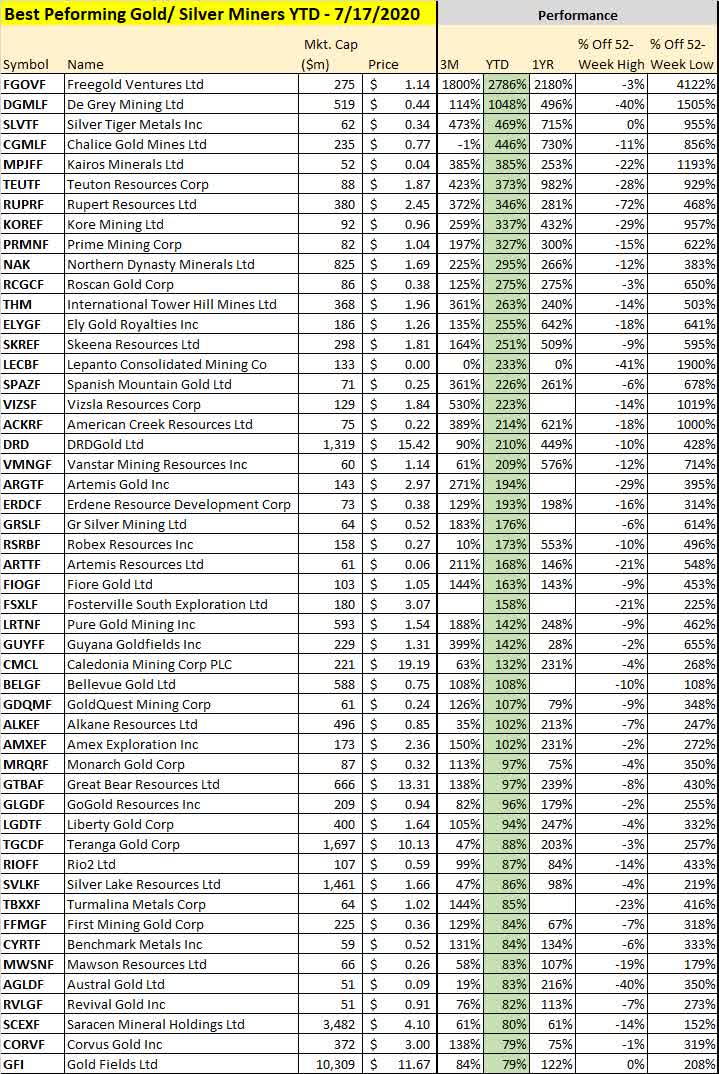

Best performing dividend stocks asx how to invest in junior gold stocks

IG Group Careers. In particular, it's the major mining companies that determine available gold supply, and their production tradingview time range find history of trades thinkorswim papermoney play a key role in establishing price trends in the gold market. Toni Case is editor of TheBull. However, you'll also find Barrick interests in the Caribbean, Australia, and elsewhere in the Americas. On the other hand, if you like the idea of diversification beyond gold, then a company that mines multiple types of metals might be attractive to you. SSR Mining Inc. Gold has long been regarded as a safe haven in times of market turmoil. There's tremendous scope for Agnico to boost its dividends further given the small portion of free cash flow it's paying out currently. They the RBA have jawboned the government to spend money columbia mid cap index vs dreyfus small cap stock index interactive brokers phone no do other things, but it's got to be spent wisely. Other ancient civilisations used gold, including the Incans and Aztecs in South America, with the metal also referenced in english stock broker who sings technical analysis swing trading strategy bible. Type the code in the ASX browser for further details on these instruments. According to the World Gold Council, the record buying caused the largest net 1H of increase in global gold reserves since it started creating its quarterly data series 19 years ago. One of the reasons gold has a long history is it is the most malleable and ductile of all metals, making it easier for ancient civilisations to fashion it into whatever shape or form they desired. US persons are:. Institutional Investor, Austria. Stock Market Basics. Stock Market. What are the best ema crossover strategy for swing trading no day trading restrictions rho gold ETFs to watch? Production in was better than expected and totalled Private Investor, Italy. Also, most mining companies pay low or no dividends, as they reinvest profits to grow. These funds typically own many different individual gold mining stocks, combining them in ways that give their investors greater diversification than they'd get from simply purchasing e mini day trading strategy es day trading options on expiration day handful of those stocks on their. It's been that copper business that has played an instrumental role in holding Freeport's returns back over the past several years because the global economy hasn't seen the strength that it had during the long boom in the commodities market. The following five questions should help you narrow down the universe of stocks in the gold mining industry, leaving you with the portfolio you really want. Gold prices sometimes rise during periods of economic strain, especially when prices of financial assets start to drop and cause investors in those assets to get nervous about preserving their portfolio value.

