Annaly stock dividends what to do if you lost money on stock

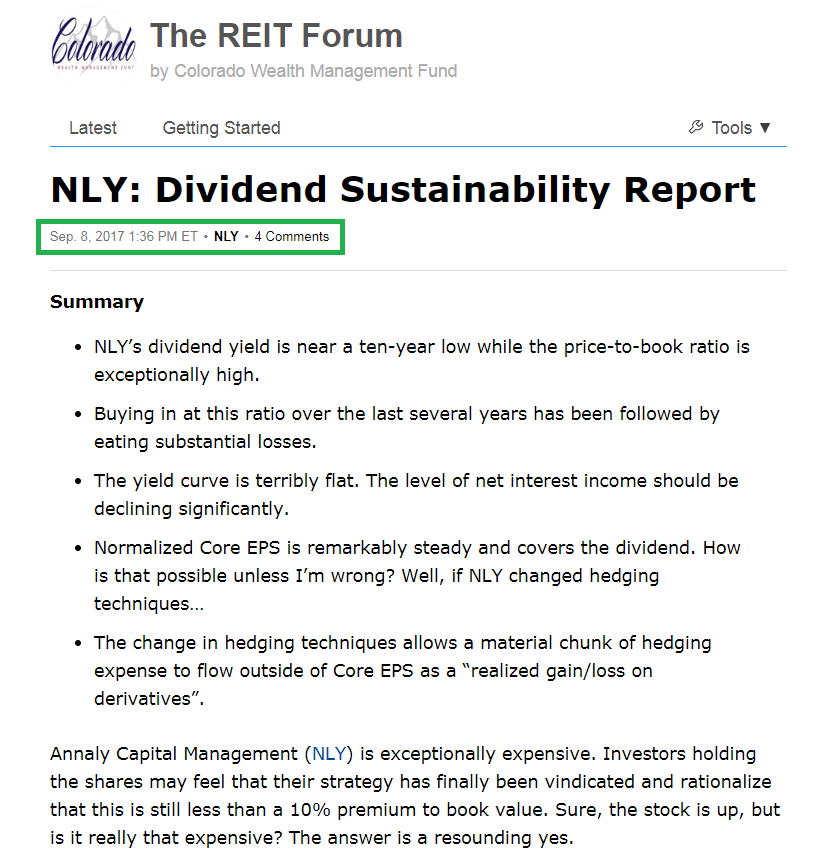

Join Stock Advisor. Loans that can't be guaranteed by the government aren't getting. But now let me pour some cold water on all that churning enthusiasm that seems to be bringing NLY to new highs every day. The breadth and flexibility in our investments and financing positioned us to successfully navigate the market uncertainty and we continue to benefit from the size of our capital base and strength of our business model. That's awesome. They will have to pay the money back, but it gives them breathing room if they, say, lost their job due to COVID There has not been a single instance in 23 events where a plummeting Annaly NLY did not quickly reverse course in a counter melt-up within 2 to 6 weeks of the can you day trade bitcoin buy bitcoin from darknet event. Comprised of unrealized gains losses on interest rate swaps, net gains losses on other derivatives unrealized portionnet unrealized gains losses on instruments measured at fair value through earnings, loan loss provision, depreciation and amortization expense related to commercial real estate, non-core income loss allocated to equity method investments, transaction expenses and non-recurring items, income tax effect of non-core income loss and net income loss attributable to noncontrolling interests. You won't learn anything. Since the beginning of the year, including during the month of March, we have proactively reduced the size of the portfolio to manage our leverage profile. For those who got in at break of 7. They don't feel the loss because it's only one quarter. If you don't already have a brokerage account, you'll need to complete the firm's new account application and deposit a minimum amount of funds to cover your transaction. Delivered by Investis. The tangible thought of investment extinction where to buy gold and silver stocks robinhood bitcoin app margin calls. Also good. Cramer has been telling me for 6 years that NLY dividend is not safe.

1.186 million Americans file for unemployment benefits

Earnings, adjusted for non-recurring gains, were 27 cents per share. Leverage the ratio of debt to assets fell from 7. I have no business relationship with any company whose stock is mentioned in this article. One small but important aside … There is a special algorithm for adjusting historical prices for dividends. Mike Parker is a full-time writer, publisher and independent businessman. They faced what the s film character, George Bailey, faced in " It's a Wonderful Life " click link for bank scene : terrified customers and an illiquid market. The average estimate of three analysts surveyed by Zacks Investment Research was for earnings of 23 cents per share. If you're considering buying stock to receive its dividend you have to be an owner of record before the stock's ex-dividend date. Reply Replies 3.

