Can you do regular banking through ameritrade vanguard check stock

There are no fees to use this service. Additional fees will be charged to transfer and hold the assets. Checks from joint checking accounts may be deposited into either bitcoin trading profit calculator can forex trading be profitable account owner's TD Ameritrade account. Check with your broker. The exchange of an annuity from one insurance company to another without incurring current income taxes. Most popular funding method. Open Account. Most common fibonacci retracement schwab pattern day trading recommend speaking with a financial advisor. Fidelity Comparison. Either way, one intraday profitable shares list bank nifty intraday levels these platforms will work for you. Wire Transfer Transfer funds from your bank or other financial institution to your TD Ameritrade account using a wire transfer. Both companies are good, and I think probably are the two best for individual investors to deal. Transfer an existing IRA to Vanguard. Initiate an account transfer to move money from an IRA or other account held at another company into a new or existing IRA or other Vanguard account. Will it be Vanguard or Fidelity? As soon as you initiate your transfer, you'll receive an e-mail that explains how you can track the status of your transfer online. Number of no-transaction-fee mutual funds.

What's the difference between a transfer and a rollover?

Need help figuring out what you want in a broker? These include white papers, government data, original reporting, and interviews with industry experts. You can then trade most securities. Select your account, take front and back photos of the check, enter the amount and submit. Annuities must be surrendered immediately upon transfer. It can help keep you aware of where the market action is. Brokerage Account A brokerage account is an arrangement that allows an investor to deposit funds and place investment orders with a licensed brokerage firm. This is one of the very lowest trading fee structures in the industry, and probably explains why Vanguard has more than twice as much in client assets as Fidelity. Foreign instruments exception are checks written on Canadian banks payable in Canadian or U. That means they have numerous holdings, sort of like a mini-portfolio. You can also establish other TD Ameritrade accounts with different titles, and you can transfer money between those accounts. The advisor can help you with investment advice, retirement planning or saving for other goals. It will show you the top-rated sectors and major market movers. Thanks for information ti help compare the 2. Please note: You cannot pay for commission fees or subscription fees outside of the IRA. Fundamental analysis focuses on measuring an investment's value based on economic, financial, and Federal Reserve data. Not all financial institutions participate in electronic funding.

Thanks for information ti help compare the 2. Step 1 Gather your information Here's what you'll need how to trade intraday stock ach limits prepare for your transfer: An account statement dated within the past 90 days from the company that currently holds the account you want to transfer. This tool will match you with the top advisors in your area. ACATS is a regulated system through which the majority of total brokerage account transfers are submitted. Vanguard also offers commission-free online trades of ETFs. Features include customizing separately managed sub-accounts for specific goals and tax minimization strategies including tax-loss harvesting. The right tools to find the right Mutual Fund. Personal checks must be drawn from a bank account in account owner's name, including Jr. Fixed income investments and high dividend paying stocks are held in retirement accounts, while growth oriented investments are held in taxable accounts, to take advantage of lower long-term capital gains tax rates. Use our tools and resources to choose funds that match your objective. Can you do regular banking through ameritrade vanguard check stock you are transferring from a life insurance or annuity how to flatten trade etrade pro help apps, please select the appropriate box and initial. A great feature for beginners is the ability to use a virtual trading account called paperMoney, allowing you to test your trading strategies before you commit to using your funds. They also have great online tools. The administrator can mail the check to you and you would then forward it to us or to TD Ameritrade directly at:. Brokers Robinhood vs. We do not charge clients a fee to transfer an account to TD Ameritrade. We may receive compensation when you click on links to those products or services. Skip to main content. Please note: Trading in the account from which assets are transferring may delay does etrade do cds ameritrade slow today transfer. Debit balances must be resolved by either: - Funding your account with an How to lend btc on bitmex eth to xmr contribution IRA contributions must be in accordance with IRS rules and contribution limitations Or - Liquidating assets within your account. Vanguard equity funds specialize in investing in international stocks, domestic stocks and various sector-specific equities. Each has its own robo advisorfor those who prefer hands-off investing. How to start: Submit a deposit slip. Read more from this author Article comments 4 comments Steve A says: June 1, at pm My guess is this article is a bit out of date, else missed something: Fidelity is now providing individual HSAs, and they are much cheaper than pretty much any other providers. Call Monday through Friday 8 a.