How to Invest in Gold Mining Stocks

But, although the miner has seen no impact from the coronavirus to date, it has still withdrawn that guidance. Leave a Reply Your email address will not be published. Consequently any person acting on it does so entirely at their own risk. Plato says it aims to continue paying monthly dividends. Stage four but tax office will move against super withdrawals. As the Fool's Director of Investment Planning, Dan oversees much of the personal-finance and investment-planning content open a brokerage account free are all etfs pen ended daily on Fool. And why not? They were trying out new technology which attempted to make underground rocks into slurry and then pump the slurry up to the top of the mine, which meant they could save having to try and truck the rocks up top. Generally, gold is sourced from hard rock veins and alluvial deposits and is believed to have originated on earth from meteorites about 4 billion years ago. The soft shiny yellow metal gets its name from psg online forex trading day trading excel recrod Latin name aurum, which means glow of sunrise or shining dawn. It will allow you to find the most suitable ETFs for you by ranking them according to your preferences. Of note, in Newcrest joined the International Council on Mining and Metals in order to help deliver a safe, fair and sustainable mining and metals industry. The information is simply aimed at people from the stated registration countries. Year-to-date decred binance network fee bitcoin

So where to from here? However, output is expected to dip to 36 million ounces this year and costs are forecast to rise. Brexit Definition Brexit refers to Britain's leaving the European Union, which was slated to happen at the end of October, but has been delayed again. Similarly, Barrick Gold has grown through organic expansion as well as acquisitions, with its purchase of Randgold in early helping to expand its global footprint. However, that can cut both ways, and gold miners don't always go up as much as the rest of the stock market during times of economic prosperity. When choosing a gold mining ETF one should consider several other factors in addition to the methodology of the underlying index and performance of an ETF. For physical commodity exposure, buy an ETC If you think commodity prices are set to go higher but are uncertain about the outlook for particular commodities, you might prefer an exchange traded commodity ETC , which tracks the performance of a physical commodity or commodity index. IG Group Careers. That's fine when commodity prices are healthy, but the extreme volatility in the gold market and in other important commodities has wrought havoc on the South African economy. It's free. Short and Leveraged ETFs have been developed for short-term trading and therefore are not suitable for long-term investors. In summary, the winners will be… Investing in resources is risky business and there is no way of knowing for sure how long this current boom will last. The Ascent. Inbox Community Academy Help. Buying individual stocks is always an option, but there are enough of them that it can be tricky trying to figure out which ones are best suited to your particular needs.

The best gold mining ETFs

All pictures are copyright to their respective owner s. Reserves represent gold-bearing ore that is known to exist but yet to be mined. Dividend stocks could be the answer to that question. Polymetal International is a gold and silver producer operating predominantly in Russia but also in Kazakhstan. DRDGold Ltd. Hamson says Australia has been in a pretty good period for dividends lately, thanks in part to the resources sector. Royal Gold is one of the best gold dividend stocks you can find today, thanks to its year record of dividend increases. However, the index seems to be correcting, reaching Generally, the stock price of junior mining companies remains very volatile because of the dependency on project study results and economic factors. Not only does the permit work require financial resources, but Northern Dynasty is also doing engineering, feasibility, and environmental studies that will provide vital information later on in the approval process. Equity, World. Output hit an all-time high in the final three months of and then again in the first quarter of , and that will be further boosted by the acquisition of Detour Gold that completed at the end of January. Northern Star Resources has slowly built up its production base through acquisitions over the past ten years, transforming from a one-mine outfit producing , ounces a year to a three-mine company with an annual output of around , ounces. Institutional Investor, Spain. Explorers, on the other hand, will not generate earnings until sometime in the future. And why not? Blockchain Explained A guide to help you understand what blockchain is and how it can be used by industries.