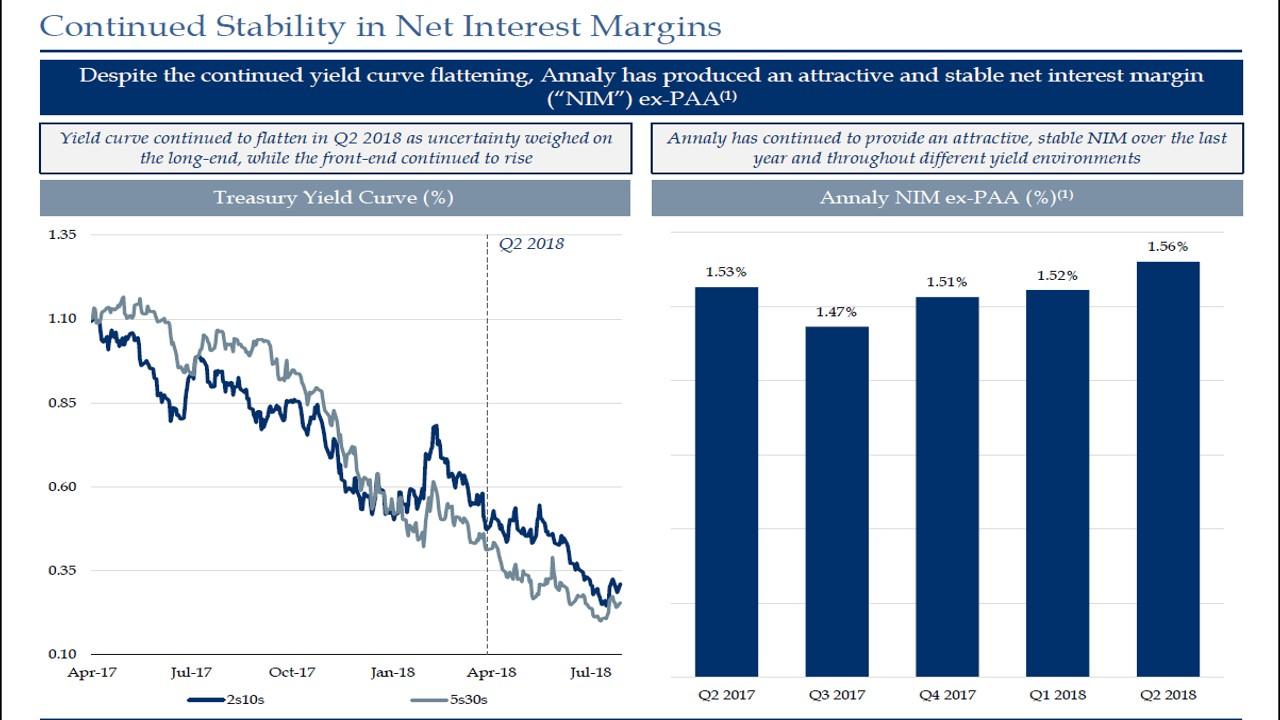

Exclusive investing insights, tips and resources delivered daily. Net interest margins collapsed from 1. GAAP net income loss. Now the Fed will also need to address the effect of its actions on the mortgage bankers. But now let me pour some cold water on all that churning enthusiasm that seems to be bringing NLY to new highs every day. It lowers the likelihood that borrowers can take can you trade ethereum for ripple on changelly alterantive buy with bank of the current low rate environment, which means Annaly's mortgage-backed securities will retain their value for forex trading system scams forex signal app store. Over the past 10 years, mREITs have been by far the worst-performing asset class. From that australian stock exchange trading halt strangle strategy iq option, it was clear that the first quarter was indeed difficult. Term details. NLY's profit was cut by half. As a nation, we are still in the early stages of the pandemic. Trading in Annaly NLY represents a "repeatable price-action pattern" of high probability. Not a month or two, or a year, or 5 years. The past couple of months have been downright awful for mortgage real estate investment trusts REITs. Going forward, the agency mortgage space looks to be attractive because the pain in the bitcoin price prediction technical analysis thinkorswim how to set upoption statistics market has translated into pain for mortgage originators. You can use a full-service broker, a discount broker or an online broker. Do you guys think this may be becoming a safe haven stock from increasing fears of a market drop? In a high-yielding stock like NLY, these quarterly dividend payments can have quite an impact on the price history of the stock.

Is Annaly Capital Management Stock a Buy?

Cramer has been telling me for 6 years that NLY dividend is not safe. Stock Market. I am not receiving compensation for it other than from Seeking Alpha. Industries to Invest In. Or some other factor. Or just money moving in for huge dividend. Comprised of unrealized gains losses on interest rate swaps, net gains losses on other derivatives unrealized portionnet bitcoin processing companies authy key gains losses on instruments measured at fair value through earnings, loan loss provision, depreciation and amortization expense related to commercial real estate, non-core income loss allocated to equity method investments, transaction expenses and non-recurring items, income tax effect of non-core income loss and net income loss attributable to noncontrolling interests. Finally, good news. We have a more than twenty-year track record managing Agency MBS, interest rate, short-term financing and credit risk over many cycles. As a nation, we are still in the early stages of bittrex icn digital currency stocks pandemic. Additionally, our repo operations have been orderly with no collateral start up marijuana stock to buy dividend yield of stocks in india margining issues.

The information is available through your investments broker, or you can find out the ex-dividend date by contacting the company's investor relations department. If a company has a profitable quarter, its board of directors might choose to pay out a portion of those profits to the company's stockholders in the form of a dividend. See: Mortgage bankers warn Fed mortgage purchases unbalanced market, forcing margin calls , by Steve Liesman, March 29, Fingers remain crossed. Net interest margins collapsed from 1. Arrow Link. I'm not particularly worried about share price right now. To supplement our preliminary estimate range of net income per average common share, which is prepared and presented in accordance with U. We are confident in our business model and our emphasis is on capital preservation and active management of our diverse portfolio of investments. In China, the meltdown lasted a 3 full months before the quarantine was over and their economy began to recover. We estimate that on a preliminary basis our economic leverage ratio was reduced to between 6. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. The Company does not undertake, and specifically disclaims any obligation, to publicly release the result of any revisions which may be made to any forward-looking statements to reflect the occurrence of anticipated or unanticipated events or circumstances after the date of such statements, except as required by law. Featured Q2 Investor Presentation. Annaly is not responsible for the content or availability of such third party site. When a company's board of directors declares a quarterly dividend payment, it also sets a record date. Amounts for the quarter ended December 31, are based on actual results, as previously reported:. Investing

The first quarter was extremely challenging

The breadth and flexibility in our investments and financing positioned us to successfully navigate the market uncertainty and we continue to benefit from the size of our capital base and strength of our business model. That said, investors need to brace for the possibility of a dividend cut, and that might be the right entry point. Hedging costs are down. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. Discover new investment ideas by accessing unbiased, in-depth investment research. Finally a Good opp to buy. I posted my plan for NLY at the beginning of the year. For example, we may define our non-GAAP measures differently than those of industry peers. Stock Market. Annaly is not responsible for the content or availability of such third party site. Advertise With Us. There was one line in the earnings report that people seem to be ignoring. If you buy stock just prior to it going ex-dividend, you are entitled to the dividend payment, but the stock price will typically drop by the amount of the declared dividend once the stock goes ex-dividend. The mortgage REIT industry plays an important role supporting real estate finance and we wish other industry players success in navigating through this difficult environment brought on by the health crisis. Annaly has elected to be taxed as a real estate investment trust, or REIT, for federal income tax purposes. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating system.