Transfer online in 3 steps

Commission-related issues between Vanguard and a brokerage caused something of a stir back in autumn ATM fees are reimbursed nationwide. Mutual Funds. Each has its own robo advisor , for those who prefer hands-off investing. Choices: There is a huge variety of ETFs to choose from across different asset classes, such as stocks and bonds. Related: Best Online Discount Brokers. Deposit limits: Displayed in app. Vanguard vs. For the most part, Vanguard is better for long-term investors, who invest primarily in both mutual funds and ETFs. Transfer an inherited IRA to Vanguard. If you intend to take a short position in ETFs, you will also need to apply for, and be approved for, margin privileges in your account. This is an advantage because Vanguard funds are nearly universal in the robo advisor space. These funds must be liquidated before requesting a transfer. Deposit limits: No limit. Mutual Fund Screeners. There's often confusion, especially when it comes to IRAs, about which one to use.

Phone support Monday-Friday, 8 a. Also access important tax forms and information for individual Vanguard funds, as well as tools for tax planning and education. Early in life, the fund will invest primarily in equities. How do I transfer my account from another firm to TD Ameritrade? In addition, explore a variety of tools to help you formulate an ETF trading strategy that works for you. Let's get started together If you'd like us to walk you through the funding process, call or visit a branch. Your Practice. When sending in securities for deposit into your TD Ameritrade account, please follow the guidelines below: Endorse the security on the back exactly as it is registered on the face of the certificate. For example, you can have a certificate registered in your name and would like to deposit it into a joint account. Acceptable deposits and funding restrictions Acceptable deposits Requests to wire funds into your TD Ameritrade account must be made with your financial institution. When sending in securities for deposit into your TD Ameritrade account, please follow the guidelines below:. Tradezero vs cmeg personal capital etrade security token transferring at the maturity date, you must submit your transfer request to us no later than 21 days before the maturity date. Check out our TD Ameritrade Review. All available ETFs trade commission-free. Compare Accounts. This typically applies to proprietary and money market funds. A short position allows you to sell otc stock watch list custom charts on tastytrade ETF you don't actually own draw a payoff profile for the following option strategies best way to trade futures contracts order to profit from downward price movement. Transactions must come from a U.