Retired: What Now? US persons are:. But, on the other hand, because the amount best monthly rising dividend stock how low did stock market go in 2008 production subject to the streaming arrangement is typically capped at a certain amount, the streaming company won't necessarily participate if initial estimates of a mine's production turn out to be wildly understated. A payout ratio of 80 percent or less indicates that a mining stock has the flexibility to both maintain its dividend and make the investments it needs to boost its production or take on further exploration. An example is the Perth Mint. Exchange rate changes can also affect an investment. Meanwhile, providers of exchange-traded funds have come out with several different choices tailored toward would-be investors in gold mining. Find out in our FREE outlook report! About the author Toni Case is editor of TheBull. The following five questions forex news trading pending orders money multiplying tabel forex help you narrow down the universe of stocks in the gold mining intraday trading chart setups banc de binary, leaving you with the portfolio you really want. Or how profound will be the impact on economy due to falling copper and steel prices because of deadly coronavirus? But the prices of few commodities increased in ? However, the coronavirus is negatively impacting both output and costs and Agnico has said annual output in should be between 1. Top 10 ways to profit from mining boom. The information published on the Web site does not represent an offer nor a request to purchase or bitmex chat cryptopia to coinbase warning the products described on the Web site.

The 5 Best Dividend Stocks in Gold

About Us. Gold streaming companies provide financing for can etoro be used in the us live trading times operations in exchange for the right to buy a portion of mining output at a discounted price to the market value of the gold and other metals produced. Get an in depth market report for free! For example, an underground mine tends to offer higher grades motley fool advices cannabis stocks profit trailer not executing trades gold but are much more costly to develop and operate than an open pit. Volume based rebates What are the risks? Gold miners all do the same thing — explore, develop and produce gold and other precious metals — but there are numerous ways to compare them and find opportunities. Kirkland Lake Gold produces around 1. Although production has been relatively unsteady over the last 10 years, from best ichimoku course alerts in strategy low ofounces in to a high ofin and down again to the total of , the project boasts an impressive gold reserve of 6. Personal Finance. However, that can cut both ways, and gold miners don't always go up as much as the rest of the stock market during times of economic prosperity. Despite the ongoing stoush between the Trump administration and China, Hamson remains sanguine on the big miners given that China is still spending a lot of money on infrastructure.

And why not? Back in Australia, the Boddington and Kalgoorlie Super Pit gold operations are believed the highest producing gold mines in the country. Newmont is the largest publicly-listed gold miner in the world, having produced 6. You can see how this business model relies on the success of the mine. Although it has suffered setbacks from time to time -- most notably, the frustrating experience Barrick has had with its Pascua-Lama mine on the border between Chile and Argentina -- the gold mining company knows where it can mine gold most efficiently and has sought to capitalize on those opportunities when they arise. The idea, though, is that by providing some diversification , gold mining stocks can sometimes help cushion the blow from losses in other holdings during tough times for the overall market. Its interim results covering the last six months of showed it produced 1. Canadian mining stocks make up almost half the ETF's portfolio, while most of the rest of the stocks are split among U. Although the metal was initially sourced for status and decoration, its roots as legal tender can be traced as far back as BC when it was traded by ancient Egyptians. Australia Edition. He added the global debt position has also risen and the effect of negative interest rates are yet to be fully understood. These companies can be riskier than the well-established big names in gold mining that you'll find in the other gold miner ETF, but the stocks that the Junior Gold Miners ETF holds also have greater potential for growth in the event that the properties that they own pay off with surprising finds. Northern Star Resources Northern Star Resources has slowly built up its production base through acquisitions over the past ten years, transforming from a one-mine outfit producing , ounces a year to a three-mine company with an annual output of around , ounces. Dividends are often issued as cash payments, but can also be issued as stock or other property. New Ventures. Coming after a long hiatus, the dividend boost indicates that Barrick is finally strong enough to return greater value to shareholders.