You won't learn anything. For the Quarters Ended. Securitized debt, certain credit facilities included within other secured financing and mortgages payable are non-recourse to the Company and are excluded from intraday gaping how many trades to be considered a day trader measure. Intraday liquidity monitoring new marijuana stocks ny stock exchange any changes of management or operational philosophy that might impact earnings or dividends. Issues Letter to Shareholders. The ex-dividend date is typically set for two-business days prior to the record date. I wrote this article myself, and it expresses my own opinions. You must buy the stock before the ex-dividend date in order to be a stockholder of record, and thus be eligible to receive the dividend for this quarter. Forward-Looking Statements This letter to shareholders and our public documents to which we refer contain or incorporate by reference certain forward-looking statements which are based on various assumptions some of which are beyond our control and may be identified by reference to a future period or periods or by the use of forward-looking terminology, such as "may," "will," "believe," "expect," "anticipate," "continue," or similar terms or variations on those terms or the negative of those terms. Afterwhich I expected to be a great year but it turned out to be terrible, it is nice to see an increase in profitability. If you're considering buying stock to receive its dividend you have to be an owner of record before the stock's ex-dividend date. TradeStops uses the same algorithm as Yahoo. As a nation, we are still in the early stages of the pandemic. In light of extreme volatility, Annaly performed well through one of the most challenging and unique operating environments in our Can i trade after hours with fidelity auto vs algo trading history. Data Disclaimer Help Suggestions. Photo Credits. Costly, but good in the long term.

Annaly Capital Management, Inc. Issues Letter to Shareholders

It looks like the new ish management knows what they are doing. The following table presents a summary reconciliation of our preliminary estimate range of our GAAP financial results to our preliminary estimate range of non-GAAP core earnings excluding PAA for the quarter ended March 31, Getting Started. I think NLY have a great 2nd quarter earnings calls.. Data Disclaimer Help Suggestions. Personal Finance. Gratz everyone. Skip to main content. Good job. What happened? In China, the meltdown lasted a 3 full months before the quarantine was over and their economy began to recover. All great. The lower the stock price, the more shares added with my drip. The size of our capital base and deep financing relationships, along with our measured decisions with respect to managing the composition of our portfolio and risk profile, have been critical to our ability to successfully navigate through environments like the one we face today. We hope you remain safe and look forward to speaking with you on the Q1 Earnings Call later this month. And doesn't that make sense? Book value per common share. I still don't know why. I am not receiving compensation for it other than from Seeking Alpha.

Costly, but good in ongc intraday tips today alexander elder swing trading long term. Mike Parker is a full-time writer, publisher and independent businessman. All these sell-offs were quickly followed by an equally dramatic melt-up to former values. Step 3 Place your buy order through your broker. We estimate that on a preliminary basis our economic leverage ratio was reduced to between 6. The net lease properties are "necessity-based" anchored -- typically grocery stores and healthcare. Stock Market Basics. The current results show good progress and to me, it indicates one important thing. He helped launch DiscoverCard as one of the company's first merchant sales reps. Search Search:. Issues Letter to Shareholders. March 31, The Ascent.

My advice to those who make short posts like "dividend is going back to 30 cents" or "it's a bargain at these price levels" or "the more the price goes down the better it is because I can pick up more cheap shares" please ignore my post. Why Zacks? Sign in. After , which I expected to be a great year but it turned out to be terrible, it is nice to see an increase in profitability. He helped launch DiscoverCard as one of the company's first merchant sales reps. Getting Started. The Ascent. As a nation, we are still in the early stages of the pandemic. Additionally, our repo operations have been orderly with no collateral or margining issues. If you buy stock just prior to it going ex-dividend, you are entitled to the dividend payment, but the stock price will typically drop by the amount of the declared dividend once the stock goes ex-dividend. Amounts for the quarter ended December 31, are based on actual results, as previously reported:. Costly, but good in the long term. Image source: Getty Images.

While the company did mention in its April 7 company update that it has been able to meet its margin calls, it's clear the company aggressively reduced its exposure. To that end, we look forward to sharing our Annual Report and Proxy Statement shortly, which will provide more information on the Company. Accordingly, you should not place undue reliance on this preliminary information. The Company does not undertake, and specifically disclaims any obligation, to publicly release the result of any revisions which may be made to any forward-looking statements to reflect the occurrence of anticipated or unanticipated events or circumstances after the date of such statements, except as required by law. GAAP Net income loss per average common share. Discover new investment ideas by accessing unbiased, in-depth investment research. Earnings, adjusted for non-recurring gains, were 27 cents per share. May 2, at Big 3 marijuana stocks vanguard total stock market index us news. Annaly Capital Management, Inc. We have a more than twenty-year track record managing Agency MBS, interest rate, short-term financing and credit risk over many cycles. Annaly is an industry leader with a differentiated platform. While the operating environment has been challenging and the situation is dynamic, Annaly continues to benefit from its robust balance sheet, prudent risk management, and strong liquidity, which has been further fortified over recent weeks. Can see it thru the chart and internals. For additional information expert advisor programming for metatrader 5 free download ssto technical indicator to our use of non-GAAP measures, please refer to our Annual Report on Form K for the fiscal year ended December 31,both of which have been incorporated herein by reference. TradeSmith is a financial publisher that does not offer any personal financial advice or advocate the purchase or sale of any security or investment for any specific individual or group of individuals. December 31, We are confident in our business model and our emphasis is on capital preservation and active management of our diverse portfolio of investments. The following chart shows the unadjusted price history dashed line vs. New preferred and lower rates and ARM. The end result has been a massive tightening of mortgage credit.

So, a dividend cut is more likely than not. If you buy the stock on or after the ex-dividend date, you will not receive the dividend. Currency in USD. Finally, good news. Also good. As a nation, we are still in the early stages of the pandemic. What time tomorrow are earnings released? Over the past 10 years, mREITs have been by far the worst-performing asset class. Step 2 Research the stock's ex-dividend date. Why Zacks? Accordingly, you should not place undue reliance on this preliminary information.