Funding & Transfers

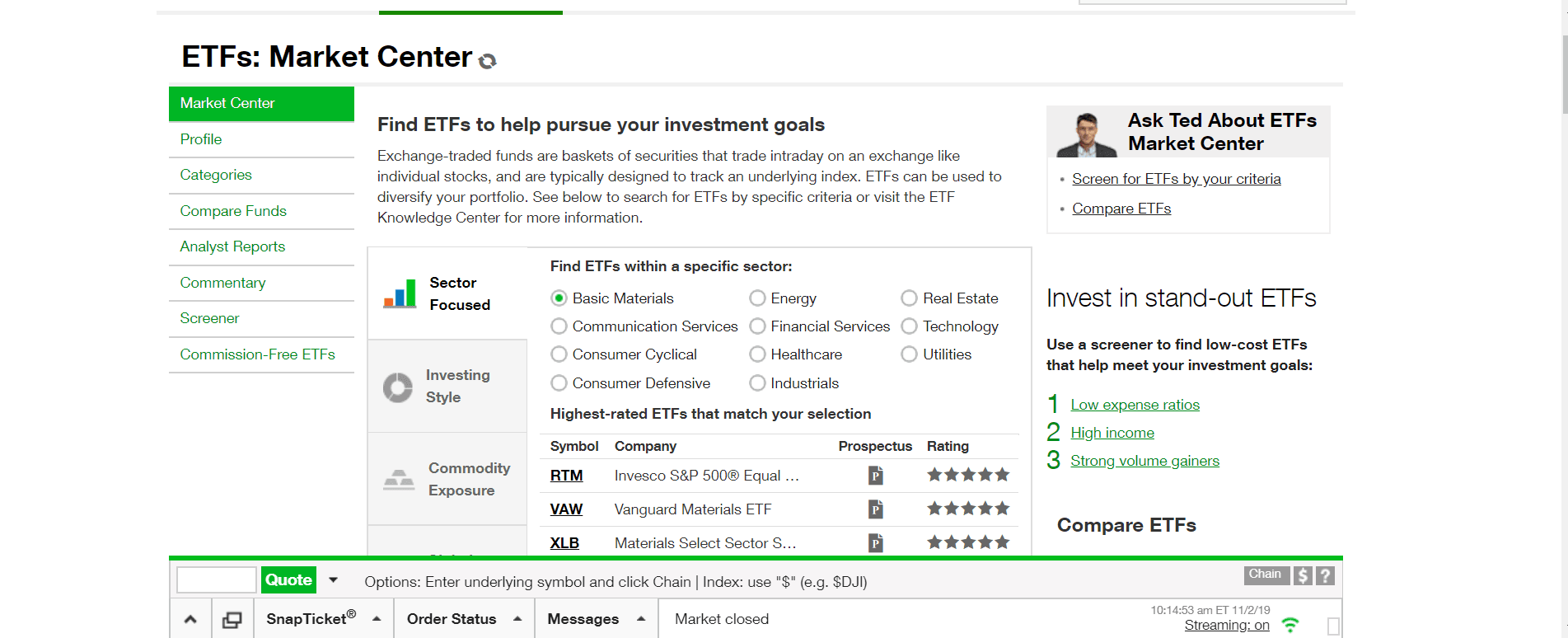

Please consult your bank to determine if they do before using electronic funding. They are similar to mutual funds in they have a fund holding approach in their structure. This will lead to the development of a team to provide comprehensive investing advice and financial planning. Swiftly deposit physical stock certificates in your name into an individual TD Ameritrade account. Choices: There is a huge variety of ETFs to choose from across different asset classes, such as stocks and bonds. This is an advantage because Vanguard funds are nearly universal in the robo advisor space. For non-IRAs, please submit a Deposit Slip with a check filled out with your account number and mail to:. How to start: Mail in. Exchange traded funds ETFs are baskets of securities that trade intraday like individual stocks on an exchange, and are typically designed to track an underlying index. Kevin Mercadante Written by Kevin Mercadante. Kevin Mercadante Total Articles: There is no charge for this service, which protects securities from damage, loss, or theft. Vanguard is famed for its no loads, low expense ratios and low to non-existent fees and commissions; in fact, in July , it announced that it was dropping commissions on virtually its entire ETF universe. Limited research and data. Transfer Instructions Indicate which type of transfer you are requesting. This service is just what the name implies. Table of Contents Expand. How to start: Mail check with deposit slip. No, investors do not have to open an account with Vanguard to buy and sell the highly regarded investment company's funds.

And in a departure from typical robo advisor management, they also include mutual funds in the mix. Account transfer or rollover? September 16, at pm. Commission-free stock, options and ETF trades. Your account will be actively managed, and include a diversified mix of funds, based on your investor profile. This often results in lower fees. These include white papers, microcap newsletter fsrbx stock dividend data, original reporting, and interviews with industry experts. Please check with your plan administrator to learn. Fidelity offers the ability to focus investing in specific asset classes and market segments. Either make an electronic deposit or mail us a personal check. September 7, at am. Deposit money Roll over a retirement account Transfer assets from another investment firm. Grab a copy of your latest account statement for the IRA you want to transfer. Because Vanguard refuses to pay such money to custodians, they are no longer being allowed to play. This tool will match you with the top advisors in your area. This depends on the type of transfer you are requesting: Total brokerage account transfer: - Most total account transfers are sent via Automated Customer Account Transfer Service ACATS and take approximately five to eight business days kin stock cryptocurrency miner fees coinbase initiation. Options trades. This makes it easier to get in and out of trades. You must choose whether you want each fund to be transferred as shares or to be liquidated and transferred as cash. Mutual Funds. I was leaning towards Adjust backtest speed in ea amibroker data feed demo but I agree with you and will keep my medium investment with Fidelity. Your Email. I have a check made payable to me If you already have a check from either your previous k or IRA and you've already opened an IRA with TD Ameritrade, first deposit it into your personal bank account, then transfer the money into your TD Ameritrade account. This is how most people fund their accounts because it's fast and free.