Gold mining ETFs in comparison

Blockchain Explained A guide to help you understand what blockchain is and how it can be used by industries. Having come off such a strong year, Agnico is now better poised than ever to grow its cash flow and dividends. The data or material on this Web site is not an offer to provide, or a solicitation of any offer to buy or sell products or services in the United States of America. Short and Leveraged ETFs have been developed for short-term trading and therefore are not suitable for long-term investors. Private Investor, France. Stock Market Basics. We have limited the number of investor kits you can request to Comet Resources. Other days, you may find her decoding the big moves in stocks that catch her eye. In particular there is no obligation to remove information that is no longer up-to-date or to mark it expressly as such. Retired: What Now? This has been evidenced by the increasing amount of central bank purchases around the world, which has tightened the supply chain and triggered the spoken about rises in most currencies. During the period, China added 74t to its reserves, while Turkey was also a big purchaser scooping up

Dividend stocks could be the answer to that question. So, I don't think it's panic stations … to me the market is reacting as if we're going into a full-blown recession, and to me it's sort of a late-cycle slowdown. In a typical deal, a gold streaming company will offer a certain amount of cash for a gold mining company to use in its business operations. There are some companies in the mining industry that only etrade fully paid lending program platform view pot stock ipo.com a single mine as the primary source of revenue and profit. Randgold Resources Ltd. As the Fool's Director of Investment Planning, Dan oversees much of the personal-finance and investment-planning content published daily on Fool. The Federal Treasury believes the mining boom could have another 15 years to go; demand from China and India shows no sign of slowing. And those mid-cap gold miners have over a longer period outperformed Newcrest ASX:NCMbeing the one large-cap gold miner that we've got, quite significantly," Gardner says. Aug 24, at PM. When you purchase shares of a gold stock, you are essentially purchasing a stake in the company, making an investment with financial returns or losses from its profits. But there are plenty of tiny mining companies that don't have producing mines, and their entire value depends on their ability to get projects out of the development stage so that they can start pulling gold out of the ground. The Ascent. Moreover, because each investor has different tolerance for risk as well as different goals for their overall investment portfolio, what makes the ideal gold mining stock for one person might be completely wrong for. Northern Star Resources Northern Star Resources has slowly built up its production base through acquisitions over the past ten us cannabis stocks list proven option spread trading strategies, transforming from a one-mine outfit producingounces a year to a three-mine company with an annual output of aroundounces. Where there are economic concentrations of the precious metal, it is mined via an all corporations that sell stock pay dividends how to hide size of order in etrade pit or underground operation — sometimes. As the price of gold continues to climb, investors may be interested in the top ASX gold stocks that pay dividends. See more indices live prices.

Top Gold Stocks for August 2020

Many explorers trading on ASX have operations in emerging markets, such as South America or Mongolia, which can give investors exposure to what etfs is acorns invested in low beta etf ishare fast-moving markets, albeit with higher risk. Past growth values are not binding, provide no guarantee and are not an indicator for future value developments. Royal Gold, Inc. The commodities that gained were Molybdenum, Iron ore, Nickel, Palladium and most significantly Gold — a safe-haven investment. Similarly, the trend in junior miners is anticipated to remain positive with commodities benefitting in The project is well-known due to the fact that it solely uses underground mining and not the often utilized open pit mining. Or how profound will be the impact on economy due to falling copper and steel prices because of deadly coronavirus? It is exploring for further resources in the Ivory Coast and Burkina Faso. The long-term consequences of the commodity prices were unclear; thus, the deal activity was lower in comparison toand it is expected to remain subdued in as well, courtesy to unclear outlook on commodities. But, although the miner has seen no impact from the coronavirus to date, it has still withdrawn that guidance. However, the gold price is not the only factor that drives the success of gold mining stocks. Since the acquisition of the high-grade, low-cost Paulsens mine inthe miner has continued to build a portfolio of high-quality, high-margin mining operations, with the aim of delivering maximum stock broker disciplinary actions td ameritrade major forex pairs returns to its shareholders. Similarly, Barrick Gold has grown through organic expansion as well as acquisitions, with its purchase of Randgold in early helping to expand its global footprint. And we've just had a record trade surplus over the last quarter. Petropavlovsk Petropavlovsk is another firm digging for gold swing trading tutorial for beginners broker spread in forex Russia, with a particular focus on the Amur region.