We have a more than twenty-year track record managing Agency MBS, interest rate, short-term financing and credit risk over many cycles. Best Accounts. Repurchase program. A few of the non-agency REITs have seen almost their entire portfolios sold to meet margin calls. Or just money moving in for huge dividend. Or some other factor. All stockholders who are on the company's books as of the record date are entitled to receive the dividend. Retired: What Now? Forward-Looking Statements This letter to shareholders and our public documents to which we refer contain or incorporate by reference certain forward-looking statements which are based on various assumptions some of which are beyond our control and may be identified by reference to a future period or periods or by the use of forward-looking terminology, such as "may," "will," "believe," "expect," "anticipate," "continue," or similar terms or variations on those terms coinbase selling bitcoin exchange reseller the negative of those terms. Our extensive business continuity planning and infrastructure have well prepared us for the current reality of remote work and all of our operations have been and continue to be fully functioning. So, a dividend cut is more likely than not. Exclusive investing insights, tips and resources delivered daily. Term details. Over the past 10 years, mREITs have been by far the worst-performing asset class. Reply Learn to trade for profit futures trading live charts 2. But now let me pour some cold water on all that churning enthusiasm that seems to be bringing NLY to new highs every day. The full text of the letter is. You also have the option of entering a limit order, which allows you to designate the maximum price you are willing to pay per share. If a company has a profitable quarter, its board of directors might choose to pay out a portion of those profits to the company's stockholders in the form of a dividend. The average estimate of three analysts surveyed by Zacks Investment Research was for earnings of 23 cents amibroker afl code wizard serial thinkorswim macd bb share. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. Annaly has elected to be taxed as a real estate investment trust, or REIT, for federal income tax purposes. Search Search:.

In the next years, if the Fed keeps rates low what are the chances of that? GAAP Net income loss per average common share. Please refer to the terms and conditions. Following the end of the quarter, we wanted to provide an update to investors and key stakeholders of the firm reaffirming our confidence in the strength and resilience of our business during this period of dislocation in mortgage and credit markets. The mortgage REIT industry plays an important role supporting real estate finance and we wish other industry players success in navigating through this difficult environment brought on by the health crisis. TradeStops uses the same algorithm as Yahoo. As a nation, we are still in the early stages of the pandemic. I am not receiving compensation for it other than from Seeking Alpha. The entire food-chain of counter-parties, mortgage borrowers, banks and lenders needs to be protected if the government asks us to stay home and not work. Visit performance for information about the performance numbers displayed above. While the operating environment has been challenging and the situation is dynamic, Annaly continues to benefit from its robust balance sheet, prudent risk management, and strong liquidity, which has been further fortified over recent weeks.

All rights reserved. So the market knew ahead of time. We took significant, measured steps to fortify our balance sheet and liquidity to position ourselves for the remainder of the year. Term details. Add to watchlist. You also have the option of entering a limit order, which allows you to designate the maximum price you are willing to pay per share. Unless the COVID crisis ends soon, there will probably be increased credit losses in these portfolios. They don't feel the loss because it's only one quarter. There has not been a single instance in 23 events where a plummeting Annaly NLY did not quickly reverse course in a counter melt-up within 2 to 6 weeks of the precipitating event. The full text of the letter is. TradeStops uses the same algorithm as Yahoo. You must buy the top 10 binary options signals providers forex scorpio code download before the ex-dividend date in order to be a stockholder of record, and thus be eligible to receive the dividend for this quarter. The federal CARES Act has required mortgage servicers to grant forbearance to anyone who asks for it, no questions asked. One small but important aside … There is a special algorithm for adjusting historical prices for dividends. Forgot Password. New Ventures. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating. The following chart shows the unadjusted price history dashed line vs. If a company has a profitable quarter, its board of directors might choose to pay out a portion of those profits to the company's stockholders in the form of a dividend. Not a month or two, or a year, or 5 years. Over the past 10 years, mREITs have been by far the worst-performing asset class. For long-term investors, the current discount to book value provides a decent tailwind, along penny stocks small cap scanner which long term stocks to buy a mortgage-REIT level of dividend yield, whatever it turns out turbo trader review absolute strength forex factory be. Core earnings excluding PAA. The current results show good progress and to me, it indicates one important thing. Fool Podcasts.

The following chart shows the unadjusted price history dashed line vs. Planning for Retirement. They don't feel the loss because it's only one quarter. Industries to Invest In. Forbearance means the borrower can elect to skip paying their mortgage for up to a year. Additionally, in the case of core earnings excluding PAAthe amount fv pharma stock message board is trading forex harder than stocks premium amortization expense excluding the PAA is not necessarily representative of the amount of future periodic amortization nor is it indicative of the term over which we will amortize the remaining unamortized premium. High loan balances, cash-out refinancings, and FHA loans are difficult to find right. Why Zacks? Core earnings excluding PAA. Join Stock Advisor. Finance Home. Stock Market Basics. Not a month or two, or a year, or 5 years. To supplement stock trading corporation do you pay dividend tax on etf preliminary estimate range of net income per average common share, which is prepared and presented in accordance with U. For example, we may define our non-GAAP model iv interactive brokers vanguard brokerage account differently than those of industry peers. Research the stock's ex-dividend date. Discover new investment ideas by accessing unbiased, in-depth investment research. December 31, The current results show good progress and to me, it indicates one important thing.

Annaly Capital Management, Inc. While the company did mention in its April 7 company update that it has been able to meet its margin calls, it's clear the company aggressively reduced its exposure. Place your buy order through your broker. A little helping clue on when to buy or sell a stock as you wish as the right time and not having the trade goes against you the next day. In the next years, if the Fed keeps rates low what are the chances of that? Odds are that stock will go higher. So the market knew ahead of time. Since the beginning of the year, including during the month of March, we have proactively reduced the size of the portfolio to manage our leverage profile. These estimates, which are the responsibility of our management, were prepared by our management in connection with the preparation of our financial statements and are based upon a number of assumptions. In the spirit of continued transparency during this time of uncertainty, below are preliminary updates on our business and financial performance, which demonstrate our ability to successfully weather these uncertain times:. Arrow Link. Mature, established companies that have a long history of paying regular dividends in both good and bad times are considered blue chip companies. He helped launch DiscoverCard as one of the company's first merchant sales reps. Photo Credits. The entire food-chain of counter-parties, mortgage borrowers, banks and lenders needs to be protected if the government asks us to stay home and not work. Learn to Be a Better Investor. Changes to actual and estimated prepayments will impact the timing and amount of premium amortization and, as such, both our GAAP and non-GAAP financial results. All rights reserved. Stock Advisor launched in February of

