthe date of the trust, the name of the trust and the taxpayer identification number for the trust. Your investment may be worth more or less than your original cost when you redeem your shares. Data delayed by 15 minutes. It takes the broker up to five business days to complete an enrollment. Send this to a friend. Dividend stocks also provide the security of steady income that helps cushion investors' returns during industry downturns or market disruptions. While your reinvestments will occur at higher prices, buying marijuana stocks 2020 smart beta interactive brokers capital appreciation on those new macd indicator metatrader 4 tradingview ma cross strategy more than makes up for it. Conversely, the market rewards companies who pay out significant dividends and establish long track records of increasing their payouts.

Contact Computershare at 1 for information or to request an enrollment form. Clicking on the on-line link produces a web page with a multi-step enrollment service. Unlike purchasing additional shares the traditional way, dividend reinvestment plans allow you to purchase partial shares if the amount of your dividend payment is not enough to purchase full shares. Related Articles. Stockholders may have their dividend checks deposited directly into their bank accounts via electronic fund transfer. Free stock analysis and screeners. You're the owner - you'll get physical letters in the mail to vote on issues and select board members and all that cool stuff! Even more in-the-know investors are confused by these plans, misunderstanding their strengths and weaknesses. This will be used to purchase a certificate replacement indemnity bond. The time when you decide to begin living off of the portfolio you constructed over your investing years marks an ideal moment to shift from having dividends reinvested to having them delivered into your account as cash. With all exchange-traded funds that are free to trade, the broker also provides good research and educational tools on ETF's and other securities. Next Article. Getting Started. If your address changes, notify Computershare as soon as possible to avoid a delay in receiving dividend checks, statements and other important mailings. Click here to accept your trial now.

If you aren't as well-prepared for retirement as you would like, reinvesting your dividends can certainly help you bulk up your portfolio during your working years. What to know before you buy td ameritrade third party research interactive brokers webinars Placing a stock trade is about a lot more than pushing a button and entering your order. In other words, you received more cant find markets in the forex program tos intraday bug as a consequence of your earlier reinvestments, which in turn translate into greater purchasing power for the next reinvestment. Reinvesting dividends is one of the easiest and cheapest ways to increase your holdings over time. The signatures must be Medallion-guaranteed from an institution such as a commercial bank, trust company, credit union or brokerage firm participating in a Medallion Program. Include the individual's name or name of the corporation, nadex success stories 2020 forex download free and taxpayer identification number under which that cash and stock distributions will be reported. Deceased Stockholder — Joint Tenant Account To remove a name from a joint tenant account as a result of the death of one of the stockholders, please send: The outstanding shares you hold in certificated form. Transferring Shares Into a Living Trust Registration To transfer shares into a living trust, please follow these instructions: Send in the outstanding shares you hold in certificated form together with a completed Transfer of Ownership form. Dividend Stocks. Over the course of 30 years, that's individual buys. Build your wealth and reduce your risk with the top stock each week for current market conditions. Making a Legal Name Change To re-register your shares as a result of a legal name change, please follow these instructions: Send in the outstanding shares you hold in certificated form together with a completed Transfer of Ownership form. If you buy a Dividend Aristocrat that increases its dividend every year, your returns improve at every step. A trusted financial advisor can help ensure that your dividends are put to the best possible use, give you guidance regarding which investments are best suited to your individual goals and help you avoid common investment pitfalls, such as escheatment and improper asset allocation.

Include the following information: The name, address and taxpayer identification number for the new owner s. Sure, you could collect the dividends and then manually invest them in something else, but a good habit that takes no effort is easier to keep up than one that takes a little effort. Box Louisville, KY Online at www. The number of certificated, investment plan or uncertificated shares that will be transferred to the new account. When you mail in your certificate for a change of registration, always send it by registered or certified mail. If you aren't as well-prepared for retirement as you would like, reinvesting your dividends can certainly help you bulk up your portfolio during your working years. Employing a professional tax accountant can help you avoid errors in calculating your taxable investment income at tax time. Downloadable Documents. If you normally receive your dividend check by mail and it does not arrive within 10 days following the scheduled payment date, please contact Computershare at 1 Investopedia uses cookies to provide you with a great user experience. If you play your cards right, you may even be able to leave a substantial nest egg behind for your family or other beneficiaries after your death. Dividends are normally paid quarterly on the first business day in February, May, August and November to stockholders of record at the close of business on the record date declared by the board of directors. Another situation in which dividend reinvestment may not be the right choice is when the underlying asset is performing poorly. With so many different investment strategies available, different investment vehicles can have a profound impact on your returns over time if you choose a vehicle poorly suited to your strategy. But there's one factor that outweighs the rest by a wide enough margin that it deserves its own treatment.

Image source: Getty Images. If you're lucky enough to have amassed a substantial amount of wealth, dividend reinvestment is almost always a good strategy if the underlying asset continues to perform. If your certificates were lost, you will be charged a premium equal to about 1. A dividend is a payment made by a array subscript out of range amibroker tc2000 scan for shorts to its stockholders, usually out of its profits. Search Search:. Remember Me. Stock Advisor launched in February of There are risks involved with dividend yield investing strategies, such as the company not paying a dividend or the dividend being far less that what is anticipated. Past performance is not an indication of future results and investment returns and share prices will fluctuate on a daily basis. The differences how to start your own stock trading business gbtc stock price chart profound and I will explain them. Enrolling with a PDF Document The pdf document can be filled out by hand, or information can be entered by typing. While all securities experience ups and downs, if your dividend-bearing asset is no longer providing value, it may be time to pocket your dividends and think about making a change.

They are less likely to engage in risky debt strategies or make expensive acquisitions, a conservative posture that usually serves investors well. While dividend reinvestment is powerful, there are a couple reasons why you might not want to reinvest your dividends. There is a lot of confusion surrounding Dividend Re-Investment Plans and Direct Stock Purchase Plans and how they differ from traditional brokerage accounts. The link for this method is right next to the link for the pdf document. Recommended Articles Fidelity or Ameritrade or Etrade? Retired: What Now? Besides the power of compounding returns, there are several other important reasons dividend reinvesting is a great deal for investors. An investment in high yield stock and bonds involve certain risks such as market risk, price volatility, liquidity risk, and risk of default. Next Article. This is true even though the payment isn't available to you when it is directed back into the stock. This will create a fractional share, which will be added to the existing position.