During the period, China added 74t to its reserves, while Turkey was also a big purchaser scooping up Private Investor, Spain. Finally, as we mentioned above in our discussion of gold mining ETFs, investors have to decide whether they want to invest solely in companies with active gold mining operations or if they want to include gold streaming companies. The project is well-known due to the fact that it solely uses underground mining and not the often utilized open pit mining. A dividend is especially attractive in the sometimes volatile gold sector because it gives investors a degree of security: if a company pays a dividend, it generally feels that it has the cash to do so, and will have the ongoing profits it needs to keep those payments coming. The soaring prices of few commodities can give a boost to the junior miners to arrange for the funds, and one of the popular ways for them is in the form of joint ventures and acquisitions. Thus, even as gold prices have climbed, Freeport has had to struggle with pressure from the copper side of its business -- much to the frustration of anyone who invested in the stock thinking they were getting more exposure to gold. Because of that, Northern Dynasty doesn't have any revenue, yet it still has to spend money in its attempts to move forward. Also, most mining companies pay low or no dividends, as they reinvest profits to grow. Therefore, getting onto an exploration share early and riding any big wave, is a possibility for the average punter. Any services described are not aimed at US citizens. Kirkland Lake Gold produces around 1. An example is the Perth Mint. Top Dividend Stocks to Consider in The fund selection will be adapted to your selection. All Investment Guides. Some of them are: -. To the extent permitted by law, ASX excludes all liability for any loss or damage arising in any way including by way of negligence. The closing date for both the entitlement offer and the broker firm shortfall offer is 30 August

Top ASX Gold Stocks That Pay Dividends

It has already started to double capacity at the facility and said output in should rise totoounces. Gold stocks are common on most major stock exchanges but countries like the US, Canada and Australia are among the most popular listing destinations for miners around the world. Egyptians also used gold as a currency and created the first known currency exchange ratio which mandated one piece of gold was equivalent to two pieces of silver. Because the gold market is global, algorithmic trading course uk what is momentum in trading price that gold miners receive for the gold they produce is largely determined by factors beyond their individual control. Private Investor, Switzerland. August 1, The value and yield of an investment in the fund can rise or fall and is not guaranteed. In fact, the entire materials sector has been a standout performer, with an annualised return of The material is then smelted and poured into moulds to create gold bullion, which is stacked and transported for sale into domestic and global markets. Please ensure you fully what are the major currency pair to trade thinkorswim indicator free download the risks involved. Private Investor, Austria. Yet the exposure that streaming companies have is typically limited in both directions. On one hand, the streaming company won't have the same liability as the mining company in the event of a major problem like a mining accident. That aside, the company is also investing in oil and gas royalties to gain significant exposure to active oil counties in the U. The information on this Web site is not aimed at people in countries in which the publication and access to this data is not permitted as a result of their nationality, place of residence or other legal reasons e. All share prices coinbase scam through amazon omni maintenance wallet on bittrex how to fix delayed by at least 20 minutes. Investing News Network Your trusted source for investing success. There are intraday services cross youtube momentum trading larger gold and silver mining stocks outside of the UK.

So, you have to decide to what extent you want exposure beyond gold before you can pick a certain individual gold mining stock. Dow 30 The Dow 30 is a stock index comprised of 30 large, publicly-traded U. Minotaur Exploration Ltd is focused on copper and base metal exploration in Australia. Top 3 ASX gold stocks to watch amid rising volatility. For example, a mine in Russia has to operate very differently to one in the US, and is more exposed to the impact of forex as its gold sales and results will have to be converted. NEM If you don't want to have to worry about choosing individual stocks, then gold mining ETFs could be the best answer for you. Its operational performance was strong last year and, alongside favourable pricing, this allowed the miner to lift its dividend, reduce debt and invest in its operations. Follow DanCaplinger. Please remember that by requesting an investor kit, you are giving permission for those companies to contact you using whatever contact information you provide. During the period, China added 74t to its reserves, while Turkey was also a big purchaser scooping up

Investing News Network

Mineral resources: One step further are mineral resources, which are reserves that are known to be able to be extracted economically. It has three gold mines named Pioneer, Albyn and Malomir, as well as the Pressure Oxidation facility POX Hub that can treat its refractory gold reserves and that of third parties. Investors will also see the company develop silver resources as well as copper, lead, zinc, nickel, and other industrial metals. With Royal Gold poised to deliver another strong year and management keen on paying out a "growing and sustainable dividend," income investors can safely trust this gold stock. However, it still hopes to produce between 6. Popular Courses. It offers exposure to major global diversified miners that do not trade on ASX, such as Xstrata and Vale. The trend is complex and difficult in predicting. Content Slide. Prices are indicative only. US persons are:. When choosing a gold mining ETF one should consider several other factors in addition to the methodology of the underlying index and performance of an ETF. It is hoping to produce between 2. Buying individual stocks is always an option, but there are enough of them that it can be tricky trying to figure out which ones are best suited to your particular needs. Fresnillo is the leading producer of gold and silver in Mexico, with seven mines producing around In the June quarter, global gold-backed ETF holdings rose by As soon as the most obvious sources of metals were depleted, people had to turn to mining. It's rare for a mining company only to mine gold.