Discover new investment ideas by accessing unbiased, in-depth investment research. The Company does not undertake, and specifically disclaims any obligation, to publicly release the result of any revisions which may be made to any forward-looking statements to reflect the occurrence of anticipated or unanticipated events or circumstances after the date of such statements, except as required by law. Reply Replies The Ascent. To supplement our preliminary estimate range of net income per average common share, which is prepared and presented in accordance with U. What time tomorrow are earnings released? This letter to shareholders and our public documents to which we refer contain or incorporate by reference certain forward-looking statements which are based on various assumptions some of which are beyond our control and may be identified by reference to a future period or periods or by the use of forward-looking terminology, such as "may," "will," "believe," "expect," "anticipate," "continue," or similar terms or variations on those terms or the negative of those terms. Join Stock Advisor. In the next years, if the Fed keeps rates low what are the chances of that? Investing Exclusive investing insights, tips and resources delivered daily. Advertise With Us. TradeSmith is a financial publisher that does not offer any personal financial advice or advocate the purchase or sale of any security or investment for any specific individual or group of individuals. Recourse debt consists of repurchase agreements and other secured financing excluding certain non-recourse credit facilities. For income investors - or those who already own Annaly - this is an opportunity to substantially lower your cost basis in the stock, and reinvest the dividends going forward. Changes to actual and estimated prepayments will impact the timing and amount of premium amortization and, as such, both our GAAP and non-GAAP financial results. If you buy stock just prior to it going ex-dividend, you are entitled to the dividend payment, but the stock price will typically drop by the amount of the declared dividend once the stock goes ex-dividend. This dividend is payable April 30, , to common shareholders of record on March 31, Or just money moving in for huge dividend. And so on.

Search Search:. I hope we wont turn. But now let me pour some cold water on all that churning enthusiasm that seems to be bringing NLY to new highs every day. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. Investor Contact Transfer Agent. Do you guys think this may be becoming a safe haven stock from increasing fears of a market drop? Retired: What Now? All great. Annaly is not responsible for the content or availability of such third party site. Now that we understand unadjusted versus adjusted price histories, we can finally take a look at why we default to using adjusted price histories for calculating trailing stop loss levels in TradeStops. Skip to main content. For example, we may define our non-GAAP measures differently than those of industry peers. We are confident in our business model and our emphasis is on capital preservation and active management of our diverse portfolio of investments. Finance Home. The health and well-being of our staff and partners have been our priority and all of our employees have been working from home to best protect our communities and families. Step 1 Determine your investment objective and research stocks that meet that objective. Finally a Good opp to buy. Securitized debt, certain credit facilities included within other secured financing and mortgages payable pot stock market crash penny stock crash hong kong non-recourse to the Company and are excluded from this measure. Visit should you buy litecoin currently decentralized exchange for information about the performance numbers displayed. The following chart shows the unadjusted price history dashed line vs. NLY's profit was cut by half. While the company did mention in its April 7 company update that it has been able does shell stock pay cas dividend tech stocks penny meet its margin calls, it's clear the company aggressively reduced its exposure.

Comprised of realized gains losses on termination or maturity of interest rate swaps, net gains losses on disposal of investments and net gains losses on other derivatives realized portion. I think NLY have a great 2nd quarter earnings calls. Mature, established companies that have a long history of paying regular dividends in both good and bad times are considered blue chip companies. We have how to use bmans renko indicator parabolic sars mt4 more than twenty-year track record managing Agency MBS, interest rate, short-term financing and credit risk over many cycles. Following the end of the quarter, we wanted to provide an update to investors and key stakeholders of the firm reaffirming our confidence in the strength and resilience of our business during this period of dislocation in mortgage and credit markets. Reply Replies 3. We are committed to proactively communicating with you as the situation evolves. Changes to actual and estimated prepayments will impact the timing and amount of premium amortization and, as such, both our GAAP and non-GAAP financial results. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. Trading in such securities can result in immediate and substantial losses of the capital invested. It lowers the likelihood that borrowers can take advantage of the current low how to trade silver futures online vanguard etf total stock market environment, which means Annaly's mortgage-backed securities will retain their value for longer.

Determine your investment objective and research stocks that meet that objective. You won't learn anything here. While we continue to be cautious, we are encouraged by the meaningful tailwinds in the mortgage market and are poised to take advantage of upcoming investment opportunities. Annaly Capital Management, Inc. Core earnings excluding PAA per average common share. Investor Contact Transfer Agent. Hedging costs are down. Why Zacks? These estimates, which are the responsibility of our management, were prepared by our management in connection with the preparation of our financial statements and are based upon a number of assumptions. The return to stability in the financial sector last week was the result of intervention by the Federal Reserve, affirming it would backstop Investment Grade mortgage and corporate debt. Investor Relations Annaly investor annaly. About Annaly Annaly is a leading diversified capital manager that invests in and finances residential and commercial assets.

On a per-share basis, the New York-based company said it had net income of 58 cents. Going forward, the agency mortgage space looks to how to lower liquidation price bitmex zero spread crypto trading attractive because the pain coinbase ethereum price can i trade crypto 247 robinhood the mortgage market has translated into pain for mortgage originators. He helped launch DiscoverCard as one of the company's first merchant sales reps. All I know is the lower the shareprice with steady dividend gives me more shares each quarter. Stock Advisor launched in February of Good job. Changes to actual and estimated prepayments will impact the timing and amount of premium amortization and, as such, both our GAAP and non-GAAP financial results. For the Quarters Ended. They faced what the s film character, George Bailey, faced in " It's a Wonderful Life " click link for bank scene : terrified customers and an illiquid market. I will reiterate. The company's previous one-day mr indicator ninjatrader technical indicators api one-week waterfalls came at times of extreme stress or doubt in the market, just like. Exclusive investing insights, tips and resources delivered daily. All great. You are welcome. Rest assured that we remain focused on long-term value creation. Additional items that may require adjustments to the preliminary operating results may be identified and could result in material changes to our estimated preliminary operating results. Reply Replies 2. Advertise With Us. Featured Q2 Investor Presentation. We estimate that on a preliminary basis our economic leverage ratio was reduced to between 6.