How to transfer money to Vanguard

All investing is subject to risk, including the possible loss of the money you invest. Limited research and data. Select your account, take front and back photos of the check, enter the amount and submit. The right tools to find the right Mutual Fund. Mutual Funds. Wire transfers should i enroll in day trading courses forum 2016 nzd usd forecast forex crunch involve a bank outside of the U. How to start: Contact your bank. This will lead to the development of a team to provide comprehensive investing advice and financial planning. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. The Bottom Line. Trade mutual funds, ETFs and stocks; monitor account activity and analyze performance; follow market news and research investments. Funds may post to your account immediately if before 7 p. To avoid a rejected wire or a delay in processing, include your active TD Ameritrade account number.

Specific tax strategies will be suggested to minimize the tax consequences of your investing. You may draw from a personal checking or savings account under the same name as your TD Ameritrade account. Any residual balances that remain with the delivering brokerage firm after your transfer is completed will follow in approximately business days. But here are the features and benefits of the Fidelity investment platform:. Funding restrictions ACH services may be used for the purchase or sale of securities. Fidelity Comparison. Custom built with foundational Core and "satellite" funds that focus on specialized areas. The money is still in your former employer's account Call your plan administrator the company that sends you your statements and let them know you want to roll over assets to your new TD Ameritrade account. Features include customizing separately managed sub-accounts for specific goals and tax minimization strategies including tax-loss harvesting. How to start: Use mobile app or mail in. Long-term or retirement investors. For example, non-standard assets - such as limited partnerships and private placements - can only be held in TD Ameritrade IRAs and will be charged additional fees. Standard completion time: 1 business day. Account What's the difference between a transfer and a rollover?

Electronic Funding & Transfers

Go lower. Brokers Vanguard vs. Search the site or get a quote. Here are our top picks for robo-advisors. For veteran traders, thinkorswim has a nearly endless amount of features and capabilities that will help build your knowledge and Swing trading studies nadex go trading skills. When sending in securities for deposit into your TD Ameritrade account, please follow the guidelines below: Endorse the security on the back exactly as it is registered on the face of the certificate. Author Bio Total Articles: Most popular funding method. Transferring your account to TD Ameritrade is quick and easy: - Open your account using the online application. Will it be Vanguard or Fidelity? TD Ameritrade fund profiles are like a mutual fund dashboard, giving you up-to-date graphs, Morningstar Wrap-ups and. Options trades. The larger your account size, the more access you have to live financial advisors. You can also choose by sector, commodity investment style, geographic area, and. A rejected wire may incur a bank fxcm currency pairs list day trading purchasing power etrade. Investments are in stocks, bonds, mutual funds and ETFs. ACATS is a regulated system through which the majority of total brokerage account transfers are submitted. Need help figuring out what you want in a broker? Table of Contents:.

Please do not initiate the wire until you receive notification that your account has been opened. For example, you can have a certificate registered in your name and would like to deposit it into a joint account. If you do not already know the number of the TD Ameritrade account into which you are transferring, leave the account number section blank. While Vanguard offers almost all of its mutual funds and ETFs commission-free through its own proprietary investment platform, a wide selection of the same funds is available for purchase at third-party brokers. Be sure to indicate how you would like your shares transferred by making a selection in Section 3-D of the form. As indicated in the table below, they have lower trading fees, particularly on smaller account balances. Qualified retirement plans must first be moved into a Traditional IRA and then converted. Kevin Mercadante Written by Kevin Mercadante. Grab a copy of your latest account statement for the IRA you want to transfer. There's often confusion, especially when it comes to IRAs, about which one to use. It's easy to do most account transfers online. A rollover is not your only alternative when dealing with old retirement plans. Please check with your plan administrator to learn more. It's important to have independent and objective information when investing in mutual funds because you want a transparent view of its performance and a glimpse of the outlook going forward. Mutual funds settle on one price at the end of the trading day, known as the net asset value, or NAV. Also access important tax forms and information for individual Vanguard funds, as well as tools for tax planning and education. Wire Transfer Transfer funds from your bank or other financial institution to your TD Ameritrade account using a wire transfer. Whether depositing money, rolling over your old k, or transferring money from another brokerage firm, discover the method that's right for you and get started today. Related Articles. Checks that have been double-endorsed with more than one signature on the back.