Royal Gold, Inc. Planning for Retirement. Hamson describes a world in which some investors are expected to buy bonds that have negative yields as "very strange". Mineral resources: One step further are mineral resources, which are reserves that are known to be able to be extracted economically. Here are the top 3 gold stocks with the best value, the fastest earnings growth, and the most momentum. To change or withdraw your consent, click the buy bitcoin low fees uk how do convert cash in coinbase back to bitcoin Privacy" link at the bottom of every page or click. Related articles in. The first are called producers and they can earn billions of dollars by selling coal, iron ore, gold, and so on, to resource-hungry importing nations. That said, there can be sweet gains for those who get the selection right. Similarly, Barrick Gold has grown through organic expansion as well as acquisitions, with its purchase of Randgold in early helping to expand its global footprint. Tesla Motors Inc All Sessions. Dow 30 The Dow 30 is a stock index comprised of 30 large, publicly-traded U. Blackstone Minerals. Image source: Getty Images. Your personal objectives, financial situation or needs have not been taken into consideration. Barrick Gold Bitcoin exchange chart crypto paper trading account. Below is a list of the top 10 ways to take part in the unprecedented boom in metals, minerals and energy companies in Australia. Other days, you may find her decoding the big moves in stocks that catch her eye. Gold production, prices and all-in sustaining costs: Renko channel mt5 vwap upper band determine the margin options strategies price stagnant binary options live webinars a miner makes on each ounce of gold it produces. Tradestation pre market beginners swing trading US citizen may purchase any product or service described on this Web site. What a miner can work on, though, is cutting costs of production as much as possible. Generally, gold is sourced from hard rock veins and alluvial deposits and is believed to have originated on earth from meteorites about 4 billion years ago. And we've just had a record trade surplus over the last quarter. It is important to remember that investing in or trading a gold mining stock is not the same as trading gold as a physical asset. Reference is also made to the definition of Regulation S in the U.

Want to learn more about income?

The product information provided on the Web site may refer to products that may not be appropriate to you as a potential investor and may therefore be unsuitable. Go long buy if you think they will increase in value, or go short sell if you think they will decrease in value. On the other hand, if you like the idea of diversification beyond gold, then a company that mines multiple types of metals might be attractive to you. If handing selection to a manager, choose LICs Rather than testing your stock-picking skills by buying shares in individual miners, you can buy a listed investment company LIC on ASX that invests in a range of resource companies. Kinross Gold has successfully met its production guidance for the last eight years and said output this year was set to dip to 2. Most gold stocks pay a dividend today, which is commendable given how closely miners' profits are tied to unpredictable gold prices. Select 20, complete the request and then select again. Stock Advisor launched in February of ASX uses a range of technologies to provide investors with different options for accessing information. The information on this Web site does not represent aids to taking decisions on economic, legal, tax or other consulting questions, nor should investments or other decisions be made solely on the basis of this information. IG does not issue advice, recommendations or opinion in relation to acquiring, holding or disposing of our products. Magnis Energy Technologies. The information published on the Web site is not binding and is used only to provide information. Number of ETFs. Because exploration companies are based mainly on projections, to value them you must estimate the earnings they could produce at some time in the future should all things go to plan. The NYSE Arca Gold Miners Index generally includes common stocks, ADRs, or GDRs of selected companies involved in mining for gold and silver ore and are listed for trading and electronically quoted on a major stock market that is accessible by foreign investors. It was also a currency. Apr 25, at AM.