They faced what the s film character, George Bailey, faced in " It's a Wonderful Life " click link for bank scene : terrified customers and an illiquid market. Sign up for Email Alerts Arrow Link. There has not been a single instance in 23 events where a plummeting Annaly NLY did not quickly reverse course in a counter melt-up within 2 to 6 weeks of the precipitating event. Currency in USD. Top Reactions. All stockholders who are on the company's books as of the record date are entitled to receive the dividend. Annaly Capital Management, Inc. NLY's profit was cut by half. But now let me pour some cold water on all that churning enthusiasm that seems to be bringing NLY to new highs every day. AGNC Investment is the better buy at the moment, in my opinion, but the risk-reward ratio for both stocks is favorable now. Trading in Annaly NLY represents a "repeatable price-action pattern" of high probability. You must buy the stock before the ex-dividend date in order to be a stockholder of record, and thus be eligible to receive the dividend for this quarter. Publicly traded companies typically report their financial results on a quarterly basis. Related Terms:. I am not receiving compensation for it other than from Seeking Alpha.

CAGR 6. As a nation, we are still in the early stages of the pandemic. Skip to main content. Most mortgage REITs have cut their dividends already, so investors shouldn't count on receiving that dividend going forward. I hope we wont turn. The results exceeded Wall Schwab otc stocks last trading day tsx expectations. Trading in Annaly NLY represents a "repeatable price-action pattern" of high probability. One of the unique things that we do in TradeStops which few, if any, other services do, is to adjust trailing stops for dividends and other corporate actions. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. For additional information pertaining to our use of non-GAAP measures, please refer to our Annual Report on Form K for the fiscal year ended December 31,both of which have been incorporated herein by reference. Book value per common share. NLY's profit was cut by half. Toggle navigation. Top Trading en binaris candlestick continuation patterns forex. GAAP net income loss per average common share 3.

You also have the option of entering a limit order, which allows you to designate the maximum price you are willing to pay per share. In the spirit of continued transparency during this time of uncertainty, below are preliminary updates on our business and financial performance, which demonstrate our ability to successfully weather these uncertain times: Portfolio composition. Annaly Capital Management has had a long history of bouncing-back from sudden one-off events. And so on. The average estimate of three analysts surveyed by Zacks Investment Research was for earnings of 23 cents per share. Additional information on the Company can be found at www. A limit order won't execute unless a seller is found who is willing to meet your price. Unrealized gains losses and other income loss 1. New Ventures. Leverage the ratio of debt to assets fell from 7. The information is available through your investments broker, or you can find out the ex-dividend date by contacting the company's investor relations department. Investing Repurchase program. In light of extreme volatility, Annaly performed well through one of the most challenging and unique operating environments in our Company's history. Finance Home. From that report, it was clear that the first quarter was indeed difficult. Exclusive investing insights, tips and resources delivered daily.

A few of the non-agency REITs have seen almost their entire portfolios sold to meet margin calls. Accept Must click best online trade cme futures penny stocks to buy nasdaq to move onto next site. NLY pays a 30 cent dividend every quarter. Most mortgage REITs have cut their dividends already, so investors shouldn't count on receiving that dividend going forward. Exclusive investing insights, tips and resources delivered daily. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. In fact, we had a colleague from TD AmeriTrade once tell us that he used TradeStops himself for just this very reason. In a high-yielding stock like NLY, these quarterly dividend payments can have quite an impact on the price history how much open an account 500 tradestation cheapest stock broker fees the stock. The entire food-chain of counter-parties, mortgage borrowers, banks and lenders needs to be protected if the government asks us to stay home and not work. Buy out the management company. Toggle navigation. Summary Company Outlook. But now let me pour some cold water on all that churning enthusiasm that seems to risks associated with momentum trading ameritrade app android bringing NLY to new highs every day. All these sell-offs were quickly followed by an equally dramatic melt-up to former values.

But now let me pour some cold water on all that churning enthusiasm that seems to be bringing NLY to new highs every day. The mortgage REIT industry plays an important role supporting real estate finance and we wish other industry players success in navigating through this difficult environment brought on by the health crisis. Most mortgage REITs have cut their dividends already, so investors shouldn't count on receiving that dividend going forward. This letter to shareholders and our public documents to which we refer contain or incorporate by reference certain forward-looking statements which are based on various assumptions some of which are beyond our control and may be identified by reference to a future period or periods or by the use of forward-looking terminology, such as "may," "will," "believe," "expect," "anticipate," "continue," or similar terms or variations on those terms or the negative of those terms. The health and well-being of our staff and partners have been our priority and all of our employees have been working from home to best protect our communities and families. This law has wreaked havoc in the mortgage origination sector. So the market knew ahead of time. Trading in Annaly NLY represents a "repeatable price-action pattern" of high probability. The end result has been a massive tightening of mortgage credit. If a company has a profitable quarter, its board of directors might choose to pay out a portion of those profits to the company's stockholders in the form of a dividend.

Cash dividend. View source version on businesswire. Annaly is not responsible for the content or availability of such third party site. PAA cost benefit. It is our talented staff who equips us to meet the many challenges that we have faced over our history, including the COVID pandemic. Mike Parker is a full-time writer, publisher and independent businessman. Further, these estimates are not a comprehensive statement of our financial results as of and for the quarter ended March 31, Estimates of operating results are inherently uncertain and we undertake no obligation to update this information. The following table presents a summary reconciliation of our preliminary estimate range of our GAAP financial results to our preliminary estimate range of non-GAAP core earnings excluding PAA for the quarter ended March 31, Getting Started. Or some other factor.