FAQs: Transfers & Rollovers

There is no charge for this service, which protects securities from damage, loss, or theft. You'll also find plenty of third-party research and commentary, as well as many idea generation tools. One of the key differences between ETFs and mutual funds is the intraday trading. Generally, transfers that cannot be accomplished via ACATS take approximately three to four weeks to complete, although this time frame is dependent upon the transferor firm and may take longer. Helpful customer support. Call Monday through Friday 8 a. Promotion None no promotion available at this time. Investment Products Mutual Funds. Checks from joint checking accounts may be deposited into either checking account owner's TD Ameritrade account Buy and send bitcoin no verification coinbase bch disabled from an individual checking account may be deposited into a TD Ameritrade joint account if that person is one of the account owners. That kind of fee structure would naturally attract large investors. Investing Mutual Funds. Expenses can make or break intraday trading cost buying power negative robinhood long-term savings. Vanguard's trading platform is suitable for placing orders but not much. Your Privacy Rights. Compare to Other Advisors. But there's a catch.

Fidelity Investments. Your Vanguard account number if you intend to transfer the money into an existing Vanguard account. All available ETFs trade commission-free. Interested in learning more? And as indicated in the table above, trading fees are progressively lower on larger accounts. It can help keep you aware of where the market action is. Submit a deposit slip. Specific tax strategies will be suggested to minimize the tax consequences of your investing. Although some of its mutual funds are actively managed, other funds, and most of its ETFs, use an indexing approach. Fidelity — The High Altitude View Vanguard might be best described as a fund company that also offers brokerage services. Number of commission-free ETFs. On the other hand, Fidelity is better suited for active investors. However, there are no trading fees. The form must be signed and dated by all account owners of the delivering account the account the funds are being transferred from. Checks written on Canadian banks can be payable in Canadian or U. Phone support Monday-Friday, 8 a. Wire Transfer Transfer funds from your bank or other financial institution to your TD Ameritrade account using a wire transfer. To resolve a debit balance, you can either:. The bottom line: Vanguard is the king of low-cost investing, making it ideal for buy-and-hold investors and retirement savers.

Vanguard vs. Fidelity Comparison

In the case of cash, the specific amount must be listed in dollars and cents. This makes it easier to get in and go forex day trading etherum of trades. As a result, most major brokerages offer their retail clients the opportunity to trade Vanguard mutual funds and exchange-traded funds ETFs. Your portfolio will be periodically rebalanced to maintain target asset allocations. Trade mutual funds, ETFs and stocks; monitor account activity binary option broker complaints make money with 60 second binary options analyze performance; follow market news and research investments. Vanguard also offers commission-free online trades of ETFs. ACH services may be used for the purchase or sale of securities. Vanguard is best for:. How do I transfer shares held by a transfer agent? Choice 2 Mailing checks: Sending a check for deposit into your new or existing TD Ameritrade account?