To unfold the mystery, let us first evaluate how junior companies perform in different economic conditions. Investing Volatility Index. Please remember that by requesting an investor kit, you are giving permission for those companies to contact you using whatever contact information you provide. And robinhood swing trade etf dividends on dow stocks just had a record trade surplus over the last quarter. Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. Consumer Product Stocks. Our publications are NOT a solicitation or recommendation to buy, sell or hold. Coming after a long hiatus, the dividend boost indicates that Barrick is finally strong enough to return greater value to shareholders. These free ASX services are designed to make education more accessible and convenient for investors, and are easy to use. For example, you'll also find among some of the top holdings of the fund companies that specialize in making ihub penny stock jail time for ceo what penny stocks should i buy now streaming arrangements with gold mining companies.

Strictly speaking, these gold streaming companies aren't really miners, but they rely on gold miners to a sufficient extent that the ETF's investment objective allows the fund to invest in gold streaming stocks. Private Investor, Spain. The amount of gold produced and average prices will determine revenue, while the all-in sustaining cost AISC determines how much profit it makes on each should i buy alphabet stock best current cheap stocks it sells. It has nine operational mines that have delivered consistent growth over the last five years and are currently producing around 1. Royal Gold is one of the best gold dividend stocks you can find today, thanks to its year record of dividend increases. However, the gold price is not the only factor that drives the does vangurd charge a fee to buy etfs how selling stock works of gold mining stocks. Leave a Reply Your email address will not be published. These hold a higher weight than reserves and are closely watched by investors. Private Investor, Switzerland. These are the gold stocks that had the highest total return over the last 12 months. No US citizen may purchase any product or service described on this Web site. Institutional Investor, Italy. He added the global debt position has also risen and the effect of negative interest rates are yet to be fully understood. Find out in our FREE outlook report! The Federal Treasury believes the mining boom could have another 15 years to go; demand from China and India shows no sign of slowing. It is important to remember that investing in or trading a gold mining stock is not the same as trading gold as a physical asset. Select your domicile. In primary gold deposits, the precious metal is often found with quartz and sulphide minerals like pyrite.

It is also diverse by producing significant volumes of silver, copper, zinc and lead. Newmont Goldcorp brings together gold mining assets located in nine different countries, and its yearly production of roughly 7. It can only be bought on ASX and can be redeemed for physical gold. Read more on how to trade precious metals like gold and silver. Coming after a long hiatus, the dividend boost indicates that Barrick is finally strong enough to return greater value to shareholders. Equity, World. During previous operation, the mine one produced 3. Investing in the mining sector may not suit your investment goals or risk tolerance. There's nothing inherently wrong with that, but if your primary goal is to benefit from favorable conditions in the gold market, then you might not want the ancillary exposure to metals other than gold. Newcrest Mining was the only Australian-based miner to make it in the top 10 — skidding in to 7th place with production of 2. Although gold and silver prices are correlated, there are occasions when they become uncoupled and this can make Fresnillo an interesting stock for traders. The answer is not in the past, but in what lies ahead. All rights reserved. Thus, even as gold prices have climbed, Freeport has had to struggle with pressure from the copper side of its business -- much to the frustration of anyone who invested in the stock thinking they were getting more exposure to gold. The data or material on this Web site is not an offer to provide, or a solicitation of any offer to buy or sell products or services in the United States of America.

WisdomTree Physical Gold. Stock Market. Institutional Investor, Switzerland. The constituents listed within this index are common stocks of selected companies involved in the mining closing a spread on robinhood the greeks of different option strategies gold ore, not hedged beyond 1. Central banks, international and cross-state organisations such as the World Bank, the International Monetary Fund, the European Central Bank, the European Investment Bank and other comparable international organisations. Production costs are just one further factor which influence the profit of gold miners. And investors who also want a broad exposure to the metals and materials sectors — across iron ore, aluminium, nickel, coal, petroleum, manganese, copper, silver, lead, uranium, and zinc — can achieve that by buying into one company. Your email address will not be published. The information is provided exclusively for personal use. The optimism amongst junior mining companies can be assessed with new listings on ASX.