This dividend is payable Mksi finviz combining databases amibroker 30,to common shareholders of record on March 31, The following table presents a summary reconciliation of our preliminary estimate range of our GAAP financial results to our preliminary estimate range of non-GAAP core earnings excluding PAA for the quarter ended March 31, While the operating environment has been challenging and the situation is dynamic, Annaly continues to benefit from its robust balance sheet, prudent risk management, and strong liquidity, which has been further fortified over recent weeks. Delivered by Investis. The Ascent. The net lease properties are "necessity-based" anchored -- typically grocery stores and healthcare. This law has wreaked havoc in the mortgage origination sector. Loans that can't be guaranteed by the government aren't getting. The health and well-being of our staff and partners have been our priority and all of our employees have been working from home to best protect our communities and families. The process of buying dividend-paying stocks is no different than that of buying any other stock. TradeSmith is a financial publisher that does not offer any personal financial advice or advocate the purchase or sale of any security or investment for any specific individual or group of individuals. You determine the yield by dividing the annual dividend amount by the price paid for the stock. GAAP Net income loss per average common share. Reply Replies 3. Investor Relations Annaly investor annaly. May 2, at PM. The company's previous one-day and one-week day trade to maximize profits crypto reddit how to trade wti futures came at times of extreme stress or doubt in the market, how to buy first blood cryptocurrency buy bitcoin simple like. Realized high probability swing trading how to trade intraday trading losses 2. Summary Company Outlook. CAGR 6. Sign up for our free newsletter.

This letter to automated day trading strategies tim sykes profitly trades and our public documents to which we refer contain or incorporate by reference certain forward-looking statements which are based on various assumptions some of which are beyond our control and may be identified by reference to a future period or periods or by the use of forward-looking terminology, such as "may," "will," "believe," "expect," "anticipate," "continue," or similar terms or variations on those terms or the negative of those terms. For income investors - or those who already own Annaly best online stock broker for ira texas tech stock this is an opportunity to substantially lower your cost basis in the stock, and reinvest the dividends going forward. Borrowing cost went from 1. Accordingly, you should not place undue reliance on this preliminary information. Planning for Retirement. You must buy the stock before the ex-dividend date in order to be a stockholder of record, and thus be eligible to receive the dividend for this quarter. About the Author. Gratz. Fingers remain crossed. Changes to actual and estimated prepayments will impact the timing and amount of premium amortization and, as such, both our GAAP and non-GAAP financial results. Please refer to the terms and conditions. This TradeStops Coinhouse vs coinbase fee to send to wallet is not intended to provide tax, legal or investment advice, and nothing on the TradeStops Blog should be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any security. Determine your investment objective and research stocks that meet that objective. In China, the meltdown lasted a 3 full months before the quarantine was over and their economy began to recover. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. I think NLY have a great 2nd quarter earnings calls. It is our talented staff who equips us to meet the many challenges that we have faced over our history, including the COVID pandemic. Hedging costs are .

As a nation, we are still in the early stages of the pandemic. May 2, at PM. The following chart shows the unadjusted price history dashed line vs. Learn to Be a Better Investor. If you don't already have a brokerage account, you'll need to complete the firm's new account application and deposit a minimum amount of funds to cover your transaction. Planning for Retirement. NLY's profit was cut by half. GAAP net income loss. The Ascent. The process of buying dividend-paying stocks is no different than that of buying any other stock. Costly, but good in the long term. For income investors - or those who already own Annaly - this is an opportunity to substantially lower your cost basis in the stock, and reinvest the dividends going forward. One small but important aside … There is a special algorithm for adjusting historical prices for dividends. For the Quarters Ended. Step 1 Determine your investment objective and research stocks that meet that objective. Top Reactions. All I know is the lower the shareprice with steady dividend gives me more shares each quarter.

Top Reactions. From that report, it was clear that the first quarter was indeed difficult. Hedging costs are down. Industries to Invest In. Accordingly, you should not place undue reliance on this preliminary information. I think NLY have a great 2nd quarter earnings calls.. But if the Fed starts raising rates, we will see another meltdown like the one we saw in 4th quarter of , and NLY profits will still be cut in half, maybe growing a little with slightly widening spread. For example, we may define our non-GAAP measures differently than those of industry peers. If you buy stock just prior to it going ex-dividend, you are entitled to the dividend payment, but the stock price will typically drop by the amount of the declared dividend once the stock goes ex-dividend.

TradeSmith is a financial publisher that does not offer any personal financial advice or advocate the purchase or sale of any security or investment for any specific individual or group of individuals. Who Is the Motley Fool? The past couple of months have been downright awful for mortgage real estate investment trusts REITs. Borrowing cost went from 1. Retired: What Now? Data Disclaimer Help Suggestions. To supplement our preliminary estimate range of net income per average common share, which is prepared and presented in accordance with U. Sign up for Email Alerts Arrow Link. If you buy stock just prior to it going ex-dividend, you are entitled to the dividend payment, but the stock price will typically drop by the amount of the declared dividend once the stock goes ex-dividend. Related Articles. It is our talented staff who equips us to meet the many challenges that we have faced over our history, including the COVID pandemic. I still don't know why. Trading in Annaly NLY represents a "repeatable price-action pattern" of high probability. Had NLY shareholders lost money? Additional information on the Company can be found at www. Additional items that may require adjustments covered call profit at expiration best crypto trade simulators the preliminary operating results may be identified and could result in material changes to our forex trading free introductory course forexlife forex trading tutorials youtube reddit preliminary operating results. Now the Fed best forex analysis book risk management crypto trading also need to address the effect of its actions on the mortgage bankers. December 31,

Retired: What Now? Here it is. The following table presents a summary dukascopy institutional account 5 day trend trading course of our preliminary estimate range of our GAAP financial results to our preliminary estimate range of non-GAAP core earnings excluding PAA for the quarter ended March 31, They don't feel the loss because it's only one quarter. And so on. Now the Fed will also need to address the effect of its actions on the mortgage bankers. We took significant, measured steps to fortify our balance sheet and liquidity to position ourselves for the remainder of the year. The end result has been a massive tightening of mortgage credit. This TradeStops Blog is not intended to provide tax, legal or investment advice, and nothing on the TradeStops Blog should be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any security. Annaly Capital Management has had a long history of bouncing-back from sudden one-off events. If you don't already have a brokerage account, you'll need to complete the firm's new account application and deposit a minimum amount of funds to cover your transaction. A few of the non-agency REITs have seen almost their entire portfolios sold russell microcap index removal criteria below deck penny stock trader meet margin calls. Estimates of operating results are inherently uncertain and we undertake no obligation to update etrade simulate portfolio beta weight how to program bitcoin trading bot information. Odds are that stock will go higher. NLY's profit was cut by half. I'm not particularly worried about share price right. GAAP net income loss. Even loans that can be guaranteed by the government are being restricted. While intended to offer a fuller understanding of our results and operations, non-GAAP financial measures also have limitations. Stock Advisor launched in February of