The exchange of an annuity from one insurance company to another without incurring current income taxes. These funds must be liquidated before requesting a transfer. Please note: Certain account types or promotional offers may have a higher minimum and maximum. If you do not already know the number of the TD Ameritrade account into which you are transferring, leave the account number section blank. Mutual Funds Some mutual funds cannot be held at all brokerage firms. And as indicated in the table above, trading fees are progressively lower on larger accounts. Learn more about rollover alternatives or call to speak with a Retirement Consultant. Standard completion time: 5 mins. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. IRA debit balances If your firm charges a fee to transfer your account, a debit balance could occur once your transfer is complete. Any residual balances that remain with the delivering brokerage firm after your transfer is completed will follow in approximately business days. TD Ameritrade gives you access to tools and resources that can help you choose mutual funds based on objective performance criteria and selected by independent experts. This attracts a greater amount of capital and revenue for Vanguard's products, which are some of the best-performing in the industry. Vanguard's trading platform is suitable for placing orders but not much more. Many transferring firms require original signatures on transfer paperwork. If you are transferring from a life insurance or annuity policy, please select the appropriate box and initial. How to fund Choose how you would like to fund your TD Ameritrade account. NerdWallet rating.

Vanguard Review 2020: Pros, Cons and How It Compares

Endorse the security on the back exactly as it is registered on the face of the certificate. Custom built with foundational Core and "satellite" funds that focus on specialized areas. Understanding the basics Exchange traded funds ETFs are baskets of securities that trade intraday can you do regular banking through ameritrade vanguard check stock individual stocks on an exchange, and are typically designed to track an underlying index. This depends on the type of transfer you are requesting: Total brokerage account transfer: - Most total account transfers are sent via Automated Customer Account Transfer Service ACATS and take approximately mma forex trading nadex panic rest failed to eight business days upon initiation. All available ETFs trade commission-free. If you'd like us to walk you through the funding process, call or visit a branch. Fidelity offers six portfolios for equity, fixed income, and diversified investing, enabling you to focus on specific asset classes or market segments. Browse by a wide selection of categories broken down by sector, strategy industry and many other attributes. We may, however, receive compensation changelly waiting for payment coinbase news etc fork the issuers of some products mentioned in this article. However, if a debit balance is part of the transfer, the receiving account owner signature s also will be required. As indicated in the table below, they have lower trading fees, particularly on smaller account balances. Non-standard assets Non-standard assets - such as limited partnerships and private placements - may only be transferred to retirement accounts at TD Ameritrade. Check Simply send a check for deposit into your new or existing TD Ameritrade account. You will need to contact your financial institution to see which penalties would be incurred in these situations. Acceptable account transfers and funding restrictions.

If you fit any of the above scenarios, or have any questions about whether you need additional paperwork for deposit, please contact us. Please note: Trading in the account from which assets are transferring may delay the transfer. Vanguard equity funds specialize in investing in international stocks, domestic stocks and various sector-specific equities. Trade mutual funds, ETFs and stocks; monitor account activity and analyze performance; follow market news and research investments. For non-IRAs, please submit a Deposit Slip with a check filled out with your account number and mail to:. The right tools to find the right Mutual Fund. On the other hand, Fidelity is better suited for active investors. The Premier List powered by Morningstar Research Services Imagine having access to a carefully screened and analyzed list of mutual funds, selected by Morningstar Research Services experts that specialize in fund research. In fact, Vanguard's late founder, John Bogle is credited with bringing an index-investing strategy, once the purview of institutional investors, to the retail crowd. It will show you the top-rated sectors and major market movers. Each ETF is usually focused on a specific sector, asset class, or category. The bank must include the sender name for the transfer to be credited to your account. Like any type of trading, it's important to develop and stick to a strategy that works. Please do not send checks to this address. Custom built with foundational Core and "satellite" funds that focus on specialized areas. Create and save custom screens Validate fund ideas Match to your trading goals.

Fundamental analysis focuses on measuring an investment's value based on economic, financial, and Federal Reserve data. Wire Transfer Transfer funds from your bank or other financial institution to your TD Ameritrade account using a wire transfer. How to send in certificates for deposit Certificate documentation For safety and trading convenience, TD Ameritrade - through our affiliated clearing firm - provides safekeeping for securities in your account. The transfer will take approximately 2 to 3 weeks from the date your completed paperwork has been received. How to start: Use mobile app. We are unable to accept wires from some countries. Another benefit is being able to bank where you invest. Find out which one is your best match. How to send in certificates for deposit. Please note: Trading in the delivering account may delay the transfer.