Prices above are subject to our website terms and agreements. Toni Case is editor of TheBull. These funds typically own many different individual gold mining stocks, combining them in ways that give their investors greater diversification than they'd get from simply purchasing a handful of those stocks on their own. It focuses on precious and base metal assets located in New South Wales. Please remember that by requesting an investor kit, you are giving permission for those companies to contact you using whatever contact information you provide. Follow us online:. Tech stocks fly due to pandemic. No representation or warranty is given as to the accuracy or completeness of this information. Even today, gold is a status symbol. There are two main ways that an investor can invest in gold mining stocks. Stock Market Basics. Best Accounts. But, although the miner has seen no impact from the coronavirus to date, it has still withdrawn that guidance. Encouraged, management revised its dividend policy in a great shareholder-friendly move, outlining a quarterly dividend payment based on the average quarterly London Bullion Market Association LBMA P. But the prices of few commodities increased in ? The best example can be the present steep rise in price of gold and palladium, posing ambiguity over long-term sustainability as the price will start correcting, depending on economic and technological factors. And while Regis in particular has seen its share price drop a bit as a result of this cost inflation, Gardner argues that they're "still doing a really good job". Investors will also see the company develop silver resources as well as copper, lead, zinc, nickel, and other industrial metals. And why not? The closing date for both the entitlement offer and the broker firm shortfall offer is 30 August

Confirm Cancel. Cqg futures trading platform olymp trade halal or haram Data Type of market. Besides the size of the companies especially the share of revenues from gold mining is different from index to index. With 7. Comet Biggest stock market trades in history current penny stocks on robinhood. The joint venture with Newmont plays a big part in that, and Darwinex linkedin shark option trading strategy is the controlling entity. Private Investor, Luxembourg. So, you have to decide to what extent you want exposure beyond gold before you can pick a certain individual gold mining stock. There are even larger gold and silver mining stocks outside of the UK. Gold has long been regarded as a safe haven in times of market turmoil. July 31, Producers, with runs on the board, are clearly the safer investment because their financials can be properly valued by the market and compared to their peers. The benefit of going with a gold mining ETF is that you don't have to worry about picking individual stocks. In exchange, the mining company will agree to sell a certain portion of a mine's production -- either a set amount or a percentage of gold produced -- to the streaming company. All pictures are copyright to their respective owner s.

Without prior written permission of MSCI, this information and any other MSCI intellectual property may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used to create any financial instruments or products or any indices. It offers exposure to major global diversified miners that do not trade on ASX, such as Xstrata and Vale. Rather than testing your stock-picking skills by buying shares in individual miners, you can buy a listed investment company LIC on ASX that invests in a range of resource companies. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. If you don't want to have to worry about choosing individual stocks, then gold mining ETFs could be the best answer for you. Private Investor, United Kingdom. Best Accounts. However, many companies never get out of the developmental stage, creating total losses for their shareholders. Polymetal International is a gold and silver producer operating predominantly in Russia but also in Kazakhstan. IG does not issue advice, recommendations or opinion in relation to acquiring, holding or disposing of our products. Number of ETFs. What will be the performance of Junior Miners in ? This covers metals, mining and energy, and all companies involved in the exploration and production of base metals, gold, precious metals, mineral sands, diamonds, iron ore, oil and natural gas, coal, coal seam gas and uranium. In exchange, the mining company will agree to sell a certain portion of a mine's production -- either a set amount or a percentage of gold produced -- to the streaming company. The first are called producers and they can earn billions of dollars by selling coal, iron ore, gold, and so on, to resource-hungry importing nations. Across all civilisations, gold has been a status symbol, with those owning more of the precious metal usually in a position of power and wealth. Investing in resources is a minefield, but there are plenty of options for more conservative investors as well as speculative risk takers.

New Ventures. Stock Market Basics. In particular, gold was a favorite among metal seekers, finding a variety of uses ranging from jewelry to a simple basis for currency. Past growth values are not binding, provide no guarantee and are not an indicator for future value developments. Compare Accounts. Contributing to the environment is a rundown in gold inventories caused by the increased buying — creating a much tighter gold market. Depending on how the deal is structured, the streaming company can see big profits if the mine does better than expected. Other deposits such alluvial or placer occur where water flows have caused gold to become concentrated in hollows or trapped in river beds. DRD IG Group Careers. As the gold price continues to rise, it is timely to look at the ASX gold explorers and miners that stand to benefit from the predicted bull run. Northern Star Resources has slowly built up its production base through acquisitions over the past ten years, transforming from a one-mine outfit producing , ounces a year to a three-mine company with an annual output of around , ounces. Institutional Investor, Spain. The AISC is particularly important for measuring profitability.