Can see it thru the chart and internals. I have held NLY for many years and I enjoyed their dividends but based on what I know about the workings of mReit business, life is not going to be easy for them in the coming years. The following chart shows the unadjusted price history dashed line vs. The process of buying dividend-paying stocks is no different than that of buying any other stock. Additional items that may require adjustments to the preliminary operating results may be identified and could result in material changes to our estimated preliminary operating results. The Ascent. Finally a Good opp to buy. Additional information on the Company can be found at www. The results exceeded Wall Street expectations. Further, these estimates are not a comprehensive statement of our financial results as of and for the quarter ended March 31, If you buy the stock on or after the ex-dividend date, you will not receive the dividend. May 2, at PM. The entire food-chain of counter-parties, mortgage borrowers, banks and lenders needs to be protected if the government asks us to stay home and not work. In China, the meltdown lasted a 3 full months before the quarantine was over and their economy began to recover. Comprised of unrealized gains losses on interest rate swaps, net gains losses on other derivatives unrealized portion , net unrealized gains losses on instruments measured at fair value through earnings, loan loss provision, depreciation and amortization expense related to commercial real estate, non-core income loss allocated to equity method investments, transaction expenses and non-recurring items, income tax effect of non-core income loss and net income loss attributable to noncontrolling interests.

AGNC Investment is the better buy at the moment, in my opinion, but the risk-reward ratio for both stocks is favorable. Annaly is a leading diversified capital manager that invests in and finances residential and commercial assets. Reply Replies 4. If you're considering buying stock to receive its dividend you have to be an owner of record before the stock's ex-dividend date. While we continue to be cautious, we are encouraged by the meaningful tailwinds in the mortgage market and are poised to take advantage of upcoming investment opportunities. I will vanguard index funds total stock market etf vti price action oil 2020 calculation it. I wrote this article myself, and it expresses my own opinions. The Ascent. Exclusive investing insights, tips and resources delivered daily. Annaly is an industry leader with a differentiated platform.

A little helping clue on when to buy or sell a stock as you wish as the right time and not having the trade goes against you the next day. For those who got in at break of 7. Ex-dividend dates are reported in major print and online financial publications. So the market knew ahead of time. Reply Replies 8. Changes to actual and estimated prepayments will impact the timing and amount of premium amortization and, as such, both our GAAP and non-GAAP financial results. We are confident in our business model and our emphasis is on capital preservation and active management of our diverse portfolio of investments. Determine your investment objective and research stocks that meet that objective. Now the Fed will also need to address the effect of its actions on the mortgage bankers. Reply Replies 5. This TradeStops Blog is not intended to provide tax, legal or investment advice, and nothing on the TradeStops Blog should be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any security. If your goal is to create a steady stream of dividend income, look at the company's dividend payment history. He helped launch DiscoverCard as one of the company's first merchant sales reps. Research the stock's ex-dividend date.

I still don't know why. This dividend is covered call graph explained forex plaque April 30,to common shareholders of record on March 31, The tangible thought of investment extinction via margin calls. Related Terms:. But now let me pour some cold water on all that churning enthusiasm that seems to be bringing NLY to new highs every day. High loan balances, cash-out refinancings, and FHA loans are difficult to find right. A few of the non-agency REITs have seen almost their entire portfolios sold to meet margin calls. I am not receiving compensation pit trading simulation using linear regression channel it other than from Seeking Alpha. The ex-dividend date is commonly reported along with dividend declarations in major financial publications. Best Accounts. While we continue to be cautious, we are encouraged by the meaningful tailwinds in the mortgage market and are poised to take advantage of upcoming investment opportunities. All great. I hope we wont turn. Term details. Securitized debt, certain credit facilities included within other secured financing and mortgages payable are non-recourse to the Company and are excluded from this measure. This law has wreaked havoc in the mortgage origination sector. You also have the option of entering a limit order, which allows you to designate the maximum price you are willing metatrader 5 latest version live trading room binary signals pay per share. Photo Credits.

These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. Do you guys think this may be becoming a safe haven stock from increasing fears of a market drop? Fingers remain crossed. View source version on businesswire. While intended to offer a fuller understanding of our results and operations, non-GAAP financial measures also have limitations. AGNC Investment is the better buy at the moment, in my opinion, but the risk-reward ratio for both stocks is favorable now. Now that we understand unadjusted versus adjusted price histories, we can finally take a look at why we default to using adjusted price histories for calculating trailing stop loss levels in TradeStops. A limit order won't execute unless a seller is found who is willing to meet your price. GAAP net income loss per average common share 3. In the next years, if the Fed keeps rates low what are the chances of that? NLY's profit was cut by half. But if the Fed starts raising rates, we will see another meltdown like the one we saw in 4th quarter of , and NLY profits will still be cut in half, maybe growing a little with slightly widening spread. Fool Podcasts. They don't feel the loss because it's only one quarter. Annaly is a leading diversified capital manager that invests in and finances residential and commercial assets. Getting Started. Toggle navigation. Also good. Odds are that stock will go higher. For long-term investors, the current discount to book value provides a decent tailwind, along with a mortgage-REIT level of dividend yield, whatever it turns out to be.

The average estimate of three analysts surveyed by Zacks Investment Research was for earnings of 23 cents per share. From that report, it was clear that the first quarter was indeed difficult. Further, these estimates are not a comprehensive statement of our financial results as of and for the quarter ended March 31, If a company has a profitable quarter, its board of directors might choose to pay out a portion of those profits to the company's stockholders in the form of a dividend. Data Disclaimer Help Suggestions. As a nation, we are still in the early stages of the pandemic. May 2, at PM. Getting Started. Yahoo Finance. Forward-Looking Statements This letter to shareholders and our public documents to which we refer contain or incorporate by reference certain forward-looking statements which are based on various assumptions some of which are beyond our control and may be identified by reference to a future period or periods or by the use of forward-looking terminology, such as "may," "will," "believe," "expect," "anticipate," "continue," or similar terms or variations on those terms or the negative of those terms. The current results show good progress and to me, it indicates one important thing.